Intro — Why you should care (and why I’m talking straight)

Hey — Klaus here from CRYPTO with KLAUS. If you follow my channel you know I keep things blunt, informative, and a little salty when it helps get the point across. Today I’m laying out the latest that actually matters: big signals from the Fed, a surprising stance from the SEC, the Treasury openly flirting with stablecoins as buyers of U.S. debt, and what all this means for XRP, HBAR and the broader market.

This article is for people who want real clarity—no fluff—about how policy, regulation and money flows will shape the price action and strategic choices over the next 6–12 months. We’ll break down the headlines, walk through on-chain and chart context, and give practical ideas for positioning yourself safely and intelligently.

Quick note on SEO: this article is optimized for the search phrase Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing because that’s the corner of the internet so many of you frequent. I’ll mention Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing throughout so this post gets into the hands of folks hunting for the exact mix of policy, charts and strategy you care about.

Key takeaways — TL;DR before we deep dive

- The new SEC chair said “very few tokens are securities.” That’s a political and operational shift — it doesn’t mean the SEC vanishes overnight, but it does change the regulatory narrative.

- The U.S. Treasury openly acknowledges stablecoins backed by treasuries could be big buyers of U.S. government debt. Translation: stablecoin issuers may become large demand sources for Treasuries.

- Some Fed officials (notably Michelle Bowman) are pro-crypto-friendly when it comes to experimentation and are warning banks they’ll be irrelevant without blockchain adoption.

- XRP and HBAR have very different 1-year charts and narratives — XRP’s showing resilience in the face of profit-taking; HBAR is in discount territory with the potential for a cleaner technical setup if regs and ETFs progress.

- ETFs and clearer regs are the next big catalysts; timing looks like late summer through November for meaningful legislative and ETF-driven moves.

And yes, I’ll say it plainly: this is the moment where policy meets product-market fit. The intersection is noisy, but it’s where big winners will be separated from the also-rans.

SEC: “Very few tokens are securities” — what that actually means

The remark from the new SEC chair that “very few tokens are securities” is headline-friendly, but layered. On the surface it feels pro-innovation: most tokens aren’t being pre-labeled as securities, and classification depends on packaging and sale. On a practical level it’s both a relief and a tease.

Relief, because if most tokens aren’t securities, projects that are truly utility-focused or decentralized can breathe easier. Tease, because the SEC still has enforcement power and can — and will — push when it believes actions look like unregistered securities offerings.

Bottom line: regulators are moving from a binary “token = security” position toward a facts-and-circumstances approach. That’s progress. But it also means we can expect a continued mixture of enforcement and guidance until Congress or a clearer market-structure bill settles the boundaries.

For investors and builders, that’s an important distinction. Work on fundamentals, decentralization, documented utility and transparent token distribution. And keep an eye on any enforcement actions from the SEC that clarify boundaries — those will be the playbooks moving forward.

I’m saying it up front: if you’re a trader or builder, don’t assume the SEC will stop enforcing. Assume they’ll focus more selectively. And yes, that matters for your risk modeling.

Practical steps in response to the SEC shift

- Projects: document sources of value (utility, staking, fees) and keep token sales regulation-friendly.

- Investors: treat each project on its facts; don’t lump everything together.

- Exchanges and custodians: prepare compliance playbooks that show how assets are classified and traded.

And for the record: I mention all this under the umbrella of Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing because regulatory clarity is the key that unlocks institutional flow.

Treasury + Stablecoins = Buyers of U.S. Debt? Welcome to fiscal utility

This is the part of the story I want everyone to understand: the Treasury isn’t looking at stablecoins just through the lens of consumer protection. They’re seeing stablecoins as a potential new set of buyers for U.S. treasuries.

Why does that matter? The U.S. government sells debt to fund operations. Stablecoin issuers, especially those mandated to back U.S.-pegged stablecoins with short-term Treasury bills, create demand for Treasuries. This puts stablecoins in the middle of fiscal financing, not just payments or DeFi.

