I'm Altcoin Daily — and in this breakdown I unpack why a small slice of global retirement assets, upcoming U.S. market-structure legislation, and real-world asset tokenization on Solana could set the stage for a huge Q4 in crypto.

Table of Contents

- Key takeaways

- Why $60 trillion in retirement funds matters for Bitcoin

- Market structure and the CLARITY-style legislation — timeline and implications

- Solana, RWAs, and the “DeFi + TradFi” future

- XRP ETFs: don’t forget October 2025

- Putting it together: consolidation, capitulation, and the next leg up

- Final thoughts

Key takeaways

- Bill Miller IV argues that 1% of $60T in retirement assets flowing into Bitcoin could add roughly $30k per BTC.

- Simple math (and tight circulating supply on exchanges) suggests even smaller inflows can cause outsized price moves.

- The CLARITY-style market structure bill has a clear Senate timeline — lawmakers expect to finish this year, which could unlock institutional flows.

- Solana is rapidly tokenizing real-world assets (RWAs), and XRP ETF decisions are likely to be pushed to October 2025.

Why $60 trillion in retirement funds matters for Bitcoin

Investing veteran Bill Miller IV recently pointed out a striking statistic: there’s roughly $60 trillion parked in global retirement accounts today — and those accounts currently have essentially zero allocation to digital assets. If even 1% of that $60T found its way into Bitcoin, Miller argues it could boost Bitcoin’s price materially (he estimates roughly $30k per BTC).

This idea is simple but powerful: a small percentage of a massive pool of capital moving into a relatively constrained asset can produce outsized price impact. Put another way, one percent of $60T is about $600 billion — meaningful relative to Bitcoin’s market cap.

