Have you ever stopped scrolling through social media and wondered: How is everyone affording life right now? Luxury vacations, designer clothes, dream homes, and seemingly effortless spending—especially from people your age or even younger—make it feel like you’re living in a completely different financial reality. You work hard, save diligently, and budget carefully, yet you still feel like you’re falling behind. Meanwhile, your friends are buying houses, traveling to Europe, dining at fancy restaurants with sparkling water priced at twelve dollars, and somehow still smiling through it all.

Sound familiar? You’re not alone. Millions of people feel this way, caught in the tension between their financial reality and the curated illusions they see online. The truth is, you’re probably doing better than you think. But the financial landscape has changed dramatically, fueled by rising debt, soaring interest rates, and a social media machine that distorts reality. In this article, inspired by insights from Andrei Jikh, we’ll unpack why you feel this way, what’s really happening behind the scenes, and how you can navigate this new normal with confidence.

The Illusion of Financial Prosperity: Social Media’s Big Lie

Social media is the greatest amplifier of financial FOMO (fear of missing out) we’ve ever seen. Over 90% of young people use social media daily, with more than half checking it 30+ times a week. But it’s not just mindless scrolling—it fundamentally shapes how we perceive our lives and financial health.

Studies reveal that 41% of millennials admit to buying things just to keep up with others they see online, and nearly 40% drive themselves into debt because of this pressure. This phenomenon isn’t limited to millennials; Gen Z reports even higher levels of financial FOMO, with about 70% feeling left out financially based solely on what they see online.

This distorted perception has been dubbed money dysmorphia. Roughly 43% of Gen Z and 41% of millennials report that their perception of their own financial health is skewed—even when their actual financial numbers tell a very different story.

TikTok, in particular, has transformed the way young people shop. Over half of TikTok users say they’re more likely to buy products recommended by creators with Amazon storefronts. Gen Z shoppers are 34% more likely to make purchases influenced by TikTok creators than traditional ads. This shift has changed not only consumer behavior but also how businesses market their products.

Live shopping events, where influencers demonstrate and sell products in real-time, are projected to account for 10-20% of all online sales by 2026. Every scroll could easily lead to an impulsive purchase, creating a cycle of spending that often ends in regret. Around 25% of TikTok shoppers say they wish they hadn’t made certain purchases.

Why This Matters for Bitcoin, Crypto, BTC, Blockchain, and Investing

While millions are overspending on impulse buys and lifestyle inflation, only about 58% of Americans own any stocks, and that percentage is lower for younger generations. Among millennials, only one in three feels confident investing in the stock market, and Gen Z confidence is even lower.

