If you’ve been tracking the world of cryptocurrency, you know how exhilarating the recent market movements have been. Bitcoin (BTC) is once again rallying, pushing altcoins like Ripple’s XRP to ride the momentum. This surge isn’t just a random spike; it’s backed by a series of upcoming events, market dynamics, and institutional interest that could reshape the crypto landscape. In this article, we’re diving deep into the price action, market trends, and the critical catalysts driving this exciting phase in Bitcoin, Crypto, BTC, Blockchain, and Investing.

Whether you're an ETH holder, a Bitcoin enthusiast, or an XRP warrior, there’s something juicy here for everyone. Let’s break down what’s happening, why it matters, and what to expect next in this fast-evolving market.

The Weekend Crypto Surge: Bitcoin and XRP Heating Up

Bitcoin is roaring again, getting ready to touch — and potentially break — its all-time highs. Alongside BTC, XRP is showing remarkable strength with volume that’s downright juicy, especially for a weekend when market activity usually cools down.

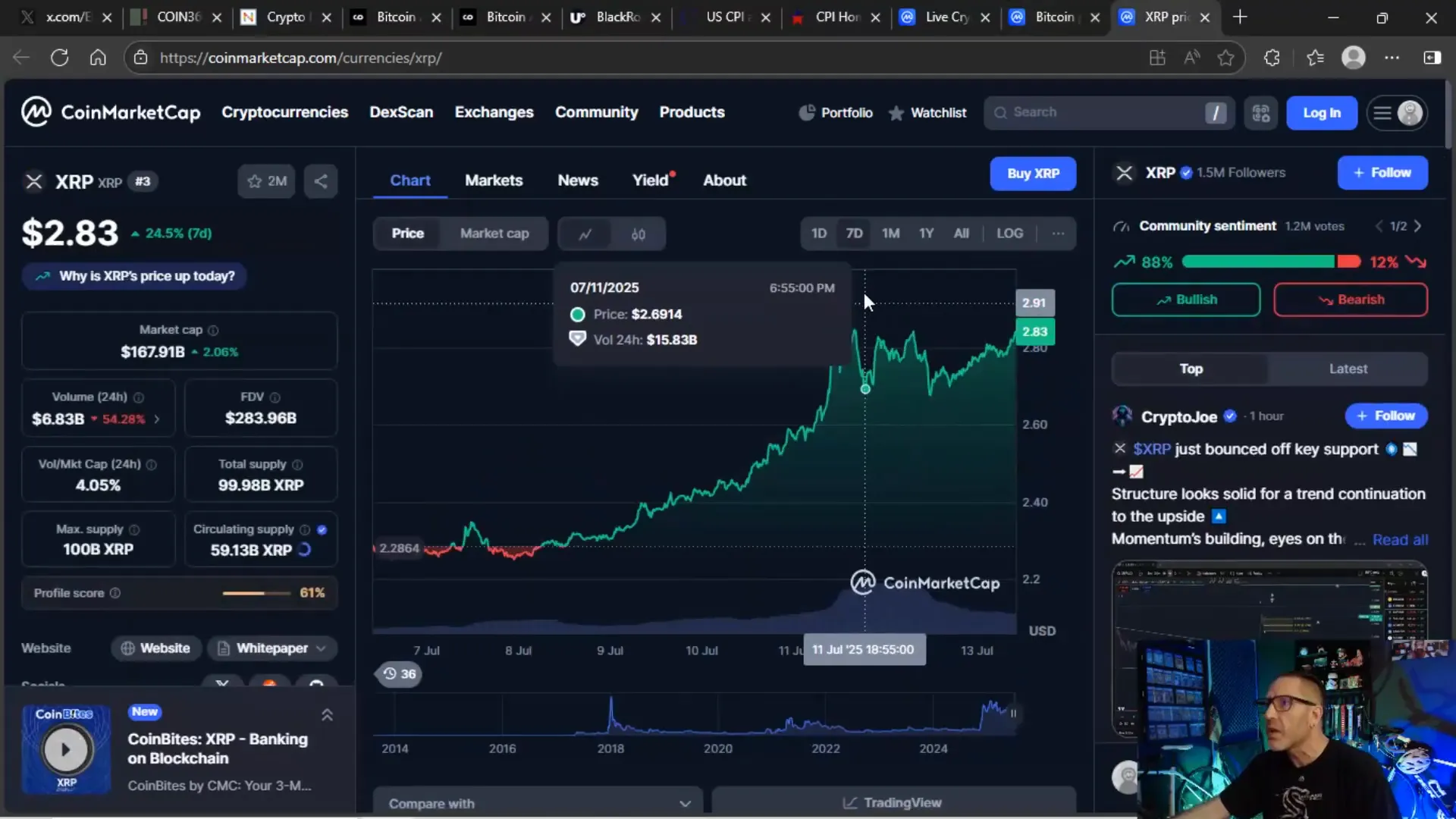

Take a look at the charts: the seven-day and one-day price action for XRP clearly shows a strong upward trend. This isn’t just a flash in the pan; it’s sustained momentum that’s capturing the attention of traders and investors alike.

Why does this matter? Weekend volume in crypto is often driven by retail traders, while institutional players tend to take breaks. So, when you see this kind of robust activity outside traditional business hours, it signals genuine enthusiasm and a potential precursor to even bigger moves once the institutions jump back in.

