By CRYPTO with KLAUS

If you woke up to green screens, salty comments, and a coffee-fueled market breakdown, welcome to my Wednesday. In today’s deep-dive I break down the headlines that matter: Ethereum roaring toward all-time highs, the Ripple vs. SEC saga finally resolved, the political fallout that’s pushed major players into crypto, and what it all means for XRP and your portfolio. This piece pulls the threads together so you can make smart decisions in the fast lane of Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — with a little attitude because that’s how I roll.

Key takeaways

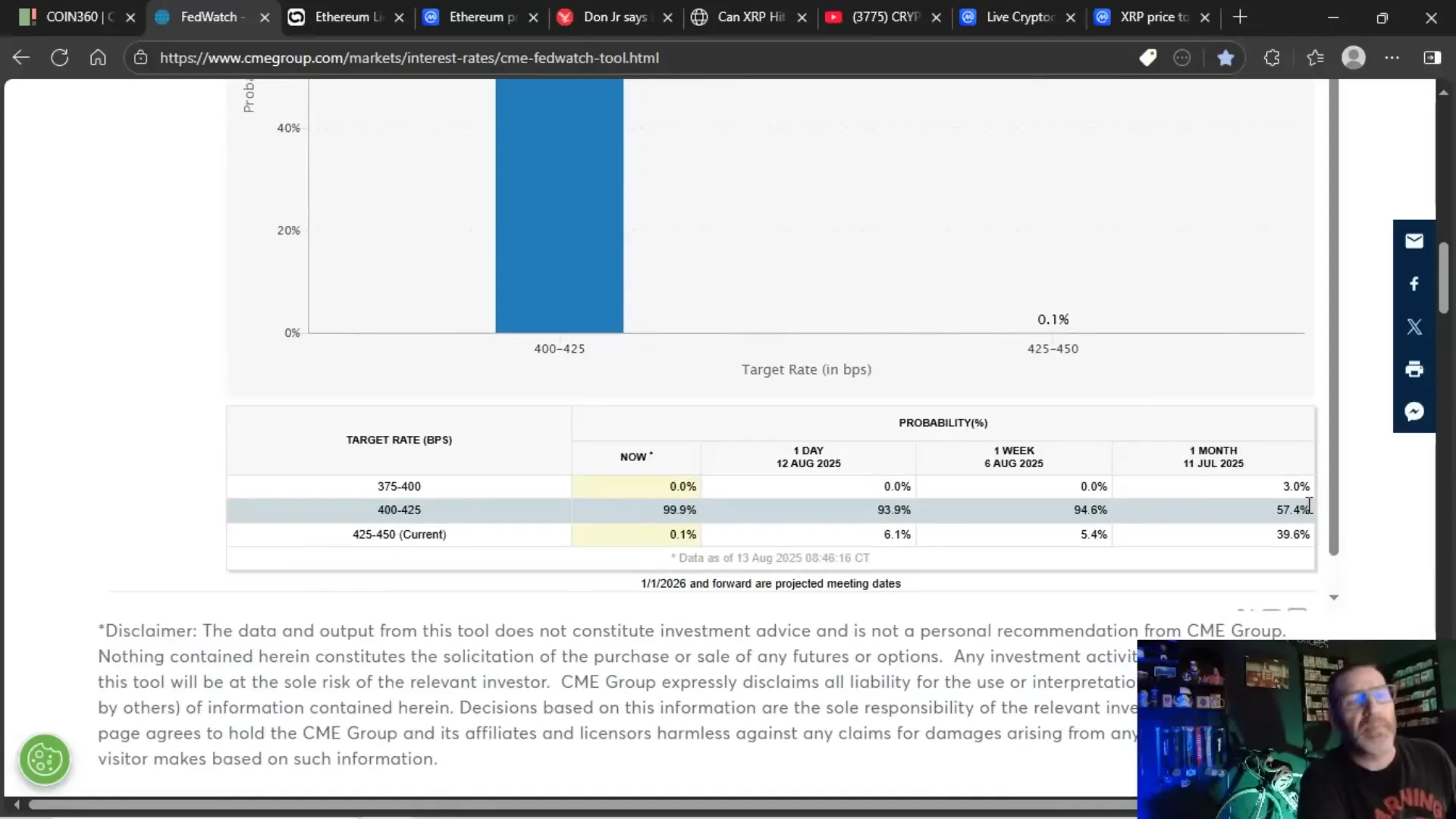

- Fed rate-cut expectations surged: the market now prices a high chance of a September cut, which fuels risk assets and alt seasons.

