If you’ve been following the crypto world lately, you’ve probably noticed a fascinating and somewhat frustrating trend: despite South Korean banks’ strong affinity for XRP, they’re choosing to launch their own stablecoin instead of leveraging XRP for payments. Meanwhile, Coinbase stock is surging, and Federal Reserve Chair Jerome Powell is signaling a new era of crypto legitimacy. What’s really going on behind the scenes? And what does this mean for Bitcoin, Crypto, BTC, Blockchain, and the broader investing landscape? Let’s break it all down with a clear, no-nonsense take that cuts through the hype and hopium.

This deep dive pulls no punches and brings you the good, the bad, the happy, and the sad news from the crypto trenches. Buckle up.

Why Did Korean Banks Reject XRP and Go Their Own Stablecoin Route?

South Korea’s banking giants have been some of XRP’s staunchest supporters. So why the sudden pivot to creating their own won-based stablecoin? This question is at the heart of crypto conversations right now. The answer? It boils down to stability, control, and regulatory comfort.

Eight of South Korea’s major commercial banks—including KB Kookmin, Shinhan, Woori, NongHyup, IBK, Suhyup, Citibank Korea, and SC First Bank—recently announced they are joining forces to prepare a won-backed stablecoin. Their goal is to establish a global stablecoin presence while strengthening national digital currency capabilities. This consortium model will operate independently from any central bank digital currency (CBDC) initiatives.

Why not just use XRP, which already has established rails and a working ecosystem? Simple: banks want stability and direct control over the assets they use for payments. Stablecoins, pegged one-to-one with fiat currency like the won, offer a predictable value with minimal volatility. That’s a massive draw for traditional financial institutions that shy away from the wild price swings of native digital assets like XRP.

The consortium plans to issue stablecoins using two methods: a trust-based approach, where customer funds are held separately, and a deposit token format, backed one-to-one with bank deposits. Both models are undergoing legal and technical reviews to ensure compliance.

What does this mean practically? Banks are signaling loud and clear: they’re not here to gamble on crypto’s price rollercoaster. They want smooth, reliable payment rails with minimal risk.

The Reality of Banks and Crypto: Why Stablecoins Are Winning

This move by Korean banks isn’t isolated. Globally, major players like JPMorgan, Wells Fargo, PayPal, and even Ripple itself are launching their own stablecoins. It’s a clear trend: banks are flocking to stablecoins because they’re easier to regulate, less volatile, and more compatible with traditional finance’s risk-averse nature.

Stablecoins provide a bridge between the crypto world and traditional finance by offering the benefits of digital assets—like faster settlement and reduced costs—without the headaches of price unpredictability. For banks, that’s a game-changer.

Take USDC, for example. It runs on multiple blockchain networks, including Stellar (XLM), which helps reduce transaction costs to fractions of a cent. But here’s the kicker: the banks and issuers behind these stablecoins don’t make money on transaction gas fees or token burns. The real profits come from the financial services built around these stablecoins and the trust that users place in them.

That’s why the banking world is betting big on stablecoins. They want the digital asset benefits but with the stability and regulatory clarity that native cryptocurrencies like XRP can’t yet offer on a large scale.

Stablecoins vs. Native Digital Assets: The Volatility Factor

Let’s get real about volatility. XRP, like many native cryptocurrencies, experiences significant price swings. For example, in a single day recently, XRP’s price fluctuated from a low of $1.96 to a high of $2.17. That’s a big swing for any bank that’s thinking about holding billions of dollars in assets.

Banks want things smooth and predictable. They don’t want to see their reserves jump 10-20% up or down in a single day. Stablecoins, pegged to fiat currencies, offer that much-needed stability.

This is why stablecoins are dominating the narrative right now, especially as regulators focus their efforts on creating clear frameworks around them. The upcoming “Genius Act” in the U.S. Congress is a prime example of legislation geared toward stablecoin regulation, which is viewed as easier and more urgent than broader crypto laws.

Coinbase Stock Soars Amid Regulatory Clarity and Volatility

While banks are busy launching stablecoins, crypto exchanges like Coinbase are thriving on the volatility and volume that come with uncertain markets. Coinbase’s stock recently surged 38%, hitting its highest price in a year. This surge came after increased national and global regulatory clarity, combined with ongoing market volatility.

Why does volatility help exchanges? It’s simple: no matter if traders are buying or selling, exchanges make money from transaction fees. More volume means more fees, and more fees mean higher revenues and, in turn, higher stock prices.

We’re also seeing a wave of crypto IPOs on the horizon, including Gemini and OKX, following the juicy Circle IPO. These public offerings are a sign that crypto infrastructure companies are maturing and attracting significant investor interest.

Jerome Powell’s Remarks: Is Crypto Finally Legit?

Federal Reserve Chair Jerome Powell recently made headlines by acknowledging that Bitcoin, crypto, and digital assets have matured and become more mainstream. This is a significant shift from the Fed’s past stance, which was more cautious and sometimes openly hostile toward crypto.