What’s Behind This Weekend Rally?

Several factors are converging to fuel this rally:

- BTC’s breakout potential: Bitcoin’s steady climb towards all-time highs is encouraging more players to join the party.

- Altcoins following: XRP and other altcoins are benefiting from Bitcoin’s momentum, moving in tandem rather than lagging behind.

- Upcoming major events: Next week promises critical developments, including CPI data releases, Crypto Week activities, and legislative hearings that could impact crypto regulations.

All these factors combined create a perfect storm for price action and volume surges.

ETH Holders, Listen Up: Institutional Custody and Crypto Insurance

Ethereum (ETH) holders have had a somewhat slower ride compared to BTC and XRP, but recent developments suggest ETH is warming up too. Institutional custody remains a hot topic in the crypto space, and many viewers have voiced strong opinions on this.

One viewer, EOC 4126, expressed a common sentiment: “I’m a strong believer in institutional custody just like stocks.” However, a critical caveat was raised — without insurance, institutional investors might stay cautious.

This brings us to a key question: What if the crypto ecosystem had an FDIC-like insurance system? Imagine the flood of capital that would pour into the market if investors knew their holdings were protected against scams, hacks, and failures.

Scams and schemes remain a significant barrier to mass adoption, but insurance could act as a powerful shield, bringing billions of dollars in fresh investment. This would not only boost confidence but also help regulate the market in a way that fosters growth and stability.

