If you’ve been following the wild world of cryptocurrency, you’ve probably noticed how tensions between Bitcoin (BTC) maximalists and altcoin supporters, especially XRP fans, are heating up. The battle isn’t just about price anymore—it’s about survival, market dominance, and who controls the future of crypto investing. In this detailed blog post, we’ll dive into why XRP is being called “the crypto for the truly retarded” by some Bitcoin maximalists, why that’s actually a sign of strength, and why putting all your eggs in the Bitcoin basket might be riskier than you think.

This article breaks down the recent headlines, market moves, and expert warnings, all while keeping it real and straightforward—no fluff, just facts and a bit of humor, much like the style of CRYPTO with KLAUS, who’s been calling out the drama with refreshingly candid commentary. Whether you’re a BTC die-hard, an XRP enthusiast, or just curious about the latest in Bitcoin, crypto, BTC, blockchain, and investing, this post is for you.

Table of Contents

- Bitcoin Maximalists vs XRP: The Battle for Crypto Supremacy

- Michael Saylor and Strategy’s BTC Obsession: Smart or Risky?

- Galaxy Digital’s Market Warning: The Fragility of Treasury-Heavy Crypto

- XRP Overtakes Ethereum in Coinbase Revenue: Why Maxis Are Freaking Out

- Altcoins Draining BTC Liquidity: What This Means for Investors

- Diversification in Crypto: Why Putting All Your Chips on BTC Is Dangerous

- XRP Price Action and Market Outlook: The New $3 Floor

- Final Thoughts: Hopium, Risk, and Keeping It Real in Crypto Investing

Bitcoin Maximalists vs XRP: The Battle for Crypto Supremacy

Let’s kick things off with the spicy headline that’s been buzzing around the crypto community: “XRP is the crypto for the truly retarded.” Harsh? Absolutely. But who said it? A Bitcoin maximalist, a “BTC maxi” for short. Now, before you jump to conclusions, this isn’t just random trolling; it’s a reaction to a real threat.

Bitcoin maximalists have long held the belief that Bitcoin is the one true crypto, the digital gold, and anything else is just noise. But XRP and other altcoins have been quietly chipping away at Bitcoin’s dominance, both in terms of market share and utility. That’s why you hear the shade being thrown—because XRP and altcoins are starting to look like legitimate competition.

Remember, you only catch flack when you’re over the target. XRP’s growing presence and increasing market influence have the BTC maximalists feeling threatened, which explains the harsh rhetoric.

This tension is not just about words; it’s about market dynamics. XRP is gaining traction on exchanges, and its trading volumes and revenues are starting to rival Ethereum's, which has traditionally been the second most dominant crypto after Bitcoin. The fact that XRP is now making more money from trading on Coinbase than Ethereum is a significant development that BTC maximalists don’t want to admit.

Michael Saylor and Strategy’s BTC Obsession: Smart or Risky?

Enter Michael Saylor, the outspoken Bitcoin evangelist and former CEO of MicroStrategy, who now runs Strategy, a public company that owns a massive stash of Bitcoin. Saylor recently doubled down on his BTC-only strategy, claiming that owning up to 7% of the total Bitcoin supply isn’t too much for a company leading the way in digital capital.

But here’s the kicker: Strategy’s business model isn’t about innovation or diversification; it’s about using other people’s money—leveraging debt and stock offerings—to buy more Bitcoin. Right now, Strategy holds around 628,000 BTC, roughly 3% of the total fixed Bitcoin supply. That’s a huge bet on one asset.

Is it smart? Or is it risky as hell? The problem is that putting all your chips on Bitcoin, especially by leveraging other people’s money, creates a fragile financial structure. If Bitcoin’s price takes a major hit, Strategy and similar companies could be forced to sell their Bitcoin holdings to cover their operations, potentially triggering a domino effect in the market.

Galaxy Digital’s Market Warning: The Fragility of Treasury-Heavy Crypto

Speaking of risks, Galaxy Digital, a well-known crypto finance service company, recently issued a stark warning about the rise of digital asset treasury companies (DATCOs). These companies, which collectively hold over $100 billion in digital assets, operate on a simple but dangerous cycle:

- Acquire more equity

- Purchase more cryptocurrencies like BTC, ETH, and SOL

- Repeat the process

This one-way trade depends heavily on three factors:

- Investor sentiment

- Cryptocurrency values

- Liquidity of the capital markets

If any of these factors falter, the entire market structure could collapse like a house of cards.