Here’s the blunt version: the Genius Act (the new rule that requires certain stablecoins to hold secure assets, including Treasury bills) nudges stablecoin issuers to buy U.S. debt. The government is frankly happy about that. The Treasury’s public admission that stablecoin issuers could become meaningful buyers is a major shift — it sends a message to markets that the state sees crypto players as part of the financial plumbing, not strictly as a threat.

That alignment — stablecoins buying Treasuries — is a political and economic handshake. It comes with strings: compliance, auditing, and regulatory oversight. But it also creates a fiscal incentive for the government to promote stability in the space. That’s a net positive for institutional adoption.

Implications for investors

- Stablecoin-backed asset flows could support Treasury demand and help keep yields lower than otherwise — beneficial for risk assets, including Bitcoin and altcoins, in certain macro conditions.

- Stablecoin issuers will become highly regulated financial intermediaries. Expect increased KYC/AML controls and tighter banking relationships.

- This fuels an institutional narrative: build compliant, mintable and transparent stablecoin rails, and you unlock both retail utility and institutional funding flows.

Again, this all loops back to the central theme: policy influences capital flows. That’s why Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing readers should care about the Treasury’s tone — it could reshape the balance between crypto-native liquidity and mainstream financial demand.

The Fed, Fed personalities and the “who replaces Powell” question

Jerome Powell is not going anywhere immediately — he’s the Fed chair through May 2026 unless something dramatic happens. But the chatter about potential replacements matters. It’s not just politics; it’s about policy attitudes.

Enter Michelle Bowman. She’s not the firebrand everyone screams for (and she cracks a mean pair of glasses), but she’s vocal about experimentation and blockchain adoption. Two quotes I loved from her recent comments: loosen the personal crypto investment ban for Fed staff to increase understanding, and banks should adopt blockchain or risk irrelevance.

That mentality matters because regulators who push for experiment-first learning are far more likely to support measured adoption frameworks and pilot programs. Bowman’s stance on encouraging banks to bank legal crypto businesses also hits a core pain point: debanking. When banks refuse services to legal entities for reputational or political reasons, it creates real economic harm and suppresses innovation.

Practical impact: if the Fed cultivates internal knowledge via experimentation, policy decisions will be more technically informed. That reduces the chance of knee-jerk bans and increases the chance of sandboxed, supervised deployments. For builders, that’s a net win.

What to watch at the Fed

- Federal Reserve job postings or pilot programs that mention DLT/blockchain or tokenization.

- Public statements about repayment, tokenized Treasuries, and internal experiments — they often foreshadow policy changes.

- Banking charters and guidance that affect how banks custody and service crypto businesses.

Because whether you own XRP, HBAR, Bitcoin or Ethereum, Fed posture impacts liquidity, rates and the banking plumbing that underpins exchanges, custodians and stablecoin issuers. For the keyword-driven among you: Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing is fundamentally connected to these Fed choices.

HBAR price action — Discount aisle, double bottom chatter

Let’s get into technicals and narrative. HBAR has been under 25 cents and some folks on social make it sound like those levels are never coming back. That’s what FUD looks like when you stop looking at timeframes.

Zoomed out, the one-year chart shows a pretty clear double-bottom pattern around the low-12 cent area. That’s meaningful: a double bottom suggests buyers showed up at roughly the same price twice, creating a base. But the path up from there has been slow and choppy — we’re trading in the 23–25 cent range with occasional floats above 25 but without a sustained breakout.

Why are we stuck? A couple reasons:

- Clarity/regulatory headlines are still pending. Institutional adoption needs guardrails.

- Liquidity is muted compared to bigger caps. HBAR’s market depth makes it more volatile on flows.

- Hype cycles ebb and flow. HBAR had big aspirations in 2024–2025; the market is now debating utility vs. speculation.

