3 Major Signals That Could Change the Future of crytocurency, bitcoin

In the past 24 hours the crypto landscape shifted in three clear ways that matter for investors and builders alike. If you follow crytocurency, bitcoin and broader digital assets, these are not small headlines — they signal changes in regulation, capital flows, and even government positioning. Below I break down what happened, why it matters, and how to think about positioning without hype.

Table of Contents

- Key takeaways

- 1) The Fed’s policy shift: from special program back to normal supervision

- 2) BlackRock and the Ethereum stampede

- 3) Treasury positioning: U.S. government and Bitcoin reserves

- Putting these signals together: what it means for markets

- How to think and act — practical positioning

- Why this isn’t the old crypto cycle

- Conclusion

Key takeaways

- The Federal Reserve has announced it will roll back a special supervision program for bank crypto and fintech activities, moving oversight into standard supervisory processes.

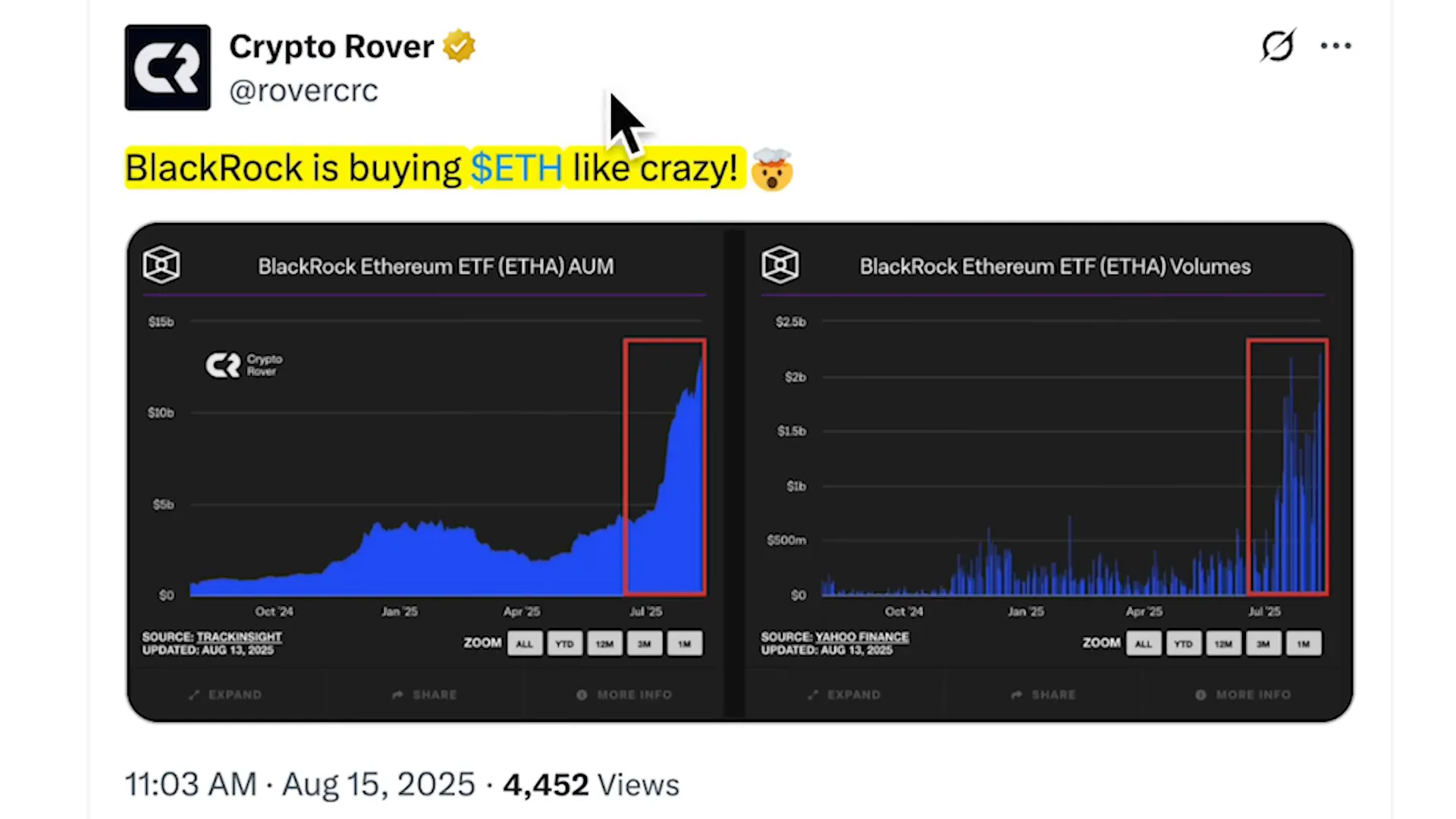

- BlackRock and other large institutional buyers are piling into Ethereum ETFs, producing unusually large inflows that dwarf Bitcoin ETF flows in recent days.

- Comments from the U.S. Treasury suggest government-held Bitcoin reserves and even potential future purchases are back on the table.

1) The Fed’s policy shift: from special program back to normal supervision

The biggest quiet development is regulatory normalization. The Federal Reserve announced it is sunsetting its Novel Activities Supervision Program and integrating what it learned about crypto risks into its standard supervisory framework. On paper that sounds procedural; in practice it’s a signal.

“Banks are free to provide banking services to the crypto industry to crypto companies.”

That quote captures the rhetorical shift. For years banks operated under conservative guidance, and many avoided crypto relationships. When the Fed says it’s comfortable moving crypto oversight into regular channels, it reduces a key barrier for large banks to service crypto firms and for banks themselves to explore crypto-related activities.

Why this matters: capital flows follow permission. When the largest custodians and asset managers perceive lower regulatory friction, more institutional dollars can enter. That’s a structural tailwind for crytocurency, bitcoin and for tokenized financial products.

2) BlackRock and the Ethereum stampede

Institutional adoption is visible in flows. Ethereum ETFs — led by big firms like BlackRock — just posted one of their largest inflow days: roughly $600 million over 24 hours and a streak of consecutive positive inflows. In the last several days ETH ETF flows have been roughly 2x those of Bitcoin.

What’s happening is simple: asset managers and their clients are buying exposure through ETFs, which is cleaner for many investors than spot custody. These inflows also reflect a broader acknowledgment that Ethereum’s ecosystem — not just token price — is durable. For investors who want diversified crypto exposure, that realization changes risk allocation and product design in portfolios that once held only Bitcoin.

3) Treasury positioning: U.S. government and Bitcoin reserves

The third signal is political and symbolic. The Treasury has clarified its approach to seized crypto assets, and Treasury officials have left the door open on future Bitcoin purchases by the government. That’s noteworthy in two ways: it creates a public store-of-value narrative and it reduces selling pressure from confiscated assets.

“New Bitcoin purchases by the US government are very much still on the table.”

Whether or not the Treasury actually buys more Bitcoin, the mere possibility changes market psychology. It sends a message that crypto is part of national asset-management conversations — not just fringe speculation. That mainstreaming nudges sovereign wealth funds, family offices, and large corporates to revisit allocations to crytocurency, bitcoin.

Putting these signals together: what it means for markets

Individually each development matters; together they form a narrative: regulatory acceptance, institutional product demand, and neutral-to-positive government posture. That combination is often what drives multi-year trends.

- Regulatory normalization lowers the cost of entry for big banks and custodians.

- ETF inflows concentrate demand through familiar financial products, making on-ramps easier for traditional investors.

- Government-level acceptance reduces tail-risk for extreme policy actions and changes the risk premium for long-term holders.

How to think and act — practical positioning

There’s no one-size-fits-all play, but here are pragmatic principles I use and recommend to others thinking about crytocurency, bitcoin exposure now:

- Prioritize core holdings: if your goal is long-term exposure, focus on high-conviction assets first (for many, that’s Bitcoin and Ethereum).

- Use regulated products where appropriate: ETFs and custodial solutions from established players can reduce operational risk for sizeable allocations.

- Scale in over time: large institutions buy the story in tranches; individual investors can mirror that — avoid all-or-nothing moves.

- Keep liquidity and risk tools ready: with increased institutional flows, volatility can still be sharp. Have a plan for rebalancing and risk management.

