Crytocurency, bitcoin: Why AI Could Reprice Where Long-Term Value Lives

Table of Contents

- Key takeaways

- AI as a moat-destroying force

- Why the hyperscalers matter

- Security, recursive improvement, and acceleration

- Where long-term value might migrate

- Practical steps for investors

- How to use AI in everyday investing and life

- Final thoughts

Key takeaways

- AI is a structural shift that may compress valuation multiples across many software-driven businesses.

- Defensibility is changing: abundant intelligence reduces traditional moats built on software and scale.

- Capital allocation may rotate toward scarce assets and physical build-outs as growth multiples migrate.

- Bitcoin becomes a tactical candidate for portfolios seeking a scarce growth asset with a different kind of moat.

The intersection of artificial intelligence and markets is not merely a new theme. It is reshaping how businesses defend profits and how capital flows between asset classes. If you hold crytocurency, bitcoin or you follow tech-heavy indexes, the implications are immediate: many assets that have behaved like durable growth plays may face multiple compression as AI commoditizes capability.

AI as a moat-destroying force

When intelligence becomes abundant, scalable, and cheap, the natural consequence is the erosion of traditional competitive advantages. Software companies that once relied on proprietary models, distribution, or user lock-in face a new reality: capabilities that used to take engineering teams months or years to build can now be replicated or improved quickly.

"AI is not a temporary thing."

That sentence captures the difference between a panic and a structural regime change. Markets rarely misprice short-term noise, but they frequently misprice long-term transformations. For investors, this matters because the metric that often drives portfolio size is multiples. Revenue can persist while multiples compress if perceived defensibility declines.

Why the hyperscalers matter

The companies building and hosting frontier models are central to this shift. Four large cloud and platform players are investing hundreds of billions into AI infrastructure. Their decisions—how much they monetize, how quickly they scale, and how they price access—determine whether the market treats AI as a benefit concentrated in a few winners or as a distributed capability that undermines incumbent moats.

If revenues tied to these massive investments do not scale in line with expectations, equity valuations for a broad swath of the market can reprice downward. The practical consequence: large pools of capital benchmarked to growth mandates may need new homes if growth multiples across software compress.

Security, recursive improvement, and acceleration

Two dynamics accelerate the transition. First, model improvements are happening rapidly; incremental releases can create step-function gains in capability. Second, those capabilities enable agent swarms that can probe, automate, and optimize at scale, which raises new security risks for both companies and consumers.

The combination of fast model improvement and emerging security vectors forces enterprises and governments to spend more on physical infrastructure, safeguards, and defensive technologies. That spending pattern favors assets tied to physical capacity and cryptography.

Where long-term value might migrate

If AI compresses margins and reduces company-level defensibility, capital historically allocated to "growth" may look elsewhere. Most institutional mandates are structured around growth allocations. Commodities and cyclicals do not usually fill that bucket. Enter scarce digital assets and physical infrastructure.

Bitcoin is notable because its supply dynamics are fixed. Unlike software platforms that can be iterated, diluted, or undercut by better models, bitcoin's protocol delivers scarcity that cannot be altered by competitive intelligence. That structural scarcity is why some investors position crytocurency, bitcoin as a potential recipient of growth-oriented capital if traditional software multiples slide.

Important caveats

- Bitcoin is not immune to risk-off correlation. Expect volatility during broad market stress.

- The timing of any rotation is uncertain. Multiple compression can play out over months or years.

- Scarcity alone is not a return guarantee; adoption, regulation, and macro cycles matter.

Practical steps for investors

The landscape calls for a thoughtful rebalance rather than panic. Consider these actions:

- Audit concentration in your portfolio—especially exposure to software-heavy indexes and ETFs.

- Stress-test growth allocations for scenarios where AI reduces margins and compresses multiples.

- Maintain optionality by sizing positions in scarce assets, infrastructure plays, and liquid hedges.

- Allocate for time—if you believe the structural case, allow for multi-year horizons and tolerate interim volatility.

How to use AI in everyday investing and life

The tools reshaping markets also improve individual productivity. Use AI daily to:

- Summarize research and identify blind spots in your theses.

- Automate repetitive data pulls and backtests.

- Upskill quickly—teach your children or team members practical skills that complement AI.

AI cannot yet replace human context and narrative. Original thinking, framing, and the ability to connect insights to real human problems remain valuable. Combine rapid AI-enabled research with judgment that understands what people actually want to read, buy, or use.

Final thoughts

Structural shifts are easiest to see in hindsight. Today, investors face a choice: assume AI is a temporary shock or accept it as a permanent, redistributive force. If the latter is correct, crytocurency, bitcoin and physical infrastructure could attract capital from compressed growth allocations over time. That does not make them immune to short-term drawdowns, but it frames them as part of a longer rotation.

The sensible path is to prepare: reduce unchecked concentration, learn to use AI as a force-multiplier, and consider how scarce assets fit into a diversified plan that expects change rather than clings to old defensive assumptions.

XRP UP 🚨BLACKROCK DUMPING MORE BTC ETH🚨 — Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — if you read one no-nonsense breakdown of what’s moving markets today, this is it. Market volume is soft, ETF flows are messy, a few big players are reshuffling balance sheets, NFT valuations are still smoking from the boom-to-bust, and influencers keep getting paid to hype stuff that often collapses. I’ll walk through the real mechanics behind the headlines so you don’t get burned chasing noise.

Quick market snapshot — liquidity, volume, and the headline noise

The crypto market opened the week with volume that can only be described as “meh”: roughly $94 billion across the board. That matters because when volume is low, price moves look louder and bigger than they actually are. The usual suspects — Bitcoin and Ethereum — looked soft, altcoins were volatile, and a couple of tokens saw inflows while most funds bled capital for the fourth straight week.

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing shows up everywhere right now because the conversation is dominated by ETFs, capital flows, and regulation — everything that affects how participants allocate money, and how fast that allocation changes when the music stops.

Regional flows tell the real story: the United States dominates the ETF asset base. When U.S. ETFs move, global liquidity follows. That’s why headlines saying “BlackRock dumped crypto” are technically accurate but deliberately incomplete. They’re not dumping spot Bitcoin on an exchange; they’re dealing with ETF redemptions and the associated removal of underlying assets.

BlackRock vs. crypto headlines: ETFs, not direct coins

Here’s the key distinction everyone should understand: when people read “BlackRock dumped $400 million of crypto,” they often picture Wall Street moving giant bags of BTC and ETH on exchanges. The reality is more prosaic and, frankly, more structural: the asset manager saw outflows from its spot BTC and ETH ETFs and had to reduce the ETFs’ underlying holdings accordingly.

Over the week in question, BlackRock’s spot BTC ETF (IBIT) recorded roughly $261 million in outflows while the ETH spot ETF faced about $157 million. Combined, that’s around $374 million of assets leaving ETFs — not a direct sale of Bitcoin from BlackRock’s corporate treasury into the open market.

Why does this distinction matter? Because ETFs create a flow-through mechanism. Investors sell ETF shares when they want out, and the ETF provider adjusts the vehicle’s holdings to reflect that. It’s a mechanical process. Market headlines conflate the ETF share redemptions with an aggressive, unilateral “dump” of crypto, which fuels panic and misleads retail holders.

Put simply: ETF outflows = share redemptions, which lead to asset reductions. The panic spin says “institutional dump.” The reality is: institutional products handled investor requests, like any other investment vehicle would. Yet the impact on market sentiment and price can be very real, because exchange-traded outflows remove liquidity and amplify price moves when volumes are thin.

ETF flows look weak — and have since October

The last 30-day window hasn’t been pretty for ETF flows. The major product launches drew a lot of attention in October, but sustained inflows have been inconsistent. When inflows reverse, ETF providers either redeem or sell underlying assets. That’s the plumbing of the market, and it’s boring — until it’s not.

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing participants need to keep an eye on these flows because ETF behavior often sets the tone for institutional sentiment. If ETF flows turn negative consistently, expect headline volatility and a continued fragile bid under prices.

