I'm Klaus from CRYPTO with KLAUS, and if you watched the short-and-savage breakdown I did on market action this Monday, you know the vibe: markets are red, the macro story is messy, and everyone is obsessing about rates instead of the fundamentals. In this long-form write-up I’ll walk through everything I covered — the red heat map, why rate-cut expectations are wrecking liquidity, the Jackson Hole angle with Jerome Powell, a viral misinformation debunk about XRP and escrow, record ETF volumes for ETH, institutional moves like Strategy buying BTC, and a tech update from David Schwartz on the XRPL hub server. I’ll also give practical takeaways for traders and investors who want to survive this “vacuum month.” Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Before we dive in: yes, this is blunt, sometimes salty, and unapologetically direct — same tone as my channel. This piece will be thorough, evidence-based, and tactical. Let’s get into it. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Quick snapshot — what’s happening right now

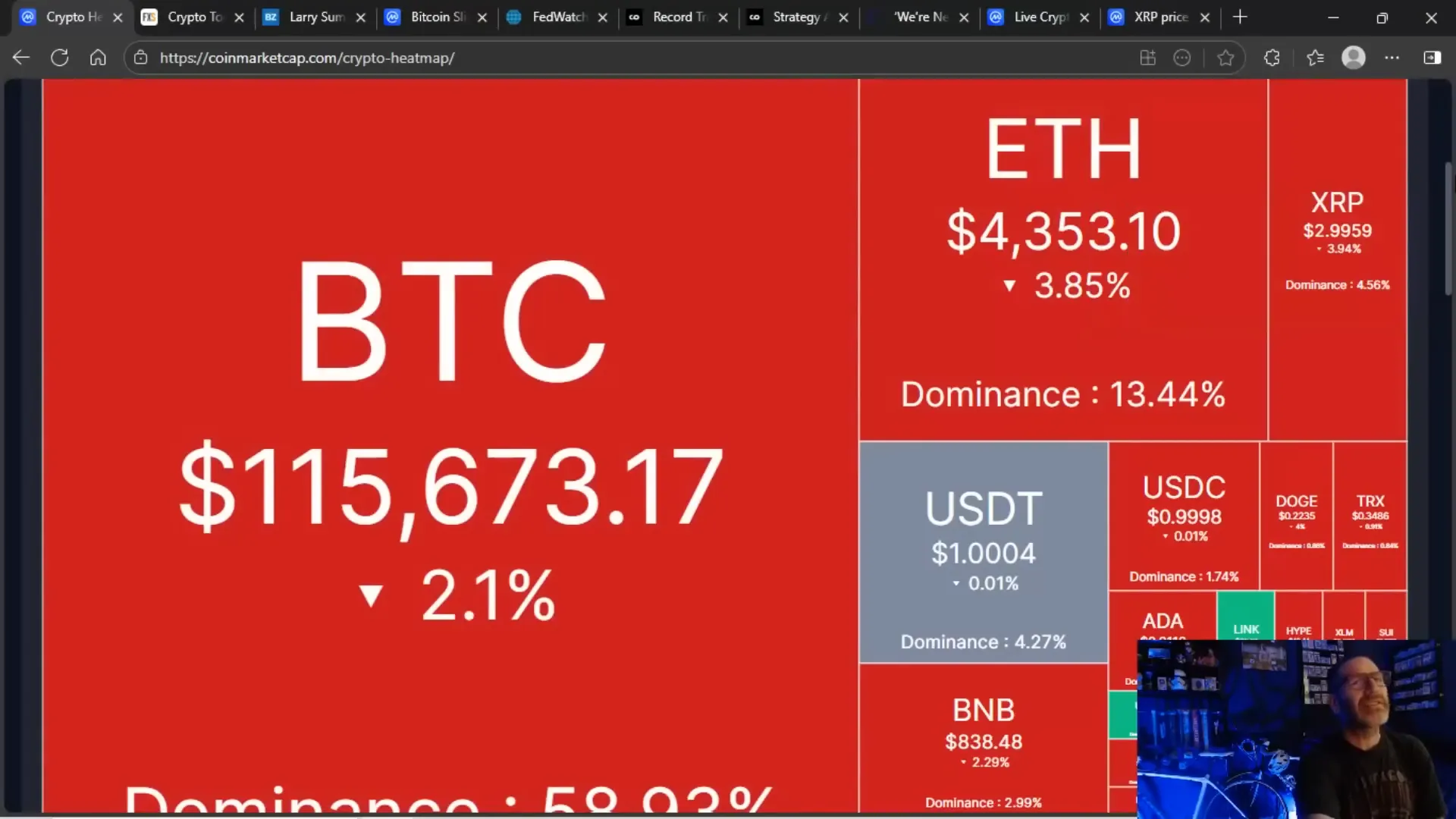

Markets opened the week in red. Not a gentle pullback — we saw mass liquidations across the crypto sphere, bigger-than-normal ETF volume swings, and traders suddenly repositioning because the macro narrative shifted overnight. The main driver? Rate cut expectations getting pushed back after higher-than-expected PPI and talk of tariffs spiking inflation. Jerome Powell is due to speak at Jackson Hole in a few days, and that alone is enough to make traders hit the sell button to hedge for a hawkish tone.

Let me get the summary bullets out before we deep-dive:

- Macro data (PPI) came in hot, making traders less confident about imminent rate cuts.

- Markets priced in a high probability of a September rate cut — the CME FedWatch tool showed about 85% — and then started to unwind that outlook.

- Jackson Hole (Powell’s speech) is the headline event this week; a hawkish tone could extend the red across crypto.

- Despite supply increases from Ripple’s escrow releases, XRP's price moved higher during periods of regulatory optimism — which means escrow dumps aren’t the whole story.

- Ethereum ETFs experienced record weekly volumes (~$17B) and have started to narrow the gap with Bitcoin ETFs.

- Institutional players are still making buy moves (Strategy acquired ~430 BTC recently), but many are on the sidelines waiting for rate clarity.

I’ll unpack each of these, starting with the narrative that’s killing short-term crypto liquidity: rates, tariffs, and timing. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Why red? Rate-cut expectations, Jackson Hole, and the August vacuum

