If you follow macro markets and Bitcoin, you already know the headlines move fast and the noise is louder than the signal. In this deep-dive I’ll walk you through one of the oldest, most trusted macro indicators—the copper/gold ratio—and why its multi-year bottom could be the single biggest macro signal fueling the next parabolic leg for Bitcoin. I’m DZ from Discover Crypto, and I’ll break down the history, the mechanics, the technicals, and the practical playbook so you can make smarter decisions in a noisy market. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

What this article covers — the roadmap

- Why the copper/gold ratio is a powerful macro indicator and how it connects to economic cycles.

- How the copper/gold ratio has historically preceded major Bitcoin bull runs.

- The current evidence that the ratio has formed a multi-year bottom and why that matters for BTC.

- Technical clues (like RSI divergence) to watch and how to interpret them.

- A practical action plan for investors and traders—what to do now and how to size positions.

- Risks, caveats, and counterpoints.

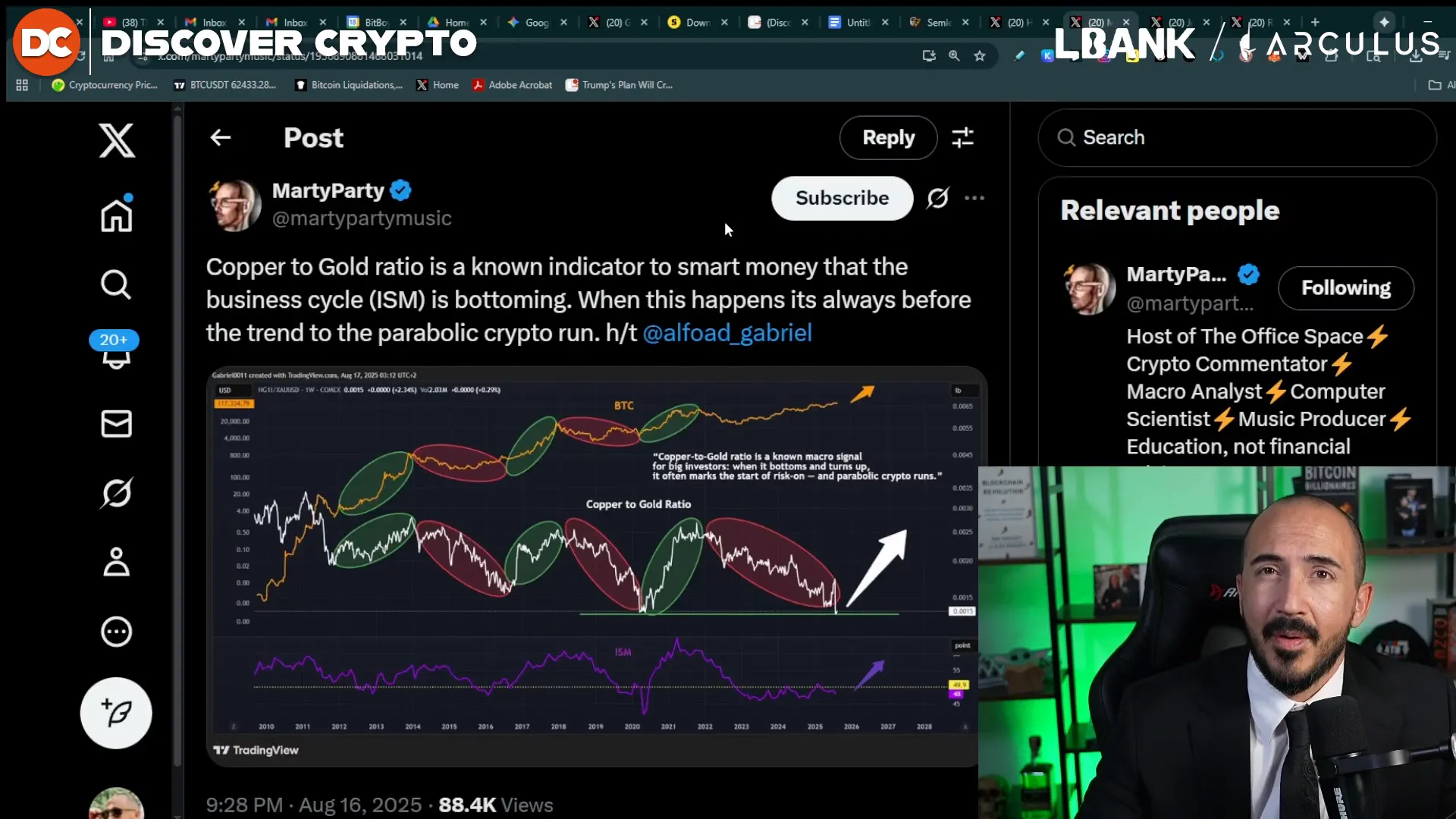

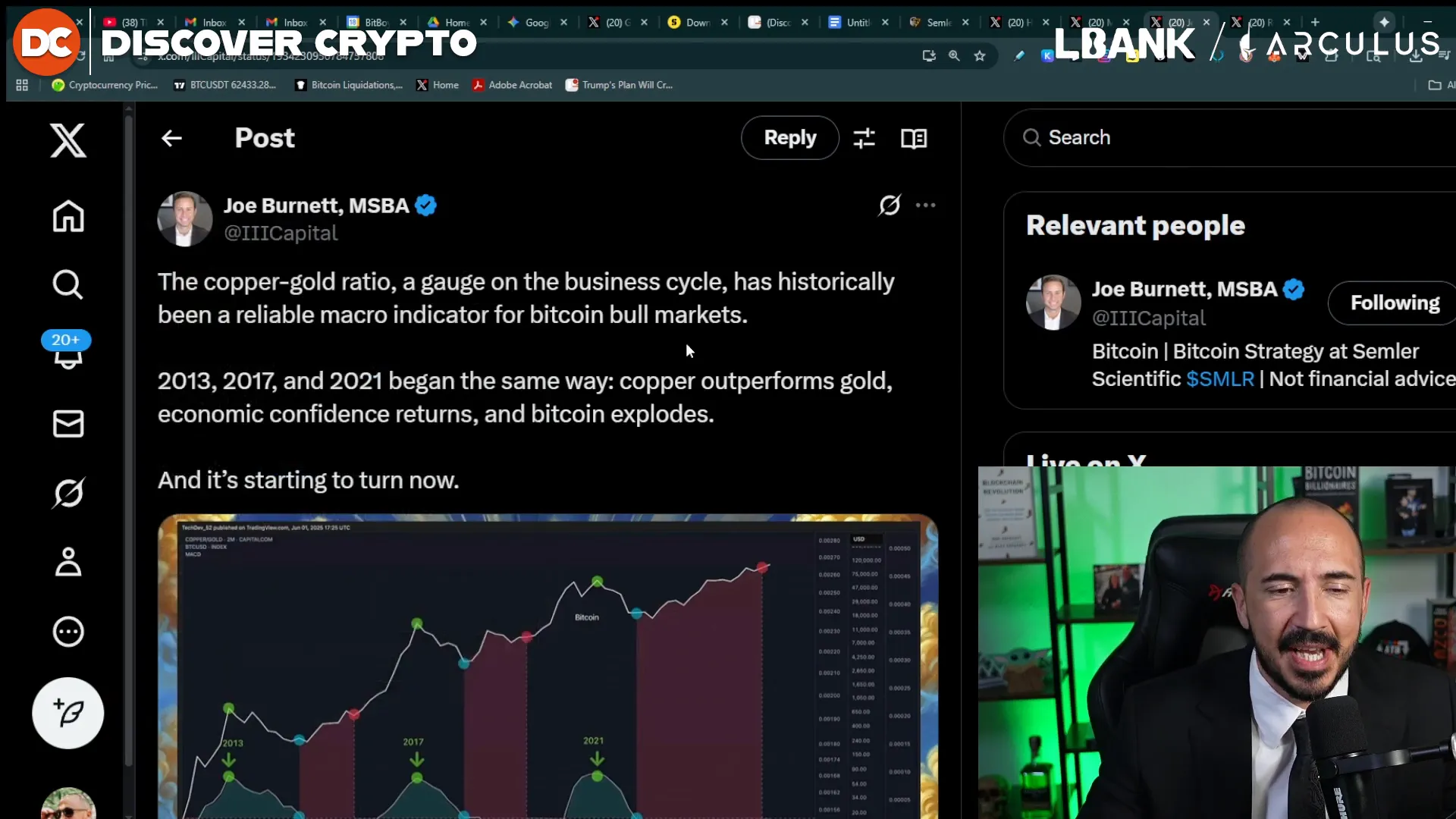

Throughout this article I’ll reference work from other analysts—big shout to Marty Pardy and Joe Burnett of Semler Scientific—and connect the dots between macro commodities and the digital gold narrative. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Why the copper/gold ratio matters

