Author: CRYPTO with KLAUS

Alright — let’s cut through the noise. I’m Klaus, and today we’re walking through what’s happening in the markets right now: the broad dump across crypto, ETF outflows, whales taking profits, and why the FOMC minutes and Jackson Hole chatter are making August feel like a trap month. If you want the blunt version with no fluff — stick around. This write-up captures the same energy and voice you already know: blunt, to-the-point, and a little salty. We’ll cover BTC and ETH dynamics, XRP price action, Coinbase’s perp futures move, where whales are playing, and how you should think about dry powder and buying dips.

Also yes — I said it on August 6: buckle up for a rough August. If you watched that video and kept dry powder ready, you’re laughing right now. If you didn’t — well, you’re probably cursing. Either way, there are lessons to extract and actions to plan. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Key takeaways

- Short-term profit taking is the immediate driver — ETH and BTC hit big levels and traders cashed out.

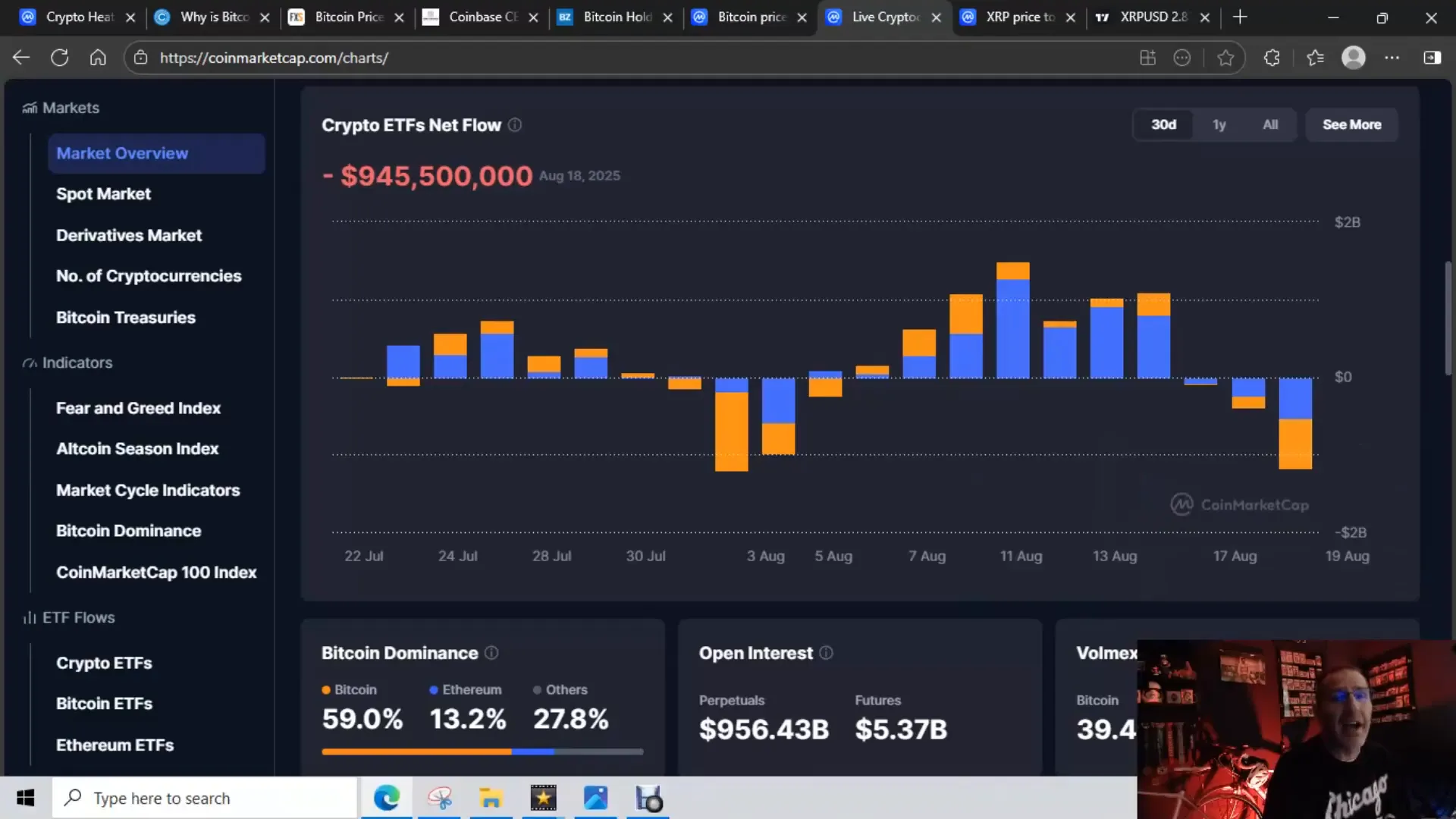

- ETF inflows flipped to outflows and intensified: recent half-billion-dollar outflows in BTC and ETH are significant.

- We’re in a data vacuum for August: FOMC minutes today and Powell at Jackson Hole make this a trap month.

- Coinbase adding XRP and SOL perp futures helps exchanges’ P&L, not retail holders — these are cash-settled contracts.

- XRP is trading sub-$3 now, but volume is healthy; odds of a rebound north of $3 are high in my view.

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Why I’m writing this — and why you should read the whole thing

I recorded a video that walks through the same points I’m about to lay out. This article expands those points into a structured guide: what happened, why it happened, what to watch for next, how it affects XRP specifically, and what a sensible trader/investor could do in this environment. I keep my tone casual and direct because markets don’t reward sugarcoating — especially not in a month like August.

We’ll use a mix of technical observation and macro context: inflows/outflows, ETF behavior, Fed policy signals, PPI data, and exchange behavior. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Market snapshot: what’s red and why it matters

