If you’ve been following the latest waves in the cryptocurrency world, you already know it’s a rollercoaster ride filled with twists, turns, and some eyebrow-raising moments. From XRP battling to hold its $3 support level amid profit-taking to big banks like JPMorgan Chase warming up to crypto partnerships, and the SEC’s seemingly contradictory stance on regulation, there’s a lot to unpack.

In this deep dive, we’ll break down the current state of XRP’s price action, explore how traditional finance (TradeFi) is inching closer to crypto, analyze Kraken’s IPO buzz, and get a front-row seat to the ongoing tug-of-war between the SEC and the crypto ecosystem. Buckle up, because this isn’t your typical crypto news update — it’s a candid, no-nonsense look at what’s really going on in Bitcoin, Crypto, BTC, Blockchain, and Investing right now.

Price Action: XRP’s Struggle and Market Sentiment

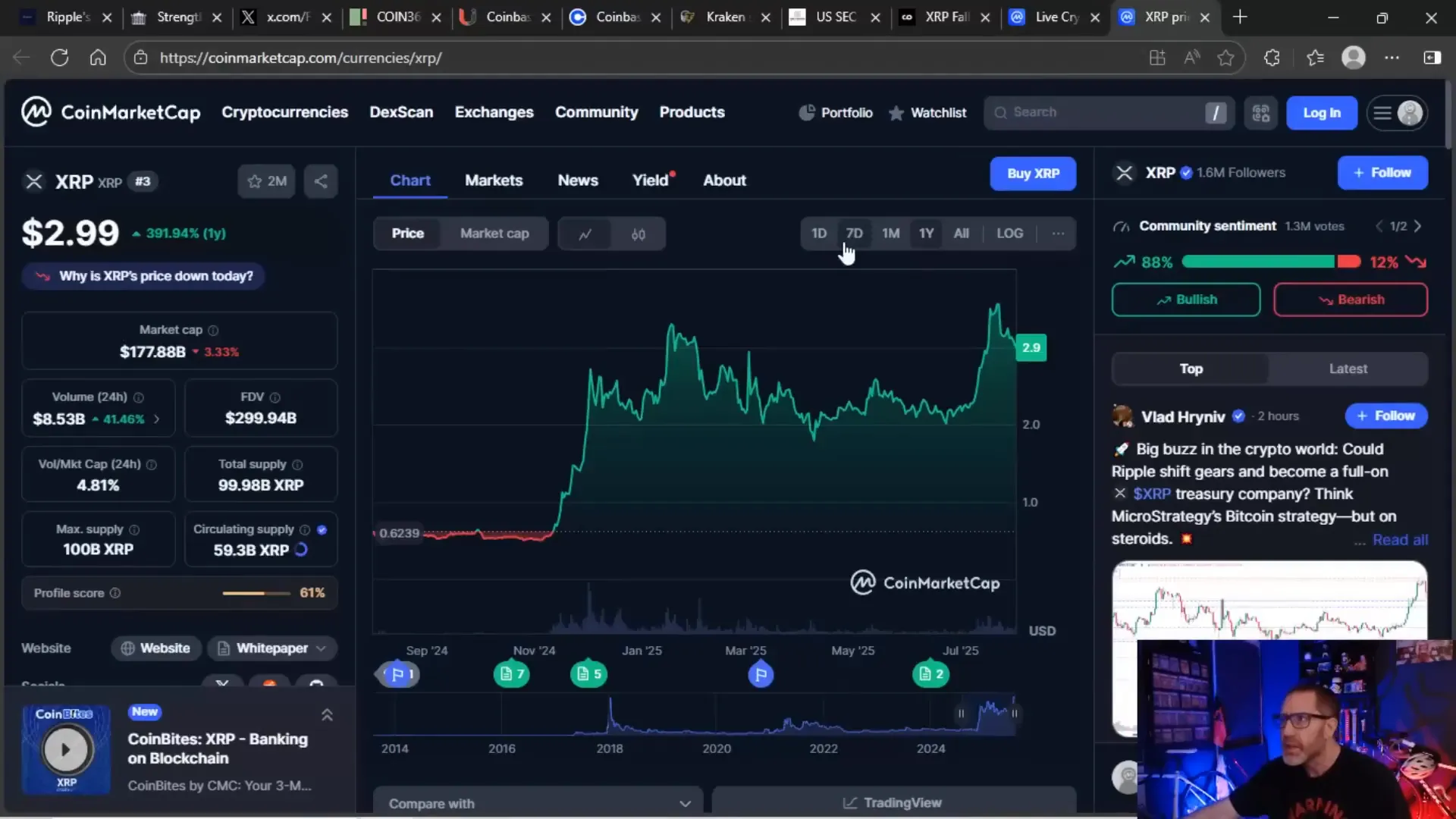

XRP is currently under some sell-off pressure but remains resilient, maintaining a crucial $3 floor support. This support level has been tested multiple times, and while dips below $3 have occurred, the price often bounces right back up — a pattern reminiscent of previous tests near the $2 mark.