Powell emphasized that banks should have the freedom to choose their customers and business models. However, this statement contrasts sharply with actions by banks like Barclays, which have restricted crypto-related transactions from debit and credit cards.

Powell’s comments came in response to Senator Cynthia Lummis, who asked about changes in stablecoin risk since the Fed’s 2023 policy statements. The Fed’s official stance remains cautious, stating that issuing tokens on public or decentralized networks is likely inconsistent with safe banking practices. Still, Powell acknowledged that the industry is maturing and that the Fed is revisiting policies imposed during the previous administration.

This leaves us in a regulatory limbo—while crypto is gaining legitimacy, concrete regulations are still pending. The current regulatory environment is heavily influenced by the political climate, and until formal regulations are in place, executive orders and shifting policies continue to shape the landscape.

Why We Need Clear Crypto Regulations

The lack of clear crypto regulations creates uncertainty for investors, companies, and banks alike. Without a stable regulatory framework, banks are hesitant to fully embrace crypto assets, especially volatile ones like XRP. Stablecoins, by contrast, are easier to regulate due to their peg to fiat currencies and more predictable behavior.

This is why many in the industry are pushing for stablecoin regulations first. Once those are in place, broader crypto regulations can follow, paving the way for more institutional adoption.

The Hype vs. Reality: XRP Price Predictions and Market Sentiment

Now, let’s talk about the hype surrounding XRP. Recently, a so-called “master analyst” published a bold claim that XRP is about to smash through $17, even projecting a move as high as $27.30 in the near term. Let me be blunt: that’s pure hopium and unrealistic speculation.

