In this deep-dive article I’m breaking down what happened in my latest video — and why the SEC’s newest delays matter for traders, stackers, institutions, and anyone paying attention to Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing. I’m Klaus, the host behind CRYPTO with KLAUS, and I walk through the SEC’s ETF decision delays, the Treasury’s call for public input under the Genius Act, institutional Bitcoin treasury moves in Europe, the brutal shrinkage in NFT market cap, and practical strategies you can use now.

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — if those words get your pulse up, stick around. This post is structured like a tactical guide: key takeaways up front, then the full blow-by-blow context, market action, tactical moves, and a checklist you can use to respond to the October decision dates that the SEC just set.

Key takeaways

- Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — the SEC just delayed key ETF decisions across multiple products, including Bitcoin, Ethereum, Solana and XRP. New decision dates landed in October, creating a period of baked-in uncertainty and volatility.

- Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — the Department of the Treasury is soliciting public comments on AML and stablecoin controls under the Genius Act; this is a chance to weigh in on APIs, AI, and digital identity — even if you’re skeptical government agencies will actually heed the public.

- Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — institutional adoption is progressing. Dutch crypto firm Amdax announced an Amsterdam Bitcoin Treasury strategy, signaling growing corporate/institutional FOMO for BTC allocation.

- Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — market structure matters: XRP’s market cap dwarfs the entire NFT market right now. With XRP around $3 and a market cap in the hundreds of billions, there are both speculative and stacking opportunities depending on risk appetite.

- Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — plan for the end of Q3 and Q4: rate cut expectations, regulatory timing, and ETF approvals or denials will squeeze volatility. You need a clear trading/staking plan and risk rules for when volatility spikes.

What actually happened: SEC delays and what was pushed back

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — let’s be blunt: the SEC kicked the can. Multiple ETF approval decisions were pushed back to October. The agency cited the need for more time to evaluate filings, and the effect was a wave of frustration across crypto communities that had hoped for near-term clarity.

The specific filings affected included ETF applications tied to Bitcoin and Ethereum (from True Social), Solana products from Bitwise and 21Shares, and a 21Shares spot XRP trust. The SEC set new decision dates: October 8 for the True Social Bitcoin ETF, October 16 for Bitwise’s Solana ETF, and October 19 for the 21Shares Core XRP trust. That’s a lot of calendar real estate dedicated to waiting.

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — why does that matter? Because every time the SEC delays, traders and institutions recalibrate risk models and capital commitments. Uncertainty breeds volatility and volume—which benefits exchanges—and it torpedoes any hope of a neat, cleared path to mainstream institutional exposure via spot ETFs.

What the SEC delays really mean

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — a delay is not an outright rejection. But it's worse than a quick yes-or-no because a delay extends uncertainty. For institutions, that means capital remains on the sidelines. For traders, it means whip-saw price action. For retail holders, it means another episode of thinking: “Is now the moment to buy or to bail?”

The SEC’s posture under current leadership feels like a continuation of the Gary Gensler era—meticulous, skeptical, and willing to drag processes out rather than provide decisive guidance. That approach forces the market to price in regulatory ambiguity for longer, and that’s why you saw XRP dip and then rebound as the day wore on.

Treasury wants input on AML, APIs, AI, and digital identity — Genius Act opens the comment box

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — the Treasury Department formally asked for public input on what financial institutions should do to detect and prevent illicit activity in digital assets, under provisions of the recently passed stablecoin bill (the Genius Act). This is big because it sets the stage for how AML frameworks, compliance tooling, and identity verification will be shaped.

The Treasury's request is focused on emerging technologies and practices: application programming interfaces (APIs), artificial intelligence models for transaction monitoring, and digital identity solutions. These are precisely the areas where private-sector innovation is fastest, and they’ll be central to any practical AML policy that doesn’t crush legitimate innovation.

