From CRYPTO with KLAUS: If you watched my latest breakdown you know we’re in a red market mood and there’s more potential pain incoming this week. In this article I’ll walk you through what’s happening across Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing headlines, how macro events like tariffs and Jerome Powell’s Jackson Hole remarks feed volatility, and why Ripple just acted like a bank by extending credit to Gemini. I’ll keep the tone blunt, direct, and useful — the same way I talk to you on camera: no fluff, straight-up market reality.

This piece covers the same themes: a choppy market, the ETH and BTC pullbacks, what Home Depot tariff-driven price hikes mean for inflation expectations, the Jackson Hole event this Friday and its potential to drive risk asset pain, Ripple’s newly revealed $75 million credit line to Gemini and what RLUSD entering a big exchange could mean for the stablecoin race, and a practical view on XRP price action and risk management as we navigate August’s known “trap month.” This is Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing territory — and we’ll approach it head-on.

Quick summary: what you need to know right now

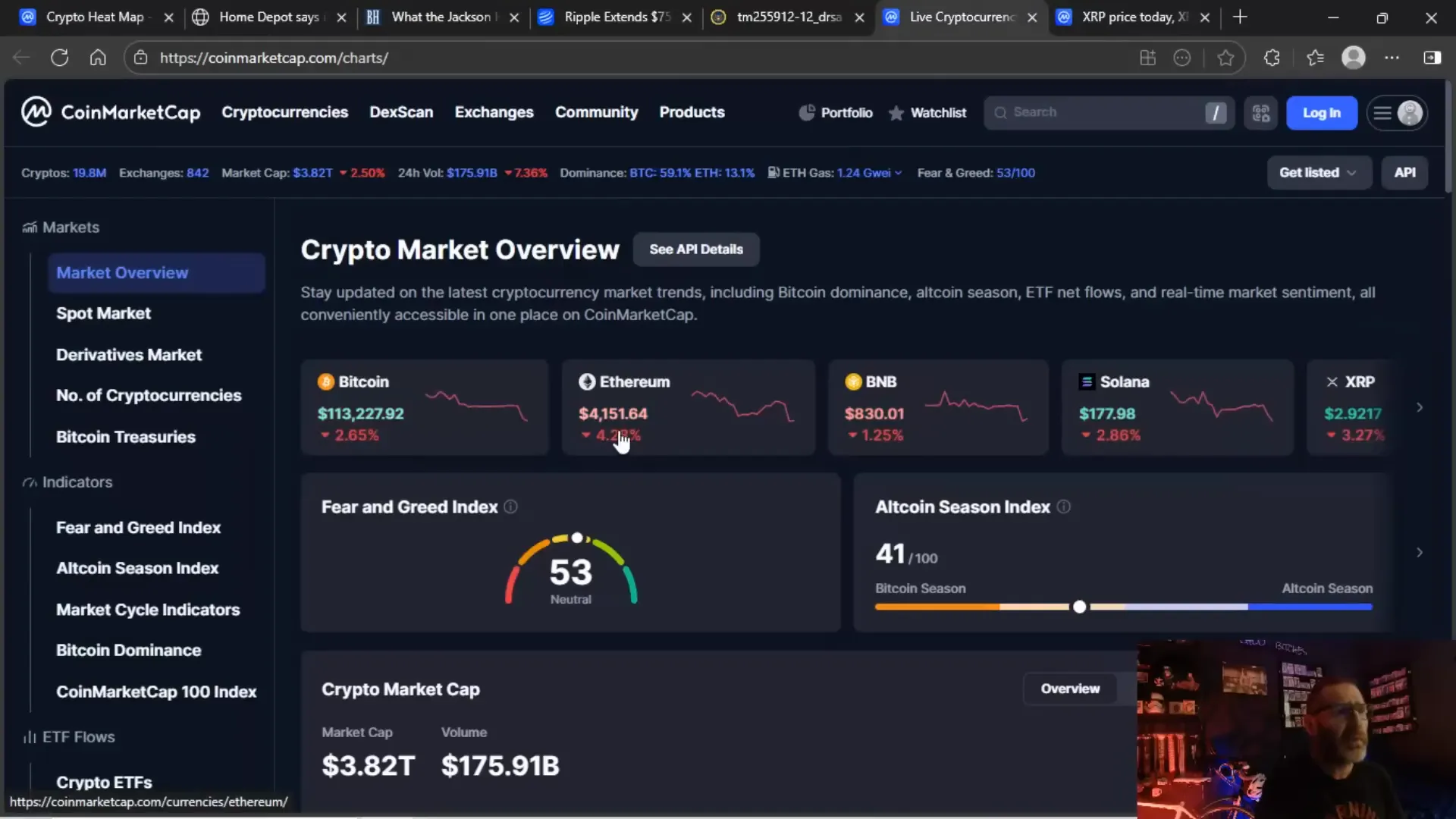

- Market mood: Risk-off. Bitcoin and Ethereum have pulled back after recent tops and profit-taking.

