Welcome to a deep dive into the current state and future potential of the cryptocurrency market. The landscape of Bitcoin, crypto, BTC, blockchain technology, and investing continues to evolve, and today we focus on a subtle but powerful trend: altcoins quietly gaining strength while the market appears to be consolidating. Whether you’re a seasoned trader, a casual investor, or simply curious about CryptoNews and the latest movements in the digital asset space, this comprehensive guide will equip you with the insights and strategies you need to navigate the market effectively.

We’ll explore key technical patterns, review major altcoins like Ethereum, Cardano, Chainlink, Avalanche, and Dogecoin, and look at what these movements could mean for your investment strategy. Let’s get started.

Market in Consolidation: Why This Is the Time to Build a Strategy

For many investors, the cryptocurrency market has felt frustratingly sideways lately. We’ve seen bursts of excitement—sharp rallies and dips—but these have been followed by extended periods of consolidation and sideways price action. This kind of market can be boring, even discouraging, but it’s also a crucial phase where smart investors prepare for the next big moves.

The current market feels like one of the most consolidative we’ve seen in a while. This means prices are trading in relatively tight ranges, with low volatility compared to previous explosive cycles. It’s easy to get bored or impatient, but the real opportunity lies in using this time to build a strategic plan.

Many traders miss out on the next large pump because they assume the sideways trend will continue longer than it actually does. When the market shifts, it can catch people off guard. That’s why I emphasize preparation now. The altcoins, in particular, look poised to make significant moves in the near to mid-term, alongside Bitcoin’s anticipated rally to the $130,000 to $140,000 range — a target that, percentage-wise, is quite reasonable from current levels.

If you’re interested in altcoins, now is the time to set your sights and prepare your trades accordingly.

Channel Partner Spotlight: Blofin Exchange Overview

Before diving into the charts and technical analysis, I want to highlight our channel’s exchange partner, Blofin. Blofin is one of the fastest growing cryptocurrency exchanges globally, offering no KYC requirements, deep liquidity, and fast execution speeds.

What I appreciate most about Blofin is its wide selection of trading pairs across both futures and spot markets. Since 2023, when many exchanges tightened KYC policies, I’ve personally been trading on Blofin without issues such as downtime or transaction delays. It’s one of the few exchanges I genuinely trust and recommend.

If you’re interested in joining Blofin, check out the link in the description below. They’re offering a deposit bonus of up to $1,000 (with some conditions), so be sure to read the details carefully.

Altcoin Market Holding Key Support: The TOTAL2 Chart

Now, let’s get into the technicals that suggest altcoins are quietly gaining strength. One of the key charts I follow is the TOTAL2 chart, which tracks the total market capitalization of altcoins, excluding Bitcoin.

This chart has formed one of the cleanest “cup and handle” patterns I’ve seen in crypto markets—a classic bullish technical setup. A cup and handle pattern typically signals a continuation or reversal to the upside, with a measured move that can be quite significant.

In this case, the pattern suggests a potential move from around $1.5 trillion in altcoin market cap up to the $3 trillion range. The crucial level to watch is the $1.33 trillion mark, which we want to see flip from resistance into support. We’ve seen a bounce from this level and some consolidation, which is encouraging. As long as altcoins hold above this key support, there is room for more upside.