Why this isn’t the old crypto cycle

Look at who’s driving the current wave: policymakers, large asset managers, and wealthy family offices. Four years ago, retail and early adopters dominated narrative and price action. Today it’s suits and institutional balance sheets — that’s a different market ecology. That doesn’t mean prices only go up, but it does change the playbook on how adoption unfolds.

Conclusion

These three events — the Fed’s supervisory change, massive Ethereum ETF inflows led by BlackRock, and renewed Treasury openness on Bitcoin holdings — are connected threads. Together they lower barriers, increase demand, and shift perception of crytocurency, bitcoin from niche experiment to mainstream asset class consideration.

My advice: focus on fundamentals, size positions thoughtfully, and treat this phase as a structural opportunity rather than a short-term momentum trade.

Why the 60/40 Portfolio Is Dead: How crytocurency, bitcoin Is Reshaping Retirement Strategy

From a hard-hitting interview with Jack Mallers on Savvy Finance, the investment rules many of us grew up with are cracking. This article breaks down the case Mallers lays out: the traditional 60/40 mix of stocks and bonds is failing institutional savers, and crytocurency, bitcoin is emerging not as a speculative punt but as a strategic reserve asset. Read on for the data, the policy moves, and what this means for long-term portfolios.

Table of Contents

- Key takeaways

- Why the 60/40 myth is breaking

- Policy levers: How governments are responding

- Institutional adoption: Harvard, Meta Planet and the new reserve buyers

- The portfolio question: How much crypto exposure is sensible?

- Data points that back the shift

- What to watch next (practical checklist)

- Conclusion: A new monetary era or a passing vogue?

Key takeaways

- The classic 60% stocks / 40% bonds portfolio is under severe strain: multi-year bond losses and a commercial real estate collapse have eroded long-duration savings.

- Policy changes — notably broader access to Bitcoin and gold in retirement plans — are being framed as a rescue strategy for battered savings accounts.

- When top institutions and endowments allocate to crytocurency, bitcoin it signals a structural shift from fiat-denominated assets to scarce digital money.

- For anyone responsible for multi-decade liabilities (pensions, endowments, sovereign funds), diversifying into non-fiat, non-bond assets is becoming an operational necessity — not an ideological choice.

Why the 60/40 myth is breaking

For decades, the 60/40 model worked because bonds reliably provided stability while equities provided growth. That equilibrium depended on low debt, stable inflation expectations, and positive real bond returns. Those assumptions are no longer holding.

Key points Mallers highlights:

- Five straight years of losses in many bond buckets have turned the “stable” half of the portfolio into dead weight.

- Commercial real estate valuations have been written down as much as ~85%, inflicting direct losses on municipal and corporate pensions.

- Much of the broad market's apparent nominal gains are a function of dollar debasement; measured in real terms (relative to a stable monetary standard) most of the S&P 500 constituents have not kept pace with inflation.

Real-world consequences

When pensions and endowments are underwater, public services get starved. Mallers points to underfunded police forces, broken municipal budgets, and strained public sector services as downstream effects. In short: broken money systems create social costs.

Policy levers: How governments are responding

Rather than allowing portfolios to slowly wither, policymakers are taking active steps. Two critical moves highlighted:

- Executive actions expanding retirement plan options to include Bitcoin and gold. This opens a channel for savers to gain exposure to scarce assets inside their 401(k) accounts.

- Central bank / treasury discussions about balance sheet transformations — including reassessing gold valuations — as a way to create fiscal space and potentially seed strategic reserves that could include Bitcoin.

These moves change the universe of possible portfolio responses. If the only way to arrest erosion is to dilute the currency (debase the dollar) while giving savers realistic exposure to appreciating stores of value, then allowing crypto and gold into tax-advantaged accounts becomes a policy tool — a liquidity escape valve, as Mallers puts it.

Institutional adoption: Harvard, Meta Planet and the new reserve buyers

Institutional interest matters because these are conservative, long-duration allocators. When universities, sovereign funds, and corporations put nine-figure positions on their balance sheets, it changes the narrative from “speculation” to “capital preservation.”

Notable examples:

- Harvard disclosed a six- or seven-figure (reported as over $100M) position — the kind of vote of confidence that changes institutional peer behavior.

- Meta Planet and other corporations steadily accumulating large Bitcoin treasuries demonstrate that corporate treasury strategy is shifting toward assets that cannot be inflated away.

Why this matters for pensions and endowments

Pensions and endowments are fiduciaries with long horizons. If long-duration bonds and many equities no longer protect purchasing power, rotating even a fraction of reserves into scarce assets can dramatically alter long-term outcomes. Mallers argues that this shift isn't marginal — it's foundational.

The portfolio question: How much crypto exposure is sensible?

Mallers challenges the popular “1% allocation” take. His argument is blunt: if you truly believe Bitcoin is superior money, allocating a token percentage while keeping the vast majority in assets that structurally lose real value doesn't align with long-term preservation goals.

That said, practical implementation should consider:

- Fiduciary duty and regulatory guidance

- Liquidity needs and volatility tolerance

- Custody and security arrangements for digital assets

- Gradual, audited allocations as part of an overall risk-managed framework

Data points that back the shift

- Five consecutive years of losses in many bond classes.

- Commercial real estate markdowns up to ~85% in some pockets.

- Most of the S&P 500 (493 companies excluding mega-cap winners) expected to deliver 2–3% net income growth — often below real inflation.

- Over 200 public companies now holding Bitcoin on their balance sheets; recent multi-million-dollar corporate buys continue to accumulate supply.

What to watch next (practical checklist)

- Regulatory guidance on holding digital assets in retirement accounts and fiduciary best practices.

- Further institutional disclosures from endowments, sovereigns, and corporate treasuries.

- Market reaction to any formal moves by central banks or treasuries to revalue gold or create sovereign digital reserves.

- Product availability that lets ordinary savers access crytocurency, bitcoin inside tax-advantaged wrappers with professional custody.

Conclusion: A new monetary era or a passing vogue?

The case Mallers lays out is not a price call — it's structural. Broken bond markets, a stretched equity universe, collapsing real estate valuations, and active policy responses are combining to create a powerful incentive for institutional diversification into scarce, non-sovereign assets.

Whether you call it crytocurency, bitcoin or digital money, the practical implication is clear: institutions that must preserve value for decades are starting to treat Bitcoin like insurance against currency debasement. That changes capital flows and, over time, the architecture of global savings.

"The sixty forty portfolio is dead." — a blunt, repeated refrain that captures the gravity of the shift.

Do you agree that the 60/40 portfolio is collapsing and that crytocurency, bitcoin deserves a strategic allocation for long-term savers? I encourage you to watch the full interview on the Savvy Finance channel and weigh the data for yourself — then consider how your own long-term plans might adapt.

US Reverses Bitcoin Strategy (Crypto Run Ending!?) — Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

I’m Discover Crypto, and in this deep-dive I’m breaking down the market-moving comments from U.S. Treasury Secretary Scott Bessent, the “flash crash” that followed, and what historic post-halving patterns tell us about where Bitcoin could top in the final months of this cycle. I’ll explain why the headlines felt bearish, why there’s a silver lining in the same soundbite, and how the historical pattern first pointed out by Ben Cowen might shape the rest of the bull run. If you want clear, practical thinking on Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing—this is for you.

Key takeaways

- The U.S. Treasury clarified it will not buy Bitcoin for a new strategic reserve; instead it will use confiscated crypto assets.

- Bitcoin experienced a rapid, sharp price drop (a flash crash) after the announcement but the government also said it will stop selling its existing seized Bitcoin holdings.

- Historical patterns across post-halving years (2013, 2017, 2021) show a consistent pattern: summer pumps into July/August, a September pullback, and a final rally to a Q4 cycle top.

- That pattern suggests a likely market cycle top in Q4 2025, and that should inform—not dictate—how you manage risk and position exposure.

- Actionable steps: review risk tolerance, consider scaling exposure, use stop-losses or hedging, and keep long-term conviction if you’re a believer in Bitcoin’s fundamentals.

Why this matters: politics, policy, and the market reaction

When a top Treasury official says, “A Bitcoin strategic reserve, we’re not gonna be buying that,” a lot of investors stop and listen—especially in a market as sentiment-driven as crypto. That quote sparked immediate price movement: Bitcoin dropped thousands of dollars in minutes. Headlines screamed: the U.S. won’t buy Bitcoin, the crypto reserve idea is dead, sell-off ensues.

