If you're deep into the world of cryptocurrency, especially XRP, you know the landscape is always shifting. Today, we're diving into some crucial updates that every XRP fan should know, along with broader insights into Bitcoin, altcoins, stablecoins, and the evolving crypto custody landscape. Strap in because this isn’t your typical sugar-coated crypto hype. We’re getting raw, real, and ready to open some eyes on what’s really going on in the space.

This article covers everything from the recent announcement about 28,000 physical locations where you can buy XRP, to a deep dive into stablecoin market caps across blockchains, and the latest moves by a deep-sea mining company adding Bitcoin to its treasury. Plus, we explore the IPO ambitions of crypto custody giant BitGo and why the hype around XRP and its stablecoin ecosystem might be, well, a bit misplaced.

What’s the Real Deal with XRP and 28,000 Physical Locations?

Let’s kick things off with some news you may have seen buzzing around: Coinme, a leading cryptocurrency cash exchange, has announced that XRP and Solana (SOL) are now available to buy and sell with cash at over 28,000 Coinme-powered retail locations across the United States.

That’s a big number. Twenty-eight thousand physical kiosks where folks can walk in with cash and buy XRP or SOL. Sounds like a massive adoption boost, right? Not so fast.

Here’s the kicker: Who exactly is going to these kiosks? In the age of smartphones and crypto apps that let you buy XRP with a few taps, it’s hard to imagine many seasoned crypto enthusiasts lining up at kiosks to buy XRP with cash. These kiosks primarily target people who don’t have access to traditional banking or crypto apps — the unbanked or underbanked populations.

Unfortunately, these kiosks often charge a premium, meaning these users pay more for the convenience of cash-to-crypto conversion. While expanding access is a good thing, the cost burden on these users is a real downside. So, while this move by Coinme might help XRP’s relevance in certain circles, it’s not the game-changer some might hope for.

Bottom line: It’s a step for accessibility but not necessarily a catalyst for massive price gains or mainstream adoption among crypto-savvy investors.

Deep-Sea Mining Company Goes Bitcoin Heavy: The Treasury Play

Over in Norway, Green Minerals, a deep-sea mining company, made waves by announcing a bold treasury strategy — they plan to build a $1.2 billion Bitcoin treasury. Recently, they bought their first four BTC, worth about $420,000 at the time.

That’s a drop in the bucket compared to their ambitious goal, but it signals a growing trend: companies using Bitcoin as a hedge against inflation and store of value. Green Minerals joins a growing list of firms converting parts of their balance sheets into BTC, betting on crypto’s long-term value preservation.

However, for XRP fans, this is a mixed bag. While it’s great to see crypto adoption, Bitcoin continues to dominate the treasury strategies of big players, which means altcoins like XRP have to fight harder for attention and capital.

Bitcoin is just four percent shy of its all-time high, while XRP remains about 43% below its peak. Other altcoins like Hedera (HBAR) are even further behind, 74% down from their all-time highs. This dominance of BTC in treasury strategies keeps the spotlight firmly on Bitcoin, making it tough for alts to shine.

BitGo Eyes IPO Amid Exploding Crypto Custody Market

Another major story in the crypto space is BitGo’s plans for an IPO, potentially in late 2025. BitGo’s Asia Pacific managing director, Abel Cao, revealed that the company’s Assets Under Custody (AUC) have surged from $60 billion to $100 billion in just six months, reflecting the rapid global adoption of crypto.

Founded in 2013, BitGo isn’t just a custody provider; it offers a full institutional platform with trading, lending, and borrowing solutions. Their IPO ambitions come on the heels of Circle’s successful public listing, which opened the floodgates for crypto companies to bridge into traditional finance.

This surge in custody assets also signals growing institutional confidence in crypto markets, which can have positive ripple effects (pun intended) across the ecosystem. However, it also means competition is heating up — with Gemini and others eyeing IPOs as well.

