Hey — it’s Klaus from CRYPTO with KLAUS, and if you care about Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing, you’re in the right place. Today I’m breaking down a stack of genuinely bullish signals across the crypto market, giving you the context, the numbers, and the tactical takeaways you can use right now. I’ll walk through price action, DeFi metrics, why altcoins are stealing market share from BTC, and why XRP specifically has that "army" of supporters behind it. No fluff, just the reality of what the charts and on-chain data are actually showing — plus my take on what it means for investors and builders.

Quick key takeaways

- Market breadth is improving: Total market cap and volume are expanding, and altcoins are drawing more capital relative to Bitcoin.

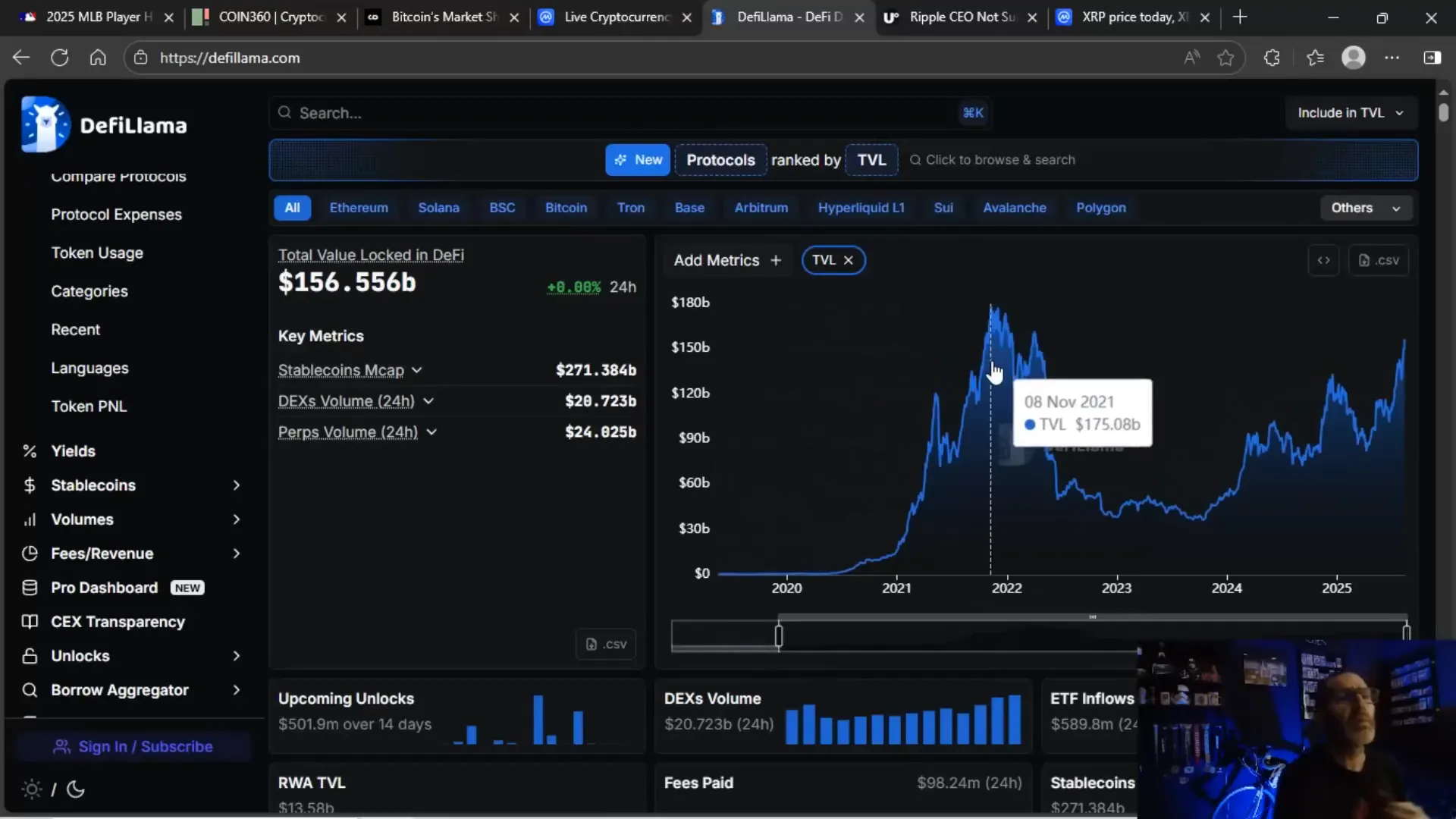

- TVL (Total Value Locked) is climbing: Current TVL is the second-highest ever — only behind the 2021–2022 peak — and this is happening with interest rates still elevated.