At its core, the copper/gold ratio is simple: it compares the market price of copper to the market price of gold. But simple doesn’t mean unimportant. Copper is the industrial metal—used in construction, electrical wiring, vehicles, renewable energy infrastructure, and industrial machinery. When economies expand and businesses plan capital investment, demand for copper rises. Gold, on the other hand, is the classic safe haven and inflation hedge. People buy gold when they expect instability, inflation, currency debasement, or economic uncertainty.

So the ratio acts like a market sentiment barometer: rising copper relative to gold = bet on growth; rising gold relative to copper = bet on uncertainty. Because the ratio integrates global demand expectations for both industrial output and safe-haven flows, it’s a practical, market-implied read on where the business cycle might be heading.

From an investor’s point of view, that matters for Bitcoin for two reasons. First, Bitcoin has behaved like a risk-on asset in recent cycles—when confidence returns, money rotates into risk assets and Bitcoin often outperforms. Second, when the macro narrative flips from fear to growth, more capital flows into risk-on markets, raising the odds of a strong BTC run. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Simple intuition: copper goes up when the economy grows; gold rises when people fear it won’t

Imagine a big infrastructure plan gets announced. Construction firms buy more copper, electrical contractors ramp up purchases, factories plan to expand—copper demand rises and so does its price. Now imagine geopolitical upheaval or runaway inflation. Investors shift into gold as a hedge and the copper/gold ratio falls. This interplay between industrial demand and safe-haven demand is precisely why the ratio is a favorite among macro managers and “smart money.”

Macro traders use this ratio as an early warning or early green light. When copper begins to outperform gold—even if both are volatile—the market is implicitly signaling that investors expect future growth. Put another way: the copper/gold ratio gives a forward-looking market signal about the probability of a sustained growth regime. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Historical evidence: copper/gold and Bitcoin cycles

What makes the copper/gold ratio so interesting for crypto investors is the repeated historical pattern. If you look at the major Bitcoin bull runs, the copper/gold ratio showed consistent behavior:

- It found a decisive bottom.

- Confidence returned to markets as the ratio rose.

- Bitcoin then entered a parabolic upswing.

Let’s walk through the key examples so you can see the pattern.

2016–2017: recovery, rising copper, and Bitcoin’s first major parabolic run

After the commodity bear-market pain earlier in the decade, copper started to recover around 2016. The copper/gold ratio climbed as industrial activity expectations recovered. Over that same period, Bitcoin moved from roughly $400 to over $1,000 during 2016, and then accelerated into 2017, eventually peaking near $20,000. The ratio’s recovery and Bitcoin’s rally were contemporaneous—copper outperformance coincided with a growing risk-on narrative and capital migrating into speculative assets.

That pattern—ratio bottom → rising ratio → Bitcoin parabolic—was one of the early signals that something structural was changing in markets.

2020–2021: post-lockdown recovery and the Bitcoin mega-rally

Fast forward to the COVID crash and the reopening trade of 2020: copper rallied strongly as the world exited lockdowns and governments rolled out fiscal stimulus and renewed infrastructure focus. The copper/gold ratio spiked, cash and credit were abundant, and risk appetite surged. Bitcoin moved from lows around $5,000 to an astonishing peak near $69,000 in 2021. Again, the ratio’s move preceded or coincided with the re-acceleration of the Bitcoin bull market.

Semler Scientific’s head of Bitcoin strategy, Joe Burnett, highlighted that the pattern in 2016 and 2020 aligned with Bitcoin’s jumps. The copper/gold ratio effectively kickstarted those bull runs. That’s not coincidence; it’s a macro signal reflecting growth expectations that spill into markets like equities, commodities, and crypto. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Why the correlation matters—top timing and cycle symmetry

It’s not just bottoms that matter. Historically, tops in the copper/gold ratio also mapped closely to peaks in Bitcoin cycles. The ratio’s strength ahead of a top suggests the market was in full-on growth euphoria, and when that euphoria crested, both copper relative to gold and Bitcoin’s price often peaked around similar times. That correlation gives traders a powerful cross-check: watching both the ratio and Bitcoin helps you spot when a cycle is maturing or when a trend is still gaining fuel.

