Investing in the stock market can seem daunting, especially with the flood of information and metrics to consider. Whether you’re interested in traditional stocks or curious about how Bitcoin, Crypto, BTC, Blockchain, and CryptoNews intersect with investing strategies, understanding how to value a stock thoroughly is crucial. In this comprehensive guide, I’ll walk you through a step-by-step process to evaluate stocks like a pro, inspired by the investing philosophy of Warren Buffett. Along the way, I’ll introduce you to powerful free tools and essential metrics that will help you uncover undervalued gems and make smarter investment decisions.

Stock valuation isn’t just about numbers—it’s about understanding the business behind those numbers, the competitive landscape, and future growth prospects. By mastering this approach, you’ll be better equipped to navigate the dynamic world of investing, whether you prefer stocks or are exploring crypto assets.

Understanding the Business: The Foundation of Valuation

The very first step in valuing a stock is to deeply understand the company itself. This might sound obvious, but it’s the most overlooked aspect by many investors who focus solely on charts and financial statements. The stock ticker symbol you see on your screen represents a living, breathing business. This business has products, services, customers, competitors, and a unique market position.

Ask yourself:

- What does the company do?

- Is the company growing?

- Is it profitable?

- Does it have a competitive advantage?

Competitive advantage is the secret sauce that separates successful companies from those that struggle or fail. Without a meaningful competitive advantage, a company’s profits are vulnerable to competitors who may swoop in and erode market share.

When I teach entrepreneurial finance at the university, I challenge students to think critically about why customers would choose their startup over established giants. For instance, if they’re launching a fitness clothing brand, I ask, “Why would someone switch from Nike or Adidas to your brand?” Or if they’re opening a coffee shop, “Why would customers leave Starbucks, a brand they already trust and enjoy, for your new shop?” This exercise forces them to identify a clear, defensible moat around their business.

What Is a Moat and Why Does Warren Buffett Care?

Warren Buffett, one of the most successful investors of all time, emphasizes the importance of a moat—an economic moat, that is. A moat is a sustainable competitive advantage that protects a company’s profits from competitors. Buffett isn’t interested in small ponds; he wants companies with wide, deep moats that keep rivals at bay for years or decades.

"We think in terms of that moat and the ability to keep its width and its impossibility of being crossed as the primary criterion of a great business. And to our managers, we say we want the moat widened every year."

Finding a moat means identifying what makes the company special and difficult to replicate. Here are some common types of moats I look for:

Types of Competitive Advantages (Moats)

- Brand Power: Strong consumer recognition and loyalty. Think Coca-Cola, Apple, Nike. These companies enjoy high customer retention, pricing power, and premium branding.

- Cost Advantage: The ability to produce goods or services cheaper than competitors. Walmart, Costco, and Southwest Airlines exemplify this. Look for economies of scale, efficient logistics, and high operating margins.

- Network Effects: The product or service becomes more valuable as more people use it. Facebook (Meta), Visa, and Uber benefit from this. Rapid user growth, lock-in effects, and platform business models are key signs.

- Switching Costs: Customers face high friction or costs to switch to competitors. Adobe, Microsoft Office, and Salesforce have subscriptions and integrations that keep customers locked in.

- Intellectual Property: Patents, trademarks, or exclusive rights that prevent copying. Pfizer, Qualcomm, and Disney hold valuable patent portfolios and licensing revenue streams.

- Regulatory Advantages: Government-granted licenses or protections. Utilities, defense contractors, and telecom companies often enjoy this. Palantir is a modern example with high barriers to entry and regulatory approvals.

Before diving into financial metrics, it’s critical that you understand the qualitative aspects of the company. Numbers alone won’t tell you if the business has a moat or if it’s a fad. This understanding forms the foundation for all further analysis.

Key Financial Metrics to Spot Undervalued Stocks

Once you’re confident about the company’s business model and competitive position, it’s time to analyze the numbers. Here’s a cheat sheet of essential financial metrics to start your stock valuation journey:

- Price-to-Earnings (PE) Ratio: Look for a PE ratio below the sector average. This suggests cheaper earnings relative to peers.

- Price/Earnings to Growth (PEG) Ratio: A PEG under 1 indicates undervaluation relative to growth. This is especially useful for growth stocks.

- Free Cash Flow (FCF) Yield: Greater than 5% is desirable, showing cash flow efficiency.

- Discounted Cash Flow (DCF) Value: If the intrinsic value is greater than the market price, the stock may be undervalued.

- Price-to-Book (PB) Ratio: Typically less than 1.5, useful for asset-heavy companies.

