By Josh (Crypto World)

Key takeaways

- Bitcoin has confirmed multi-timeframe bearish divergences (4H/Day/Weekly) and is showing short-term weakness — expect potential further downside to the $110k–$112k area if key supports fail.

- Ethereum is underperforming Bitcoin (ETHBTC) and is currently respecting a daily bearish divergence; a tactical short is in place with staged profit-taking around $4,100 and $4,000, and stronger support near $3,900.

- Bitcoin dominance is bouncing slightly on the 3-day chart — that short-term bounce is typically unfavorable for altcoins until it resolves.

- Altcoins like Solana, XRP and Chainlink are showing early signs of rejection and potential pullbacks; identify zone-based supports and trade with a plan.

- Risk management: scale out on support levels, keep stops tight and consider hedging; volatility creates both risks and opportunities.

My goal here is simple: walk you through the current technical structure across Bitcoin and major altcoins, explain why I am positioned the way I am, and share the exact trade management approach I’m using so you can learn a repeatable method for trading bearish and choppy markets.

Why this update matters — the big-picture view

I'm Josh, and I trade the market’s structure and momentum. Right now we are in a situation where the charts that matter (4H, Daily, Weekly for Bitcoin) are all signaling caution. The broader market narrative many are repeating — immediate, relentless upside to new all-time highs — is being challenged by real technical evidence: confirmed bearish divergences across multiple timeframes and liquidity sweeps that suggest sellers are active.

When you combine Bitcoin losing short-term support levels with ETH underperforming on ETHBTC and a temporary bounce in Bitcoin dominance, the setup becomes clear: the market is likely to see more weakness in the short-to-mid term, and that means opportunities for disciplined traders. I’ll explain the evidence and how I’m trading it.

Structure of this article

- Understanding the Bitcoin structure (multi-timeframe divergences)

- Short-term targets, liquidity, and where I expect support

- Why I shorted Ethereum — the thesis and active trade plan

- Bitcoin dominance and how it impacts altcoins

- Altcoin breakdowns (Solana, XRP, Chainlink) and trade ideas

- Exact trade management: entries, scaling, stop placement, and how I secure profits

- Psychology, risk controls, and a repeatable process

- Final thoughts and action checklist

Understanding the Bitcoin structure (multi-timeframe divergences)

Let’s begin with Bitcoin because it sets the tone for everything else. The market is interconnected: when BTC shows multi-timeframe weakness, alts usually follow. Here's what I’m seeing on the charts:

Weekly framework

The SuperTrend remains green on the weekly chart — a reminder that structural momentum can remain intact while price corrects. However, the weekly RSI has been showing lower highs while price made higher highs. That’s a classic weekly bearish divergence. Divergences on the weekly chart aren’t a short-term signal — they indicate reduced bullish momentum and a higher probability of a multi-week or multi-month slowdown or correction.

What does this mean in plain terms? Even if the tape is bullish in the short run, at the weekly level bulls are losing vigor. That translates to increased chance of a prolonged consolidation or a pullback into the weeks ahead. It’s the kind of environment where you want to be prepared to trade both directions, or at least protect existing long exposure.

Daily and 3-day confirmation

I don’t trade off the weekly alone. On the daily and 3-day charts we have confirmed bearish divergences as well — daily price made higher highs while the daily RSI made lower highs. On the 3-day chart the MACD has drifted bearish. The point is simple: multiple timeframe tools all telling the same story materially increases the odds that price action will favor the bears, at least for the coming days to weeks.

When multiple timeframes converge on the same bias it’s not certainty, but it is probability. As traders we plan around probabilities and prepare for multiple outcomes while sizing positions in a way that survivability and repetition are prioritized.

Short-term targets and liquidity levels — where to watch

Price is currently rejecting at the exact resistance level I’ve highlighted on my charts. We retested ~117k and rejected, and the immediate support level that matters now is ~115k. If we confirm daily candles below 115k, the next major target zone I’m watching is roughly 110k–112k. I’m defining this as a support zone because price previously reversed relative to resistance in that area — meaning it has historical relevance to market participants.