- XRP momentum: Institutional and retail narratives around XRP are heating up, with strong 24-hour trading volume and multi-year returns that have created believers.

- Macro tailwinds are brewing: CPI softness and talk of rate cuts are making risky assets more attractive; as rates fall, expect VC and development capital to flow back into crypto.

- Regulatory headwinds are easing: We’ve survived tougher regulatory seasons; now the environment looks more permissive, and that matters for long-term growth.

Why this matters: a short framing

If you spend time in crypto, you know how quickly narratives can flip. One day the story is "regulation kills innovation," the next day it’s "institutions pile into altcoins." I’m not here for hot takes or blind hope. I’m here to parse the numbers and the narratives. The data I’m sharing shows that we’re in a compound-positive environment: market cap growth, high volumes, rising TVL, and a meaningful rotation into altcoins — all while rates are higher than during the last big TVL peak.

That last point is critical. When people piled into DeFi in 2021–2022, rates were near zero. Today, despite higher yields elsewhere, crypto money is flowing in. That tells you the conviction running through parts of the market is real. And when macro conditions shift (read: rate cuts), the faucet could open wider.

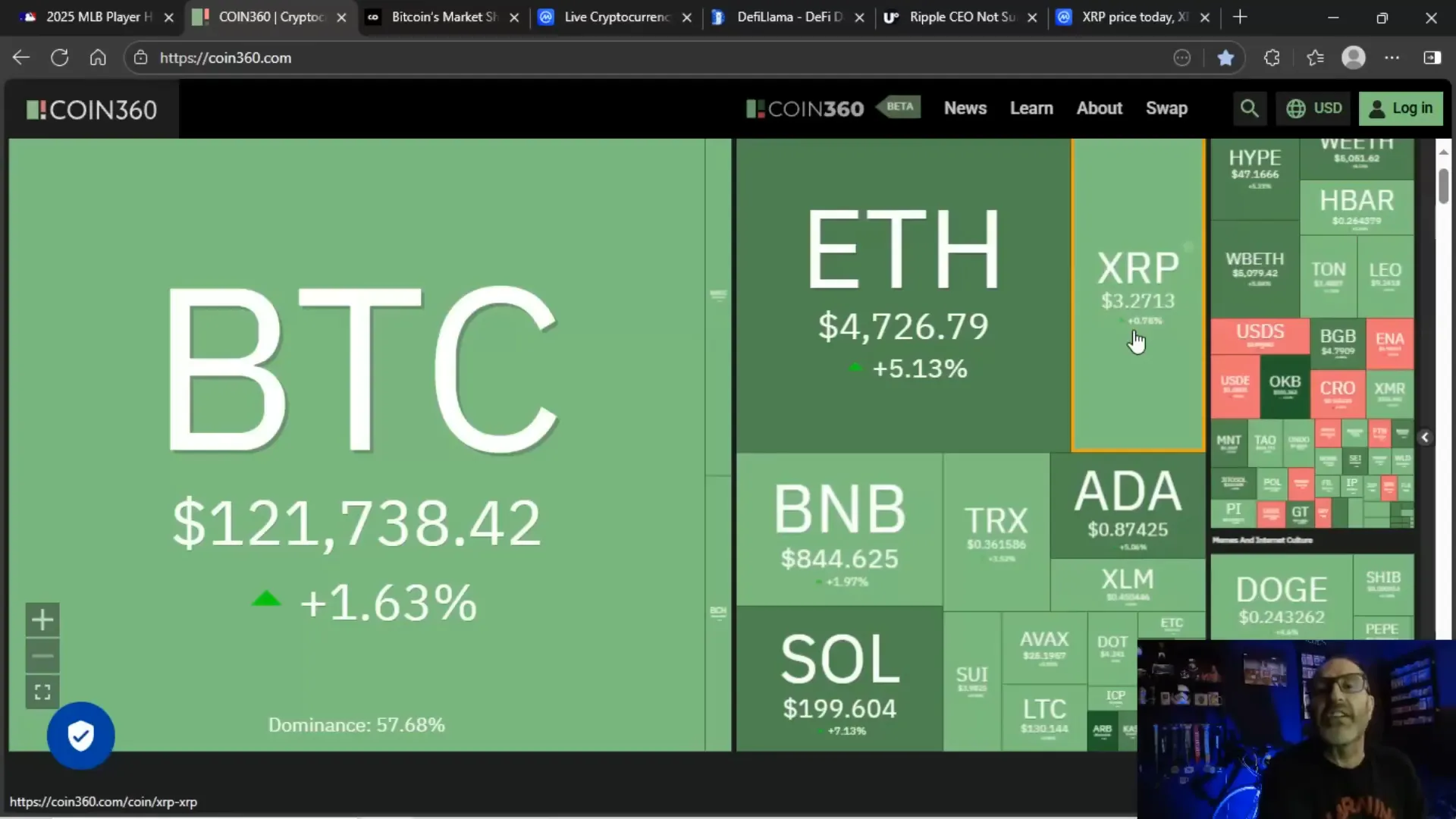

Market snapshot: price action and the green up

Let’s start with the most obvious: price. You saw the screen — I did not conjure those numbers out of thin air. Bitcoin’s been making moves, but the market’s currently broader than BTC alone. Ethereum, Solana, XRP, and several other altcoins are attracting capital. At the time of this snapshot, price reads looked like this: BTC printed impressive levels, ETH showed strength, ADA and SOL were catching attention, and XRP cracked multi-dollar levels with juicy volume metrics.

Here’s what matters in plain language: green screens across a wide set of assets mean sentiment is receptive to risk. When Bitcoin is up and alts are up too, that’s not just a BTC-led rally — it’s a market-wide risk-on environment. And that’s what we’re seeing right now.

BTC dominance is dropping — why that’s important

Bitcoin dominance — the share of total crypto market cap that BTC represents — fell from around 65% to the high 50s. That kind of move is a signal: capital is rotating into alternatives. Why does that matter? Because altcoin outperformance typically indicates investors are seeking higher returns (and taking on more risk). It’s a sign of confidence in specific projects, ecosystems, and narratives beyond Bitcoin’s store-of-value story.