Galaxy Digital’s warning highlights a critical issue that many investors overlook: diversification. It’s common sense to spread risk across different asset classes and investments, but many crypto companies and investors are going all-in on Bitcoin without any backup plan.

Think about it: Do you keep all your cash under your mattress, in one bank, or split it up? The same principle applies to crypto investing. Relying solely on Bitcoin, especially when leveraged, is a recipe for disaster.

XRP Overtakes Ethereum in Coinbase Revenue: Why Maxis Are Freaking Out

Now, here’s the part that’s really got the Bitcoin maximalists sweating. According to Coinbase’s Q2 2025 earnings report, XRP generated more revenue from trading than Ethereum. Specifically, XRP accounted for 13% of Coinbase’s earnings that quarter, while ETH made up 12%. This is a huge deal.

Why does this matter? Because exchanges like Coinbase care about one thing above all else: making money. When XRP starts to chip away at Ethereum’s market share and revenue, it signals that more traders and investors are interested in XRP products. This shift threatens the dominance of BTC and ETH, shaking the foundations of what many thought was the untouchable crypto hierarchy.

The rise of XRP and other altcoins is not just a market trend; it’s a signal that the crypto ecosystem is diversifying and that investors are looking beyond Bitcoin and Ethereum for opportunities.

Altcoins Draining BTC Liquidity: What This Means for Investors

Another important development is how altcoins are draining liquidity from Bitcoin. The BTC dominance chart, which tracks Bitcoin’s share of the total crypto market, has been falling over the years—from dominance levels as high as 92% in the early days to much lower levels now as altcoins gain ground.

Altcoins like XRP, Solana, and Hedera Hashgraph (HBAR) are now commanding attention and treasury allocations that didn’t exist two years ago. Treasury-heavy altcoin companies are emerging, diversifying the crypto landscape and threatening Bitcoin’s dominance.

What’s more, the recent White House crypto report made no mention of a BTC strategic reserve, which was a big disappointment to BTC maximalists hoping for government support in the form of strategic Bitcoin purchases. This absence further highlights the shifting power dynamics in crypto.

Altcoins pulling liquidity from Bitcoin means Bitcoin’s price could be more volatile, and investors may need to rethink their strategies.

Diversification in Crypto: Why Putting All Your Chips on BTC Is Dangerous

Let’s be blunt: maximalism is dangerous. Whether you’re a maximalist for Bitcoin, remote controls, or even GoPro cameras, putting all your eggs in one basket is risky. Galaxy Digital’s report and the market’s current state make it clear that diversification is essential.

Many players in the crypto space are doubling down on Bitcoin alone, ignoring the benefits of spreading risk across different assets. This creates a bubble ripe for bursting if Bitcoin’s price declines sharply.

Smart investors don’t just diversify within crypto—they diversify outside crypto as well. Consider adding gold, real estate, or even something fun like Trek bikes to your portfolio. The goal is to reduce risk and avoid exposure to a single asset class or market.

Remember, even Michael Saylor, the BTC Messiah, went belly up during the dot-com crash. History has a way of repeating itself if we don’t learn from it.