Liquidity sweeps are also important. The liquidation heat maps show we just wiped out the liquidity at ~114k and earlier we cleared the area just above 115k. That means nearby liquidity that could fuel a quick mean reversion bounce is gone, which increases the chance of a continued leg down to the next pooled liquidity — which is in that 110k–112k window. Always watch the liquidity heat map when planning intra-range plays; the market hunts it.

So — immediate plan for Bitcoin:

- If price holds above 115k with bullish momentum, expect choppy consolidation and possible retests of 117k as resistance.

- If we get daily closes below 115k, target 110k–112k next, and be ready for possible overshoots if liquidity gets swept lower.

- If a four-hour bullish divergence forms and confirms, it could give a short-term bounce candidate — but don’t assume it reverses the daily/weekly bias.

Why I shorted Ethereum — the thesis explained

Ethereum is exhibiting the textbook signs of underperformance against Bitcoin and USD. Here’s the core of my short thesis:

- Daily bearish divergence on ETHUSD: price made highs near ~4.8k–4.9k while daily RSI formed lower highs and then we confirmed downside with red candle closes.

- ETHBTC is also bearish — Ethereum is underperforming Bitcoin. That’s a separate structural signal telling us that if Bitcoin backtracks, ETH often moves more aggressively lower.

- Bitcoin’s own weakening backdrop and a slight bounce in BTC dominance compounds the risk for altcoins like ETH.

When these signals align — ETHUSD daily divergence + ETHBTC underperformance + BTC weakness — you have a high-probability short setup. That’s precisely the scenario that prompted me to take a short position on ETH.

Trade execution and management — my exact approach

I initiated a short on Ethereum once Bitcoin broke below the level I was watching and ETHBTC kept showing relative weakness. The trigger was a breakdown below a key Bitcoin level (that 117k level) and the confirmation of ETH daily bearish entries (the two red candle closes I wait for to confirm momentum shift). Let’s walk through the trade plan I used and why.

Entry rules I use for shorts

- Confirm bearish divergence on the daily (no guesswork — wait for the confirmation candles).

- Confirm breakdown in related correlation (BTC breakdown and ETHBTC weakness).

- Enter on a pullback to a resistance flip or on clear momentum continuation after the breakdown.