Why is this important? Because holding this $3 floor is symbolic for XRP’s health and investor confidence. It’s a psychological anchor that traders watch closely. Falling below it could signal deeper issues, but so far, it seems to be holding strong despite some profit-taking and market jitters.

Bitcoin (BTC) hasn’t been immune to pressure either. Sitting around $115,732, Bitcoin’s recent slide has dragged much of the crypto market down with it. The culprit? Federal Reserve Chair Jerome Powell’s recent comments dampening expectations for a September rate cut. Powell’s message was clear: Don’t count on a rate cut this year, and maybe only one in 2025 if you’re lucky.

This shift in monetary policy expectations has caused a ripple effect, triggering sell-offs across the board as traders recalibrate their risk tolerance and portfolios.

Community Voices Reflect the Market Mood

It’s not just numbers and charts — the crypto community’s pulse tells a story too. Comments from viewers like Will Will Do It reveal the exhausting noise on social platforms, where bots and overzealous traders flood conversations. Meanwhile, Mark Johnson’s skeptical take on bullishness toward companies like Visa highlights the skepticism around hype-driven narratives.

People are reacting emotionally to news, some overreacting to mentions of Ripple in White House reports or seeing FTX’s name pop up and wondering if that’s a good sign. The truth? Context matters, and not every mention means “go buy now.”

How Banks Are Easing Into Crypto — Slowly but Surely

One of the most interesting developments is how banks, especially JPMorgan Chase, are starting to embrace crypto — but cautiously. JPMorgan has partnered with Coinbase to allow Chase customers to redeem their Ultimate Rewards points in USDC stablecoins. This collaboration also lets Chase clients onboard onto Coinbase using their Chase cards and bank accounts, streamlining the process.

This is a big deal because many banks have historically been wary or outright hostile toward crypto. Some have blocked transactions or access to crypto platforms. But JPMorgan’s move signals a softening stance — a toe dip rather than a dive.

However, it’s important to note this isn’t full crypto adoption for Chase’s clientele just yet. It’s about reducing friction to make it easier for customers to access crypto assets through Coinbase, a trusted exchange. The bank plans to allow direct crypto purchases and statement integration by 2026, which means full crypto banking services might still be a few years away.

Why the caution? Banks want protection and regulatory clarity before going “full balls deep” into crypto. This partnership is a win-win, boosting Coinbase’s user base while giving JPMorgan a controlled way to enter the space.

Kraken’s IPO: A $15 Billion Valuation and What It Means for Crypto Exchanges

Kraken, one of the largest American crypto exchanges, is reportedly planning to raise $500 million in funding at a $15 billion valuation ahead of a possible IPO. This is a significant jump from its $11 billion valuation in 2022, marking nearly a 40% increase.

The timing is telling. Kraken is aiming for a public debut as early as Q1 2026, banking on a friendlier regulatory environment. Bloomberg’s report pointed to optimism stemming from the Trump administration’s approach to crypto regulation, though the political landscape could always shift.

With daily trading volumes around $1.37 billion and over 1,100 crypto pairs, Kraken is a major player, though it still trails Coinbase, which boasts roughly double the volume. The IPO could be a strategic move to capitalize on the recent boom in crypto exchange offerings, following the success of platforms like eToro and Circle.

For investors and the crypto community, Kraken’s IPO raises questions about market maturity and how exchanges are positioning themselves amid ongoing regulatory flux. Will Kraken’s public listing open new doors, or will it face the same hurdles as others in the space? Time will tell.

The SEC’s Project Crypto: Regulation or Power Play?

The U.S. Securities and Exchange Commission (SEC) recently launched “Project Crypto,” a new initiative aimed at bringing all markets on-chain, updating outdated regulations, facilitating super apps, and enhancing crypto custody. SEC Chair Paul Atkins emphasized developing clear regulatory policies to attract crypto back to America.

But here’s the kicker: Atkins stressed that most cryptocurrencies are not securities. So why is the SEC pushing to regulate them so heavily? It’s a question that’s baffling to many in the crypto world.

This paradox points to a broader issue: the SEC’s desire to maintain control and power over the crypto space, even as it acknowledges that most tokens don’t fall under its traditional jurisdiction. It’s about influence and authority, not necessarily about protecting investors or fostering innovation.

