Video note: This post is inspired by a conversation with James Lavish on The Sams Podcast and presented by Savvy Finance. Below I break down the core ideas and what they mean for investors, institutions, and anyone trying to understand crytocurency, bitcoin today.

Table of Contents

- Key takeaways

- Why decentralization helps adoption, not hurts it

- Institutional demand: it's here, but not the full wave

- Risk-adjusted returns: startups vs. treasury allocations

- Adoption curve ≠ price curve

- Why young investors choose Bitcoin over real estate or gold

- Macroeconomics: soft default and why that helps Bitcoin

- So when will the 'ticking time bomb' go off?

- Final thoughts

Key takeaways

- Decentralization is not a barrier to adoption — it fuels organic understanding.

- Institutional money is sitting on the sidelines; ETFs today are mostly tools for hedge funds.

- Adoption (wallets, lending, integrations) moves differently from price — don’t confuse the two.

- Governments prefer "soft default" (inflate away debt) over hard defaults — this dynamic favors Bitcoin as hard money.

- If institutions allocate meaningful portions of bond portfolios to crypto, the next bull run could be extremely steep.

Why decentralization helps adoption, not hurts it

One of the first things I stressed is simple: decentralization isn't the enemy of growth. In fact, the opposite is true. Decentralization forces people to learn what this technology is and why it behaves differently than stocks, bonds, or gold.

“Decentralization isn't holding Bitcoin back. It's fueling an organic explosion of understanding.”

That organic spread of understanding—the conversations, the experiments with wallets, the curiosity-driven learning—creates a foundation far deeper than an investment fad. People who understand crytocurency, bitcoin are more likely to hold through volatility and adopt real use cases.

Institutional demand: it's here, but not the full wave

Yes, ETFs exist and large hedge funds are active. But that’s not the same as the big, patient institutional capital that moves markets for decades. Right now, many institutional instruments are being used tactically—arbitrage, futures strategies, leverage—not as long-term treasury allocations.

When major endowments, pension funds, and sovereign managers meaningfully allocate to crytocurency, bitcoin, the ripple effect will be enormous. These organizations manage money for millions of beneficiaries; their allocations filter into headlines, trustee decisions, and eventually personal portfolios.

Why corporate treasuries and pensions matter

Corporate treasury allocations and pension fund moves are different beasts. They affect real people—employees, retirees, students—so when they adopt, adoption is validated across the financial system. That validation is often the trigger for massive flows of capital.

Risk-adjusted returns: startups vs. treasury allocations

We focus on “real companies with real revenues and real profits” for a reason. Early-stage ventures tied to Bitcoin can take a decade or more to mature and carry high failure rates. Traditional investors with a 7–10 year horizon need to match duration and liquidity to investor expectations.

- Early-stage Bitcoin startups: long timelines (10–20 years), high failure rate.

- Corporate or later-stage investments: easier to model cash flows and risk-adjusted returns.

- Direct Bitcoin allocation: straightforward portfolio sleeve—2–5% minimum for many managers today.

Adoption curve ≠ price curve

People often overlay an S-curve adoption model on price and expect the two to match. That’s a mistake. Adoption can increase steadily—more wallets, more lending rails, more integrations—without an immediate, linear price response.

Price often follows a power-law-like pattern: long periods of consolidation, punctuated by sharp moves. Put price on a log chart and you get a far better measure of where the market is versus raw adoption metrics.

“Adoption is a little different than that price curve. If you put it in log, you get a much better understanding of what's going on.”

Why young investors choose Bitcoin over real estate or gold

For many younger investors, Bitcoin's appeal is practical: no property taxes, no maintenance, no landlord headaches. It's a simple store-of-value instrument you can buy and hold. That doesn't make it superior for everyone, but it explains a structural shift in demand among certain demographics.