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — my immediate reaction? Fine — ask the public. But don’t treat public comments like theatre. If you’re an AML engineer, a privacy advocate, a developer building privacy-preserving identity layers, or just a retail holder who worries about overbearing surveillance, this is the moment to submit clear, practical comments. And you should suggest phased compliance pathways so smaller firms aren’t immediately crushed by compliance costs.

Practical points you can raise in a comment

- Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — prioritize risk-based approaches: one-size-fits-all rules will force innovation offshore.

- Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — encourage the use of open APIs and standards for blockchain analytics so firms can interoperate and audit AML tooling.

- Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — require explainability in AI models used for transaction monitoring to avoid black-box enforcement that hits legitimate users.

- Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — protect privacy with minimal data exposure: consider zero-knowledge proofs or tiered identity verification for low-risk transfers.

- Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — set minimum thresholds and graduated compliance obligations so small firms and startups can comply without being destroyed.

Institutions getting into strategic BTC reserves: Amdax and the Bitcoin treasury story

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — this one’s simple: institutions keep dipping toes in BTC. Dutch crypto platform Amdax announced plans to launch an Amsterdam Bitcoin Treasury strategy (AMBTS) and pursue a listing on Euronext Amsterdam. Their CEO framed it as a response to the growing portion of Bitcoin held by corporations, governments, and institutions.

That matters because it signals supply-side pressure on available liquidity and highlights the narrative driving institutional FOMO. If corporations and funds allocate even a few percent of treasury assets to Bitcoin, that reduces available sell-side supply and can create structural support for price appreciation over medium term.

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — think of it as a voluntary corporate adoption wave. It’s different from a single ETF approval; this is a broader institutional attitude shift where multiple corporate actors start to treat BTC as a treasury asset rather than purely speculative exposure.

Why corporate BTC treasuries shift the market dynamics

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — corporate treasuries buy to hold. That changes the supply-demand mechanics in a way that retail buying alone cannot. Corporations generally have long-term horizons, risk controls, and internal governance. When they convert part of cash reserves to Bitcoin, it’s not trading activity—it’s capital allocation. Over time that meaningfully tightens float.

Combine that with ETF flows (if and when approvals come), and you’ve got a situation where structurally less BTC is available on exchanges for margin trading and rapid liquidation. That’s bullish on the margin—assuming demand continues to rise or even stays steady.

NFT market’s crash in perspective: $8.1B market cap vs XRP’s hundreds of billions

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — the NFT market cap has cratered to roughly $8.1 billion. That’s the entire market for NFTs as valued on-chain at the moment. For context, XRP’s market cap is sitting north of $180 billion. Yes — XRP is massively larger in market cap than the whole NFT industry right now.

This is a reality check on where speculative capital went and where it’s returned. Remember when ridiculous JPEGs were fetching millions? That era is virtually over—at least for the headline-making bubble trades. Now, NFTs are a smaller, more specialized market focused on utility, memberships, gaming, and IP collaborations instead of pure speculative art flippers.

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — the NFT crash matters because it reshapes where speculative crypto capital flows. When NFTs implode, some of that liquidity flows back into tokens, stablecoins, or into yield strategies. That reallocation can influence altcoin pump cycles or provide buying power for assets like XRP, SOL, or ETH when they dip.

