If you’re deep into the world of Bitcoin, Crypto, BTC, Blockchain, and all things CryptoNews and Investing, then buckle up. We’ve got some major updates for the Ripple RLUSD fam and the broader crypto community that you absolutely need to know. From a hot new global bank partnership with Ripple’s RLUSD stablecoin to looming tariff deadlines shaking the entire crypto market, there’s a lot on the table right now. And trust me, it’s anything but boring.

Whether you’re an XRP holder, a crypto trader, or just someone keeping an eye on the crypto ecosystem, this detailed breakdown will help you understand the current market dynamics, upcoming regulatory events, and what to watch for in these next crucial weeks. So grab your drink, hydrate in between, and let’s dive in.

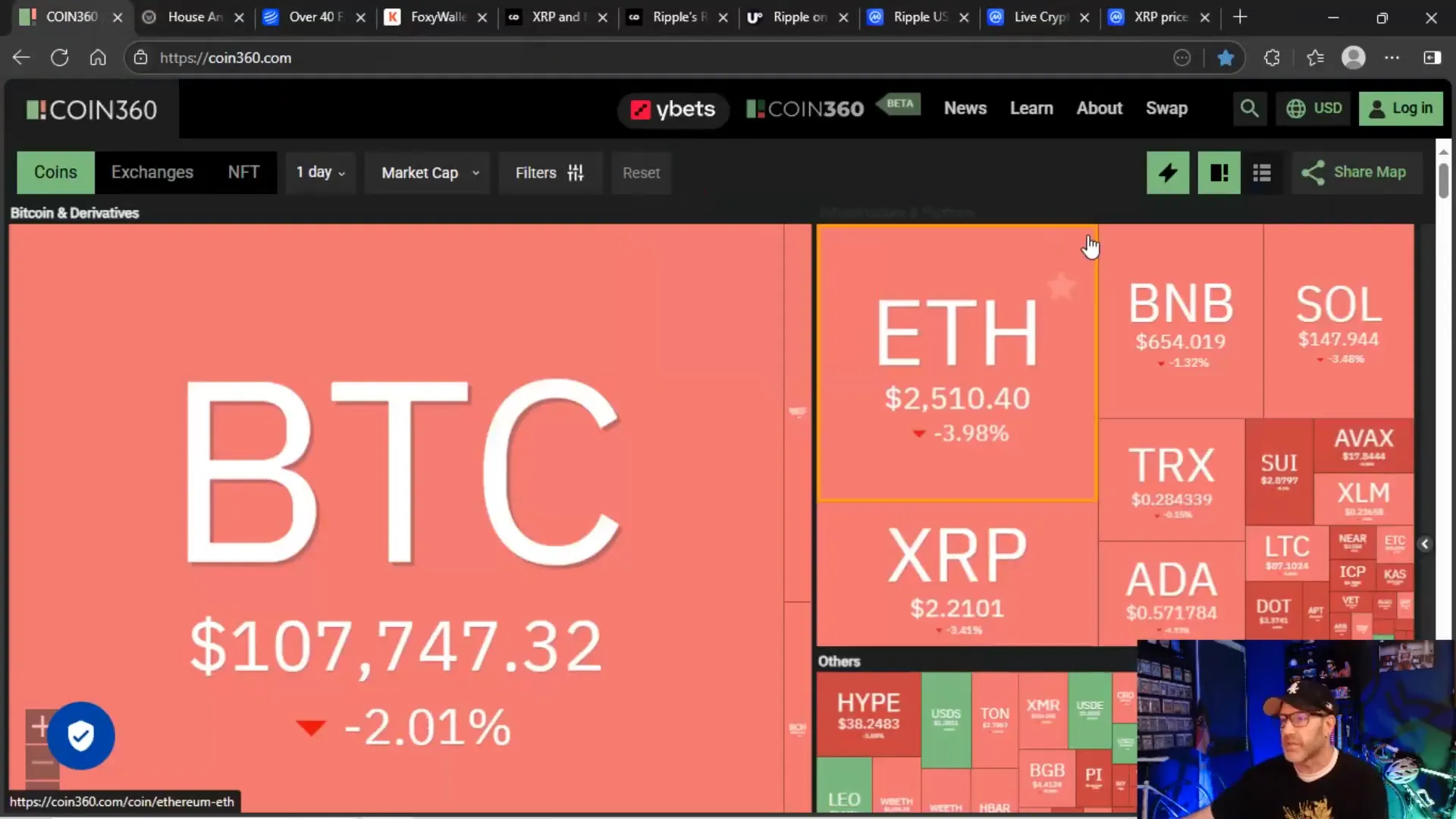

The Crypto Market in the Red: What’s Causing the Dip?