- Macro risk is rising: tariffs and retailer price hikes are increasing inflation worries, which could keep rates higher for longer.

- Jackson Hole (Powell, Friday) is a key event — hawkish tone could deepen selling in crypto.

- Ripple just extended a $75M credit line to Gemini — not an XRP loan but a corporate credit facility, with RLUSD flagged as a potential funding option after $75M is passed.

- XRP is pulling back (~3.5% down in the latest snapshot) but remains in play to resume the rally once volatility calms.

This is Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing land — if you’re in it, you’ve got to accept volatility as the default.

Why the market’s red: the simple chain from tariffs to crypto pain

First, let’s get the obvious out of the way: when big players see a reason to lock in profits, they do it. But profits don’t get taken in a vacuum — they’re driven by macro signals. This week a cluster of retail headlines (Home Depot saying some prices will rise because of tariffs) triggered concerns about higher input costs and persistent inflation. That’s not isolated: when multiple retailers and suppliers warn of higher costs, markets price in a higher-for-longer interest-rate environment.

Higher interest rates equal higher discount rates for future cash flows. For speculative, high-volatility assets such as crypto, the consequence is simple: lower present valuations, more selling pressure, and higher probability of knee-jerk moves. That’s what you’re seeing — red across the heat map, ETH and BTC pulling back, and traders squinting at their screens wondering if the rally is over.

It’s easy to mock corporations for raising prices, but markets react to expectations. If tariffs increase the cost curve for a company like Home Depot, it signals two things: consumers may see reduced discretionary spending (slower growth), and inflation readings may stay elevated. Both are bad for risk assets in the short term.

This is Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing reality: macro and micro feed each other fast, and sentiment can flip on seemingly mundane retail updates.

Read-through to crypto

When retail prices rise, central bankers watch employment, wages, and inflation. If they don’t think inflation is tamed, they keep rates firm. For crypto, the consequence is amplified: fewer buyers for high-beta assets, more leverage liquidation, and greater volatility. That’s what produces the heat-map red you’re staring at now.

This is Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing territory — and it’s ruthless on weak hands.

Jackson Hole and Jerome Powell: Friday’s mic matters

There’s a heavyweight speaking this Friday at Jackson Hole: Jerome Powell. He has a platform that moves markets — especially when markets are already nervous. Powell’s tone is what traders call the “policy risk” lever. In a world where inflation is sticky and the labor market is just beginning to cool, even neutral language can be hawkish relative to market hopes.

Remember two things: first, Jackson Hole is an influential speech but not a formal FOMC meeting. Still, Powell’s commentary frames the Fed’s likely path and sets expectations for future meetings. Second, Powell’s term ends in May 2026 — meaning each public appearance in this cycle carries extra signaling power about policy normalization and balance sheet expectations.

If Powell is hawkish, rates expectations can rise, bond yields can climb, and equity/crypto risk assets will get clobbered further. The market is already jittery: there’s no FOMC meeting this month to provide a broader context, so Powell’s words fill the information vacuum. That’s why Friday is a potential pain point.

This is Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — macro events deliver headline risk, and when the headlines matter, so does your risk budget.

ETH and BTC: why “touch the big number = dump” keeps repeating

We looked at ETH’s all-time chart and highlighted a repeated behavior: every time ETH touched a major psychological or technical high, there was a sell-off. That’s not a conspiracy — that’s human traders taking profits at obvious levels. The same pattern shows in many assets: pump to a big round number, sellers step in, and the price gives back gains.

BTC has been doing the sideways-lurch-then-dump pattern this month too. Market structure shows chop with sudden drops: sideways accumulation followed by quick distribution. That’s the textbook sign of profit-taking and market participants moving to the sidelines ahead of potential macro shocks — like Jackson Hole.

The takeaway is simple: when major assets look extended, expect rotation and volatility. If ETH or BTC roll over, alts will likely follow. Use that intel for position sizing and stop placement.