Price action breakdown: XRP, ETH, BTC, and market structure

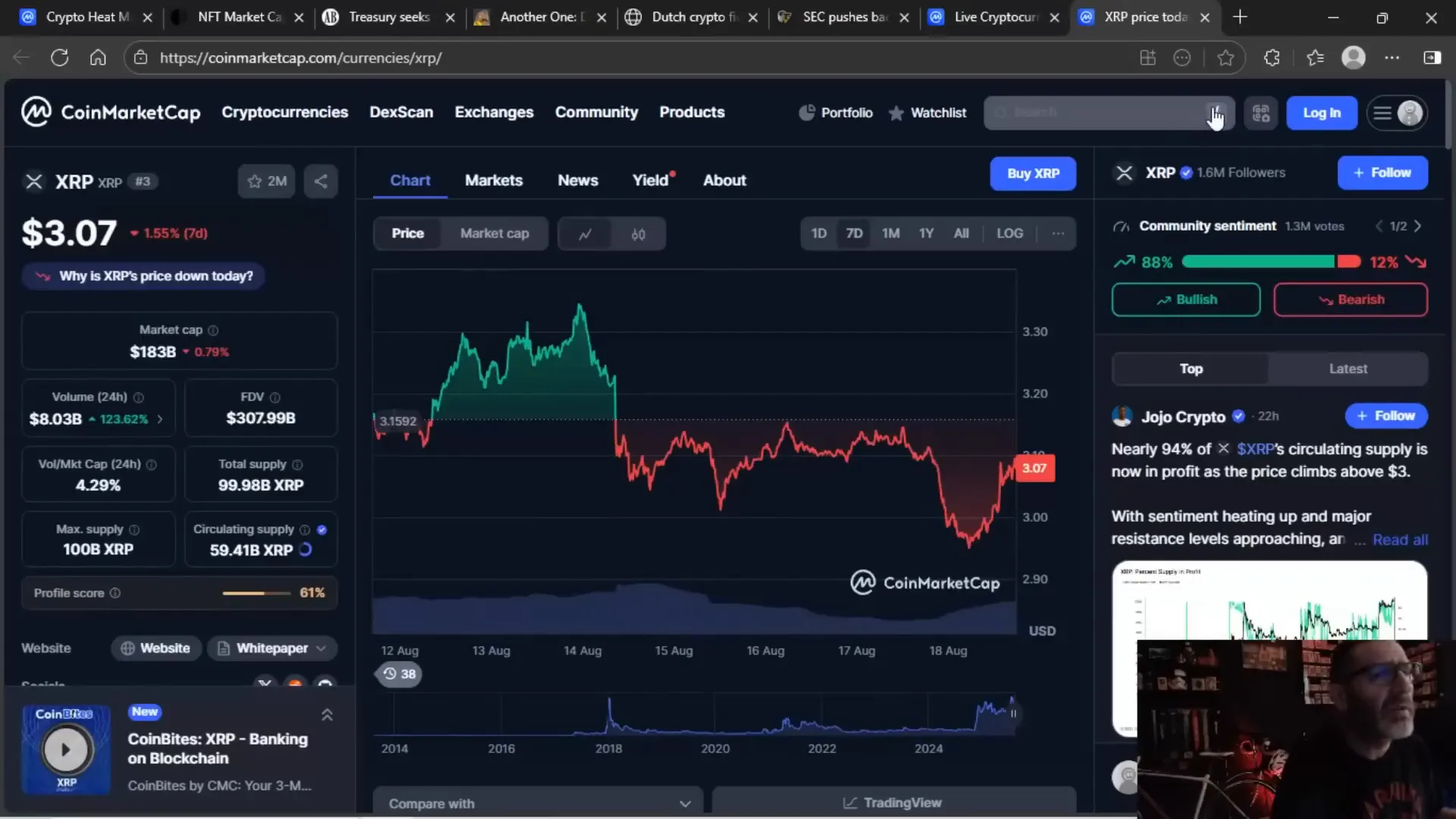

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — the market was rattled, but then it rebounded. XRP dipped sub-$3 (mid-$2.90s) on the headlines and then rallied back to roughly $3.07 during intraday recovery. Volume was heavy—XRP saw roughly $8 billion in trading volume on the day, and overall crypto market volume hovered near $194 billion.

XRP’s market cap is eye-catching: roughly $183 billion vs NFT market cap at $8.1 billion. That disparity tells you where the market’s attention and liquidity currently lie. Large cap tokens like XRP and BTC dominate the available capital, while more niche sectors struggle for traction.