How I size and manage the trade

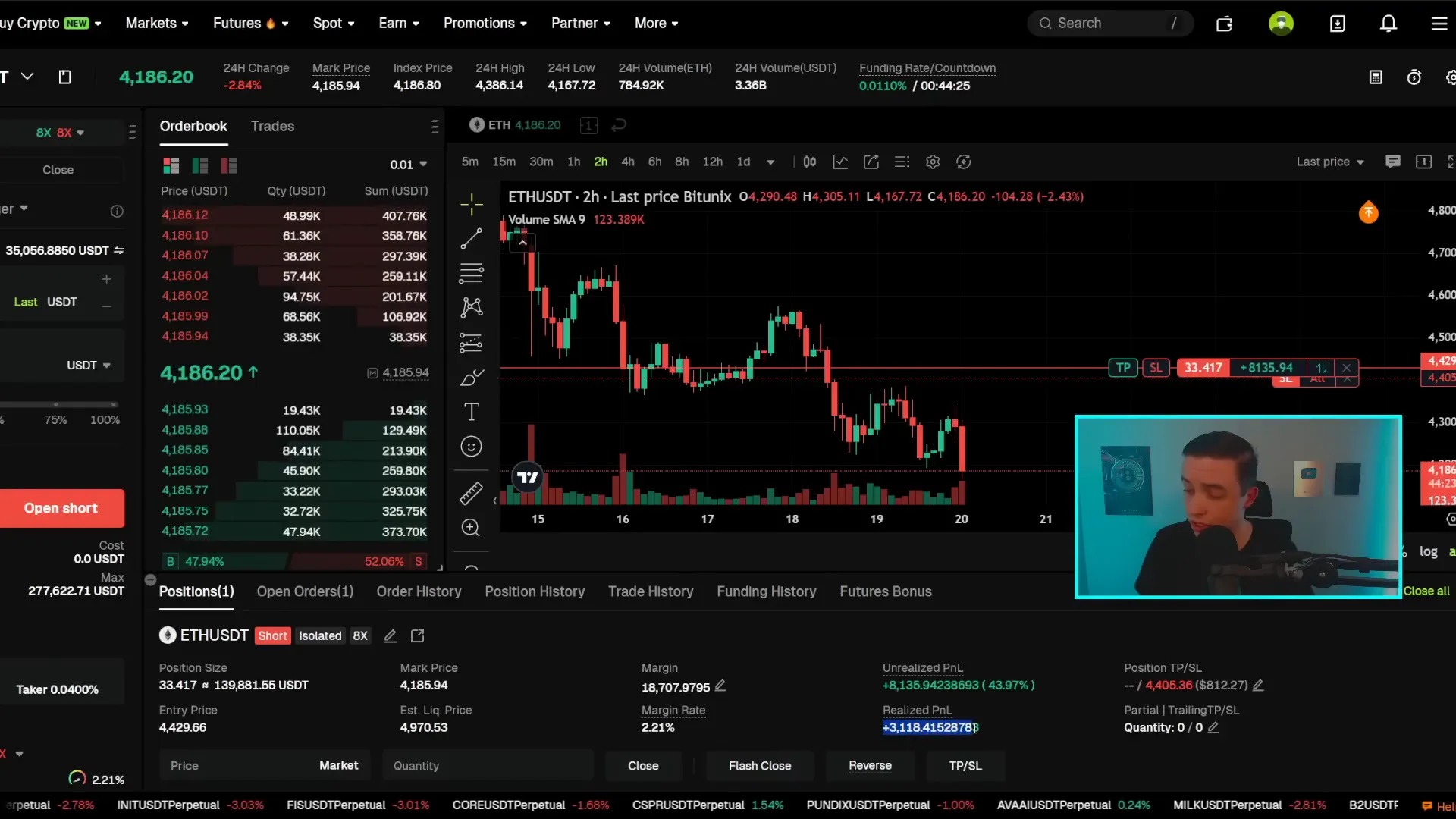

My active ETH short is currently about a $140,000 notional position. I did not go “all-in.” I scaled in and am managing the trade by taking profits at pre-defined support areas and tightening stops as the price moves in my favor. This is how I structure it:

- Initial partial size at entry with a stop above a technical resistance level — risk per trade sized to risk tolerance.

- As price moves in favor, take partial profits at my first support target (~4.1k–4.2k). This secures gains and reduces position risk if the market bounces.

- Let remaining size run to stronger support levels (3.9k and below) with trailing stops tightened into profits.

- If price unexpectedly rallies and invalidates the thesis (e.g., strong reclaim above the initial resistance), close or flip bias quickly to prevent larger drawdowns.

At the time of this update, this Ethereum short delivered quick gains: several thousand dollars realized within a day and meaningful unrealized profits. I then trimmed exposure at potential support levels to lock in gains while preserving the ability to profit if the move continues. This two-step approach — secure profits early while retaining upside to the move — is how I create a risk-managed, “win-win” outcome where the worst-case scenario after scaling becomes a net profit.

Bitcoin dominance — why it matters and what it’s telling us

Bitcoin dominance measures BTC's market cap relative to the rest of the crypto market. Right now, on the 3-day chart, we’re seeing a slight bounce in dominance. What that typically means in practical terms:

- If dominance rises (BTC outperforms alts), altcoins often suffer short-term pullbacks because capital rotates into BTC.

- If dominance drops (alts outperform), altcoins can rally even if BTC is flat.

