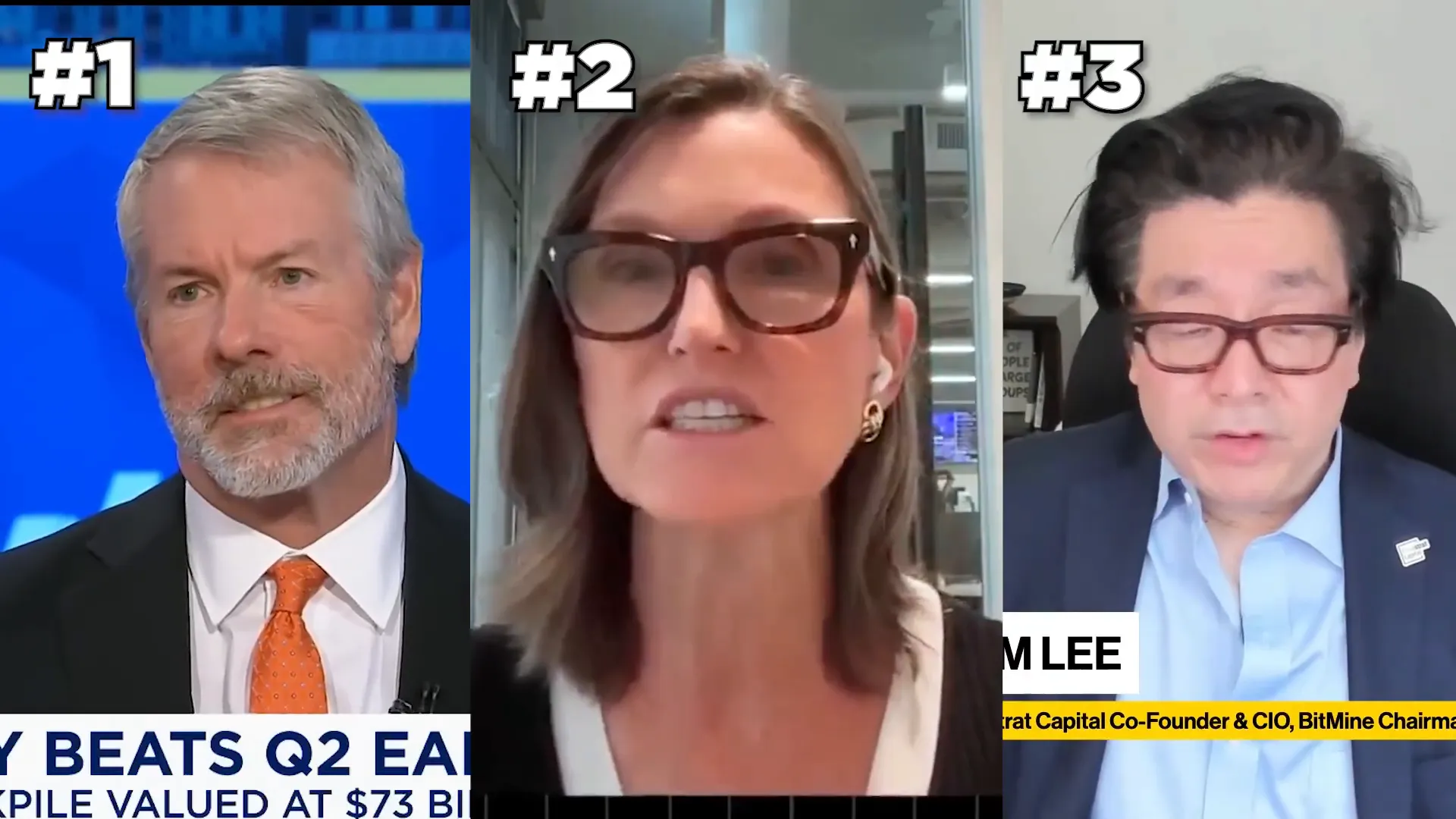

If you've been watching the cryptocurrency market closely, you know the current dip is stirring up a lot of buzz. Leading voices like Michael Saylor, Cathie Wood, and Tom Lee are united in their bullish outlook, calling this moment a rare opportunity to become a millionaire in crypto. In this article, we'll unpack their perspectives on cryptocurrency, bitcoin, and Ethereum, and why now might be your last chance to buy before prices soar.

Table of Contents

- Bitcoin’s Role in Demonetizing Traditional Assets

- The Urgency of This Crypto Dip: Why Act Now?

- SEC’s New Stance: A Pro-Crypto Regulatory Environment

- Ethereum’s Rejuvenation and Price Potential

- How to Take Advantage of This Moment

- Final Thoughts

Bitcoin’s Role in Demonetizing Traditional Assets

Michael Saylor, Executive Chairman of MicroStrategy, whose company owns roughly 3% of all Bitcoin ever to be minted, paints a compelling picture of Bitcoin’s growing influence. According to him, Bitcoin is actively demonetizing traditional store-of-value assets worldwide. He explains:

Bitcoin is demonetizing foreign real estate, private equity, public equity, and other store-of-value assets everywhere in the world. Twentieth-century physical analog assets are becoming twenty-first-century digital assets.