- Ethereum’s near all-time-high move pushed massive liquidations and is acting as the engine for altcoin momentum right now.

- The end of the SEC vs. Ripple case removes a headline driver for XRP — that’s both good and bad.

- Debanking and “operation choke point” style policies pushed high-profile actors (including political families and executives) toward crypto solutions, accelerating institutional interest.

- XRP can reach $4 in 2025 under the right macro and regulatory conditions; $3 as a more conservative milestone is very plausible.

- Primary catalysts to watch: regulations (Congress), spot ETFs, Fed policy (rate cuts), and institutional flows rotating from BTC to ETH and alts.

Why this article — and why now?

I do these deep dives because markets move fast and the noise is thick. When Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing conversations ramp up, you need a clear map: what changed, what’s likely next, and how to position yourself without panicking. I’m giving you that map, plus the kind of no-nonsense color commentary you’ve come to expect.

Fed pivot: rate cuts moving from theory to expectation

One month ago, the market priced the probability of a Fed cut at roughly 57%. As of today, it’s basically priced in. That’s a seismic shift. When Fed risk pivots like this, money doesn’t just trickle back into equities and crypto — it floods. The result: demand pressure across risk assets, and particularly a new wave of appetite for altcoins and ETH.

Why does this matter for XRP and the rest of the crypto market? Because Central Bank policy shapes risk-on vs. risk-off behavior. Lower interest rates (or the expectation of them) decrease the opportunity cost of holding volatile assets and increase leverage/carry trades that feed rallies. In plain terms: if Jerome Powell gets squeezed into cutting — and the market bets on that — BTC and ETH go up, and alts get a serious look.

Remember the exact phrase that the headlines scream? Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — all appear in corridors where market flows are being repriced. The macro environment is the umbrella that decides whether XRP’s potential rocket has fuel or not.

What to watch in the next Fed updates

- Jobs data: if payrolls soften and unemployment ticks up, that’s further fuel for the market to expect cuts.

- CPI and core inflation trends: disinflationary signs will accelerate central bank dovishness.

- Fed official speak: a shift in rhetoric from “higher for longer” to “data dependent” could trigger new flows.

Ethereum roaring — why ETH matters to the alt market

Ethereum’s move toward its all-time high is not just an “ETH thing.” ETH acts like a gateway. Institutional flows are telling the story: daily inflows into ETH spot and futures products have outpaced BTC on multiple recent days. When ETH runs, it sucks attention and capital toward smart contract ecosystems and altcoins built on or adjacent to that momentum.

