Hi — I’m Josh from Crypto World. In this deep-dive I’ll walk you through the exact technical setups, trade management, and altcoin rotation signals I’m watching right now. I’ll also share the real trades I’ve taken, how I’m sizing and adjusting stops, and the bots and exchanges I use so you can take actionable steps on your own. This is a practical, play-by-play Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing update designed to be useful whether you’re trading actively or building passive exposure.

What you’ll get from this guide

- Clear read of Bitcoin’s weekly and short-term technicals: resistance zones, momentum indicators, and realistic upside targets.

- My personal trade plan — entries, profit-taking, stop loss moves and mental framework for managing a large directional long position.

- How Bitcoin dominance is shaping an altcoin season and which altcoins I want to trade: Ethereum, Solana, XRP and Chainlink.

- How I use exchanges, bots and passive strategies to both actively trade and earn passive profits.

- Practical trade setups, support/resistance levels and contingency plans if price rejects or breaks out.

Heads up: this piece reflects my current view and trade plan. It's educational and transparent — I put my money where my mouth is and explain why. If you want the short version: Bitcoin is at a major resistance band, the BTC weekly structure has a longer-term bearish divergence to respect, but the short-term structure remains bullish and I'm still long. I'll explain what that means and how I’m navigating both the potential all-time high breakout and a possible pullback. This is for Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing readers hungry for actionable clarity.

Quick snapshot: The macro and the trade

- Macro: Bitcoin weekly still shows a bullish trend but with a notable bearish divergence on the weekly RSI. Divergences are not immediate sell signals — they are longer-term warnings to watch price behavior around key levels.

- Short-term: The 8-hour structure is bullish — higher highs and higher lows — and momentum on the 3-day MACD is neutral (no strong directional bias yet).