Quick snapshot from the screen: BTC around 113k, ETH roughly 4,178, XRP around $2.88, DOGE ~ $0.21, ADA slipping below $0.90 into the mid-$0.80s, BNB at ~$830. Volume across exchanges sits high — around $190B — which means exchanges are making money whether the market is green or red. That’s the cold reality.

Why the red? Three immediate drivers:

- Short-term profit taking after massive run-ups (BTC touching 124k, ETH flirting with 4,700+ earlier).

- ETF flow behavior flipping from inflows to outflows and deepening outflows over the last days.

- Macro uncertainty — no rate cuts this month likely, tariffs pushing inflation, and Fed minutes + Jackson Hole looming.

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Profit taking is obvious — but the scale matters

Anyone trading crypto knows the script: when the market spikes, short-term holders take profits. That’s not new. What’s noteworthy this time is the magnitude and coordination with ETF flows. ETH and BTC hit levels that invited profit taking across many holders — retail, whales, and institutions. Profit taking alone wouldn’t be a big deal if not for the ETF structural behavior that amplified the sell pressure. And that’s the part a lot of casual observers missed.

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

ETF outflows: the hidden amplifier

Here’s the ugly detail: we saw a transition where BTC inflows were being replaced by ETH inflows — for a moment ETH led the party. Then minor outflows started showing, and they ramped to major outflows. Yesterday alone we saw roughly half a billion dollars of BTC outflows and a similar order of magnitude for ETH. That is not trivial; it’s material and it pushed prices lower across the board.

Exchanges and market-makers breathe when flows are steady. A big change in direction — especially outflows — forces rebalancing and hedging that can create cascade selling. So those ETF flows function like a pressure valve that was suddenly opened and the market felt it hard.

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

FOMC minutes and Jackson Hole: the macro backdrop

Let’s get macro-simple: August has very little in the way of fresh, deterministic economic guidance. What we get instead are relics and previews — the FOMC minutes from the last meeting (released today) and Jerome Powell’s speech at Jackson Hole later this week. The minutes are the market’s immediate focus because they offer additional texture on Fed thinking — were the minutes leaning toward a September rate cut expectation or more hawkish caution?