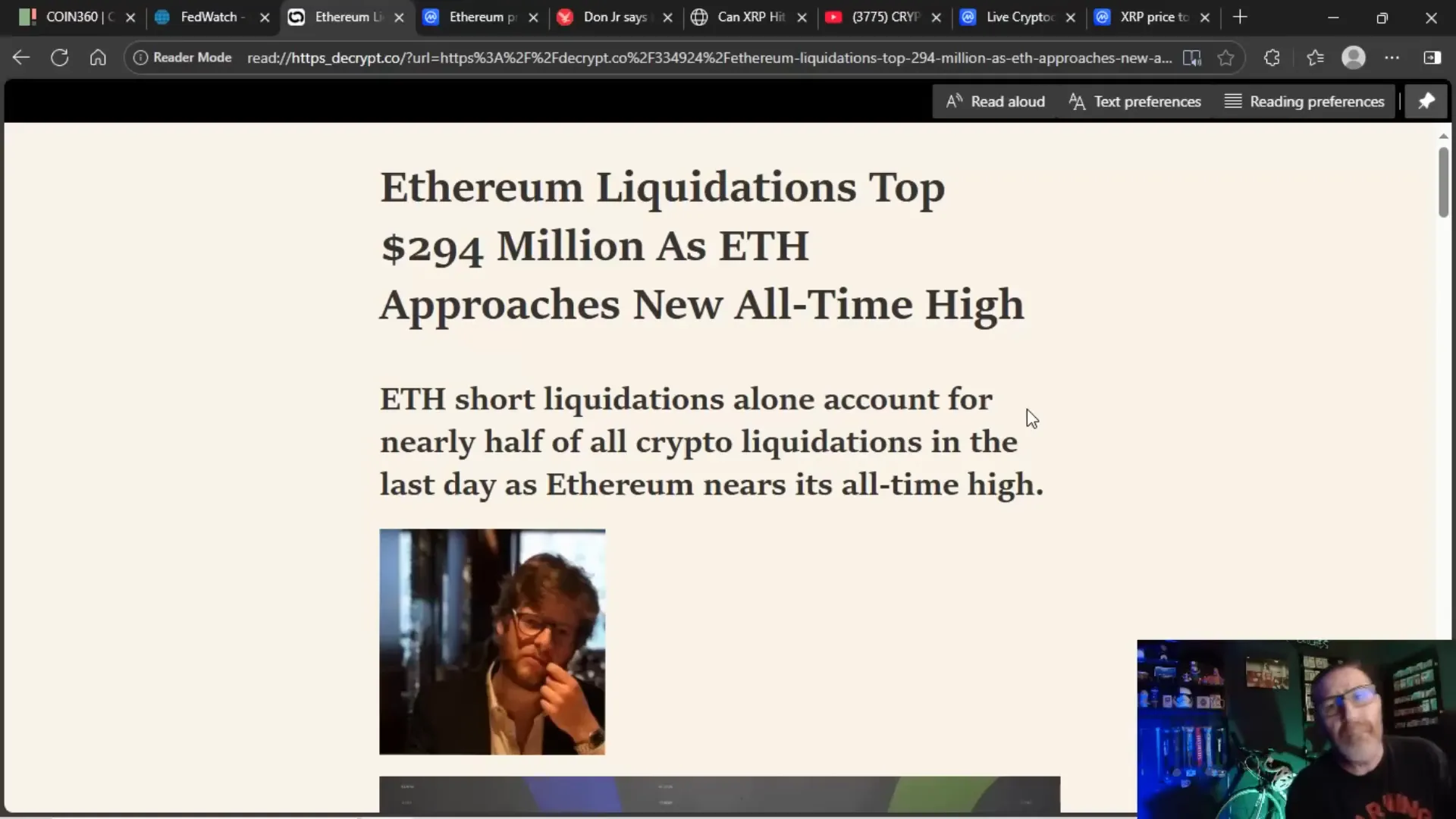

Case in point: ETH came within about 4% of its previous ATH and wiped out nearly $294 million in liquidations. That’s not small potatoes. It cleaned up a bunch of bearish open interest and removed resistance levels from the market — the kind of technical clearing that can pave the way for new highs.

Here’s the technical nuance: ETH historically struggles to hold breakouts above previous ATHs. Every time it cracks that ceiling, profit-taking has sent it back down. The key question now is whether ETH can sustain the breakout. If it does, altcoins get a wave; if it fails, we could see a brief pullback where higher-beta alts bleed.

Again: Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — these themes are converging. ETH’s run informs institutional appetite. When institutions rotate from BTC to ETH, alts go on the radar. And that’s good news for XRP if the macro and regulatory winds cooperate.

Institutional flow snapshot

- Recent days: $500M-ish into ETH compared to $65M into BTC.

- Prior day: $1B into ETH vs. $178M into BTC.

- Implication: institutions see more upside in ETH’s runway versus BTC’s current price level.

