If you’re deep into Bitcoin, Crypto, BTC, Blockchain, and CryptoNews, you know how wild and unpredictable this space can be. Today, we’re diving into some fresh updates that mix the strategic reserve moves by the U.S. government, insider trading drama, and what’s really happening with XRP and Ripple. Plus, I’ll share some brutally honest thoughts on price action and why I’m lowering my buy targets. Buckle up, because this ride is anything but boring.

U.S. Government’s Strategic BTC Reserve: What’s Really Going On?

First up, let’s talk about the United States and their strategic Bitcoin reserve. Yes, you heard me right — a strategic BTC reserve. This news is both intriguing and frustrating.

According to Beau Hines, the infrastructure for the strategic U.S. Bitcoin reserve is actively being built. Remember President Trump’s March executive order? It didn’t force the Treasury to publish a report on government-held Bitcoin, but there’s a chance the administration might choose to release that information publicly. The goal? Accumulate more BTC in a budget-neutral way.

Sounds promising, right? But here’s the kicker: this reserve appears to be Bitcoin-only. What about Ethereum, Solana, Cardano, or XRP? Nothing. Zip. Zero mention of these altcoins in the government’s wallets.

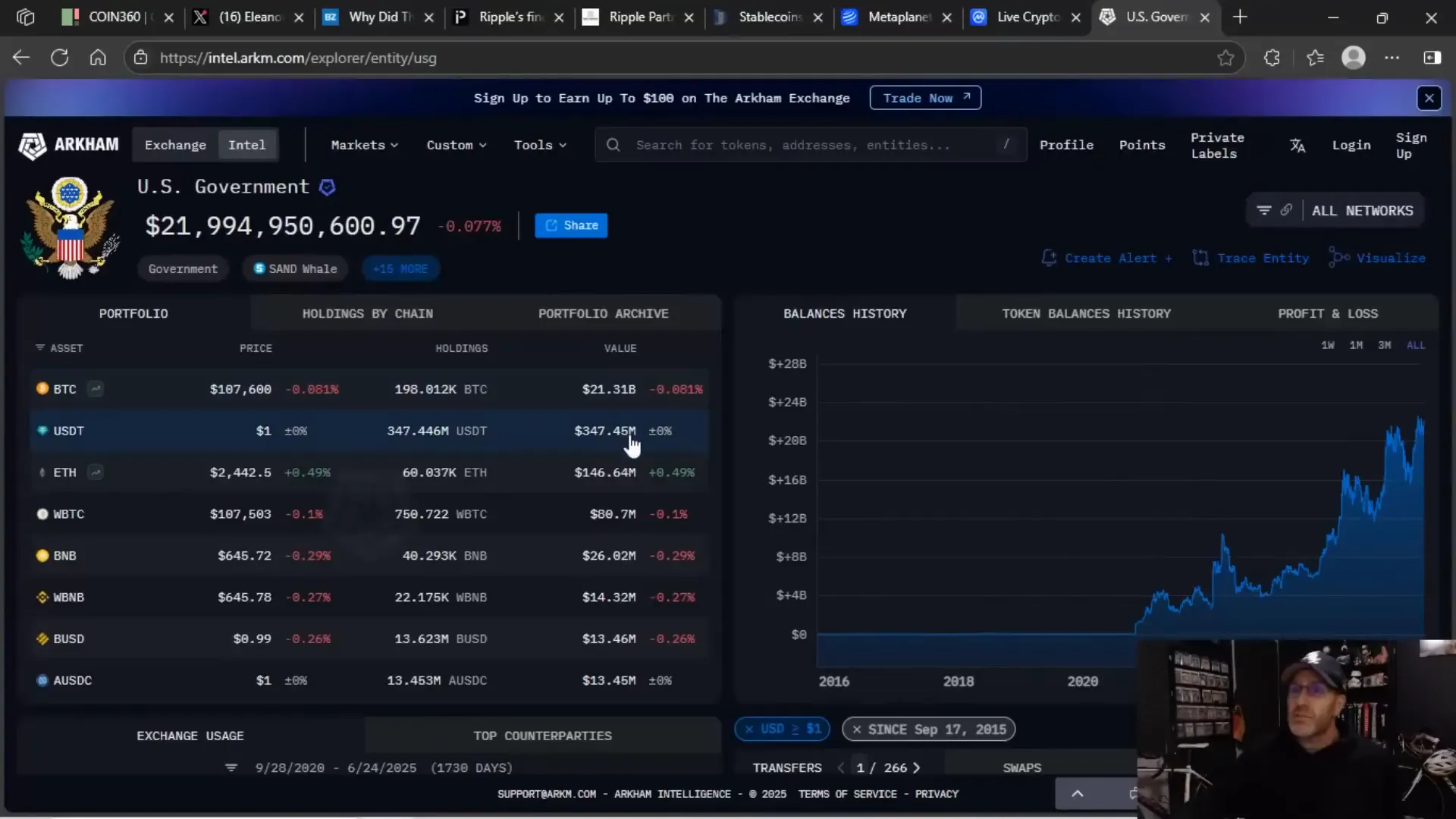

Currently, the government’s crypto holdings total just under $22 billion. Out of that, $21.3 billion is BTC, $340 million in USDT, $146 million in ETH, and smaller amounts spread across wrapped BTC, BNB, BUSD, and even some SHIB and Maker tokens. But guess what? No XRP anywhere to be found.

This “budget-neutral” accumulation strategy is a slap in the face to many altcoin holders. It begs the question: what was the point of Trump’s early tweets hyping Seoul, ADA, and XRP if the government itself isn’t backing them?

Who’s Buying What? Insider Moves and the UAE’s $100M Token Purchase

Speaking of being played, check this out. A United Arab Emirates-based Web3 fund called AquaOne just dropped $100 million on governance tokens from World Liberty Financial, a company tied to Trump. What’s the play here? Schmoozing the White House, no doubt.

This purchase supports World Liberty Financial’s decentralized platform focused on blockchain development and cozying up to political bigwigs. We’ve seen players rubbing elbows with the White House insiders, and it looks like the inside deals are flowing.

Ripple SEC Case Update: Judge Torres Isn’t Playing Around

Let’s switch gears to Ripple and the ongoing SEC lawsuit saga. Judge Torres recently shot down any attempts to reduce the settlement penalty. Despite the SEC trying to lower the fine from $125 million to $50 million, Torres said “No, no, no.” The original penalty stands firm.

Honestly, it’s been a frustrating waste of time and taxpayer money. The case has dragged on for years, and the judge is clearly not interested in cutting any slack for either party. My take? Pay the $125 million, wrap this up, and move on.

Ripple Partners with Wormhole: Multichain Interoperability — Game Changer or Not?

Here’s some interesting news for the XRP ecosystem: Ripple has partnered with Wormhole to bring multichain interoperability to XRPL and the XRPL Ethereum Virtual Machine (EVM) sidechain.

Wormhole’s platform already powers 200+ applications across dozens of blockchains and has supported over $60 billion in cross-chain volume since launching in 2020. This integration means XRPL developers can now transfer XRP IOUs and multipurpose tokens to and from other chains more seamlessly.

Robinson Berkey, cofounder of Wormhole Foundation, says this collaboration opens up a broader range of possibilities for XRPL. Sounds good on paper, right?

But here’s the harsh reality: XRPL usage is still painfully low. The most dominant stablecoin on XRPL is RLUSD, making up 92% of the $71 million total stablecoins on the chain. Compare that to Aptos with $1.23 billion, Avalanche $1.3 billion, and Polygon with $2.4 billion in stablecoins — XRPL is missing a massive chunk of zeros.

Even Stellar, which many consider a weaker chain, ranks 14th with $594 million in stablecoins, dwarfing XRPL’s 33rd place with just $71 million. So, while the Wormhole partnership is a step forward, it’s not going to suddenly flip the game for XRP price or adoption.

BTC Big Players Doubling Down on Strategic Reserves

Meanwhile, Bitcoin whales and institutional players aren’t sitting still. Meta Planet recently added 12,324 BTC to its treasury, pushing its total holdings to 12,345 BTC. More big players are stacking BTC strategically, reinforcing Bitcoin’s dominance in the crypto market.

Bitcoin dominance currently sits at 20% out of 100%, signaling growing strength for BTC relative to altcoins. This dominance trend is frustrating for altcoin investors but confirms where the smart money is moving.

XRP Price Action: A Story of Overpromising and Under-delivery

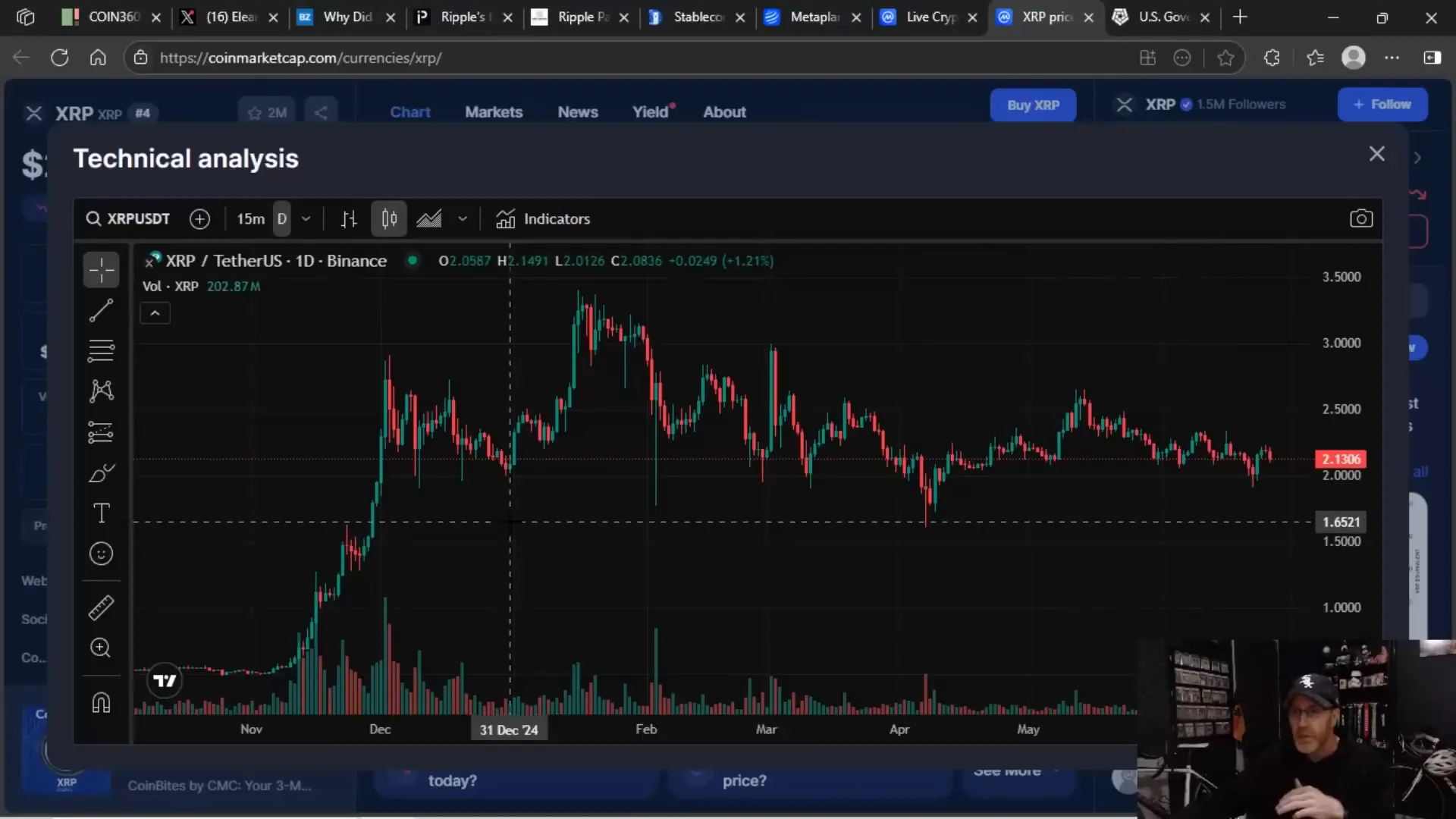

Now, let’s get to the heart of the matter: XRP price action. Spoiler alert: it’s been dull, disappointing, and downright frustrating.