The market wants clarity and don’t have it. That vacuum leads to chop. Investors hate uncertainty. Add in hot PPI data and tariff-driven inflation concerns and you get a market that’s priced to expect higher-for-longer rates. That’s bearish for risk assets and particularly punishing for leveraged crypto positions.

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Why a data vacuum is a “trap month”

I called August a trap month back on August 6 — and the reasons are the usual suspects: limited headline economic data, market participants looking forward to major central bank events, and seasonal low liquidity in many traditional markets. When traditional markets thin out (holidays, vacations), crypto volatility can spike because orders impact price more severely.

Without new policy decisions, markets tend to trade on rumors, second-order data (like ETF flows and PPI), and headline noise. That environment is perfect for profit taking, manipulation, and sudden reversals — and I want you to be mentally prepared for that.

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Coinbase, perpetual futures, and why exchanges win

Coinbase moved to add perpetual futures for assets like XRP and SOL in the US (cash-settled). Brian Armstrong applauded it — not out of altruism, but because more perp products = more trading volume = more fee revenue. That’s the simple economic reality of exchange business models. Whether retail wins or loses on the underlying is irrelevant to those revenue flows.

Perp futures are settled in cash, which means adding an XRP perp does not add XRP demand for spot holders. It just allows traders to bet on direction without touching spot tokens. When markets are red and volatility runs high, these derivatives make exchanges money on fees and funding rates. In plain language: Coinbase is smiling when traders are getting chopped because the exchange is collecting fees every trade.

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

What cash-settled perp futures mean for retail

Traders, especially leveraged ones, will trade perp futures for quick exposure. But because they are cash-settled, they don't require exchanges to hold or ship the actual asset. This can lead to dislocations between perp price and spot price, and it means retail spot holders don’t automatically gain liquidity support from these instruments. So while exchanges praise the progress of more perp offerings, spot markets don’t necessarily benefit.

Keep that in mind when you see headlines: “Coinbase launches XRP perps!” — your reaction should be: “cool for trading, not necessarily for spot price support.”

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

XRP price action: why we’re sub-$3 and why I still like the odds of a rebound

XRP traded around $3.50 a short time ago and has now slid to about $2.88 on heavy volume (~$7.37B). That kind of volume usually signals distribution — big players selling into strength or retail panic-selling. The short-term chart shows we broke a key level yesterday and have been grinding below $3 on the 15-minute chart since. Now we’re testing the $2.90 zone.

Despite the dip, I still believe the $3 floor is likely to hold. Why? Because August’s vacuum dynamics and the lack of policy guidance make this a month where price compresses and creates buying opportunities. Traditional markets being closed on Monday further reduces liquidity and makes Powell’s Jackson Hole talk on Friday even more impactful. Expect muted volumes through the weekend and Monday, then larger moves around Friday’s headline.

My read: the odds of a rebound north of $3 are high — I peg them around 90% right now, given the context. That’s not a guarantee, it’s a probability based on flow, volume, and current macro conditions.

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Important nuance: volume is healthy, but it’s selling volume

High volume during a drop can be alarming, but it’s not always the end of the world. It depends on who's selling. Right now, volume is healthy — meaning lots of activity — but the sentiment is skewed toward selling. Exchanges are getting the trades, whales are rotating, and Korean won pairings often show local buyers stepping in to buy the dip. Historically, those Korean pairings can be early indicators of a buying wave.

So watch volume for a change-of-character: if volume dries up and price consolidates, that’s one sign. If volume is still high but price forms higher lows, that’s another sign. For now, we’re in the early test of $3 as psychological support.

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Whales and flows: what big players are doing right now

Let’s be blunt: the bigs are selling to lock in profits. Institutions and whales needed to take chips off the table after the massive run-ups. No one ever went broke taking profits. That’s market hygiene. The pattern looked like this:

- ETH ran hard (benefitting from ETF-related flows).

