I put this guide together after watching Coin Bureau’s latest breakdown with Nick. If you’ve been asking "Is my altcoin dead?" or wondering whether to hold, sell, or double down, this is the practical checklist you need to make a thoughtful decision about your position in the crytocurency, bitcoin market.

Table of Contents

- Why this matters: the four-year market cycle

- Step 1 — Where are we in the cycle? (Why timing matters)

- Step 2 — Will your specific altcoin recover?

- Step 3 — When could it recover? (Timing the rotation)

- Step 4 — Does your altcoin still have upside potential?

- Putting it together: a quick decision checklist

- Final thoughts

Why this matters: the four-year market cycle

Crypto historically follows a roughly four-year cycle: one to two years of bull markets and two to three years of bear markets. The explosive returns—especially for altcoins—typically come in the final year of the cycle, and altcoin rallies usually concentrate in the last two to three months as Bitcoin approaches its cycle top.

That pattern matters because Bitcoin’s trajectory often signals where altcoins are heading. Right now Bitcoin appears to be breaking out and making higher highs, which suggests that the cycle top may still be ahead of us. If Bitcoin’s peak is ahead, the classic logic says altcoin season is, too—potentially within the next 12 months.

Step 1 — Where are we in the cycle? (Why timing matters)

Ask this first: are we in the late-stage rally phase or still in accumulation? Historically:

- Altcoins tend to surge when Bitcoin is near its cycle top.

- Many investors who came in during 2021 bought altcoins early in 2024 expecting a similar two-legged alt-season; when the second leg failed to materialize, selling pressure dragged many alts down.

- Because so many established investors already sold, they may become net buyers again as the next alt-season approaches—creating the conditions for sharp rallies.

That said, predicting exact timing is impossible. Use Bitcoin’s behavior as a primary timing gauge, but prepare for fast rotations and short alt-seasons—potentially more like 2017 (2–3 months) than 2021 (6+ months).

Step 2 — Will your specific altcoin recover?

Price alone doesn’t tell the whole story. To decide if a project can bounce back, check whether the fundamentals have changed since you bought in. Key signals that a project is still alive:

- The team is actively building and shipping updates.

- The community remains engaged (development activity, social momentum, governance participation).

- There are upcoming upgrades, partnerships, or real-world milestones on the roadmap.

If the answer to all of the above is "yes," your altcoin is likely asleep, not dead. If the project has gone quiet, development stopped, or the community evaporated, it may be time to accept the loss and redeploy capital.

Which niches have the best shot?