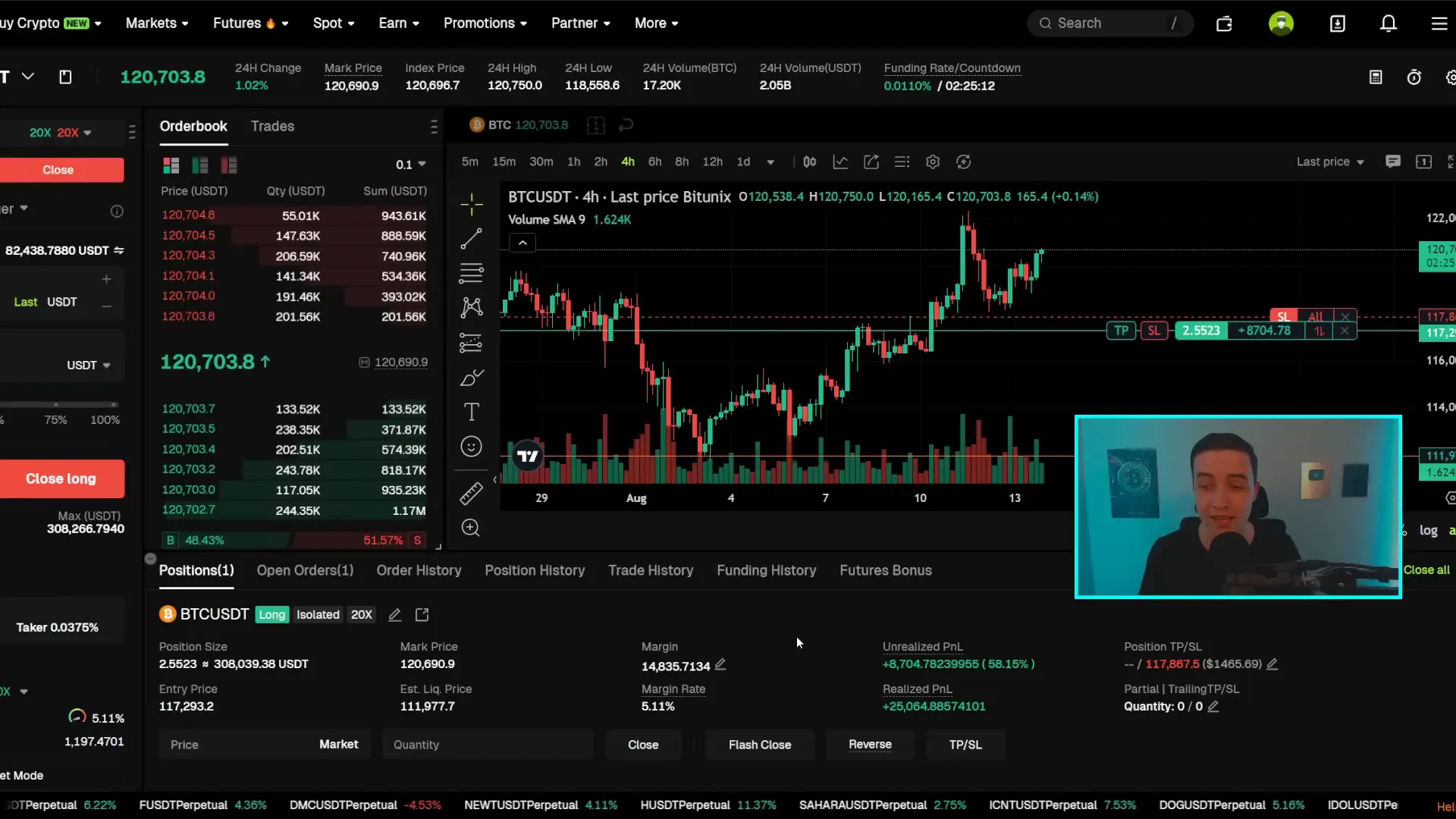

- My position: Roughly a $300,000 long on Bitcoin. I have taken partial realized profits (~$25,000) and adjusted my stop to lock in more gains. I plan to remain long while price structure stays bullish, trimming into resistance and adding on pullbacks.

This is a live trading plan you can model or adapt for your own risk tolerance as part of your Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing workflow.

Bitcoin technicals: weekly vs short-term

Weekly view — the bigger picture

Zooming out to the weekly Bitcoin chart, the super trend (a trend-following filter) remains green. That means the broader trend is bullish. But we also have a classic technical red flag: a bearish divergence between price and the weekly RSI. In plain language: Bitcoin has made higher highs, while the weekly momentum reading has not matched the strength — it’s making lower highs. Historically that pattern preceded a larger multi-week pullback on the prior cycle.

Bearish divergences on a weekly timeframe are not immediate sell signals — they are strategic caution signs. They tell you to respect resistance levels and to be conservative with leverage. They also mean that while a breakout above all-time highs is possible, we should avoid extrapolating parabolic targets (like instantly assuming a move to $200k) without watching how price handles the near-term resistance band. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Short-term (8-hour / 3-day) — what’s happening now

On shorter timeframes the story is more constructive. The 8-hour price structure shows higher lows and higher highs — that’s bullish price action. However, the 3-day MACD is lacking strong directional momentum. Translation: momentum hasn’t fully swung to the upside yet, but price structure is set up for a move.

Key immediate resistance: the 120k–123k band. This region is a cluster: psychological round number (120k), Fibonacci extension (~121.5k) and prior liquidity pockets. If Bitcoin can close daily candles above ~121–122k and hold them as new support, we will likely call it an all-time high breakout and target the next logical range of $125k–$130k.

But because of the weekly divergence, I’m not assuming an uninterrupted vertical move. I’m prepared for either: a clean breakout with follow-through into the $125k–$130k range, or a short-term rejection and pullback that presents another buying opportunity. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

My live trade: structure, sizing and management

I want to be transparent: I’ve been long Bitcoin for about a week, with multiple adjustments. I initiated an initial long, added into a pullback around ~$118–119k, took profits near resistance, and added again. My current exposure is roughly a $300,000 long.