Bitcoin Adoption: What Public Companies Are Saying

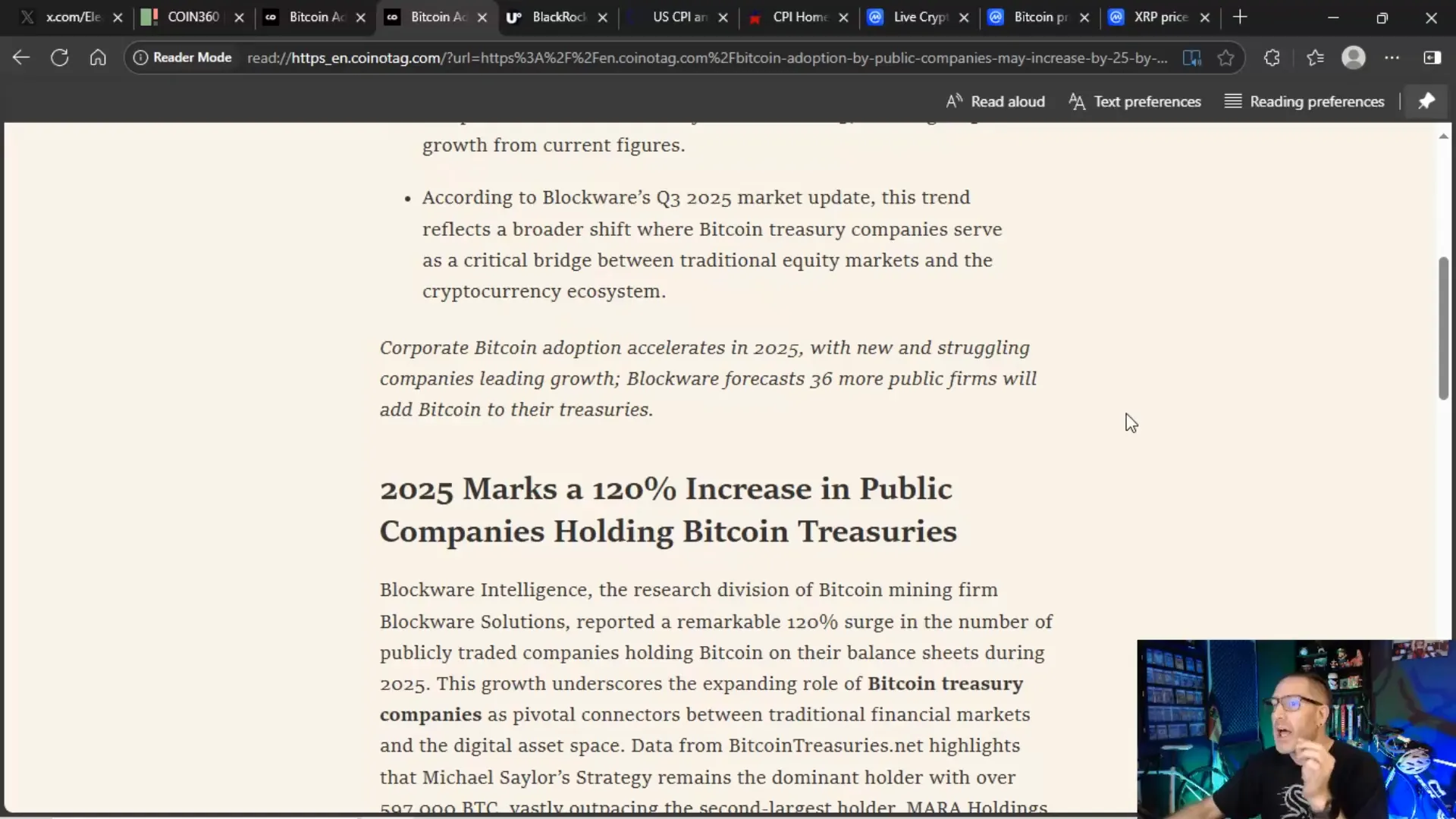

One of the most telling signs of Bitcoin’s growing legitimacy is its increasing adoption by public companies. Blockware Solutions’ recent analysis shows a marked rise in Bitcoin integration within corporate portfolios.

Let’s unpack this:

- Current landscape: Many public companies have dipped their toes into BTC, holding it as a strategic asset.

- Projected growth: Blockware Intelligence forecasts at least 36 public companies will hold Bitcoin by the end of 2025, representing a 25% increase from today.

- Surge in adoption: A 120% increase in companies holding BTC was reported in 2025, signaling a strong institutional appetite.

Bitcoin is being embraced not just as a speculative asset but as a hedge against inflation and portfolio diversifier. This shift could signal broader corporate strategy changes, where crypto becomes a standard part of treasury management.

Think about it: public companies are massive players compared to individual investors. Their entry into Bitcoin markets could drive unprecedented liquidity and price stability.

BlackRock’s Ethereum Milestone: A Sign of Things to Come

While Bitcoin has been stealing the spotlight, Ethereum is quietly making strides. BlackRock, the world’s largest asset manager, recently broke a major milestone by accumulating over 2 million ETH in their Ethereum ETF as of July 13th.

This inflow is significant because ETH has traditionally lagged behind BTC in institutional adoption. BlackRock’s warm embrace of Ethereum signals growing confidence in ETH’s long-term value and utility, especially with upcoming upgrades and the expanding DeFi ecosystem.

This milestone aligns with broader market optimism and could spur fresh interest in Ethereum from both retail and institutional investors.