But context matters. The administration’s earlier executive order laid the foundation for a new structure—a “Bitcoin reserve” and a “strategic digital asset stockpile.” That sounded bullish to some people, because the idea of a government accumulation of Bitcoin implies long-term, institutional demand. When the Treasury says it won’t be buying Bitcoin, that can feel like removing an upgrade to the demand side of the market, and the market reacted accordingly. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

The immediate market response was dramatic: a flash move that wiped thousands off the price in minutes. Why do these things happen? Because crypto markets are still relatively thin compared to traditional FX or equities, large stop clusters exist around key levels, and algorithmic traders amplify moves. A single authoritative soundbite can trigger stop-outs and liquidations that snowball quickly. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Flash crash vs. structural change

There’s a distinction between a temporary price shock and a long-term fundamental change. A flash crash—like the sudden $3,500 drop you may have seen—can be brutal in the short term but has zero bearing on whether Bitcoin’s fundamentals or the cycle structure remain intact.

In this case, the quote caused a short-term liquidity event. But the Treasury’s larger framework remains unchanged: the two stockpiles would initially be funded with seized cryptocurrency from criminal activity. That means the policy does not entail aggressive market purchases using taxpayer dollars. That’s important because it clarifies intent and the sourcing of supply for the reserve. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Parsing the public remarks: the silver lining

After the initial shock, the Treasury offered a notable piece of reassurance: it plans to stop selling the government’s existing crypto holdings. That’s a material policy decision. If prior practice involved liquidating seized crypto to cover costs, a shift to “we’re going to stop selling that” effectively removes an ongoing source of downward pressure on price. For market structure nerds, that’s a non-trivial long-term positive.

Let’s be honest—this hasn’t been a smooth romance between government agencies and crypto. The fact that the seized crypto would form the initial stockpile is aligned with enforcement and forfeiture policies, not with a strategic accumulation plan that buys on open markets. But the decision to stop sales matters because it’s a change to the supply dynamics. The government holding and not dumping seized BTC reduces expected future sell pressure. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Markets, however, often emphasize headline simplicity over nuance. “We’re not going to be buying” was an easy soundbite. The line about using seized assets and stopping sales didn’t have the initial viral punch. That’s a classic case of market psychology: the short-run price move follows the emotional headline; the slower, steadier recognition of the strategic shift into “stop selling” can be absorbed over days and weeks. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

The bigger picture: What does this mean for the bull run?

This is the heart of the question: does this Treasury clarification change the long-term bull market thesis? The short answer: no, not by itself. The longer answer: it adds nuance that can temporarily influence market dynamics, but cycle timing is governed by a complex mixture of macro liquidity, on-chain demand, miner economics, and psychology.

There are two competing narratives that often play out here. Narrative A: institutional demand from governments or big institutions is the “third rail” that will propel Bitcoin to new highs if it becomes real. Narrative B: Bitcoin’s cycle dynamics—halving-induced supply shocks, network growth, and macro liquidity cycles—drive the bull markets independent of one-off institutional actions.

The Treasury story touches Narrative A but doesn’t fulfill it. The initial administration-level conversation about a crypto reserve suggested a possible new buyer in the market. The Treasury’s clarification removed that hypothetical buyer. But history shows Q4 tops in previous post-halving years happened without government strategic purchases. That’s where Ben Cowen’s pattern becomes interesting. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Understanding the post-halving pattern

Ben Cowen identified a repeatable pattern across post-halving years: each “year after halving” (i.e., 2013, 2017, 2021) showed a similar trajectory—pump into July and August, a pullback in September, then a final rally into a Q4 top. If you map this to halving years (2012 → 2013, 2016 → 2017, 2020 → 2021, 2024 → 2025), the pattern becomes striking.

Why would this pattern repeat? There are a few plausible explanations:

- Behavioral cycles. Retail and institutional participants often follow seasonal patterns tied to fiscal quarters, bonuses, portfolio rebalancing, and end-of-year flows.

- Macroeconomic timing. Q3 often sees lower liquidity and a re-evaluation period, with new macro catalysts emerging in Q4.

- On-chain orphan timing. Miners, lock-ups, and investor timelines create waves of accumulation and profit-taking at similar calendar points.

Across the three prior post-halving cycles, the pattern held. You saw a summer surge, a September retrace, then a late-year push to the cycle top. If 2025 follows the same mechanics, Q4 2025 becomes a natural candidate for the cycle apex. Again—this doesn’t mean price absolutely must top then, but it’s a historically meaningful pattern worth watching. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

What the charts show (and what they don’t)

The comparison charts show three things consistently: a mid-year acceleration, a September correction, and a Q4 blow-off top. These are visible even on multi-month timeframes and three-day candle charts. But charts are descriptive, not prescriptive. They show what happened; they don’t tell you exactly why participants behaved that way—or whether the same forces will be in play this cycle.

In 2013, the market structure was very different—fewer derivatives and less leverage. Yet the seasonality persisted. In 2017, leverage was higher, and the September pullback was followed by explosive momentum into December. In 2021, despite broader macro noise (pandemic, stimulus), the pattern repeated. That lends credibility to the idea that a repeating behavioral cycle is at work. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Putting it together: Are we at the top this year?

Short answer: unlikely to be an immediate call, but Q4 becomes the highest-probability window for the cycle top if historical patterns hold. The most useful frame is probabilistic: given the historical evidence, there’s an elevated chance that the cycle top arrives in Q4 2025 after a summer run and a September correction.

We should emphasize: this is about timing probability, not price targets. You can believe in Bitcoin’s long-term trajectory and still recognize that market cycles include tops and corrections. If you’re asking whether you should “sell everything now,” the answer depends on personal risk tolerance, time horizon, and whether you need liquidity. For many long-term holders, the right action is to rebalance—not exit entirely. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

My read on the current setup

Here’s how I see it unfolding. The Treasury’s soundbite introduced short-term noise and triggered a liquidity-driven drop. The message that the government will stop selling seized BTC is a medium-term positive. Meanwhile, on-chain metrics, institutional flows, ETF demand, and macro liquidity seem supportive.

Given the repeating post-halving pattern and the recent macro context, the highest-probability scenario is: continued strength into July/August, a consolidation or pullback in September, and a renewed run into Q4, where we hit the cycle top. That’s exactly what Ben Cowen outlined; I’m giving it weight because history has repeated here before. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

What I’m doing with my Bitcoin (and how you can think about your position)

First, quick disclosure: this is my personal view and not financial advice. That said, I want to be transparent about how I’m positioning given this higher-probability timeline. I’m not selling everything. I’m not fleeing the market. But I’m using a more nuanced, tiered approach:

- Review exposure vs. risk tolerance. If you’re heavily leveraged or need liquidity soon, consider de-risking earlier rather than later.

- Scale positions. Rather than an all-or-nothing sell, scale out into strength. Take profits incrementally in Q3 and Q4 on outsized gains.

- Use hedges. Options or inverse products can be used to lock in gains while staying exposed to upside if the market continues.

- Hold core conviction. Keep a core allocation if you’re a long-term believer. This core is invested for years, not quarters.

- Rebalance systematically. Use a rules-based approach to rebalance exposure at predefined thresholds or schedules rather than emotion-driven timing.

This approach aims to capture upside while managing the risk that historical cycles often end with sharp reversals. If Q4 2025 indeed represents a cycle top, those who scaled profits will be in a better position to redeploy at lower levels. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Concrete adjustments you can consider

- Set target sell bands: e.g., sell 10–25% of holdings at predefined price points or percentage gains.

- Establish a rainy-day fund: make sure you have 6–12 months of cash so you’re not forced to sell into volatility.

- Don’t be overly leveraged: margin amplifies risk and can force exits at the worst times.

- Consider dollar-cost averaging (DCA) into derivatives hedges if you want downside protection without fully exiting spot exposure.

- Keep at least a trim-and-hold mindset: trim on rallies, hold a long-term core, and redeploy during weakness.