MicroStrategy, Saylor, and the funny-money problem

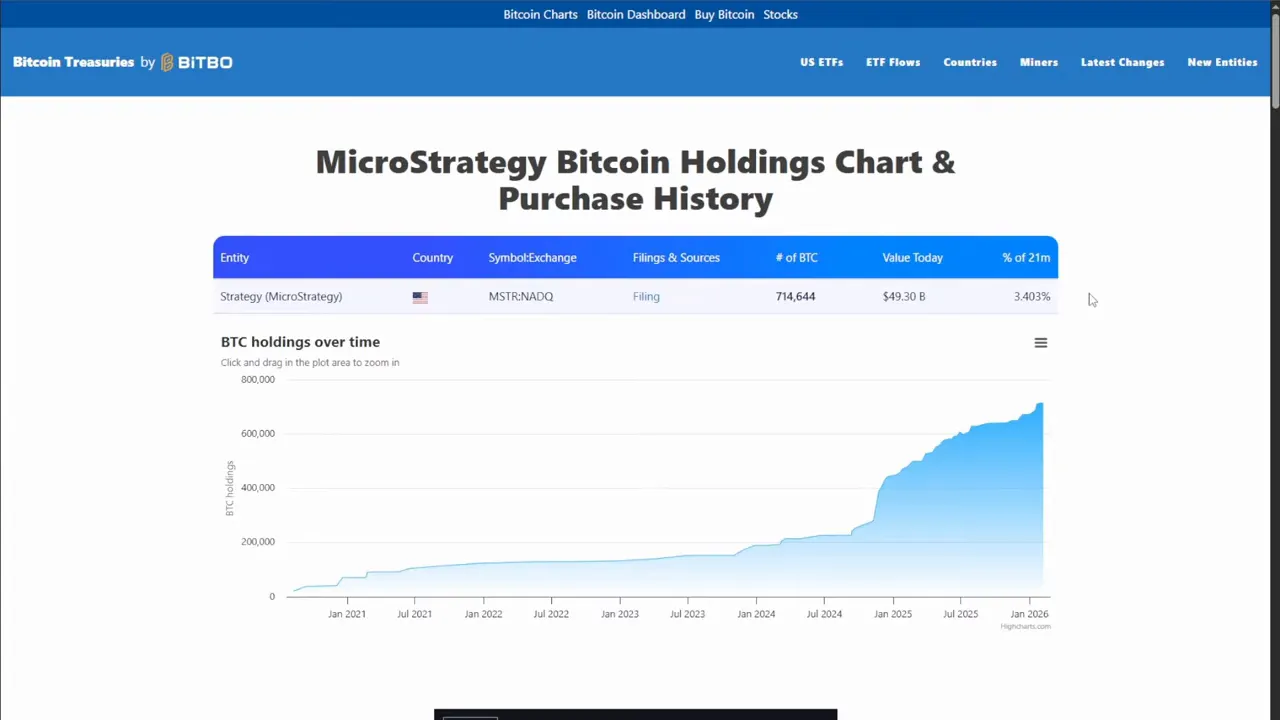

MicroStrategy announced a plan to swap roughly $6 billion of convertible debt for equity. On the surface, that looks like balance sheet management: convert debt into equity, reduce interest obligations, and reposition the company. But there’s a catch related to how Bitcoin holdings are valued versus how easy they would be to liquidate in a crisis.

The company claims it can withstand a hypothetical drop in Bitcoin price down to $8,000 and still cover its debts. That’s a math game that makes sense on paper but not in practice. If a company holds a massive position in BTC and needs to liquidate that position to pay down debt, attempting to sell a large chunk while markets are thin would push the price down — meaning you’d realize substantially less than the theoretical $8,000 per coin.

This isn’t theoretical nitpicking. When a single holder controls a meaningful percentage of floating supply, forced selling begets lower prices. Lower prices trigger margin calls, panic selling, and eventual cascades. It’s the old liquidity trap: assets are worth nominal values until mass selling realizes lower market prices because of market depth limits. And yes, that reduces the real-world value of those holdings the moment liquidation begins.

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing investors should watch large holders’ intentions closely because they can become the axis around which market shocks rotate.

NFTs, influencers, and the Trove Markets debacle

NFT valuations cratered after the speculative boom. High-profile purchases became cautionary tales. Case in point: a celebrity bought a Bored Ape for 500 ETH (about $1.2 million at the time), and its value later tumbled to roughly $12,000 — an eye-watering 99.99% decline for anyone who bought at the peak.

That story isn’t about talent or celebrity; it’s about market bubbly behavior and the toxic combination of hype-plus-liquidity. Money does not equal skill. People with deep pockets buy things they don’t understand because influencers and social proof are powerful. Then the market corrects.

Trove Markets: paid influencers and a refund in stablecoins

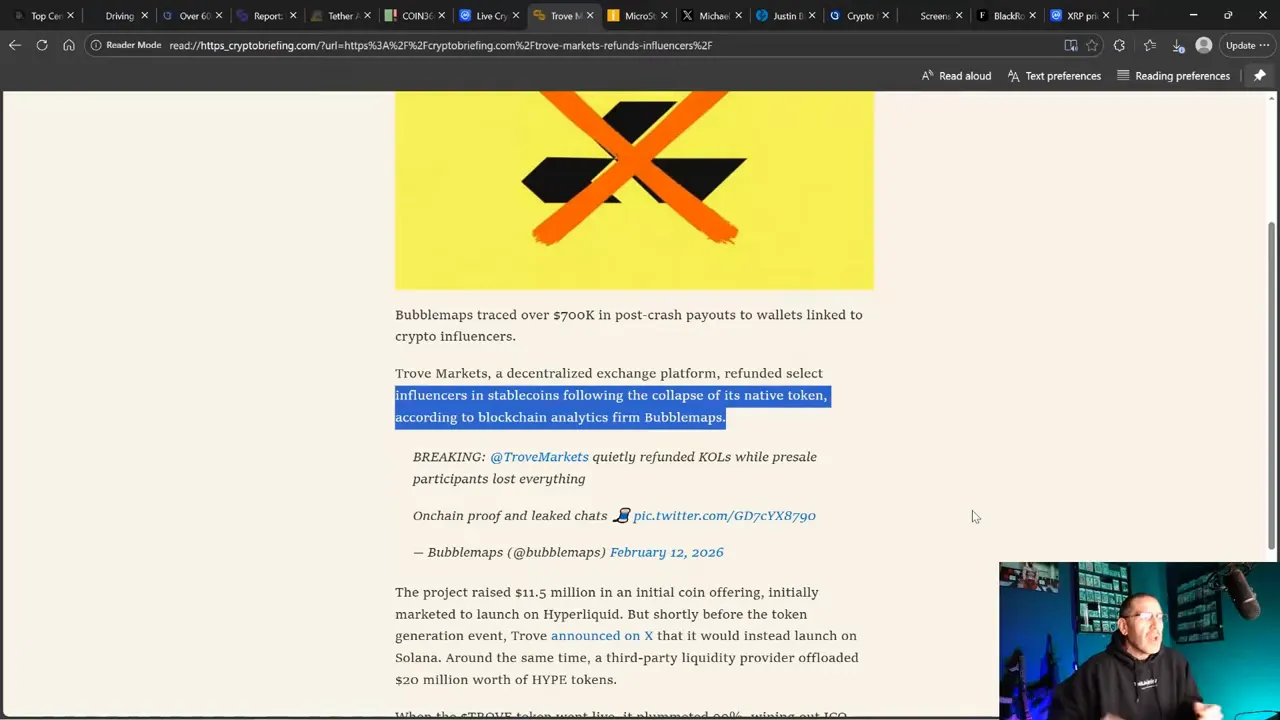

Trove Markets’ token launch is a recent, ugly example — and it’s textbook. The project raised around $11.5 million in an ICO, used influencers to build hype, then pivoted launch chains at the last minute. A third-party liquidity provider offloaded $20 million in hype tokens ahead of launch and, when the token went live, it collapsed roughly 99% — wiping out retail investor capital.