We have a possible bullish divergence forming on the 3-day dominance chart, but it hasn’t confirmed yet. If that dominance bounce breaks and confirms, we can expect a short-term weakening in the altcoin market. That’s another reason I kept a bearish tilt on ETH and several other altcoins — a rising dominance is rarely friendly to broad altcoin strength.

Altcoin watchlist — Solana, XRP, Chainlink

Now let’s break down the key altcoins I’m watching. Each of these has its own structure and support/resistance zones. Treat them individually but read the market's mood from Bitcoin and dominance first.

Solana (SOL)

On the 2-day timeframe, Solana failed into a resistance zone around $190–$200 and is now pulling back. The immediate short-term support sits near $167–$170. If that level breaks, the next supports are around $156–$157, with major support further below between $143–$146. The overarching takeaway: if BTC and ETH continue to fall, SOL is likely to show weakness as well, and the resistance zone near $190–$200 is a reliable place to flip bias to the short side on a confirmed rejection.

XRP

XRP has been showing a weekly bearish divergence for some time — the weekly RSI made lower highs while price made higher highs. On the daily chart, since the break below $3.40, XRP’s structure has turned more bearish. Expect resistance on any bounce roughly at $3.10–$3.15 and heavier resistance between $3.35–$3.40. Immediate support is around $2.90 to $3.00; a confirmed break below $2.90 would expose $2.75 and then a larger zone around $2.55–$2.62.

The similarity to earlier price action this year is important. Similar structures often produce similar outcomes unless new macro catalysts intervene. So the path forward is likely more consolidation or pullback until a clear structural reclaim occurs.

Chainlink (LINK)

LINK’s daily picture is interesting: the larger structure still looks bullish (higher highs, higher lows), but right now the asset is retesting its prior resistance zone around $24–$25 which could flip into support. If that level holds, the bulls can remain in control. If we confirm a daily close below $24, that would increase the likelihood of a deeper pullback toward $20–$21, and a confirmed break below $20 would be more problematic and could open lower ranges.

Also pay attention to the RSI: a lower-high RSI improving while price forms a higher high would be a bearish divergence. Currently there's a potential divergence forming, but it’s not yet confirmed. Confirmations matter — waiting for them reduces false signals and emotional trades.

Exact trade management: entries, scaling, and stop placement

Trading is easy to conceptualize and hard to execute. The difference is risk control and disciplined trade management. Here’s my repeatable framework that you can apply in volatile markets like this one:

1) Define the thesis and time horizon

Before you enter any position, write down the reason for the trade and the expected time horizon. Is it an intra-day scalp, a swing trade to run for days, or a position that will last weeks? My current ETH short is a swing-style trade with intraday scaling and weekly context.

2) Identify structural levels

Plot key support and resistance across timeframes — 4H, Daily, Weekly. Use liquidity clusters, prior reaction zones, and horizontal levels that represent many participants’ mental price anchors. These are where you will set entries, take-profits, and stops.

3) Entry execution

Avoid market-timing perfection. I prefer staged entries:

- Initial entry: partial size at an actionable signal (breakdown, pullback to resistance, or momentum continuation).

- Add-on entry: if confirmation appears and momentum convicts the move, add the remaining planned size.

4) Scaling out and stop logic

- Take partial profits at first predetermined support (capture early gains and reduce emotional exposure).

- Move stop to breakeven once a reasonable portion of the trade is in profit.

- For the remaining size, trail stops into profit or take additional profits at major wider support zones.

5) Use an expected outcomes matrix

Before entering, list three outcomes — best case, base case, worst case — and plan actions for each. If price behaves like the best case, execute planned scale-outs. If it’s the base case, secure profits and move stops. If the worst case happens, accept the loss swiftly and account for the trade (Journaling reduces repeated mistakes).

Position sizing and risk (practical rules)

These rules are not optional; they are designed to let you survive and trade again:

- Risk no more than 1–2% of account capital per trade on initial risk (adjust based on your risk tolerance).

