In the ever-evolving world of cryptocurrency, Bitcoin continues to capture the spotlight as a powerful new asset class. Veteran strategist Tom Lee offers a compelling perspective on why Bitcoin is poised not just to survive but to thrive—potentially reaching prices between $200,000 and $250,000 by the end of this year. As institutional demand surges and macroeconomic forces shift, Lee makes a strong case for Bitcoin as the digital replacement for gold, while also highlighting Ethereum’s rising role in reshaping the financial system. Let’s dive into the key insights that every investor and crypto enthusiast should know.

Table of Contents

- Bitcoin as Digital Gold: The Simplest and Strongest Use Case

- Healthy Skepticism and Market Resilience

- Institutional Demand and the Shrinking OTC Supply

- Bitcoin Treasuries: Winners and Losers in a Scarce Market

- Ethereum: The Next Decade’s Macro Trade

- Mitigating Risks and Looking Ahead

- Conclusion: The Best Years Are Still Ahead for Cryptocurrency

Bitcoin as Digital Gold: The Simplest and Strongest Use Case

Tom Lee simplifies the complex narrative around Bitcoin by framing it as a digital substitute for gold. For those uncertain about Bitcoin’s many use cases, Lee emphasizes this one as the clearest and most convincing. He believes Bitcoin's scarcity and growing institutional adoption position it to eventually surpass the $1 million mark in value.

"To me, the most the simplest way to think about Bitcoin is that it's gaining traction as replacement for gold."

"Bitcoin should really build upon this $120,000 level before the end of the year—potentially hitting $200,000 to $250,000."

This analogy to gold isn’t just rhetorical. Bitcoin’s fixed supply, decentralized nature, and increasing acceptance by corporate treasuries and sovereign institutions bolster its status as a digital reserve asset. Companies like MicroStrategy have demonstrated the power of this strategy, accumulating significant Bitcoin holdings and seeing their stock prices multiply as a result.