Price-to-Earnings (PE) Ratio

The PE ratio is calculated as:

Stock Price ÷ Earnings Per Share (EPS)

A lower PE compared to industry peers can indicate undervaluation. However, be cautious—earnings might be temporarily depressed due to one-time events. Generally, a PE under 20 is considered reasonable, but growth stocks like Tesla or Palantir often have much higher PE ratios, sometimes exceeding 100 or even 600.

Price/Earnings to Growth (PEG) Ratio

The PEG ratio adjusts the PE by expected earnings growth:

PEG = PE Ratio ÷ Expected EPS Growth Rate

A PEG below 1 suggests the stock is undervalued relative to its growth. This metric is particularly helpful for high-growth companies like Nvidia, where the PE might be high, but the PEG remains attractive. Be wary of stocks like Palantir where the PEG remains extremely high, indicating potential overvaluation.

Price-to-Book (PB) Ratio

This ratio compares the market price to the company’s book value (assets minus liabilities):

Stock Price ÷ Book Value Per Share

It’s most useful for asset-heavy companies such as banks or energy firms. A PB under 1 can be a sign of undervaluation, but only if the assets are valued properly on the balance sheet.

Free Cash Flow (FCF) Yield

The FCF yield measures cash flow efficiency:

FCF Per Share ÷ Stock Price

A higher FCF yield, typically above 5%, indicates the company generates solid cash flow relative to its market value. Compare this to the yield on a 10-year Treasury bond to assess the risk premium.