- Use margin/leverage conservatively. Leverage multiplies both gains and losses — use it only if you understand the math.

- Scale into larger positions rather than risking an outsized single entry. That allows you to chase lower prices without blowing up your account.

- Keep a running log of realized profits and losses; if you’re ahead, lock in gains systematically.

Examples from current trades — practical application

Concrete examples help translate theory to practice. Below are the decisions I made and why — note that these are not trade calls for you to follow blindly, but rather teaching examples.

Ethereum short example

Reasons for entry:

- Daily bearish divergence confirmed.

- ETHBTC trending lower (relative underperformance).

- BTC broke key support (117k) and liquidity sweep cleared near-term buy-stops.

Management decisions:

- Initial partial entry at the momentum breakdown.

- Take ~20–30% off at the first support (around $4.1k–$4.2k).

- Trail stop above a recent swing high once partial profits are realized.

- Hold the remaining size to test $3.9k and consider adding a small scale if we see continuation and liquidity to the downside.

Psychology: this was a confident trade because all signals aligned. I still used conservative sizing and partial profit-taking to remove emotional pressure and ensure I was not forced to make irrational decisions if price snapped back.

Solana example

Plan:

- If SOL retests $190–$200 and shows rejection (wicks, bearish candles), consider a short with small size.

- Target $167–$170 for partial profit; then $156–$157 and $143–$146 as deeper targets if BTC continues lower.

- Stop above the $200 handle or above the local swing high depending on entry precision.

Chainlink example

Plan:

- Watch $24–$25 closely. If it holds as support with reversal structure, consider small bull size with tight stops.

- If $24 breaks on daily close, consider short exposure targeting $20–$21.

- Be ready to bail if volatility spikes without structural confirmations.

Reading liquidity and the liquidation heat map

Liquidity maps are one of the best ways to visually understand where the market’s stops and orders are stacked. When the market sweeps a liquidity cluster it often triggers rapid moves as algorithms and retail stops are hit. Here’s how I incorporate this tool:

- Identify recent stacked liquidity zones (areas with tight stops and many market orders). These are often near previous swing lows/highs or round numbers.

- Watch for liquidity sweeps; if the market takes out a cluster quickly, expect momentum to follow because stops fuel the move.

- Adjust support/resistance assumptions after liquidity is cleared — a swept area leaves a vacuum that can lead to continuation until the next liquidity pool is found.

We recently swept liquidity just above 115k and around 114k; that explains why momentum accelerated and why the next logical resting place is in the 110k–112k zone. Put simply: when liquidity is gone, price has fewer nearby buffers and can move more freely.

What to watch next — the event checklist

Here are the actionable items I’m watching and why they matter. Think of this as your radar for the next few trading sessions:

- Daily candle closes relative to 115k for BTC — below that and the path to 110k–112k becomes much more probable.

- ETH daily closes relative to $3.9k–$4.1k — hold and bounce, or break and accelerate lower.

- BTC dominance 3-day — confirmation of the bullish divergence would likely keep alts under pressure until it resolves.

- Chainlink holding $24 or breaking it — determines whether LINK stays range-bound or accelerates downside.

- Volume spikes on breakdowns — confirmation that moves are real and not low-volume fakes.

Common questions and clarifications

“Isn’t shorting risky in a bull market?”

Yes, if you treat it as the new permanent reality. But markets are cyclical and bullish long-term narratives do not negate short-term corrections. You can short in a bull market if you manage risk, size properly, and have clear stop rules. Many strong bull markets still have sharp pullbacks — our job as traders is to plan for them.

“Why not just hold long and wait for new highs?”

Holding long is a valid strategy for investors with long time horizons. As a trader, I am capitalizing on price inefficiencies and volatility. Both approaches can be profitable — they just require different risk profiles and mindset. The key is to be honest with yourself about which approach you are following and to execute the plan consistently.

“What if macro news suddenly changes everything?”

