By Coin Bureau

This post unpacks the CFTC’s new “crypto sprint,” the White House roadmap that prompted it, and what traders, exchanges and projects should watch next. If you watched the original breakdown from Coin Bureau, this is the same clear, practical take with extra context so you can act (or just understand what’s coming). Note: this is educational content, not financial advice.

Table of Contents

- Why the CFTC looks friendlier than the SEC

- The crypto sprint: what it is and why it matters

- Winners, losers and market mechanics

- Key takeaways

Why the CFTC looks friendlier than the SEC

At a high level the difference is mandate. The SEC polices securities markets; the CFTC supervises derivatives tied to commodities and enforces against fraud and manipulation in commodity spot markets. That means the CFTC already has real oversight over Bitcoin and Ethereum futures on regulated venues like the CME and authority to pursue fraud in spot markets.

Crucially, CFTC-registered exchanges can list new derivatives through a streamlined self-certification process. For crypto firms, that translates to speed, clarity and predictable rules — traits the industry has long preferred over the SEC’s stricter securities framework. The White House’s recent digital assets report explicitly encourages the CFTC to take a lead on non-security digital assets, and the agency moved quickly.

The crypto sprint: what it is and why it matters

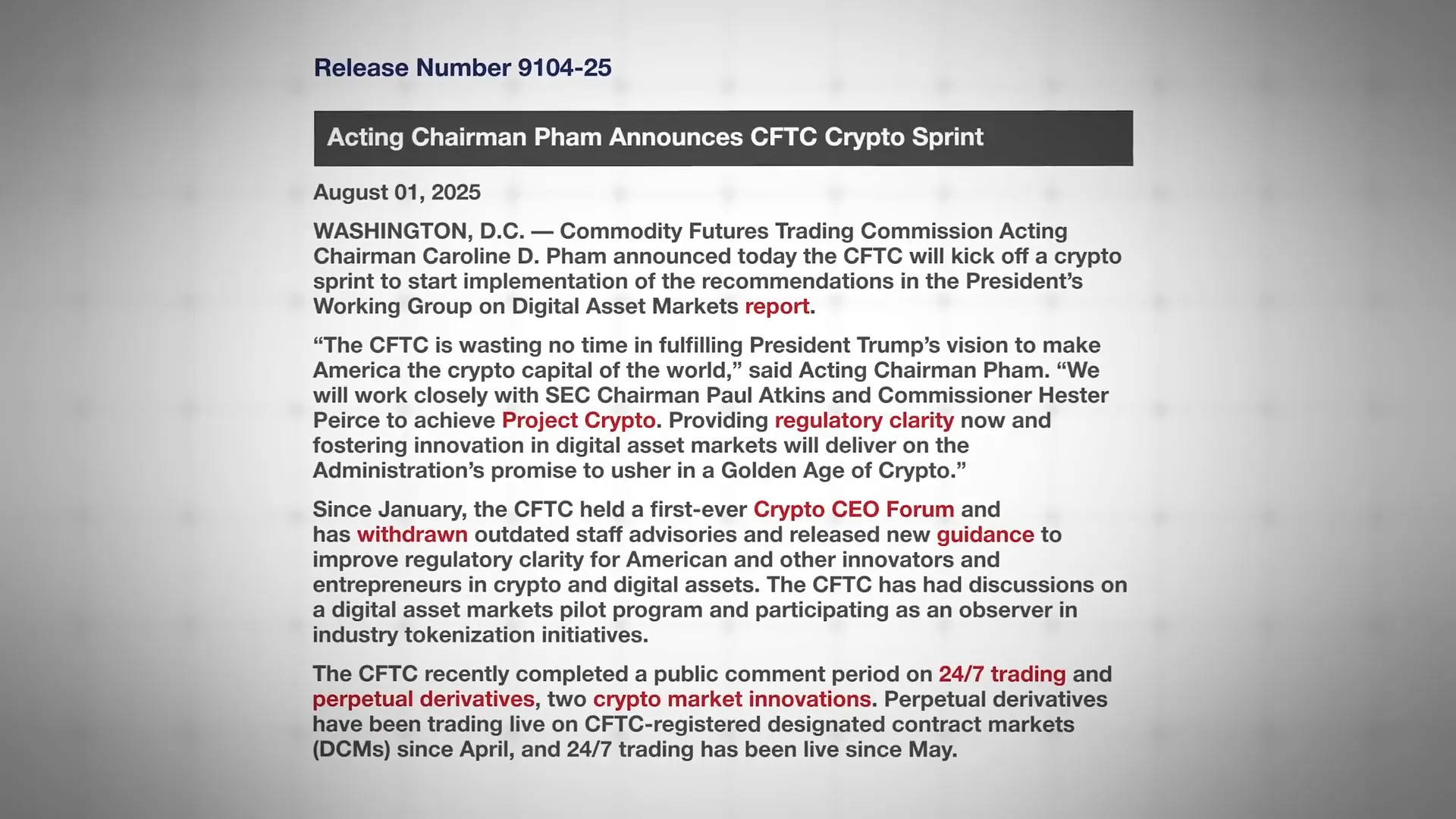

On August 1 the CFTC launched a focused initiative to implement the White House’s recommendations. Phase one: solicit public feedback on how to enable spot crypto trading on designated contract markets (DCMs) — in plain terms, bring spot trading of underlying assets onto federally supervised futures exchanges that already list crypto futures.

The agency is asking for practical input on custody, trading windows, how to handle tokens that could also be securities, and how self-certification could be used. Comments were solicited on a tight timeline (comments due August 18 in the announcement), reflecting the executive branch’s directive to act quickly without waiting for new legislation.

Where the SEC fits in

The White House wants the SEC to remove regulatory roadblocks that unintentionally block activity that might fall under CFTC jurisdiction. Under new SEC leadership the agency has launched “Project Crypto” to modernize its digital-asset approach and already published guidance suggesting some liquid staking setups may not be securities.

That coordination is central: if the CFTC enables spot listings while the SEC clarifies custody and securities boundaries, US trading infrastructure could be unified, reducing the “sorry, US not supported” friction many users face today.

Winners, losers and market mechanics