Here’s the precise logic behind my moves:

- Entry points: I prefer buying into pullbacks inside a bullish structure — for me that was around the $118–119k area after the small correction.

- Scaling: I add in tranches. I will take partial profits near obvious resistance levels (like the 120–123k zone) and redeploy into clear, shallow pullbacks that hold higher lows.

- Stop placement: I’ve moved my stop into profit as the trade moved in my favor. Even in the worst-case scenario right now, with partial profits already realized (~$25k), the stop would lock the remaining exposure at a modest profit (~$1.5k) — meaning I wouldn’t give back all my gains.

- Risk management: This trade is actively monitored and rebalanced. Because of the weekly divergence, I’m conservative with leverage and willing to trim size if we get aggressive rejection candles around the major resistance band.

Why this trade plan? Two reasons: (1) the short-term structure is bullish, offering clear higher-low buying opportunities; (2) the weekly divergence calls for partial locking of gains and tighter risk management at major resistance. The combination lets me participate in an upside breakout while preserving capital if top-side momentum fades. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Profit targets and scenarios

- Scenario A — breakout confirmed: Daily closes above ~121–122k hold → target $125k–$130k as the next short-term range.

- Scenario B — rejection at resistance: Expect a multi-week pullback or sideways consolidation. Use 1–2 week consolidations as re-entry zones if higher lows stay intact.

- Leverage examples: A non-levered move from $200 → $230 (Solana example later) is +15%; at 10x that’s +150% on margin. I prefer low leverage on Bitcoin while the weekly divergence exists.

Liquidation heatmap and liquidity levels

One practical reason Bitcoin often stalls around certain zones is liquidity: stop orders cluster around round numbers and prior highs. The heatmap shows we already swept liquidity near ~$121k, and there’s still liquidity around ~$123k. Traders chasing stop runs can trigger squeezes that either fuel a breakout or reverse into a rejection. My approach: respect areas of liquidity and don’t try to outguess a stop run — position size for either outcome and let price confirm.

If you prefer tactical exposure, consider splitting capital into:

- Core-long (buy & hold) with no leverage.

- Active swing allocation to trade breakouts/pullbacks with modest leverage and defined stops.

- Passive exposure via grid bots or DCA to smooth returns over time.

This three-layer approach balances long-term conviction with short-term opportunity. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