Here’s the kicker: Trove reportedly refunded select influencers in stablecoins after the crash. That means the influencers who promoted the token were quietly made whole, while ordinary contributors were left holding a wrecked token. Blockchain trace data showed hundreds of thousands of dollars in USDC and USDT moved through wallets linked to the project within hours of the crash.

This pattern is not new. Promoted posts, paid placements, and undisclosed sponsorships have been in crypto for years. What changed is the scale and audacity: projects now sometimes use stablecoins to settle influencer debts after rug pulls, meaning the people doing the public convincing get paid while investors eat the losses.

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing enthusiasts must learn to spot paid hype. If a token shows an organized wave of promotion across many accounts at the same time, that’s a red flag. If the promoters don’t disclose sponsorship or compensation, that’s a legal and ethical problem and a signal to keep your wallet closed.

How to spot shilled projects and avoid getting wrecked

Detecting shilled projects is both art and checklist. The market loves narratives, and scammers exploit that. Protect yourself with a few practical checks before clicking buy:

- Look for coordinated promotion. A sudden flood of social posts, identical language across channels, and a rush of “hot tips” are classic signs that a promo campaign is running.

- Check token distribution and liquidity. Who holds the tokens? Are there whale wallets or concentration that looks dangerous? If a few wallets hold most tokens, the exit risk is high.

- Follow the money on-chain. Large, suspicious transfers before or immediately after launch often reveal the rug pull playbook.

- Read the fine print. Promotions should disclose sponsorship. If the influencers hyping it aren’t transparent about being paid, consider that an implicit warning.

- Value real utility over narrative. Is the project solving a verifiable problem, or is it all buzzwords and vague promises?

These aren’t foolproof knives in the dark, but they move you from pure FOMO to informed skepticism. The market is fueled on hype. The moment you feel like you can’t afford to miss out, step back and run the checks above.

XRP, Solana, and fund flows: who’s winning the inflows?

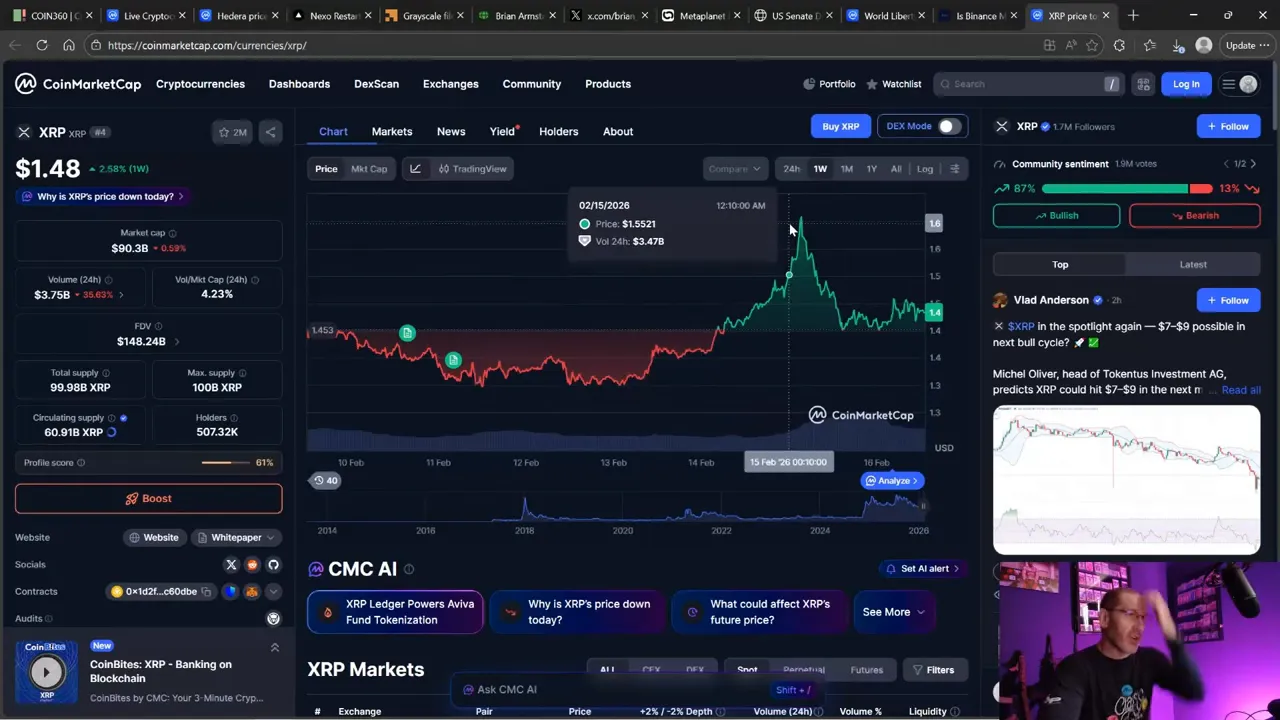

Amid the general outflows, a couple of assets still attracted capital. XRP and Solana (SOL) saw inflows in contrast to the broader bleeding across crypto funds. XRP’s price bounced back to about $1.50, and its weekly volume held up better than many altcoins.

Why does that matter? Because hot money migrates to perceived momentum, and flows to XRP and Solana suggest traders still see pockets of opportunity. But flow behavior is fickle—what goes in this week can evaporate next week if the market narrative shifts.

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing participants should treat these inflows cautiously. A handful of funds or a few regional markets pushing money into a token doesn’t equate to durable demand. Watch on-chain activity and sustained usage metrics, not just headline inflows.

Regulatory timing and the Senate Banking Committee delay

If there’s one thing that could flip markets from fragile to confident, it’s regulatory clarity. Unfortunately, the Senate Banking Committee delayed a mega-markup vote that included crypto provisions, and it’s now been more than a month with little public progress. That delay matters.

Why? Because regulatory clarity opens windows for institutional products, custody, and clear accounting rules. When the timeline drifts through election season, the window for constructive policy can close for a long stretch. That drives capital patience lower and market volatility higher.

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing participants should keep an eye on policy calendars. An announced vote or compromise can create momentum; radio silence often puts the market on edge.

Why the U.S. matters more than any other market

Asset under management (AUM) stats put the scale disparity on full display. Of roughly $132 billion in AUM across the ETF landscape discussed, about $110 billion sits in U.S.-listed products — around 83% of the market. The U.S. is the heavyweight: when it moves, the rest of the world feels it.

Germany and Switzerland show up as influential regional players, but they’re nowhere near the U.S. in total AUM. That concentration means that U.S. ETF investors set much of the tone. That can be stabilizing or destabilizing depending on whether flows are net positive or negative.

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing folks need to plan for U.S.-centric risk because global capital allocation often mirrors what happens in U.S. products.

Practical moves — how to navigate the current landscape

Markets are messy, headlines are louder than reality, and the typical pump-and-shill cycle keeps repeating. If you want to protect capital and position for opportunity without turning into a headline chaser, consider these practical steps:

- Reassess portfolio liquidity needs. In low-volume environments, selling large positions quickly can materially lower execution prices. Plan trades in tranches and use limit orders where possible.

- Hold cash or stablecoins for opportunities. Volatility creates openings. Holding deployment capital avoids FOMO buys at the peak of the hype cycle.

- Use on-chain analytics and flow data. Watch ETF flows, whale movements, and exchange balances. Changes in those metrics often precede price action.

- Verify influencer promotions. If a token is being hyped hard, assume it’s paid until proven otherwise. Don’t chase promoted narratives.

- Diversify allocation across risk profiles. Keep a mix of core (BTC, ETH), tactical (high-conviction altcoins), and opportunistic positions (small caps or liquidity events), sized to your risk tolerance.

- Stay updated on regulatory milestones. Votes, committee announcements, and rule changes move capital. Mark calendars and avoid surprise exposure around big policy events.

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing reputation is built by those who survive cycles, not those who call tops and bottoms loudly. Long-term success doesn’t come from hype; it comes from position sizing, timing, and patience.

Real talk: influencers, paid promotions, and who gets paid when projects fail

There’s an uncomfortable truth in crypto communities: promoters often get paid regardless of outcomes. The Trove Markets example shows refunds to influencers in stablecoins while ordinary investors lost value. That’s not a unique story — it’s a pattern.

