If you’re deep into Bitcoin, crypto, BTC, blockchain, and all things CryptoNews and investing, then you know how wild the ride can get sometimes. This week, we saw some classic crypto market drama: XRP’s frustrating price action that had everyone yelling “pumperoni dumperoni,” Bitcoin’s iron grip on market dominance, and a game-changing move by Circle aiming to become a US National Trust Bank. Buckle up, because we’re diving into everything you need to know to stay ahead in the crypto game.

This breakdown captures the essence of what’s happening right now with Bitcoin, crypto markets, and the major players shaking things up. Let’s get into the nitty-gritty.

The Frustrating XRP Price Action: Pumperoni Dumperoni Sandwich

First off, let’s talk about XRP’s price rollercoaster, because honestly, it was frustrating AF. If you caught the action live, you saw XRP make a sudden, explosive move that looked like a breakout, only to get slammed right back down in what’s become a painfully familiar pattern.

Picture this: XRP was cruising around the $2.19 mark, then suddenly surged past the $2.30 resistance level with volume booming. It looked like a serious breakout, the kind that could finally give XRP some real momentum outside of Bitcoin’s shadow. But then, just as quickly, it dumped right back down to where it started. Someone out there definitely ordered that “pumperoni dumperoni” sandwich, and it tasted like total market manipulation.

This move happened in real-time as the price was breaking the $2.30 mark. The initial candlestick got rejected, the next one hovered right around $2.30, and for about an hour, it looked like XRP might hold the gains. But then it all peeled back fast, erasing those gains.

What’s maddening is that this isn’t the first time we’ve seen this pattern. About two weeks ago, XRP ran from around $2.20 to $2.33, only to dump right back down again. It’s like the market is keeping XRP stuck in a “friend zone” — close enough to excite, but never quite allowed to break free.

So what’s behind this? Market manipulation? Bots and algos flipping XRP back and forth to create exit liquidity? Insider trading? All of the above? It’s frustrating because the volume on XRP surged 128% to $4.47 billion, meaning exchanges made a killing on fees, and some players likely pocketed serious green profiteroni.

Let’s break down the timeline:

- Price hit a high of $2.3271 on a 15-minute candlestick.

- The initial pause was at $2.3045.

- After about an hour hovering near $2.30, price peeled back down to previous levels.

This kind of short-lived pump and dump leaves retail traders frustrated and weary. It’s like ordering Taco Bell before a five-hour drive—exciting at first, but you’re stuck in bumper-to-bumper traffic wondering why you ever took the risk.