Volume sits in the mid-hundreds of millions — not terrible, but not screaming institutional action. ETFs could change that. If the market gets some form of exchange-traded products or clearer custody rules, expect liquidity to increase and discount windows to shrink.

Trading perspective for HBAR:

- Short-term traders: watch for break-and-retest patterns above $0.25–$0.30. Volume confirmation matters.

- Swing/position traders: double-bottom plus higher timeframe structural support gives a tolerable risk/reward — but size positions accordingly.

- Long-term holders: if you bought the narrative — token utility, enterprise adoption — then patience is required. This is a long play that depends on regs and real-world adoption.

If you’re asking whether we’ll see the $1–$2 targets some people threw around last year, be realistic: those targets are contingent on large macro and regulatory wins, massive institutional flows, and product adoption that’s still rolling out. Don’t base retirement on hypotheticals. Instead, use position sizing and time in the market wisely.

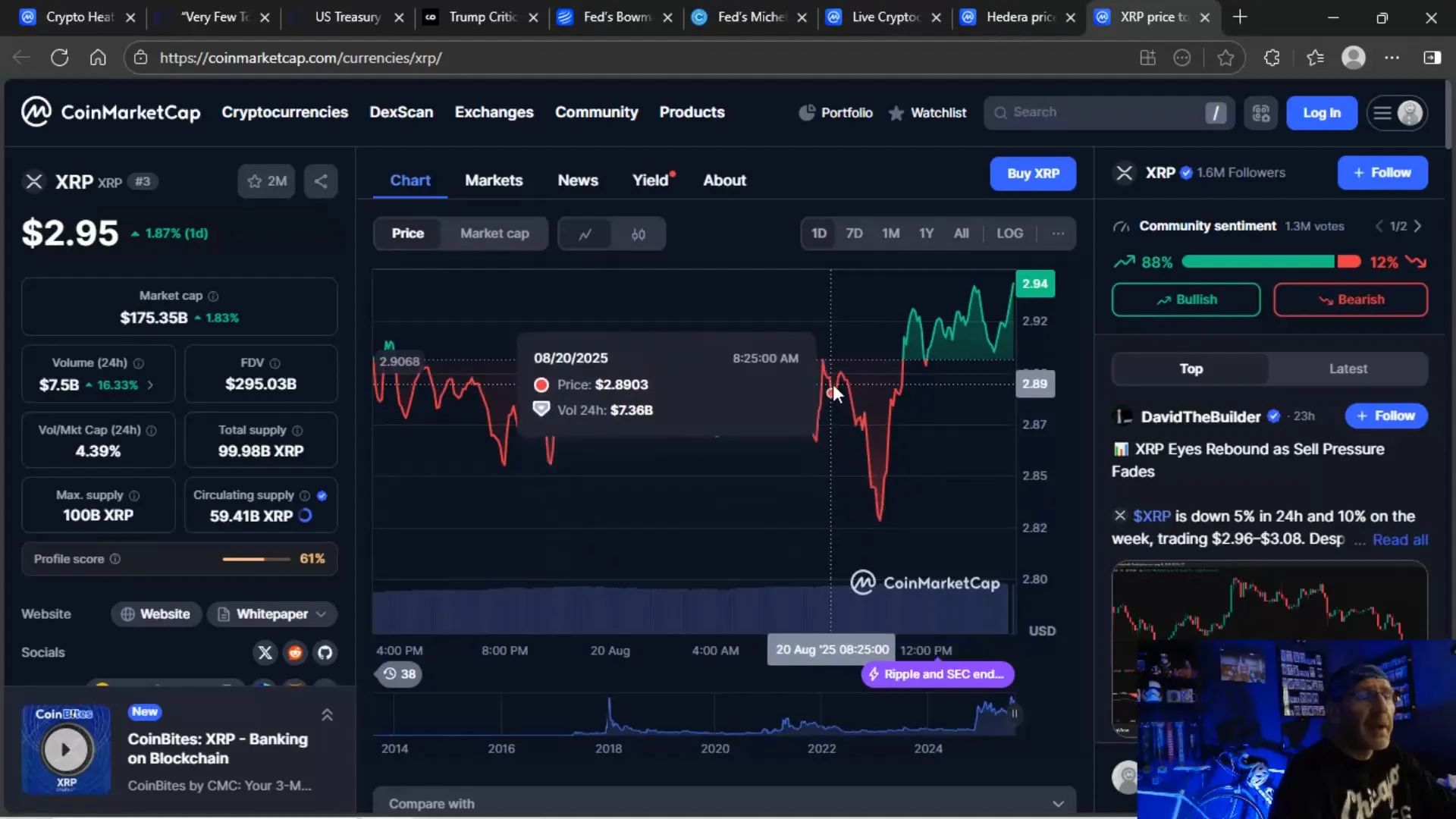

XRP price action — resilience, ETFs and profit-taking

XRP sits around the $2.90 mark as I write. The charts are telling a mixed story. On the 7-day timeline, things look shaky — profit-taking happens after rally moves. On the 24-hour timeframe, we see classic panic selling into stops and then a stronger rebound as buyers step in. That’s healthy market behavior in a developing liquidity environment.

XRP’s narrative is stronger in a couple ways: the asset already has several ETF applications and there’s regulatory clarity improving. XRP’s case is different from HBAR because XRP has legal history and a lot of real-world payment rails narrative. That doesn’t immunize it from dump-and-rebound cycles, but it gives it different fundamental tailwinds.

Why the sell-offs? Funds take profits. Traders scale out after big run-ups. Some retail stops get cascaded. All normal. The healthy sign is rebounds on decent volume — current volume shows market participants are still willing to hold near these levels.

Strategy for XRP:

- If you’re a trader: scale into dips and use trailing stops. The flow from ETFs and any favorable regulatory news can create explosive moves; being long with manageable risk is key.