Influencers and projects sometimes work a deal that compensates promotional work. If the token tanks, promoters may get stablecoin refunds, meaning their public-facing advocacy cost them nothing. Meanwhile, retail participants who bought tokens during the hype often absorb the loss.

That creates perverse incentives. When marketing outweighs product, the market becomes a machine that transfers wealth from late retail into early-stage promoters and insiders. Smart players watch the promoter side of the ledger—and then decide if they want to play that game.

My final take and what matters going forward

BlackRock’s “dump” headlines need to be read through the ETF lens. The company isn’t necessarily selling spot holdings from corporate coffers; ETFs are inherently flow-through instruments. MicroStrategy’s debt-equity swaps highlight liquidity illusion risk when a huge holder would be forced to sell into low depth. Trove Markets and the larger influencer ecosystem show scammers and promoters remain active, and regulatory delays keep institutional adoption uncertain.

Market participants should treat every hyped narrative with a dose of skepticism and evaluate risk with sober tools: on-chain data, flow charts, AUM figures, and clarity on who benefits when a token surges. Use the checks listed above to spot organized promotion and keep position sizes appropriate for your tolerance.

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing will keep changing. Headlines will scream. Influencers will promote. Projects will pump and then dump. The players who do best are the ones who separate signal from noise, watch flows, and keep enough capital in reserve to act when opportunity presents itself.

What to do next

If you want to act rather than react:

- Keep a small core of BTC and ETH as portfolio anchors.

- Watch ETF flows daily if you trade around macro headlines.

- Run on-chain checks before buying hyped tokens: token distribution, liquidity, and early whale activity.

- Avoid flashing cash into influencer-driven launches unless the promoter discloses compensation and you understand the vesting/liquidity schedule.

- Track regulatory calendars; treat delayed policy votes as reasons for cautious exposure.

Markets love drama. But you don’t have to be a participant in every episode. Keep your plan, mind the flows, and don’t confuse publicity with validity.

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing is here to stay as an asset class and a technology. The noise will change form, but the core drivers — adoption, liquidity, and regulation — remain constant. Learn to read those signals; the rest is just background noise.

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — Did BTC Hit a Real Bottom After a 52% Crash?

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing are more than tags — they’re the lens through which every move in markets gets interpreted right now. A 52% pullback from October highs down to early-February lows has left a lot of investors asking whether a durable bottom is in place for Bitcoin. This piece walks through what the charts are telling us, why institutional and corporate flows changed the game, where risk is concentrated, and how to think about positioning across crypto, equities, and precious metals over the next few months.

Where we are: the short-term setup for Bitcoin

Price action matters first. After a sharp pullback — roughly 50% off the highs — the immediate question is whether Bitcoin can reclaim the technical territory that indicates stabilization. Two signals matter most for a short-term bounce:

- Reclaiming the 21-day moving average. When price moves far from the 21-day, a reversion to the mean often follows. If BTC can climb back above the 21-day and press toward longer-term averages, a relief rally into the $80k–$85k band is within the realm of reasonable outcomes.

- 200-week support. The long-term 200-week moving average has been a structural bid. Holding that level and building higher lows is the textbook way a local bottom forms after heavy sell-offs.

If both of those hold, expect short-term tradable rallies. That doesn’t mean the cycle is over or that a new parabolic phase has begun — but it does offer tactical windows for traders to take advantage of a mean reversion move. For context on the market frame, remember that Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing remain top-of-mind for every allocation discussion right now.

What a relief rally looks like

Relief rallies are typically stair-stepped. You’ll see short, aggressive moves up that retrace part of the sell-off, followed by consolidation and either a renewed leg higher or another leg lower. In practical terms:

- Expect volatility. Moves above the 21-day may be sharp and driven by short-covering and tactical buying.

- Take profits along the way rather than assuming a straight-line run to new highs.

- Watch altcoin dynamics — sometimes they outperform on relief ripples; sometimes they lag until BTC stability is confirmed.

And yes, from an SEO and conversation perspective, the topics of Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing keep coming back because they are the framework for how investors think about allocation, risk, and opportunity today.

Why Bitcoin tanked: institutional and corporate flows changed the rules

The market environment that allowed Bitcoin to run up in previous cycles is different today. Two structural buyers used to act as the reliable engines of demand:

- Spot ETFs and institutional flows — big dollar inflows to spot Bitcoin ETFs created substantial, predictable bid days that supported higher prices.

- Corporate treasuries — public companies buying Bitcoin and holding it as a corporate asset created another consistent layer of demand.

Over the last year, those engines have shifted. ETF inflows have become more inconsistent and, at times, turned to net outflows. When the ETFs are net negative in spot Bitcoin consumption, the supply/demand balance is challenged and price momentum weakens. This structural dampening of demand helps explain why Bitcoin fell despite periodic big buyers stepping in.

It’s worth repeating the lens: Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing are tightly coupled to where institutional capital chooses to allocate — and that allocation has become less one-directional.

Reading the ETF data

Two useful ways to read ETF impact:

- Dollar flows — how much capital is entering or leaving ETFs in fiat. Large positive days supported the prior uptrend; increasing frequency and size of outflows are a warning sign.

- Bitcoin consumption — the actual number of BTC bought or sold by ETFs. It directly changes available supply.

When both metrics go neutral or negative for sustained periods, momentum dries up. That’s a structural backdrop for lower highs and deeper corrections until new types of buyers emerge or existing buyers return in force.

MicroStrategy: the elephant in the room

One corporate name dominates the conversation: MicroStrategy. It’s not an exchange, it’s not a cold wallet in a broad distribution — it’s a public company that has intentionally built a large BTC position using debt and balance sheet resources.

Between the cyclical highs and the recent lows MicroStrategy acquired roughly 70,000 additional Bitcoin. Yet during that same period, market price declined by roughly 50%. That disparity highlights a few painful realities:

- Concentration risk. Large, single-entity holdings act differently than distributed holdings. If sentiment turns, the market reacts not just to Satoshi or exchange-held coins, but to the behavior and constraints of concentrated corporate buyers.

- Liability-driven selling. MicroStrategy has debt maturities and obligations. If the macro environment turns sour — equities falling across the board — the company may need to raise cash, refinance under worse conditions, or sell BTC to meet debt payments.

- Psychological impact. Heavy corporate buying once reassured markets. Now the market asks: who will buy if big corporate buyers can’t keep adding without introducing systemic risk?

That last point is crucial: Bitcoin used to have one narrative — scarcity meets growing demand. Now the narrative includes balance-sheet mechanics, refinancing risk, and the question of buyer breadth. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing conversations must factor in balance-sheet realities when assessing upside potential.

MicroStrategy’s limits aren’t just liquidation risk

MicroStrategy’s leadership has suggested liquidation levels are far below current prices, implying comfort. But liquidation is only one channel by which their BTC position can affect markets. The other is cash flow needs. Paying interest, rolling debt, and covering corporate expenses can create selling pressure even if outright liquidation thresholds haven’t been hit.

That nuance matters because it changes how a market digests incremental buys from a company like MicroStrategy: purchases may not signal uninterrupted accumulation; they can be a stopgap or tactical move while long-term liabilities loom.

Short-term trading vs. mid/long-term investing

Different horizons require different rules. For traders, short-term reclaims of the 21-day and moves into the 80k–85k band are actionable. For investors with longer horizons, the broader macro picture dictates whether those rallies are buying opportunities or traps.

- Traders — use risk-defined entries, scale into moves above the 21-day, and take profits on strength. Consider smaller degree leverage only if risk controls are in place.

- Investors — avoid averaging blindly into weakness without a framework for where systemic risk resides. If equities and commodities turn lower as part of a broad de-risking, crypto correlations can increase and amplify downside.

Across both approaches, the statement “don’t expect a straight-line march to new all-time highs” is a practical rule. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing are all subject to macro cycles; reflexive optimism without risk management is a recipe for being “bagged” when the music stops.