Operation Choke Point 2.0 — debanking fuels crypto adoption

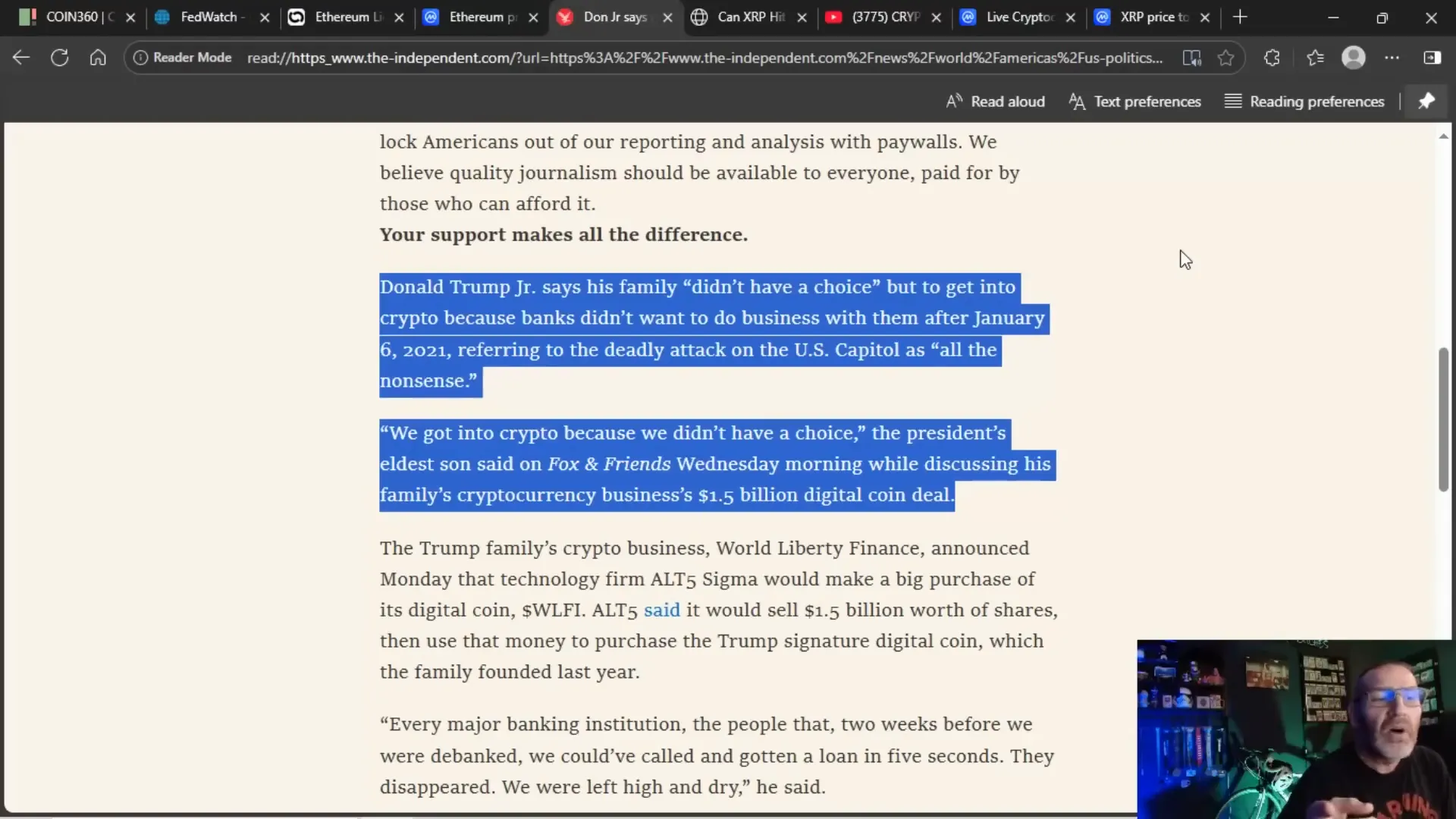

Let’s call it what it is: when banks shut you out, you innovate. That’s been the story for a lot of players in crypto. We saw Ripple executives and others get debanked, and now high-profile families—yes, even those in politics—say they moved into crypto because banks refused service after controversial events.

When big names and businesses get pushed away from traditional rails, two things happen:

- They look for alternatives — crypto and custody solutions are attractive because they provide resilience and control.

- They often bring capital, legitimacy, and lobbying power. This can accelerate regulatory clarity and institutional product development.

Brad Garlinghouse getting debanked personally is a perfect microcosm. The message that sends is: if the system won’t play fair, build a parallel system. And Ripple, with its payments rails and custody ambitions, is one of those builders.

It’s cyclical: debanking drove innovation in the crypto rails, which then put pressure on banks to adapt or get left behind. So when you hear “operation choke point,” remember it’s not just a phrase — it’s a catalyst that helped turn private frustration into public investment and adoption. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — the ecosystem benefits from that tectonic shift.

XRP: SEC case over — why that’s both a relief and a new challenge

Alright jabronis, here’s the heart of it: the SEC vs. Ripple case being over is a major milestone. The legal overhang is gone — that’s obviously good. But that very overhang served as a dramatic headline engine that kept XRP relevant in mainstream and crypto press for years. Now the question is: can Ripple maintain the spotlight without the litigation drama?

