Buenos dias muchachos y muchachos! If you’ve been keeping an eye on the crypto markets lately, you know things are heating up. I’m bringing you the freshest updates from the crypto world, and today, it’s all about XRP milestones, juicy price action, and the explosive stablecoin moves banks are making as the Genius Act nears a vote. Plus, there’s some spicy chatter about Jerome Powell possibly quitting or being fired, which could shake the entire financial landscape.

Whether you're a Bitcoin enthusiast, an altcoin trader, or a blockchain believer, this week’s developments are crucial for your investing strategies. So buckle up as we unpack the latest news, analyze the market, and explore what could lie ahead for Bitcoin, Crypto, BTC, Blockchain, and Investing in general.

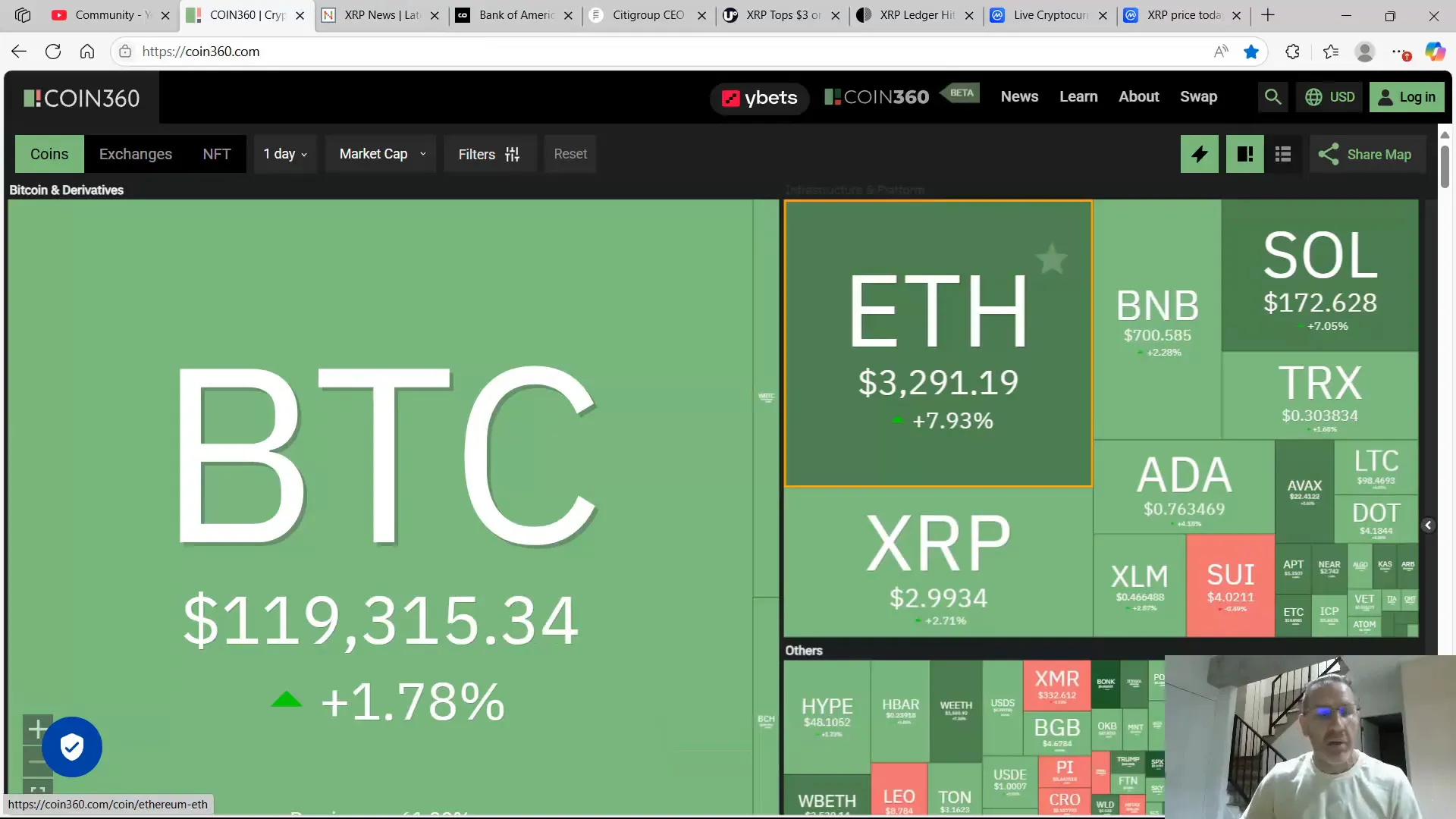

The Crypto Market Pulse: Green Screens and Growing Optimism

First things first, let’s talk about the market vibe. The charts are showing green, but maybe your portfolio doesn’t quite feel the same yet. That’s okay. Market volume has dipped a little, but price action remains strong, especially for XRP, which is flirting with the $3 mark. Bitcoin is holding steady around $19,000, and Ethereum is pushing past $3,000. This sustained momentum comes despite some concerns about potential sell-offs.

Why is this significant? Because it tells us the market isn’t just surviving—it’s gearing up. Investors are holding their ground, and some are getting ready to push even harder, especially if regulatory clarity arrives soon. This optimism is a sign that the crypto community expects some big moves, particularly around stablecoins and XRP.