This is Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing behavior — traders love to take profits at obvious highs, and algorithms amplify it.

Ripple’s $75M credit line to Gemini — what actually happened?

This is one of the bigger structural stories in the video: Ripple extended a $75 million credit line to Gemini as part of the exchange’s IPO filings. Let’s be precise about the mechanics and why it matters.

- It is not a loan denominated in XRP to Gemini’s customers. It’s a corporate credit facility: Ripple, the company, agreed to provide credit to Gemini, the exchange, to support operations or growth ahead of a planned IPO.

- Per the SEC filing, Gemini can borrow in tranches of $5 million at an interest rate in the range of 6.5%–8.5%. That’s a reasonable corporate rate, certainly not predatory loan-shark territory.

- As the credit utilization exceeds $75 million, the agreement signals that loans may be issued in RLUSD — Ripple’s USD-pegged stablecoin — effectively giving RLUSD an on-ramp into a major U.S.-facing exchange.

- At the time of the filing, no funds were drawn yet. The facility exists as a conditional line of credit tied to Gemini’s IPO process.

The headlines that misreported this as “Ripple loaned XRP to Gemini” were wrong. It’s a loan facility from Ripple to Gemini in USD terms (or potentially RLUSD), secured by collateral and subject to contractual terms.

Why does this matter? Corporates offering credit to exchanges is not new, but when a major crypto firm like Ripple steps in, it demonstrates balance-sheet strength and strategic positioning. It gives ripple (pun intended) effects for stablecoin adoption if a major exchange starts accepting RLUSD as part of the facility. It also positions Ripple as a counterparty in the exchange ecosystem — more than a protocol token issuer, but a company with corporate finance muscle.

This is Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing-level news: corporate credit facilities move market structure, and the potential for RLUSD to hit a large exchange is strategically significant.

Why RLUSD matters

RLUSD is Ripple’s new USD-pegged stablecoin. If loans under the facility convert or are denominated into RLUSD after the $75M cliff, that would mean immediate RLUSD liquidity in a major exchange. Why is that important?

- Stablecoin distribution: If RLUSD becomes available on Gemini, traders and institutional desks get another stablecoin option. That aids liquidity, arbitrage, and trading pairs.

- Market share battle: The stablecoin market is competitive (USDT, USDC, DAI, etc.). RLUSD landing on Gemini gives Ripple a foothold to compete where liquidity and exchange integrations matter most.

- Regulatory optics: A stablecoin integrated via corporate credit could attract regulatory scrutiny, but it also shows Ripple is pursuing pragmatic on-ramps and partnerships rather than only protocol-level adoption.

Note: at the time of the filing no funds were drawn and the use of RLUSD was conditional — still, it’s a strategic play to watch. This is Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing territory — new stablecoins landing on major exchanges change the plumbing under trading desks.

Gemini: making money or losing money? The odd paradox

One curious line in the discussion: why would Gemini be losing money when exchange volumes are high? That’s a good question. Exchanges can be profitable, but profits depend on many factors: operating costs, legal or regulatory expenses, custody overhead, customer acquisition costs, and settlement liabilities.

Gemini has been navigating regulatory and competitive pressure while investing in growth and compliance. If trading volume rebounds but margins compress due to heavy investment or legal bills, an exchange can post losses despite the overall market being more active. That’s corporate reality — revenue is not the same as profit, especially in a business handling custody, legal, and compliance complexities.

Ripple stepping in with a credit facility implies two things: Ripple has cash or capital to deploy, and Gemini sees value in having standby financing ahead of an IPO. For traders, the takeaway is structural: the exchange landscape is consolidating and precarious — liquidity, fees, and counterparty credit matter.

This is Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing context: an exchange’s top-line volume is not a guarantee of profitability.

XRP price action: the technicals and the traps

XRP saw a modest pullback at the latest snapshot — about 3.5% down in the clip where I was talking. That’s not catastrophic, but it’s enough to make headlines and shake confidence for traders parading around the $3 psychological level. Let’s dig into the technicals and mindset you should have during August’s “trap month.”

First, the technical setup: XRP staged a significant run heading into the month, which naturally draws profit-taking once key resistance and psychological numbers are tested. The pattern we’re seeing is typical of an extended alt during a macro-risk event: minor pullbacks that test buyers, followed by volatile chop when macro headlines hit.

- Volume matters: daily volume around $6.5B indicates market participants are active. That’s not tiny volume — it’s meaningful liquidity.

