If you’ve been following the crypto space lately, you’ve probably noticed the waves of criticism thrown at XRP and the XRP Ledger (XRPL). Maxis from all sides are throwing shade, but let me tell you—XRP and XRPL have plenty of firepower and resilience to stand tall. In this deep dive, we’re going to unpack everything from XRP price action, insider moves in meme coins, and the SEC’s regulatory ambitions, to some juicy legal drama and a spirited defense of XRP by Ripple’s CTO, David Schwartz.

Welcome to this comprehensive analysis where Bitcoin, Crypto, BTC, Blockchain, CryptoNews, and Investing intersect in one place. Let’s break down the key developments shaping the market, while I keep it real and raw, just like you expect.

Starting Strong: XRP Holding Above the $3 Mark

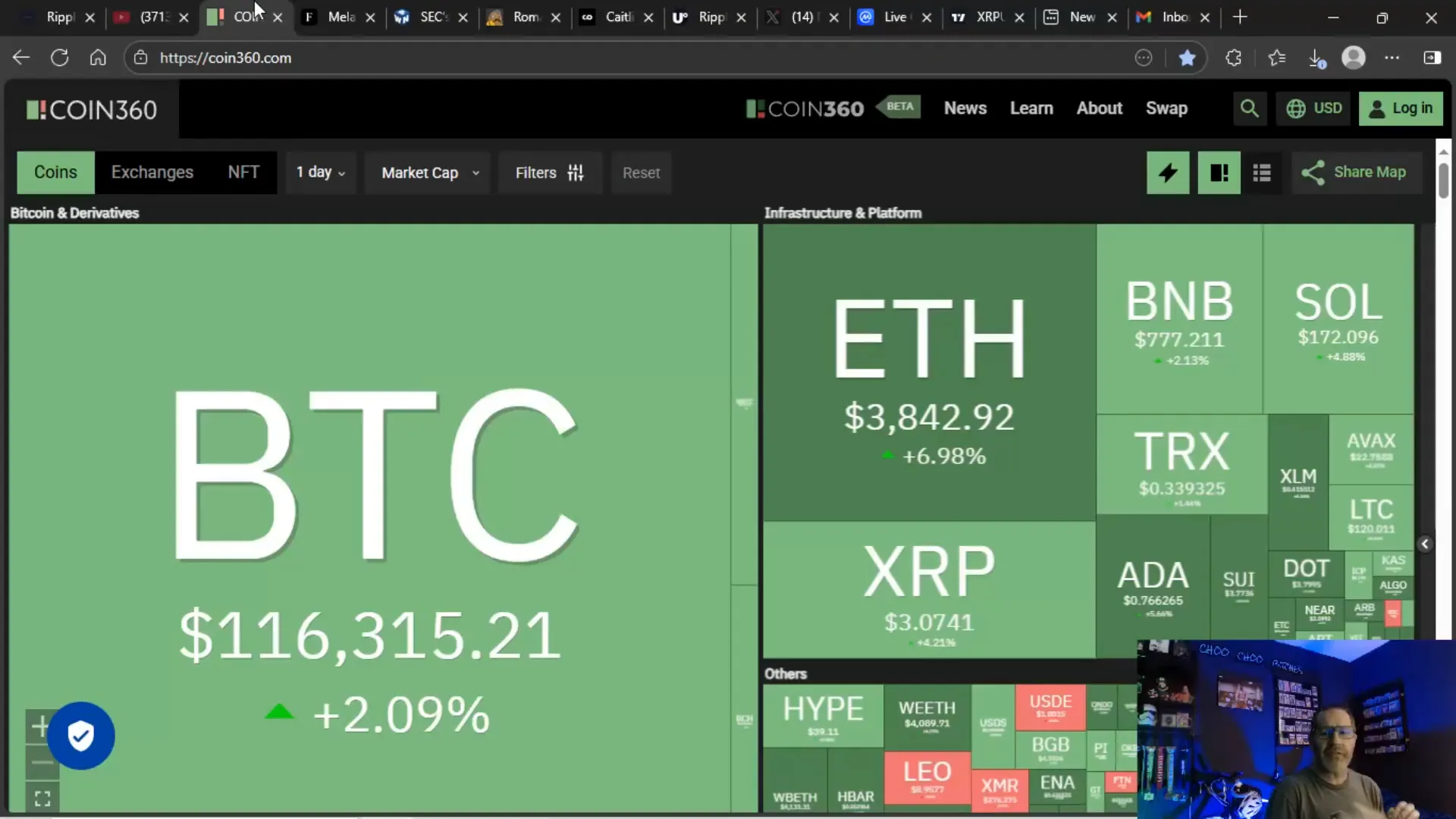

First things first, XRP is flexing some muscle. We’re currently sitting above the $3 floor—a significant psychological and technical level that many doubted we’d hold. This is a big deal because maintaining this level signals strength and confidence in the market.

For weeks, I’ve been bullish on this $3 floor, and it’s finally materializing. It’s not just hype; the volume and price action back it up. XRP’s daily trading volume is around $4.8 billion, showing a healthy appetite from traders and investors alike.

Just like David Schwartz, Ripple’s CTO, who’s been hands-on building a mega rig to support the XRPL infrastructure, the XRP community is rallying behind their token. It’s a slow burn sometimes, but XRP has shown it can sustain and grow over time, just like Bitcoin did in its early years.

Why Holding the $3 Floor Matters

- Investor Confidence: Holding above $3 reassures investors that XRP isn’t just a flash in the pan.

- Market Stability: A strong support level prevents wild swings and creates a foundation for future gains.

- Regulatory Anticipation: With Ripple’s pending banking license and ongoing SEC cases, price stability is crucial.

Speaking of Ripple’s banking license, if it gets approved in August, it could be a massive catalyst for XRP and the broader crypto market. That’s a game-changer waiting to happen.

Meme Coin Madness: Melania Coin’s 98% Crash and Insider Moves

