In the past 24 hours the crypto landscape shifted in three clear ways that matter for investors and builders alike. If you follow crytocurency, bitcoin and broader digital assets, these are not small headlines — they signal changes in regulation, capital flows, and even government positioning. Below I break down what happened, why it matters, and how to think about positioning without hype.

Table of Contents

- Key takeaways

- 1) The Fed’s policy shift: from special program back to normal supervision

- 2) BlackRock and the Ethereum stampede

- 3) Treasury positioning: U.S. government and Bitcoin reserves

- Putting these signals together: what it means for markets

- How to think and act — practical positioning

- Why this isn’t the old crypto cycle

- Conclusion

Key takeaways

- The Federal Reserve has announced it will roll back a special supervision program for bank crypto and fintech activities, moving oversight into standard supervisory processes.

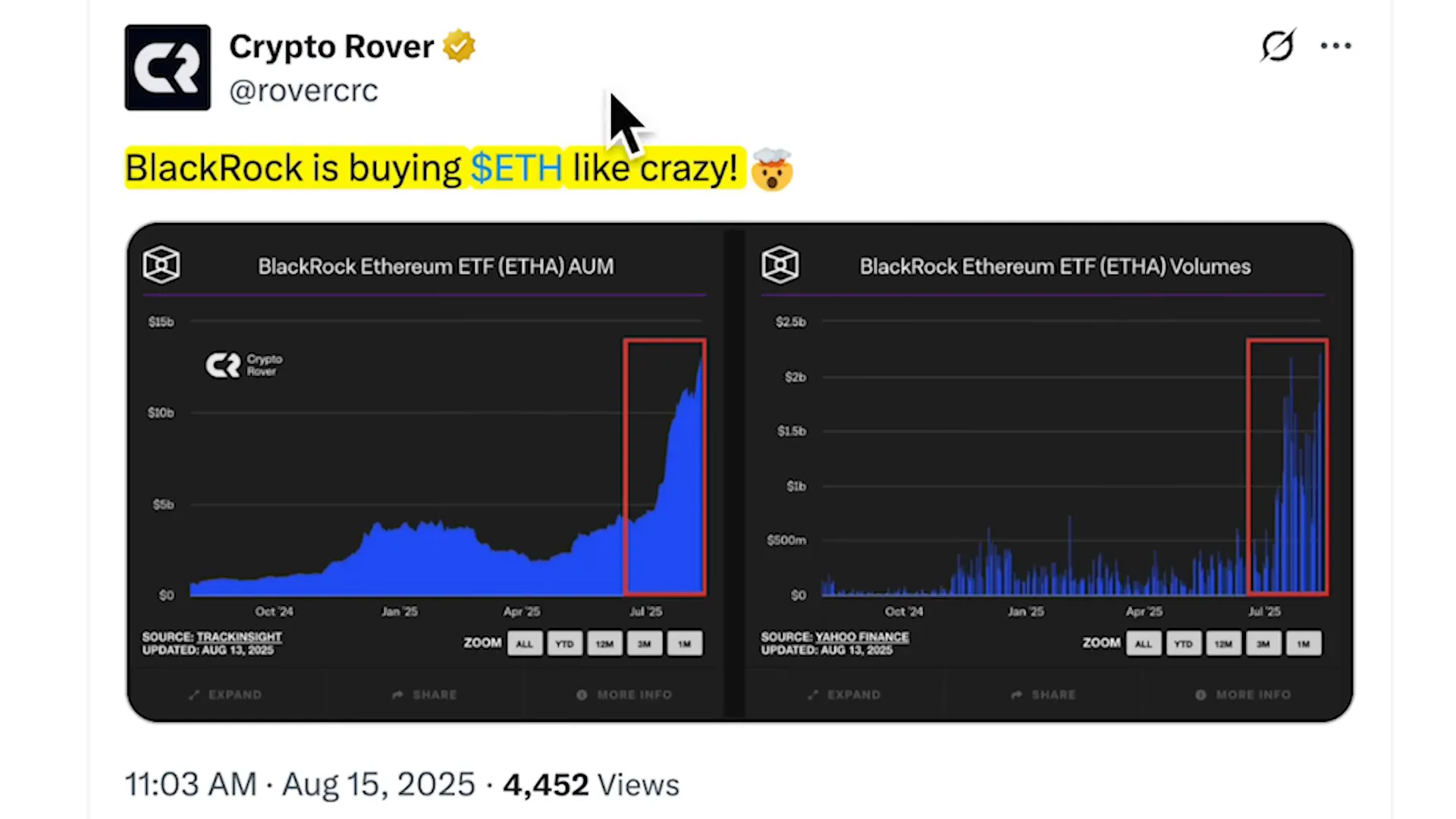

- BlackRock and other large institutional buyers are piling into Ethereum ETFs, producing unusually large inflows that dwarf Bitcoin ETF flows in recent days.