Healthy Skepticism and Market Resilience

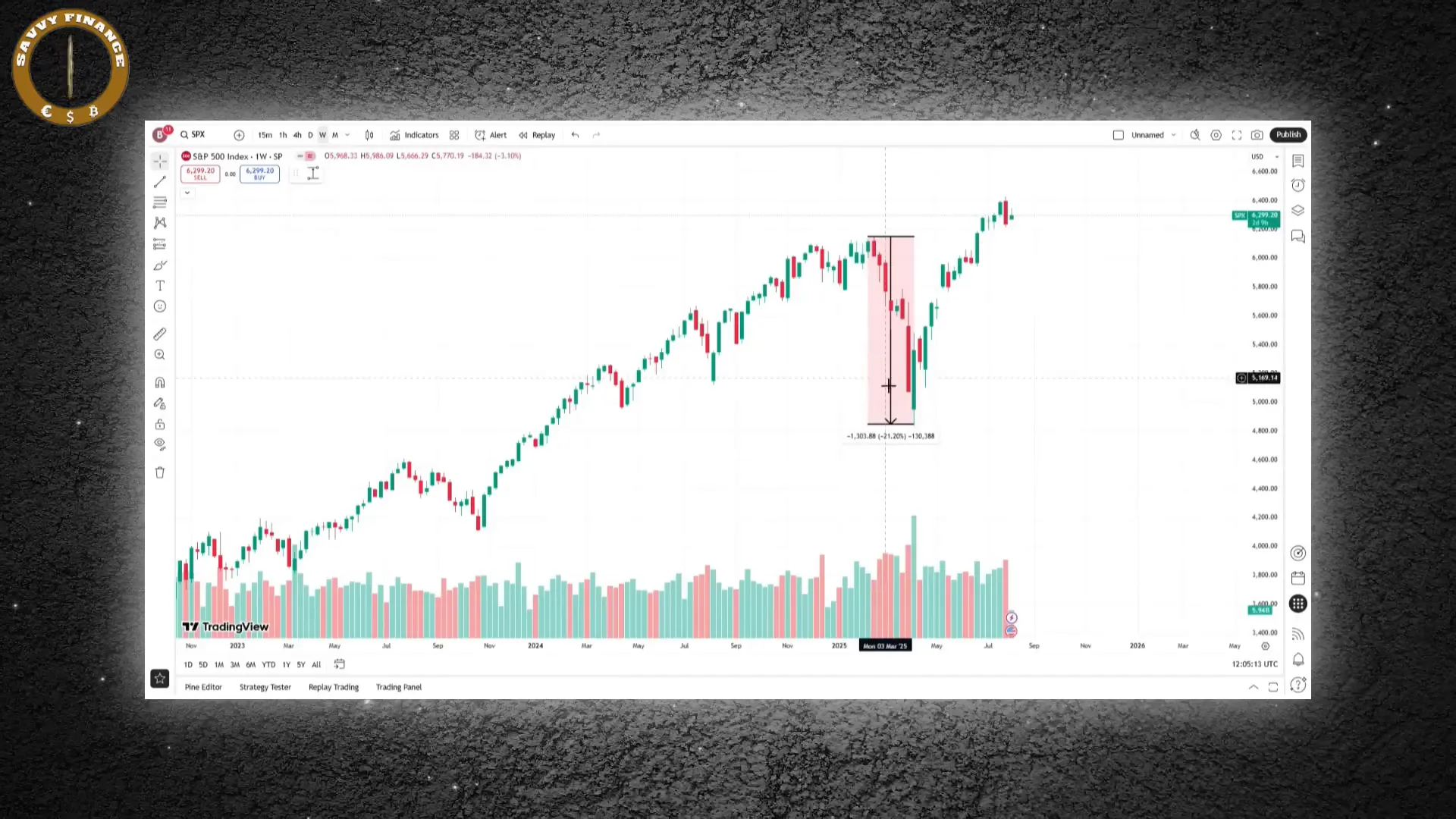

Interestingly, Lee views the current skepticism around Bitcoin and broader markets as a healthy sign. The market’s “v-shaped rally” has been met with doubt due to factors like Federal Reserve policies and geopolitical tensions. However, this skepticism indicates ongoing price discovery, meaning the market still has room to surprise on the upside.

Lee draws parallels to the resilience of the traditional equity market, which has weathered multiple shocks—COVID-19, supply chain crises, inflation surges, and geopolitical conflicts—yet continues to show robust earnings growth and recovery. This resilience, he believes, supports a higher valuation environment for risk assets including Bitcoin.

Institutional Demand and the Shrinking OTC Supply

One of the most compelling pieces of evidence for Bitcoin’s looming breakout is the rapid depletion of Bitcoin inventories on over-the-counter (OTC) desks. These desks facilitate large institutional purchases discreetly, without immediately impacting spot prices. According to recent data, OTC Bitcoin balances have fallen to just 155,000 BTC—one of the lowest levels ever recorded.

With companies like MicroStrategy and Bitcoin ETFs absorbing billions of dollars in Bitcoin this year, OTC desks are running dry. This means future institutional buying will increasingly have to occur in public markets, potentially triggering a supply squeeze that could send prices soaring.

Coupled with expectations of Federal Reserve rate cuts by September, which would inject new liquidity into markets, the conditions are ripe for a parabolic Bitcoin rally. Lee’s forecast aligns perfectly with these structural supply-demand dynamics, suggesting that Bitcoin’s next big surge might come sooner than many anticipate.

Bitcoin Treasuries: Winners and Losers in a Scarce Market

As Bitcoin scarcity intensifies, companies holding Bitcoin on their balance sheets are gaining strategic advantages. Lee points out that not all Bitcoin treasury strategies are equally effective. MicroStrategy stands out by turning its shareholders into dedicated supporters, maintaining a premium valuation, and setting a benchmark for others.

While there are about 50 companies with Bitcoin treasury strategies, only a handful will likely emerge as winners due to differing execution quality and geographic factors. For example, Japan’s Meta Planet and emerging players in the UK and Korea showcase how regional differences affect these strategies.

Ethereum: The Next Decade’s Macro Trade

While Bitcoin is carving its space as digital gold, Lee highlights Ethereum as a transformative force in the digital economy. Ethereum’s capabilities for tokenization, smart contracts, and hosting stablecoins position it at the center of a broader financial system overhaul.

Wall Street is increasingly embracing Ethereum’s blockchain for tokenizing assets like stocks and real estate, as well as for deploying legally compliant stablecoins. This emerging infrastructure could propel Ethereum to become the next trillion-dollar crypto asset.

Lee candidly explains that Ethereum and Bitcoin serve different but complementary roles. Bitcoin is the “immaculate” store of value, while Ethereum is the platform enabling the digitalization and tokenization of business and finance. He even notes that his own firm, BitMine, actively invests in Ethereum, reflecting its institutional relevance and growth potential.

Mitigating Risks and Looking Ahead

Concerns like regulatory classification of Ethereum as a security remain valid. However, Lee argues that these risks pale in comparison to the fragility of the current financial system, which relies on outdated and vulnerable infrastructures prone to fraud and inefficiencies.

He stresses the importance of recognizing the generational shift: younger generations growing up in an AI-driven, token-based economy will redefine value and money concepts, leaving behind the notion that only physical assets can store value.

Conclusion: The Best Years Are Still Ahead for Cryptocurrency

Tom Lee’s insights paint a bullish picture for both Bitcoin and Ethereum. With Bitcoin acting as the new gold and Ethereum driving the tokenization revolution, the cryptocurrency market is entering a historic supercycle fueled by institutional adoption, macroeconomic shifts, and technological innovation.

The drying up of OTC Bitcoin supply combined with potential Fed rate cuts creates a perfect storm for a parabolic Bitcoin rally. For investors, understanding these dynamics and positioning accordingly could be key to capturing significant gains in the evolving digital economy.

Whether you’re a seasoned crypto believer or just beginning to explore, now is the time to pay close attention. The next wave of growth in cryptocurrency, bitcoin, and digital assets may unfold faster and more powerfully than expected.

Cryptocurrency, Bitcoin, and the Coming Parabolic Surge: Insights from Tom Lee. There are any Cryptocurrency, Bitcoin, and the Coming Parabolic Surge: Insights from Tom Lee in here.