Let’s be blunt. The court case kept XRP in the headlines. Headlines drive retail attention, and attention drives speculative flows. Remove the biggest headline and you suddenly have to compete for shelf space among nearly 20 million crypto tokens. So the challenge is real: Ripple will need to lean on product wins, partnerships, and regulatory clarity to stay front and center.

Here’s what I’m watching for Ripple and XRP to continue their narrative: banking rails adoption, bank-trust integrations, stablecoin playbooks, enterprise use-cases, and the potential of an XRP ETF narrative. Those are the bullets they now have to fire to remain relevant beyond the courtroom drama.

Why the SEC outcome hurts and helps

- Helps: Legal risk removed. Institutional and retail participants can price XRP without worrying about regulatory tail risk tied directly to that case.

- Hurts: Loss of massive, recurring headlines — the market needs news to stay excited and allocate capital.

- Net: The removal of legal risk is a long-term positive. The short-term headline vacuum can be bridged by product and regulatory catalysts.

And yes — I still think XRP can hit $4 in 2025. But it will take things going right: rate cuts, ETF momentum, and crypto-friendly regulations. I’m more confident in a $3 floor sooner than $4 firing off, but with the catalysts lined up, $4 is absolutely possible.

Price, volume, and the on-chain picture for XRP right now

Short-term technicals look healthy. Volume is strong — I flagged ~9.4 billion in trading volume as a positive sign, and XRP’s one-hour candles show momentum above the $3 support area. Open interest looks healthy and the market structure suggests institutional-sized players are comfortable at current levels.

Key technical points to monitor:

- Support: $3 is the critical baseline right now. If that holds, bullish momentum is the higher probability outcome.

- Resistance levels: $3.30–$3.50 is immediate resistance to flip to support for a move to higher targets.

- Volume confirmation: keep an eye for elevated volume on up candles; that’s needed to sustain moves toward $4+.

How institutional rotation from BTC to ETH benefits alts — including XRP

Institutions aren’t dumb. They watch risk-reward. At BTC’s current levels, some are deciding the upside is limited on a percentage basis. Meanwhile ETH has more perceived runway — and the institutions are buying in. Once ETH has momentum, capital tends to flow into higher beta plays, one of which is XRP.

That rotation has a clear path:

- Institutions buy spot ETH and ETH products (because it’s cheaper to double than BTC is to double).

- Gains in ETH create portfolio performance that allows other risk plays to be added.

- Alts and mid-cap tokens (where XRP sits in market terms and utility) see inflows once liquidity and regulatory certainty (or clarity) improve.

So institutions aren’t just betting on ETH. They’re building a ladder into the broader crypto market — and XRP can be on that ladder if the narrative shifts from legal drama to payments rails and enterprise adoption. Again: Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — all those words matter because they describe the ecosystem the institutions operate in.

Can XRP hit $4 in 2025? The scenario analysis

Short answer: yes. Medium answer: it depends. Here’s the scenario breakdown — with probabilities and what needs to happen.

Base case (40% probability): $3 floor, $4 by late 2025 if catalysts align

- Fed cuts in September boost risk appetite.

- Congress or regulators issue clearer crypto rules that are pro-growth.

- Spot and institutional ETFs gain momentum and incorporate alt exposure flows.

- Ripple continues enterprise wins, partnerships with financial institutions, and shows adoption on rails and stablecoin integration.

Optimistic case (25% probability): Rapid alt melt-up, XRP surpasses $4 early

- Fed aggressively dovish, multiple cuts come sooner than expected.

- Large spot ETF approvals and substantial inflows broaden investor base.

- Ripple announces significant bank or payment processor integrations, creating a utility-based narrative shift.

Conservative case (35% probability): Volatility and sideways movement, $3 takes longer

- Macro shocks (geopolitical, inflation surprises) dampen risk appetite.

- Regulatory delays or new constraints slow inflows into alts.

- Market rotates back to BTC; ETH fails to sustain breakout.

So what’s my play? Allocate with conviction but keep risk sizing sensible. I see a clear path to $4, but it’s not guaranteed. Position size accordingly.

Risks you must be honest about

No market is without risk — and crypto is chock-full of them. Here are the things that could wreck an otherwise tidy bullish thesis for XRP and alts:

- Geopolitical flare-ups that drive a flight to safety. Oil shocks or Middle East escalations can re-price risk rapidly.