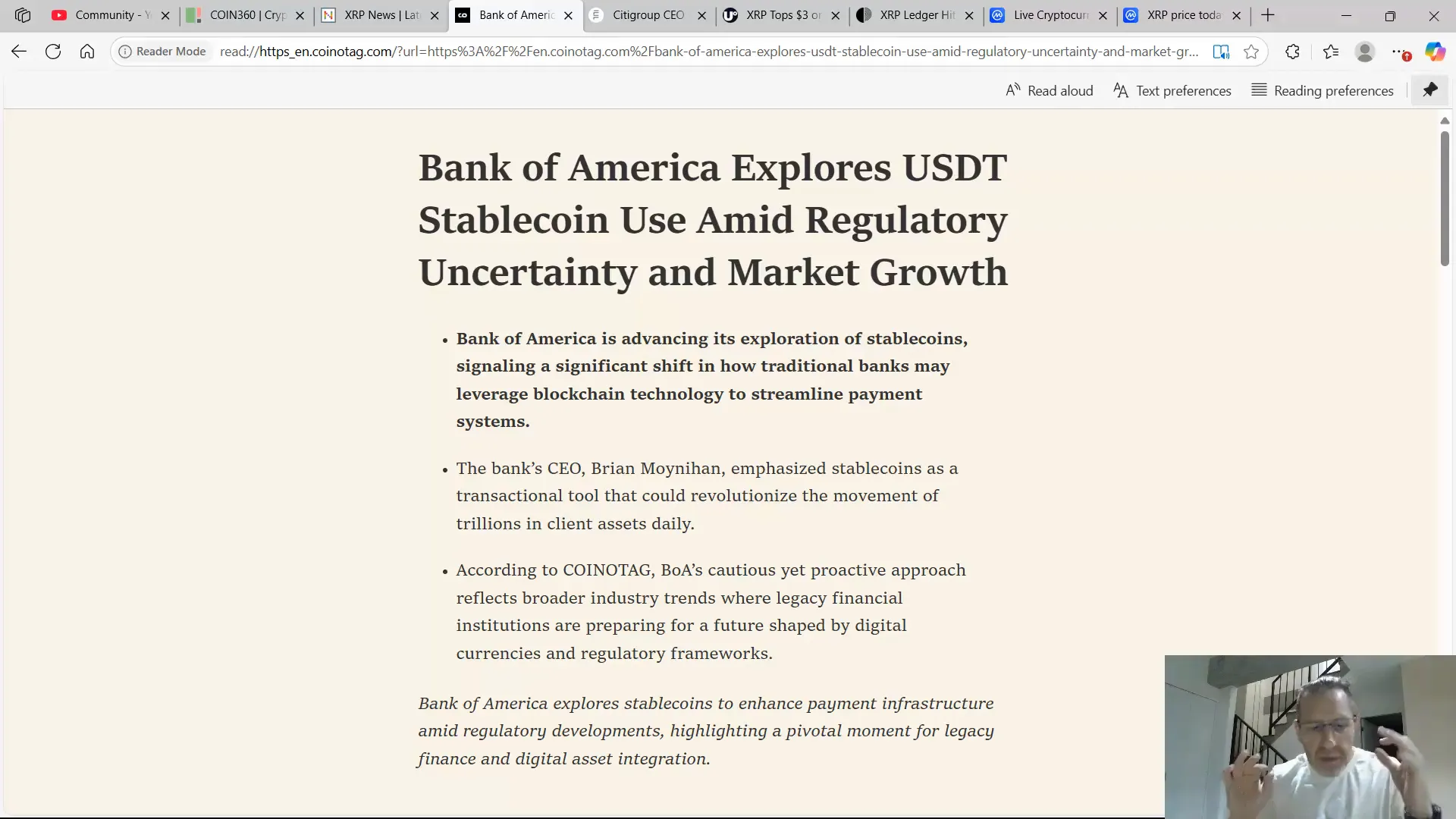

Banks Diving Into Stablecoins: Bank of America Leads the Charge with USDT

One of the juiciest stories this week is how traditional banks are increasingly embracing stablecoins. Bank of America, for instance, has been exploring the use of Tether’s USDT stablecoin rather than creating their own from scratch. This is a smart move that highlights the growing importance of stablecoins in modern banking.

Why stablecoins? Because moving money the traditional way is expensive and slow. Banks want to save money and improve transactional efficiency. Stablecoins like USDT offer a way to transfer funds quickly, safely, and at low costs. Banks are positioning themselves at the forefront of this adoption, aiming to integrate stablecoins into their existing payment infrastructures.

Bank of America’s CEO, Brademayin, emphasized during their Q2 earnings call that stablecoins could revolutionize how banks handle client funds by enabling faster and more efficient transfers. This isn't just about saving pennies; it’s about modernizing the entire financial system.

Interestingly, while some banks will create their own stablecoins, others will adopt existing ones like USDT or USDC. This dual approach allows banks to experiment and find the best fit for their transactional needs.

Citigroup’s Vision: Citicoin and the Stablecoin Future

Citigroup is not far behind. Their CEO Jane Fraser recently called stablecoins "the future" and revealed the bank’s plans to consider launching its own stablecoin, tentatively named Citicoin. This move fits a broader trend among Wall Street giants like JPMorgan and Bank of America, all eyeing stablecoin projects.