On the flip side of the crypto spectrum, the Melania meme coin saga is a cautionary tale. This coin has plummeted a staggering 98% from its all-time highs, and guess what? Insiders were cashing out big time.

Three weeks ago, I broke the story about insider selling in Melania coin, and it’s a classic example of how celebrity-driven meme coins often get pumped and dumped by those in the know long before the public gets a whiff.

Here’s the kicker: 10% of holders control 90% of Melania meme coin. That’s a recipe for disaster if you’re a small holder chasing hype. The lesson? Be extremely cautious with meme coins and celebrity hype. The insiders almost always get out first.

Why Insider Action Matters

- Early Access: Insiders buy in way before public sales or presales.

- Market Manipulation Risk: These holders can pump the price and then dump, leaving retail investors holding the bag.

- Volatility: Meme coins can skyrocket or tank overnight, making them risky bets.

So, if you’re thinking about jumping on the next big meme coin, remember Melania’s crash and ask yourself: Are you getting in too late?

SEC and Paul Atkins: Regulatory Clarity or Just More Fluff?

The SEC’s regulatory ambitions are under the spotlight again, with former commissioner Paul Atkins pushing hard for crypto regulatory clarity. He’s advocating for clear definitions that distinguish securities from commodities, which is something the entire crypto industry desperately needs.

But here’s the reality check: regulatory clarity won’t come from the SEC alone—it needs Congressional action. Atkins can push all he wants, but if the next administration appoints someone like Gary Gensler, we could be stuck with another round of heavy-handed and unclear rules.

The market needs a comprehensive market structure bill that clearly defines crypto assets and provides a framework that fosters innovation while protecting investors.

Current Regulatory Challenges

- Slow Approvals: ETFs and other crypto products are getting denied repeatedly.

- Unclear Guidance: Staking, mixers, and DeFi protocols are in regulatory gray zones.

- Market Uncertainty: Investors and companies are hesitant to move forward without clear rules.

Until Congress steps up, we’re in a holding pattern, and that’s why August could be a “trap month” — a vacuum of news, policy, and market action that could lull investors into complacency.