If you prefer simpler actions, just reduce allocation to a level where you can comfortably sleep at night. That’s the most practical guidance for most people. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Practical risk-management checklist

Here’s a short checklist you can use right now to review your Bitcoin position and preparedness for a possible Q4 top scenario:

- Do I know my time horizon? (Short-term trader vs. long-term investor)

- How much of my net worth is in crypto? Is this an acceptable concentration?

- Do I hold any positions with margin or leverage? If yes, can I survive a 50% drop?

- Do I have a defined sell plan or profit-taking rules?

- Have I set up secure custody for core holdings (hardware wallets, multi-sig)?

- Have I considered tax implications of any planned trades or sales?

- Do I have hedges or insurance (options, inverse ETFs) to protect a portion of gains?

Work through this checklist honestly. Market cycles punish overconfidence, not humility. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Addressing common questions and objections

“If the government doesn’t buy, isn’t this bearish?”

Not necessarily. Government purchases would be an incremental and symbolic source of demand. But they’re not necessary for a bull market. Past cycles saw major price appreciation without direct government accumulation. The market has many demand drivers: retail adoption, ETFs, corporate treasuries, sovereign wealth interest, and improved custody and regulatory clarity. The removal of a hypothetical buyer is not the same as a structural collapse in demand. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

“Why does September correct historically?”

September often aligns with liquidity normalization after summer, tax planning windows, fiscal quarter adjustments, and institutional rebalancing. These end-of-quarter dynamics can trigger take-profits or repositioning. The repeatability across cycles indicates persistent behavioral or structural forces at play. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

“Is Q4 always the top?”

Historically in the post-halving years we referenced, Q4 was the top. That’s three data points (2013, 2017, 2021) that align. But history is not destiny. Q4 is the highest-probability window given past patterns, but markets can surprise. Keep probability and risk management front-and-center. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Scenario planning: three plausible paths

It helps to think in scenarios so you can prepare. Here are three plausible paths for the remainder of the cycle and how you might position for each.

Scenario A — Baseline (Historical Repeat)

- Summer rally into July/August followed by a September correction and a Q4 top.

- Action: Scale profits during the late summer rally, tighten hedges before September, and protect gains in Q4.

- Probable outcomes: Significant late-year volatility, possible multi-month drawdown after the top.

Scenario B — Acceleration

- ETF inflows, macro liquidity, and strengthening on-chain metrics push the price higher into an earlier Q4 or even late Q3 top without a pronounced September correction.

- Action: Take partial profits on rallies; maintain hedges and prepare to redeploy if correction follows a sharper blow-off top.

- Probable outcomes: Rapid profit-taking opportunities but heightened risk of a sharp reversal.

Scenario C — Disrupted Cycle

- Unexpected regulatory actions, macro shocks, or large sell pressure from major holders disrupt the pattern and cause a deeper drawdown outside the historical window.

- Action: Reduce leverage, maintain cash reserves, and only incrementally reenter on confirmed levels of stability.

- Probable outcomes: Extended consolidation or bear move; opportunities for value buys for long-term holders.

Plan for the baseline but remain flexible. Use Scenario B and C as guardrails—if the market starts to behave like B or C, adjust quickly. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

On-chain indicators to watch

If you want more data-driven signals beyond cycle seasonality, watch these on-chain metrics closely:

- Exchange net flows: sustained outflows to cold storage can indicate accumulation; large inflows often precede sell pressure.

- Realized profit/loss: spikes in realized profit commonly coincide with major tops and corrections.

- Active addresses and transaction counts: increasing activity often supports sustainable price moves.

- Long-term holder supply change: if long-term holders significantly reduce holdings, that can precede a top.

- Miner selling pressure: look at miner outflows relative to revenue—if miners start selling heavily it adds supply pressure.

Combine these with market structure indicators (funding rates, open interest, option skew) for a fuller picture. The post-halving seasonality is useful, but coupling seasonality with on-chain and derivatives data gives a more robust edge. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Practical next steps for investors

If you’re unsure what to do next, here are practical steps to consider over the coming months:

- Audit your allocation: ensure you’re not overexposed relative to your risk tolerance.

- Build liquidity buffers: cash or stablecoins to capitalize on dips.

- Set alerts and plan profit-taking bands for Q3 and Q4.

- Secure long-term holdings in cold storage with best practices for seed security and multi-sig.

- Follow on-chain and derivatives metrics weekly—not hourly—to avoid overreacting to noise.

- Consider gaining exposure to hedging instruments if you want downside protection without fully exiting spot positions.

Remember: markets reward preparation. You don’t need perfect timing to do well—just rules that protect capital and allow you to capture upside. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Final thoughts and a personal note

Let me leave you with a few closing reflections. The Treasury’s statement was headline-catching, but the story is nuanced and contains a silver lining: stopping the sale of seized Bitcoin can be a positive structural change. The flash crash was painful but short-lived, a reminder of crypto’s unique market dynamics. The broader cycle dynamics—particularly the post-halving pattern Ben Cowen highlighted—still matter.

Historically we’ve seen similar calendar patterns repeat, and that suggests a Q4 top is a high-probability event for the post-2024 halving cycle. That doesn’t mean you should panic-sell. Instead, think probabilistically: scale exposure, hedge selectively, and protect capital. I’m not dropping my core BTC position. I’ll trim into rallies and manage risk proactively.

Whether you’re an active trader, long-term holder, or somewhere in between, the combination of policy nuance, market behavior, and historical pattern should guide your plan—not headlines alone. And if you want to keep sharpening your strategy, review the metrics we mentioned and make rules you can follow when the market inevitably gets emotional again. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Thanks for reading. Keep your life, goals, and risk tolerance in the driver’s seat—markets will do what they do. See you at the top (or on the other side of the next retrace). Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Altcoins Set to Explode: Why Ethereum, Solana and More Will Rally — crytocurency, bitcoin Insights

Table of Contents

- Introduction

- Key takeaways

- Why institutional access changes the game

- Ethereum vs Bitcoin: different roles, complementary upside

- Expert voices you should know

- What this means for altcoins

- Actionable steps for traders and investors

- Conclusion

Introduction

This piece is inspired by Altcoin Daily’s latest breakdown with Aaron, and it distills why institutional moves and expert calls are lining up to push altcoins — especially Ethereum — much higher. If you follow crytocurency, bitcoin narratives, you already know this cycle feels different: Fidelity opening institutional Ethereum trading, on-chain yield opportunities, and major Wall Street voices all converging. Below I walk through the data, the expert voices, and what this could mean for traders and long-term investors.

Key takeaways

- Institutional access to Ethereum (Fidelity rolling out ETH trading) is a major catalyst for flows into altcoins.

- Experts like Tom Lee and Kevin O'Leary see huge upside: Tom Lee suggests a potential path to $60k ETH; Kevin O'Leary sees Bitcoin hitting $250k within a year of regulatory clarity.

- Ethereum’s programmability, yield and smart-contract ecosystem make it more attractive to financial institutions than Bitcoin alone.

- Altcoin season could arrive on Bitcoin’s strength — expect Solana, Layer-2s, and selected quality alts to outperform.

Why institutional access changes the game

When Fidelity makes Ethereum available to its customers, it isn’t just another product listing — it signals mainstream distribution. Institutions and wealth managers now have easier on-ramps to ETH exposure. For people tracking crytocurency, bitcoin flows, institutional distribution has historically driven sustained price appreciation.

What institutional demand looks like

- Direct trading and custody via big platforms.

- Corporate treasuries accumulating crypto (Bitcoin and increasingly ETH) for balance-sheet allocation.

- Development of regulated financial products built on Ethereum smart contracts and stablecoins.

Ethereum vs Bitcoin: different roles, complementary upside

Bitcoin remains the dominant store-of-value narrative — many still call it "digital gold." But Ethereum brings programmability and yield. This matters to Wall Street: whereas Bitcoin is largely unproductive (no native yield), ETH can be used in protocols that generate returns (staking, fees, DeFi yield). For anyone following crytocurency, bitcoin headlines, this dynamic explains why some managers are shifting to both assets rather than just BTC.

“Ether is like digital oil. For every transaction on the Ethereum blockchain, it requires a micropayment of this digital commodity, and it generates yield.”

Expert voices you should know

Several high-profile figures are publicly bullish — and their arguments are important to parse:

- Tom Lee: Sees Ethereum as one of the biggest macro trades over the next decade. He models scenarios where financial activity migrating to Ethereum could imply a network valuation consistent with much higher ETH prices — he’s discussed paths to $60k per ETH under certain adoption assumptions.

