Landing in Dubai, the crypto scene is buzzing with seismic shifts that could redefine the market landscape. The Federal Reserve is signaling major rate cuts ahead, setting the stage for what could be the next massive crypto pump. Meanwhile, the SEC has announced a pivotal regulatory change by no longer classifying liquid staking as a security, a move that could benefit specific altcoins significantly. Add China’s announcement of launching its own stablecoin and high-profile endorsements like JD Vance revealing his Bitcoin holdings, and you have a perfect storm for the next crypto bull run.

In this deep dive, we’ll explore all the critical factors shaping the future of Bitcoin, crypto, BTC, blockchain, and the broader crypto ecosystem. From understanding the Federal Reserve’s monetary policy impact to dissecting which altcoins are poised to surge, this article is your ultimate guide to navigating the next wave of crypto investing.

The Federal Reserve’s Role in the Next Crypto Bull Run

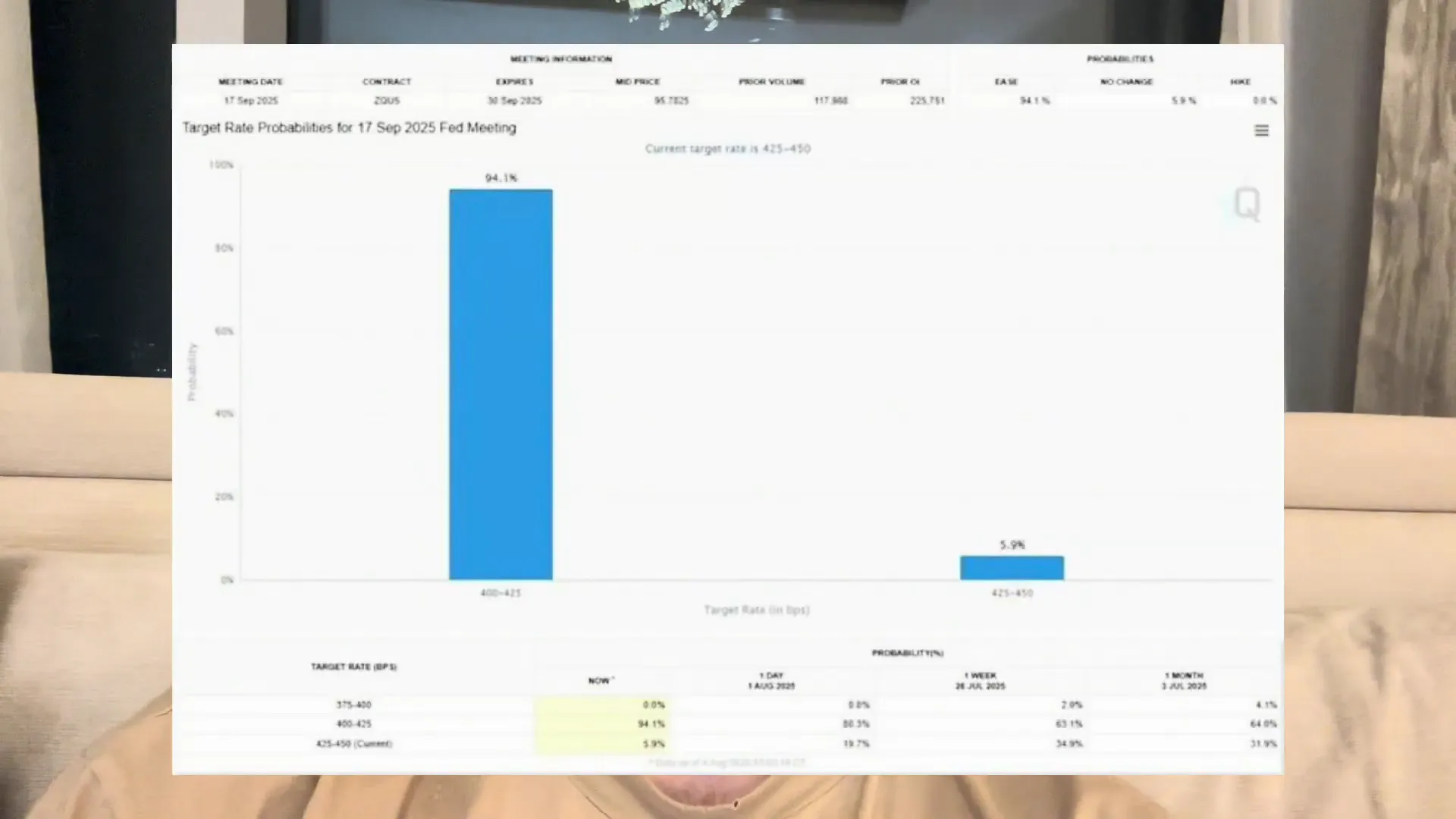

Understanding the Federal Reserve’s influence on crypto markets is essential for any investor. Recently, the Fed confirmed plans for two interest rate cuts, with a strong likelihood of a 50 basis point reduction. This monetary easing is a game-changer for risk-on assets like Bitcoin and altcoins.

Historically, lower interest rates translate to cheaper liquidity and increased money supply, which often fuels asset price inflation. In the crypto world, this means more capital flowing into digital assets, driving prices higher. The first rate cut is predicted to take place in June 2025, although recent developments have pushed this timeline to September due to Chinese tariffs.

These macroeconomic moves align perfectly with a maturing crypto market ready for a substantial rally. The Federal Reserve’s easing policy will likely usher in a “bull run” phase, where investors can expect significant returns on Bitcoin, crypto, BTC, blockchain projects, and altcoins.

Why Interest Rate Cuts Matter for Crypto Investors

- Cheaper Money: Lower interest rates reduce borrowing costs, encouraging investment in higher-risk assets like cryptocurrencies.

- Liquidity Boost: More liquidity in the financial system means more capital available for crypto purchases.

- Inflation Hedge: As fiat money inflates, investors seek stores of value, making Bitcoin and blockchain assets attractive.

Overall, the Fed’s moves create an environment ripe for a crypto market pump, especially for those who position themselves early and wisely.

