If you’ve been tracking the cryptocurrency markets lately, you know things are heating up—especially for XRP. In this deep dive, we’ll explore the latest XRP price action, social media buzz, wallet growth, and regulatory developments that are shaping the crypto landscape right now. We’ll also touch on Bitcoin’s resilience above key levels and what that means for altcoin season, including insights from Brad Garlinghouse’s recent fiery response in DC. This article is packed with fresh data, analysis, and some candid takes on the state of crypto regulation—all brought to you with the same energy and unfiltered style crypto enthusiasts love.

Let’s get into it!

The Current Crypto Climate: Bitcoin Holds, Altcoins Surge

Bitcoin (BTC) has been the rock of the crypto market this past week, holding strong above the psychologically important $110,000 mark. This stability is critical because, as many traders and analysts point out, Bitcoin’s strength tends to be the foundation for altcoin rallies. When Bitcoin is solid, investors feel more comfortable redistributing profits into other cryptocurrencies, fueling what many call altcoin season.

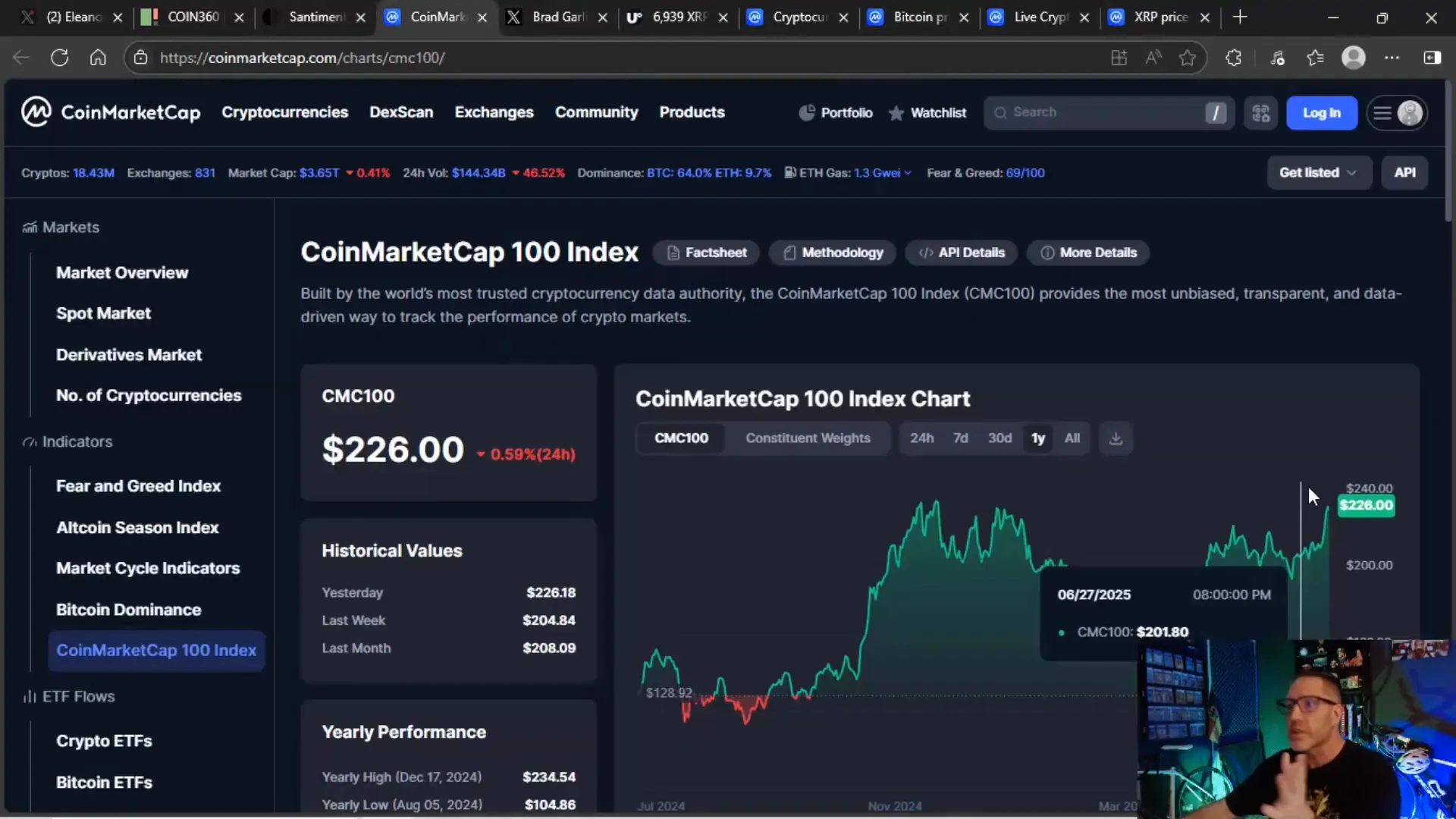

This week, the altcoins are definitely showing signs of life. The Crypto Market Cap 100 Index, which tracks the top 100 cryptocurrencies by market capitalization, has seen a significant move upwards—jumping from around 204 to 225 over the past week. This is a healthy gain, demonstrating that the market is not just riding Bitcoin’s wave but also seeing genuine momentum in altcoins like Ethereum (ETH), Solana (SOL), Binance Coin (BNB), and of course, XRP.

It’s important to understand that while Bitcoin dominates the market with roughly 69% of the total cap, altcoins are carving out their own space. Ethereum holds about 10%, XRP around 4%, and BNB contributes alongside them. This diversification is a positive sign for the health and maturity of the crypto ecosystem.

Altcoin Season Declared by Santiment

Crypto analytics firm Santiment recently declared that we are officially in altcoin season. This declaration is based on several key metrics: the surge in altcoin prices, increased network activity, and a notable rise in new wallet creations, especially for XRP.

The number of XRP wallets holding more than one million coins has reached an all-time high of 2,743. This is a bullish indicator, showing growing confidence and accumulation among whales or significant investors. Alongside this, overall crypto trading volume has increased, signaling active market participation.