Altcoin dominance and short-term rotation

Altcoins sometimes rally when Bitcoin stabilizes. Right now, there are signs of altcoin life: meme coins, AI plays, and select DeFi names have popped in small windows. That’s normal. Two structural notes on alt rotation:

- Dominance cycles matter. Alt dominance rising above key moving averages suggests risk appetite is returning, at least temporarily. Those moves often coincide with relief rallies in BTC.

- Be earlier, not later. Multiples in alt markets are rarely as explosive as they used to be once retail and institutional access mature. The best returns come from being ahead of narratives rather than chasing post-mania.

Short-term opportunities exist, but they are not identical to the multi-year moonshots of previous cycles. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing all remain theme anchors — but the payoff curves have changed.

Wider markets: equities flashing warning signs

The bigger, scarier part of the thesis is not whether BTC ticks up for a few weeks. It’s whether global risk assets are entering the phase where a long secular expansion ends or at least pauses for a prolonged correction.

What to watch in equities:

- Moving averages flipping roles. The 21- and 100-day moving averages have been acting as magnets and support in earlier phases. When they flip to resistance, the speed of expansion slows and corrections deepen.

- Gap fills and long-term resistance lines. The S&P 500 has structural gap zones and a very long historic resistance line around certain levels. If price reclaims that line as support after a gap-fill, a new leg up is possible. If it fails, a much larger correction becomes more likely.

- Chopping into moving averages. If indices chop below the 100-day and then struggle to break back above, that’s often a prelude to deeper pullbacks toward the 200-day.

My working target to watch on the S&P is a gap-fill zone around 6,000, which would be the area where prior resistance from decades past becomes a potential support. If the market finds support there and treats the line as a base, it can be the springboard for another expansion. If it fails, it’s a clear signal to de-risk risk assets, including crypto.

NASDAQ and the technology cycle

The NASDAQ deserves special attention. It has not set a new high since October and has already used the 21- and 100-day averages as resistance in multiple attempts. A move to the 200-day and a gap-fill from earlier in the prior year is entirely plausible. That scenario is not extreme — it is a 15%–18% correction — but when taken with other signals, it points to a market that’s more fragile than many expect.

Remember: even a 15%–20% correction in equities can easily reverberate into crypto because of correlated flows and risk-on/risk-off dynamics. Bitcoin is not immune to macro risk, despite its unique narrative.

Commodities and precious metals: late-stage signals

Precious metals have already rallied significantly. Commodities are often the late-arriving indicator — they catch up once equities and risk assets have already run higher for a while. That makes recent strength in gold and silver an important signal, not the final proof on its own.

Silver in particular has been volatile and historically prone to multi-year cycles where highs can be tested and then fail multiple times before a definitive bottom or new trend appears. A gap-smack or flash down can be a powerful sign that a speculative phase has exhausted itself.

If precious metals have topped in the near-term while equities are showing signs of stalling, the combination is a classic late-cycle indicator. It’s not a guarantee for a devastating collapse across all assets, but it increases the probability that risk assets will experience deeper mean reversion.

Once again, place this in the framing: Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing are all sensitive to where capital flows when the macro narrative shifts from expansion to contraction.

Where to hide (and where not to hide) if risk assets break

When the music stops, the immediate instinct is to avoid holding cash. There’s a narrative that central banks will print and devalue currencies, so being in cash feels like “losing” by default. Reality is messier.

- Cash and high-yield liquid placements are underrated in a market drawdown. Having liquidity allows you to buy at lower prices and deploy capital after the worst of the selling happens.

- Assets that decline plus currency debasement are double punishment. If you’re forced to sell assets during a drawdown, the timing and price matter far more than theoretical future printing.

- Yield-bearing liquid instruments — short-term Treasuries, high-quality money market funds, or short-duration instruments that provide yield without excessive price volatility — are pragmatic places to park capital until the dust settles.

Important caveat: hyperinflation scenarios are rare and extreme. For the typical investor, the balanced approach is to preserve optionality with cash and liquid yield while keeping a playbook to buy meaningful dislocations.

For crypto-native investors, that might mean keeping a portion of capital in stablecoins on reputable platforms or custody, ready to deploy into quality selling. For broader investors, it’s about trimming exposure and keeping dry powder to take advantage of severe market dislocations.

Portfolio actions to consider now

Here are practical, tactical actions that map to different risk tolerances and timeframes:

- Conservative: Reduce directional exposure to risk assets. Increase cash or short-duration yield. Keep a clear buy plan for meaningful market weakness.

- Moderate: Take profits on large winners, scale into stablecoins/cash, and keep a checklist of macro signals that would trigger incremental buys (e.g., gap-fill plus moving average support confirmed).

- Aggressive: If comfortable with high drawdowns, set staggered buy levels for BTC and selected altcoins below current price. Use tight position sizing and risk management because the market can remain irrational longer than expected.

Across all buckets, the golden rule is clear: define where you will add, and do not add as a reflex to headlines without a plan. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing are all part of a larger allocation decision — not a stand-alone ticket to unlimited upside without risk controls.

Behavioral traps and mental models

Markets punish common behavioral mistakes:

- Blind averaging — adding to losing positions without a thesis or stop can be destructive.

- FOMO on every bounce — assuming every rally is the start of a new bull run leads to being whipsawed.

- Overconfidence from recent gains — recent outperformance creates complacency. Remember history: extended expansions are followed by meaningful corrections.

Good habits: write down your plan, include targets and stop rules, and test emotions against facts. When the market is noisy, process-driven approaches win over gut instincts.

What a multi-asset downturn could look like

If the worst-case plays out — gap fills, long-term resistance failing, and broad deleveraging — the world could see a 40%–50% drawdown in equities and correlated assets. Crypto would likely be hit harder in percentage terms because of leverage and cross-asset flows.

That scenario is not the base case; it’s a plausible tail risk. The difference between a garden-variety correction and a full reset is the speed of de-risking and how central banks respond. Historically, the biggest corrections coincide with long-term credit tightening, valuation extremes, or exogenous shocks.

Prepare for both paths: an orderly mean-reversion that creates buying opportunities, or a deeper correction that requires patient accumulation and risk control.

Practical trade setups and watchlist items

For traders and active allocators, here are concrete items to watch and trade:

- BTC reclaim of 21-day — if BTC reclaims and holds, look for short-term swing entries with tight risk management and predefined profit targets.

- Altcoin rotation — monitor dominance metrics and rotate into higher-quality alts that show relative strength during BTC relief rallies.

- S&P gap-fill and 200-day — use the gap-fill area as a framework for scaling exposure. If price treats the area as base, increase exposure; if it fails, reduce exposure aggressively.

- MicroStrategy equity vs BTC — watch MSTR’s share action relative to BTC. Short-term, MSTR can outperform BTC on an oversold stock bounce; long-term, its balance-sheet dynamics remain a risk.

Each setup should include position size, stop, and target. Avoid the common mistake of trading setups without a risk exit.

How to think about opportunities without getting reckless

Opportunities look different today than in prior cycles. With broader access to crypto and more institutional involvement, rallies may be shallower and less frequent unless macro liquidity conditions tilt aggressively toward easing.

To capture upside without getting reckless:

- Be early to trends but small: allocate small, staggered positions rather than going all-in on narratives.

- Focus on quality projects and reputable counterparties to reduce execution and custodial risk.

- Keep a multi-asset view: crypto can outperform in select regimes, but correlations rise during panic. Have a plan for cross-asset drawdowns.

It’s tempting to chase calls for 200k or 300k BTC. Those outcomes are possible under certain macro conditions, but not inevitable. Build for optionality and protect capital first.

A realistic outlook for the coming months

Short-term: a relief rebound into the 80k band for BTC is plausible if the 21-day is reclaimed and ETFs stabilize. MicroStrategy and certain altcoins may offer tactical bounces.

Medium-term: the broader macro picture — equities, commodities, and precious metals — will dictate whether those bounces are a pause or the start of a new expansion. If indices gap-fill and hold long-term support, a new leg up becomes more likely. If they don’t, drawdowns deepen and cash becomes a strategic asset.

