Bitcoin enthusiasts and skeptics alike have been closely watching the market dynamics, especially following the recent updates from Plan B, the anonymous Dutch quant behind the legendary stock-to-flow model. Despite claims that this model was dead after Bitcoin’s turbulent 2022, Plan B is back with renewed confidence, showing that Bitcoin’s price action is unfolding exactly as predicted after past halving events. This article dives deep into why this setup could be a game-changer and why it might just terrify the bears.

Table of Contents

- The Resilience of the Stock-to-Flow Model

- Zooming Out: Long-Term Trends Over Temporary Dips

- Tom Lee’s Network Effect Model: Explaining Bitcoin’s Price Movements

- Why Tom Lee is More Bullish Than Ever

- Michael Bucella Explains the Price-Demand Puzzle

- Bitcoin: The Hardest Asset in a Weakening Global Currency Landscape

- Michael Saylor’s Bold Bitcoin Predictions

- Understanding Bitcoin’s Scarcity: A Digital Land Analogy

- Jack Mallers: The Blunt Truth About Bitcoin

- Recent Price Volatility Amid Geopolitical Tensions

- Conclusion: Are We on the Cusp of a Major Bitcoin Breakout?

The Resilience of the Stock-to-Flow Model

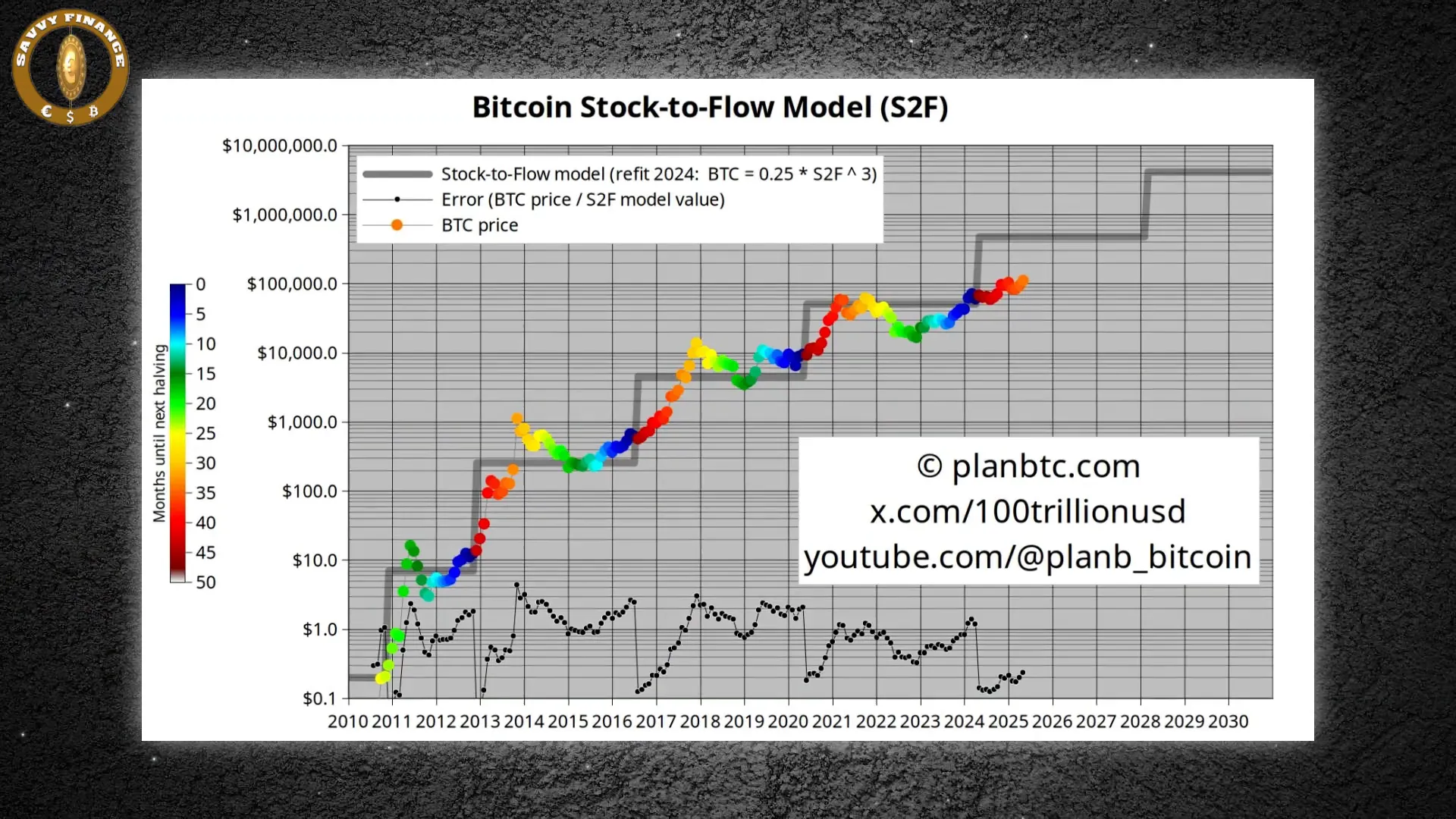

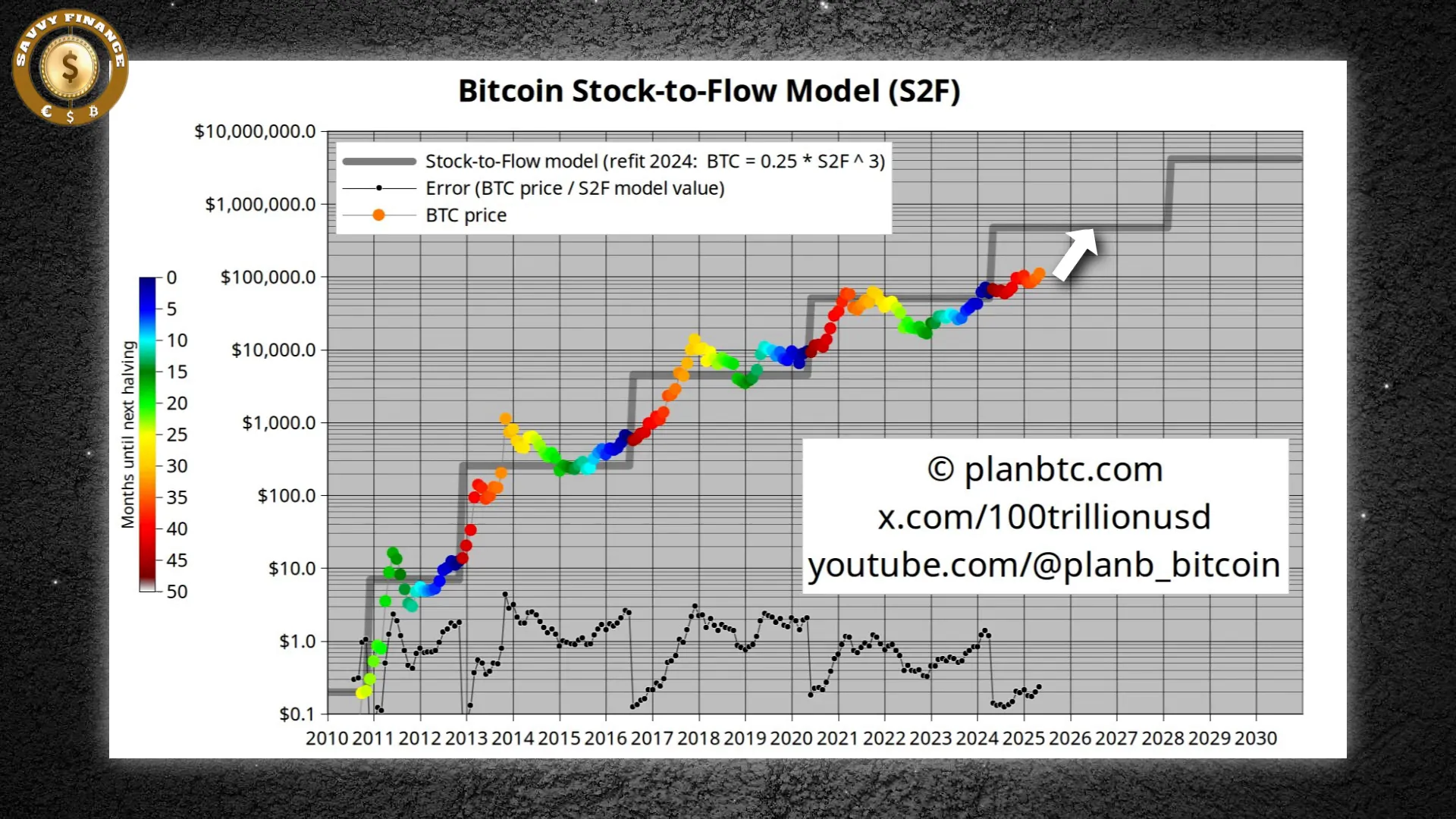

Plan B’s stock-to-flow model has weathered incredible storms: three Bitcoin halvings, a global pandemic, soaring inflation, a banking crisis, and a brutal crypto winter. Yet, it remains intact. The model charts Bitcoin’s current price movements almost perfectly mirroring the post-halving patterns seen in 2013, 2017, and 2021. Historically, Bitcoin doesn’t simply crawl upward after halvings—it snaps upward in explosive breakouts.

Currently, Bitcoin is grinding sideways, precisely as it has done after previous halvings, indicating that the market is gearing up for another major rally. According to Plan B, we are “right on time” and the “breakout isn’t late; it’s loading.” With only two months elapsed since the latest halving, the most significant part of this cycle could still be ahead.