- Kevin O’Leary: Predicts a post-regulatory clarity rally in Bitcoin to $250k within a year — a strong Bitcoin market typically lifts quality altcoins too.

- Cathie Wood: Remains extremely bullish on Bitcoin long-term (she’s discussed $1M+ in five years) and expects altcoins to benefit in the same broad bull market.

- Andrew Keyes (Ether Machine): Emphasizes Ethereum’s addressable market beyond gold — the ability to digitize assets and embed smart contracts is a structural advantage.

What this means for altcoins

Altcoins historically rally after Bitcoin leads. The current setup — rate cuts potential, market structure clarity (e.g., “Clarity Act” style reforms), and institutional product launches — provides a multi-headed tailwind. Expect the following:

- Ethereum and Layer-2 networks capture financial product activity and stablecoin issuance.

- Solana and other high-throughput chains may see targeted allocations from funds (some managers already overweight SOL).

- Staking and yield-bearing treasuries make Ether an attractive treasury asset compared to plain Bitcoin.

- Quality alts (LINK, XRP, AVAX, DOT, etc.) could benefit from rotational flows as investors search for higher returns.

Actionable steps for traders and investors

If you’re preparing for a possible altcoin run, consider the following disciplined approach:

- Reassess portfolio weightings: core allocation to Bitcoin and Ethereum first, then selective exposure to high-quality alts.

- Use on-chain analytics (tx volume, active addresses, staking ratios) to validate interest before increasing exposure.

- Consider dollar-cost averaging into positions rather than lump-sum buys on hype.

- Keep liquidity for quick rebalancing — alt seasons can be fast and violent.

Conclusion

The combination of institutional access (Fidelity), regulatory clarity catalysts, macro tailwinds, and the structural differences between Bitcoin and Ethereum create an environment where altcoins could outperform. For those tracking crytocurency, bitcoin markets, the rules of engagement remain the same: prioritize capital preservation, focus on quality protocols with real utility, and use measured entries. Altcoin season may be coming — but preparation and thoughtful risk management will separate smart gains from noise.

Final thought

I'm still accumulating Bitcoin and Ethereum, and increasing selective exposure to altcoins with clear utility and strong teams. If you want a checklist for evaluating altcoins or a simple allocation framework, drop a comment and I’ll walk through it next.

BITCOIN & ALTCOIN SEASON: All-Time Highs, Trading Strategy and Price Targets — Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

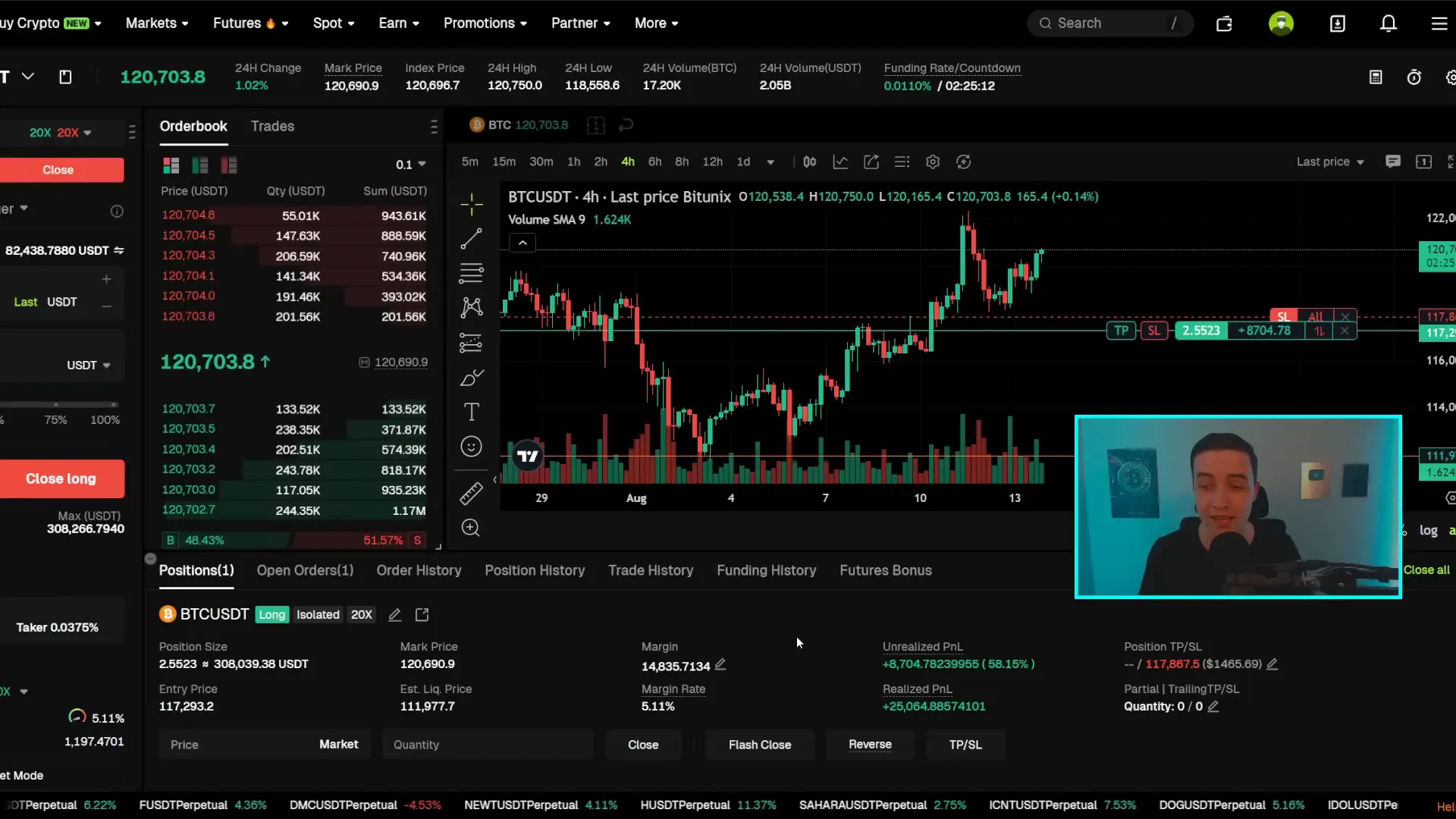

Hi — I’m Josh from Crypto World. In this deep-dive I’ll walk you through the exact technical setups, trade management, and altcoin rotation signals I’m watching right now. I’ll also share the real trades I’ve taken, how I’m sizing and adjusting stops, and the bots and exchanges I use so you can take actionable steps on your own. This is a practical, play-by-play Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing update designed to be useful whether you’re trading actively or building passive exposure.

What you’ll get from this guide

- Clear read of Bitcoin’s weekly and short-term technicals: resistance zones, momentum indicators, and realistic upside targets.

- My personal trade plan — entries, profit-taking, stop loss moves and mental framework for managing a large directional long position.

- How Bitcoin dominance is shaping an altcoin season and which altcoins I want to trade: Ethereum, Solana, XRP and Chainlink.

- How I use exchanges, bots and passive strategies to both actively trade and earn passive profits.

- Practical trade setups, support/resistance levels and contingency plans if price rejects or breaks out.

Heads up: this piece reflects my current view and trade plan. It's educational and transparent — I put my money where my mouth is and explain why. If you want the short version: Bitcoin is at a major resistance band, the BTC weekly structure has a longer-term bearish divergence to respect, but the short-term structure remains bullish and I'm still long. I'll explain what that means and how I’m navigating both the potential all-time high breakout and a possible pullback. This is for Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing readers hungry for actionable clarity.

Quick snapshot: The macro and the trade

- Macro: Bitcoin weekly still shows a bullish trend but with a notable bearish divergence on the weekly RSI. Divergences are not immediate sell signals — they are longer-term warnings to watch price behavior around key levels.

- Short-term: The 8-hour structure is bullish — higher highs and higher lows — and momentum on the 3-day MACD is neutral (no strong directional bias yet).

- My position: Roughly a $300,000 long on Bitcoin. I have taken partial realized profits (~$25,000) and adjusted my stop to lock in more gains. I plan to remain long while price structure stays bullish, trimming into resistance and adding on pullbacks.