- Fed surprises: if they don’t cut or talk about tightening again, crypto could test prior lows.

- Regulation failing to pass or swinging the wrong way. If lawmakers impose heavy restrictions, institutional flows could stall.

- Market sentiment shift: retail mania can evaporate quickly. Without institutional follow-through, rallies can be fragile.

Still, the fundamental case remains stronger than before the SEC case resolution. The regulatory overhang is cleared; the risk bucket is lighter. That should attract more measured capital and open the door for more structured products — ETFs, custody services, on-ramps — and that’s what institutions look for.

Practical playbook: how to act (not react)

Here’s a pragmatic plan whether you’re a short-term trader, swing trader, or long-term investor. Remember: this is not financial advice — it’s a tactical framework I use and teach.

For short-term traders (days to weeks)

- Trade the momentum. Look for entries on consolidation above $3 with volume confirmation.

- Use tight stops. Volatility can ambush leveraged positions — limit downside.

- Keep a watch on ETH > ATH motion. If ETH confirms sustained strength, alt momentum will likely follow.

For swing traders (weeks to months)

- Pick entries on retests of the $3 zone or on breakouts above $3.50 with volume rebound.

- Scale into positions as news flow (regulatory clarity, ETFs, partnerships) comes in.

- Set logical profit targets — e.g., partial at $4, more at $5+ depending on macro backing.

For long-term investors (years)

- Dollar-cost average into XRP and a mix of high-conviction alts while keeping Bitcoin and ETH core in your allocation.

- Keep an eye on regulatory moves and custody solutions — these are the enablers of institutional adoption.

- Re-evaluate allocation if macro regime shifts drastically (e.g., rapid rate hikes or a deep recession).

Whatever your timeframe: never bet the house on a single token. Diversify across BTC, ETH, and a handful of strong alt projects including utility plays like XRP. And for the love of sane risk management — size positions by what you can stomach.

What to watch — the checklist of catalysts

Be ready to react, not to panic. Here’s the checklist I have open at all times:

- Fed rate decision and the lead-up jobs/CPI prints (September meeting is critical).

- Regulatory movement: Congressional or regulator clarity on spot ETFs or alt-specific rules.

- Spot ETF inflows into ETH and BTC — and if institutional flow starts into alt-focused products.

- Ripple announcements: bank integrations, custody partnerships, or stablecoin and rail rollouts.

- Geopolitical or macro shocks that could force deleveraging.

When those align (Fed dovish + regulatory clarity + ETF/institutional flows + Ripple product wins), the probability of a strong XRP run materially increases. Keep the radar on for these, and act deliberately.

How the community and sentiment factor in

Community sentiment used to be driven by headlines like the SEC case. Now that one major headline is gone, the community can either pivot to fundamentals or get bored. I’m optimistic because the fundamentals are actually improving — enterprise adoption, payments rails, and custody infrastructure. But sentiment can still move price dramatically in the short-term.