In every scenario, return to basics: risk management, plan-driven entries, and liquidity to buy real dislocations. And yes, the set of conversations labeled Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing will persist because these themes sit at the intersection of technology, finance, and macro policy.

Where I’m watching closely (checklist)

- BTC above the 21-day and reaction at long-term moving averages

- Spot ETF inflows vs outflows and total BTC consumption by ETFs

- MicroStrategy debt schedule and any signs of balance-sheet-driven selling

- S&P 500 gap-fill around 6,000 and whether it becomes support

- NASDAQ response to the 200-day and gap-fill from the previous year

- Gold and silver’s reaction at 100-day levels and whether commodities remain elevated

Voice of caution with a readiness to act

Caution is not pessimism; it’s preparation. Markets have cycles, and the rules of engagement evolved as institutional and corporate flows reshaped the crypto landscape. Keep liquidity, insist on risk-defined positions, and look to add to allocations only when your checklist signals a higher probability setup.

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing are themes worth staying engaged with — but engagement must be disciplined. The road ahead offers opportunity, but it also asks for humility.

Final thoughts and action plan

There’s no magic answer that applies to everyone. If you prefer a simple framework to follow this season, try this:

- Define your horizon: trading, swing, or multi-year investing.

- Set specific trigger points where you will add, trim, or exit positions (moving averages, gap-fills, and ETF flows are great anchors).

- Hold cash or yield instruments ready to deploy into dislocations.

- Keep position sizes small relative to total net worth if you are in risky, high-volatility assets.

- Reassess quarterly and after major macro events; don’t anchor to a single narrative.

This plan isn’t sexy, but it preserves optionality when outcomes are uncertain. Most importantly, it avoids the single biggest mistake: getting caught holding the bag when a broad correction finally arrives.

If you track market moves with these markers in mind, you’ll be able to respond rather than react. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing will continue to generate headlines and headlines can be loud — but steady, process-driven decisions win over time.

crytocurency, bitcoin: $100K Ahead — Why a Final Shakeout Could Hurt Before It Helps

Table of Contents

- Key takeaways

- What’s different this cycle

- Why Bitcoin still looks like a store of value

- Where market structure warns: Ben Cowen’s framing

- Practical rules for positioning

- Short checklist for investors

- Final perspective

Key takeaways

- Long-term store of value comparison: Bitcoin has historically outpaced inflation far more often than gold since 2010.

- Two plausible paths: A short, painful capitulation under key cost-basis levels or an early end to the winter and a steady climb toward higher targets.

- Risk management matters: Leveraged positions and impulse chasing are common causes of ruin during bear phases.

- Sentiment signals: Apathy, not mania, has characterized the latest cycle top — and that changes how corrections play out.

The crytocurency, bitcoin story today is less about whether $100K is possible and more about what must happen before a credible push higher. Two market voices converge on a pragmatic view: Bitcoin remains an attractive inflation hedge over the long run, but history and market structure argue that pain often precedes sustained breakouts.

What’s different this cycle

Past Bitcoin tops were loud. Headlines, retail mania, and parabolic momentum pushed prices into what many models called a terminal zone. This time the top arrived quietly. Social interest data shows indifference rather than mania — prices stalled not because everyone was buying, but because few cared.

That matters because the mechanism of a correction looks different depending on how a market tops. Euphoric tops tend to produce clear blow-off collapses that are easy to spot in hindsight. Apathy-driven tops often unwind via sharper resets that catch participants offside and make bottoms feel heavier.

Why Bitcoin still looks like a store of value

Comparing assets is about performance under stress, not headlines. Since 2010, Bitcoin has outpaced inflation the vast majority of time, while gold has been less consistent. That does not mean gold cannot rally — it can and has — but the long-run data favors Bitcoin when measured against inflation-adjusted returns over the past decade and a half.

Three practical points follow:

- Inflation matters: Real purchasing power erosion creates demand for assets that preserve value. Bitcoin benefits when currencies weaken or policy mistakes pile up.

- Scale effects: Gold’s market cap and liquidity make its moves large enough to draw capital and attention, which can temporarily siphon flows from smaller asset classes like crypto.

- Context is key: A few months of outperformance by gold do not erase a decade of data showing Bitcoin’s relative inflation protection.

Where market structure warns: Ben Cowen’s framing

Historical bear cycles share a common choreography: price first falls below the realized price and then beneath the balance (or cost-basis) price. In past cycles, these moments corresponded to maximum holder pain and eventual capitulation. That pattern has repeated in 2011, 2015, 2018, and 2022.

“Every bottom is V-shaped.”

Two technical levels are worth noting as reference points: the realized price around mid-50Ks and the balance price near 40K (levels will move over time). While no one can predict exact bottoms, history suggests there is a credible path that includes brief undercuts of these levels before a durable bull market resumes.

Why this analysis matters

- It explains why bottoms can be sharp even when there was no preceding bubble.

- It provides a framework for understanding potential downside and where long-term holders typically capitulate.

- It highlights the risk that headline-driven narratives (gold is back, Bitcoin is broken) often peak when selling is near its end, not the beginning.

Practical rules for positioning

Whether you believe the sell-off is nearly done or expect further pain, apply rules that favor survival and optionality.

- Size positions to risk tolerance. Avoid leverage. Even directionally correct trades can be wiped out by intraday volatility.

- Dollar-cost average rather than trying to time a perfect bottom. Many meaningful entries are missed by waiting for an exact low; historically, V-shaped recoveries penalize perfect timers.

- Keep an eye on macro signals. A more dovish central bank, cooling inflation, and a turning business cycle have historically supported risk assets — including crypto.

- Watch sentiment and flows. Peak pessimism among traditional finance professionals and ongoing rage selling inside crypto are useful contrarian indicators.

- Plan exit and re-entry rules. Define clear stop-losses and re-entry triggers so emotions do not dictate decisions during rapid moves.

Pro tip: Treat position sizing and a written plan as nonnegotiable. Survival in bear markets preserves optionality to participate when momentum turns.

Short checklist for investors

- Have you limited leverage to zero or near-zero exposure?

- Do you use dollar-cost averaging if you expect further volatility?

- Are you comfortable holding through a V-shaped bottom?

- Do you monitor realized-price and balance-price zones as psychological and structural reference points?

Final perspective

The crytocurency, bitcoin conversation is often binary: breakout or bust. A more useful lens accepts both possibilities and prepares for either. The odds favor a future where Bitcoin reaches higher nominal targets, but not without intermittent pain that cleanses weak hands and clears the path for sustainable growth.

History does not guarantee outcomes, but it offers recurring patterns: tops formed by apathy can precede painful undercuts, and momentum in other safe-haven assets can temporarily redirect capital. Keep plans simple, risk-managed, and rooted in the difference between holding and trading.

Are you planning for a final shakeout or positioning for an early end to winter? Use the checklist above to decide—and let risk management do the heavy lifting.

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing: Why Wash Trading, Treasury Losses, and Regulatory Drama Matter Right Now

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing—those six words summarize what’s driving markets, headlines, and a lot of investor angst this week. Prices are wobbling, exchange behavior is under scrutiny, corporate treasuries are showing losses, and regulators are circling deals that smell politically sensitive. This is a fast-moving market where liquidity, perception, and regulation combine to move prices far more than fundamentals alone. If you trade, hold, or even think about crypto, you need to understand what’s happening beneath the surface so you don’t get blindsided.

Quick snapshot: the three big stories you need to know

- MetaPlanet’s massive Bitcoin exposure and a reported $605 million full-year loss after spending billions accumulating BTC.

- Allegations of wash trading on Binance that may have produced rapid XRP pumps and dumps, triggering liquidations and false volume signals.

- Regulatory theater and platform moves — from Senate inquiries into politically linked crypto investments to Nexo restarting services in the U.S. amid ongoing regulatory uncertainty.