Short answer: the initial winners are the assets already active in CFTC-regulated futures markets — notably Bitcoin and Ethereum. Leading altcoins with existing futures (Solana, XRP) are next in line. Spot listings on the same regulated venues reduce friction and could attract institutional liquidity onshore.

Two market effects to watch:

- Basis trading: co-listing spot and futures on one venue makes classic basis strategies (buy spot, short futures) easier and more efficient, increasing liquidity without creating new net demand for the underlying asset.

- Perpetual futures and 24/7 trading: the CFTC is evaluating regulated frameworks for perps and round-the-clock trading. If approved, some traders currently using offshore DEX perps (often via VPN) may migrate to regulated U.S. venues, shifting volumes onshore.

What won’t change immediately

- Tokens that remain investment contracts or securities will remain under SEC jurisdiction and won’t qualify for CFTC-listed spot trading.

- The so-called “morphing asset” problem — tokens that launched as securities but now function more like non-securities — is still a gray area, though the White House urged the SEC to allow secondary trading off SEC platforms with safeguards.

- Stablecoins are on a separate regulatory track per the recent federal legislation discussions and won’t be tangled in this particular uncertainty.

Key takeaways

- Regulatory momentum: The White House report gave both agencies marching orders; the CFTC’s crypto sprint is the fastest visible response.

- Short timeline: The CFTC requested comments on spot listings with a rapid comment window; expect industry filings and self-certifications to follow if feedback is favorable.

- Market impact: crytocurency, bitcoin and other leading coins stand to benefit first, while offshore platforms could lose share as liquidity moves onshore.

- Operational change: co-listing spot and futures encourages institutional strategies (basis trades, perps) that deepen US liquidity without necessarily increasing net demand.

- Coordination matters: crytocurency, bitcoin outcomes depend on SEC clarifications (Project Crypto) and how the two agencies handle custody, segmentation and morphing assets.

Final thoughts: this is a stepwise process, not an overnight switch. Expect multiple pro-crypto announcements over coming weeks and months, public comment filings that reveal industry positions, and then exchanges using established tools (like self-certification) to roll out spot products. If regulators stick to the plan, the U.S. could see a rapid upgrade in regulated crypto rails — and that’s big for crytocurency, bitcoin traders and the broader market.

Disclaimer: This article is informational only and not financial, legal, or tax advice. Consult a qualified professional before making investment decisions.

Crypto Is About to Change FOREVER: How the CFTC’s Crypto Sprint Could Rewire crytocurency, bitcoin Trading. There are any Crypto Is About to Change FOREVER: How the CFTC’s Crypto Sprint Could Rewire crytocurency, bitcoin Trading in here.