To be crystal clear: this isn’t a condemnatory note against BTC. Bitcoin remains the bedrock of crypto. But when ETH, SOL, and other alt ecosystems start seeing relative inflows, it often foreshadows a phase of stronger returns for those assets if the trend continues. And when institutions and big wallets increase exposure to alt chains, that’s structural change — not just retail hype.

Deeper look: market cap, volume, and total value locked (TVL)

Numbers don’t have feelings, and that’s the beauty of them. Right now, total crypto market cap is north of four trillion dollars — specifically around $4.12 trillion at the time of the snapshot we’re discussing — and daily volume was roughly $242 billion. Those are big-kid numbers. That magnitude of capital and liquidity matters. It enables institutional flows, smoother execution, and deeper markets for traders and builders alike.

Now the TVL story. Total Value Locked across DeFi protocols is now the second highest it’s ever been, behind only the 2021–2022 peak. That’s a big, big deal. Think about what TVL represents: capital users and institutions are willing to commit funds into protocols for yield, utility, and transactional purposes. That the TVL is nearly at all-time highs despite higher interest rates speaks to the strength of the DeFi ecosystem today.

Why is it noteworthy that this is happening with rates higher than during the last TVL peak? Because it means participants are choosing crypto over safer yields in other parts of the market. When rates trend down, you can reasonably expect TVL and speculative capital to expand even further. That’s a major tailwind for builders, protocol revenue, and token valuations.

Volume and liquidity are not jokes

Liquidity matters. When volume surges — especially across altcoins — execution risk falls and more traders and institutions will consider participating. This cycle we’ve got high volumes in ETH, SOL, XRP, and some other names. Institutional interest in ETH is especially material; ETH picking up institutional volumes indicates the market is maturing beyond retail-driven cycles.

All of these metrics together — high market cap, high volume, growing TVL, altcoin flow — paint a picture of a market stepping into a more mature phase. That doesn’t mean straight-line gains, but it does mean there’s foundation for multi-year constructive growth.