Where we are now: a multi-year copper/gold bottom

Here’s the headline punchline: the copper/gold ratio has formed a multi-year bottom, and that matters because Bitcoin historically followed this pattern—ratio bottom followed by renewed confidence and a parabolic BTC move. But the current cycle has some nuanced differences that actually make the signal more interesting.

In the last three cycles, Bitcoin’s parabolic leg began after the copper/gold ratio bottomed. In this current cycle, copper has largely underperformed gold during much of Bitcoin’s recent rally. That’s unusual: Bitcoin is already in a strong uptrend while copper was still weak relative to gold. In plain terms, BTC began running before the broad macro signal flipped in favor of growth. If copper now confirms a bottom and turns up, it can act like a second wave of liquidity and confidence entering markets—and that second wave could be the fuel that drives Bitcoin into its next major top.

Joe Burnett pointed out that June’s bearish period looked like a local bottom, but that the ratio might have to test previous COVID lows before we could confidently call the macro bottom. Now, the pattern suggests that the copper/gold ratio is finally lining up, with bullish technical signals like RSI divergence in place that mirror previous cycle turnarounds. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Bullish RSI divergence: why technicians are excited

One of the technical pieces Joe and others flagged is RSI (Relative Strength Index) bullish divergence on weekly charts. Bullish divergence happens when price makes a lower low but the RSI makes a higher low. This is a classic sign that momentum is weakening on the downside and that buyers are stepping in earlier than price alone would suggest. In 2020, we saw a similar pattern: price made a lower low while RSI didn’t confirm that strength loss, and soon after the ratio—and markets broadly—reversed.

Bullish divergence doesn’t guarantee a runaway rally, but combined with a macro bottom in copper/gold, it becomes high-quality evidence that the macro regime may be shifting. If copper outperforms gold from here, capital that was previously cautious could rotate into risk assets—Bitcoin included. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

What this could mean for Bitcoin price targets

Analysts and managers who follow macro-to-crypto linkages often provide scenario ranges rather than single numbers. Based on historical cycle amplification and the potential for renewed macro rotation from bonds, cash, and gold-like assets into growth, some projections put Bitcoin’s target this cycle in a wide range—conservative to aggressive. Joe Burnett and others have referenced targets like $175,000 to $200,000 as plausible if the macro momentum fully rotates into growth and easy liquidity remains supportive.

It’s important to frame these numbers as scenario outcomes, not predictions. What could push BTC to those levels?

- Broad risk-on rotation supported by rising copper/gold ratio, signaling a global growth regime.

- Continued institutional adoption and accumulation by funds like Semler Scientific and others.

- Supply-side constraints in Bitcoin—halving cycles and long-term accumulation—combined with rising demand.

- Macro policy that keeps real yields low or negative—making alternative stores of value attractive.

All of these variables interacting could push Bitcoin into the low-to-mid six-figure territory this cycle. That said, the timing and the path there will likely include pullbacks and volatility. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

How the current pattern differs from prior cycles

Three key differences this cycle:

- Bitcoin started running while copper was still underperforming gold. In prior cycles, the ratio bottom came first.

- Institutional participation and narrative adoption are more mature now. Firms like Semler Scientific publicly plan massive bitcoin accumulation goals—Semler wants 100,000 BTC by 2027—and institutions like Morgan Stanley showing up as big shareholders change market dynamics.

- Macro policy and inflation dynamics are different: central banks tested aggressive tightening in recent years; the interplay between policy, growth expectations, and commodities is dynamic and must be monitored.

Because of those differences, the copper/gold bottom now can serve as a strong tailwind for a Bitcoin continuation rather than the single ignition source. If the ratio joins the party, leverage and momentum could drive an amplified move. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

How to monitor the copper/gold ratio yourself

Being proactive and able to interpret the ratio will help you make better trading and allocation choices. Here’s a practical checklist for watching the copper/gold ratio as part of a broader crypto and macro toolkit.

- Where to find the ratio: Many commodity platforms and charting services (TradingView, Bloomberg, Refinitiv) allow you to create a price ratio easily—use a copper futures contract divided by a gold futures contract or an index that tracks copper vs gold.