Citigroup’s approach is to use their stablecoin for internal transactions, allowing customers to move money 24/7, 365 days a year. This kind of instant transfer service would be a game-changer for everyday banking and investing.

However, the full crypto route for banks like Citigroup remains contingent on regulatory clarity. Many are waiting on the passage of the Genius Act, which could provide the framework needed for banks to fully embrace cryptocurrencies beyond stablecoins.

Jerome Powell’s Future: Rumors of Resignation or Firing Shake Markets

Now, onto the political drama that’s got crypto investors buzzing. There are rumors swirling that Jerome Powell, the Chair of the Federal Reserve, might be ousted or resign soon. While some speculate that former President Trump could fire Powell, the reality is more complicated. The Fed operates as a private entity, and firing a Fed chair would require legal proceedings, which could create a significant mess.

Powell’s current term runs until May 2026, but he’s facing heavy pressure from Washington due to his policy decisions, especially around interest rates. High rates have made loans expensive—from mortgages and car loans to business expansions—holding back economic growth and, by extension, the crypto market.

If Powell were to step down or be removed, the market could respond with a massive rally. The green on your screen right now would pale in comparison to the potential surge. This is because lower interest rates generally boost risk-on assets like Bitcoin and altcoins, including XRP.

“Cryptocurrency mogul No Regrets recently urged investors to buy BTC, criticizing calls for Powell’s termination as banana republic moves.”

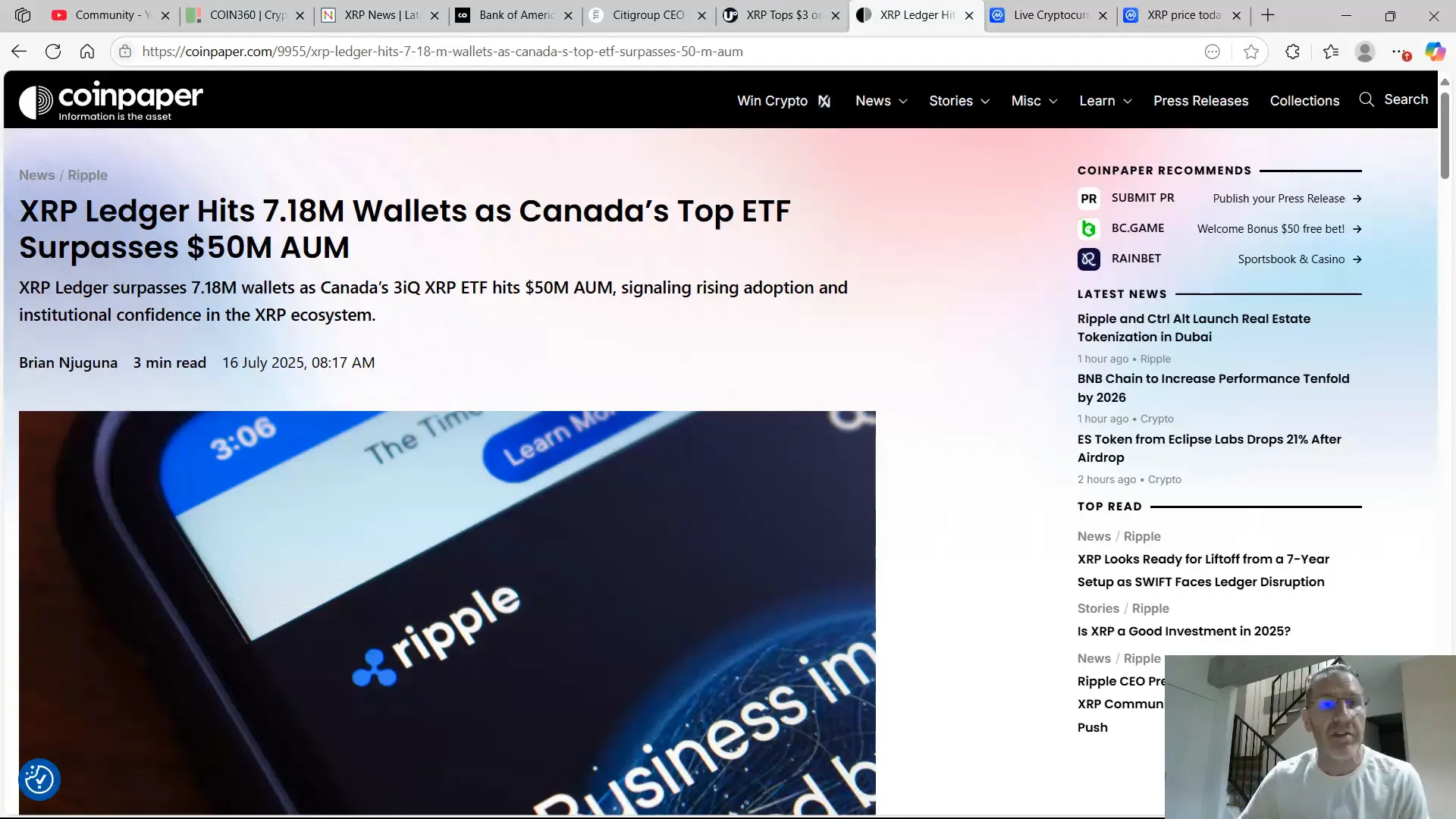

XRP Milestones: 7.18 Million Wallets and ETF Growth in Canada

XRP is making waves not just in price but in adoption and institutional interest. The XRP Ledger recently hit a milestone of over 7.18 million wallets, a strong indicator of growing user engagement and trust in the ecosystem.

On the institutional front, Canada’s XRP ETF has surpassed $50 million in assets under management (AUM). While $50 million might not seem huge compared to XRP’s $7 billion 24-hour trading volume, it’s a clear sign of increasing institutional confidence. The ETF’s growth suggests that more traditional investors are starting to dip their toes into XRP and crypto markets.

Market Overview: Healthy Volume and Altcoins on the Rise

Looking at the broader crypto market, volume is slightly down but remains healthy at around $183 billion. The Fear and Greed Index sits at 68, signaling optimism among investors. Meanwhile, the Altcoin Season Index has climbed to 35 out of 100, indicating altcoins like XRP are gaining momentum alongside Bitcoin.

This uptick in altcoin strength is vital. It means investors are diversifying beyond Bitcoin, exploring potential gains in other digital assets. XRP’s recent trend is particularly healthy, pushing back against profit-taking and maintaining a strong foothold near the $3 mark.