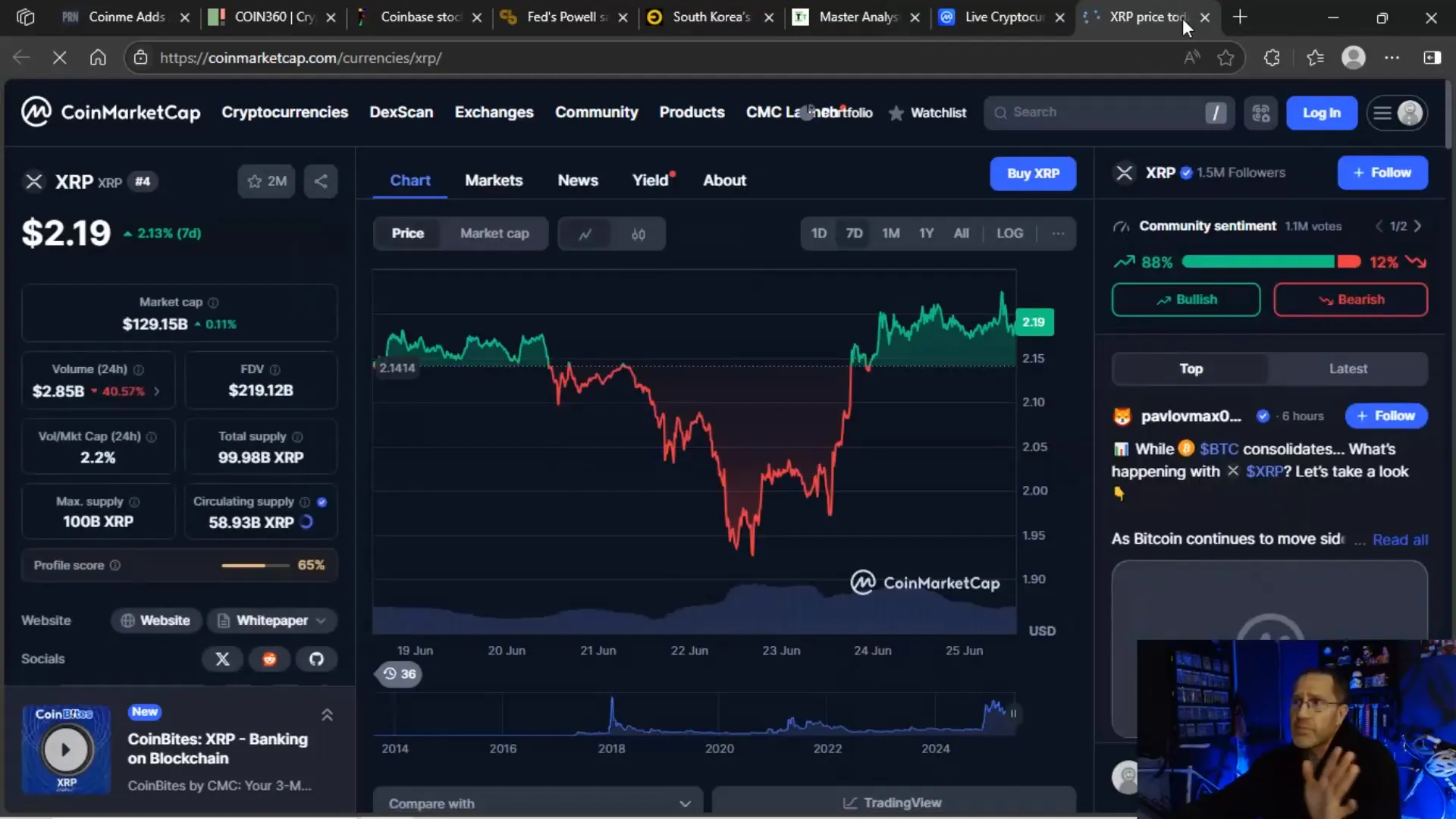

At the time of writing, XRP is holding around $2.19. We’ve seen XRP’s highs gradually decline from over $3.40 to below $2.60, while the price floor has remained roughly around $2. This pattern indicates waning excitement and volume in the market, not a rocket launch to the stratosphere.

Volume is a critical indicator here. During the peak hype months—November through January—volume was sky-high. Today, it’s a shadow of its former self. Less volume means less momentum, and less momentum means less price movement upward.

Many of these wild price predictions come from unreliable sources pushing technical analysis gimmicks like “kangaroo leaping zones” and “rainbow bands.” While technical analysis can be useful, it needs to be grounded in realistic market behavior and fundamentals.

Why Banks Are Not Betting on XRP for Payments

Despite XRP’s role as a digital asset designed for fast cross-border payments, banks are reluctant to use it as their primary payment rail because of its price volatility and regulatory uncertainty. Instead, banks prefer stablecoins that reduce risk and offer value stability.

This doesn’t mean XRP is dead or useless. Some companies are strategically using XRP as a reserve asset, but that’s a niche use case compared to the broad adoption banks want for payment systems.

What’s Next for XRP and the Crypto Market?

There’s still hope for XRP if the ecosystem evolves and regulatory clarity improves. Here are a few factors that could support XRP’s growth:

- XRPL Development: New innovations and upgrades on the XRP Ledger could make it more appealing for payments and other use cases.

- Regulatory Clarity: The ongoing push for crypto regulations, especially around stablecoins, could spill over to provide protections and clarity for XRP and other digital assets.

- Market Conditions: Potential rate cuts by the Fed and broader macroeconomic shifts could spur renewed interest in cryptocurrencies.

Still, for banks and traditional finance, stablecoins remain the primary vehicle for digital asset adoption. The market is moving toward stability, predictability, and regulatory compliance, which native cryptocurrencies like XRP will need to adapt to if they want to play a bigger role.

Who’s Really Making Money in Crypto Right Now?

It’s not the speculative traders riding price swings—it’s the exchanges and infrastructure providers. Exchanges like Coinbase are raking in profits from increased trading volume and volatility. Stablecoin issuers like Circle have also benefitted immensely, as shown by their soaring IPO valuations.

Meanwhile, banks and consortia worldwide are collaborating to create their own stablecoins, signaling where the money and focus truly lie.

Stablecoins Are the Future of Institutional Crypto Adoption

Let’s face it: stablecoins are dominating the crypto narrative for a reason. They offer:

- Price Stability: Pegged to fiat, stablecoins avoid wild swings.

- Regulatory Friendliness: Easier to regulate than native tokens.

- Operational Efficiency: Lower costs and faster settlements.

- Institutional Trust: Banks and corporations prefer stable assets for treasury management.

Examples abound: Circle’s USDC, Tether, RLUSD, and even political figures like Trump launching stablecoins—all pointing to where the “juice” is right now.

Stablecoins are smooth, boring, but incredibly powerful tools quietly transforming how money moves in the digital age.

Final Thoughts: Navigating the Crypto Landscape

The crypto market is a complex mix of hype, innovation, regulation, and traditional finance’s cautious embrace. Korean banks rejecting XRP in favor of their own stablecoin isn’t a slight against XRP—it’s a strategic choice rooted in stability and regulatory comfort. Meanwhile, Coinbase’s stock surge and Powell’s evolving stance signal that crypto is maturing, but we’re still waiting for clear rules to emerge.

For investors and enthusiasts, understanding where the market is headed means recognizing that stablecoins are the current institutional darling, while native digital assets like XRP play a more speculative and evolving role.

So, keep an eye on regulatory developments, stablecoin innovations, and market dynamics. And remember: in the world of Bitcoin, Crypto, BTC, Blockchain, and Investing, volatility creates opportunity—but stability builds the foundation for the future.

🚨 XRP Rejected by Korean Banks: What Jerome Powell’s Crypto Remarks Mean for Bitcoin, Crypto, BTC, Blockchain, and Investing 🚨. There are any 🚨 XRP Rejected by Korean Banks: What Jerome Powell’s Crypto Remarks Mean for Bitcoin, Crypto, BTC, Blockchain, and Investing 🚨 in here.