It’s tempting to blame everything on some single thing — “the Fed is the enemy,” “tariffs killed us,” “XRP escrow dumped.” The truth is slightly more nuanced: markets care about forward-looking expectations. Right now, the markets were pricing in a strong chance of a September rate cut. When the short-term inflation prints (PPI) came in higher, that forced traders to reassess that expectation. If you’re pricing in easing, and then you see inflation pressure, you tighten your stance or delay easing. That creates instant volatility when a large portion of traders are positioned for a dovish pivot.

Throw in Jackson Hole — a platform where Jerome Powell and other central bankers can telegraph policy — and you have a volatile week. Powell can move markets with tone alone. If he says “we’ll wait for more data” and sounds hawkish, the market will price out rate cuts and risk assets like crypto will sell off. If he hints at being open to cuts, the market will rally. Simple as that.

The problem: August is a vacuum month. There aren’t big FOMC meetings or massive scheduled data dates to anchor markets, which makes smaller events (like Jackson Hole, PPI, and tariff chatter) have an outsized effect. That’s what I call the August trap: everything tiny is suddenly enormously important.

As I said in the video: the market wants guidance. And until Powell speaks, we’re all leaning on small prints and voice tones — and that promotes volatility. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Tariffs, PPI, and why inflation chatter matters to crypto

PPI (Producer Price Index) came in hotter than many hoped, and that’s feeding the tariff narrative. Tariffs can create short-term price shocks in supply chains, which pushes costs up. Jerome Powell has long been clear that tariffs are a source of short-term inflation. So when PPI spikes and tariffs are in the news, traders think: do we need to keep rates higher for longer?

For crypto specifically, this is bad in two ways:

- Higher rates reduce present-value calculations. Risk assets like crypto get discounted more when yields are higher.

- If big capital expects rates to stay higher, they park cash in yield-bearing instruments and pull liquidity out of markets. Less liquidity = more volatility and pressure on altcoins.

Put simply: if big money decides to wait for a rate cut, they take cash off the table. That’s sell pressure. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Liquidations and volume — the mechanics of the sell-off

One of the reasons the price action looked so ugly was mass liquidations. The short-term futures market can blow up quickly when leveraged positions get squeezed. Liquidations create cascades: forced selling hits the order book, which slams prices, which triggers more liquidations. The recent figures crossed a half a billion dollars in liquidations across Bitcoin, ETH, and XRP.