The SEC’s promises to modernize crypto custody and affirm Americans’ right to self-custody sound good on paper, but critics argue that real change requires Congressional action. The SEC can create guidelines and hold roundtables, but it doesn’t write the laws. That power lies with Congress.

And therein lies the uncertainty. If a new SEC chair or administration comes in hostile to crypto, all these efforts could be reversed overnight. So while Project Crypto is a step forward, it’s still a long road to regulatory clarity and stability.

XRP’s Current Market Dynamics: Profit-Taking, Not Panic

XRP’s recent drop below $3 is attributed mainly to profit-taking by retail and large holders, not panic selling. On-chain data and technical indicators back this up, showing that while selling pressure is strong, it’s a healthy market behavior after a significant rally.

For context, XRP surged from $2 to $3.50 within two weeks, making some profit-taking inevitable. Despite the bearish trend indicators, the market appears to be digesting gains rather than fleeing.

The current trading volume for XRP is healthy, up 41% to approximately $8.5 billion, signaling continued interest. The key is whether XRP can hold the $3 support as the market braces for upcoming catalysts like ETF approvals, regulatory clarity, and potential Fed rate cuts.

Holding this support level is crucial. Falling below it could trigger more significant downside, possibly testing $2.75. But given the current data and market sentiment, the outlook remains cautiously optimistic.

Institutional Flows Paint a Mixed Picture

Institutional buying is a major factor to watch. Recent data shows outflows of BTC and only minor inflows of ETH, which isn’t the trend crypto bulls want to see. The big players have been pulling back since mid-July, and the market is feeling the impact.

This shrinking institutional interest could explain some of the selling pressure and market stagnation. However, it also highlights the importance of regulatory clarity and positive catalysts to reignite confidence.

Looking Ahead: The Road to Regulatory Clarity and Market Recovery

Despite the frustrations and slow pace, there are reasons to be hopeful. Initiatives like the Genius Act and ongoing discussions around the Clarity Act aim to provide some regulatory framework, though they’re not going to happen overnight. ETFs, stablecoin regulations, and other market structures take time to develop and implement.

Traditional finance is inching toward crypto integration, but it’s a slow process. The JPMorgan-Chase and Coinbase partnership is a sign that banks are dipping their toes in the water, but full adoption will require more regulatory certainty and infrastructure development.

The U.S. government’s approach remains inconsistent. While the White House report mentioned Ripple and other crypto entities, there’s been little follow-through on strategic reserves or other bold initiatives. Political theater continues with conflicting voices within Congress and the administration, which doesn’t help the market’s clarity or confidence.

Still, the crypto space today is in a better position than a year ago. Market participants are more sophisticated, infrastructure is stronger, and the conversation has shifted toward integration rather than outright bans.

What Investors Should Keep an Eye On

- XRP’s $3 support level: This is the battleground for XRP’s near-term health.

- SEC’s regulatory actions: Watch for clear guidelines or Congressional movement on crypto laws.

- Institutional flows: Renewed buying from big players could spark the next rally.

- Rate cuts or monetary policy shifts: Fed decisions will continue to impact crypto sentiment.

- Exchange IPOs: Kraken’s debut could signal market maturity and investor appetite.

Patience is key. The players in this space are taking their time, and sudden mega rallies are unlikely until the regulatory fog clears and economic conditions improve.

Remember, investing in Bitcoin, Crypto, BTC, Blockchain, and related assets is a marathon, not a sprint. Staying informed, keeping a level head, and watching the key indicators will help you navigate this evolving landscape.

Final Thoughts

The crypto market is at a critical juncture. XRP is holding its ground amid profit-taking, banks are cautiously embracing crypto, and the SEC’s power struggle underscores the complexity of regulating this new asset class. The interplay of these factors will shape the trajectory of Bitcoin, Crypto, BTC, Blockchain, and Investing in the coming months.

Whether you’re a trader, investor, or crypto enthusiast, staying vigilant and informed is more important than ever. The market’s next big move depends on regulatory clarity, institutional confidence, and broader economic trends. Until then, keep your eyes on the $3 mark for XRP, watch how banks evolve their crypto strategies, and stay skeptical of hype — because in crypto, patience and knowledge pay off.

XRP Breaking Point, Banks Embrace Crypto, and the SEC’s Power Struggle: What You Need to Know About Bitcoin, Crypto, BTC, Blockchain, and Investing. There are any XRP Breaking Point, Banks Embrace Crypto, and the SEC’s Power Struggle: What You Need to Know About Bitcoin, Crypto, BTC, Blockchain, and Investing in here.