However, there’s a caveat. Santiment and other analysts suggest that altcoin season will continue only as long as Bitcoin remains above that critical $110,000 level. If Bitcoin dips below this, the market could shift back into risk-off mode, with investors retreating to Bitcoin or even fiat.

That said, some voices in the community, including myself, feel that $110,000 might be a bit too soft as a floor for Bitcoin. A seven percent pullback from recent highs could cause panic, given how jittery the market gets with even 2-3% corrections. A more realistic support level could be around $112,500 to $113,000, which would provide a sturdier foundation for altcoins to thrive.

Brad Garlinghouse’s Fiery Response in Washington DC

One of the most talked-about moments this week was Ripple CEO Brad Garlinghouse’s appearance in Washington, DC. Brad didn’t hold back, delivering some sharp remarks that left regulators and lawmakers silent—so much so that follow-up questions were noticeably absent.

“Pending upon an SEC and CFTC to work together assumes good faith appointed officials in doing that. What we have seen previously is the SEC actually sowed confusion in the marketplace. They took contradictory positions under chairman Gensler. They took actually contradictory positions in different court cases, which actually created more confusion.”

“Federal judges said the SEC was being arbitrary and capricious in their application of the law, not following a ‘faithful allegiance to law.’ My concern is depending upon unelected appointees to make these decisions assumes good faith actors. What we saw recently was a war against the industry without consistent application of the law.”

Brad’s points resonate deeply within the crypto community. His critique highlights the frustration with regulatory inconsistency and the dangers of leaving too much power in the hands of unelected officials with their own agendas. As the crypto market braces for “Crypto Week” in Congress, and ongoing discussions about regulation, Brad’s stance is a bold call for clearer, fairer, and more transparent rules.

XRP’s Organic Growth and Wallet Surge

Let’s get into some of the numbers that tell the story behind XRP’s recent price rally. On a single day, a whopping 6,939 new XRP wallets were created—the highest daily figure since March 1st. This is a significant metric indicating fresh interest and growing retail participation.