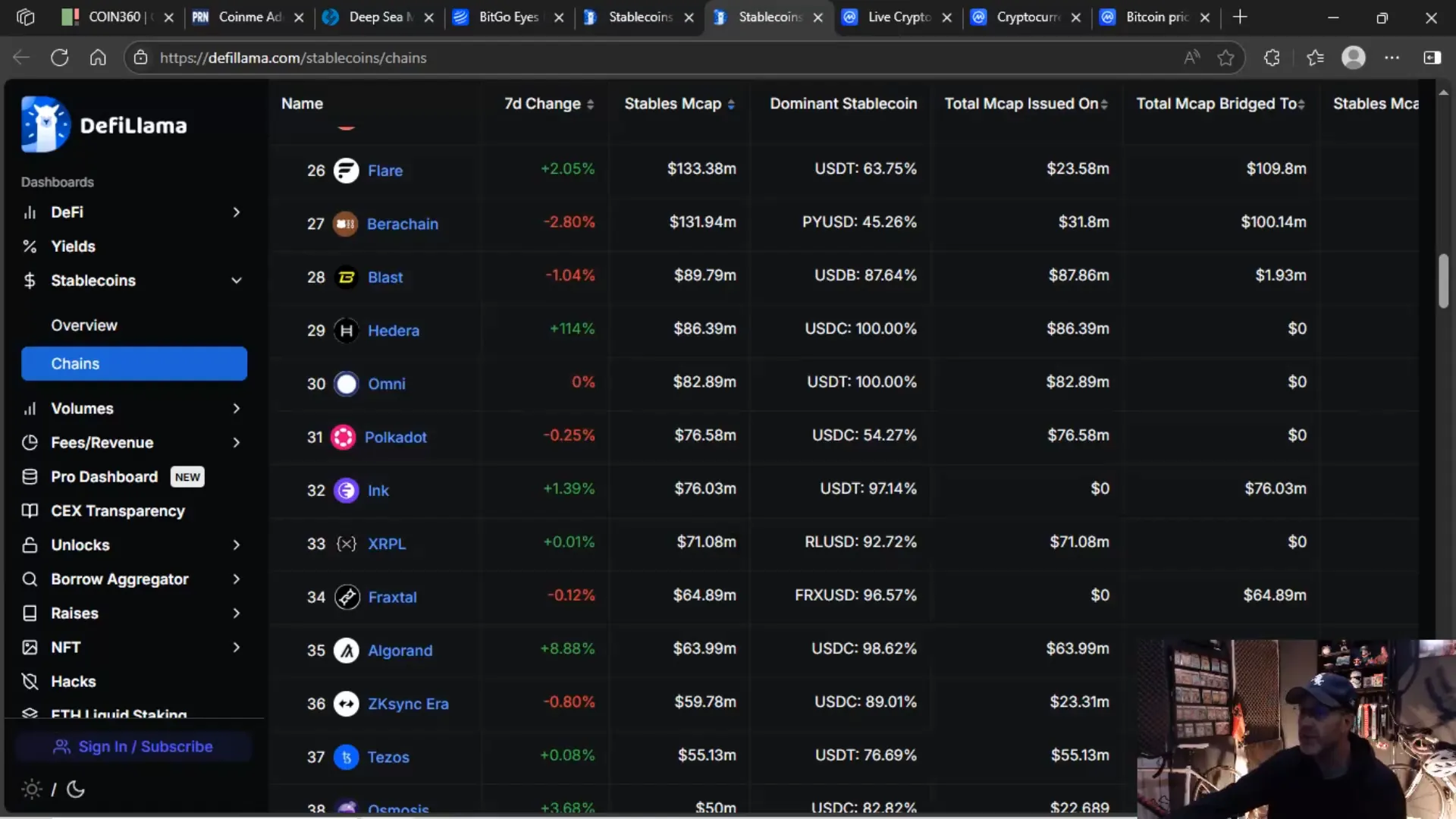

Stablecoins: The Backbone of Crypto Payments and Why XRPL Isn’t Leading the Pack

Let’s get to the heart of the matter for XRP fans: stablecoins and the blockchain rails they run on. A lot of chatter out there claims that stablecoins will run predominantly on the XRP Ledger (XRPL), making XRP a crucial asset in the process. But the numbers tell a different story.

The total market cap for stablecoins is a whopping $252 billion and growing fast. But where are these stablecoins primarily issued?

- Ethereum: Holds about half of the stablecoin market cap with $125 billion.

- Tron: Commands 32% of the market with $80 billion.

- Solana: Comes in third with $10 billion.

- Binance Smart Chain, Base, Hyper Liquid, Arvinum, Polygon, Avalanche, Aftos, Swede, NEAR, TON, Stellar: All follow in descending order.

- XRPL: Sits way down the list at 33rd place, with just $71 million in stablecoin market cap — that’s an “M,” not a “B.”

To put that in perspective, XRPL’s stablecoin market cap is dwarfed by Ethereum’s by a factor of over 1,700 times. Even Stellar (XLM), which is 14th on the list with nearly $600 million in stablecoins, vastly outsizes XRPL.

So, what does this mean for XRP holders? It means that despite the hype about XRPL being the go-to ledger for stablecoins, the real-world adoption and stablecoin issuance on XRPL is minimal. Even Stellar, with far more stablecoins on its chain, struggles with price performance. Its token XLM sits at around $0.24, far from its all-time highs.

Looking at XLM’s price chart, the biggest pumps correlate with external political events and macroeconomic factors, not stablecoin launches or adoption. So stablecoins alone don’t guarantee price action or ecosystem growth.