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — technical traders were eyeing the $3 mark as a pivot. The advice I gave in the video: snipe the dips if you’re comfortable, but be patient. You don’t need a one-in-a-million three-sixty no-scope. Wait for clear liquidity gaps and use limit orders to stack at strategic price bands. If you swing-trade, consider taking partial profits at 10–15% because this market loves to mean-revert after headline squeezes.

What traders were watching

- Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — decision dates in October (Oct 8, Oct 16, Oct 19) were the immediate catalysts.

- Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — altcoin season index was in the low 40s, signaling mixed breadth: not a full-on alt season, but enough action to move midcaps on volume spikes.

- Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — exchanges were making money on volatility: sign-ups, spreads, fees, and liquidation events are profit centers for trading venues during these swings.

How to think about risk and opportunity right now

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — you should be both pragmatic and opportunistic. Delays create both fear and opportunity. Here’s how to frame it:

For long-term stackers

- Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — continue DCA (dollar-cost averaging) into core holdings like BTC and ETH if you’re building a long-term exposure to the sector. Regulatory noise will ebb and flow; long-term value accrues to networks with real utility.

- Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — consider adding high-conviction alt allocations like XRP if you believe in their fundamentals and legal outcomes, but size positions conservatively relative to core holdings.

- Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — set a multi-year plan and avoid being shaken out by short-term delays unless your thesis changes materially.

For swing traders

- Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — trade the volatility, but minimize overnight directional exposure across key event windows (e.g., the day before and the day of SEC decisions).

- Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — use defined stop-losses and target partial profit-taking at 10–20% ranges. Remember, headlines can reverse moves swiftly.

- Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — prefer limit orders to market orders when sniping dips to avoid slippage during thin liquidity moments.

For more active or leveraged traders

- Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — watch funding rates and exchange margin conditions. When volatility spikes, funding rates can explode and liquidations can cascade.

- Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — keep leverage conservative near decision dates. A small move can wipe out overleveraged positions.

- Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — consider options strategies (e.g., buying puts or selling covered calls) to hedge big directional exposure if you expect a squeeze event.

Practical trading checklist you can use today

- Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — calendar the SEC decision dates (Oct 8, Oct 16, Oct 19) and reduce position size before those days if you’re risk-averse.

- Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — set limit buys at key psychological levels (e.g., for XRP around $3 mark) rather than market buys during headline dumps.

- Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — distribute sell targets: 10% take profit at first target, 25% at next, and hold the rest if your longer-term thesis still holds.

- Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — confirm liquidity: check order book depth before placing large orders so you don’t suffer excessive slippage.

- Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — log your trades and evaluate performance after each event window. Iterative improvement is the name of the game.

How the narrative could flip into a Q4 rally — or a continued slog

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — the setup for Q4 is interesting. You’ve got decision dates in October, a widely anticipated Fed pivot or rate cuts looming in the back half of the year, and a tidal wave of institutional interest nudging supply lower.

If the Fed signals a genuine pivot (or the market believes a pivot is imminent), liquidity conditions improve for risk assets. Coupled with ETF approvals, that could create a strong bid for both BTC and select alts. In that bullish scenario, buyers who layer in during dips could see rapid upside as sidelined capital flows back into the market.

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — the opposite is also possible. Continued delays, a hawkish Fed tone, or a messy geopolitical event could prolong the squeeze on risk assets. In that case, volatility will remain elevated and mean-reversion trades will dominate.

Scenario planning for both outcomes

- Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — bullish scenario (Fed pivots + ETF approvals): prepare to scale into positions as confirmation arrives, but keep stop losses to lock in gains if the news is priced in too quickly.

- Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — bearish scenario (delays persist + no pivot): consider increasing cash allocation, tightening risk exposures, and rotating into stablecoins or hedging instruments.

Regulation and the SEC’s posture: what to expect next

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — the SEC’s willingness to delay suggests they’re not comfortable giving quick thumbs-ups for spot ETFs across the board. That means many filings will enter a lengthy review cycle where legal, market structure, and surveillance concerns become bargaining chips.

