I recently broke down a wave that’s sweeping corporate treasuries: companies pivoting from plain old crytocurency, bitcoin hoarding to aggressive Ethereum accumulation. In the original video I created for Coin Bureau, I walk through the five biggest Ethereum treasury companies — who they are, how they operate, how much ETH they’ve bought, and what it could mean for ETH’s price. Below is a thoughtful, reader-friendly write-up of that breakdown so you can get up to speed quickly.

Key takeaways

- Public companies are raising capital specifically to buy and stake ETH — not just BTC.

- These firms can generate yield on ETH (staking, DeFi), which can turbocharge their MNAV versus simply holding BTC.

- The top five public ETH treasuries already hold roughly 2.3M ETH (~2% of supply); if planned raises are executed, corporate ETH holdings could approach 7% of supply.

- The model is powerful but carries risks: negative MNAVs or forced liquidations would pressure ETH’s price.

Table of Contents

- What is an Ethereum treasury company and why now?

- 1) BitMine (formerly Bitmine Immersion Tech)

- 2) Sharplink Gaming (sBET) — “Ethereum’s MicroStrategy”?

- 3) The Ether Machine (ETHM)

- 4) Bit Digital (BTBT)

- 5) ETHzilla (formerly 180 Life Sciences)

- Putting the numbers together — why this matters for ETH

- Final thoughts

What is an Ethereum treasury company and why now?

An Ethereum treasury company is a publicly traded (or planning to be) firm that raises cash — via private placements, PIPEs, or ATM stock sales — and converts that capital into ETH. Unlike pure Bitcoin treasuries, ETH treasuries can earn native yield through staking, lending, liquidity provision, and other DeFi activity. That yield can compound holdings, improving a firm's multiple on net asset value (MNAV) and attracting more investors in a virtuous loop.

Put simply: firms raise cash → buy ETH → stake or deploy it for yield → report a NAV that can trade at a premium to straight ETH exposure. That premium is what makes investors choose a stock over buying tokens directly.

1) BitMine (formerly Bitmine Immersion Tech)

BitMine — a company originally incorporated as a Bitcoin miner — made the splashiest pivot, announcing on June 30 it would launch an ETH treasury after a $250M private placement. The stock (BMNR) exploded, rallying thousands of percent in days. BitMine has been buying large blocks of ETH repeatedly: multiple purchases in July and August brought its holdings to about 1.2M ETH (~1% of supply) worth several billion dollars at the time of recording.

How they fund it: reinvest cash flows from mining, stake rewards, opportunistic buys (buying dips) and ongoing capital raises. The company has publicly stated an ambition to accumulate up to $25B of ETH for its treasury — a jaw-dropping target that helped push ETH price action higher.

2) Sharplink Gaming (sBET) — “Ethereum’s MicroStrategy”?

Sharplink began life in 1995 as a sports-betting and casino marketing firm. In March it announced a $425M private placement to pivot into an ETH treasury. The firm’s chair, Joseph Lubin — one of Ethereum’s cofounders and founder of ConsenSys — brought immediate credibility and bold ambition.

Sharplink’s moves: initial $463M buy in June made it, for a moment, the largest public ETH holder. The company has staked all its accumulated ETH so far and has filed to sell up to $1B (then expanded to $6B) in equity to buy more ETH. That appetite fueled investor excitement — and volatility — as the stock spiked and later retraced when new issuance plans surfaced.

3) The Ether Machine (ETHM)

Born from a merger between Ether Reserve and Dynamics Corp, The Ether Machine aims to list under ETHM and targets a $1.6B raise to amass on-chain ETH while building yield via staking, restaking, and DeFi participation. Co-founders have ConsenSys pedigrees, and their initial buys were aggressive — almost 320k ETH in one late-July purchase plus additional smaller buys. They still have several hundred million USD left to deploy.

4) Bit Digital (BTBT)

Bit Digital — once a Bitcoin miner and earlier a car rental company — shifted strategy in June, exiting Bitcoin mining to focus on ETH. It sold shares and redeployed proceeds, buying ~100k ETH for $172M in early July and adding more later. Bit Digital emphasizes repurposing assets (including its HPC subsidiary) and intends to become a “pure play Ethereum staking and treasury company.”

5) ETHzilla (formerly 180 Life Sciences)

ETHzilla rebranded after raising $425M from institutions and crypto-native funds (Polychain, Electric Capital, and others) to build an ETH treasury. The firm intends to add debt funding and use staking, lending, and liquidity provisioning to outperform simple staking yields. A high-profile stake by Peter Thiel briefly sent the stock parabolic, and the company purchased ~82k ETH (~$313M) in one go on August 12.