- BTC had quietly softened with some outflow days at the end of July and beginning of August, then tiny inflows early August.

- Once ETH popped, everyone noticed it — but many missed that BTC was already weakening under the surface.

- As ETH’s fast move excited traders, rotation happened; then profit-taking accelerated and ETFs began to see outflows.

Sell-offs like this are a coordination of profit-taking and flow mechanics. Whales don’t need to crash the market maliciously — they simply need to rebalance. When many of them do the same at roughly the same time, prices fall sharply. Traders calling this a “dump” aren’t wrong — but it’s not chaos without reason.

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Where whales are likely to buy back in

Whales generally buy on strength or at perceived value. Common tactics:

- Buy after a multi-day consolidation when volume decreases.

- Buy in layers when macro headlines are clarified (e.g., after FOMC minutes or Powell’s speech).

- Use regional pairings (e.g., KRW) to scoop dips as well as OTC desks for larger transactions without moving the spot book much.

Watch on-chain data and large transfer addresses, exchange flow charts, and spot funding rates on derivatives exchanges. These are your signals for where whales are accumulating or distributing. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Trading and position strategy for the current environment

If you’re trading or managing a position, adapt to the noise. Here are practical, real-world actions you can take today, in the exact tone I’d tell you on camera:

1) Dry powder and scaling in

Do not throw money at the market all at once just because someone on Twitter said prices will spike. Instead, scale in with dry powder. Dollar-cost averaging on a tapering schedule reduces timing risk. If you’re bullish on XRP or BTC longer-term, buying in 3–7 tranches as price dips and consolidates is smart. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

2) Tighten risk controls

Volatility spikes. Use tight stops if you’re a short-term trader, or hedging strategies if you’re larger. Consider options protection, albeit options pricing can be expensive during high volatility. If you’re a leveraged perp trader, be extra cautious — funding rates and liquidation cascades can hurt.

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

3) Watch flows, not noise

ETF flows, exchange balances, and on-chain transfers will tell you where the real pressure points are. News headlines and clickbait will make your blood pressure spike, but flows reveal intentions. Track inflows/outflows daily and watch for a turnaround to confirm the bottom.

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

4) Use regional cues

Korean won pairing often buys dips early. If you see KRW volume spike while USD pairs are muted, that can be an early sign of a bounce. Similarly, watch JPYC and other regional flows for asymmetric demand clues. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

5) Expect noise around Powell

Jerome Powell at Jackson Hole can swing sentiment dramatically. I expect hawkish tone overall, which favors caution until we see his precise words and market interpretation. After that, the market may whip fast and hard. Have a plan for both reactionary fade trades and momentum continuation trades.

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Deconstructing the headlines: how to read the news

News articles will call this a “market dump,” others will say “correction,” and influencers will shout predictions. Here’s how to filter those:

- Ask: does the article cite flows or is it speculative? If no flows, apply skepticism.

- Verify claims about percentages and comparisons (e.g., BTC outperforming DOGE). Check charts yourself.

- Recognize agenda: exchanges and derivatives firms love volatility. Headlines can be framed to drive interest and trading volume.

For instance, a piece saying “Bitcoin holds 113k as XRP, ETH, DOGE dip” might be partially true, but miss the nuance that ETH was beating BTC over the last month. Always verify the data. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Personal note — because this is also a human sport

Look — markets are numbers, but people trade them. Today’s a big day for me personally: I get my CAT scan done. I’ve waited weeks for it and I’m actually relieved to get it behind me. I’m also a proud (and delusional) White Sox fan — wore the hat and shirt for good luck. Life happens while markets do their thing. If you’re stressed about a dip, remember to breathe and handle the real-life things first. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

What to watch next — timeline and checklist

If you prefer a checklist, here’s a practical timeline of what I’m watching and what you should too:

- Today: FOMC minutes release — watch market reaction to any wording about rate cut timing.