The $3 Mark: XRP’s Crucial Battle

XRP has been hovering around the $3 price level for five days now, a notable feat given the volatility of crypto markets. This level is a key battleground — breaking above and holding $3 could signal a strong bullish trend, while failing to do so might mean a pullback.

Looking at the hourly candlestick charts, XRP has made multiple attempts to breach the $3 barrier but has faced resistance. The upcoming votes related to the Genius Act will likely dictate whether XRP can break through this threshold or if it will retreat.

The Genius Act and Clarity Act: Regulatory Stakes for Crypto

All eyes are on the Genius Act (also known as the Clarity Act), which could be a game-changer for cryptocurrency regulation in the United States. This legislation aims to provide clear guidelines for digital assets, including stablecoins and cryptocurrencies like XRP.

If the Act passes cleanly, banks and financial institutions will likely accelerate their crypto adoption, pumping liquidity and legitimacy into the market. This could send XRP and other cryptos soaring, making it an exciting time for investors.

However, there’s some friction. Rumors suggest that not all Republicans are on board, and since the party holds a slim majority, any dissent could jeopardize the bill’s passage. If the Act fails or faces significant hurdles, expect downward pressure on XRP and the broader market.

In essence, the Genius Act’s fate is the fulcrum on which the crypto market’s near-term future balances. Passage means juice and growth; friction means pain and pullbacks.

What This Means for Bitcoin, Crypto, BTC, Blockchain, and Investing

So, what do all these developments mean for investors and enthusiasts in Bitcoin, Crypto, BTC, Blockchain, and Investing? Quite a lot. Here's a breakdown:

- Stablecoin Adoption by Banks: As banks adopt stablecoins, we’re likely to see deeper integration of blockchain tech into everyday banking. This will lower costs, speed up transactions, and create new investment opportunities.

- Regulatory Clarity: The Genius Act could provide the regulatory framework needed for institutional crypto adoption, boosting confidence and market growth.

- XRP’s Position: XRP is at a critical price and adoption milestone. Its performance this week could set the tone for altcoins in general.

- Interest Rate Speculation: Jerome Powell’s future is tied to macroeconomic conditions that affect all risk assets, including crypto. Any changes here could be a catalyst for market moves.

- Market Sentiment: The current optimism, reflected in volume and altcoin strength, suggests investors expect positive news, but caution remains due to political and regulatory uncertainties.

Tips for Investors This Week

- Watch the Genius Act votes closely: The outcome will likely dictate market direction in the short term.

- Monitor XRP price action around $3: This is a key resistance level that could trigger bigger moves.

- Stay updated on Jerome Powell news: Any announcements regarding his position could cause volatility.

- Consider diversification: With altcoins gaining strength, spreading your portfolio beyond Bitcoin might be wise.

- Keep an eye on stablecoin developments: Banks adopting stablecoins could open new avenues for investing and payments.

Sharing the News from a Beautiful City

By the way, I’m sharing this update from a temporary studio in one of the most beautiful cities in the world. While the lighting and background might not be what you’re used to, rest assured I’m committed to bringing you the news wherever I am because you, the viewer and reader, matter most. Stay tuned for more updates and clues about this incredible location throughout the week!

Remember, the crypto world never sleeps, and neither does the news. Whether you’re a seasoned investor or just getting started, these developments are shaping the future of Bitcoin, Crypto, BTC, Blockchain, and Investing. Stay alert, stay informed, and keep your eyes on the charts!

Final Thoughts: The Week Ahead Could Be a Game-Changer

This week is pivotal for XRP and the broader crypto market. With banks diving headfirst into stablecoins, regulatory clarity potentially on the horizon, and macroeconomic factors like Jerome Powell’s position stirring the pot, investors have a lot to digest.

Expect volatility, but also opportunity. The passage of the Genius Act could send XRP and other cryptocurrencies to new heights, while any setbacks could cause temporary pullbacks. Stay informed, keep your strategy flexible, and don’t forget that in crypto, patience and timing are everything.

Are you ready for the juice action? Let’s see what the market brings!

🚨 XRP Mega Hot News: Jerome Powell Quitting or Fired? What It Means for Bitcoin, Crypto, BTC, Blockchain, and Investing. There are any 🚨 XRP Mega Hot News: Jerome Powell Quitting or Fired? What It Means for Bitcoin, Crypto, BTC, Blockchain, and Investing in here.