Upcoming Market Catalysts: CPI Data and Crypto Week

As we look ahead, the market is gearing up for several critical events that could trigger volatility and opportunity:

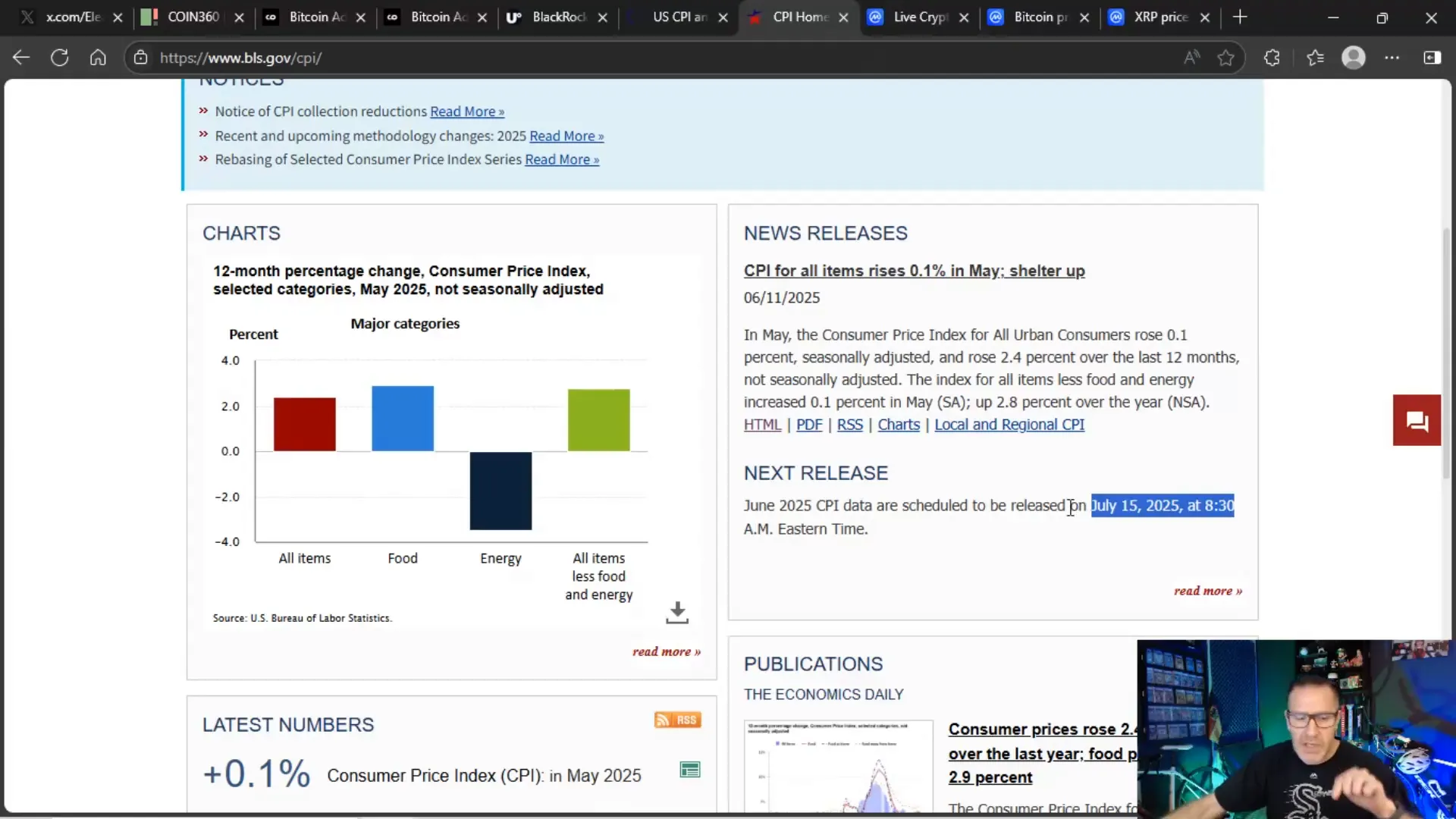

- US CPI and Core CPI Data (Tuesday): The Consumer Price Index (CPI) data, scheduled for release on Tuesday at 8:30 AM Eastern Time, is a key economic indicator that measures inflation by tracking the price change of goods and services.

- Crypto Week and Legislative Hearings: The House and Senate are hosting crypto-related hearings, including discussions on anti-corruption and regulatory clarity acts that could impact Bitcoin, XRP, and other digital assets.