How a corporate treasury gone wrong becomes everyone’s problem

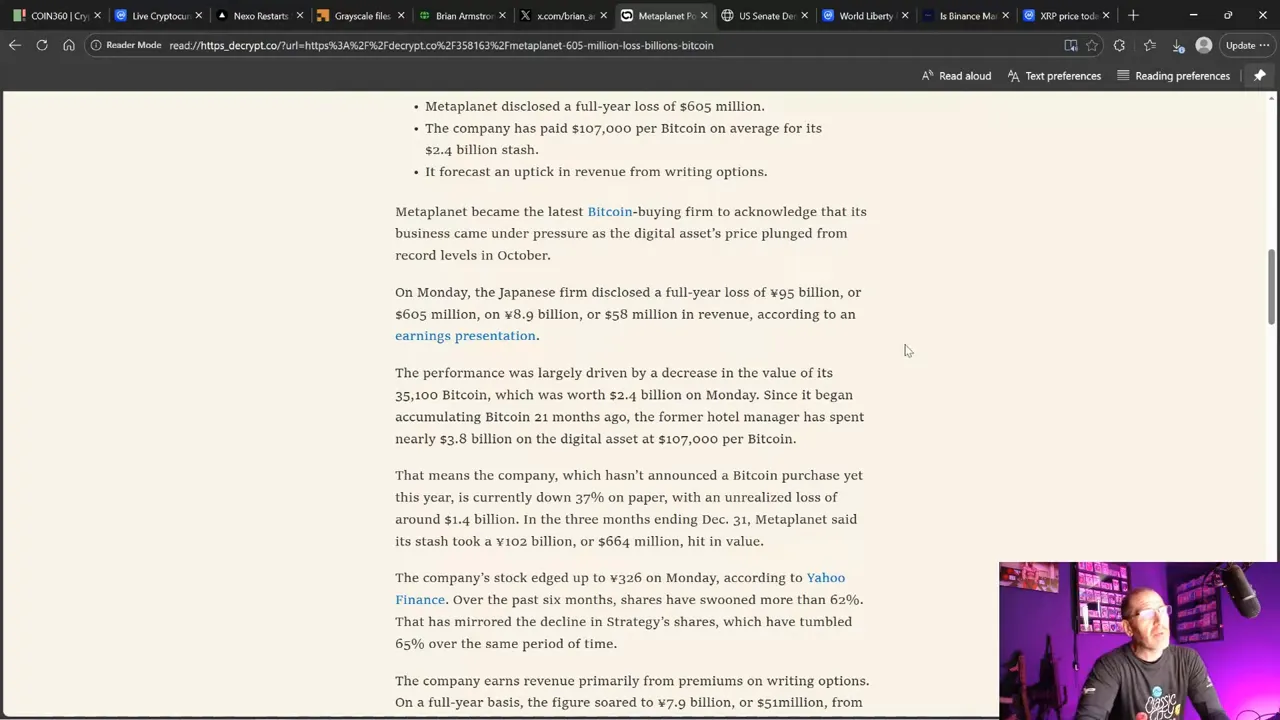

MetaPlanet, a Japanese firm that pivoted into Bitcoin accumulation, disclosed a full-year loss on the order of $605 million. They spent nearly $3.8 billion acquiring around 235,100 BTC over 21 months, but that stash was worth roughly $2.4 billion at the time of reporting. On paper that’s a roughly 37 percent unrealized drop from cost—painful, and it raises a critical question: how many firms with crypto-heavy treasuries can absorb another drawdown?

Think about it like personal finance. If you lost your job tomorrow, how many months of expenses could you cover? Corporate treasuries face the same test. Companies that allocated large shares of their balance sheet to BTC during frothy markets are now exposed to sharp drawdowns if they can’t or don’t top up positions.

Why does that matter for the broader market? Because treasury sales, or the inability to buy the dip, changes supply dynamics. Firms that are underwater may pause further accumulation or even sell into weakness to cover liabilities or preserve cash. That directly reduces demand at lower prices, making bounces shallower and corrections deeper.

Practical takeaway

- Monitor public treasury disclosures. A single firm liquidating several thousand BTC can pressure price action.

- Don’t assume corporate buy-ins are endless—balance sheets get stretched.

- When headlines trumpet a “treasury buy,” check purchase dates and current holdings vs cost basis.

What is wash trading and why XRP traders are worried

Wash trading is an old market manipulation tactic where the same capital is moved back and forth between accounts to create the appearance of high volume and artificial price movement. In crypto, that looks like two wallets or accounts repeatedly trading the same asset so charts show big pumping action while no real new money enters the order book.

Why do manipulators care? Because fake volume and sudden price spikes can:

- Trigger stop-loss orders and liquidate leveraged short positions.

- Create FOMO among retail buyers who think a breakout is real.

- Allow the orchestrators to sell into the manufactured liquidity, then buy back lower after liquidations work through the system.

Recently, sharp intraday moves in XRP—rapid surges up to $1.40–$1.60 followed by quick dumpbacks—have many traders pointing fingers at wash trading on major venues like Binance. The pattern looks familiar: a fast pump, a cascade of liquidations, then a rebound once shorts are flushed out. That sequence benefits the manipulators by letting them harvest profit on both the pump and the pullback.

Example visualization: a one-month XRP/HBAR-style spike where a quick pump erases as soon as buyers run out of conviction. Sudden volume spikes can be illusory if the same capital keeps changing hands.

How wash trading actually happens, step by step

- A large player or coordinated group moves funds between accounts and exchanges to create a visible spike in volume and price.

- Other traders—often retail—interpret this as genuine momentum and enter long positions or buy the breakout.

- Leveraged shorts that bet against the pump are liquidated, adding selling pressure at the top of the move.

- Manipulators sell their holdings into the manufactured liquidity and then buy back after the wash has subsided, profit secured.

How to spot suspicious pump-and-dump attempts

- Check on-chain and exchange order-book depth. Does traded volume show corroborating withdrawals or transfers?

- Look at time-of-day and venue concentration. If a single exchange shows outsized volume and others do not, that’s a red flag.

- Watch for repeated intraday patterns—same size, same profile—across days or weeks.

Visual cue: a pump to $1.60 and an immediate retrace back to prior levels is a classic marker that the move might not be organically supported by new buyers.

Case study: XRP, HBAR and the "pump-and-flush" rhythm

These dynamics aren’t theoretical; markets have seen them repeatedly. XRP’s surges and subsequent sell-offs mirror similar old-school pump-and-dump schemes. HBAR experienced comparable spikes that also looked engineered—short-term blasts followed by rapid erasures. When a token repeatedly exhibits that rhythm, rational investors start to conclude the moves are being manufactured.

Manipulation doesn’t have to be 100 percent malicious to be dangerous. Even coordinated or careless trading by a handful of large accounts can create knock-on stress for retail traders using leverage, for liquidity providers, and for exchanges themselves.

What retail traders should NOT do

- Don’t blindly buy into a sudden pump without checking order-book depth and cross-exchange activity.

- Avoid opening large leveraged positions during frenzied spikes—liquidations can be swift and brutal.

- Don’t rely on “volume” as a single signal. Verify the source and persistence of that volume.

Exchanges and optics: Coinbase’s 'diamond hands' moment

On the other side of the exchange spectrum, Coinbase’s CEO publicly praised retail users for holding steady during market turbulence. He called out “diamond hands” customers who kept buying the dip. That’s good PR. The optics soured, however, when it emerged the CEO had sold large amounts of company stock around the same period—legal and reasonable from a personal finance standpoint, but not great optics when juxtaposed against messaging that encourages retail to hold through volatility.

There’s a structural tension here. Exchanges profit indirectly from a healthy, active user base and trading volume. That means they talk up resilience while their executives may reduce personal exposure to company equity or take profits. The reality: corporate incentives and retail incentives often diverge.

Investor takeaway

- Separate platform PR from on-chain reality. High-level messaging can mislead about actual market health.

- Audit executives’ filings when public companies are involved; insider sales can inform sentiment—even if legal.

- Diversify across custody and execution venues to avoid concentration risk tied to a single exchange narrative.

Institutional flows and the ETF shift

Institutional appetite is changing the shape of crypto demand. Grayscale’s filings around a spot Aave ETF and other institutional-focused products show big players prefer regulated, familiar instrument wrappers rather than direct custody of tokens. ETFs lower friction for traditional investors and funnel large pools of capital through institutional rails.