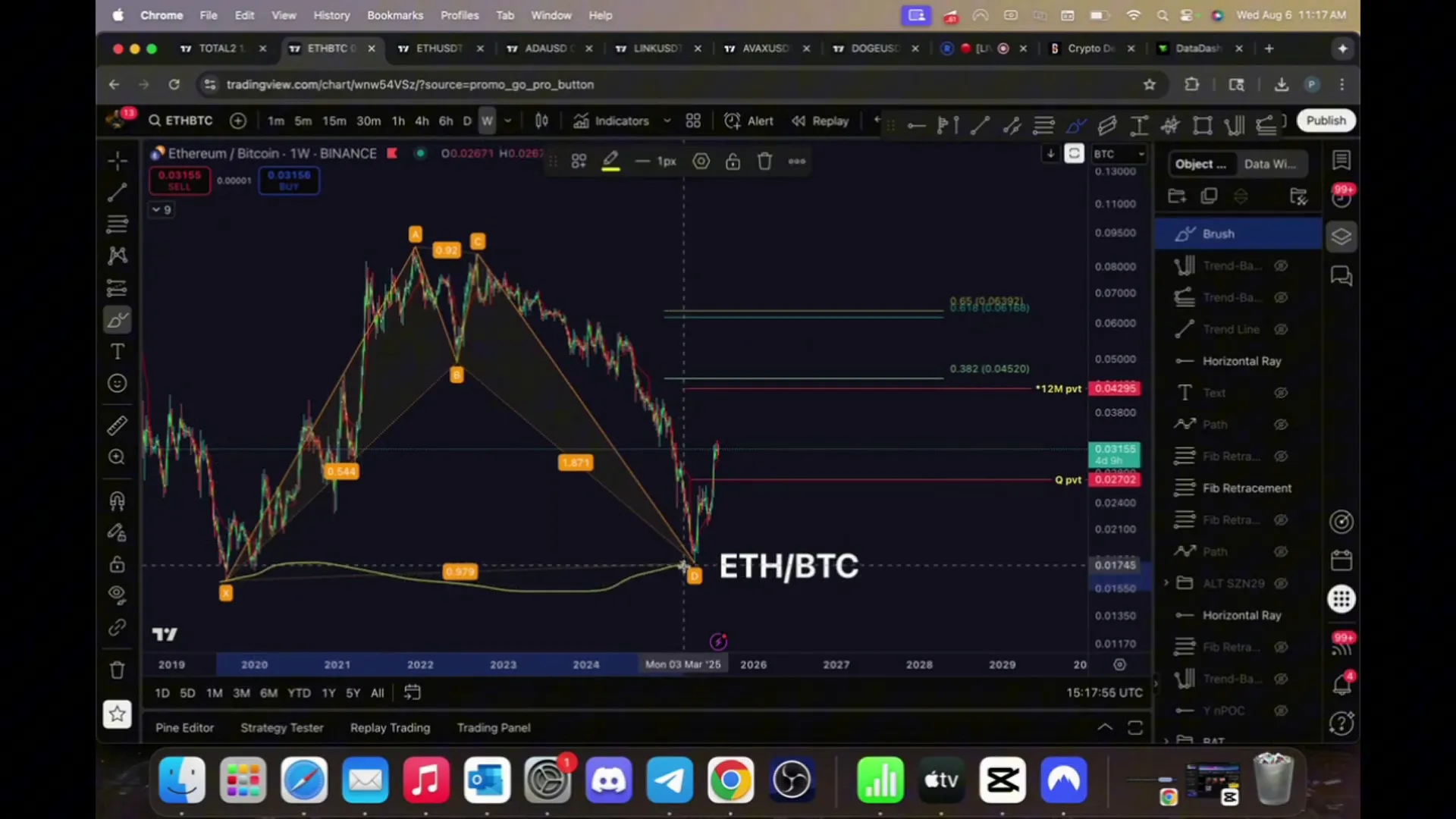

ETH/BTC Ratio Signals Potential Altcoin Strength

A second chart reinforcing the bullish outlook for altcoins is the ETH/BTC pair on the weekly timeframe. This ratio compares Ethereum’s performance relative to Bitcoin, and it’s a powerful indicator of altcoin strength.

We’ve been watching a harmonic pattern here—a sophisticated technical setup based on Fibonacci sequences—that has taken about six years to form, from 2019 through 2025. The pattern’s completion zone was targeted for March 2025, and we appear to have bottomed just a month later in April.

This harmonic pattern suggests a full-blown bullish reversal is underway for Ethereum relative to Bitcoin. Ethereum has already rallied over 100% from the lows, and several altcoins have followed suit. While some retracements have occurred, the overall trend remains positive.

Key targets for the ETH/BTC ratio include the 0.382 Fibonacci retracement level and an untapped yearly pivot, both of which align around the same price zone. It’s important to note that this is a long-term pattern and could take a year or more to reach these targets. Patience and strategic positioning will be essential.

Is Ethereum on Track for New All-Time Highs?

Ethereum began August trading near $4,000, and its monthly pivot—calculated as the average price from the previous month—served as a key target during this period. The price dipped toward that pivot, marking a roughly 15% pullback, which I consider a “red day” and a potential buying opportunity for larger-cap assets like Ethereum.

While the dip wasn’t the absolute bottom, it was a healthy correction in the context of a broader uptrend. The critical level to watch now is around $3,700 to $3,800. If Ethereum stays above this zone, it’s on decent track to test all-time highs again.

However, if Ethereum breaks below this support, we may need to look for lower levels before resuming the uptrend. For now, the technical structure supports a continuation higher, with monthly targets just above current prices and the potential to surpass previous all-time highs.

Cardano (ADA): Mid-Term Outlook & Long-Term Target Zones

Cardano’s chart is a bit muddier than others, but there are still promising signs. There’s a defined buy zone around the 10 to 15-cent level, which we recently tested. Since then, Cardano has been forming a series of higher lows and higher highs—a classic bullish structure that hints at upward momentum.

Looking ahead to the midterm, I’m eyeing resistance levels around $1.18 (monthly NPOC) and the 0.382 Fibonacci retracement level from previous cycles. These are realistic targets within the next several months, potentially delivering nearly 200% gains from current prices.