XRP Price Action and Market Outlook: The New $3 Floor

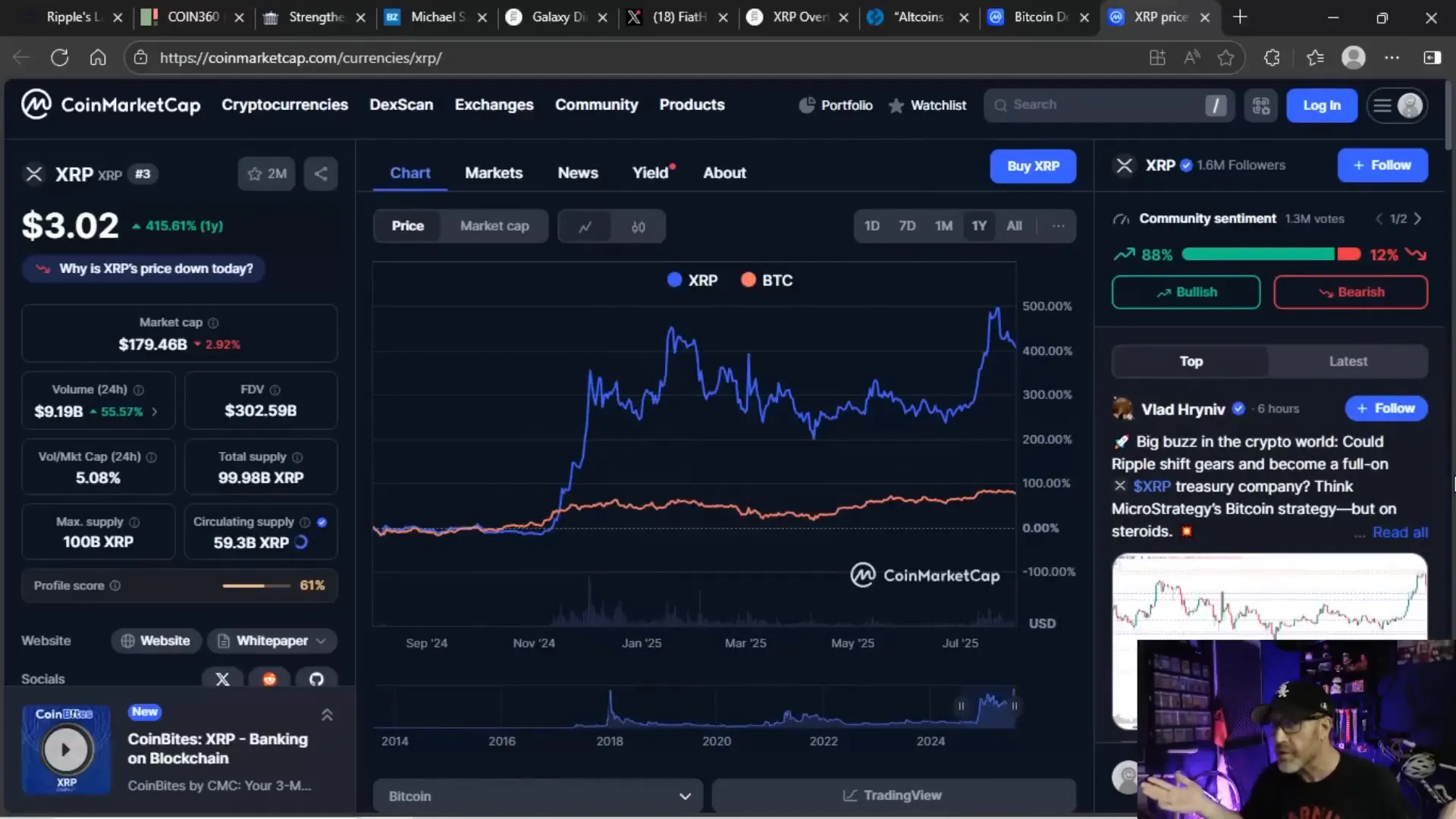

Let’s talk numbers. XRP’s price has been impressive compared to Bitcoin over the past year. Even with the usual pumps and dumps, XRP is consistently outperforming BTC, proving the skeptics wrong.

Currently, XRP is holding a strong $3 floor, with trading volumes around $9.18 billion in the last 24 hours. The candlestick charts are showing positive signs of stability and growth, with multiple green monthly candles indicating bullish momentum.

While some investors wish the price action was a bit higher, the important takeaway is that XRP is holding steady and building a solid foundation. This resilience is why XRP is starting to be seen as a serious player, not just an altcoin.

Final Thoughts: Hopium, Risk, and Keeping It Real in Crypto Investing

So, where does this leave us? The crypto market is evolving fast, and the old Bitcoin-only mindset is being challenged by altcoins like XRP that are gaining traction and market share. The harsh words from BTC maximalists are less about facts and more about fear of losing dominance.

Michael Saylor and Strategy’s BTC-only approach is risky, especially when leveraged with other people’s money. Galaxy Digital’s warning about treasury-heavy crypto companies highlights the fragile nature of this strategy. Diversification is no longer optional; it’s necessary for survival.

XRP’s rise in trading volume, revenue generation, and price action shows that altcoins are here to stay and are starting to chip away at BTC’s dominance. Investors would be wise to pay attention, diversify, and not get caught up in maximalist hype.

And hey, if you’re still holding onto the idea that BTC is the only way, maybe it’s time to touch some grass, diversify your portfolio, and keep your eyes open. The crypto world is bigger than just Bitcoin, and smart investing means embracing that reality.

Stay safe, stay informed, and keep investing smartly.

🚨 XRP Attacked, BTC Faces Huge Risk: What Every Crypto Investor Needs to Know 🚨. There are any 🚨 XRP Attacked, BTC Faces Huge Risk: What Every Crypto Investor Needs to Know 🚨 in here.