Now, you might wonder: is 6,939 new wallets a lot? Well, in the context of a market that’s no longer in discovery mode, where most people are aware of crypto, this is a solid number. The question is whether it’s enough to sustain a long-term rally or just a short-term spike fueled by hype.

XRP recently hit its highest price in four months, surging to $2.96 in just four days. This bullish breakout wasn’t just about price action; it was supported by major network growth and a rise in retail interest, especially on social media platforms.

Speaking of social media, XRP commands an impressive 5.5% share of all crypto-related discussions. Considering Bitcoin’s dominance, this level of social chatter around XRP is huge. It signals genuine retail enthusiasm and buzz that often precedes further price moves.

Price Action and Support Levels for XRP

Taking a closer look at XRP’s price chart, we see some important technical levels forming. After the surge to $2.96, the coin found strong support around $2.65. The 15-minute candlestick charts show volume spikes coinciding with these price moves, which is a positive sign of healthy trading activity.

Currently, XRP faces some near-term resistance at around $2.85. But as long as it trades within the $2.65 to $2.85 range, this is considered a win by many traders. It’s a solid consolidation phase that can pave the way for another breakout.

Zooming out to the one-year chart, XRP’s floor seems to have shifted higher. Previously, $2.00 was considered a strong support level, but now it looks like the floor might be closer to $2.50. This shift is important because it indicates growing investor confidence and a stronger base for future gains.

For comparison, other major altcoins like BNB have struggled to reclaim their previous highs, often showing more volatility and deeper dips. XRP, on the other hand, has demonstrated more stable support, making it an attractive option for investors looking for resilience.

Volume Trends and Market Dynamics

Trading volume is another crucial indicator of market health. This past weekend, total crypto volume was around $144 billion, down 46% from the previous peak. While that might sound like a sharp drop, it’s perfectly normal for volume to decline on weekends when institutional and retail activity slows.

Even so, XRP’s 24-hour volume remains strong at $11.3 billion, signaling sustained interest despite the weekend lull. This healthy volume supports the idea that the recent price moves are backed by genuine market participation rather than thin liquidity or manipulation.

What’s Next? Crypto Week and Regulatory Outlook

Looking ahead, the market is gearing up for a potentially explosive Crypto Week in Congress. This event will focus heavily on regulatory issues, including taxation, classification of crypto assets, and the broader question of how to regulate the industry fairly.

Taxation is a huge sticking point. Many investors and businesses hesitate to dive deeper into crypto because tax rules remain unclear or overly burdensome. Discussions in DC about clear tax guidance could unlock new capital flows and institutional interest.

We’re also watching for developments around ETFs and potential rate cuts from the Federal Reserve. While Jerome Powell’s stubbornness on rate changes has frustrated some, there’s speculation about a possible rate cut in September, which could further fuel market rallies.

However, a word of caution: profit-taking is inevitable. Some cryptos will lag or fail to keep pace, and investors need to be prepared for volatility. Staying informed and agile will be key to navigating this next phase.

Final Thoughts on the Current Crypto Landscape

All signs point to an exciting and dynamic week ahead in the cryptocurrency markets. XRP’s strong price action, robust wallet growth, and social media dominance set the stage for continued momentum. Bitcoin’s critical support levels will be the barometer for how altcoins perform, with $110,000 acting as a psychological marker—though a higher support level might be more realistic.

Brad Garlinghouse’s remarks in DC underscore the need for clear, consistent, and fair regulation. The crypto community is watching closely as lawmakers consider bills that could shape the industry’s future. We hope for progress that protects investors without stifling innovation.

Whether you’re an XRP holder, Bitcoin enthusiast, or altcoin trader, staying on top of these developments will be crucial. The next few weeks could bring juicy opportunities—but also challenges—so buckle up and stay engaged.

Choo choo, bitches! 🚂💥

🎯 XRP HOT NEWS 🎯 Garlinghouse Responds Amid Altcoin Season Surge | Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing Insights. There are any 🎯 XRP HOT NEWS 🎯 Garlinghouse Responds Amid Altcoin Season Surge | Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing Insights in here.