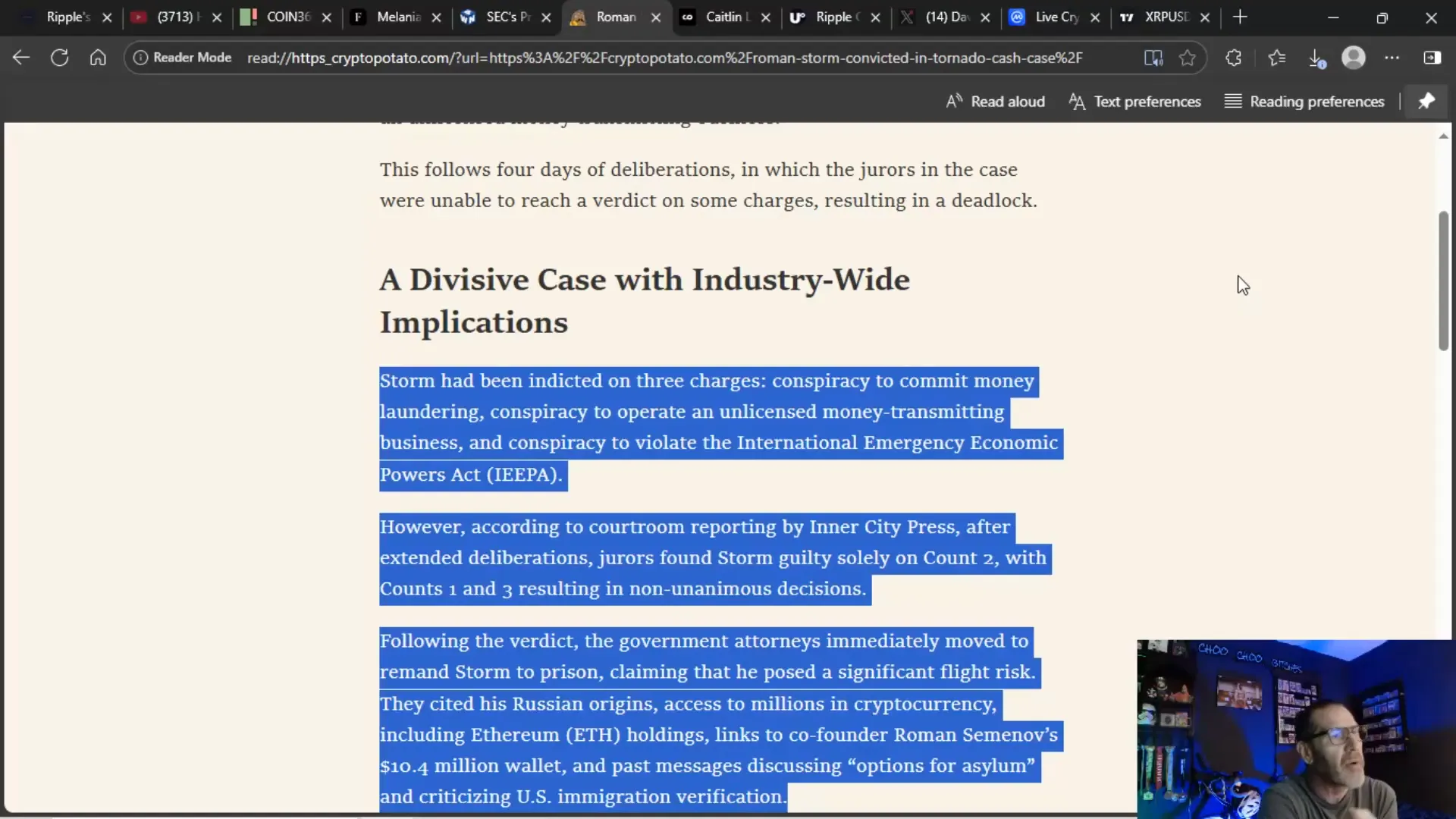

Roman Storm and Tornado Cash: The Legal Drama Unfolds

One of the hottest legal stories right now involves Roman Storm, the co-founder of Tornado Cash, who was convicted on one count related to operating an unlicensed money transmitting business. The charges included conspiracy to commit money laundering and conspiracy to violate international emergency economic powers, but the jury only convicted on the money transmitting charge.

This case raises big questions about the responsibility of protocol developers when their tools are used for illicit purposes. The government is painting Storm as a flight risk due to his Russian origins and access to millions in cryptocurrency, but the bigger debate is about the nature of privacy protocols and their place in crypto.

The Bigger Picture: Protocols vs. Users

Here’s the analogy I like to use: Do you blame BMW if a criminal uses one of their cars as a getaway vehicle? No. The fault lies with the person pulling the trigger, not the tool they used.