Macroeconomics: soft default and why that helps Bitcoin

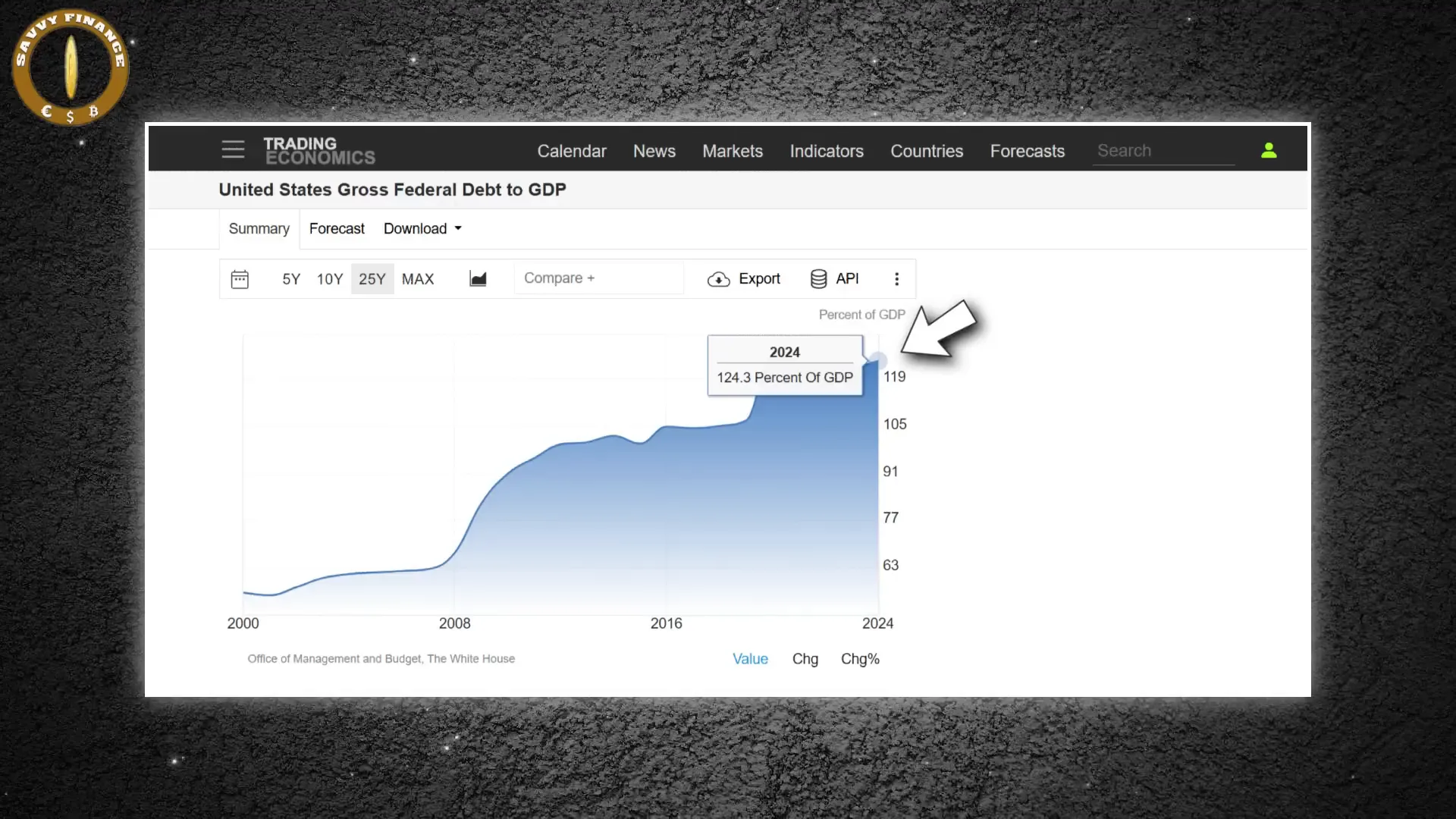

Governments face two bad choices: hard default (unlikely for major economies) or the soft default—inflate away the debt. The soft default is essentially expanding the money supply so past obligations are repaid in cheaper dollars.

That path favors assets outside the fiat printing press. As debt-to-GDP trends upward and fiscal policy drifts toward inflationary fixes, crytocurency, bitcoin becomes an attractive hedge against sustained currency debasement.

So when will the 'ticking time bomb' go off?

There are two moving parts: organic adoption and institutional firepower. The ticking time bomb I described isn't hype—it's structural. The groundwork is being laid through wallets, lending rails, and integrations. Institutions are testing the water. When those two collide—mass adoption meets big, permanent allocations—the price dynamic could shift from steady to explosive.

What to watch for

- Major pension funds or endowments announcing permanent allocations.

- Wider corporate treasury adoption beyond headline-first movers.

- Regulatory clarity that makes long-term allocations operationally safer for fiduciaries.

- Continued technological improvements that lower custody and custody-insurance risk.

Final thoughts

The story here is longer than any single market tick. Decentralization forces learning. Adoption builds quietly in wallets and rails. Institutions are circling. And macro policy is pushing savers to seek alternatives to fiat. That combination—structural adoption plus institutional allocations—could make the next crytocurency, bitcoin bull run shockingly massive.

What do you think will trigger the next big move: broader retail adoption or institutional allocation? Drop a thoughtful comment below and tell me which indicator you’re watching.

I Promise, Bitcoin's Next Bull Run Will Be Shockingly Massive — why crytocurency, bitcoin is different. There are any I Promise, Bitcoin's Next Bull Run Will Be Shockingly Massive — why crytocurency, bitcoin is different in here.