Why does CPI matter so much? Jerome Powell, the Federal Reserve Chair, consistently says he’s “waiting for the data” before making decisions on interest rates. A high CPI reading could mean prolonged higher rates, which might dampen crypto enthusiasm. Conversely, a low CPI could pave the way for rate cuts, potentially unleashing more liquidity into markets, including crypto.

Expect major volatility around these announcements — and it’s a perfect time to stay informed and ready to act.

Market Volume and Altcoin Season: What’s Happening Now

Despite being a Sunday, the crypto market is showing robust volume — over $110 billion in the last 24 hours, a figure usually reserved for weekdays. This healthy volume supports the idea that the market is primed for continued upward movement.

Moreover, the altcoin season indicator stands at 31 out of 100, meaning altcoins are moving proportionally with Bitcoin. This synchronized movement is a positive sign, suggesting investors are gaining confidence across the board rather than focusing solely on BTC.

In terms of inflows, big moves are expected next week, especially if Bitcoin maintains its momentum. Altcoins like XRP are already showing signs of strength, with impressive volume figures that underline serious retail and institutional interest.

XRP Price Action: What to Watch

XRP’s recent price action is nothing short of exciting. In the last 24 hours alone, XRP traded $7 billion in volume — a jaw-dropping figure, especially on a weekend.

Let’s break down the technicals:

- Resistance levels: XRP faced rejection around $2.97 on July 11th but has since broken through key resistance levels on July 11th and 12th, signaling a strong bullish trend.

- Support floors: Two distinct support levels around $2.66 provide a solid foundation for continued upward movement.

- Price momentum: The last time we saw such price action was back on March 2nd, underscoring how significant this rally is.

With these indicators, XRP looks poised to challenge higher price points, especially with upcoming catalysts like spot ETFs and regulatory clarity potentially encouraging companies to add XRP to their strategic reserves.

Why XRP Could Be the Next Big Winner

XRP stands out for several reasons:

- ETF Developments: Spot ETFs and basket ETFs including XRP are on the horizon, which could unlock new investment avenues.

- Legal Case Finalization: The finalization of Ripple’s court case could clear regulatory uncertainties, boosting investor confidence.

- Regulatory Clarity Acts: Proposed legislation could encourage companies to diversify their crypto holdings beyond BTC, with XRP becoming a favored asset due to clearer legal frameworks.

These factors create a powerful case for XRP’s continued momentum, especially as market optimism builds ahead of official regulatory moves.

Institutional Players and the Week Ahead

While retail traders have been driving volume over the weekend, institutional investors are expected to jump back in when the market opens on Monday. This “catch-up” effect often leads to increased volume and price volatility, creating opportunities for savvy traders and investors.

Monday could see traditional finance players making significant moves, especially as discussions around regulatory clarity, anti-CBDC surveillance bills, and other legislative initiatives unfold.

Additionally, the Senate’s crypto hearing on Tuesday adds another layer of intrigue, as lawmakers debate the future of digital currencies and their place in the financial system.

Staying Ahead of the Curve

For those invested in Bitcoin, Crypto, BTC, Blockchain, and Investing, staying informed is crucial. Here’s what to keep on your radar:

- Watch the CPI data release closely — it will influence Fed policy and market liquidity.

- Keep an eye on legislative developments, especially crypto-specific bills and hearings.

- Track volume and price action in BTC and XRP, as these often set the tone for the broader market.

- Be ready for rapid moves during Crypto Week, as news and sentiment can shift quickly.

- Consider the impact of institutional adoption — their entry could drive sustained growth beyond retail speculation.

The crypto market is dynamic and fast-paced, but with the right information and strategy, it offers unparalleled opportunities for growth and profit.

So, buckle up, stay alert, and get ready for what could be an explosive week ahead in the world of Bitcoin, Crypto, BTC, Blockchain, and Investing!

XRP BTC🔥 HUGE PUMP EVENTS COMING YES PLURAL!!!🔥 – A Deep Dive Into Bitcoin, Crypto, BTC, Blockchain, and Investing. There are any XRP BTC🔥 HUGE PUMP EVENTS COMING YES PLURAL!!!🔥 – A Deep Dive Into Bitcoin, Crypto, BTC, Blockchain, and Investing in here.