Similarly, Tornado Cash is a protocol that can be used for both legal and illegal purposes. Privacy in financial transactions isn’t inherently bad—it’s a right. But regulators want clear boundaries.

We desperately need clearer regulations that protect privacy rights while cracking down on criminal misuse. Until then, expect more legal battles and uncertainty.

Caitlin Long vs. XRP Community: The Centralization Debate

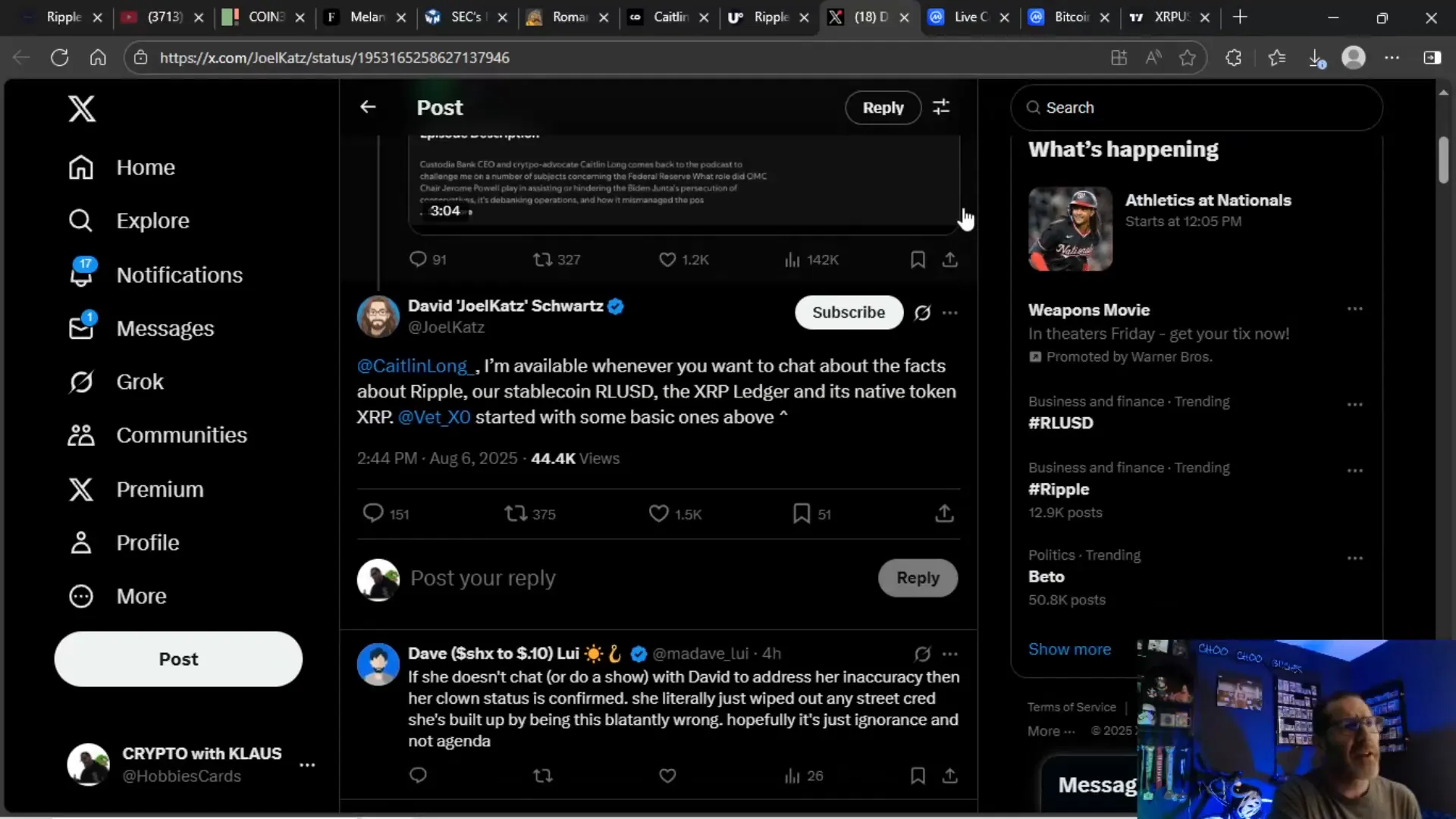

In the ongoing drama of crypto voices, Caitlin Long, founder and CEO of Avani Financial Group, has been throwing shade at XRP and XRPL, claiming the network is too centralized to succeed and doubting its future dominance.