How the supply side amplifies inflows

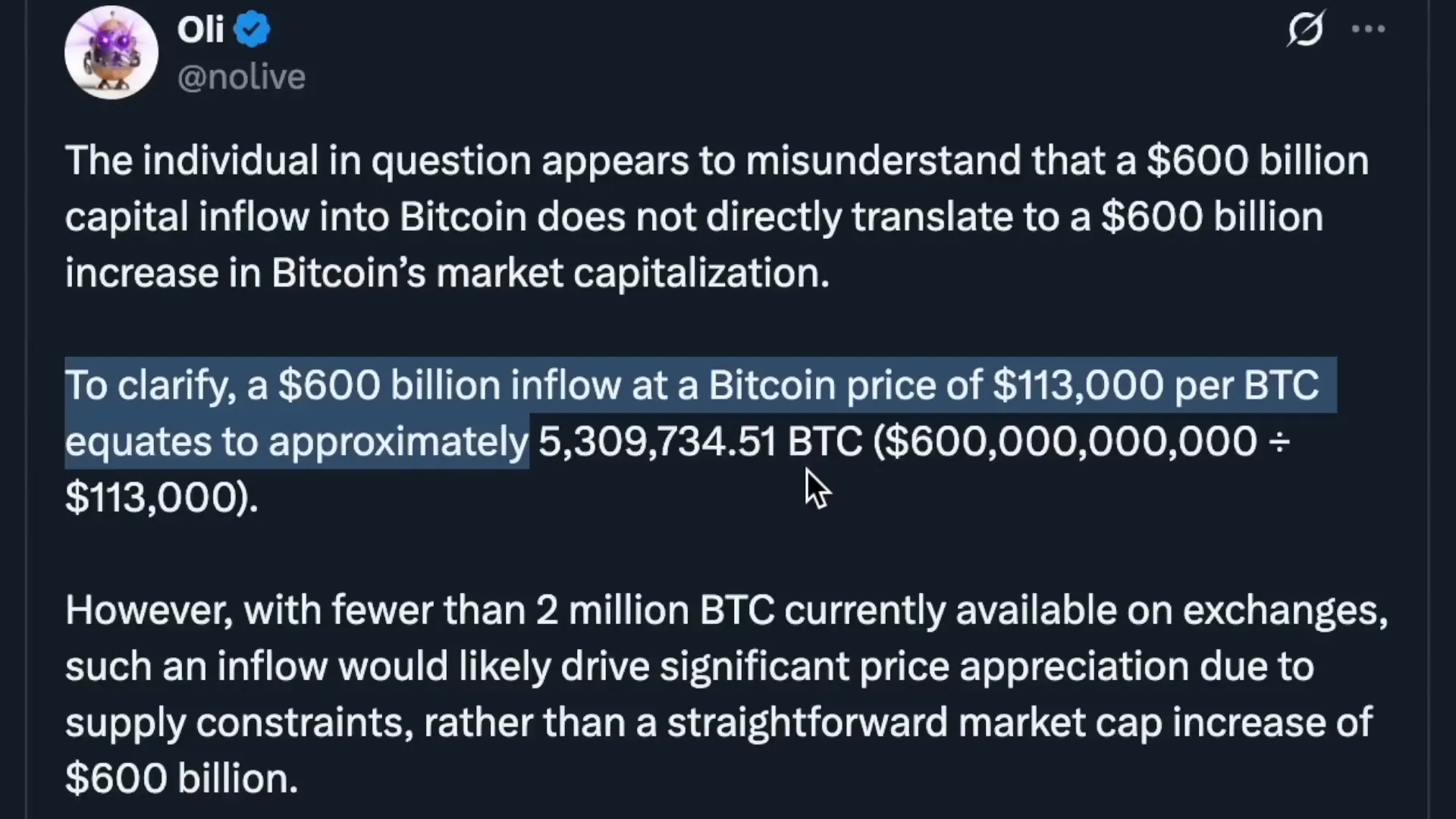

That $600B thought experiment assumes liquidity is available. In reality, much of BTC is hodled — large holders and institutions are not actively selling. At the price levels referenced in the argument (around $113k/BTC in the example), a $600B bid would imply buying over five million BTC. But fewer than two million BTC sit on exchanges today.

So the real takeaway: a sizable retirement-fund allocation wouldn't just inflate market cap linearly — it would hit supply constraints and likely trigger sharp price appreciation as bids chase limited liquid supply.

Market structure and the CLARITY-style legislation — timeline and implications

Legislative clarity matters. Senator Cynthia Lummis and other lawmakers have been moving a market-structure package designed to clarify regulatory roles (SEC, CFTC) and create guardrails for spot markets. The Senate timeline discussed aims to get the bill out of the banking committee by the end of September, have the agriculture committee work the CFTC portion in October, and send it to the president’s desk before year-end — with optimism for before Thanksgiving.

Why does this matter? Market-structure clarity is a prerequisite for trillions of institutional dollars to participate. When government bodies codify who regulates what and how products like ETFs and custody can operate, large retirement plans, endowments, and sovereign funds can build allocative frameworks around crypto.

