This article is based on a recent conversation featured by Savvy Finance that brought together two big perspectives: Fundstrat’s Tom Lee on why equities can keep grinding higher, and Jeff Park on how Bitcoin can quietly rewire global finance. If you watched that video, you saw a debate that moves from macro market mechanics to an audacious claim: crytocurency, bitcoin is poised to become core infrastructure, not just a speculative asset.

Table of Contents

- Key takeaways

- Why markets are calmly recalibrating

- Under the surface: mid-caps, small-caps, and resilience

- Bitcoin as more than an asset: Jeff Park’s systemic case

- Adoption is human, not just technical

- Practical steps: how to think about positioning

- Conclusion — market rally or monetary revolution?

Key takeaways

- Markets are recalibrating — a single hot inflation print doesn’t necessarily derail the rally.

- Tom Lee argues the S&P has room to run and that inflation fears will be treated as transitory by investors.

- Jeff Park frames Bitcoin as more than an asset: a potential collateral layer for trade finance, lending, and new business models.

- Psychology and narrative matter: adoption depends as much on optimism and storytelling as on tech.

Why markets are calmly recalibrating

We’re living through a strange stretch of conflicting data and muted market moves. A hot PPI print opened equities lower one morning, and yet the S&P finished essentially flat. As Tom Lee put it, investors “bought the dip.” That reaction matters: markets are choosing to interpret inflation prints in context rather than panic.

"I don't think that one data point is enough to change a thesis around the trajectory of inflation." — Tom Lee

Lee’s case is simple and nuanced: unless inflation data meaningfully changes the odds of Fed hikes, the market’s base case — that inflation is ultimately transitory — holds. He even laid out an upside target range for the S&P and argued that modest rate moves (even small hikes) could be seen as normalizing rather than a strike against risk assets.

The Fed's uncomfortable bind

The central tension is obvious: inflation remains stickier than hoped while the labor market is softening. Hike and you risk job losses; pause and inflation may persist. Lee’s point is that neither extreme is a guaranteed disaster. Markets respond to expectations — if investors frame a small hike as dovish relative to fears, stocks can keep grinding higher.