This is a live trading plan you can model or adapt for your own risk tolerance as part of your Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing workflow.

Bitcoin technicals: weekly vs short-term

Weekly view — the bigger picture

Zooming out to the weekly Bitcoin chart, the super trend (a trend-following filter) remains green. That means the broader trend is bullish. But we also have a classic technical red flag: a bearish divergence between price and the weekly RSI. In plain language: Bitcoin has made higher highs, while the weekly momentum reading has not matched the strength — it’s making lower highs. Historically that pattern preceded a larger multi-week pullback on the prior cycle.

Bearish divergences on a weekly timeframe are not immediate sell signals — they are strategic caution signs. They tell you to respect resistance levels and to be conservative with leverage. They also mean that while a breakout above all-time highs is possible, we should avoid extrapolating parabolic targets (like instantly assuming a move to $200k) without watching how price handles the near-term resistance band. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Short-term (8-hour / 3-day) — what’s happening now

On shorter timeframes the story is more constructive. The 8-hour price structure shows higher lows and higher highs — that’s bullish price action. However, the 3-day MACD is lacking strong directional momentum. Translation: momentum hasn’t fully swung to the upside yet, but price structure is set up for a move.

Key immediate resistance: the 120k–123k band. This region is a cluster: psychological round number (120k), Fibonacci extension (~121.5k) and prior liquidity pockets. If Bitcoin can close daily candles above ~121–122k and hold them as new support, we will likely call it an all-time high breakout and target the next logical range of $125k–$130k.

But because of the weekly divergence, I’m not assuming an uninterrupted vertical move. I’m prepared for either: a clean breakout with follow-through into the $125k–$130k range, or a short-term rejection and pullback that presents another buying opportunity. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

My live trade: structure, sizing and management

I want to be transparent: I’ve been long Bitcoin for about a week, with multiple adjustments. I initiated an initial long, added into a pullback around ~$118–119k, took profits near resistance, and added again. My current exposure is roughly a $300,000 long.

Here’s the precise logic behind my moves:

- Entry points: I prefer buying into pullbacks inside a bullish structure — for me that was around the $118–119k area after the small correction.

- Scaling: I add in tranches. I will take partial profits near obvious resistance levels (like the 120–123k zone) and redeploy into clear, shallow pullbacks that hold higher lows.

- Stop placement: I’ve moved my stop into profit as the trade moved in my favor. Even in the worst-case scenario right now, with partial profits already realized (~$25k), the stop would lock the remaining exposure at a modest profit (~$1.5k) — meaning I wouldn’t give back all my gains.

- Risk management: This trade is actively monitored and rebalanced. Because of the weekly divergence, I’m conservative with leverage and willing to trim size if we get aggressive rejection candles around the major resistance band.

Why this trade plan? Two reasons: (1) the short-term structure is bullish, offering clear higher-low buying opportunities; (2) the weekly divergence calls for partial locking of gains and tighter risk management at major resistance. The combination lets me participate in an upside breakout while preserving capital if top-side momentum fades. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Profit targets and scenarios

- Scenario A — breakout confirmed: Daily closes above ~121–122k hold → target $125k–$130k as the next short-term range.

- Scenario B — rejection at resistance: Expect a multi-week pullback or sideways consolidation. Use 1–2 week consolidations as re-entry zones if higher lows stay intact.

- Leverage examples: A non-levered move from $200 → $230 (Solana example later) is +15%; at 10x that’s +150% on margin. I prefer low leverage on Bitcoin while the weekly divergence exists.

Liquidation heatmap and liquidity levels

One practical reason Bitcoin often stalls around certain zones is liquidity: stop orders cluster around round numbers and prior highs. The heatmap shows we already swept liquidity near ~$121k, and there’s still liquidity around ~$123k. Traders chasing stop runs can trigger squeezes that either fuel a breakout or reverse into a rejection. My approach: respect areas of liquidity and don’t try to outguess a stop run — position size for either outcome and let price confirm.

If you prefer tactical exposure, consider splitting capital into:

- Core-long (buy & hold) with no leverage.

- Active swing allocation to trade breakouts/pullbacks with modest leverage and defined stops.

- Passive exposure via grid bots or DCA to smooth returns over time.

This three-layer approach balances long-term conviction with short-term opportunity. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