- Timeframes: Use weekly charts for macro signals and daily charts for tactical entries. Weekly candles smooth noise and show structural bottoms or tops more reliably.

- RSI and momentum: Look for bullish divergence on weekly RSI (price low vs RSI higher low). Also watch MACD crossovers and longer-term moving average behavior.

- Confirm with macro data: When the ratio turns up, corroborate with industrial data—PMI prints, manufacturing output, freight and shipment data, and commodity demand forecasts.

- Cross-check Bitcoin technicals: For a high-probability setup, you want both the ratio confirming a bottom and Bitcoin showing trend strength—higher highs, supportive volume, and favorable on-chain metrics like exchange outflows and increasing hodler balances.

Monitoring these tools in concert gives you a much clearer read than any single indicator. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Technical nuance: weekly candles and false bottoms

Markets are noisy and false bottoms happen. The ratio might bounce and then retest prior lows before making a durable reversal. That’s why weekly candles matter: they filter intraday noise and false positives. Also, wait for momentum confirmation—RSI divergence, rising weekly closes, and improving volume profile—before declaring a macro bottom. This reduces the risk of misreading a temporary countertrend. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Trading and investing implications — strategy options

Everyone’s risk profile is different. Below are practical allocation frameworks that reflect common risk appetites: conservative hodler, balanced investor, and trader. I’ll be transparent about my stance—I’m aggressively bullish and personally increase exposure when macro signals like the copper/gold ratio line up with technical confirmation. That said, here’s how to think about sizing.

Conservative hodler (long-term focus)

- Primary goal: preserve capital, accumulate over time.

- Allocation approach: dollar-cost average (DCA) into Bitcoin on a weekly or monthly cadence, increasing cadence modestly if the copper/gold ratio confirms a durable bottom.

- Risk management: maintain cash buffer, keep no more than 5–10% of liquid net worth in high-volatility assets if you’re risk-averse.

This approach benefits from long-term compounding and avoids the stress of market timing. If the copper/gold ratio flips up, consider increasing DCA amounts slightly, but avoid trying to “time the top.” Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Balanced investor (growth + safety)

- Primary goal: growth with risk controls.

- Allocation approach: maintain a diversified portfolio—equities, bonds, commodities, and a tactical allocation to crypto. If the copper/gold ratio confirms a bottom, gradually shift allocations toward risk assets including Bitcoin.

- Risk management: set strategic rebalancing rules, like quarterly rebalancing and sell-rules when Bitcoin outperforms by X% relative to portfolio target.

Balanced investors can use the copper/gold ratio as an early signal to increase exposure to risk assets incrementally instead of making large directional bets. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Trader / tactical speculator

- Primary goal: capture volatility and directional moves.

- Allocation approach: use technicals for entries and exits. Watch weekly confirmation on the copper/gold ratio, then trade BTC with clear stop-losses and profit targets. Consider option strategies to control risk and profit from skew in volatility.

- Risk management: never risk more than a small percentage of capital on any one trade; use leverage cautiously—macro signals can flip quickly.

Traders should be nimble. If the copper/gold ratio confirms and Bitcoin breaks key resistance with volume, a trader might take a more aggressive position size while running tight risk controls. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Practical action plan — what I’m doing and what you might consider

Below is a step-by-step action plan reflecting a blend of macro and micro execution. Use this as a template and adapt to your personal risk tolerance and time horizon.

- Confirm the macro flip: Watch weekly closes of the copper/gold ratio. I want to see two to three consecutive weekly closes above recent resistance with RSI picking up.

- Check Bitcoin confirmation: Look for BTC to hold key moving averages, break relevant resistances, and show increased on-chain accumulation—especially if institutions are publicly accumulating (e.g., Semler's stated goals).

- Scale in using DCA and tactical buys: Combine DCA for long-term exposure with tactical buys on confirmed breakouts. If you’re more aggressive, increase tactical allocation after macro confirmation.

- Use options or protected positions for leverage: Rather than using naked leverage, consider buying calls or structured products that define downside risk. This is cleaner risk management in highly volatile markets.

- Set pre-defined rules for trimming and rebalancing: Decide beforehand how you’ll take profits at major milestones—e.g., trim 10–20% at measured move targets—and rebalance back into safer assets on corrections.