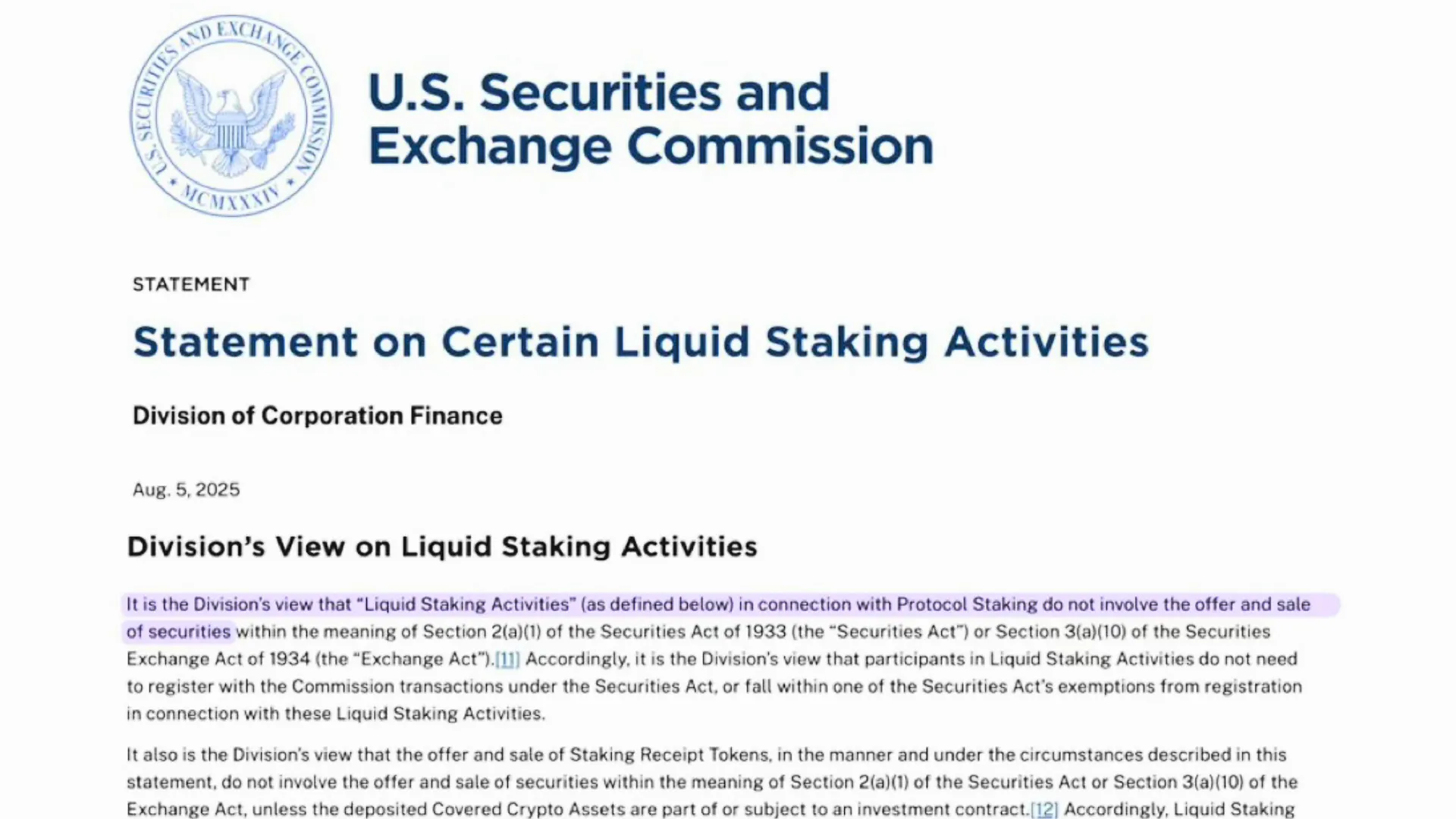

SEC’s New Stance on Liquid Staking: A Game Changer for Ethereum and Altcoins

In a surprising shift, the U.S. Securities and Exchange Commission (SEC) announced that liquid staking is no longer classified as a security. This regulatory clarity is a huge positive for the crypto market, especially for Ethereum and other altcoins with significant liquid staking protocols.

Ethereum, the second-largest cryptocurrency by market cap, leads in liquid staking with over $31 billion locked up in various protocols. This vast liquidity pool is critical because it accelerates the approval of Ethereum ETFs (Exchange Traded Funds), which can attract institutional investors and further legitimize the crypto asset class.

Altcoins Set to Benefit from SEC’s Liquid Staking Decision

Several altcoins are positioned to gain from this new regulatory environment:

- Ethereum (ETH): With the largest liquid staking service, Ethereum stands to gain the most as ETF approvals become faster and more frequent.

- Solana (SOL) and Jito (JITO): Known for their fast transaction speeds and scalability, these projects could see increased investor interest.

- Swell (WELL): A sleeper project focused on noncustodial Ethereum liquid staking, poised to capture niche market segments.

- Frax, Anchor Staking, Eigenlayer, and Cardano (ADA): These prominent protocols and coins are also on the radar for bullish momentum.

This regulatory clarity is a massive step forward for the crypto ecosystem, making it easier for investors to trust and engage with liquid staking projects.

Making the Case for Crypto: Why It Matters in a Digital Age

Crypto is not just a speculative asset; it represents a fundamental shift in how we transact and store value in the modern digital era. As one influential voice recently shared, "A hundred years ago, if you wanted to buy something, you'd put a dollar bill or a gold coin on the table. Bitcoin serves that same function but in a digital age, offering security and protection from fraud."

This perspective highlights crypto’s core value proposition: it’s a secure, decentralized, and technologically advanced way to transact and store wealth. It’s a hedge against traditional financial system risks and an enabler of global financial inclusion.

However, acknowledging risks is crucial. Like any new technology, crypto carries uncertainties, but the approach should be to allow innovation to flourish under common-sense regulations rather than restrictive government intervention.