The XRP story: why an "army" shows up

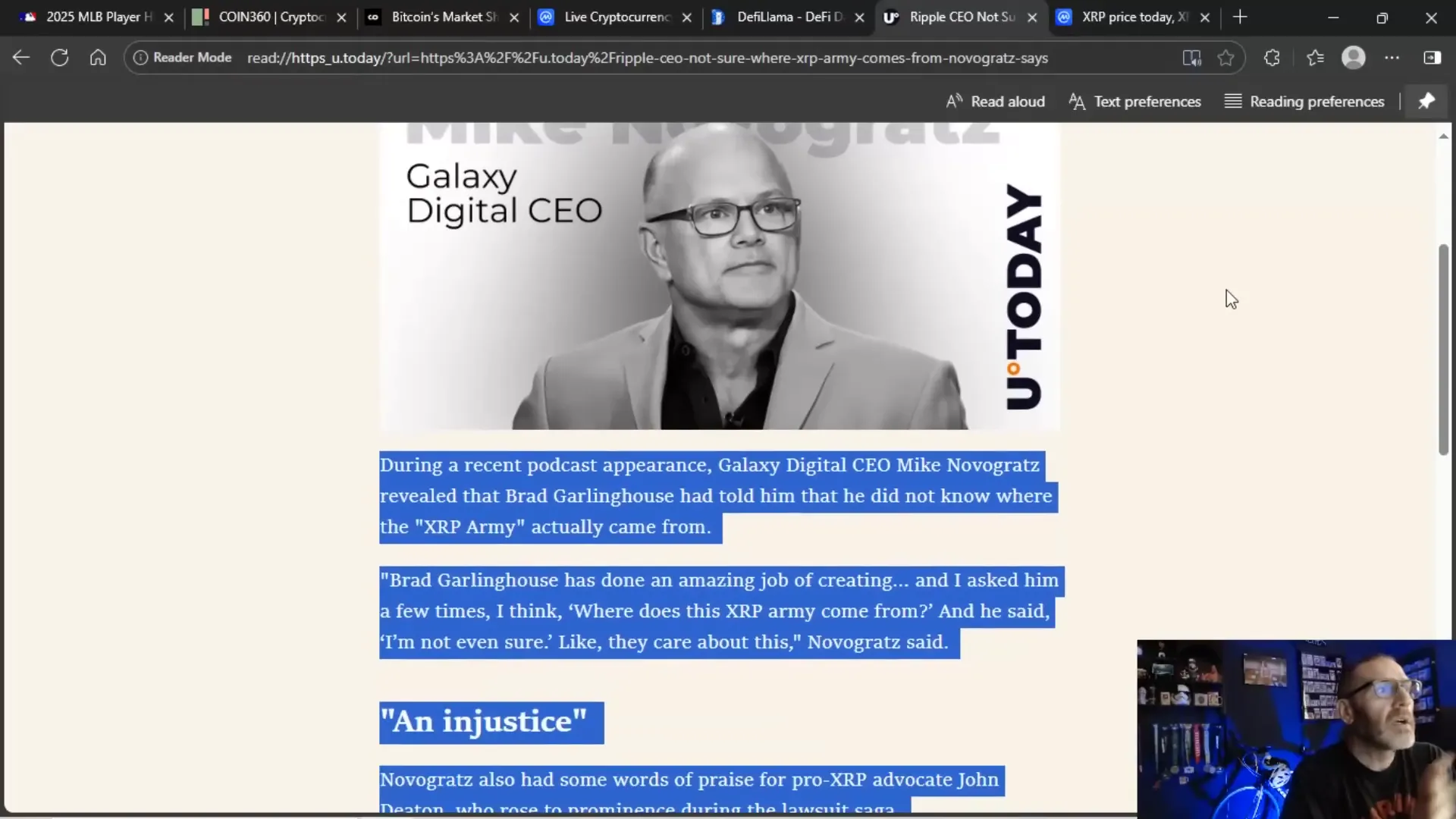

Let’s get into the XRP-specific news. Mike Novogratz shared something telling on a recent podcast: Brad Garlinghouse (Ripple CEO) reportedly told him he wasn’t sure where the “XRP army” actually comes from. That’s a candid comment, but the answer is obvious once you pull the camera back.

People don’t rally around tokens for the same reasons they rally behind traditional investments. The XRP army is partly a narrative movement — people identifying with a David-vs-Goliath storyline. XRP’s conflict with the SEC created a clear-cut antagonist and a group of people who saw Ripple and its holders as being treated unfairly. That’s fertile ground for a passionate community. Look, I’m not writing romance novels here: what drives that army is a mix of justice sentiment, financial success stories, and the undeniable fact that early XRP holders who bought at tiny prices have seen their holdings multiply many times over.