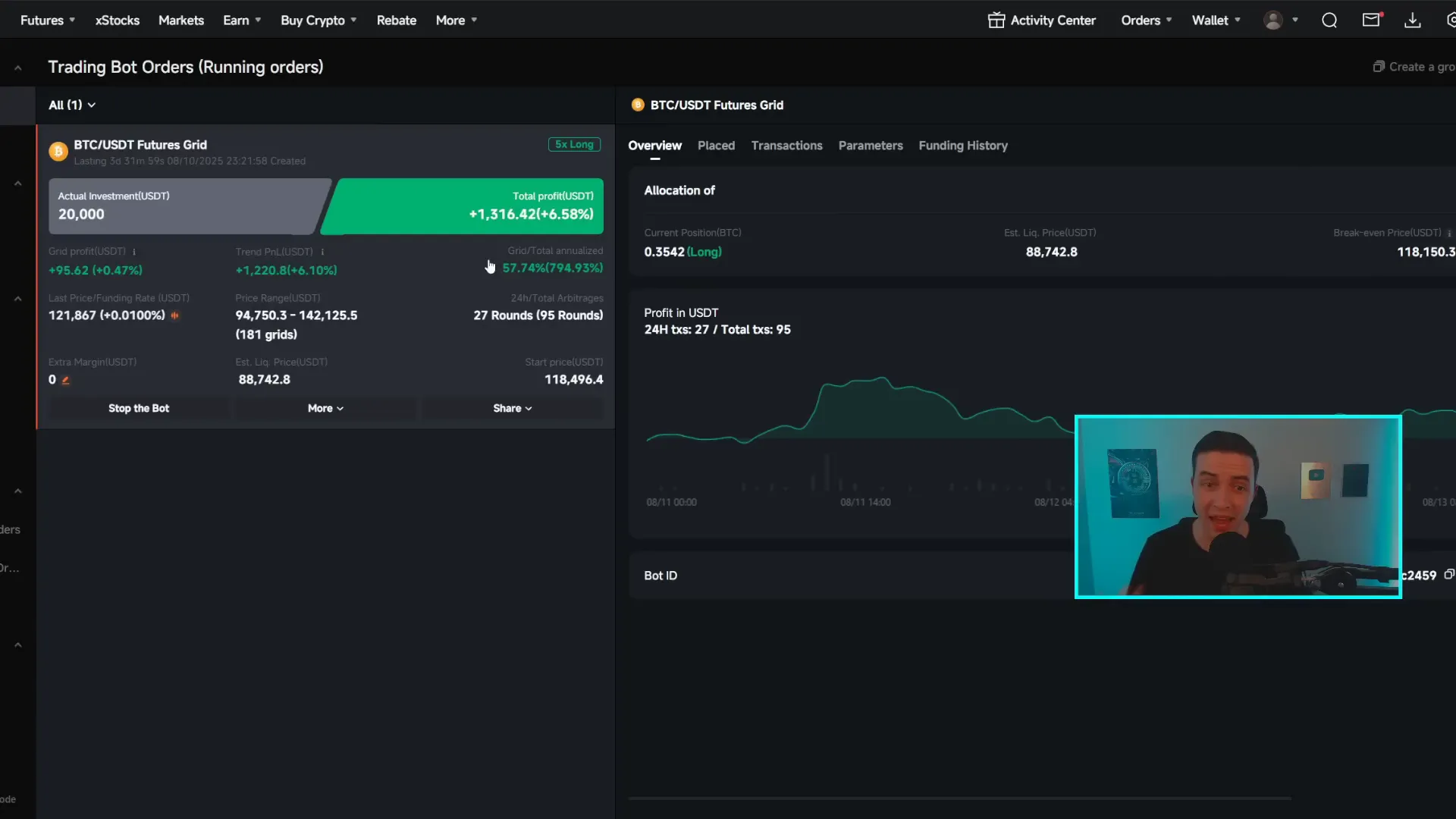

Exchanges, bots and how I collect passive income

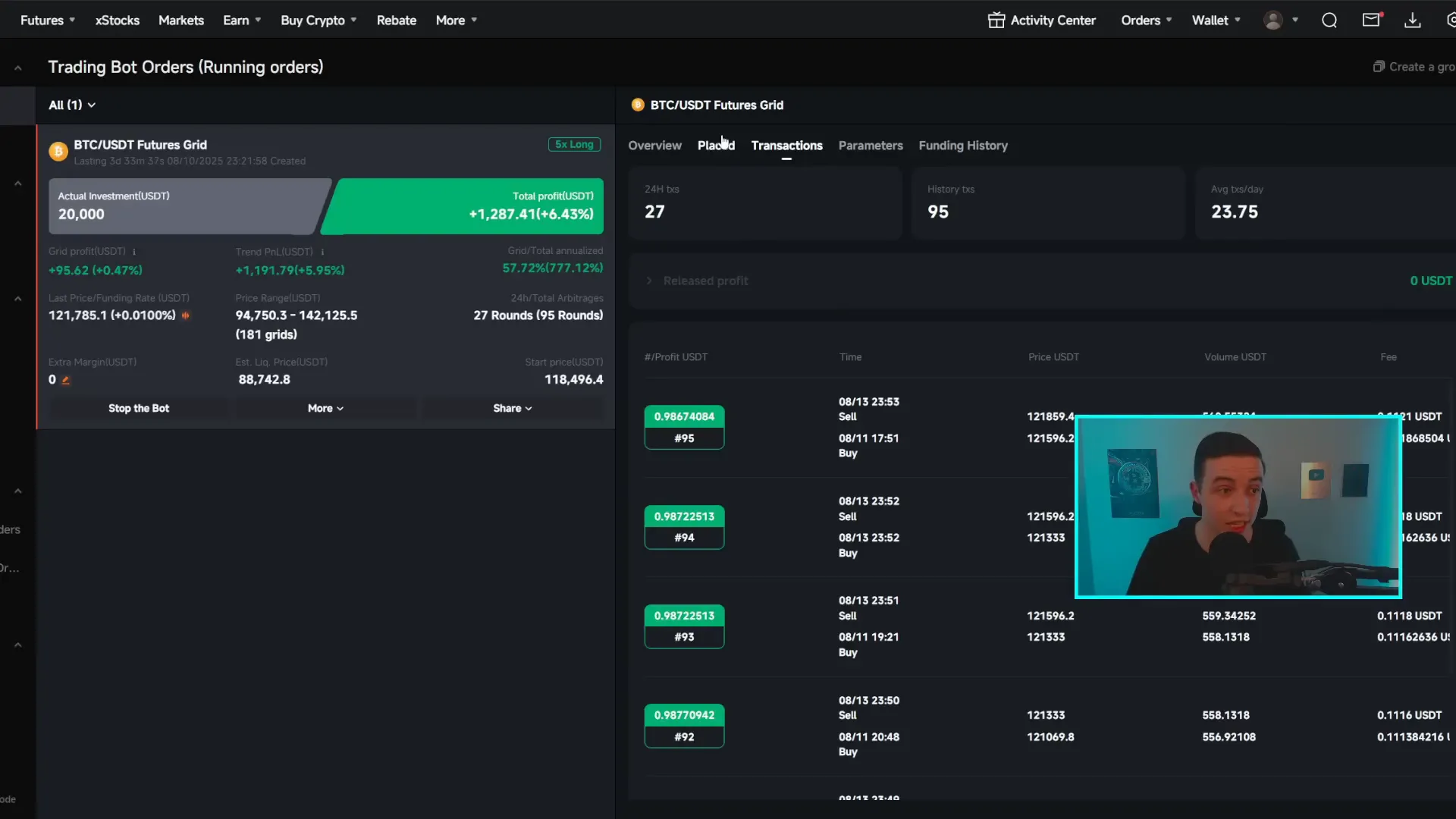

I trade actively on an exchange for my directional longs and use a separate platform for automated grid trading that produces passive profits. For this trade I’m using Bitunix (no KYC in some regions) and Pionex for my grid bot. Pionex’s grid bot lets me set a price range and automatically buys low and sells high inside that band.

Example: I set a grid bot between $94k and $142k. If price oscillates, the bot repeatedly buys dips and sells rebounds. Over the recent move it’s generated well over $1,000 in passive profit so far. That’s cashflow I’d otherwise miss if I were strictly waiting for clean entries. It’s not a magic bullet — the bot loses money if price trends strongly below the lower bound — but it works well inside a range or consolidation.

Important implementation notes:

- Only use a grid bot inside a price range you are comfortable holding in case the market breaks lower (i.e., set lower bound where you would still hold the asset).

- Grid spacing and number of grids determine trade frequency and profit per cycle. Finer grids = more trades, smaller profit per trade.

- Copying a bot: if you want to replicate my grid, you can copy the exact settings. Always understand the downside — an extended crash below the bot’s lower bound will require manual intervention.

For active trading I use Bitunix (or other regulated/accessible exchanges depending on jurisdiction). Check local regs before using any exchange. Layering active trades with bot income is a practical way to earn while you wait for the bigger structural outcome. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

The Bitcoin dominance story: fueling Altcoin season

One technical read that’s been decisive for my altcoin exposure is Bitcoin dominance. On the multi-day timeframe Bitcoin dominance has broken down from support around 60.5%–61%. That matters because when Bitcoin loses dominance (market share), capital rotates into altcoins — especially large-cap alts like Ethereum and Solana.