Solana, RWAs, and the “DeFi + TradFi” future

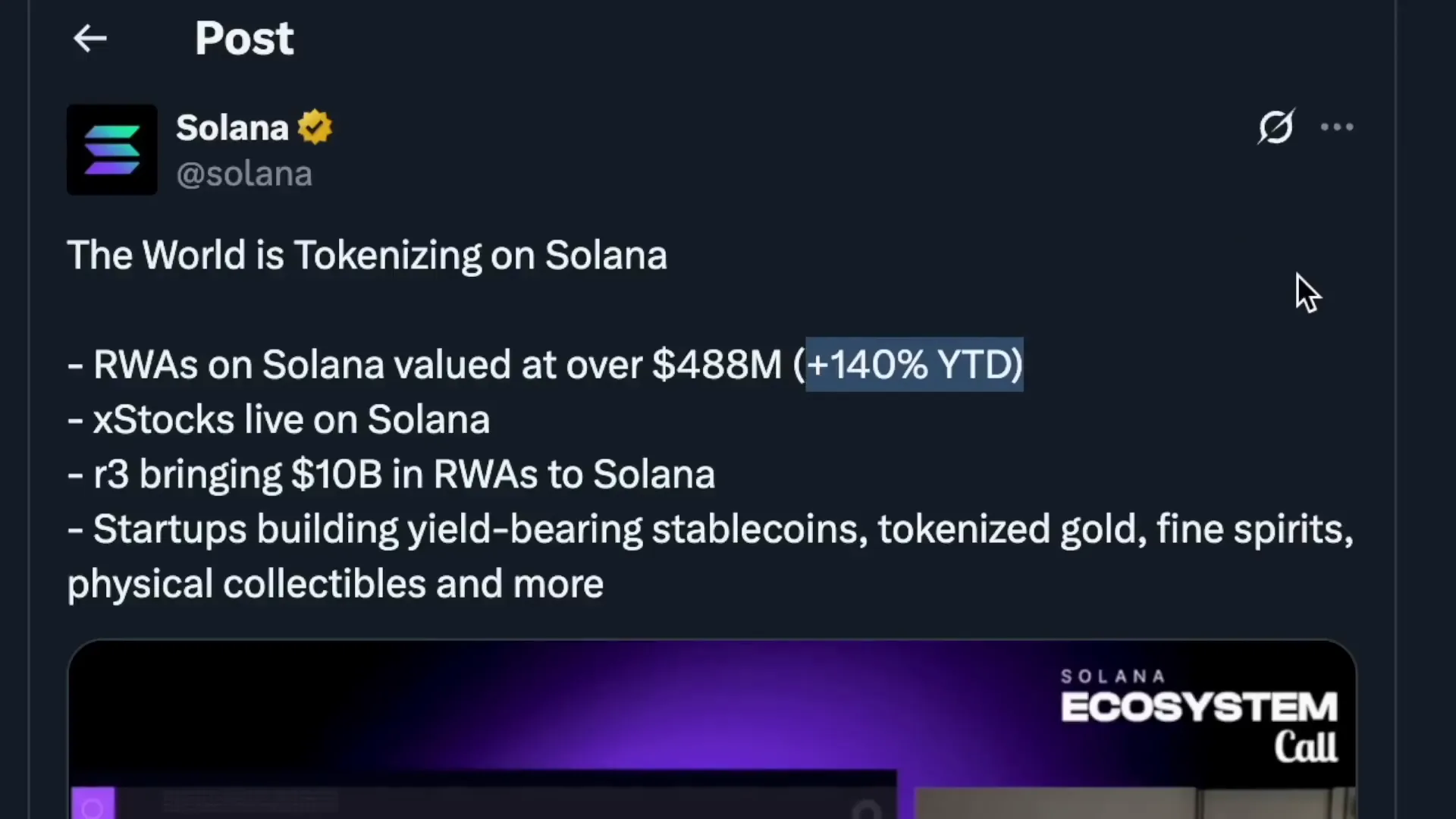

While BTC grabs headlines, other ecosystems are building the plumbing for mainstream finance. Solana’s growth milestone shows real-world assets (RWAs) on-chain up over 140% year-to-date, approaching roughly $500M in tokenized assets. Tokenized stocks (Tesla, Apple, etc.) and projects pursuing multi-billion-dollar RWA pools are becoming real and show how DeFi and TradFi can converge.

This is the thesis I’ve repeated: the future isn’t DeFi versus TradFi — it’s DeFi plus TradFi. Internet-native assets plus tokenized real-world assets create a unified, global market that can unlock new liquidity and use cases.

XRP ETFs: don’t forget October 2025

On the regulatory front, the SEC has delayed decisions on multiple spot XRP ETF filings. The review window extensions point to revised deadlines in October 2025 — notably October 18th for Grayscale’s XRP Trust and October 19th for Cboe’s 21Shares XRP Trust. These milestones matter for XRP traders and for sentiment across markets heading into Q4 next year.

Putting it together: consolidation, capitulation, and the next leg up

Historically Bitcoin consolidates before major upward moves — before ETF approvals, before big regulatory milestones, even before elections. We’ve seen dips and consolidations that shake out weak hands and concentrate supply into stronger hands. Combine that market behavior with potential institutional allocations from retirement funds, plus clearer market structure and tokenization progress on altchains, and the ingredients for a strong Q4 are present.

That said, nothing is guaranteed. Regulatory delays, macro shocks, or a mismatch between buyer interest and available liquidity could produce different outcomes. Always weigh risk, diversify, and consider time horizons.

Final thoughts

- Bill Miller’s math highlights why institutional and retirement capital matters — even a small allocation can move markets.

- Supply constraints on exchanges mean inflows may have exaggerated price effects.

- Watch the Senate timeline for market-structure legislation and the October 2025 ETF deadlines for XRP.

- Tokenization on Solana shows the broader trend: financial assets moving on-chain, combining DeFi and TradFi.

We’re still early. If you’re positioning for the next cycle, focus on fundamentals, regulatory developments, and liquidity dynamics. Expect consolidation, but be ready — meaningful capital flows could change the market quickly.

Note: This is opinion and educational content, not financial advice. Do your own research and manage risk appropriately.

Bitcoin, crytocurency, bitcoin: Why $60T in Retirement Funds Could Push BTC to New Highs. There are any Bitcoin, crytocurency, bitcoin: Why $60T in Retirement Funds Could Push BTC to New Highs in here.