Bitcoin Dominance: The King Still Rules at 83%

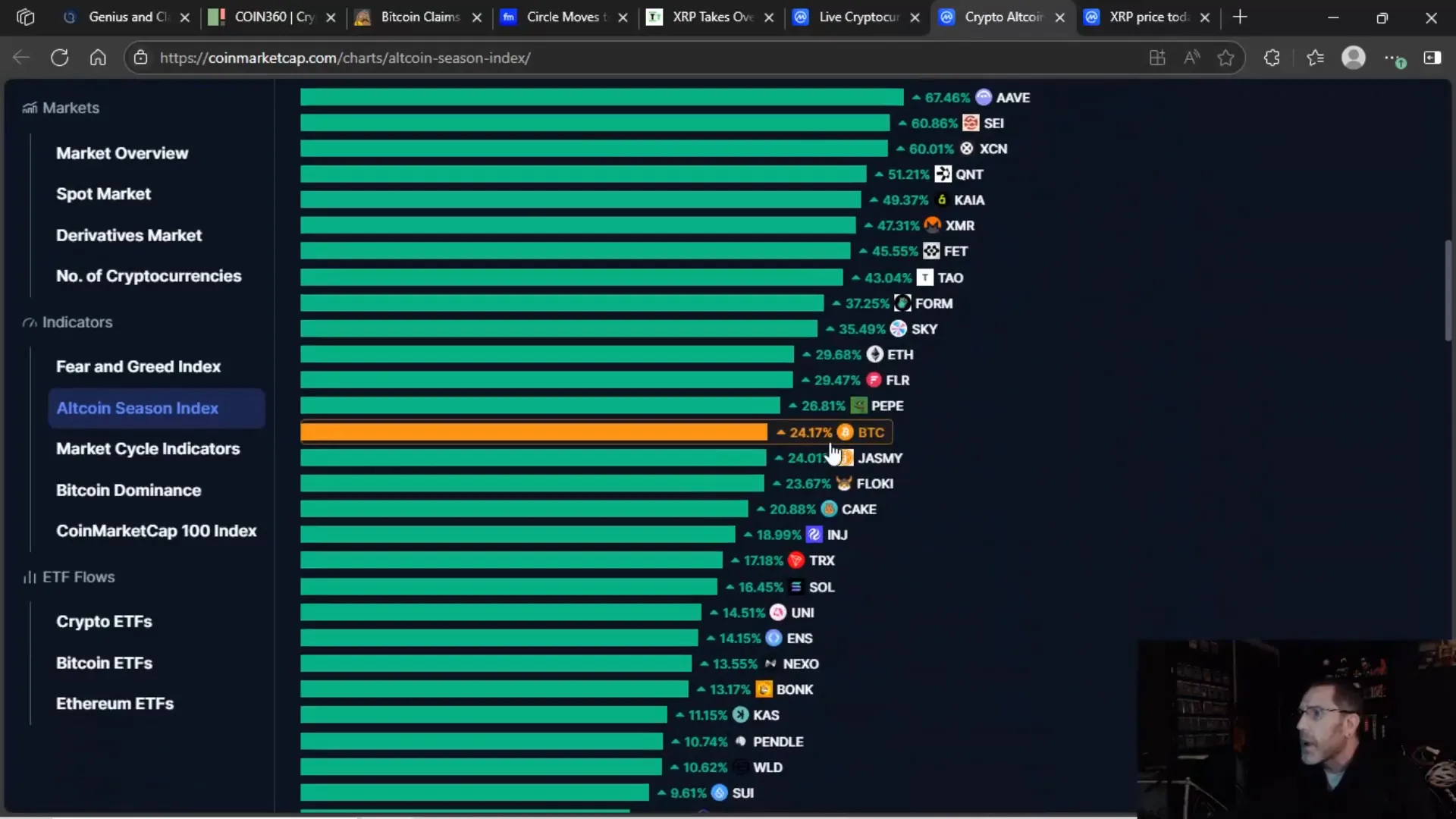

While XRP was busy with its wild ride, Bitcoin kept flexing its muscles. Bitcoin dominance is sitting at a staggering 83%, meaning it claims the lion’s share of crypto inflows and market attention. Altcoin season? Not yet.

Here’s the cold hard truth: out of the top 100 cryptocurrencies, only 22 are outperforming BTC, and many of those are hype-driven “fart coins” and meme tokens. This tells us that institutional money is still bullish on Bitcoin, seeing it as the safest bet amid geopolitical tensions and monetary policy uncertainty.

Digital asset funds have pumped $2.7 billion into crypto over the last week, but the vast majority—about $2.2 billion—flowed into Bitcoin alone. This marks the 11th consecutive week of positive inflows for BTC, pushing total digital asset fund holdings to $16.9 billion, almost matching last year’s midyear momentum of $18.3 billion.

According to CoinShares, the ongoing investor interest is driven by a mix of:

- Increased geopolitical tension

- Uncertainty around monetary policy

Bitcoin’s position near its all-time highs (just 3-4% away) is attracting big whales gobbling up coins, reinforcing its dominance. Meanwhile, altcoins like XRP remain about 40% below their all-time highs, struggling to replicate Bitcoin’s momentum.

Institutional Inflows: XRP vs Ethereum vs Solana

While Bitcoin dominates inflows, let’s look at some other players. XRP did see some inflows—about $10.6 million last week—ranking third after ETH ($429 million) and Solana ($5.3 million). However, $10.6 million is relatively small for institutional players, showing that XRP still has some catching up to do.

This data comes from CoinShares’ weekly digital asset fund flows report, which tracks institutional inflows and outflows. It’s a solid resource for understanding where the big money is moving.

Circle’s Ambitious Leap: From Stablecoin Issuer to US National Trust Bank

In some of the most exciting news this week, Circle—the company behind the USDC stablecoin—is applying to become a US National Trust Bank. This move could transform Circle from a stablecoin issuer into a federally regulated mega bank conglomerate.

Here’s the scoop:

- Circle announced on Monday it filed for a national trust charter.

- If approved, Circle’s new bank would operate as a federally regulated trust institution.

- This institution would manage the USDC reserve on behalf of Circle’s US issuer.

- Approval would strengthen the infrastructure supporting USDC issuance and circulation.