But here’s an important nuance: volume also surged. That’s worth watching. Volume spiking means institutional and retail participants were actively repositioning, not just capitulating. People were moving money in and out. That volatility is where traders can find opportunity, but it’s also where risk management matters most. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Ethereum ETFs are roaring — record $17B week

If you want to understand where liquidity is flowing, look at ETF volume. Ethereum spot ETFs posted approximately $17 billion in weekly volume — the highest ever recorded for ETH ETFs. Analyst Eric Pichunas (quoted in the coverage I linked to) noted that trading volume for both BTC and ETH ETFs surpassed prior highs, with ETH ETFs narrowing the performance gap with BTC.

Why does this matter?

- It signals renewed institutional interest in ETH, and it’s not just BTC domination anymore.

- Rising ETF volumes mean institutional access is maturing; institutional investors are using regulated wrappers to get exposure.

- When ETH volumes spike relative to BTC, market dynamics shift. Alts can get a liquidity injection because ETH often acts as a gateway to altcoin speculation.

In the immediate term, this helps explain why ETH looked a little stronger than BTC during the sell-off. ETFs are concentrated pockets of liquidity — they can prop up and pull down prices depending on flows. For traders, watching ETF volume is almost as important as watching on-chain metrics right now. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Institutional play: Strategy’s small buy and the bigger picture

We saw Strategy acquire another 430 BTC at an average price of $119,666. Yes, that purchase is underwater at current prices, but it’s part of a broader accumulation trend: Strategy now holds nearly 629,376 BTC. For them, the incremental buy is a minor top-up.

Institutional accumulation might look different from retail FOMO. Big holders operate with long horizons and huge balance sheets. A quarter-basis-point change in policy rates means a lot when you’re managing billions; the savings compound. That’s why institutions are glued to Powell’s body language: a pivot in rates can make or break multi-billion-dollar strategies. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

The takeaways here:

- Big players are still buying selectively, but they’re waiting for macro clarity.

- Small buys by institutions don’t mean instant rally; they’re portfolio management.

- For retail traders, watching accumulation by institutions gives important context about long-term conviction versus short-term noise.

Debunking the XRP escrow myth — supply vs. price reality

This one gets a lot of people hot-headed. A viewer claim that “XRP price will not appreciate till Ripple stops releasing tokens from escrow or the escrow is depleted” is simply wrong. Flat out. I call it what it is: misinformation.

Let’s break it down logically and empirically.

- Ripple has been releasing tokens from escrow — yes. Since mid-March they averaged ~60 million tokens every two weeks, with occasional spikes over 100 million.

- During the same period, XRP’s circulating supply increased — yes.

- Yet during that time, XRP’s price has also moved up significantly on two major events: the November election regulatory optimism and the Crypto Week announcement (plus continuing regulatory optimism). So price increased while supply was increasing.

Why does this matter? Because the claim that “escrow releases alone prevent price appreciation” ignores the broader market drivers: regulatory clarity, macro environment, narrative momentum, and demand. Supply does affect price in any market — that’s basic economics — but it's only one variable. The demand side (speculation, institutional flows, regulatory tailwinds) can more than offset increased supply.

“They've been releasing an average of sixty million tokens every two weeks since mid March with occasional spikes over a hundred million. Supply does affect price. Basic market dynamics just stating facts.” — quoted viewer statement, which I debunked in the video.

Here’s the blunt truth: if you look at the price chart over the last year, XRP rose when regulatory optimism rose. The timing lines up with major news events more than it aligns with token issuance schedules. So yes: escrow releases are part of the picture, but they are not the full story. Don’t let simplistic narratives rob you of seeing the reality. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

XRPL tech update — David Schwartz’s hub server and collector improvements

On the technical front, Ripple CTO David Schwartz pushed an update around the XRPL hub server project. He’s been working on a hub server to improve how the network aggregates information, prevent glitches, and basically make the XRPL more resilient. The update included notes about a bug/glitch that was identified and addressed in the collector, and reassurances that improvements are in progress to prevent similar issues in the future.

Why does this matter?

- Technical robustness matters to institutional adoption. If the network has observable operational flaws, institutions will hesitate to allocate capital.

- Schwartz’s work is near production-ready and he’s putting resources into the project (even using beefy Ryzen rigs), which signals seriousness.

- A properly working hub server helps maintain integrity of messaging and state across the XRPL, which reduces downstream risks for exchanges and custodians.