Right now, the market looks more like an ‘Ethereum season’ — meaning ETH and ETH-related alts are outperforming. That’s not necessarily bearish for Bitcoin price; Bitcoin can run higher while dominance drops if altcoins outpace BTC in market capitalization gains. For traders, this is an opportunity to rotate a portion of profits from ETH into promising alts or to trade altcoins outright during the rotation. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Ethereum analysis: breakout, targets and what to watch

Price action and confirmation

Ethereum moved above a key resistance range around $3.9k–$4.1k and confirmed it with a candle close above $4.1k. That breakout validated the bullish narrative and opened the path to the prior all-time high area in the mid-to-high $4k range. My primary price target from that breakout is $5,000, which would be a legitimate ATH continuation once cleared.

Short-term risk: there’s a possible daily bearish divergence forming on ETHUSD (higher highs in price vs. lower highs in daily RSI). It’s not confirmed yet, but if it materializes, we should expect a short consolidation or pullback — potentially 1–2 weeks — before another leg higher. That’s normal even in strong bull trends and doesn't invalidate the larger bullish thesis unless price breaks key support levels. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

ETH vs BTC (ETHBTC)

On the ETHBTC chart there's also a possible bearish divergence in the daily RSI. If that confirms, Ethereum may underperform Bitcoin for a while — meaning Bitcoin could reclaim relative strength versus ETH. However, with BTC dominance falling, ETHBTC might stay bullish or at least flat because capital flows into ETH from smaller alts. Keep watching the dominance structure to interpret ETHBTC moves correctly. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

How I approach ETH trades

- Take partial profits near prior ATH resistance and rotate to other alts if ETH shows fatigue.

- Watch daily momentum (RSI + MACD) for divergence confirmations. If confirmed, expect short consolidation, not necessarily a trend reversal.

- If ETH breaks and holds above its ATH convincingly, look to add with tight risk management.

Solana (SOL): breakout attempt and rotation opportunity

Solana is now testing the $190–$200 resistance band. At the time of analysis Solana was slightly above $200 but had not yet secured a multi-day close above the level. Ideally you want to see at least a daily or two-day candle close and then a hold above the zone for a valid breakout.

If SOL confirms the breakout and holds, the next logical target is around $230 — roughly a +14–15% move from $200. For traders using leverage that’s an attractive short-term swing: 10x leverage would amplify that to ~150% profit (but I don’t advise using such leverage on altcoins without strict risk controls).

Why Solana? Two reasons:

- It hasn’t had as aggressive a run as Ethereum during this leg, so there’s room for catch-up moves if traders rotate profits from ETH.

- With Bitcoin dominance falling, money that was parked in ETH near its breakout might cascade into other large-cap alts like SOL.

Support to watch for SOL: $190–$200 initial flip, then $180 and $167 as deeper supports. If SOL fails to hold $167 on a multi-day close, the breakout attempt has weakened. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

XRP: structure, resistance and longer-term watch

XRP’s weekly chart shows a confirmed higher high in price but a corresponding lower high in the weekly RSI — meaning a weekly bearish divergence exists. Historically that suggests a risk of a larger pullback across the next several weeks or months. However, on the daily timeframe, XRP is catching a short-term bullish move while BTC dominance is dumping.

Key resistance zones:

- $3.35–$3.40 is the immediate resistance to test.

- If XRP breaks and closes convincingly above ~$3.40, the next target is the prior ATH range near $3.50–$3.60.