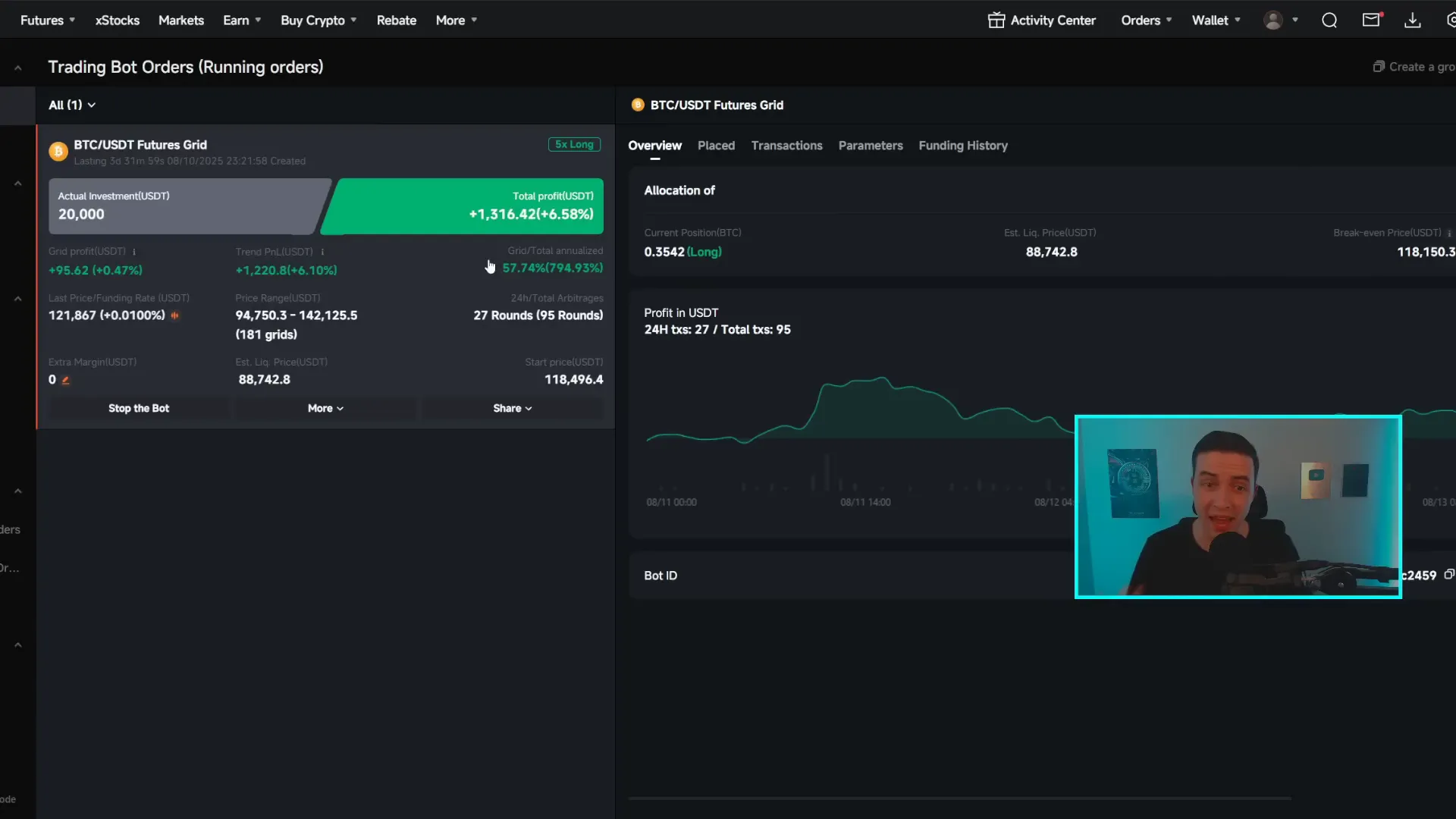

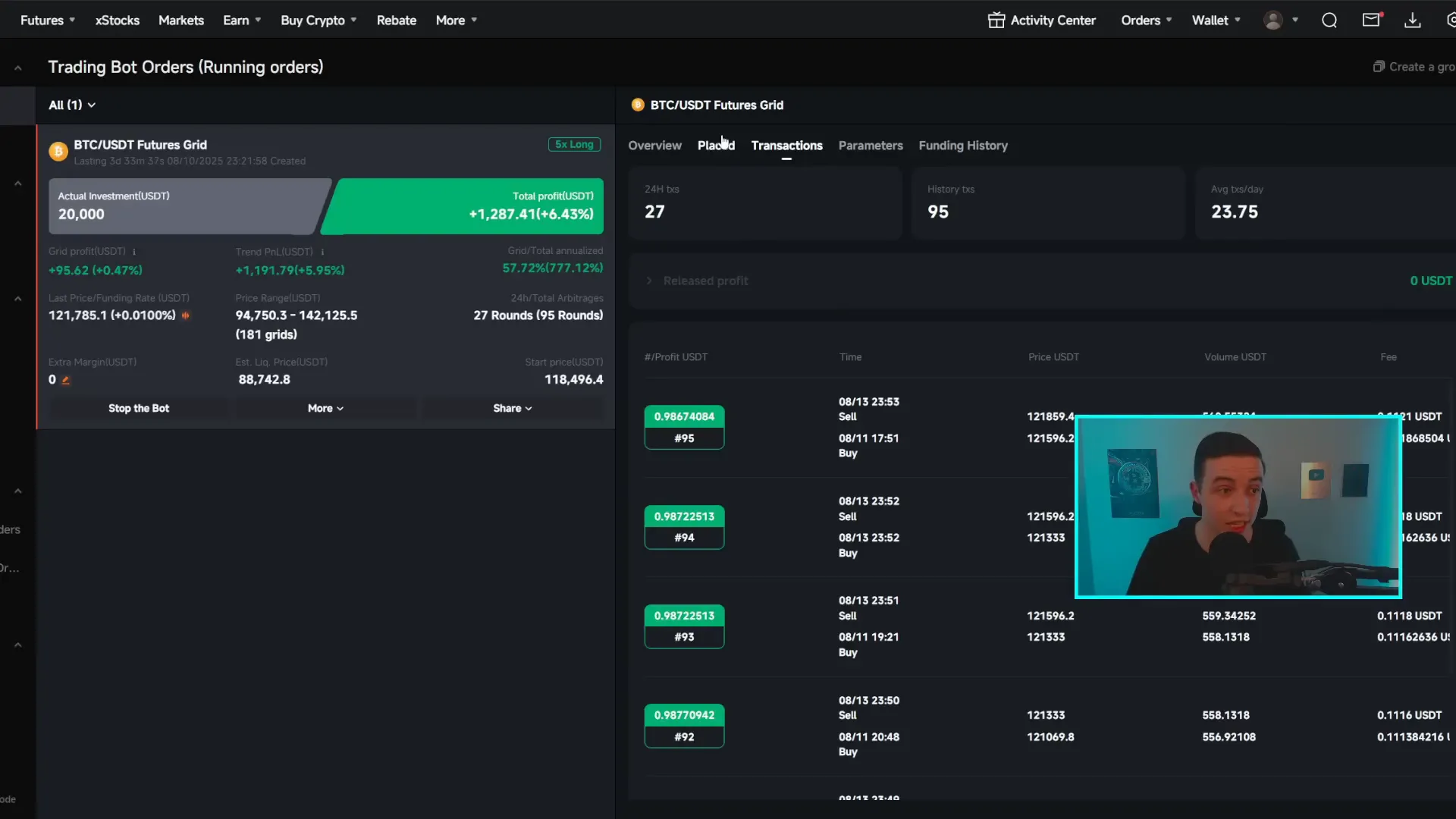

Exchanges, bots and how I collect passive income

I trade actively on an exchange for my directional longs and use a separate platform for automated grid trading that produces passive profits. For this trade I’m using Bitunix (no KYC in some regions) and Pionex for my grid bot. Pionex’s grid bot lets me set a price range and automatically buys low and sells high inside that band.

Example: I set a grid bot between $94k and $142k. If price oscillates, the bot repeatedly buys dips and sells rebounds. Over the recent move it’s generated well over $1,000 in passive profit so far. That’s cashflow I’d otherwise miss if I were strictly waiting for clean entries. It’s not a magic bullet — the bot loses money if price trends strongly below the lower bound — but it works well inside a range or consolidation.

Important implementation notes:

- Only use a grid bot inside a price range you are comfortable holding in case the market breaks lower (i.e., set lower bound where you would still hold the asset).

- Grid spacing and number of grids determine trade frequency and profit per cycle. Finer grids = more trades, smaller profit per trade.

- Copying a bot: if you want to replicate my grid, you can copy the exact settings. Always understand the downside — an extended crash below the bot’s lower bound will require manual intervention.

For active trading I use Bitunix (or other regulated/accessible exchanges depending on jurisdiction). Check local regs before using any exchange. Layering active trades with bot income is a practical way to earn while you wait for the bigger structural outcome. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

The Bitcoin dominance story: fueling Altcoin season

One technical read that’s been decisive for my altcoin exposure is Bitcoin dominance. On the multi-day timeframe Bitcoin dominance has broken down from support around 60.5%–61%. That matters because when Bitcoin loses dominance (market share), capital rotates into altcoins — especially large-cap alts like Ethereum and Solana.

Right now, the market looks more like an ‘Ethereum season’ — meaning ETH and ETH-related alts are outperforming. That’s not necessarily bearish for Bitcoin price; Bitcoin can run higher while dominance drops if altcoins outpace BTC in market capitalization gains. For traders, this is an opportunity to rotate a portion of profits from ETH into promising alts or to trade altcoins outright during the rotation. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Ethereum analysis: breakout, targets and what to watch

Price action and confirmation

Ethereum moved above a key resistance range around $3.9k–$4.1k and confirmed it with a candle close above $4.1k. That breakout validated the bullish narrative and opened the path to the prior all-time high area in the mid-to-high $4k range. My primary price target from that breakout is $5,000, which would be a legitimate ATH continuation once cleared.

Short-term risk: there’s a possible daily bearish divergence forming on ETHUSD (higher highs in price vs. lower highs in daily RSI). It’s not confirmed yet, but if it materializes, we should expect a short consolidation or pullback — potentially 1–2 weeks — before another leg higher. That’s normal even in strong bull trends and doesn't invalidate the larger bullish thesis unless price breaks key support levels. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

ETH vs BTC (ETHBTC)

On the ETHBTC chart there's also a possible bearish divergence in the daily RSI. If that confirms, Ethereum may underperform Bitcoin for a while — meaning Bitcoin could reclaim relative strength versus ETH. However, with BTC dominance falling, ETHBTC might stay bullish or at least flat because capital flows into ETH from smaller alts. Keep watching the dominance structure to interpret ETHBTC moves correctly. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

How I approach ETH trades

- Take partial profits near prior ATH resistance and rotate to other alts if ETH shows fatigue.

- Watch daily momentum (RSI + MACD) for divergence confirmations. If confirmed, expect short consolidation, not necessarily a trend reversal.

- If ETH breaks and holds above its ATH convincingly, look to add with tight risk management.

Solana (SOL): breakout attempt and rotation opportunity

Solana is now testing the $190–$200 resistance band. At the time of analysis Solana was slightly above $200 but had not yet secured a multi-day close above the level. Ideally you want to see at least a daily or two-day candle close and then a hold above the zone for a valid breakout.

If SOL confirms the breakout and holds, the next logical target is around $230 — roughly a +14–15% move from $200. For traders using leverage that’s an attractive short-term swing: 10x leverage would amplify that to ~150% profit (but I don’t advise using such leverage on altcoins without strict risk controls).

Why Solana? Two reasons:

- It hasn’t had as aggressive a run as Ethereum during this leg, so there’s room for catch-up moves if traders rotate profits from ETH.

- With Bitcoin dominance falling, money that was parked in ETH near its breakout might cascade into other large-cap alts like SOL.

