Based on a Savvy Finance conversation with Anthony Scaramucci and on-chain analyst Willy Woo, this article distills what matters now for crytocurency, bitcoin: the institutional on‑ramps driving price action, the math behind supply and demand, and the hidden risks that could turn adoption into centralization. If you watched the original Savvy Finance breakdown, you already know the stakes. Below I walk through the arguments, the numbers, and a practical checklist you can use today.

Key takeaways

- Institutional ETFs (led by BlackRock's iShares iBit) are real and meaningful—this is a new on‑ramp for huge pools of capital.

- Supply math is persuasive: only ~450 new BTC are minted daily, creating a strong supply squeeze if demand keeps rising.

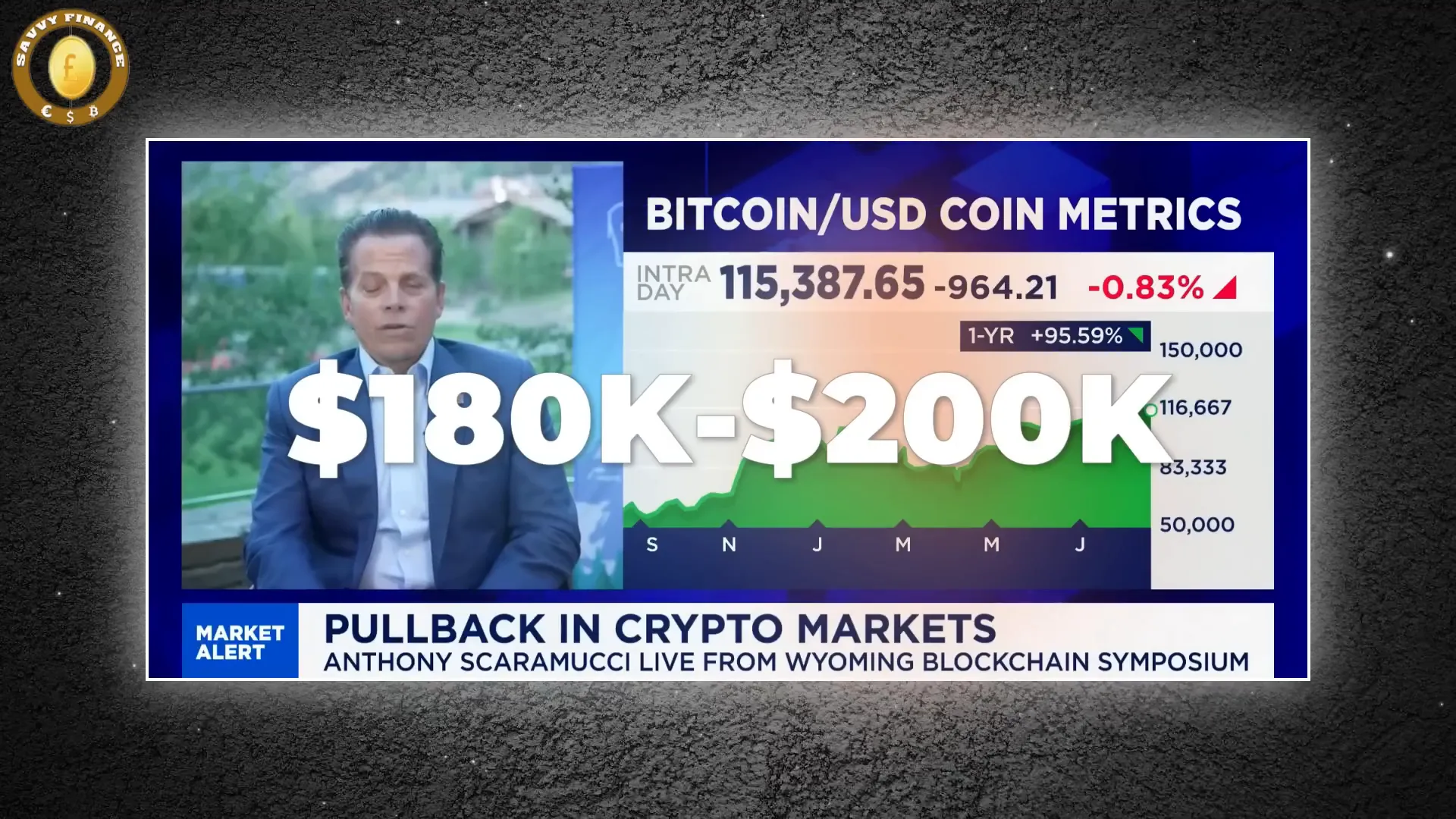

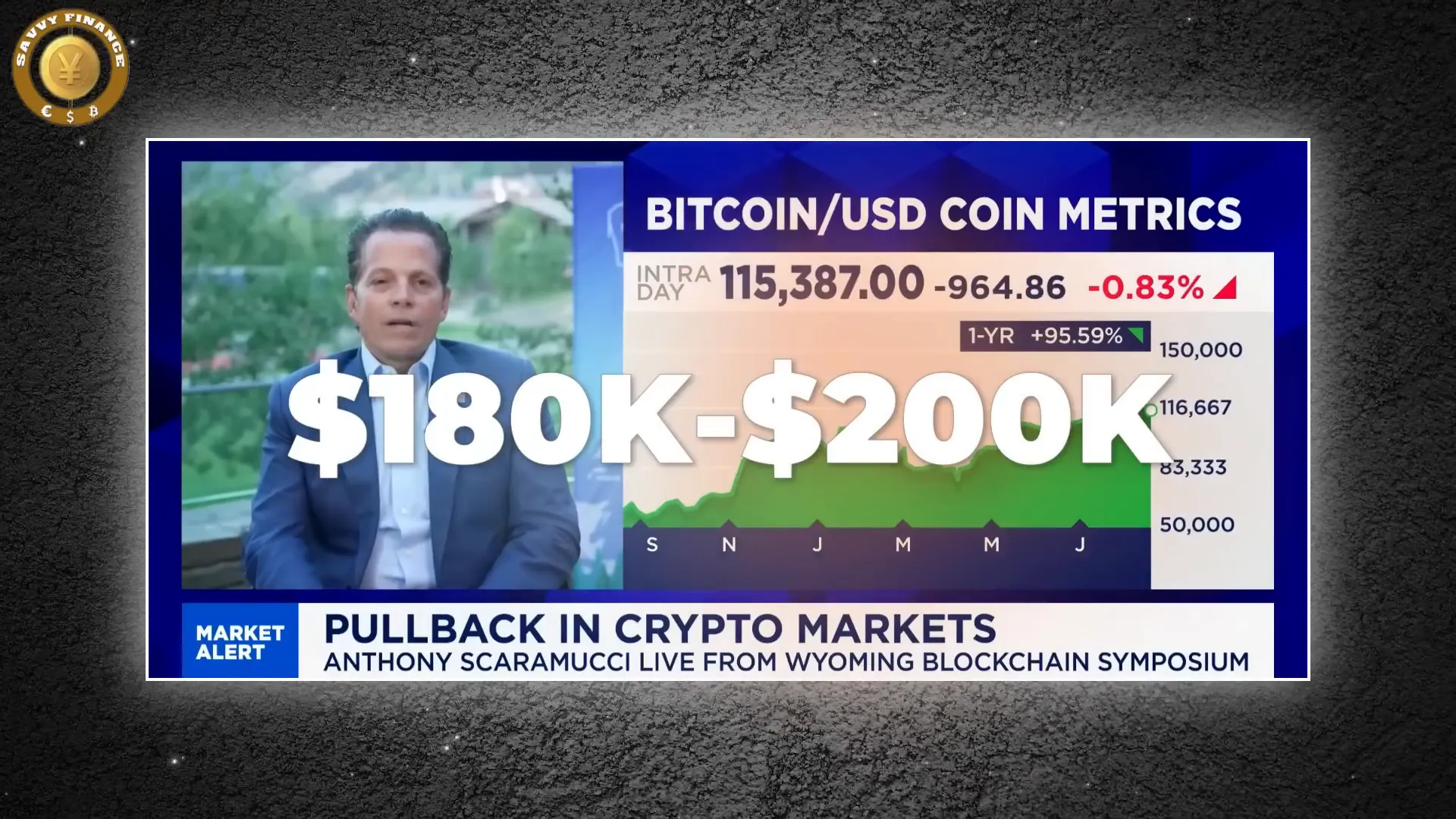

- Anthony Scaramucci maintains a year‑end target of $180k–$200k for Bitcoin; he sees consolidation and healthy ownership rotation.

- Willy Woo warns adoption can act like a Trojan horse—centralization and even nationalization are real risks if large holders concentrate control.

- Practical rule: custody matters. "Hold your own keys" remains the clearest defense against the very vulnerabilities adoption can introduce.

Why institutions matter — Scaramucci's bullish case

Anthony Scaramucci's argument is simple and largely quantitative: institutional demand is arriving at scale. He points to ETF flows—most notably the BlackRock iBit ETF—as the cleanest, fastest bridge between traditional finance and crypto markets. As institutions allocate, early whales are selling into the demand. Scaramucci frames that as "change of ownership" rather than capitulation.