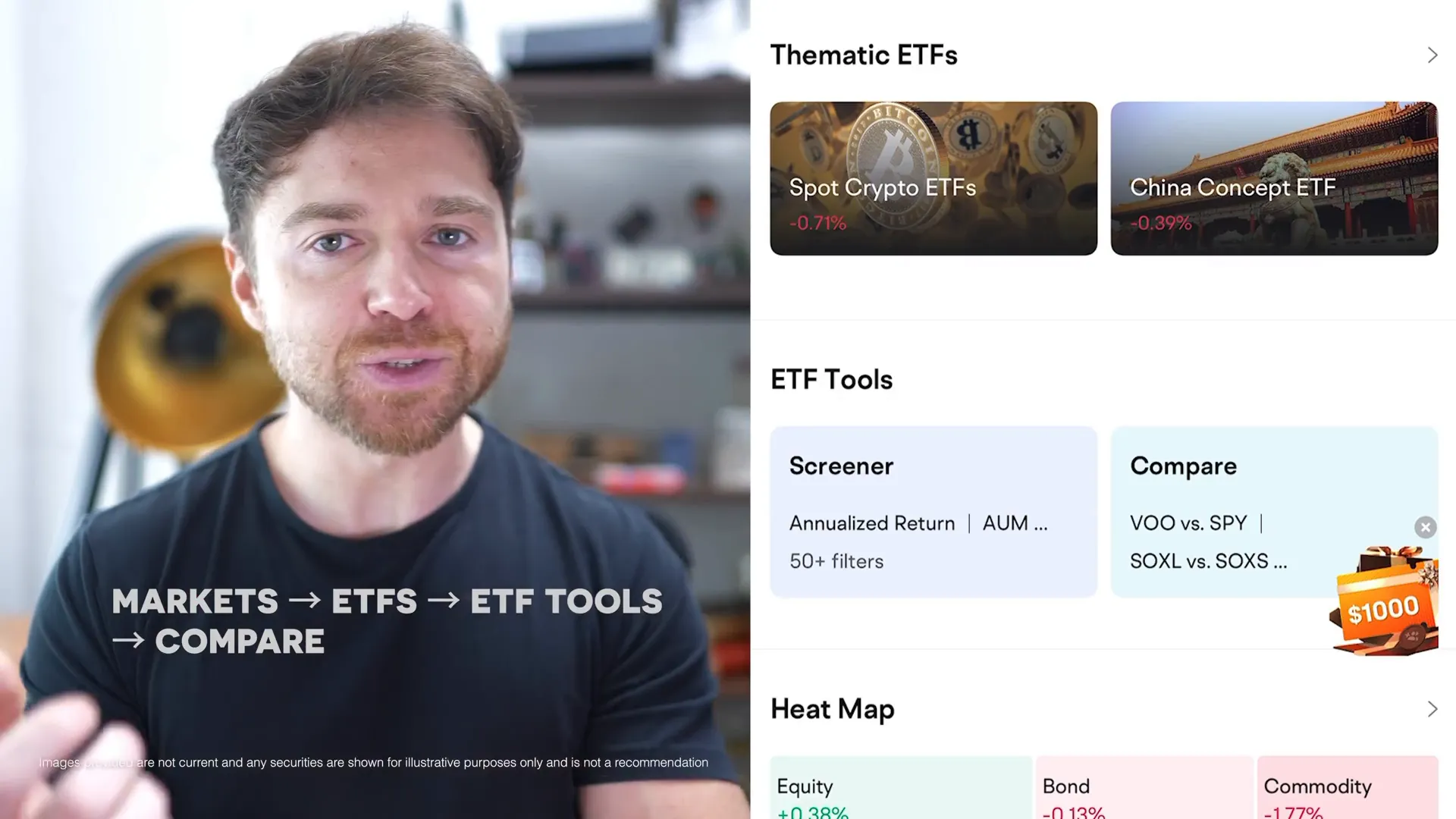

This is a crucial point because owning assets—whether stocks, ETFs, or crypto—is a key differentiator between building wealth and merely keeping up. Platforms like Moomoo make investing more accessible by letting users explore thematic ETFs and trade pre-market and post-market, helping investors capitalize on trends like rising oil prices or potential Fed rate cuts.

Investing wisely and consistently, even in small amounts, can help you build wealth over time and break free from the cycle of financial anxiety fueled by social media comparisons.

The Real Financial Picture: Debt, Interest Rates, and the Cost of Living

Behind the social media illusions, the financial reality is sobering. Household debt in America has reached a record-breaking $18.2 trillion, increasing by $170 billion in just the last three months alone. This debt largely comes from mortgages, but the fastest-growing segment is credit card debt, which now exceeds $1.3 trillion.

What makes this particularly alarming is the cost of borrowing. The average credit card APR is now over 24%, the highest it’s been in decades. To put that into perspective, if you charged $1,000 and only made minimum payments, you’d pay closer to $1,400 by the time the debt is cleared—not just the original amount plus a small interest fee.

This means people are often paying a heavy premium to finance lifestyles that appear enviable online. Yet, despite understanding the math, many continue swiping their cards because this behavior feels normal in today’s economy.

The Rise of Buy Now, Pay Later

Traditional credit cards aren’t the only culprits. Buy Now, Pay Later (BNPL) services like Klarna, Afterpay, and Affirm have exploded in popularity, especially among millennials and Gen Z. In 2021, Americans spent around $2 billion via BNPL; by 2024, that number is projected to exceed $46 billion.

BNPL isn’t just for luxury items; people are using it to finance groceries, clothing, gas, and even entertainment like concerts. According to LendingTree, 1 in 4 BNPL users have used it to buy essentials, and 41% have missed a payment, highlighting the risk of falling behind on these short-term loans.

In reality, many people aren’t effortlessly spending—they’re borrowing invisibly and often unsustainably to maintain appearances.

Soaring Interest Rates Make Everything Pricier

Adding to the financial strain is the rising cost of borrowing. The Federal Reserve’s target rate currently sits between 5.25% and 5.5%, impacting everything from car loans to mortgages and student loans.

- Car loans now average 7.5% to 9%, depending on credit.

- 30-year fixed mortgage rates have doubled in just a few years, now hovering between 6% and 7%.

To illustrate, a $500,000 home purchased in 2020 at 3% interest would have had a monthly payment around $2,100. Today, at 7%, that same home costs over $3,300 per month—an increase of $1,200 every month for the same house, purely due to the cost of money rising.

This is the hidden culprit pricing many out of the middle-class lifestyle. It’s not that you’re making less money; it’s that borrowing money is significantly more expensive than it was a few years ago.