First things first, the crypto market is currently showing red across the board. Yes, even the big players like Bitcoin and Ethereum are feeling the heat. But some altcoins are really taking a beating. Take Pi Coin, for example, which is now well under fifty cents. Then there’s ADA, sitting at about fifty-seven cents, and that’s rough for holders. This widespread dip isn’t random — it’s directly tied to an impending tariff deadline that’s looming over the market like a dark cloud.

If you forgot about the tariff deadline, don’t worry — I didn’t. It’s my job to keep you in the loop on these critical events that affect crypto price action. The market jitters are real because the current ninety-day tariff reprieve is set to expire on July 9th. That’s less than a week away, and traders are getting nervous about what might happen if new tariffs kick in.

Let’s break down why tariffs matter so much to crypto markets. When tariffs increase, it can lead to a short-term bump in inflation. Inflation scares the Federal Reserve, and Jerome Powell, the Fed Chair, has stated that higher inflation means they can’t lower interest rates anytime soon. For crypto, which is considered a risk asset, higher rates mean less appetite for risk, and that usually translates to price drops and lower trading volumes.

Tariffs, Trade Wars, and Their Ripple Effect on Crypto

Remember when we had that ninety-day tariff reprieve? It was a temporary pause on escalating tariffs between the U.S. and its trading partners. The hope was to negotiate deals before the deadline, but as we approach July 9th, it looks like not everyone has come to an agreement. President Trump announced upcoming tariff letters to key trading partners, outlining potential tariffs ranging anywhere from 10% to a staggering 70%. This has reignited fears of a prolonged trade war, and the crypto market is reacting accordingly.

Why does this matter for crypto? Because tariffs affect global trade, which impacts economic growth and inflation. If tariffs increase, inflation goes up short-term, and the Fed tends to keep interest rates higher for longer. Higher interest rates make borrowing more expensive and reduce liquidity in the market. Crypto, being a volatile and speculative asset class, often suffers in such an environment.

So, traders are watching the tariff deadline like hawks. If deals get done, we could see a relief rally. If not, expect more downward pressure. It’s a classic risk-on versus risk-off scenario playing out in real-time.

Crypto Week and Regulatory Developments: What to Expect

Adding more fuel to the fire, the week of July 14th is being dubbed “Crypto Week.” Why? Because the U.S. House Committee on Financial Services and its subcommittees are set to discuss three major crypto bills. These bills could shape the regulatory landscape for crypto, stablecoins, and digital assets for years to come.

This is huge. The outcomes of these discussions will tell us:

- What the pain points are in crypto regulation

- How soon we can expect new regulations

- Whether these bills will even pass, and if so, in what form

One of the most watched pieces of legislation is the stablecoin bill. There’s a lot of speculation about whether it will pass cleanly or if lawmakers will add amendments (“junk”) that could delay it further by sending it back to the Senate. Either way, Crypto Week promises to be a pivotal moment for the industry.

Stay Safe: Beware of Fake Crypto Wallet Extensions

Before we get deeper into market analysis, here’s a quick but crucial warning for anyone using Firefox for crypto transactions. Security firm Koi recently uncovered more than 40 fake crypto wallet extensions on Firefox’s plugin store. These malicious extensions impersonate popular wallets like Coinbase, Metamask, OKX, Bitget, and Ethereum Wallet, among others.

If you use Firefox, be extremely careful installing wallet extensions. Always verify the source, check reviews, and stay updated on security news. The crypto space is lucrative, and where there’s money, hackers, scammers, and schemers are never far behind.

Ripple’s RLUSD Stablecoin Scores Big: Partnership with AMINA Bank

Now for some good news amidst the uncertainty: Ripple’s USD-backed stablecoin RLUSD is making waves with a new integration at AMINA Bank. This is a significant milestone as AMINA Bank becomes the first global bank to adopt RLUSD into its infrastructure.

Why does this matter? AMINA Bank offers comprehensive custody and trading services tailored specifically for institutional clients. This partnership broadens the utility of RLUSD and highlights the growing importance of regulated stablecoins in institutional crypto adoption.

What’s more, this partnership operates under the supervision of the New York Department of Financial Services (NYDFS), emphasizing compliance and transparency. This is exactly the kind of institutional-grade adoption Ripple has been aiming for with RLUSD, helping to bridge traditional finance and crypto.

RLUSD Market Cap Approaching Half a Billion Dollars

RLUSD is not just making headlines for partnerships—it’s also growing rapidly. The stablecoin is nearing a significant milestone: a half a billion-dollar market cap. Currently, RLUSD sits around $485 million in market value.

Interestingly, the vast majority of RLUSD is minted on the Ethereum blockchain, with roughly 80% or so of the supply running there. This shows where many players prefer to operate their stablecoins, although many in the Ripple community would love to see more RLUSD minted on the XRPL (XRP Ledger) itself.