"There's just way more demand than issued supply of Bitcoin... We still maintain our price target between a hundred and eighty and two hundred thousand by year end." — Anthony Scaramucci

The supply side is easy to understand: the Bitcoin network issues roughly 450 new coins per day. For perspective, when institutional treasuries or ETFs start buying by the millions or billions, that tiny daily issuance can't keep up. Scaramucci calls his $180k–$200k target "cautious"—and emphasizes that adoption is broader than Bitcoin ETFs (stablecoins, private custody, and corporate exposure all matter).

What institutional adoption changes

- Scale: Institutional pools represent a fraction of the $900T traditional asset base—but even a small allocation is enormous for BTC.

- Liquidity dynamics: ETFs create predictable demand and efficient market access for pension funds, endowments, and wealth managers.

- Productization: Expect more "copycats"—Ethereum, Solana, etc.—but Bitcoin remains the purest play, says Scaramucci.

The Trojan horse: Willy Woo's centralization and nationalization warning

Willy Woo agrees that institutional capital is necessary for Bitcoin to become a global monetary standard—but he also calls this phase a potential Trojan horse. His fear: adoption could concentrate Bitcoin into too few custodians, funds, or corporate treasuries, recreating single points of failure.

"You can think of Bitcoin as little Pac Man... The tipping point was last year when the BlackRock ETF came on board." — Willy Woo

Woo draws a stark historical parallel: in the 1930s, governments consolidated gold. He says a modern equivalent—what he calls a "digital Fort Knox"—is possible if a nation state or large custody provider ends up holding outsized Bitcoin reserves. That could allow coercive or incentivized acquisitions of corporate Bitcoin treasuries, effectively turning a decentralized monetary experiment back toward fiat control.

Copycat treasuries and leverage risk

Woo also highlights a nearer‑term danger: companies copying MicroStrategy's treasury strategy but using short‑dated or highly leveraged debt to buy BTC. If market conditions flip and these firms cannot roll or service debt, forced liquidations could produce cascades of selling—bad headlines, reputational damage, and real losses for investors.

- Long‑dated, conservative treasury buys (MicroStrategy style) are different from fast, debt‑financed purchases.

- Watch for short maturities, complex preferred structures, and hedge‑fund style market operations—those raise liquidation risk.

Reconciling both views: a balanced roadmap

Scaramucci and Woo present two sides of the same institutional coin. The math on supply vs. demand favors higher prices in the near term. But the governance and custody structure of that flow matters deeply for Bitcoin's long‑term mission.

A practical checklist for individual investors

- Understand your exposure: Are you holding spot BTC, ETF shares, or a corporate stock with BTC on the balance sheet?

- Prioritize custody: If you want long‑term, permissionless Bitcoin ownership, self‑custody with hardware wallets protects against counterparty risk.

- Assess counterparty risk: If you use ETFs or custodians, read the filings—where are the coins held, and what legal protections exist?

- Be wary of leveraged treasury plays: Corporate treasuries using short‑term debt to buy BTC increase systemic risk in a downturn.

- Keep allocation sensible: Institutions can and will move markets; manage position sizes and use stop loss or diversification as appropriate.

Conclusion — adoption with eyes open

Institutional money is both Bitcoin's growth engine and potential vulnerability. The arrival of ETFs and corporate treasuries argues for higher prices on supply/demand grounds—Scaramucci's $180k–$200k year‑end range is anchored in that reality. But Willy Woo's Trojan‑horse warnings are a necessary counterweight: if adoption centralizes control, the experiment that made Bitcoin interesting could be undermined.

The single best rule that emerges from both perspectives is simple: crytocurency, bitcoin ownership is meaningful only when paired with attention to custody and structure. Use the new institutional rails if they fit your plan—but never forget why Bitcoin exists: to offer a decentralized, censorship‑resistant monetary layer. Hold your keys, read the fine print on custody, and treat institutional enthusiasm as both opportunity and reminder to stay vigilant.

Credits: This article is inspired by a Savvy Finance compilation of interviews with Anthony Scaramucci and Willy Woo. For the full discussion and source clips, check out Savvy Finance's channel.

"This Charts Tells Us EXACTLY What's Coming Next for BTC" — crytocurency, bitcoin insights from Willy Woo & Anthony Scaramucci. There are any "This Charts Tells Us EXACTLY What's Coming Next for BTC" — crytocurency, bitcoin insights from Willy Woo & Anthony Scaramucci in here.