Support to watch for SOL: $190–$200 initial flip, then $180 and $167 as deeper supports. If SOL fails to hold $167 on a multi-day close, the breakout attempt has weakened. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

XRP: structure, resistance and longer-term watch

XRP’s weekly chart shows a confirmed higher high in price but a corresponding lower high in the weekly RSI — meaning a weekly bearish divergence exists. Historically that suggests a risk of a larger pullback across the next several weeks or months. However, on the daily timeframe, XRP is catching a short-term bullish move while BTC dominance is dumping.

Key resistance zones:

- $3.35–$3.40 is the immediate resistance to test.

- If XRP breaks and closes convincingly above ~$3.40, the next target is the prior ATH range near $3.50–$3.60.

To truly flip the larger possible bearish price structure on longer timeframes, XRP needs to break and hold above $3.50–$3.60. If it cannot, it reinforces the view that the current structure resembles the January–February pattern where momentum faded. Tactical traders should use $3.10–$3.15 and $2.90 as support zones for buys on weakness. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Chainlink (LINK): breakout, targets and resistance

Chainlink rallied after breaking out above $20–$21 and I had been targeting ~$24 for the next move — and that’s precisely where LINK is starting to struggle now. Immediate resistance sits between $24 and $25. If LINK breaks above this band, the next target is the prior high near $26.60–$27 and beyond that $30 is the larger structural target.

Like other alts, LINK has a potential daily bearish divergence forming (higher highs in price vs. lower highs in daily RSI). Not confirmed yet, but a valid warning. If confirmed, expect short consolidations or a weeks-long cool-off. That doesn’t necessarily end the bull trend — it simply cools off an overheated leg. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Practical trade playbook — how I’d trade this environment

Whether you’re an active trader or a longer-term investor, here’s a practical playbook I use that you can adapt. These are step-by-step actions meant to be tactical and repeatable.

1) Define your role: core vs. active alloc

- Core (buy & hold): Allocate a portion of your portfolio to long-term BTC/ETH (no leverage) — this is your long-term conviction capital.

- Active allocation: Keep some capital for swing trades, breakout plays, or grid bots — this capital trades in and out more frequently.

This two-bucket method prevents emotional overtrading and ensures you always have exposure whether the market trends or ranges. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

2) Plan entries and exits (no guessing)

- Predefine the levels where you will enter, where you’ll take partial profits, and where you’ll place stops.

- For breakouts: wait for candle close above the zone and a retest as support (if it happens). For failed breakouts: consider waiting for the next higher-low confirmation.

My personal method: I place limit orders at structured pullbacks inside a bullish trend and set profit targets near obvious resistance clusters. I always move my stop to breakeven or into profit after significant runs to lock gains. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

3) Use size, not leverage, to manage risk

Size your trades so that a stop-out is tolerable. Rather than cranking leverage, use position size to dial portfolio risk. Example: If you want to risk 1% of your portfolio on a trade, calculate position size based on distance to stop; don’t just slap on 10x leverage unless you can afford full loss.

4) Trade confirmations and divergence signals

- Momentum divergence is a warning, not an immediate trigger. It signals caution and stricter risk rules.

- Wait for price structure to break or confirm — don’t trade solely on an EMI reading.

In this market, I respect the weekly divergence on BTC and other weekly divergences on select alts. They make me trim size or avoid aggressive leverage near the highest highs. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

5) Rotational trades during alt seasons

When Bitcoin dominance falls, rotate part of your profits into top alts (ETH, SOL, LINK, XRP) or trade them directly. Track correlation: if BTC rises but dominance falls, alts may outperform BTC; rotating into alts can amplify returns but increases idiosyncratic risk.

Examples of specific setups to consider

- Long BTC: Add on pullbacks that hold above the short-term higher-low level (e.g., the $118–119k range used earlier). Trim near $121–123k resistance if you’re risk-averse.

- Breakout copy: For SOL, wait for a daily close above $200 and hold, then add for a run to ~$230. Use tight stops below the breakout level if the breakout is decisive.

- Grid bot: A passive grid between $94k–$142k for BTC while volatility persists; consider smaller grid ranges for alts if you believe they’ll oscillate.

- ETH target: Add to ETH breakout above $4.1k but watch for short-term RSI divergence. If divergence confirms, reduce active exposure and resume adding on clean consolidations.

Risk checklist before placing trades

- Do I know the exact stop-loss level and will I adhere to it?

- Is my position size consistent with acceptable loss (1–3% of portfolio per trade is a common rule)?

- Am I using leverage? If yes, have I sized it conservatively?

- What are the macro triggers that would force me to re-evaluate (e.g., weekly RSI divergence confirmation, loss of structural higher-lows)?

- Do I have an exit plan for partial profits and for the rest of the position?

These questions keep you disciplined and prevent emotional decisions when volatility spikes. Discipline is the best defense against revenge trading and over-leveraging. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Managing emotions and the psychological edge

Trading is not just technical; it’s mental. I use three psychological rules:

- Lock partial profits early to remove emotional pressure — it’s easier to hold a position when part of it is already profitable.

- Pre-commit to trade rules (entry, exit, stop). If you deviate, you must have a documented reason and a re-evaluated plan.

- Accept losses — they’re part of trading. The goal is to have more winners or bigger winners than losers over time.

By combining a robust plan, proper sizing, and emotionally honest rules, you convert a chaotic market into a series of repeatable decisions that favor long-term success. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Putting it all together: a playbook for the week

This is how I’ll trade the next 7–21 days given the current reads:

- Keep core BTC holdings and avoid aggressive leverage given weekly divergence.

- Hold my active $300k BTC long with stops moved into profit; trim into $121–123k resistance if price struggles.

- If BTC breaks and holds above $122k, add a modest amount targeting $125–$130k.

- Watch BTC dominance: if it keeps falling, rotate a chunk of short-term ETH profits into SOL and LINK after confirmed breakouts.

- For ETH, expect tests of the old ATH in the high-$4k range and ultimately a push to $5k if momentum continues.

- For SOL, wait for confirmed hold above $200 and plan for $230 as the next swing target with support levels at $190, $180 and $167.

This plan balances conviction with caution. It’s a live, adaptable roadmap — not a rigid mandate. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Additional tactical notes and common questions

Q: What if BTC hits $130k in a straight run?

A: If BTC breaks the 121–123k band and accelerates strongly, I will let a portion of my position ride while taking off a meaningful tranche to lock profits. Never get overly greedy in a blowoff move — protect gains and re-assess with fresh technicals.

Q: Would I short during a rejection at all-time highs?

A: I only short with strong confirmation (clear reversal patterns, momentum failure, and loss of structure). Right now I'm not looking to short BTC as my bias is still bullish on the short-term structure. Futures and perpetual markets are tempting, but they demand stricter risk rules due to funding and liquidation risk.

Q: How do I balance active trading and long-term HODLing?

A: Use the 3-layer allocation method: (1) Core long-term holdings; (2) Active swing trading allocation; (3) Botized passive grid allocation. This way you capture the long-term upside while earning and compounding in the medium term. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Final thoughts and the edge I use

To summarize my edge right now: I blend price structure (higher lows/higher highs), momentum checks (RSI/MACD divergences), liquidity maps (heatmaps and Fibonacci levels), and disciplined trade management (scaling, stops and partial profits). That combination has allowed me to secure realized profits while keeping upside exposure in case of a confirmed breakout.

Remember — markets rarely move in a straight line. Expect re-tests, consolidations and occasional false breakouts. The profitable trader is the patient, disciplined one who plans multiple steps ahead and sizes positions for survival. If you adopt even a fraction of this approach — core allocation, active playbook, bot income and clear risk rules — you’ll be better prepared for this Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing cycle.

If you want to model any of the bots or trade setups I mentioned, start small and test the mechanics. Copying trade ideas without sizing discipline is the fastest way to lose. Trade like you have a job to keep: protect your capital first, pursue returns second. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Thanks for reading — I hope this breakdown gives you clarity, a repeatable plan, and confidence to act. Keep an eye on the 120–123k resistance for Bitcoin, the dominance for altcoin rotation, and daily momentum for divergence confirmations across ETH, SOL, XRP and LINK.

If you want to follow the full market walkthroughs and see my live adjustments, check my channel for step-by-step trade recaps and bot walkthroughs. Trade smart, size carefully, and don’t forget to lock profits when the market provides them. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing