I’m Austin from Altcoin Daily. In a new breakdown, Coinbase warned that a major altcoin season is likely as early as September — and laid out the exact mechanics behind it. In this article I pull that analysis together, explain the three triggers I follow, and give you a simple checklist to watch so you can be ready when the rotation into altcoins accelerates. If you follow crytocurency, bitcoin markets, this is the kind of macro + on-chain alignment you don’t want to miss.

Table of Contents

- Key takeaways

- How altcoin season really begins: the three-factor framework

- Regulation, ETFs, and institutional demand: the accelerating factors

- A practical checklist to watch (my playbook)

- Conclusion — be ready, not reactive

Key takeaways

- Altcoin season typically needs three things: rising global liquidity (global M2), the business cycle turning favorable for risk assets, and Bitcoin dominance rolling over.

- Coinbase sees liquidity and market structure changes lining up for a possible September move; their altcoin season index still needs breadth to expand from ~40% to ~75%.

- Institutional demand — especially for Ethereum — and a clearer regulatory framework (generic listing standards and ETF talk) are likely to accelerate capital rotation into altcoins.

How altcoin season really begins: the three-factor framework

From my perspective, altcoin season is not magic — it’s the product of three overlapping forces acting together:

- Global liquidity (global M2) rising — which historically leads Bitcoin by roughly 12 weeks.

- The broader business cycle moving into a risk-on phase, giving households and institutions spare cash to recycle into higher-risk assets.

- Bitcoin dominance faltering — when BTC’s share of total crypto market cap rolls over, capital flows into alts quickly and aggressively.

1) Global liquidity: the upstream driver

Coinbase and others point to global M2 as a primary input. Historically, when global money supply expands, risk assets follow with a lag — Bitcoin tends to track the M2 trend with an approximate 12-week delay. If global liquidity heads materially higher, the implication for crytocurency, bitcoin is straightforward: BTC can run first, then alts follow.

That correlation has been high — Coinbase cites roughly an 80% relationship — and the current setup shows M2 continuing upward. In the analysis I use, that leaves room for a meaningful BTC leg higher into late Q3, with a $140k–$150k target discussed if the liquidity wave persists. A nearer-term “high-confidence” move was highlighted around August 23 based on the typical offset timing.

2) The business cycle: why risk assets need a tailwind

Altcoin rallies rarely happen in isolation. They mirror the wider business cycle. Look at past crypto cycles: Bitcoin’s early top aligned with the broader market top around 2013; the big alt bull in 2017 synced with a risk-on environment; and the 2021 highs coincided with another business cycle peak. When corporate earnings and household incomes are subdued, capital tends to be defensive. When the cycle turns, people and institutions push further out the risk curve — small caps, credit spreads, collectibles, and yes, altcoins.

This is why I emphasize trend direction over perfect timing. Bitcoin’s uptrend since late 2022 is the foundation — if liquidity + cycle align, altcoins get the juice to outperform.

3) Bitcoin dominance rolling over: the trigger for altcoin breadth

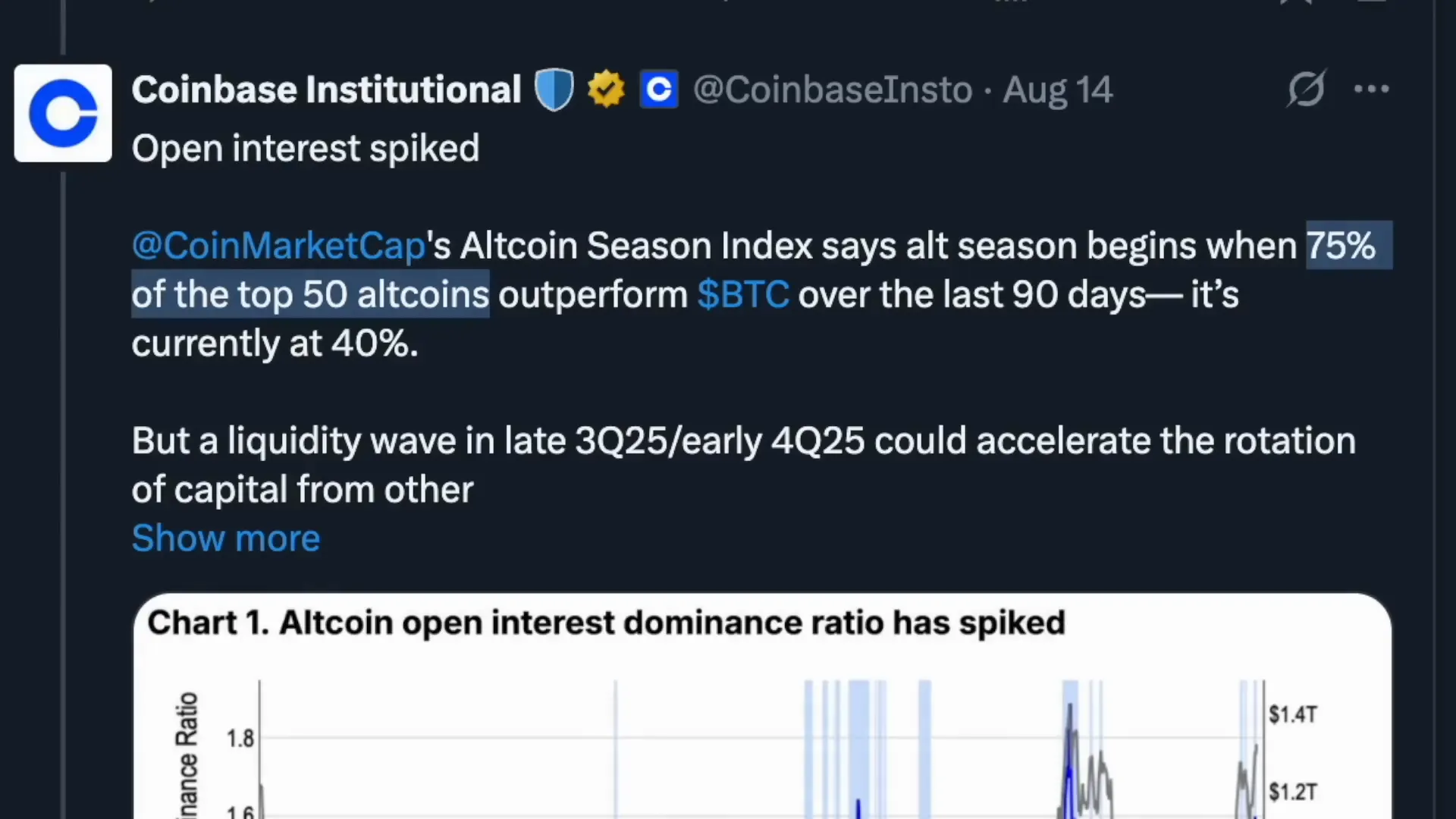

Perhaps the most actionable signal is Bitcoin dominance. Coinbase notes a sustained decline in dominance from ~65% to ~59% recently — a clear sign capital is moving away from BTC into other tokens. Their altcoin season index defines “alt season” as when 75% of the top 50 altcoins outperform BTC over the last 90 days; it’s currently near ~40% and needs to get to ~75% for a full-on alt season.

Other supporting indicators Coinbase points to: open interest spikes, recovering trading volumes, deeper order books, and net stablecoin issuance. Combined with a clearer regulatory environment for stablecoins and possible market structure changes, liquidity can rotate faster into altcoins when the conditions are right.

Regulation, ETFs, and institutional demand: the accelerating factors

Two additional catalysts are worth watching because they can compress timing:

- Regulatory clarity and a “generic listing standard” for exchanges. Industry insiders say exchanges and the SEC have been working on standards that would streamline listings — one criterion being whether a token has a U.S. futures market. If implemented, this could ease paths for altcoin products and ETFs.

- Institutional interest, especially in Ethereum. Coinbase and on-chain data show select digital asset treasuries accumulating ETH at a rapid clip — a parabolic rise in holdings. Institutional treasuries, stablecoin narratives, and custody-enabled products funnel large, steady demand into specific altcoins.

Put these together and you get a powerful setup: liquidity returns, business cycle improves, Bitcoin dominance rolls over, and institutions buy into ETH and other liquid alts. Coinbase expects a late Q3 (September) to early Q4 liquidity wave that could accelerate capital rotation — exactly the environment that creates explosive altcoin moves.

A practical checklist to watch (my playbook)

- Global M2 trend: Is money supply continuing higher? (If yes, odds favor BTC up next 8–12 weeks.)

- Macro signals: Watch Fed guidance, rate-cut expectations, and major market structure developments (bills, listing standards).

- Bitcoin dominance: A sustained roll lower from current levels is a primary trigger for broad altcoin outperformance.

- Breadth: Coinbase’s altcoin season index — move from ~40% toward 75% is the confirmation.

- On-chain flows: Stablecoin issuance, institutional ETH accumulation, and open interest spikes.

Conclusion — be ready, not reactive

Coinbase’s message is blunt: the plumbing for altcoin season is aligning. For anyone focused on crytocurency, bitcoin markets, that means prepare a watchlist, size positions with risk management, and monitor the four variables above regularly. A quick rotation into altcoins can make big moves in a matter of weeks — and history shows those windows reward readiness more than hindsight.

Final note: stay disciplined. If the macro or liquidity picture shifts, reassess. When altcoin season arrives, it often comes fast and wide — but it doesn’t last forever.

Coinbase Predicts Explosive Altcoin Season in September — crytocurency, bitcoin Outlook and How It Unfolds. There are any Coinbase Predicts Explosive Altcoin Season in September — crytocurency, bitcoin Outlook and How It Unfolds in here.