To truly flip the larger possible bearish price structure on longer timeframes, XRP needs to break and hold above $3.50–$3.60. If it cannot, it reinforces the view that the current structure resembles the January–February pattern where momentum faded. Tactical traders should use $3.10–$3.15 and $2.90 as support zones for buys on weakness. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Chainlink (LINK): breakout, targets and resistance

Chainlink rallied after breaking out above $20–$21 and I had been targeting ~$24 for the next move — and that’s precisely where LINK is starting to struggle now. Immediate resistance sits between $24 and $25. If LINK breaks above this band, the next target is the prior high near $26.60–$27 and beyond that $30 is the larger structural target.

Like other alts, LINK has a potential daily bearish divergence forming (higher highs in price vs. lower highs in daily RSI). Not confirmed yet, but a valid warning. If confirmed, expect short consolidations or a weeks-long cool-off. That doesn’t necessarily end the bull trend — it simply cools off an overheated leg. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Practical trade playbook — how I’d trade this environment

Whether you’re an active trader or a longer-term investor, here’s a practical playbook I use that you can adapt. These are step-by-step actions meant to be tactical and repeatable.

1) Define your role: core vs. active alloc

- Core (buy & hold): Allocate a portion of your portfolio to long-term BTC/ETH (no leverage) — this is your long-term conviction capital.

- Active allocation: Keep some capital for swing trades, breakout plays, or grid bots — this capital trades in and out more frequently.

This two-bucket method prevents emotional overtrading and ensures you always have exposure whether the market trends or ranges. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

2) Plan entries and exits (no guessing)

- Predefine the levels where you will enter, where you’ll take partial profits, and where you’ll place stops.

- For breakouts: wait for candle close above the zone and a retest as support (if it happens). For failed breakouts: consider waiting for the next higher-low confirmation.

My personal method: I place limit orders at structured pullbacks inside a bullish trend and set profit targets near obvious resistance clusters. I always move my stop to breakeven or into profit after significant runs to lock gains. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

3) Use size, not leverage, to manage risk

Size your trades so that a stop-out is tolerable. Rather than cranking leverage, use position size to dial portfolio risk. Example: If you want to risk 1% of your portfolio on a trade, calculate position size based on distance to stop; don’t just slap on 10x leverage unless you can afford full loss.

4) Trade confirmations and divergence signals

- Momentum divergence is a warning, not an immediate trigger. It signals caution and stricter risk rules.

- Wait for price structure to break or confirm — don’t trade solely on an EMI reading.

In this market, I respect the weekly divergence on BTC and other weekly divergences on select alts. They make me trim size or avoid aggressive leverage near the highest highs. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

5) Rotational trades during alt seasons

When Bitcoin dominance falls, rotate part of your profits into top alts (ETH, SOL, LINK, XRP) or trade them directly. Track correlation: if BTC rises but dominance falls, alts may outperform BTC; rotating into alts can amplify returns but increases idiosyncratic risk.

Examples of specific setups to consider

- Long BTC: Add on pullbacks that hold above the short-term higher-low level (e.g., the $118–119k range used earlier). Trim near $121–123k resistance if you’re risk-averse.

- Breakout copy: For SOL, wait for a daily close above $200 and hold, then add for a run to ~$230. Use tight stops below the breakout level if the breakout is decisive.

- Grid bot: A passive grid between $94k–$142k for BTC while volatility persists; consider smaller grid ranges for alts if you believe they’ll oscillate.

- ETH target: Add to ETH breakout above $4.1k but watch for short-term RSI divergence. If divergence confirms, reduce active exposure and resume adding on clean consolidations.

Risk checklist before placing trades

- Do I know the exact stop-loss level and will I adhere to it?

- Is my position size consistent with acceptable loss (1–3% of portfolio per trade is a common rule)?

- Am I using leverage? If yes, have I sized it conservatively?

- What are the macro triggers that would force me to re-evaluate (e.g., weekly RSI divergence confirmation, loss of structural higher-lows)?

- Do I have an exit plan for partial profits and for the rest of the position?