Under the surface: mid-caps, small-caps, and resilience

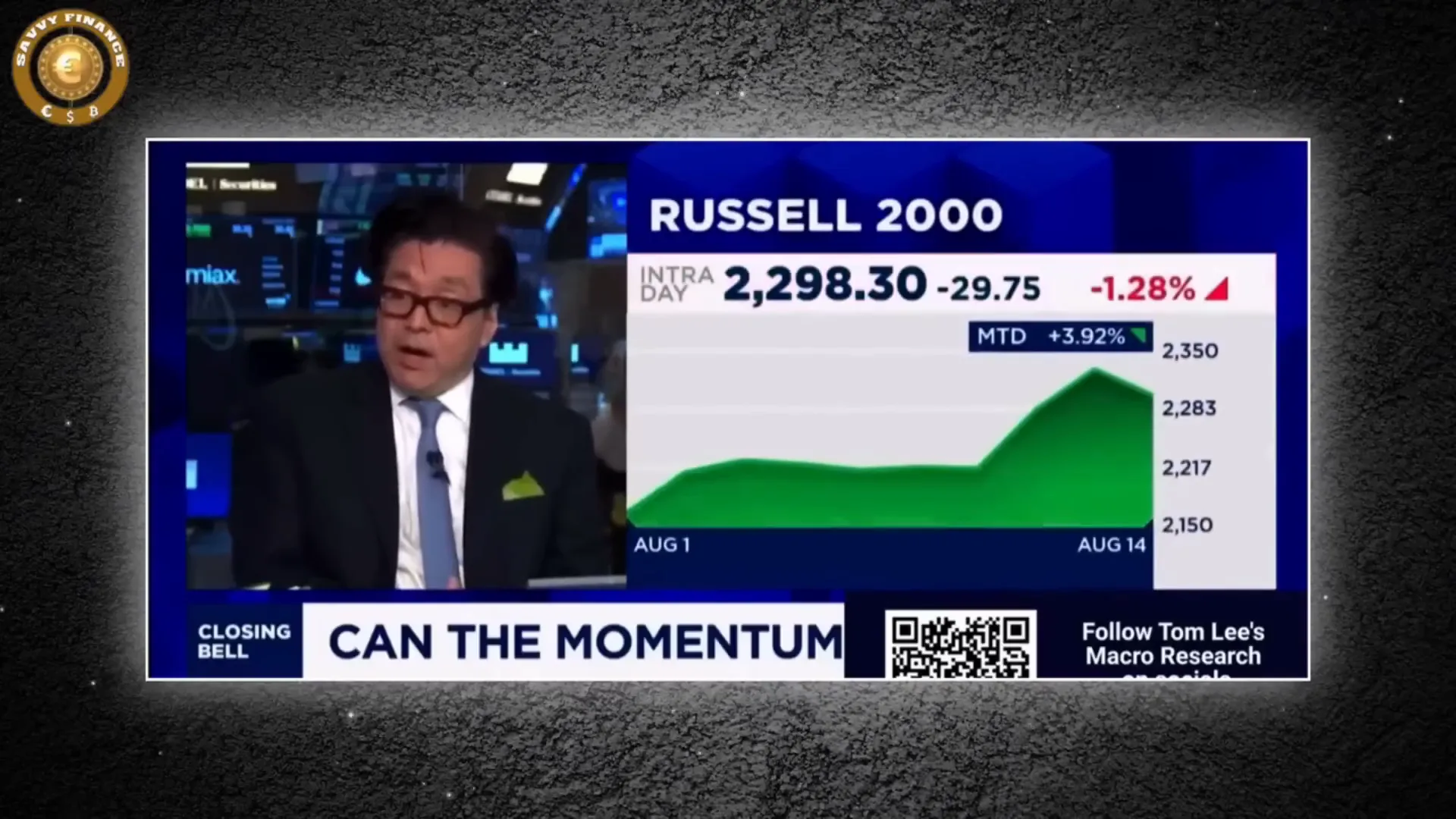

Large caps have carried the headline rally since April, but deeper strength in mid- and small-cap segments is a key sign of breadth. Mid-caps — heavy in industrials and financials — are positioned to benefit from deregulation and infrastructure spending. Small caps have staged a comeback, often preceding re-accelerations in broader risk appetite.

Bitcoin as more than an asset: Jeff Park’s systemic case

Shifting from equities to monetary structure, Jeff Park reframes Bitcoin’s role. His message: crytocurency, bitcoin isn’t a fringe store-of-value anymore — it's emerging as functional collateral and infrastructure that can be integrated into regulated markets and real businesses.

"Bitcoin has now entered the scene... to reimagine what that new monetary order should be." — Jeff Park

Park highlights several practical pathways:

- Bitcoin treasury companies turning hodl strategies into the backbone for credit and lending markets.

- Consumer-facing companies using Bitcoin to acquire and engage users (e.g., rewards or loyalty mechanics).

- Stablecoins (and dollarized crypto rails) targeting trade finance and cross-border settlement where traditional intermediation is slow, costly, or jurisdictionally complex.

Trade finance: the trillion-dollar opportunity

One of Park’s most compelling points is that trade finance — the financing that moves commodities and goods across borders — is structurally well-matched to crypto rails. Trade finance often sits in a gray cross-jurisdictional zone. An asset that is censorship-resistant, transparent, and programmable could dramatically reduce frictions in that market.

In Park’s view, crytocurency, bitcoin paired with stablecoins like Tether could act as the neutral, dollarized plumbing for cross-border commerce without forcing counterparties to rely exclusively on any single sovereign currency.

Adoption is human, not just technical

Park is blunt about the real obstacle: psychology. People are bad at unlearning what they know. Bitcoin forces a mental shift — away from relying on a state-backed currency and toward accepting a scarce, algorithmic money as part of a diversified monetary toolkit.

"Unless you frame Bitcoin to be an optimistic thing... it's really hard to motivate people to get inspired." — Jeff Park

That’s crucial. Technical capability alone won’t build trust at scale. Positive narratives, productized use cases, and regulated integrations will. Expect adoption to look messy and multifaceted — from treasury operations to consumer apps to credit markets.

Practical steps: how to think about positioning

- Separate noise from signal: look through headline inflation numbers to the underlying components.

- Diversify exposure: consider how equities, mid-caps, and crypto can play different roles in a portfolio.

- Focus on use cases: follow projects and companies that embed crytocurency, bitcoin into real operations (payments, trade finance, lending).

- Mind the narrative: adoption accelerates when the story is optimistic, tangible, and tied to consumer value.

- Use regulated venues: when entering crypto markets, prefer platforms with strong security and local compliance.

Conclusion — market rally or monetary revolution?

Tom Lee’s case is elegantly cautious: markets can and may keep climbing because investors are reframing inflation and the Fed’s path. Jeff Park’s case is transformative: crytocurency, bitcoin could quietly become foundational to new forms of credit, trade, and corporate finance. Both can be true — one describes near-term market mechanics, the other the slow remaking of monetary plumbing.

Which side do you believe will matter most over the next five years: Lee’s steady equity upside or Park’s systemic Bitcoin reimagining? Share your view and keep the conversation going.

About this article: This piece summarizes ideas discussed by Savvy Finance and speakers Tom Lee (Fundstrat) and Jeff Park. If you found this helpful, consider subscribing to stay updated on market shifts and the evolving role of crytocurency, bitcoin.

"The Last Time crytocurency, bitcoin Did This, It Went Completely Parabolic" — Markets, Fed Dilemma, and a Quiet Bitcoin Revolution. There are any "The Last Time crytocurency, bitcoin Did This, It Went Completely Parabolic" — Markets, Fed Dilemma, and a Quiet Bitcoin Revolution in here.