But this perspective misses the bigger picture. Plenty of projects, including BTC, TonCoin, and Swiss, had slow starts and grew over time. XRP’s growth trajectory has been steady and strategic, not overnight hype.

David Schwartz, Ripple’s CTO, didn’t hold back either. He offered to chat with Caitlin anytime to discuss the facts about Ripple, its stablecoin USDR, the XRP Ledger, and XRP itself.

Why the Centralization Argument Falls Short

- Growth Takes Time: Bitcoin took years before hitting its stride; XRP is on a similar path.

- Network Design: XRPL’s design choices prioritize scalability and efficiency, which might look “centralized” but serve practical purposes.

- Community and Use Cases: The real test is adoption and utility, which XRP continues to build.

Some players thrive on negativity because it gets clicks and attention. Caitlin Long’s critiques seem more about generating buzz than constructive debate.

David Schwartz: The Unsung Hero Defending XRP

While I’ve been critical of David Schwartz at times, he deserves credit for stepping up and defending XRP and XRPL passionately. Building a mega rig with a 99 950x chip to support the infrastructure isn’t just talk—it’s action.

David’s willingness to engage with critics and share facts reflects the dedication behind Ripple’s technology and vision.

It’s like the classic Ford vs. Chevy rivalry—people pick sides and defend their brands fiercely, often without fully understanding the merits of the other side. David’s standing firm helps keep XRP’s story alive and well.

Current Market Snapshot: Volume, Institutional Inflows, and Altcoin Season

Overall, the crypto market remains healthy with $145 billion in trading volume over the last 24 hours. The altcoin season index sits at 36/100, indicating some momentum but not a full-blown altcoin rally yet.

Institutional inflows, however, have stalled in the last two weeks. After mega inflows earlier in the year, there’s now a pause and even some outflows, aligning with the August trap scenario I mentioned earlier.

This vacuum in August—with no FOMC meetings, CPI data releases, or regulatory updates—is creating a quiet period that could lull investors into complacency or set the stage for sudden moves.

Putting It All Together: What This Means for Investors

Here’s the bottom line for Bitcoin, Crypto, BTC, Blockchain, CryptoNews, and Investing enthusiasts:

- XRP is showing strength: The $3 floor is holding, and volume remains healthy. Expect more action if Ripple’s banking license gets approved.

- Beware of meme coin hype: Insider selling in Melania coin is a warning sign for anyone chasing quick gains in celebrity-backed tokens.

- Regulatory clarity is still a long way off: The SEC can’t do it alone; Congress must step up. Until then, expect uncertainty and volatility.

- Legal battles highlight the need for privacy and clear rules: The Roman Storm/Tornado Cash case shows the tension between innovation and regulation.

- Community debates are part of the ecosystem: Critics like Caitlin Long stir the pot, but XRP’s fundamentals and development continue to advance.

- Market volume and institutional activity are key indicators: Watch for shifts in inflows and volume, especially during the quiet August period.

Whether you’re a seasoned investor or just getting into crypto, these insights should help you navigate the choppy waters ahead.

Final Thoughts: Stay Sharp and Keep Your Bread Fresh

Just like I give my dogs homemade wheat bread instead of the boring store-bought white bread, you’ve got to feed your crypto strategy the good stuff—the facts, the analysis, and the right mindset.

Ignore the noise, question the narratives, and focus on the fundamentals. XRP and XRPL have their challenges but also immense potential. With the right regulatory framework, continued innovation, and community support, the future looks bright.

Keep an eye on the charts, watch for institutional moves, and stay ready for the catalysts that could send Bitcoin, Crypto, BTC, Blockchain, and XRP to new heights.

Remember, in crypto as in life, it pays to pick the good bread.

💯 Defending XRP and XRPL: Hot CryptoNews, Price Action, and Regulatory Insights 💯. There are any 💯 Defending XRP and XRPL: Hot CryptoNews, Price Action, and Regulatory Insights 💯 in here.