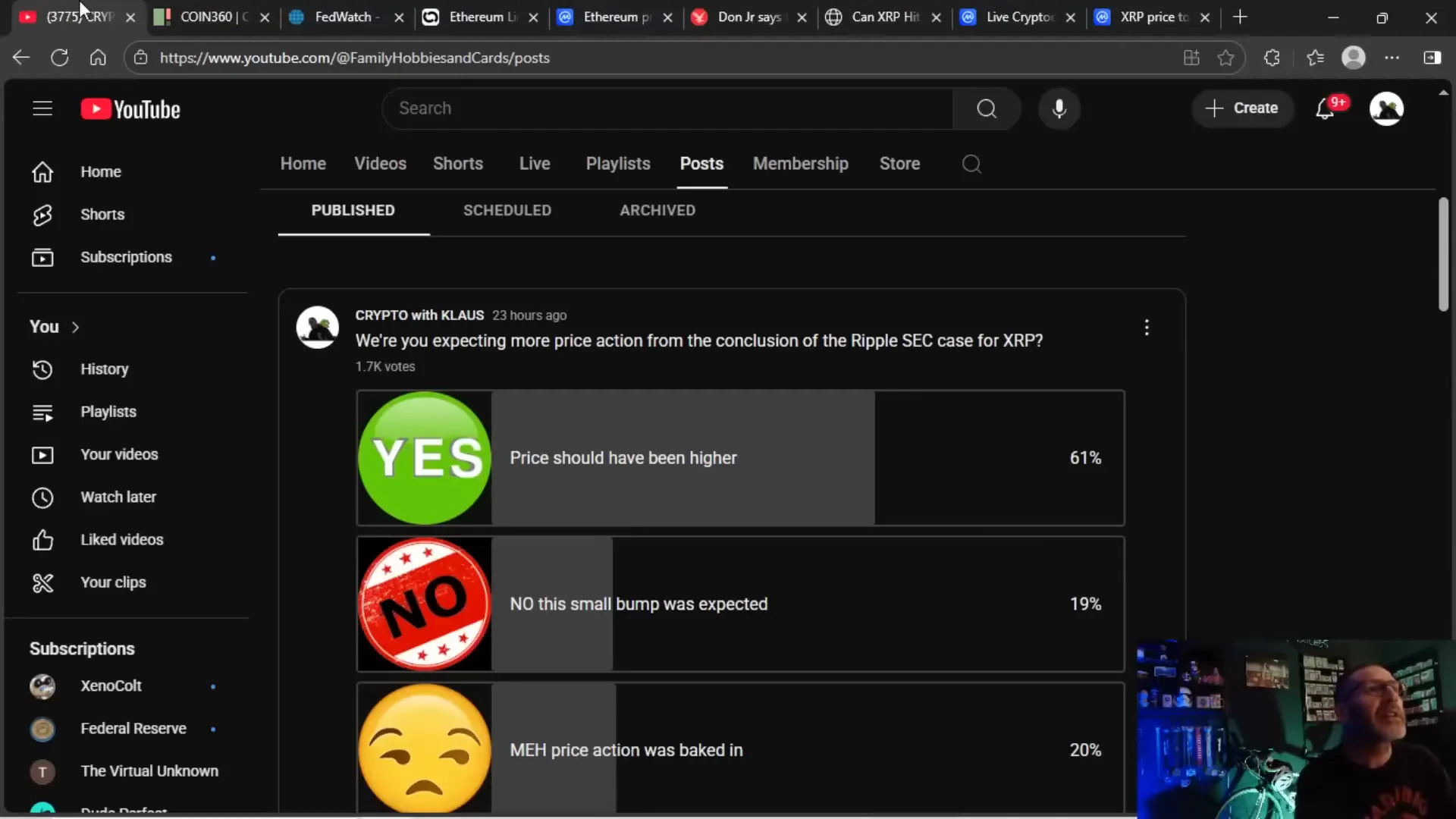

One metric I watch besides market data is social engagement: trading volume, vote polls, and community chatter. A recent community vote showed 61% of people expected a stronger price reaction from the Ripple case conclusion. That mismatch between expectation and reality can create volatility but also opportunity: if expectations are too high, dips can happen; if expectations are realistic, rallies can be stable.

My final thoughts — for now

Here’s the honest, simple truth: removing the SEC overhang is good for long-term capital inflows into XRP. If the macro environment continues to ease (i.e., rate cuts), and if regulators provide clarity and ETFs get traction, XRP is set to be a major benefactor of the next leg up in alts.

ETH is leading the charge and forcing institutions to rethink allocations. That rotation from BTC to ETH and then to alts creates the perfect environment for tokens like XRP to reassert their utility and capture value. But keep in mind the risks: geopolitics, Fed surprises, and regulatory setbacks can derail momentum very quickly.

So here’s my practical advice: stay informed, size positions intelligently, respect support / resistance levels, and keep the radar on the catalyst checklist. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — those words are not just a keyphrase for SEO; they’re the pillars of the market landscape you’re navigating.

If you liked this breakdown and want real-time heat checks, I’ll keep posting updates as news and data come in. For now, enjoy the green, keep your pullout game strong on hump day (crypto humor, you know the vibes), and stay sharp. We’re in a very interesting phase — one where the pieces could click into place for a major run, or where events could shake things up. Either way: this is the fun part.

Stay safe, trade smart, and jabronis — keep those questions coming. I’ll see you in the next update.

🚀XRP MASSIVE BULLISH NEWS JUST HIT — Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing. There are any 🚀XRP MASSIVE BULLISH NEWS JUST HIT — Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing in here.