Regardless, this growth reinforces the strength of the Ripple ecosystem and its stablecoin ambitions as more institutional players get involved.

Market Overview: Altcoin Season, Volume Drops, and Price Action

Looking at the broader crypto market, altcoin season is sitting at about 24 out of 100, meaning we’re not in full altcoin bull mode but not dead either. Institutional money inflows have been encouraging, but overall trading volume is starting to taper off heading into the July 4th weekend.

Volume is a key metric here. The total crypto market volume dropped about 32% from the previous day, settling around $95 billion. Bitcoin briefly touched $110,000 before pulling back, and Ethereum, Binance Coin, Solana, and XRP all show similar patterns of declining volume and sideways price action.

Speaking of XRP, its trading volume has been hit even harder—down 51% in the last 24 hours. This suggests that despite the exciting RLUSD partnership news, XRP price movement is still being dominated by macroeconomic factors like tariffs and regulatory uncertainty.

XRP’s price has been range-bound between approximately $2.10 and $2.30. Every time it pushes up to $2.30, profit-taking kicks in, sending it back down. This “friend zone” range has been frustrating for many holders, but it also indicates solid floor support compared to some other altcoins that are bleeding more severely.

Will XRP Hold the Line This Weekend?

With the July 9th tariff deadline fast approaching and Crypto Week just around the corner, expect trading volumes to plunge over the weekend. Traditional finance is heavily influencing crypto markets right now, and with lower liquidity, price swings could become more pronounced or subdued.

The key question is whether XRP can hold above the $2.10 support level during this low-volume period. If it does, that’s a positive sign of resilience. If it breaks below, we might see more downside before any major catalyst arrives.

Looking Ahead: What to Watch in Mid-July and Beyond

The next week and a half is shaping up to be a rollercoaster for crypto investors. Here’s what to keep your eyes on:

- July 9th Tariff Deadline: Will countries finalize trade deals or let tariffs ramp up? The answer will move the markets hard either way.

- Crypto Week (Week of July 14th): U.S. House Financial Services Committee discussions on crypto bills will provide clarity on potential regulations and stablecoin legislation.

- Stablecoin Bill Outcome: Will it pass cleanly or get bogged down with amendments? This will impact stablecoin adoption and regulatory certainty.

- Macro Economic Data: Watch for further Fed commentary, inflation data, and job reports that influence interest rate policy and risk sentiment.

One thing is clear: Jerome Powell and the Fed have more ammunition to hold rates higher for longer if tariff concerns persist. The recent strong job report only supports this stance, suggesting the economy can handle higher rates without immediate recession risks.

That means crypto’s fate is tied closely to these macroeconomic and geopolitical factors in the short term. But don’t lose sight of the bigger picture: rates, ETFs, and regulations are all expected to converge in the third quarter heading into a potentially juicy fourth quarter filled with opportunities.

Why XRP Is Still a Bright Spot

While some cryptos are struggling, XRP remains on the “good list” for many investors. The Ripple ecosystem’s partnerships, especially with RLUSD gaining traction, give XRP a solid foundation that many other altcoins lack right now.

Contrast this with ADA, where even Charles Hoskinson is reportedly considering moving $100 million worth of ADA into Bitcoin and “staples” (stable, reliable cryptos like BTC and major stablecoins) because he sees more upside there. Imagine what would happen if someone said the same about XRP—it would be a roasting session for sure.

XRP’s ability to hold strong support and maintain institutional interest sets it apart in the current market environment.

Final Thoughts: Staying Ahead in a Volatile Market

We’re in a unique moment where traditional finance, geopolitical tensions, and crypto innovation intersect. The tariff deadline on July 9th and Crypto Week in mid-July will be key inflection points that could set the tone for the rest of the year.

For investors and traders, this means staying informed, watching trading volumes, and understanding that short-term price swings may be more about macro issues than crypto fundamentals. Stablecoins like RLUSD gaining bank adoption show that institutional crypto adoption is still on track, even if the market is a bit jittery now.

As always, be cautious with security—especially if you use browsers like Firefox, given the recent discovery of fake wallet extensions. Protect your assets and only use trusted platforms.

And finally, keep your eyes on XRP. With solid partnerships and a strong community, it remains a crypto to watch as we navigate these choppy waters.

Happy investing and stay tuned for more updates. And yes, someone please send me some Portillo’s to celebrate the wins!

XRP RLUSD 🔥🔥HOT BANK PARTNERSHIP NEWS🔥🔥 – What It Means for Bitcoin, Crypto, BTC, Blockchain, CryptoNews, and Investing. There are any XRP RLUSD 🔥🔥HOT BANK PARTNERSHIP NEWS🔥🔥 – What It Means for Bitcoin, Crypto, BTC, Blockchain, CryptoNews, and Investing in here.