For most of 2023 and into 2024, XRP has been stuck in a boring $0.30 to $0.50 range. The only time XRP got “hot” was when the U.S. presidential election happened — a move entirely unrelated to XRP fundamentals but tied to hopes of crypto-friendly policy changes.

Since then, we’ve been bombarded with promises:

- “In the first 30 days, we’ll get this.”

- “In 60 days, that.”

- “In 90 days, expect the moon.”

- Crypto roundtables that were supposed to revolutionize the regulations.

- Strategic reserve additions for XRP, Solana, and Cardano.

But what’s the reality? Nothing. Crickets. The market has been "pooping itself," as I like to say.

The last big XRP pump was in mid-May, hitting $2.65, but since then, XRP has struggled to even break $2.30. The hype is wearing off fast.

Promises of regulations, support from both political parties, and supply squeezes have not materialized. Even the Genius Act, which was supposed to clear regulatory clarity, is facing hurdles and may not pass cleanly through the House.

Meanwhile, insiders are dumping tokens connected to Trump, Melania, and World Liberty Financial, signaling a lack of confidence from those closest to the action.

Lowering My Buy Targets: Time to Get Greedy for Lower Prices

Given all this, I’m lowering my buy targets across the board. Here’s what I’m thinking:

- HBAR: New buy zone is 13 cents or lower. For a while, people said HBAR would never dip below 15 cents — well, now it’s happening.

- XRP: I’m adjusting my target to around $1.90, down from previous optimistic levels. You can definitely buy XRP under $2 now.

- PieCoin: Just a quick note — PieCoin is a dumpster fire. Its price chart is a joke, and chasing lows there is pointless.

- ADA: Cardano is hitting normalized lows similar to those in April and February, and even rolling back to November levels. Patience is key here.

In short, the market is soft, and the players overpromising are losing credibility. That means better opportunities to buy at discounted prices if you’re patient and disciplined.

Why Stablecoins Are Stealing the Spotlight

While XRP and many altcoins struggle, stablecoins are booming. The market is hot for stablecoins right now, and here’s why it matters:

- The Genius Act passed through Congress regulates stablecoins, giving them a clear regulatory framework before other crypto assets.

- Stablecoins have hit an all-time high in market cap, signaling massive adoption and volume.

- Major banks like Wells Fargo, JPMorgan, and banks in Japan are launching their own stablecoins.

- PayPal and even Trump have stablecoins, showing how mainstream this segment is becoming.

Circle’s IPO is a perfect example of this trend. Their underwriter priced the offering at $24, but the current price is much lower — highlighting both hype and volatility but also the importance of stablecoins in the ecosystem.

So, if you’re wondering where the real action is, it’s with stablecoins. They have the volume, the regulation, and the adoption. The rest? Still waiting for the promised moonshots.

What’s Next? Playing It Smart in a World of Broken Promises

Here’s the bottom line: the crypto world is full of hopium, copium, and manipulation. We’ve been promised regulations, strategic reserves for altcoins, supply shocks, and bank adoptions that haven’t materialized.

That means it’s time to adjust expectations and strategies. I’m buying silver as a hedge because when gold prices are too high, investors rotate into silver. I’m also buying crypto, but I’m lowering my targets and waiting for better prices.

Don’t chase hype. Instead, watch the charts and the news with a skeptical eye. The insiders dumping tokens and the government’s BTC-only reserve tell us a lot about where the smart money is heading.

So, if you’re holding XRP, ADA, Solana, or any altcoin, be patient. The market is soft, and the opportunities will come if you wait for the right moment to get greedy.

And if you want to prove me wrong, bring your bullish arguments. Because as of now, the facts don’t lie.

Stay sharp out there, and let the market show you the way.

XRP, BTC & CryptoNews: Strategic Reserves, Insider Trading & Price Target Updates. There are any XRP, BTC & CryptoNews: Strategic Reserves, Insider Trading & Price Target Updates in here.