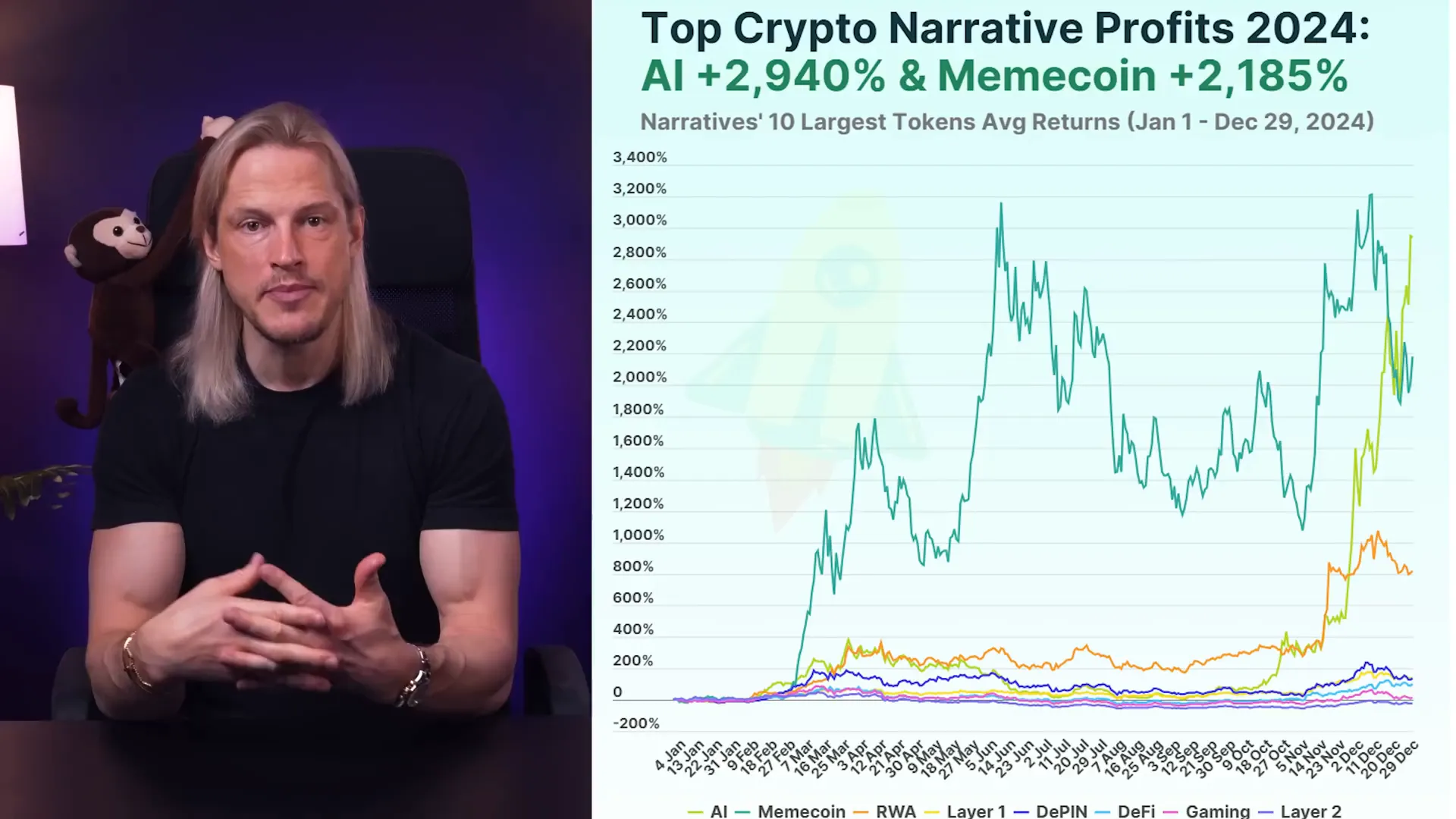

Market rotation matters. Some narratives were already hot in the last 12–24 months—meme coins and AI tokens dominated recent rallies—so those niches have already used a lot of speculative oxygen. By contrast, categories that haven’t had their turn yet—

- Layer-1s and Layer-2s

- DePIN / deepened crypto (real-world infrastructure tokens)

- DeFi primitives and GameFi

—tend to have a higher chance of meaningful recoveries because the market often rotates narrative attention only once. Examples discussed were beaten-down quality projects like Aptos (L1), Arbitrum (L2), Helium (DePIN), Lido (DeFi), and Ronin (GameFi) as types of tokens that could benefit when rotation arrives.

Step 3 — When could it recover? (Timing the rotation)

Exact timing depends on how capital rotates between niches. Two forces shape rotation:

- Borrowing and leverage: whales increasingly borrow against BTC/ETH rather than selling, injecting liquidity directly into alt markets.

- Retail attention: the 2021 cycle had an unusual setup (lockdowns gave retail extra time to learn and speculate), so future alt-seasons may play out faster and more broadly—more like 2017.

If the next alt-season resembles 2017, rotation will be less sequential and more simultaneous—meaning many altcoins could rally together over a 2–3 month window. A useful market-level signal to watch is the "others" chart (market cap of altcoins outside the top 10): when it breaks above its long-term range, broad altcoin rallies tend to begin.

Step 4 — Does your altcoin still have upside potential?

Breaking even is one thing—making 10x, 50x, or 100x is another. Use this five-point checklist to judge upside potential:

- Clear narrative: Can retail investors easily understand and "ape into" the story? Strong narratives attract buyers and sustain rallies.

- Low nominal price: Many retail buyers prefer low per-token prices (psychology matters), so a low unit price can help adoption during hype cycles.

- Small market cap: Market cap—not token price—determines how much capital is required to move a token. Smaller market caps require less capital to spike, increasing potential percentage gains.

- Supply mostly in circulation: Large token unlocks or concentrated insider holdings can create selling pressure. A healthy circulating supply reduces this risk.

- Accessibility: Ease of purchase on major centralized exchanges or fast, low-cost chains (e.g., Solana, Base) matters. If it’s hard to buy, it’s hard to become a retail favorite.

If your altcoin checks most of these boxes, it has a higher chance of doing well in the next alt-season. Remember: nothing guarantees returns—crypto is a probabilities game—so play the odds, size positions responsibly, and expect volatility.

"If the only thing wrong with the project you're holding is its price, then there's a higher chance it will recover."

Putting it together: a quick decision checklist

- Is Bitcoin still heading toward a cycle top? If yes, alt-season could be ahead.

- Is the project still building and is the community alive?

- Does the project fall into a narrative that hasn’t already burned out?

- Does the token meet the five upside criteria (narrative, price, market cap, supply, accessibility)?

- Watch the "others" chart: a breakout above its range often signals a broad rotation into altcoins.

Using these practical checks will help you decide whether to hold or redeploy funds into higher-probability opportunities when rotation begins. In short: favor quality projects with active teams, accessible tokens, and narratives that retail can grasp—and monitor macro signs like Bitcoin and the "others" market cap.

Final thoughts

Altcoins are not uniformly dead. Many are merely deeply discounted while others have structurally failed. By combining cycle awareness with project-level checks and a clear five-point upside screen, you can better separate sleep-worthy projects from the ones you should cut. Keep the keyphrase in mind as you build your watchlist—crytocurency, bitcoin—and use it as a lens: where Bitcoin goes often dictates altcoin opportunity, but project fundamentals determine who actually survives and prospers when Altcoin season finally returns.

SELL YOUR ALTCOINS? This is The ONLY Checklist That You Need! — crytocurency, bitcoin. There are any SELL YOUR ALTCOINS? This is The ONLY Checklist That You Need! — crytocurency, bitcoin in here.