Prediction markets have exploded in popularity, pulling in billions of dollars of capital, sparking lawsuits, and prompting real questions about ethics and regulation. If you follow crytocurency, bitcoin stories, this sector matters because it changes how markets price political, economic, and even product outcomes. Below I explain what prediction markets are, where they came from, how they work, how people try to profit, and what the main risks are.

Table of Contents

- What is a prediction market and how it works

- Where prediction markets came from

- Why crypto changed the game

- The hard truths: ethics, manipulation, and regulatory gaps

- How people try to profit

- Where prediction markets are heading and what it means for you

What is a prediction market and how it works

At its core, a prediction market is a market for future events. Traders buy and sell binary shares that settle to either 0 or 1 depending on an outcome. A share trading at 0.63 implies the market sees a 63 percent chance of that outcome. Buy at 0.63 and you earn 0.37 if you win. Prices shift in real time as new information arrives.

Why they matter: because money incentives tend to aggregate diverse information. In many cases prediction markets have outperformed polls and punditry by synthesizing distributed knowledge into a single probability.

Where prediction markets came from

These markets are not new. Betting on future events goes back to ancient civilizations. The modern, internet-era form started in the 1990s and matured through the 2000s. Early platforms attracted regulator attention, with high profile cases like Intrade and PredictIt testing the legal limits of event-based contracts.

In a major legal shift, a US court decision in 2023 limited agency overreach and helped clear space for event contracts. That ruling, combined with technological improvements, set the stage for rapid growth.

Why crypto changed the game

Centralized markets struggled with bottlenecks: payments, onboarding, transparency, and censorship risk. Putting markets on public blockchains fixed many of those issues. Crypto prediction markets run 24/7, accept global users, and offer fully auditable on-chain trading activity.