If you’re a developer or a hardcore XRPL fan, the update is a nice reassurance that the team is iterating on infrastructure. If you’re an investor, know that tech improvements reduce operational risk and are a positive signal for long-term adoption. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Putting it together — market dynamics, investor psychology, and practical trading guidance

We’ve covered the raw news: liquidations, ETF volume, Strategy’s BTC top-up, affordably stupid comments about escrow, and XRPL tech updates. Now let’s talk strategy: how to act when the market looks like this.

Recognize the August trap

August is a low-data month with a few high-impact events. That makes small events disproportionately potent. Jackson Hole and a hot PPI print create outsized moves. Recognize this and adjust sizing accordingly.

Trade the narrative, manage the risk

Markets move on narrative. Right now the narrative is: “are we getting cuts soon or later?” The CME FedWatch tool at the time was pricing high odds for September cuts (~85%), but I argued that was optimistic — I’d put it closer to 50/50 given recent data. If you trade on the assumption of imminent easing and you’re wrong, you’ll get hurt. So trade the narrative but size your positions for being wrong.

Watch ETF flows and on-chain metrics

ETF flows (BTC and ETH) tell us where institutional liquidity is heading. ETH’s $17B week is a signal. On-chain metrics — exchange inflows/outflows, active addresses, and stablecoin supply — still matter. Combine both. When ETF flows and on-chain demand align, you have stronger conviction.

Be aware of supply myths

Don’t let supply myths become the entire reason for your decision. Yes, escrow releases exist. Yes, supply matters. But demand, regulatory momentum, and macro forces can offset supply increases. When you hear someone say “X must happen for price to move,” test that claim against history and data.

Position size for volatility

Liquidations and leverage are the primary drivers of cascading moves. If you’re trading with leverage, keep stops tight and use risk capital only. If you invest, dollar-cost average and assume some pain in the interim. Market-wide volatility can erase double-digit gains in a matter of days; don’t bet the farm. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Scenarios to watch — best- and worst-case trajectories

Let’s lay out a range of plausible outcomes so you can prepare mentally and tactically.

Scenario A — Powell is dovish (bullcase)

If Powell’s tone at Jackson Hole is unexpectedly dovish — or he signals patience in a way that leads markets to price in September cuts — expect a short squeeze across risk assets. BTC and ETH could reclaim recent highs quickly, ETF volume might accelerate, and altcoins (including XRP) could get meaningful liquidity inflows.

- Likely triggers: dovish Powell, CPI/PPI cooling, positive regulatory headlines.

- What to do: scale into long positions, add exposure to ETH and high-quality alts during pullbacks, monitor ETF flows.

Scenario B — Powell is hawkish (basecase)

Powell’s tone is measured or hawkish. Markets price out imminent cuts, inflation fears remain elevated due to tariffs and PPI, and we see further downside. The market could retest support levels for BTC and ETH; altcoins may bleed relative to BTC/ETH.

- Likely triggers: hawkish Powell, persistent PPI/consumer-price surprises.

- What to do: reduce leverage, increase cash, rebalance portfolios, consider buying deeper support for long-term investors.

Scenario C — Unexpected macro shock (black swan)

A geopolitical event, sudden recession data, or a new regulatory shock could cause a broader risk-off. Crypto would likely be hit hard as leveraged positions unwind, and institutions would likely pause further buys.

- Likely triggers: recession data, trade wars escalating, major regulatory clampdown.

- What to do: have a stop-loss plan, consider defensive hedges (e.g., inverse ETFs for equities), hold cash for opportunistic buys later.

How to think about XRP specifically

XRP is currently trading around the psychological $3 marker. The price action over the last week included a push to ~$3.30 and then a retracement. Volume for XRP remains healthy (~$7B in recent sessions), which is notable for an asset that is often criticized for low liquidity.

Key points to watch for XRP:

- Regulatory clarity: XRP’s biggest price driver over the last year was regulatory optimism tied to institutional and legal developments. That remains true.

- Escrow releases: these matter but are not destiny. If demand and regulatory momentum increase, the market can absorb supply increases.

- On-chain signals: watch exchange balances, movement from Ripple, and large whale flows. These will telegraph selling pressure sooner than retail chatter.

- Tech developments: improvements to XRPL (like the hub server) help reduce operational risk and increase institutional acceptance.

So, if you’re bullish on the long-term thesis — interledger payments, faster settlements, regulatory clarity — a disciplined approach (DCA, position sizing, hedging) is wise. If you’re trading, watch the $3 area and manage risk tightly around it. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Practical checklist for the week (actionable steps)

If you trade or invest in crypto, here’s the exact checklist I’d run through right now.