"I'm not even sure. Like, they care about this." — Brad Garlinghouse (recounted by Mike Novogratz)

That quote captures the encryption of the movement: it’s visceral. People saw what they perceived to be harm done to holders by regulatory overreach. They saw established lawyers, advocates, and influencers step in and fight. They saw actual wallets of people who bought XRP at cents and now are sitting on meaningful gains. Combine those elements and you get a deeply motivated community — the so-called XRP army.

Underdog energy — it’s real and valuable

Humans love an underdog. In markets, underdog narratives attract capital and attention because they’re emotionally resonant. That’s part of why XRP has traction beyond its utility thesis. Add in the fact that some institutions and companies have made real returns on XRP — not theoretical or hypothetical returns, actual generational wealth for certain holders — and you have both emotional and economic incentives to back the token.

One more point: whenever a company or token is perceived as being unfairly targeted by regulators, supporters tend to dig in. You see vigorous legal defenses, community organizing around legal causes, and vocal support on social channels. That has been the case with Ripple and XRP. So no, Garlinghouse admitting he doesn’t know exactly where the army comes from isn’t a problem; it’s a feature of a movement born from perceived injustice and proven financial outcomes.

Is XRP a store of value?

Novogratz suggested XRP could become a store of value. Let’s parse that seriously.