- If you’re a hodler: dollar-cost averaging into supported levels can be effective if you believe in the payment utility narrative.

- Watch for institutional flows: increased ETF interest or clearer custodial options will materially change volatility and depth.

All of this lives under the umbrella of macro and regulatory backdrop. Remember that ETF approvals propel flows; regulatory clarity reduces risk premia. For those tracking keywords: Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — XRP sits inside that ecosystem and will be affected by both macro and regulatory pushes.

ETFs, regs and the timing game — what to expect

Everyone wants a date and a guarantee. Real life doesn’t hand that out. But here’s the realistic timeline and what it implies:

- Regulatory clarity (market-structure bills, clarity acts) — expect modifications, negotiations and reconciliations between House and Senate versions. The negotiation window puts meaningful legislative clarity into the September–November timeframe.

- ETF approvals — the SEC and exchanges need time to process filings, operational readiness (custody, surveillance), and clearance. We’re looking at potential ETF momentum around November, but watch for incremental approvals earlier or specific ETFs with narrower scopes.

- Practical adoption — once ETFs launch, flows don’t instantly become massive. They ramp. Expect 6–12 month flow cycles where institutional allocations and retail flows both contribute.

Regulatory passage tends to be slow and messy — committee markups, stakeholder input, and political bargaining all delay things. But the net effect of clearer regs + ETF availability is increased institutional participation, better custody solutions, and reduced counterparty risk. That’s the environment where altcoins like HBAR and infrastructure plays can break out from prolonged discount phases.

So what should you do today?

- Prepare for volatility — it will persist until major catalysts resolve.

- Size positions properly — treat a year-plus timeline as the playing field for many speculative alts.

- Hedge when needed — consider hedging tail risk with liquid instruments or keeping allocation to cash/reserves.

And I’ll say it again as you bookmark this: the combination of clarifying regs and ETFs is the top-lift story for the next 6–12 months in the crypto-to-institution pipeline. Keyword reminder: Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing.