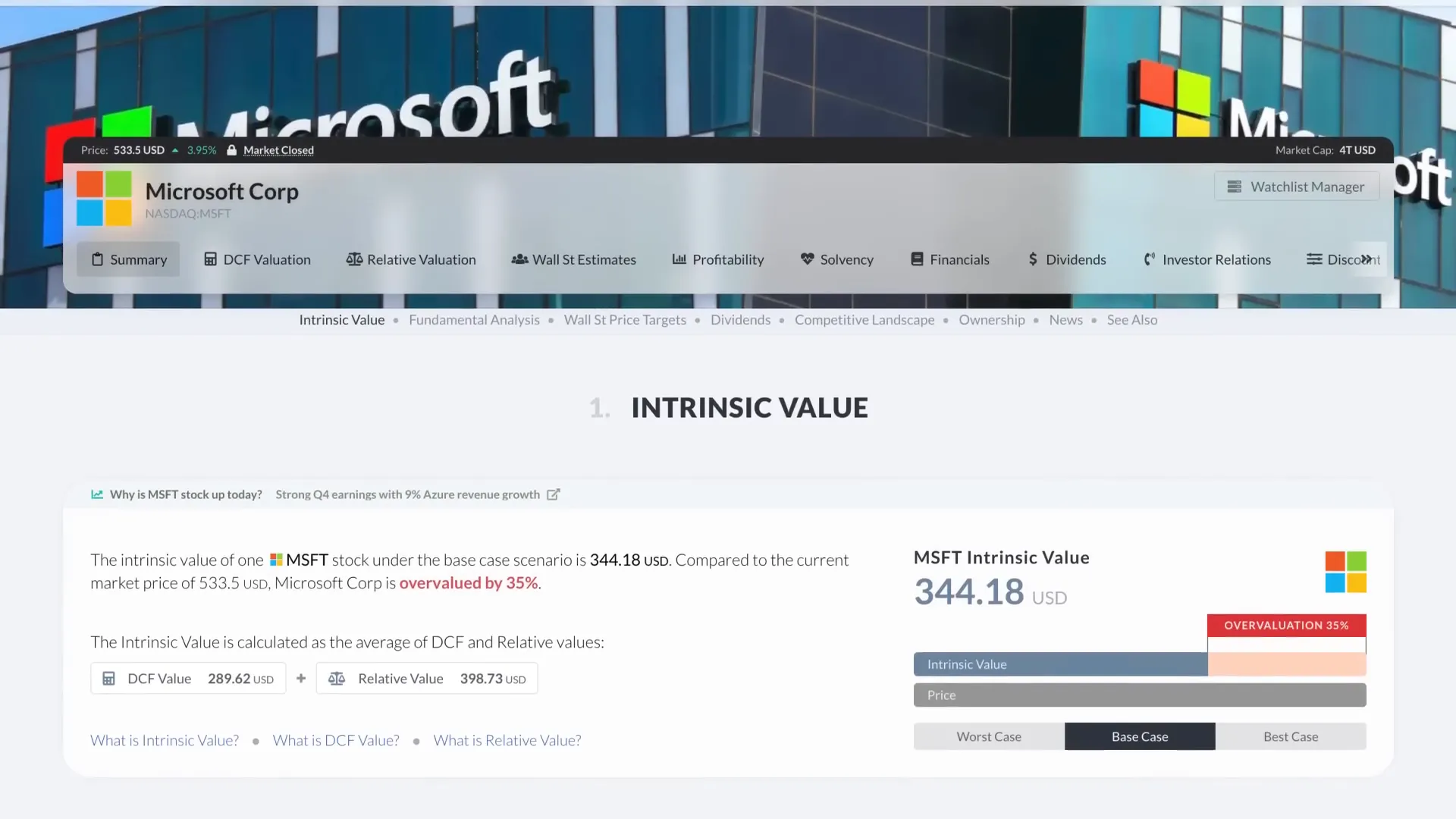

Discounted Cash Flow (DCF) Analysis

DCF analysis estimates a company’s intrinsic value based on its projected future cash flows. You forecast free cash flows for 5 to 10 years, then discount them back to their present value using a discount rate (usually 8% to 12%). If the intrinsic value exceeds the current stock price, the stock may be undervalued.

Free online tools like Finbox, GuruFocus, and my favorite, Alpha Spread, can simplify DCF calculations and provide instant intrinsic value estimates. However, don’t rely solely on these models—always verify the inputs yourself, as assumptions can change and errors can occur.

Comparing Stocks to Industry Peers

After gathering qualitative insights and crunching the numbers, the next crucial step is to compare your stock’s metrics to its industry peers. This comparison provides context—how does the company stack up against competitors?

For example, comparing Apple to Procter & Gamble wouldn’t be meaningful because they operate in different sectors. Instead, compare Apple to Microsoft or Google. This helps you identify relative undervaluation or overvaluation within the same playing field.

There are excellent free resources for side-by-side comparisons:

- Finviz.com: Great for visualizing groups of stocks or industries over various time frames.

- Seeking Alpha: Offers detailed financial data and peer comparisons.

- Morningstar: Known for in-depth analysis and valuation metrics.

Alpha Spread also offers a “competitive landscape” section near the bottom of their reports, showing similar companies for your own evaluation.

Red Flags to Watch Out For

While hunting for undervalued stocks, always be vigilant for warning signs that suggest trouble or risk:

- High Debt with Low Cash Flow: Heavy debt burdens can cripple a company, especially if cash flow is insufficient to service liabilities.

- One-Time Earnings Boosts: Watch for temporary spikes in earnings that don’t reflect sustainable performance.

- Shrinking Margins or Revenue: Declining profitability or sales can signal competitive pressure or market contraction.

- Management Turnover or Dilution: Frequent changes in leadership or excessive share issuance can undermine investor confidence.

Accounting practices can sometimes paint a rosier picture than reality, particularly in quarterly earnings reports. That’s why I recommend studying companies with a track record of 10, 20, or even 30 years. I prefer stocks and ETFs with long histories that have weathered various market cycles, both good and bad.

Why Qualitative Research Matters More Than You Think

Before you dive into formulas and ratios, remember that understanding the qualitative side of a business is challenging but essential. This is my specialty as a business professor—digging deep into what makes a company tick, its culture, competitive positioning, and long-term viability.

Numbers can guide you, but they don’t tell the whole story. The best investors combine qualitative insight with quantitative analysis for a holistic view. This is also why many of my clients appreciate working with me—they get help understanding the complexities behind the numbers.

If you want to go further, consider joining an investing community or group where you can discuss ideas, ask questions, and get live feedback. For example, I host a Patreon group where members get exclusive stock picks, live Zoom meetings, and market updates. It’s a great way to stay informed and sharpen your investing skills.

Keep Investing Simple and Focused

Investing doesn’t have to be complicated. Focus on understanding the business, identifying durable competitive advantages, and then applying a few key metrics to spot value. Whether you’re investing in traditional stocks or exploring Bitcoin, Crypto, BTC, Blockchain, and CryptoNews, the principles of good valuation remain the same.

Remember to always check multiple sources, verify calculations yourself, and never rely solely on one metric or model. This balanced approach will help you build a resilient portfolio and increase your chances of long-term success.

Next Steps to Boost Your Stock Picking Skills

To deepen your understanding, consider watching videos or reading materials that summarize the investing lessons I’ve gathered over nearly two decades. Learning from experience and continuously educating yourself is the best way to improve.

Also, take advantage of free online tools for stock analysis and stay engaged with investing communities. The world of Bitcoin, Crypto, BTC, Blockchain, and CryptoNews is evolving rapidly, and staying informed will help you spot opportunities others might miss.

Happy investing, and remember—keep investing simplified.

Essential Stock Picking Metrics 📈 (How to Value a Stock Like Warren Buffett) - Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing. There are any Essential Stock Picking Metrics 📈 (How to Value a Stock Like Warren Buffett) - Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing in here.