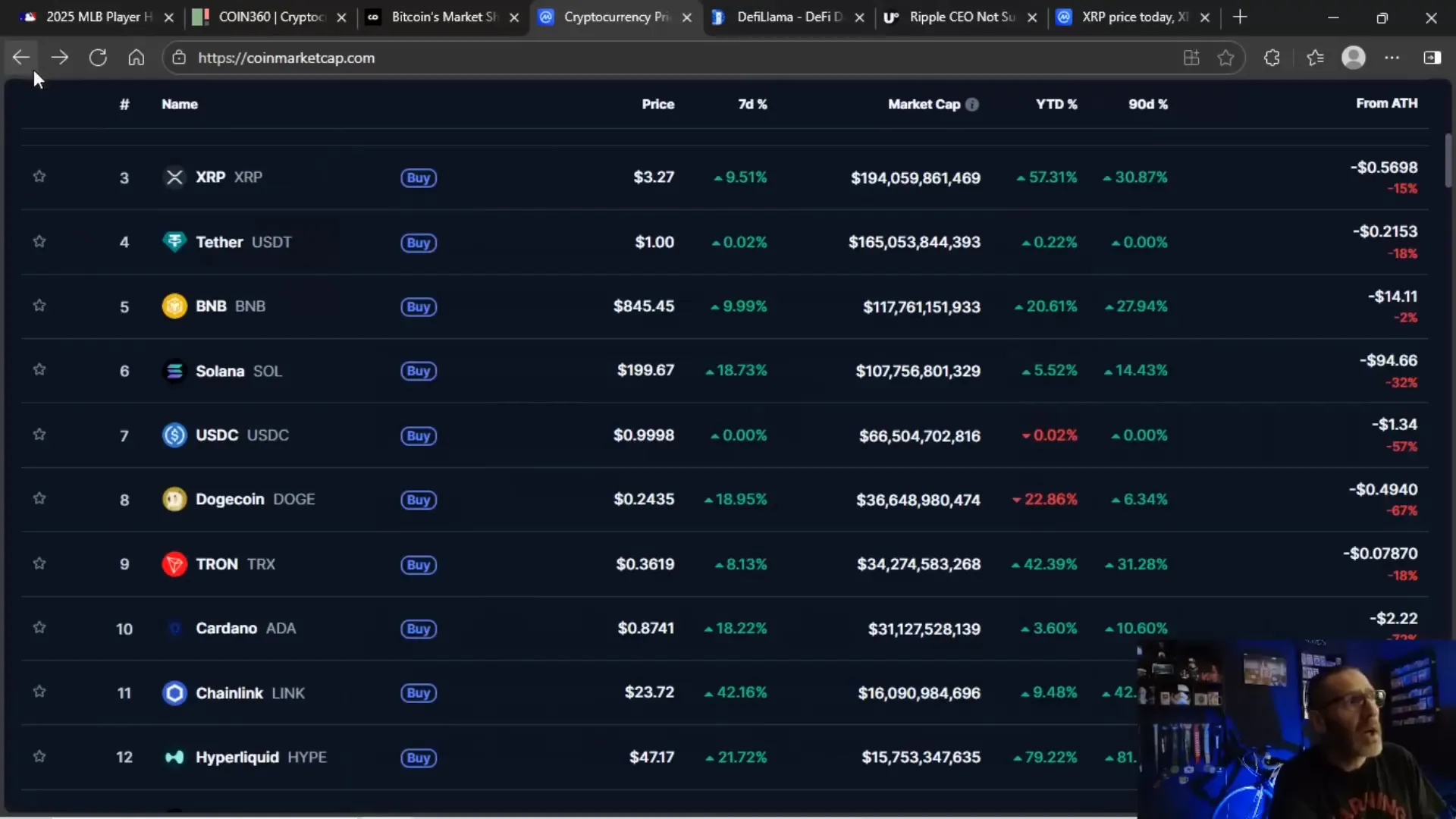

Store-of-value discussion is usually occupied by Bitcoin, but there’s nuance. A store of value needs three qualities at a minimum: liquidity, acceptance, and a narrative that preserves value across time. XRP can bill toward these characteristics under some conditions. It’s liquid — daily volumes are strong (we were seeing close to $9.49 billion in 24-hour volume at the snapshot). It’s being used in certain payment corridors and corridors of liquidity by payments clients. And it has a narrative of value creation for early holders — people who bought at sub-dollar prices and now have meaningful capital gains.

That said, XRP’s path to being a store of value would differ from BTC’s path. Bitcoin’s value proposition is scarcity and decentralized censorship resistance; XRP’s narrative is payments efficiency, liquidity provisioning, and potential value creation through enterprise adoption. If enterprises and institutions continue to find a reason to hold and use XRP, that adoption could reinforce its store-of-value characteristics in a functional sense.

Volume and the wealth creation angle

Let’s talk numbers again. XRP showed many times returns over the past year — something like a 464% one-year jump at the snapshot point — and that matter. When a token creates real wealth for individuals and companies, a cycle of adoption can follow. People who made money on XRP tell their networks. Companies or fiat-based traders may hold allocations. Liquidity providers may engage more. That’s how narratives migrate from risky experiment into an asset class with staying power for many stakeholders.

Comparing volumes: XRP vs. the crowd

When you compare 24-hour volumes across top tokens, XRP stands out. For context: Dogecoin’s 24-hour volume was lower in our snapshot, sometimes showing half or less of XRP’s volume. Tron showed spikes at times; Cardano had its own activity. What matters here is relative liquidity and trading interest. Higher volume is a proxy for market participation — more traders, more market makers, and better order execution for larger players.

Look at XRP’s volume numbers. If a token consistently shows high trade volume, it becomes more viable for institutional flows and large traders to rotate in and out without heavy slippage. That’s a practical advantage that can help support higher valuations over time if adoption continues.

Macro picture: CPI, rate cuts, and the Powell effect

Macro drives risk-on and risk-off flows. Recently the CPI softened, and market participants began speculating on rate cuts. Why does that matter? Interest rates are the friction against risk assets. When yields on safe assets (bonds, savings) are elevated, the relative attractiveness of risk assets like crypto diminishes for some investors. Conversely, when yields fall — or when investors expect them to fall — the path to more capital flowing into risk assets opens up.

There’s chatter that Fed Chair Jerome Powell may start cutting rates when data softens. I’m not in the business of predicting the Fed for entertainment — I pay attention to the data and market signals. But if rates are cut within the next 90 days, that materially changes the opportunity set for crypto. Venture capital becomes cheaper, builders reallocate capital to product development, and speculative capital tends to chase higher-growth corners of markets, namely altcoins and DeFi protocols.

Powell and the theatrical macro moves

There’s always noise when the Fed shifts. Remember: sometimes the Fed’s signaling is as impactful as the actual rate move. A credible pivot toward easing changes expectations, and markets tend to price in those shifts fast. If the market is already showing appetite for risk (as we’ve seen), then easing can amplify that appetite and lead to more substantial TVL growth and more aggressive allocation to crypto by professional investors.

Regulatory seasonality: we weathered the worst

Crypto’s had a rough regulatory couple of years. Mixed messaging, enforcement-first approaches, and political pushes have created real obstacles. But the market’s survived. That’s not a small thing.