Putting it all together: market psychology, flow and opportunity

We’re in a phase where headlines and policy moves matter more than ever. Why? Because when the state changes incentives — asking stablecoin issuers to hold Treasuries, or a regulator signaling fewer tokens are securities — capital reallocates.

Market psychology moves in predictable cycles:

- Uncertainty → price compression → speculation → clarity → re-rating → profit-taking → repeat.

Right now we’re somewhere in the uncertainty-to-clarity transition. Some assets are in discount aisles (cough, HBAR). Some are consolidating around narrative strength (XRP). Bitcoin and Ethereum remain barometers; their behavior steers sentiment for the whole class. That’s why I keep emphasizing the same SEO phrase: Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — it’s the ecosystem shorthand for where capital flows will be judged.

Opportunity is everywhere, but the simplest and least sexy advice is the best:

- Protect capital first. Protect upside second.

- Keep dry powder. Volatility creates opportunity if you can act rationally.

- Map scenarios: best case (rapid ETF adoption, clarity, flows), base case (slow adoption, selective wins), worst case (regulatory clampdowns). Prepare allocations for each.

How I’m personally thinking about allocation (example, not advice)

My own allocations center around risk buckets:

- Core (30–50%): Bitcoin and top-layer liquidity assets — these are the long-term reserve plays that anchor the portfolio.

- Growth (20–35%): High-quality layer-1s and tokens with clear utility and adoption paths — includes some ETH-focused positions where staking/cap table makes sense.

- Opportunity (10–25%): Speculative plays with clear catalysts — this is where I might hold HBAR or other discounted alts with product narratives.

- Cash/Stable (10–20%): Dry powder for dips — especially important in headline-driven markets.

Note: This is a framework and not an investment mandate. Individual risk tolerances vary. But strategy trumps emotion: positioning with conviction and limits is how you climb out of volatility alive and into returns.

Practical trade ideas and risk controls

If you want actionable ideas (again, not financial advice), here are trades and risk controls that make sense given this environment:

Short-term trades (1–6 weeks)

- Momentum entries on confirmed breakouts with volume above average; tight stops below support.

- Scalp rebounds on heavy panic candles with entry at 50% retrace; profit targets at prior resistance levels.

Swing trades (1–6 months)

- Buy-and-hold through a catalyst window (ETF/reg vote), size for event risk and set stop-losses reflecting structural support.

- Pairs trades: hedge a speculative alt with a short in BTC/ETH futures to isolate idiosyncratic alpha.

Long-term allocation (6–36 months)

- Grind positions into discounts — dollar-cost average into HBAR/XRP if you like the narrative and can tolerate volatility.

- Use options to create defined-risk exposure where available (e.g., covered calls, protective puts).

Risk controls

- Size positions so a 50% drawdown doesn’t affect your ability to act.

- Keep an emergency fiat buffer — markets make big moves during macro shocks.

- Rebalance quarterly — realize gains and move into underperforming core assets when appropriate.

Each tactic ties back to regulatory clarity and capital flows — the big levers of our industry. If you’re a regular reader of this niche, you know the keywords: Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing. They’re the language of where capital cares to go.

How to watch the news without letting it wreck your trading psychology

One of the biggest drains on returns is reactionary trading to headlines. Here’s a simple system I use and recommend:

- Scan headlines every morning. Note one or two macro items that could move markets (Fed comments, major regulatory decisions, geopolitical shock).

- Check positions against scenario plans. If a headline changes your scenario probability more than 20%, re-evaluate sizing; don’t panic-sell.

- Set alerts at price levels, not headlines. If a key support breaks or a catalyst fires, let your pre-planned response execute.

If you practice that discipline, headlines become information, not triggers for emotional trades. That’s how you stay solvent and opportunistic.

Policy watchlist — what to track daily

- SEC press releases and enforcement actions — they set the risk lens for capital.