Regulatory clarity might ultimately arrive via one of three paths: the SEC broadens supervisor-friendly rule interpretations and approves spot ETFs; Congress steps in with clearer statutory guidance; or the courts force quicker clarity via litigation outcomes (particularly in high-profile XRP-like cases). Any of these outcomes will reframe institutional appetite and capital allocation.

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — keep an eye on legal precedents. The interplay between court decisions and SEC policy can be decisive; a favorable court ruling for tokens like XRP could force the SEC to adjust its approach more rapidly than a slow regulatory rulemaking process.

How to submit a public comment to the Treasury (a small practical guide)

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — if you want to actually influence policy, here’s how to make your comment count:

- Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — be concise: regulators read thousands of comments; a clear, evidence-based 300–800 word submission is more impactful than a rambling manifesto.

- Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — include practical examples: mention specific APIs, explainability requirements for AI, and how digital identity tiers might function in practice.

- Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — propose metrics: recommend metrics for performance and accuracy of AML AI models (false positive rates, explainability thresholds).

- Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — call for balanced compliance timelines: small firms need time and resources; phased implementation works better than immediate heavy-handed mandates.

- Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — highlight risks to privacy and innovation, and suggest privacy-preserving solutions like zero-knowledge proofs for low-risk identity assertions.

Practical examples of comments you could copy/paste

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — here’s a short template you can adapt:

"I urge Treasury to adopt a risk-based AML framework that allows for tiered digital identity verification, transparent AI model reporting standards (including false positive and false negative rates), and open API standards for blockchain analytics. These measures will help financial institutions detect illicit activity without strangling legitimate innovation, and they create a defensible compliance pathway for smaller firms entering the market."

Media, market psychology, and why the SEC’s credibility matters

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — the SEC’s credibility matters because markets are social constructs. Confidence in institutions and consistent rule-of-law enforcement anchors capital allocation decisions. When the SEC delays repeatedly, it erodes predictability and pushes risk premia higher.

Media narratives amplify that uncertainty and often turn technical rulemaking into emotionally charged headlines. Smart investors keep the emotional noise at arm’s length and focus on probabilities, sizing, and expected value. But noise also creates opportunities: headline-driven liquidity vacuums let disciplined traders buy at better prices.

Final thoughts and what I’ll be watching closely

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — here’s the short list of things that will define the next few months:

- Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — the SEC decision dates in October and any accompanying commentary they publish.

- Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — the Treasury’s synthesis of public comments and whether they propose workable, phased AML rules under the Genius Act.

- Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — central bank communication on rate cuts and the Fed’s actual policy path.

- Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — institutional treasury announcements like Amdax’s AMBTS and any new corporate BTC reserves filings.

- Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — on-chain signals: active addresses, exchange inflows/outflows, and large OTC transfers that affect available float.

I’ll keep reporting and breaking down each development as it lands. If you trade or stack, get your risk rules in place before key decision windows. If you want to influence policy, take five minutes and submit a sensible comment to the Treasury. If you prefer to HODL and ignore noise, keep your plan and add incrementally on pullbacks.

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — look, it’s messy, it’s noisy, and yes, it’s frustrating. The SEC keeps delaying and that sucks. But remember: delays are time windows for you to prepare, position, and sharpen your strategy. Markets reward those who plan and punish those who react emotionally.

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing — if you liked this breakdown, use the checklist in this article to set alerts, size positions, and prepare for the October decision calendar. You don’t need to be perfect; you just need a plan that reduces emotional trading and improves expected outcomes.

Stay sharp, stack smart, and I’ll keep calling the plays bluntly and loudly — because that’s how you survive and thrive in this ecosystem.

🔴XRP ANNOUNCEMENT🔴 SEC SHUTS THE DOOR 🔴 | Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing. There are any 🔴XRP ANNOUNCEMENT🔴 SEC SHUTS THE DOOR 🔴 | Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing in here.