These questions keep you disciplined and prevent emotional decisions when volatility spikes. Discipline is the best defense against revenge trading and over-leveraging. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Managing emotions and the psychological edge

Trading is not just technical; it’s mental. I use three psychological rules:

- Lock partial profits early to remove emotional pressure — it’s easier to hold a position when part of it is already profitable.

- Pre-commit to trade rules (entry, exit, stop). If you deviate, you must have a documented reason and a re-evaluated plan.

- Accept losses — they’re part of trading. The goal is to have more winners or bigger winners than losers over time.

By combining a robust plan, proper sizing, and emotionally honest rules, you convert a chaotic market into a series of repeatable decisions that favor long-term success. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Putting it all together: a playbook for the week

This is how I’ll trade the next 7–21 days given the current reads:

- Keep core BTC holdings and avoid aggressive leverage given weekly divergence.

- Hold my active $300k BTC long with stops moved into profit; trim into $121–123k resistance if price struggles.

- If BTC breaks and holds above $122k, add a modest amount targeting $125–$130k.

- Watch BTC dominance: if it keeps falling, rotate a chunk of short-term ETH profits into SOL and LINK after confirmed breakouts.

- For ETH, expect tests of the old ATH in the high-$4k range and ultimately a push to $5k if momentum continues.

- For SOL, wait for confirmed hold above $200 and plan for $230 as the next swing target with support levels at $190, $180 and $167.

This plan balances conviction with caution. It’s a live, adaptable roadmap — not a rigid mandate. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Additional tactical notes and common questions

Q: What if BTC hits $130k in a straight run?

A: If BTC breaks the 121–123k band and accelerates strongly, I will let a portion of my position ride while taking off a meaningful tranche to lock profits. Never get overly greedy in a blowoff move — protect gains and re-assess with fresh technicals.

Q: Would I short during a rejection at all-time highs?

A: I only short with strong confirmation (clear reversal patterns, momentum failure, and loss of structure). Right now I'm not looking to short BTC as my bias is still bullish on the short-term structure. Futures and perpetual markets are tempting, but they demand stricter risk rules due to funding and liquidation risk.

Q: How do I balance active trading and long-term HODLing?

A: Use the 3-layer allocation method: (1) Core long-term holdings; (2) Active swing trading allocation; (3) Botized passive grid allocation. This way you capture the long-term upside while earning and compounding in the medium term. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Final thoughts and the edge I use

To summarize my edge right now: I blend price structure (higher lows/higher highs), momentum checks (RSI/MACD divergences), liquidity maps (heatmaps and Fibonacci levels), and disciplined trade management (scaling, stops and partial profits). That combination has allowed me to secure realized profits while keeping upside exposure in case of a confirmed breakout.

Remember — markets rarely move in a straight line. Expect re-tests, consolidations and occasional false breakouts. The profitable trader is the patient, disciplined one who plans multiple steps ahead and sizes positions for survival. If you adopt even a fraction of this approach — core allocation, active playbook, bot income and clear risk rules — you’ll be better prepared for this Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing cycle.

If you want to model any of the bots or trade setups I mentioned, start small and test the mechanics. Copying trade ideas without sizing discipline is the fastest way to lose. Trade like you have a job to keep: protect your capital first, pursue returns second. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Thanks for reading — I hope this breakdown gives you clarity, a repeatable plan, and confidence to act. Keep an eye on the 120–123k resistance for Bitcoin, the dominance for altcoin rotation, and daily momentum for divergence confirmations across ETH, SOL, XRP and LINK.

If you want to follow the full market walkthroughs and see my live adjustments, check my channel for step-by-step trade recaps and bot walkthroughs. Trade smart, size carefully, and don’t forget to lock profits when the market provides them. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

BITCOIN & ALTCOIN SEASON: All-Time Highs, Trading Strategy and Price Targets — Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing. There are any BITCOIN & ALTCOIN SEASON: All-Time Highs, Trading Strategy and Price Targets — Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing in here.