Why Regulation Should Encourage Innovation

"What you shouldn’t have is a dictatorial government that tells certain industries they’re not allowed to do what they need to do. You’ve gotta let people make these decisions on their own."

This philosophy encourages a balanced regulatory approach that fosters innovation while protecting investors. The natural market forces of supply and demand will ultimately determine winners and losers in the crypto space.

Strategic Altcoin Picks to Watch and Research

With the Federal Reserve easing and regulatory clarity improving, now is the time to focus on altcoins that could outperform in the upcoming bull market. Here’s a curated list of altcoins to watch closely:

- Ethereum (ETH): The backbone of DeFi and liquid staking, ETH is poised for growth with ETF approvals on the horizon.

- Solana (SOL): Known for its fast, low-cost transactions, SOL is a favorite among developers and investors alike.

- Jito (JITO): A rising star in the liquid staking space with promising technological advancements.

- Swell (WELL): A noncustodial Ethereum liquid staking protocol that could be the next sleeper hit.

- Frax, Anchor Staking, Eigenlayer: These projects offer innovative staking and DeFi solutions worth researching.

- Cardano (ADA): Deezy’s pick, known for its strong community and ongoing development.

These altcoins not only benefit from the current macroeconomic environment but also have strong fundamentals and active development teams.

Timing the Market: Watching Key Charts for Bitcoin and Ethereum

Market timing is crucial in maximizing returns during a crypto bull run. Two charts deserve special attention:

- Bitcoin Dominance Chart: Watch for a breakdown of the massive trend line, signaling a shift away from Bitcoin dominance towards altcoins.

- ETH/BTC Chart: This multi-year trend chart will indicate whether Ethereum is gaining strength relative to Bitcoin. A breakout to the upside could mean a powerful altcoin rally.

Understanding these charts helps investors know when to accumulate altcoins and when to be cautious of market tops or bear market transitions.

How to Position Yourself for the Next Crypto Pump

Here’s a practical approach to capitalize on the upcoming market conditions:

- Take Advantage of Pullbacks: Use market dips like Bitcoin’s recent $11k drop or Ethereum’s $3,300 level to buy at a discount.

- Research Altcoins: Focus on projects benefiting from regulatory clarity and Fed policies.

- Accumulate Strategically: Build positions during healthy corrections and flash crashes.

- Follow Market Makers: Engage with trading communities and tools that provide insider perspectives.

Remember, the market is rotating, and as Bitcoin dominance wanes, altcoins will likely take center stage. Being prepared to pivot your portfolio is key.

Join the Community: Access Real-Time Insights and Trading Strategies

For those serious about navigating this exciting crypto phase, joining a community of traders and investors can be invaluable. Platforms like the Discover Crypto Discord provide free access to portfolio insights, live trades, and direct contact with market makers who influence the crypto landscape.

Engaging with such communities accelerates learning, provides timely updates, and offers a support network for making informed investment decisions.

Final Thoughts on the Crypto Market Outlook

The convergence of Federal Reserve rate cuts, SEC regulatory clarity, and global crypto adoption signals a potentially explosive phase for Bitcoin, crypto, BTC, blockchain, and altcoins. Investors who understand the macroeconomic backdrop, regulatory nuances, and technical market signals will be best positioned to benefit.

While risks remain inherent, the current environment offers a rare opportunity to capitalize on cheap liquidity and accelerating innovation. By staying informed, researching strategically, and engaging with knowledgeable communities, you can navigate the next crypto pump with confidence.

Keep your eyes on Ethereum’s liquid staking developments, watch Bitcoin dominance and ETH/BTC charts closely, and be ready to act on pullbacks. The next bull run is gearing up, and smart investors will be ready to ride the wave.

Federal Reserve Just Triggered the NEXT Crypto Pump: What Bitcoin, Crypto, BTC, Blockchain, and CryptoNews Investors Need to Know. There are any Federal Reserve Just Triggered the NEXT Crypto Pump: What Bitcoin, Crypto, BTC, Blockchain, and CryptoNews Investors Need to Know in here.