Jeremy Allaire, CEO of Circle, said this step marks a “significant milestone” in building an internet financial system that is transparent, efficient, and accessible. The move is proactive, aiming to reinforce the USD infrastructure behind USDC.

Circle’s IPO price is expected to surge if the application is approved, despite some recent profit-taking that caused a slight price pullback. For investors holding Circle stock, here’s the timeline to keep in mind:

- The Office of the Comptroller of the Currency (OCC) accepts public comments for 30 days after the application.

- The OCC typically decides on approval or rejection within 120 days after receiving the final application.

In short, Circle is positioning itself to become a banking powerhouse in the crypto space, and this could have major implications for the stablecoin market and the broader blockchain ecosystem.

XRP Dominates Korea’s Top Exchange—But What’s Next?

Meanwhile, XRP made headlines in South Korea by surpassing Bitcoin and Ethereum in trading volume on Upbit, the country’s largest crypto exchange. This surge was sudden and impressive, with XRP’s volume hitting $163 million, although Binance still dwarfs it with $400 million.

This volume spike coincided with the price action frenzy mentioned earlier, adding fuel to the excitement. But as we saw, the gains were short-lived, and XRP quickly fell back to previous levels, leaving many traders disappointed.

The pattern of rapid pumps followed by sharp dumps raises questions about market integrity and manipulation. Bots and algorithmic trading likely play a role, flipping XRP back and forth to generate volume and fees for exchanges, while insiders take profits.

For retail investors, this is a tough pill to swallow. Watching XRP pump without sustained follow-through feels like a tease, especially when Bitcoin quietly consolidates near all-time highs.

What Traders Need to Watch

- Price levels around $2.30-$2.35 for potential breakout or rejection.

- Volume spikes and whether they correspond with sustained price moves.

- Market sentiment and news flow around XRP and Ripple Labs.

Understanding these dynamics can help traders avoid getting caught in “pumperoni dumperoni” traps and make smarter investment decisions.

Other Crypto Market News: Robinhood’s Blockchain Ambitions

While XRP, Bitcoin, and Circle dominate the headlines, don’t overlook the moves being made by Robinhood. After the GameStop saga left a bad taste for many investors, Robinhood is now planning to build its own blockchain and launch its own stablecoins.

This is a bold move to break free from existing crypto rails and create a proprietary ecosystem. It shows how traditional financial platforms are evolving rapidly to capture more of the crypto market, increasing competition and innovation.

Putting It All Together: What Does This Mean for Investors?

The crypto market is a wild, unpredictable beast. Bitcoin’s dominance remains strong, signaling institutional confidence and a flight to safety amid global uncertainty. Altcoins, including XRP, are still struggling to break free from manipulation and lack of sustained momentum.

At the same time, companies like Circle are making strategic moves to solidify their positions, aiming to become federally regulated banks that integrate traditional finance with blockchain innovation. Meanwhile, Robinhood’s blockchain plans show that the landscape is evolving fast.

For investors and traders, this means:

- Stay vigilant. Market manipulation is real, especially in altcoins like XRP.

- Follow institutional inflows and Bitcoin dominance as key indicators of market health.

- Keep an eye on regulatory developments, like Circle’s bank application, that could reshape the crypto ecosystem.

- Don’t get caught up in hype pumps; focus on long-term fundamentals.

- Use reliable sources and stay engaged with community discussions to navigate volatility.

It’s a frustrating time for many, but knowledge is power. Understanding these moves and market dynamics will help you make informed decisions and avoid the “pumperoni dumperoni” traps that leave retail traders stuck on the sidelines.

Final Thoughts

Crypto investing isn’t for the faint of heart, especially when the market dishes out “poop sandwiches” like these rapid XRP pumps and dumps. But with Bitcoin holding strong near all-time highs and major players like Circle pushing the boundaries of what’s possible in blockchain finance, the future remains exciting.

Remember, the key is to stay informed, keep your emotions in check, and focus on the bigger picture. The crypto space is evolving faster than ever, and those who adapt will be the ones who thrive.

And hey, if you ever feel like you’ve just ordered a Taco Bell before a five-hour drive stuck in traffic, just remember: you’re not alone. Keep your eyes open, your strategy tight, and keep riding the waves.

🚨 XRP Price B.S., Circle’s Mega Bank Ambitions & Bitcoin Dominance Explained 🚨. There are any 🚨 XRP Price B.S., Circle’s Mega Bank Ambitions & Bitcoin Dominance Explained 🚨 in here.