Putting the numbers together — why this matters for ETH

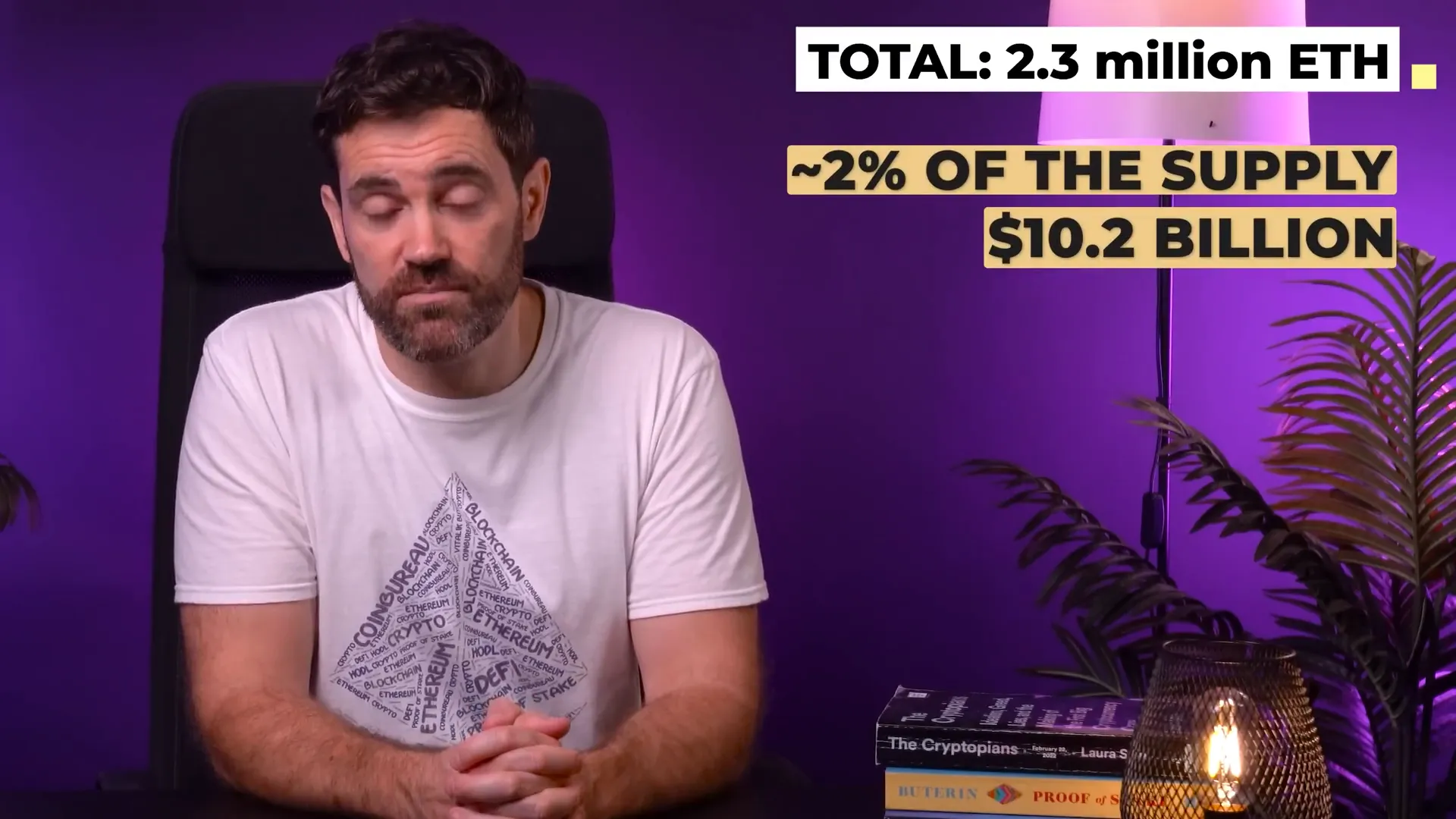

Collectively, the top five firms above have already accumulated roughly 2.3M ETH — just under 2% of the total supply and worth over $10B at the recording price. Broader trackers show all ETH treasury companies holding ~3.5M ETH (≈3% of supply).

Now the big math: these top five plan to raise roughly $33.1B in total, and have spent about $9.3B so far. That leaves a potential $23.8B still earmarked for ETH accumulation, which — if deployed at the then-current price — could buy roughly another ~5M ETH. That would push corporate ETH holdings toward ~8.5M ETH or about 7% of supply. That magnitude of demand from public markets could be a major structural tailwind for ETH’s price and liquidity dynamics.

Risks to watch

- MNAV compression: If a company’s stock trades below its NAV (negative MNAV), investors could sell or stop buying, forcing firms to slow or reverse ETH purchases.

- Forced liquidations: If treasury companies need cash to meet obligations, they might sell ETH, creating downside pressure.

- Execution risk: Yield strategies (staking, lending, restaking) add operational complexity and counterparty risk.

However, ETH treasuries have an inherent advantage versus BTC-only treasuries: ETH can be put to work to generate yield, helping firms compound holdings and support MNAV even during volatility. That makes the model resilient so long as market conditions broadly trend upward and governance/regulatory frameworks remain stable.

Final thoughts

The corporate accumulation of ETH is more than a fad — it’s an evolving structural story. Companies are racing to raise capital and stake ETH, creating a positive feedback loop: MNAV premiums bring investors, investors provide more capital, those firms buy more ETH, and the cycle repeats. That dynamic could be a primary driver of ETH’s next leg up.

That said, the strategy isn’t risk-free. MNAV collapses, mismanagement, or macro shocks could force painful liquidations. For now, though, the momentum is real and the potential upside for ETH is huge — especially if more public firms join the race.

Note: This article summarizes public moves by corporate ETH treasuries and should not be considered financial advice. If you’re digging deeper, track treasury positions and planned raises, and prioritize risk management when considering exposure to this evolving trend in crytocurency, bitcoin-led markets.

Top 5 Ethereum Whales Exposed! They Are Going ALL IN ON ETH! — crytocurency, bitcoin. There are any Top 5 Ethereum Whales Exposed! They Are Going ALL IN ON ETH! — crytocurency, bitcoin in here.