- Support and resistance: key support sits near the recent demand zones. Resistance remains the recent highs and the psychological $3 area.

- Volatility framework: August historically behaves odd because many institutional desks have lighter desks, summer liquidity is thinner, and headline risk is concentrated (like Jackson Hole).

Expectation management is crucial: short-term swings below $3 are not a technical death sentence for XRP. This is likely the trap month’s typical shakeout — whipsaw that catches momentum traders off-guard. The long-term thesis (legal clarity, on-ramps like RLUSD, and network utility) remains intact for many holders, but that doesn’t mean you should ignore risk management.

This is Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing territory — manage sizing and stops; volatility will pick off the overleveraged and the inattentive.

A practical trading plan for XRP and alts during the trap month

If you’re active in the market, here’s how you can lean into structure rather than emotion:

- Size down: reduce position sizes relative to your core. Volatility is higher; preserve capital.

- Use staged buys: instead of lightning-all-in moves, scale in on clear support zones.

- Keep dry powder: if Powell is hawkish and we get stronger dips, be ready to buy with allocation rather than emotion.

- Set stop frameworks: know where you will exit if narrative breaks (e.g., major on-chain metrics collapse, unexpected regulatory shocks, or governance crises).

- Hedge if needed: stablecoins, inverse ETFs, or options can be used to mitigate tail risk for high-net positions.

Remember: being right about a trade and being right at the right time are different things. Time your entries with awareness of macro events. This is Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing wisdom — protection first, aggression second.

The broader market picture: market cap, altcoin season index, and volume

A few numbers to center the discussion:

- Total crypto market cap touched approximately $4.2 trillion before retracing. That’s a hefty number and shows the scale of recent gains.

- We’ve seen nearly $400 billion evaporate from market cap during the pullback — headline-grabbing, but also part of intra-market re-pricing.

- Altcoin season index stood around 41/100 — not crazy bullish, but not collapsed either. It suggests rotation and selective strength remain in certain alts even with BTC and ETH pressure.

- Daily reported “juice” in volume was cited as $175 million for a particular snapshot in the video — context-specific but it demonstrates action is present.

Markets are complex ecosystems. Even when the macro narrative is negative, pockets of conviction remain. Use data — volume, open interest, and exchange flows — to judge whether the move is a structural top or a healthy correction.

This is Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing ecosystem analysis: macro matters, but so does liquidity and order flow.

Tether, Beau Hines, and political optics — why it matters for markets

We touched on an odd social note in the video: discussions around talent moves between the crypto industry and entities like Tether. The comment stream referenced Beau Hines joining Tether and the set of political connections that can come with people in the space. Whether you love the optics or hate them, corporate hires with political ties alter perception.

For the market, that perception translates into regulatory expectations and investor confidence. When insiders with government links join entities like stablecoin issuers, some traders read that as a signal of legitimacy; others see it as an entanglement that invites scrutiny. Either way, the market reacts and forms expectations.

Remember: perception often moves prices before fundamentals catch up. That matters when you’re sizing positions or thinking about which stablecoins and custodial providers you trust to custody fiat on-ramps. This is Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing reality — optics and personnel moves influence flows.

August as the trap month — why I called it and what to expect next

I called August a trap month and I stand by that framing. Here’s why August tends to produce these patterns and the consequences for the rest of the cycle.

- Lower liquidity: summer months often have thinner order books. That means the same order size can cause bigger moves.

- Concentrated news events: a few big macro events (tariff headlines, Fed speeches, earnings updates) compress collective reaction into short periods of panic or exuberance.

- Rotation: portfolio managers may rebalance into or out of crypto around quarterly cycles. August sits awkwardly between quarters and often becomes a reset point.

- ETF/regulatory delays: when expected regulatory milestones are delayed, markets sell the rumor and buy the hope — then sell again when nothing happens.

Expect continued chop until a definitive macro signal or a decisive on-chain/regulatory event changes the narrative. That could be Powell’s tone at Jackson Hole, clear regulatory guidance, or an institutional product launch that unlocks new flows. Until then, volatility rules.

This is Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing logic: patience and structure beat guesswork.

How to think about risk and time horizons in the current environment

Short answer: match time horizon to capital allocation.

If you’re trading intraday, you should be ready for wild moves and tight stop loss discipline. If you’re a swing trader, expect whipsaw and increase your margin of safety. If you’re a long-term investor, this environment is a chance to average down opportunistically but not to chase unsupported rallies.