Housing Market Realities: Why Buying a Home Feels Out of Reach

The dream of homeownership is slipping further away for many. In the 1990s, the average first-time homebuyer was 28 years old. Today, that age has climbed to 38—a full decade later. Moreover, only 24% of homebuyers are first-timers, the lowest number in over 40 years.

The affordability crisis isn’t limited to traditional expensive cities like San Francisco or New York. Over the last five years, the number of U.S. cities where starter homes cost over $1 million has nearly tripled from 85 to more than 200, including formerly affordable cities like Boise, Salt Lake City, and Austin.

To afford these inflated prices, buyers need larger down payments—the average down payment today exceeds $54,000, a daunting sum for many.

Competing with Wall Street

Adding to the challenge is the growing presence of institutional investors in the housing market. Studies show these investors own up to 10% of all single-family homes nationwide, and in some cities like Atlanta and Jacksonville, that number reaches 25%. Nearly one in four homes in these areas is purchased by investors, not families.

This competition drives prices even higher and reduces inventory available to traditional buyers, pushing more people into renting longer and causing rent prices to soar. The national median rent now hovers around $2,000 per month, with major cities like New York and Los Angeles far exceeding that.

Income Growth Has Not Kept Pace

Over the past 40 years, home prices have increased by nearly 500%, while real wages have barely budged. This growing gap means that even with disciplined saving, good credit, and careful budgeting, many feel trapped in a system where the math no longer works in their favor.

So if you’ve been saving and budgeting but still feel like homeownership is out of reach, you’re not imagining things—the rules and math have changed, but expectations haven’t caught up.

Redefining Financial Success in a New Normal

By now, this might sound overwhelming or even discouraging, but here’s the crucial perspective: you’re probably not actually behind. Almost everyone feels this way—including those who post about their luxury vacations and dream homes. If seven out of ten people say they feel financially behind, that feeling becomes the new normal.

Success today isn’t about running faster or spending more to keep up with others. It’s about stepping out of the rat race entirely—focusing on your own numbers, your own pace, and your own financial journey.

If you’re living below your means, consistently saving, investing even a little each month, and educating yourself about finance—whether that’s understanding ETFs, index funds, or even the basics of Bitcoin, Crypto, BTC, Blockchain, CryptoNews, and Investing—you’re already ahead of most people.

Consider this: 56% of Americans can’t afford a $1,000 emergency expense. If you’re budgeting, investing, or have an emergency fund, you’re doing better than the majority.

The Power of Time and Consistency in Investing

Investing isn’t about picking the perfect stock or timing the market. It’s about the combination of money invested and time. The habits you build now—staying invested despite market volatility, spending less than you earn, and resisting social media-driven impulse buys—will pay off over your lifetime.

Platforms like Moomoo can help you research and invest with confidence, offering tools to compare ETFs, explore investment themes, and trade outside regular market hours. This empowers you to make informed decisions and grow your wealth steadily.

Finding Peace Beyond Possessions

One personal insight that’s transformed my approach to money is this: true happiness comes from peace, not ownership. When I finally buy something I want, the joy isn’t in owning it but in freeing myself from the burden of wanting it.

This mindset shift—valuing the ability to buy over the act of buying—helps me resist unnecessary purchases. A simple trick I use is to save enough money for an item, then simply acknowledge that I can buy it, and often I don’t. This feeling of control and accomplishment replaces the urge to spend.

And when you think about it, that same money saved and invested could grow significantly over 20 years, multiplying your freedom and options in ways a single purchase never could.

Moving Forward with Confidence

Feeling financially behind is a widespread experience today, but it’s largely fueled by distorted perceptions, rising debt, and a challenging economic environment. The key is to focus inward—on your financial habits, your investments, and your mindset.

By educating yourself about Bitcoin, Crypto, BTC, Blockchain, CryptoNews, and Investing, and by making consistent, informed decisions, you’re investing in yourself and your future. Over time, these small steps compound into real wealth and financial freedom.

If this perspective has given you some peace of mind, consider sharing it with someone else who might need to hear it. Remember, you’re not behind—you’re learning, growing, and getting ahead.

Keep focusing on your journey, not the highlight reels of others. Your financial story is yours to write.

Why You Feel Financially Behind (Even If You're Doing Well): The Hidden Truth Behind Bitcoin, Crypto, BTC, Blockchain, CryptoNews, and Investing. There are any Why You Feel Financially Behind (Even If You're Doing Well): The Hidden Truth Behind Bitcoin, Crypto, BTC, Blockchain, CryptoNews, and Investing in here.