We endured high rates, hostile regulatory attention from certain quarters, and headline risk that would have crushed lesser ecosystems. Through it all, builders kept refining protocols, liquidity returned, and the narrative matured. Right now, we’re seeing a more stable regulatory narrative and some executive signals that are less punitive and more constructive. That doesn’t mean all regulatory risk is gone — far from it — but it does mean the market shot through the worst of that winter, and that resilience is meaningful.

What that resilience looks like in practice

- Protocols are launching with better security and vetting practices.

- VCs are once again looking at crypto-native infrastructure and real revenue models.

- Stablecoin usage and product innovation continue to increase — an on-chain sign of maturation.

- Communities that formed during legal fights (like XRP supporters) proved they can mobilize and persist.

Resilience matters. When markets withstand down cycles and return with systemic improvements, future bull runs tend to be healthier and less purely speculative.

Where venture capital and developers come in

Lower rates usually mean venture capital looks for higher growth opportunities. Crypto is one of the richest hunting grounds for innovation in finance, gaming, and infrastructure. Expect more developer activity, new protocol launches, and funding rounds as capital rotates back in. That helps the entire market: more products, more utility, and more reason for users and institutions to interact with on-chain systems.

More builders = more use cases = more reasons for tokens to accrue value. It’s a virtuous cycle when it’s real.

Investment playbook: tactical approaches for this environment

Now here’s where I get a bit tactical. You can cheer for the narrative, root for your favorites, or play popcorn investor on a tweet feed. Or you can build a plan. Below are several practical steps you can take depending on your risk tolerance and time horizon.

Conservative: baseline allocation and yield capture

- Keep a meaningful allocation to BTC as a core long-term position. Bitcoin is still the base layer of trust in crypto.

- Allocate a smaller portion to ETH for exposure to DeFi and the largest smart contract ecosystem.

- Use regulated custodial platforms for the majority of holdings if you prioritize safety and insurance options.

- Capture yield through reputable lending or staking platforms with a clear risk profile; prioritize capital preservation.

Balanced: growth plus defensives

- Core-satellite approach: keep a BTC + ETH core, then allocate a satellite portion to high-conviction altcoins like SOL, XRP, or project tokens with strong fundamentals.

- Use dollar-cost averaging to enter higher-volatility positions; avoid lump-sum entries that expose you to timing risk.

- Consider partial exposure to DeFi via blue-chip protocols with long-running TVL and audits.

- Maintain a cash buffer to buy dips if macro signals worsen temporarily.

Aggressive: alpha hunting and yield farming

- Allocate a portion to early-stage tokens, new liquidity pools, or yield strategies that offer higher yields but also higher tail risk.

- Deploy small sizes and use position sizing to limit blow-up risk.

- Keep tight stop-loss discipline and regularly rebalance to lock in gains.

- Prioritize proper research: look at tokenomics, real usage, active developer count, auditor reports, and on-chain activity.

Across all strategies, emphasize risk management, position sizing, and a plan for drawdowns. Crypto doesn’t have to be reckless; it can be methodical.

Risk checklist: what to watch for

- Regulatory headlines that materially change an asset’s legal status.

- Liquidity withdrawals from major exchanges or protocols (a sudden drop in TVL or exchange reserves can be a red flag).

- Macro surprises: stronger-than-expected inflation prints or sudden hawkish messaging from central banks.

- Security incidents: major hacks, protocol exploits, or rug pulls in smaller projects.

If multiple items on that checklist trigger at once, reassess risk-weighted exposures and consider defensive moves.

Meme coins and risk assets — be honest about the odds

Meme tokens are the most speculative corner of crypto. They can deliver outsized returns, but they’re also extremely fragile — and often driven by attention cycles. If you want to play meme land, do it as a tiny fraction of your portfolio and treat it like a highly leveraged lottery ticket, not a core investment.

That said, when liquidity is abundant and sentiment heats up, meme tokens can rally hard and fast. For traders who can handle the volatility and the psychological swings, that environment creates opportunities — but also traps. Know the difference. Play smart, size small, and lock gains when you can.

How to read the market narrative vs. reality

Narratives are easy to inflate on social channels. Reality is messy and slow. Use the following framework to separate the noise from what’s structurally real:

- Check liquidity: Is volume rising consistently across exchanges? High volume sustains moves.

- Check TVL and on-chain activity: Are more users interacting with protocols or is growth purely speculative?