Longer-term, Cardano could push toward $3.36 and even $5.30 if the market heats up significantly. These are not short-term targets but rather projections for a strong bull market extending into late 2025 or beyond. The ETH/BTC ratio’s long-term bullish pattern supports this possibility, suggesting Cardano and other altcoins could follow Ethereum’s lead.

Chainlink (LINK): Preparing for a Potential Range Breakout

Chainlink has been range-bound for a while, trading between roughly $14 and $21. While this might sound boring, it’s actually a healthy consolidation phase that can precede a breakout.

On a more local timeframe, Chainlink is forming a small uptrend with higher lows and higher highs. The key level to hold is around $14, which aligns with a “gold pocket” Fibonacci retracement zone. If Chainlink can hold this support and break above $21 resistance, the next targets would be $38 and eventually the all-time high near $54.

This setup suggests a potential breakout is brewing, but confirmation will come once Chainlink flips the $21 level decisively. Until then, trading within the range remains the prudent approach.

Avalanche (AVAX): Key Resistance at $26 — What to Watch

Avalanche is exhibiting a very similar pattern to Chainlink, with a sizable range between roughly $14 and $26. Price action has repeatedly tested the upper resistance and then pulled back to the point of control (POC), which is a key support area.

While trading in this range, I’m willing to take some risk by adding positions near the lows and potentially adding more if we see a bounce from the POC. The critical level to watch is $26—flipping this resistance into support would open the door for a strong run toward $54 to $76, and potentially even higher.

These targets represent significant upside—100% to 250% gains from current prices—and should not be overlooked by investors looking for growth in altcoin portfolios.

Dogecoin (DOGE): Signs of Compression Before a Move

Dogecoin, the “king of the memes,” has been relatively quiet lately, trading in a sideways box that I’ve highlighted as a buy zone between roughly 10 and 15 cents. We dipped near the bottom of this zone recently, around 13 cents, which was a good opportunity to accumulate.

The key level to watch now is 28 cents. Flipping this resistance would likely trigger a move back toward 40 to 56 cents, and in a strong altcoin bull market, Dogecoin could even reach $1.20—a roughly 600% gain from current prices.

While these targets are ambitious, it’s important to remain patient and wait for the market to confirm strength by breaking above key resistance levels. Until then, sideways trading and compression might continue.

Putting It All Together: What This Means for Bitcoin, Crypto, BTC, Blockchain, and Investing

Altcoins are quietly building momentum while many investors focus mainly on Bitcoin. The consolidation phase we’re experiencing is a natural part of market cycles, offering a strategic window to prepare and position for the next leg up.

Here are some key takeaways for investors and traders interested in Bitcoin, crypto, BTC, blockchain, CryptoNews, and investing:

- Patience is crucial: Market moves, especially in crypto, can take time. The ETH/BTC ratio harmonic pattern took six years to form and may take another year or more to reach its targets.

- Look for technical setups: Patterns like cup and handle on the TOTAL2 chart, harmonic reversals on ETH/BTC, and defined buy zones on altcoins provide concrete levels to watch and trade.

- Focus on key levels: Support and resistance zones such as $1.33 trillion market cap for altcoins, $3,700-$3,800 for Ethereum, $26 for Avalanche, and $28 for Dogecoin are critical for confirming trend direction.

- Diversify within altcoins: Ethereum remains the anchor, but Cardano, Chainlink, Avalanche, and Dogecoin offer compelling mid- to long-term opportunities.

- Use consolidation periods wisely: These quieter phases are ideal for strategic planning and accumulating positions on pullbacks rather than chasing rallies.

By integrating these principles into your investing approach, you can better navigate the complex crypto ecosystem and position yourself for potential gains as altcoins gain strength alongside Bitcoin.

Exclusive Access and Tools for Serious Investors

For those serious about trading and investing in Bitcoin, crypto, BTC, blockchain, and altcoins, I offer a comprehensive educational experience through DataDash Pro. This platform provides daily updates, exclusive charting insights, educational content, and direct access to my trading strategies.

Members also benefit from:

- Real-time market analysis and trade alerts

- Educational academy covering technical analysis, chart building, and crypto fundamentals

- Chart requests and personalized guidance

- Access to a vibrant community of traders and investors

If you want to elevate your trading game and stay ahead of the curve, consider joining DataDash Pro at datadashpro.com.

Remember, investing in cryptocurrencies involves risk. Always do your own research and consult with financial advisors if needed. But with the right tools and knowledge, you can make informed decisions that align with your financial goals.

Here’s to smart investing and capturing the opportunities the crypto market has to offer!

Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing: Altcoins Are Quietly Gaining Strength — Here's What You Need to Know. There are any Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing: Altcoins Are Quietly Gaining Strength — Here's What You Need to Know in here.