Key operational steps:

- Define your thesis: are you long-term because you believe in the network and utility, or are you trading momentum? Let that thesis guide position size.

- Set risk budgets: decide the % of portfolio at risk and stick to it.

- Use execution discipline: scale in and use limit orders instead of chasing market orders during panic moves.

- Keep cash reserve: dry powder is the currency of opportunity.

That’s how you survive August trap months and stay in the game for the big moves. This is Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing practice — discipline over emotion.

FAQ you might have after watching this breakdown

Q: Did Ripple loan XRP to Gemini?

No. Ripple extended a corporate credit line to Gemini. The loan facility is denominated in USD with potential RLUSD usage after certain triggers — not an XRP loan to Gemini’s customers.

This is Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing clarification: read the SEC filing for precise wording — headlines simplify and sometimes mislead.

Q: Should I sell XRP now?

That depends on your timeframe. If you need liquidity or want to reduce exposure because macro is likely to worsen, scale down. If you’re long-term and believe legal/regulatory outcomes or adoption news will favor XRP, use dips to add selectively. Remember: position size and patience are your friends.

This is Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing advice: don’t make panic-driven decisions.

Q: How much will Powell move markets on Friday?

It depends on tone and surprise. If Powell is more hawkish than market consensus, expect yields to rise and risk assets to sell. If he’s neutral or dovish, the relief could fuel a bounce. Either way, the speech is a high-probability volatility trigger.

This is Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing reality: plan for event risk and avoid being over-levered going into Friday.

Actionable checklist if you’re active in the market

- Reduce leveraged exposure ahead of Friday’s Powell speech.

- Ensure stop-losses are in place and reflect current volatility — widen them for longer-term positions, tighten them for day trades.

- Allocate dry powder for high-probability buying opportunities if the market sells off sharply.

- Track on-chain flows for XRP and large stablecoin movements — they often foreshadow price moves.

- Monitor exchange-level info: which exchanges are active, and whether RLUSD gets listed or used in meaningful flows.

This is Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing checklist-style guidance — simple, tactical steps to survive the week.

What I’m watching next — the signal list

- Powell tone at Jackson Hole: hawkish vs. dovish distinction.

- Retail inflation headlines and wage data updates.

- SEC filings and official mentions around RLUSD or other stablecoins being listed on exchanges.

- Exchange flow: large withdrawals or deposit spikes for BTC, ETH, and XRP.

- ETF or product updates that might change institutional flow expectations.

These signals will tell you if we’re in a temporary chop phase or if the market is resetting to a new regime. This is Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing monitoring — watch the data, not the noise.

Final thoughts and the practical takeaway

We’re in a volatile period driven by macro headlines and profit-taking behavior — that’s the bottom line. ETH and BTC pulled back after touching big numbers (classic profit-taking), Home Depot and other retailers’ tariff-driven price moves push inflation expectations higher, and Powell’s Jackson Hole speech this Friday is a high-impact event that could add more red to the heat map. On top of this, Ripple’s $75M credit line to Gemini is a significant structural development — it’s corporate financing, not an XRP loan — and RLUSD could get a foothold if conditions trigger that path.

What to do: manage risk, scale in with discipline, keep cash ready, and don’t over-leverage into headline events. August was called a trap month for a reason — thinner liquidity and concentrated news often create fakeouts. Treat this environment like it is: noisy, emotional, and full of opportunity if you plan your moves.

This is Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing life in a nutshell: volatility is the price of admission; patience and process are how you win.

Key takeaways — quick reference

- Market is risk-off; ETH/BTC falling dragged alts lower.

- Tariff-driven price hikes raise inflation risk and could keep rates higher for longer.

- Powell at Jackson Hole is a likely volatility trigger; be cautious into the speech.

- Ripple extended a $75M credit line to Gemini — corporate financing with potential RLUSD usage, not an XRP loan.

- XRP’s pullback is painful but not fatal; manage position sizes and watch for follow-through after macro events.

Stay alert, keep your plan, and don’t trade headlines without a clear risk framework. This market is still full of life — it’s just got a sore tooth right now.

— CRYPTO with KLAUS

This is Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — keep learning, keep sizing, and keep breathing through the pain train

🚀XRP RIPPLE BANK UPDATE🚀 CRYPTO CRASH ODDS — Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing. There are any 🚀XRP RIPPLE BANK UPDATE🚀 CRYPTO CRASH ODDS — Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing in here.