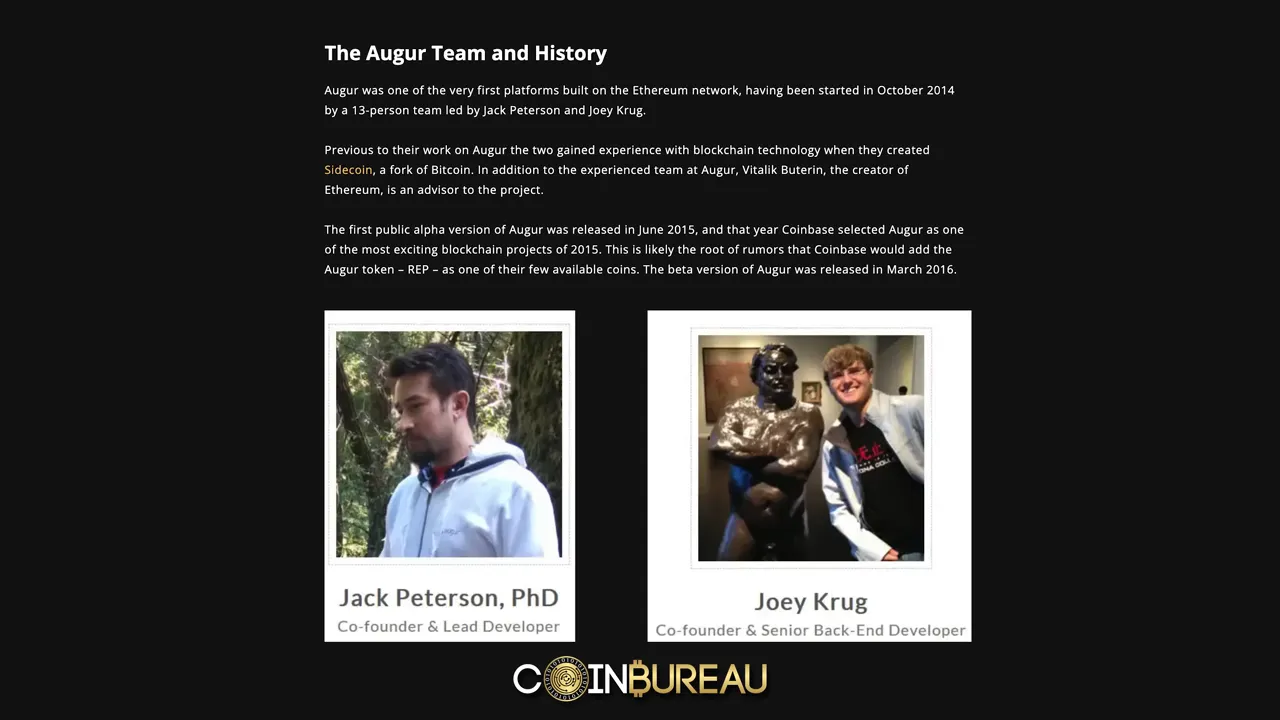

Early crypto entrants included Augur and Gnosis, which laid technical groundwork. Polymarket later ignited mainstream interest, drawing huge trading volumes during big political events. At its peak, Polymarket hit hundreds of millions in TVL around the 2024 US presidential cycle, demonstrating how quickly a crypto-native market can scale.

The hard truths: ethics, manipulation, and regulatory gaps

Growth brought problems. Many controversies involve users rather than platforms, but that distinction matters little to public trust and regulators. A few of the most troubling issues are:

- Assassination market concerns: some early markets allowed bets on deaths of public figures. That raised obvious moral and security alarms.

- Insider trading: on-chain timing has revealed suspicious wins. One pseudonymous account reportedly profited heavily on Google search ranking contracts placed just before the official release. Markets can leak real-world outcomes earlier than news outlets.

- Market influence: low-liquidity markets can be moved by large players. Massive bets during high-stakes elections drew accusations that odds were being inflated and narrative shaped.

- Platform conflicts: some operators run internal market-making teams. While that can improve liquidity, it creates perceived or real conflicts if the operator trades against users.

Regulatory uncertainty remains. Prediction markets often live under CFTC jurisdiction as event contracts, but state-level gambling rules and ethical concerns create a patchwork of policies. Platforms must balance openness with safeguards so tragic events and geopolitical crises do not become speculative playgrounds.

How people try to profit

There are several strategies used by retail and institutional players. None are risk free, but here are common approaches:

- Airdrop farming — interact with platforms early for potential token drops. Some traders use activity to qualify for future governance or utility tokens.

- Event-driven bets — place educated wagers when markets underprice a likely outcome. This requires subject knowledge and timing.

- Value capture via high-probability trades — buy shares of outcomes trading at, say, 80 percent and collect the theoretical 20 percent upside if the outcome occurs.

- Institutional hedging — firms buy contracts to hedge policy risk or narrative shifts that could harm portfolios.

Important caveats: markets can be manipulated. Political and geopolitical shocks happen with surprising frequency. Even seemingly safe bets can lose value quickly in turbulent news cycles. If you follow crytocurency, bitcoin developments, keep in mind prediction markets can amplify sentiment swings and create feedback loops into price action.

Where prediction markets are heading and what it means for you

Prediction markets are not a fad. They are becoming integrated with major exchanges and wallets, attracting venture capital and developer attention. Analysts project industry revenue could rise dramatically over the next five years. Aggregators will likely emerge to surface the best prices across many markets.

For anyone tracking crytocurency, bitcoin this creates a few practical implications:

- Prediction markets provide alternative signals. Use probability prices as one input among many when forming views on macro and political risks.

- Be mindful of liquidity and manipulation risk. Large trades can distort odds in thin markets and spill into broader narratives.

- Consider hedging: institutions are already using event contracts to offset policy-driven losses. Retail traders can learn similar principles at smaller scale.

Prediction markets offer powerful information aggregation and trading opportunities, but they also demand disciplined risk management and ethical awareness. If you engage, do so with clear limits, verify the contracts you trade, and stay alert to how these markets interact with crytocurency, bitcoin price cycles. The sector will keep evolving quickly, and informed participation will separate value-seekers from those who get burned.

The truth about prediction markets and why crytocurency, bitcoin traders should care. There are any The truth about prediction markets and why crytocurency, bitcoin traders should care in here.