Always be prepared. Macro news and on-chain events can change sentiment quickly. That’s why I keep tight stops and scale out positions. If a macro surprise invalidates a trade, I take the loss and move on — preserving capital is paramount.

Practical checklist before placing trades

- Have the thesis written down: what are you trading and why?

- Identify key levels (entry, targets, stop) across 4H, Daily and Weekly.

- Size the trade such that initial risk is within your bankroll rules.

- Set alerts for the level(s) you’ll use to scale or to cancel the plan.

- Execute partial entries if necessary and plan staggered exits.

- Log the trade in your journal after closing with clear notes on rationale and emotional state.

How to trade both directions — the mindset

Think of markets as neutral. Profit opportunities exist in both directions. The goal is not to be right all the time — it’s to have a process that makes small mistakes infrequently but wins big when probability accumulates in your favor. Here are a few mindset rules I follow:

- Detach from being “right.” Daily markets are noisy.

- Make decisions based on structure and confirmation, not opinions.

- Be ready to change the plan if price invalidates your thesis.

- Lock in profits early and let the rest run with a trailing method.

Where speculative traders often fail — and how to avoid it

Speculative traders tend to fail for four primary reasons:

- Poor position sizing: risking too much on a single trade and being wiped out by a normal market retracement.

- Lack of plan: entering trades without clear entries, targets, or stop rules.

- Chasing: entering after the move has already corrected substantially against the initial direction.

- Poor emotional control: holding onto losing positions hoping they’ll turn without evidence.

To avoid these pitfalls, always set your risk before entry, use a journal to track performance, and adopt a process where you control what you can — trade selection and risk — and accept what you cannot — short-term news and randomness.

Actionable game plan for the next week

Here is a compact, tactical plan you can follow if you want to align with my current bias. This is not financial advice — it’s a practical approach to managing trades in a weakening market environment.

- Bitcoin: monitor 115k daily candle close. If it breaks, reduce long exposure and consider short intraday trades to 110k–112k with tight stops above 115k.

- Ethereum: maintain short bias while price remains below recent swing resistances. Take partial profits at $4.1k–$4.2k and trail for $3.9k and lower.

- Solana: look for rejection at $190–$200 for short setups; targets at $167 and $156 with stops above $200 or the local high.

- XRP: watch $2.90 as immediate support. If it breaks, prepare for a move toward $2.75 and then $2.55–$2.62.

- Chainlink: defend $24; if broken on daily close, prepare short exposure to $20–$21.

Final perspective — how to profit when others panic

Opportunity is often greatest when many are convinced the market should move only one way. Right now, the structural signals suggest more short-term risk than reward for blind long positions. That creates a window for disciplined traders to make meaningful profits by trading structure and diverging from crowd emotion.

My approach is simple: analyze the charts, confirm signals across multiple timeframes, size positions conservatively, scale out at logical levels, and always protect capital with disciplined stops. That’s how I turned ambiguity into repeatable outcomes: by planning for multiple scenarios and letting probability play out in my favor.

Keep your mindset sharp, trade from evidence not emotion, and always remember that volatility equals opportunity if you prepare for it.

Stay disciplined. Trade safe, and check the charts daily. If you want to develop a repeatable trading routine, treat every trade as a learning opportunity and journal the results.

Next steps you can take right now

- Review your charts and add the levels discussed above to your watchlist.

- Set alerts for the critical levels (BTC 115k, ETH $4.1k and $3.9k, SOL $167, LINK $24).

- Write down your trade thesis before you enter your next trade.

- Practice position sizing with a demo account if you’re unsure about leverage.

If you follow a structured method, the market will reward your preparation. Remember: in trading, being prepared is the same as having an edge.

BITCOIN, Crypto, BTC, Blockchain, CryptoNews, Investing — Emergency Market Update and Tactical Trade Plan. There are any BITCOIN, Crypto, BTC, Blockchain, CryptoNews, Investing — Emergency Market Update and Tactical Trade Plan in here.