- Check developer activity: More commits, launches, and upgrades often point to genuine building.

- Check macro context: What are interest rates doing? What’s the Fed signaling?

- Check regulatory developments: Are new policies supportive, neutral, or hostile?

When multiple indicators move in the same constructive direction, the market is more likely to sustain gains. When they diverge, expect volatility and short-term whipsaws.

Practical next steps: what I’m doing and why

Transparency time. I’m keeping a BTC + ETH core, adding measured positions into altcoins with real utility and market interest, and trimming meme exposure. I’m actively watching TVL metrics, exchange inflows/outflows, and on-chain usage growth to refine entries. I also keep a ready cash buffer for meaningful dips, because that’s when opportunities most often present themselves.

Why this mix? It balances long-term conviction in Bitcoin and Ethereum with tactical exposure to altcoins that are showing strong volume and real user interest. The rising TVL and improved liquidity environment make it safer for me to allocate a portion to higher-growth assets, while still preserving a stable base.

How to use the data I talked about — a checklist for readers

- Bookmark DeFi dashboards and TVL aggregators; check them weekly rather than obsessing daily.

- Track 24-hour volumes for your core altcoins; rising relative volume is a good signal for rotation.

- Follow major legal and regulatory developments that specifically name tokens or protocols you own.

- Use dollar-cost averaging on larger positions to reduce timing risk.

- Re-assess position sizes after large runs; lock partial gains and rebalance into your core holdings.

Stories that matter beyond the numbers

Data is cold; stories warm it up. XRP’s army exists for reasons beyond price charts — people rallied behind a perceived injustice. Builders are returning because capital and clarity are improving. TVL is rising because protocols are adding usable features and better security practices. All of these threads matter because markets are collections of human choices and technological progress — not just tickers on a screen.

"We weathered that storm, everyone, and now it's our time." — This is the vibe we’re in. The worst regulatory and macro friction has largely passed, and what’s left is product, adoption, and capital flowing to where it’s useful.

What I wouldn’t do

- Don’t chase short-term hype without a plan to exit.

- Don’t allocate retirement money to single-digit percentage plays in meme coins.

- Don’t neglect security basics: hardware wallets, audited custodial solutions, and good key management.

- Don’t trade with leverage unless you understand liquidation risks and have strict risk limits.

Longer-term view: how this cycle could play out

Markets move in cycles. We move from accumulation to speculation to consolidation and back again. This cycle looks particularly constructive: stronger TVL, institutional interest in ETH and certain alt ecosystems, and a more stable regulatory backdrop. If macro conditions ease, that could accelerate the cycle into a broader, healthier bull phase with room for both Bitcoin and altcoin appreciation.

Long-term investors should watch for durable adoption signals: real users building on-chain, revenue-generating protocols, and cross-border payments or enterprise use cases that actually reduce friction. Those markers tend to separate lasting winners from transient fads.

Parting thoughts — the simplest checklist

Here’s a quick, straight-shooting checklist to carry away:

- Keep a BTC + ETH core. These remain the pillars of crypto portfolios.

- Allocate a measured satellite portion to high-conviction altcoins (XRP included if you believe in its payment and narrative potential).

- Watch TVL and volume trends — they’re more informative than single-day price moves.

- Be mindful of macro and regulatory catalysts. They can change the game quickly.

- Size risk properly and lock gains when conviction matures into profit.

If you want the raw reality: the numbers are good, the narratives are lining up, and the market’s appetite for risk is real. That doesn’t mean no volatility or no setbacks. It means the groundwork is being laid for a healthier, more liquid market that could reward builders and early supporters.

Finally, to the XRP crowd — and any community that’s been through legal drama or regulatory heat — your persistence matters. That’s what builds trust, not just tweets. When capital, community, and product converge, good things happen. Keep your head up, manage risk, and play the long game.

Alright — I’ve given you the facts, the context, and the tactical moves. Do what makes sense for your plan and risk tolerance. And remember: crypto isn’t about luck; it’s about informed choices, patience, and taking advantage of windows when the data lines up.

See you in the next update. Choo choo.

🔥🔥XRP GARLINGHOUSE HOT GOOD NEWS🔥🔥 — Market Snapshot: Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing. There are any 🔥🔥XRP GARLINGHOUSE HOT GOOD NEWS🔥🔥 — Market Snapshot: Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing in here.