Price Action Doesn’t Lie: XRP vs. XLM and Others

To understand how stablecoins influence token prices, let’s compare XRP and XLM over the past year. XRP has significantly outperformed XLM, even though XLM has more stablecoins on its ledger.

This suggests that stablecoin presence on a blockchain isn’t the main driver of price appreciation. Instead, factors like network usage, partnerships, regulatory clarity, and overall market sentiment play bigger roles.

For XRPL to climb from its 33rd place stablecoin ranking to the top tiers, something fundamental has to shift:

- Lower transaction fees to attract builders and projects.

- More robust developer ecosystems creating compelling use cases.

- Greater institutional and retail adoption of XRPL-based stablecoins.

- Clear regulatory frameworks that encourage banks and financial institutions to choose XRPL rails.

Without these changes, it’s unrealistic to expect a sudden influx of stablecoins or capital into XRPL just because XRP is a bridge asset.

Why Are Stablecoins and Blockchain Rails So Important?

Stablecoins have become the backbone of crypto payments, DeFi, and cross-border transfers. They provide the liquidity and stability needed for everyday transactions without the volatility of traditional cryptocurrencies.

Choosing the right blockchain rail for stablecoins impacts transaction speed, cost, and scalability. Ethereum currently leads due to its developer ecosystem and DeFi dominance, despite high fees and slower transactions. Tron and Binance Smart Chain offer cheaper, faster alternatives, attracting many stablecoin issuers.

XRPL has advantages like fast settlement times and low fees, but it has yet to capture significant stablecoin issuance or developer interest compared to its competitors. That’s a critical gap to close if XRP wants to solidify its place in the stablecoin economy.

Are Coinme ATMs and Kiosks a Game Changer for XRP?

Back to the 28,000 Coinme locations — they do provide physical access points for buying XRP and SOL with cash. But the reality is that these kiosks mostly serve the unbanked or those without easy app access, who often pay a premium for this convenience.

For the average crypto investor, these kiosks aren’t the primary method for buying XRP. Most crypto enthusiasts use apps and exchanges with better rates and user experience.

So while Coinme’s expansion might boost awareness and accessibility, it’s unlikely to move the needle significantly on XRP’s price or ecosystem growth.

Bitcoin’s Dominance in Treasury Strategies and Market Attention

We can’t ignore Bitcoin’s overwhelming dominance in the market. Companies like Green Minerals choosing to build Bitcoin treasuries reflect the market’s trust in BTC as the primary store of value and inflation hedge.

This trend keeps Bitcoin close to its all-time highs, while altcoins like XRP and HBAR lag behind. It’s a tough environment for altcoins to gain ground, especially if institutional money continues funneling into BTC.

Why the Hype Around XRP and Stablecoins Needs a Reality Check

There’s a lot of hype in the XRP community about stablecoins running on XRPL and the associated price gains. But the stats tell a different story:

- XRPL stablecoin market cap is tiny compared to Ethereum, Tron, and others.

- Other blockchains with more stablecoins haven’t seen proportional price gains in their native tokens.

- Stablecoins alone don’t drive price; network effects, adoption, and utility matter more.

- XRPL needs significant ecosystem development and lower fees to attract more stablecoin projects.

So, if you’re hearing the usual “XRPL will dominate stablecoins and make us all rich” spiel, take it with a grain of salt. The reality is more nuanced and requires patience and strategic growth.

Final Thoughts: A Call for Realism and Strategic Growth

Being an XRP fan means navigating through some harsh truths and separating hype from reality. The crypto market is dominated by Bitcoin right now, with altcoins and their ecosystems struggling to catch up.

Accessibility improvements like Coinme’s kiosks help broaden reach but don’t solve the bigger adoption puzzle. Stablecoins are a powerful tool, but XRPL’s current position in that market is small. To change that, XRPL needs to lower fees, attract developers, and build real-world use cases.

Meanwhile, big moves like BitGo’s IPO ambitions and corporate Bitcoin treasuries show that institutional interest in crypto is growing — but it’s still mostly focused on Bitcoin.

So, keep your eyes open, stay informed, and focus on the fundamentals rather than hype. XRP has potential, but it’s going to take more than just talk about stablecoins and kiosks to get it where it needs to be.

And hey, if you’re feeling the pain of being an XRP fan, just remember — it could be worse. Try being a White Sox fan too. Nothing like double the heartbreak to keep you humble in this wild crypto world.

Stay sharp, stay real, and keep investing wisely. The crypto journey is a marathon, not a sprint.

🔥XRP MUST SEE STORY🔥 28,000 LOCATIONS🔥 | Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing Insights. There are any 🔥XRP MUST SEE STORY🔥 28,000 LOCATIONS🔥 | Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing Insights in here.