I personally follow a hybrid approach: significant long-term BTC exposure plus tactical increases when macro indicators like copper/gold confirm a durable turn. When those indicators align, my conviction moves from “high” to “very high.” Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Risks and why the copper/gold signal is not a silver bullet

No single indicator is a guaranteed predictor. Here are the main risks and caveats to keep in mind before leaning too heavily on the copper/gold ratio:

- False positives and retests: The ratio can bounce and fail. Expect retests and possible false breakouts. Weekly confirmation helps, but nothing is perfect.

- Different drivers this cycle: Structural changes—like policy normalization, deglobalization, or technology shifts—might change the historical covariance between commodities and risk assets. What worked before might be weaker or delayed now.

- Supply shocks: Copper supply constraints or disruptions could drive the ratio independently of demand fundamentals. For instance, a supply-side shock could raise copper even if demand is weak, muddying the signal.

- Gold demand volatility: If gold demand surges for reasons unrelated to systemic fear (e.g., ETF flows from a new region), it could suppress the ratio even while growth expectations are intact.

- Policy shocks: Unexpected central bank moves, geopolitical crises, or fiscal surprises can change both commodity and crypto dynamics overnight.

Because of these risks, I treat the copper/gold ratio as a high-probability indicator to be used in concert with technicals and on-chain data—not as the only input. It’s powerful, but it's part of a suite of tools. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Common questions — quick answers

Does a rising copper/gold ratio always mean Bitcoin will go parabolic?

No. It’s neither necessary nor sufficient on its own. Historically it has preceded major bull runs, but it should be paired with BTC-specific technicals, on-chain fundamentals, and macro liquidity conditions to build a high-conviction trade.

How fast can Bitcoin move once copper/gold confirms?

Speed varies. In previous cycles the acceleration was swift once sentiment flipped—months rather than years. That said, macro rotations can happen in waves and sometimes take time to permeate through institutional allocation decisions. Expect volatility and prepare accordingly.

Should I sell my gold or buy copper directly?

Not necessarily. Directly trading metals adds commodity-specific risks. For most investors, using the ratio as a signal rather than trading the individual metals is the safer way to incorporate the indicator. If you trade metals, ensure you understand futures roll, storage, and counterparty risks.

What if the copper/gold ratio retests and breaks lower again?

Have a contingency plan. If the ratio re-tests and breaks lower, that’s a risk-off signal and could imply further pressure on risk assets. For traders, tighten stops or hedge. For hodlers, remind yourself that long-term investing tolerates short-term fluctuations—use dips to average if your thesis remains intact.

Wrapping up — a practical perspective

To bring it all together: the copper/gold ratio is a time-tested macro indicator that signals shifts in the market’s appetite for growth vs safety. Historically, when that ratio bottoms and turns up, major risk assets—Bitcoin among them—have often followed with powerful rallies. The current pattern is particularly interesting because Bitcoin began its run while copper was still underperforming gold; if copper now confirms a durable bottom, that could provide the macro fuel for a very sizable continuation of BTC’s rally.

That’s why I’m paying close attention and why I’m increasing exposure. Semler Scientific’s public accumulation plan, Joe Burnett’s research, and the technical signals like weekly RSI divergence all add to the evidence stack. Still, always remember to size positions rationally and use risk controls—nothing is guaranteed.

Big shoutouts where they’re due: Marty Pardy for highlighting this ratio and Joe Burnett at Semler Scientific for putting the research together and helping connect the macro dots to Bitcoin price action. And for anyone tracking this with me—see you at the top, whether it’s ingots of copper or packets of BTC. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Key takeaways

- The copper/gold ratio is a simple but powerful indicator of market expectations for growth vs safety.

- Historically, a bottoming copper/gold ratio has coincided with the start of Bitcoin’s major bull runs.

- The current cycle is unique: Bitcoin began running while copper lagged; if the ratio confirms a bottom now, it could provide significant additional upside for BTC.

- Watch weekly charts, RSI divergence, and on-chain/institutional accumulation to confirm the signal.

- Use the ratio as part of a broader toolkit—not the sole basis for investment decisions—and maintain disciplined risk management.

Thanks for reading. If you want to stay on top of macro signals and crypto moves, keep this indicator on your watchlist and combine it with price action, on-chain metrics, and sound allocation strategies. Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing

Bitcoin's Next Move REVEALED! (I'm ALL IN) — Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing. There are any Bitcoin's Next Move REVEALED! (I'm ALL IN) — Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing in here.