- Treasury comments on stablecoins and fiscal policy — they shape funding sources.

- Fed speeches (Bowman, Powell, and others) — watch for language on experimentation and bank guidance.

- Congressional movement on market structure or clarity acts — committee calendars and markups.

- ETF filings, approvals and exchange statements — follow the custody and surveillance details.

All of these items directly feed into the ecosystem that drives the keywords: Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing. The more you understand the interplay, the better your chance to spot asymmetric opportunities.

Real-talk takeaways — what I’d tell my family and new investors

If my relatives asked me how to play this market right now, I’d say the following things straight:

- Don’t try to “time the top” or chase the narrative. Build allocations, not bets.

- Keep learning: regulation and policy are as important as technology here.

- Hold enough fiat to buy meaningful dips — headlines create dips, and dips create opportunity.

- If you don’t want to or can’t stomach volatility, use regulated products with defined risk (ETFs, custody solutions, etc.).

And for those who like to meme and flex on social platforms: remember, loud opinions aren’t the same as actual results. The market pays attention to reality — flows, use, compliance and adoption — not merely noise. For the folks scanning SEO, remember the phrase: Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing. It’s the reality check in search form.

Putting it into practice — a 30-day checklist

If you want an executable 30-day plan to align your portfolio with the evolving market structure, here’s a checklist:

- Audit current holdings and write down why you own each asset (narrative, catalyst, time horizon).

- Set target allocation ranges based on risk buckets (core/growth/opportunity/cash).

- Establish stop-loss or hedging rules for the most volatile positions.

- Identify 2–3 headline triggers (Fed speech, ETF filing decision, congressional vote) and define actions for each.

- Allocate a specific amount of dry powder for opportunistic dips (e.g., 10% of portfolio).

- Subscribe to primary policy feeds (official SEC, Treasury, Fed channels) and check them weekly.

- Journal trades and re-evaluate monthly.

Complete that list and your odds of staying calm and profitable rise significantly. And yes, sprinkle in the usual keyword for good measure: Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing.

Where I’m watching for asymmetric upside

If you want a short list of where the most asymmetric upside might come from (read: higher reward per unit risk), consider these categories rather than specific coins:

- Layer-1 interoperability projects that solve real enterprise onboarding problems.

- Tokenized real-world asset plays with clear regulatory frameworks.

- Infrastructure projects enabling tokenized Treasuries and compliant stablecoin issuance.

- Payments rails and on/off-ramps that reduce friction for fiat-to-crypto flows.

The reason to think in categories: specific winners can change, but the category-level tailwind (adoption + regulation) persists. And yes, if you’re tracking search intent, type that keyword again into your nightly research: Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing.

Final thoughts — play the long game, but respect the short-term

We’re in a fascinating phase of the evolution of finance. The Treasury highlighting stablecoins as potential buyers of government debt, a more nuanced SEC stance, and Fed officials urging experimentation are not trivial. They’re the tectonic shifts that reframe how capital flows and trust get built into crypto markets.

That said, expect volatility. Everyone’s waiting for the next catalyst, and until the market sees sustained flows from ETFs or definitive legislative clarity, price action will be headline-driven. That means opportunity, but also risk.

So: structure your portfolio, size positions sensibly, track policy like a hawk, and keep cash ready for the inevitable discount aisles.

And because I’m shameless: if you want a single three-word takeaway — or rather six words — remember this: Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing. That’s the ecosystem. That’s the language of where money flows next.

Alright — go do your homework. Check the charts. Keep your rules. And if you’re buying HBAR at a discount or riding XRP’s narrative, do it with a plan.

Go White Sox, and yes — can someone beat the Braves once? Pretty please.

💯XRP HBAR SEC FED 💯LOTS OF GOOD News 4 Crypto — Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing. There are any 💯XRP HBAR SEC FED 💯LOTS OF GOOD News 4 Crypto — Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing in here.