- Through Friday: muted volume expected due to traditional market closures — be careful with large orders.

- Friday: Powell’s Jackson Hole speech — expect hawkish tone; potential for volatility spike.

- Next week: watch ETF flows — are we seeing sustained inflows again or continued outflows?

- Monitor key levels: BTC 100k–120k zones, ETH 4k+ levels, XRP $2.80–$3.50 range.

Once you have clear movement in flows or a decisive price action around those levels, you can increase conviction. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Signals that the market bottom might be forming

- Outflows stabilize and reverse into inflows on ETF reports.

- Spot exchange reserves drop meaningfully (people withdrawing to cold storage).

- Derivatives funding rates return to neutral or slightly negative (indicating more demand for spot vs leverage).

- Regional pairings (KRW, JPYC) see consistent buying pressure.

Any two or more of those forming together increases the odds of a sustained bounce. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

A practical example: what I would do with $10,000 right now

Hypothetical: you give me $10k and tell me to act today. Here’s an example playbook aligned with my current read:

- Allocate 40% ($4,000) to XRP in three tranches: $1,600 now, $1,200 on confirmation of a dip to ~$2.70 area, $1,200 on signs of consolidation above $3.

- Allocate 30% ($3,000) to BTC buying using a laddered entry across $110k to $100k depending on price action.

- Allocate 20% ($2,000) to ETH or an ETH product if price retests support (watch ETH/BTC dynamics closely).

- Keep 10% ($1,000) as immediate dry powder for fast opportunities around Powell news or sudden liquidation-driven drops.

Note: this is a hypothetical and reflects a moderately aggressive stance. Adjust allocations for your risk tolerance. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Common mistakes I see people make in months like this

- FOMO chase of the single “moon” tweet — buy with a plan, not hype.

- Ignoring flows — news noise is loud, but flows reveal intent.

- Overleverage in perp futures during high volatility — liquidation risk is real.

- Chasing headlines about perpetual listings as if they’re guaranteed spot price support.

Avoid these mistakes and you’ll increase your odds of surviving and thriving in choppy months like August. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

How I verify claims and headlines (quick checklist)

- Open the flow charts: ETFs, exchange inflows/outflows.

- Check spot vs derivatives liquidity and funding rates.

- Compare BTC and ETH month-to-date performance; don’t rely on sensational headlines.

- Watch regional pairings like KRW for early buying signals.

- Confirm with on-chain transfers for whale moves between wallets and exchanges.

Simple, repeatable, and far more reliable than reading a dozen hot takes. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Final thoughts — what I want you to walk away with

Here’s the no-BS summary you can use as your mental map for the next few days:

- We’re in a profit-taking, flow-driven correction driven by ETF outflows and a macro data vacuum.

- FOMC minutes and Powell’s Jackson Hole speech are the near-term catalysts — expect noise and volatility.

- Coinbase launching XRP perp futures is good for exchange revenues, not necessarily for spot XRP price support.

- XRP volume is high but selling-dominated; the $3 level is important and odds favor a rebound north of $3 in my view.

- Manage risk: scale in, keep dry powder, watch flows, and avoid reckless leverage.

If you remember nothing else: prepare for volatility, respect macro headlines, and let flows guide your moves. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Want my final, blunt piece of advice?

Don’t panic. Markets do this. If you were binge-buying during the melt-up without a plan, take a breath and set one now. If you kept dry powder and waited, you’re in a great spot and probably watched a chunk of value get handed to you at better prices. Use this opportunity to refine your entry points, protect your capital, and remember — no one goes broke taking profits.

And lastly, I’m getting my CAT scan today, so I’ll be back with more updates in the afternoon. Take care, keep your head, and if you’re into XRP, study the $3 floor and watch how ETF flows behave this week. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

🚨XRP BTC ETH TODAY'S BIG EVENT — Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing. There are any 🚨XRP BTC ETH TODAY'S BIG EVENT — Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing in here.