That shift has practical consequences:

- Spot ETFs can create sustained demand but also concentrate redemption and creation pressure inside traditional finance channels.

- Institutional flows often chase regulated products, which can increase market resilience—or quickly transmit macro shocks.

- Derivatives desks and sophisticated arbitrage players reprice risk around ETF mechanics, changing volatility patterns for underlying tokens.

Nexo’s U.S. return: a good sign or a gamble on shaky rules?

Nexo announced it’s restarting services in the United States after more than three years away, citing improved clarity in U.S. digital asset regulations. Services will be structured through partners with licensed U.S. providers, and some offerings will be routed through SEC-registered investment advisors.

But here’s the catch: there’s still no ironclad, long-term regulatory framework that guarantees a stable operating environment. Much of the progress to date looks more like a series of executive-level nudges and enforcement decisions than a comprehensive statutory regime.

That matters because executive actions can be reversed by the next administration. A platform that re-enters a jurisdiction on the basis of favorable guidance or softened enforcement may face renewed scrutiny if policy changes. That’s why Nexo’s move feels both hopeful and risky.

Questions investors should ask about re-entering firms

- Who are the onshore partners and custodians, and what licenses do they hold?

- What services are offered through SEC-registered entities and which rely on state-level charters?

- Does the firm have a plan to withstand regulatory reversals or aggressive enforcement?

Where did the cash go? Gold, silver, AI, and the reshaping of market flow

Liquidity flows are not random. During this cycle, retail and institutional capital rotated into places perceived as safer or more immediately profitable—AI stocks, a sudden gold and silver squeeze, and other macro plays. That pulled a chunk of discretionary capital away from crypto.

Printing cash alone doesn’t guarantee a return of that capital to crypto. When central banks ease, an allocation decision is still made by traders and CIOs. Right now, the capital that would have chased memecoin rallies in 2021 may instead sit in AI momentum trades or precious metals driven by hedging behavior.

Implication for crypto investors

- Don’t assume liquidity will auto-return. If altcoin volume is subdued, big rallies will likely be more selective and rely on structural flows like ETFs.

- Active money chases conviction. Where fundamentals or narratives are stronger (AI, precious metals), expect capital to stay there until a new catalyst appears.

Market health: volume, dominance, and the current backdrop

Overall market volume has been soft. BTC and ETH outflows from exchanges have been pronounced, while altcoin season indicators are tilting back toward BTC dominance. Low volume environments are primetime for manipulation because thin books amplify the effect of relatively modest orders.

When the United States takes a regulatory step or even hints at-friendly treatment, prices can rally quickly because the U.S. still controls a huge share of ETF flows and institutional demand. Conversely, when the messaging is hostile, prices can drop hard because that demand dries up.

What to monitor on a daily basis

- Exchange inflows and outflows for BTC and ETH.

- Spot vs futures basis spreads—widening spreads can reveal liquidations or supply stress.

- Large on-chain transfers to exchanges (potential sell pressure) or to cold wallets (holder accumulation).

- Regulatory announcements and commentaries from the U.S. Treasury, SEC, or Senate committees.

Practical portfolio rules for this environment

Markets characterized by thin liquidity, possible wash trading, and regulatory uncertainty call for tighter risk controls. Here are rules that help manage downside while leaving room to capitalize on upside.

Position sizing

- Limit any single speculative position to a small percentage of liquid net worth.

- Use smaller sizes on altcoins that show signs of suspicious volume or pump-and-dump behavior.

Leverage discipline

- Avoid high leverage in thin markets—liquidations happen fast and painfully.

- If you use leverage, cut it to levels you can absorb without emotional selling during a flash drop.

Execution tactics

- Break buys into staggered limit orders rather than a single market order during pumps.

- Set realistic stop losses and avoid “hoping” they won’t execute if news is uncertain.

Due diligence checklist

- Check exchange-level trade concentration. Is one exchange responsible for most of recent volume?

- Scan on-chain flows for large transfers or coordinated activity.

- Review project fundamentals—team, tokenomics, lockups, and major holders.

- Read regulatory filings for institutional-grade products tied to the token or sector.

How to respond if you suspect wash trading

If you think a token is being wash traded, treat price moves as suspect until proven otherwise. That means:

- Avoid aggressive entries at the top of sudden pumps.

- Wait for confirmation from multiple venues and on-chain indicators.

- Prefer limit orders and position sizing that account for the possibility of a quick flush.

Regulation: politics, probes, and the ultimate risk factor

Regulatory attention has intensified, and sometimes that attention is politically charged. U.S. Senate Democrats asked the Committee on Foreign Investment in the U.S. to probe a UAE investment tied to a politically exposed person. That kind of scrutiny mixes geopolitics and finance, raising questions about how quickly the rules will land and who will be exempt or targeted.

Regulation is both an opportunity and a risk. Clear rules attract institutional capital because compliance becomes easier. But regulatory crackdowns or politically driven probes can trigger rapid repricing, especially when a single country like the U.S. dominates market access through ETFs and custodial frameworks.

A practical timeline to watch

- Major committee letters and responses—these often trigger short-term volatility.

- Formal rulemakings or agency guidance from SEC, CFTC, Treasury, or the banking regulator.

- Election cycles—administration changes can flip enforcement priority overnight.

Tools to use right now

To navigate this market, use a combination of on-chain analytics, exchange flow monitors, and traditional financial filings. Some tools worth having on your dashboard:

- On-chain explorers and analytics platforms that show transfers and wallet concentrations.

- Exchange flow trackers to monitor deposit/withdrawal trends.

- Price and volume heatmaps across venues for cross-checking sudden spikes.

- SEC and corporate filings for public-company treasury disclosures.

Why this screenshot matters: corporate filings and treasury snapshots provide context for headline losses. When you see a company with billions in BTC purchases, put their disclosure on your watchlist.

Common myths—and the reality

Myth: If volume spikes, it’s always real demand

Reality: Volume can be illusionary through wash trades or coordinated transfers. Cross-check across multiple exchanges and on-chain sources.

Myth: Institutional interest means a one-way rally

Reality: Institutional products like ETFs change the flow profile, but they can create concentrated supply/demand dynamics that cut both ways during stress.

Myth: Regulatory clarity equals safe markets

Reality: Clarity helps, but it’s the content of rules and enforcement consistency that determine real safety. Executive guidance can be reversed; statutory rules are more durable.

What this all means for you

The current backdrop rewards patience, skepticism, and disciplined execution. There will be opportunities—both in BTC and selected altcoins—but the path there is noisy and occasionally malicious. Wash trading and shallow liquidity make short-term trading riskier. Corporate treasury losses and political probes increase tail risk.

That doesn’t mean stepping out of crypto entirely. It means being tactical:

- Keep a portion of capital in dry powder for genuine dips that are backed by broad liquidity and cross-exchange confirmation.

- Use smaller position sizes on assets with suspicious trading patterns.

- Prefer regulated or custodial solutions for significant allocations if you value institutional protections.

Snapshot: announcements about U.S. service restarts or regulatory signals can move price action quickly. Track the timing and substance—not just headlines.

Action checklist for the next 30 days

- Scan your portfolio for exposure to tokens with repeated pump-and-dump patterns.

- Set realistic stop-loss levels and adhere to them.

- Create a watchlist of treasuries and public filings for firms with big BTC holdings.

- Subscribe to on-chain alert feeds for large wallet transfers to exchanges.

- Keep abreast of regulatory news from the U.S. Treasury, SEC, and Senate Banking Committee.

Parting thoughts

This is a market of narratives and flows. When capital is scarce and headlines are loud, the easiest trades become the most crowded and the most manipulated. Stay skeptical of sudden volume spikes, keep risk manageable, and remember that regulatory clarity—not PR—drives sustainable institutional demand.

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing—use that framework as a mental checklist: is the move driven by real Bitcoin demand? Is it a crypto-native phenomenon? Is BTC the source of strength or just the headline? Is blockchain activity reflecting utility, or are we chasing transient narratives? Let those questions guide your actions, because in a market this fast and occasionally dirty, staying disciplined beats trying to catch every flashy pump.