- Check the CME FedWatch probabilities and how they’ve shifted in the last 24–48 hours.

- Watch the PPI and any tariff chatter — both move short-term sentiment.

- Monitor Powell’s Jackson Hole speech in real time. React to tone, not headlines.

- Review ETF flows (BTC & ETH) and adjust exposure accordingly; if ETH continues to dominate flows, pair trades may make sense.

- Scan on-chain metrics: exchange inflows/outflows, stablecoin supply, active addresses for the assets you hold.

- Size positions assuming you could be wrong; reduce leverage and raise stop discipline.

- Don’t fall for simple-soundbites (e.g., “escrow releases destroy price”); always look at historical data.

- Keep cash on the sidelines for opportunistic buys if markets flush further on hawkish Powell messaging.

Following this checklist won’t guarantee profits, but it will help you survive and capitalize on volatility. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

My personal stance — how I’m positioning

I’ll be transparent: I’m cautious but opportunistic. That means I’m not full risk-on, and I’m not cash-only. I’m doing the following:

- Keeping a core long-term allocation to blue-chip crypto (BTC, ETH) and gradually adding to positions on meaningful retracements.

- Allocating a smaller, tactical portion to high-conviction altcoins like XRP — but only with measured size given the macro uncertainty.

- Avoiding excessive leverage unless the trade has a very high probability and small risk exposure.

- Watching Jackson Hole in real-time and ready to rebalance intraday if Powell’s tone forces a large move.

I’m also watching ETF flows closely. If ETH continues to suck up institutional capital, cyclical rotations into alts are more likely when the macro pivots. If BTC remains the safe-haven crypto of choice, altcoins may grind. I’m prepared either way. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Common questions I answered in the video — and the detailed answers

Q: Will escrow releases from Ripple keep XRP down?

A: No. Escrow releases alone do not determine price. History shows XRP rose during periods of continued escrow releases. Demand and regulatory sentiment have been stronger price drivers. That doesn’t mean supply is irrelevant — it’s just not deterministic.

Q: Are we getting a rate cut in September?

A: The market was pricing heavily for it, but recent PPI and tariff noise make me skeptical. I’d assign it closer to 50/50. Jackson Hole is the immediate data point; Powell’s tone will be decisive. The CME FedWatch showed high probability, but probabilities are not certainties — they are market sentiment snapshots that move fast.

Q: Should I buy the dip in crypto now?

A: It depends on your time horizon. If you’re a long-term investor, consider dollar-cost averaging through volatility. If you’re a short-term trader, be selective, size small, and avoid blind leverage. The risk profile has increased in this August environment.

Q: What are the best signals to watch this week?

A: Jackson Hole speech from Powell, any new PPI/CPI updates, ETF flows for BTC and ETH, and big exchange movements. These are the data points that will matter most.

Final thoughts — short-term noise vs long-term fundamentals

There’s a lot of noise right now. Markets are reacting to macro prints and a Fed speech, and the August vacuum is amplifying everything. But don’t confuse short-term panic with the long-term narrative. Crypto remains an asset class with a unique risk-return profile. Regulatory clarity, institutional adoption (via ETFs), and technological improvements (like XRPL upgrades) are long-term tailwinds.

That said, the next few days are a high-probability event window. Powell can move markets with tone. Be ready to react, but don’t let knee-jerk emotion dictate your strategy. Use data, watch the flow, and respect the macro environment. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

And one more thing: call out misinformation when you see it. If someone says a single supply metric is the sole determinant of price — check the data. The market rarely operates on a single lever. Price is a multi-factor result of supply, demand, narrative, and macro.

If you liked the channel voice in the video, this long-form post is the same deal: direct, a little crude, and evidence-based. Stay sharp. I’ll be covering Powell’s speech live and dissecting the market reaction. You know I’ll call it straight — whether it’s good, bad, or absolutely stupid.

Keep the questions coming. I read the comments. And if you’re planning trades this week, do them with respect for size and risk. The market’s mood can flip on a few sentences from Jackson Hole. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

💥XRP SELLS OFF 💥CRYPTO CRUSHED INFLATION n RATES💥 — Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing. There are any 💥XRP SELLS OFF 💥CRYPTO CRUSHED INFLATION n RATES💥 — Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing in here.