He highlights the limitations companies face in traditional markets, such as SEC rules preventing tech giants like Apple and Microsoft from buying broad indexes like the S&P 500, limiting their ability to park value efficiently. Instead, these companies buy back their own stock. Saylor argues that for shareholder value, parking funds in fiat currencies or traditional assets like gold and real estate no longer makes sense.

His advice is simple yet profound: buy, hold, and wait. But he cautions, “Getting rich in crypto is simple, but it’s not easy.”

The Urgency of This Crypto Dip: Why Act Now?

All three experts agree that this dip in the market is a unique buying opportunity — potentially the last chance at these price levels before a significant surge. Michael Saylor even calls this dip a “gift from God,” urging investors to act quickly. He warns that he and others will be scooping up assets soon, which could push prices higher rapidly.

Cathie Wood, founder of ARK Invest, echoes this urgency with her bold prediction:

Our bull case was $1.5 million for Bitcoin in five years, and we still think that’s going to be right.

Wood believes institutional adoption will play a major role in driving Bitcoin’s price higher. She emphasizes Bitcoin’s scarcity — only 21 million will ever exist — and notes that with 19.6 million already mined, the scarcity value is real. As more institutions enter the market, the price impact of each dollar invested will be greater than in previous years.

Wood also points out Bitcoin’s appeal as a non-correlated asset, especially as traditional bonds and stocks become more correlated, making it an essential diversification tool for fiduciaries.

Long-Term Holders Are Holding Strong

An interesting metric Saylor highlights is the behavior of long-term Bitcoin holders—wallets that haven’t moved their coins in over 155 days. Usually, during a price rally, these holders start selling. However, recent data shows this trend reversing, signaling confidence among long-term holders who see institutional interest growing and prefer to hold their assets.

SEC’s New Stance: A Pro-Crypto Regulatory Environment

The regulatory landscape in the U.S. is shifting, and this could significantly impact the crypto market’s growth trajectory. Paul Atkins, the new SEC Chair, is championing a pro-crypto stance, aiming to make America the “crypto capital of the world.” He emphasizes regulatory certainty that allows innovation while protecting investors:

We want to provide certainty and good rules fit for purpose for the crypto industry so innovators know how to innovate and investors know what they’re investing in.

This “Project Crypto” initiative marks a departure from previous regulatory approaches and is expected to modernize rules and facilitate crypto-based trading. For investors, this means a more secure environment to grow their portfolios.

Ethereum’s Rejuvenation and Price Potential

Tom Lee, a well-known crypto analyst, aligns with Cathie Wood on Bitcoin’s potential but also doubles down on Ethereum’s prospects. He’s aiming to accumulate 5% of all Ethereum for his company, reflecting strong confidence in ETH’s future.

Lee predicts Ethereum could reach around $15,000, a figure backed by valuation metrics such as the Network Value to Transaction (NVT) ratio. He explains that Ethereum is being rejuvenated due to a galvanized community and growing interest from Wall Street, especially for tokenization projects choosing Ethereum as their platform.

Despite some investors viewing ETH as “stale” compared to newer Layer 1 blockchains like Solana or SUI, Ethereum’s reliability is a key advantage. Vitalik Buterin recently celebrated Ethereum’s tenth birthday, noting zero downtime — a critical factor for institutional investors and banks that prioritize stability.

Lee sees $4,000 as a “line in the sand” price level for ETH, but believes it’s only a matter of time before Ethereum’s price moves higher.

How to Take Advantage of This Moment

If you’re a crypto trader or investor, this is a time to seriously consider your strategy. The experts agree that accumulation is key, particularly of Bitcoin and Ethereum, which form the backbone of most serious portfolios. Trading can also be profitable, as the market offers opportunities to make money whether prices go up or down.

For active traders, there are incentives available such as bonuses up to $100,000 on partner exchanges like Bitfinex, making now an attractive time to engage with the market.

Final Thoughts

The consensus among Michael Saylor, Cathie Wood, and Tom Lee is clear: this crypto dip is a rare window to accumulate significant positions in Bitcoin and Ethereum before prices surge. With institutional adoption accelerating, regulatory clarity improving, and the underlying technology maturing, the cryptocurrency, bitcoin market is poised for explosive growth.

Whether you’re a long-term holder or an active trader, understanding these expert insights can help you position yourself to benefit from the next major move in crypto.

Remember, investing in crypto carries risks, so always do your own research and invest responsibly.

Final Chance to Become a Crypto Millionaire: Insights from 3 Experts on Bitcoin and Ethereum. There are any Final Chance to Become a Crypto Millionaire: Insights from 3 Experts on Bitcoin and Ethereum in here.