- Comments from the U.S. Treasury suggest government-held Bitcoin reserves and even potential future purchases are back on the table.

1) The Fed’s policy shift: from special program back to normal supervision

The biggest quiet development is regulatory normalization. The Federal Reserve announced it is sunsetting its Novel Activities Supervision Program and integrating what it learned about crypto risks into its standard supervisory framework. On paper that sounds procedural; in practice it’s a signal.

“Banks are free to provide banking services to the crypto industry to crypto companies.”

That quote captures the rhetorical shift. For years banks operated under conservative guidance, and many avoided crypto relationships. When the Fed says it’s comfortable moving crypto oversight into regular channels, it reduces a key barrier for large banks to service crypto firms and for banks themselves to explore crypto-related activities.

Why this matters: capital flows follow permission. When the largest custodians and asset managers perceive lower regulatory friction, more institutional dollars can enter. That’s a structural tailwind for crytocurency, bitcoin and for tokenized financial products.

2) BlackRock and the Ethereum stampede

Institutional adoption is visible in flows. Ethereum ETFs — led by big firms like BlackRock — just posted one of their largest inflow days: roughly $600 million over 24 hours and a streak of consecutive positive inflows. In the last several days ETH ETF flows have been roughly 2x those of Bitcoin.

What’s happening is simple: asset managers and their clients are buying exposure through ETFs, which is cleaner for many investors than spot custody. These inflows also reflect a broader acknowledgment that Ethereum’s ecosystem — not just token price — is durable. For investors who want diversified crypto exposure, that realization changes risk allocation and product design in portfolios that once held only Bitcoin.

3) Treasury positioning: U.S. government and Bitcoin reserves

The third signal is political and symbolic. The Treasury has clarified its approach to seized crypto assets, and Treasury officials have left the door open on future Bitcoin purchases by the government. That’s noteworthy in two ways: it creates a public store-of-value narrative and it reduces selling pressure from confiscated assets.

“New Bitcoin purchases by the US government are very much still on the table.”

Whether or not the Treasury actually buys more Bitcoin, the mere possibility changes market psychology. It sends a message that crypto is part of national asset-management conversations — not just fringe speculation. That mainstreaming nudges sovereign wealth funds, family offices, and large corporates to revisit allocations to crytocurency, bitcoin.

Putting these signals together: what it means for markets

Individually each development matters; together they form a narrative: regulatory acceptance, institutional product demand, and neutral-to-positive government posture. That combination is often what drives multi-year trends.

- Regulatory normalization lowers the cost of entry for big banks and custodians.

- ETF inflows concentrate demand through familiar financial products, making on-ramps easier for traditional investors.

- Government-level acceptance reduces tail-risk for extreme policy actions and changes the risk premium for long-term holders.

How to think and act — practical positioning

There’s no one-size-fits-all play, but here are pragmatic principles I use and recommend to others thinking about crytocurency, bitcoin exposure now:

- Prioritize core holdings: if your goal is long-term exposure, focus on high-conviction assets first (for many, that’s Bitcoin and Ethereum).

- Use regulated products where appropriate: ETFs and custodial solutions from established players can reduce operational risk for sizeable allocations.

- Scale in over time: large institutions buy the story in tranches; individual investors can mirror that — avoid all-or-nothing moves.

- Keep liquidity and risk tools ready: with increased institutional flows, volatility can still be sharp. Have a plan for rebalancing and risk management.

Why this isn’t the old crypto cycle

Look at who’s driving the current wave: policymakers, large asset managers, and wealthy family offices. Four years ago, retail and early adopters dominated narrative and price action. Today it’s suits and institutional balance sheets — that’s a different market ecology. That doesn’t mean prices only go up, but it does change the playbook on how adoption unfolds.

Conclusion

These three events — the Fed’s supervisory change, massive Ethereum ETF inflows led by BlackRock, and renewed Treasury openness on Bitcoin holdings — are connected threads. Together they lower barriers, increase demand, and shift perception of crytocurency, bitcoin from niche experiment to mainstream asset class consideration.

My advice: focus on fundamentals, size positions thoughtfully, and treat this phase as a structural opportunity rather than a short-term momentum trade.

3 Major Signals That Could Change the Future of crytocurency, bitcoin. There are any 3 Major Signals That Could Change the Future of crytocurency, bitcoin in here.