Zooming Out: Long-Term Trends Over Temporary Dips

Critics dismissed Plan B’s model in 2022, arguing that Bitcoin’s price drop invalidated the predictions. But Plan B urges everyone to zoom out. The long-term trajectory hasn’t changed. Temporary dips don’t erase the fundamental signal. Bitcoin hovering near $107,000 and holding firm is a sign it’s bending back toward its historic growth curve. If history is any guide, a parabolic surge is still on the horizon, typically occurring six to twelve months post-halving.

Tom Lee’s Network Effect Model: Explaining Bitcoin’s Price Movements

Adding to the bullish narrative, Tom Lee, a respected crypto analyst, shared insights from a 2017 research report he authored when Bitcoin was trading around $1,000. His model explained about 90% of Bitcoin’s price rise through network dynamics—specifically, the number of wallets and activity per wallet, which are logical indicators of Bitcoin’s usage and adoption.

Lee also drew a comparison between Bitcoin and gold, suggesting that Bitcoin’s digital scarcity and increasing use could eventually drive its market value to rival a portion of gold’s. While not implying Bitcoin will replace gold, this analogy highlights Bitcoin’s potential as a hard asset with significant upside.

Why Tom Lee is More Bullish Than Ever

Tom Lee emphasized a significant shift in regulatory attitudes, particularly in the United States. For the first time in years, regulators appear open to embracing the innovation that Bitcoin and blockchain technology bring to the financial system. This openness could accelerate crypto adoption and innovation. Lee also praised projects like BitTensor, which incentivize innovation in the crypto space beyond mere price speculation.

Michael Bucella Explains the Price-Demand Puzzle

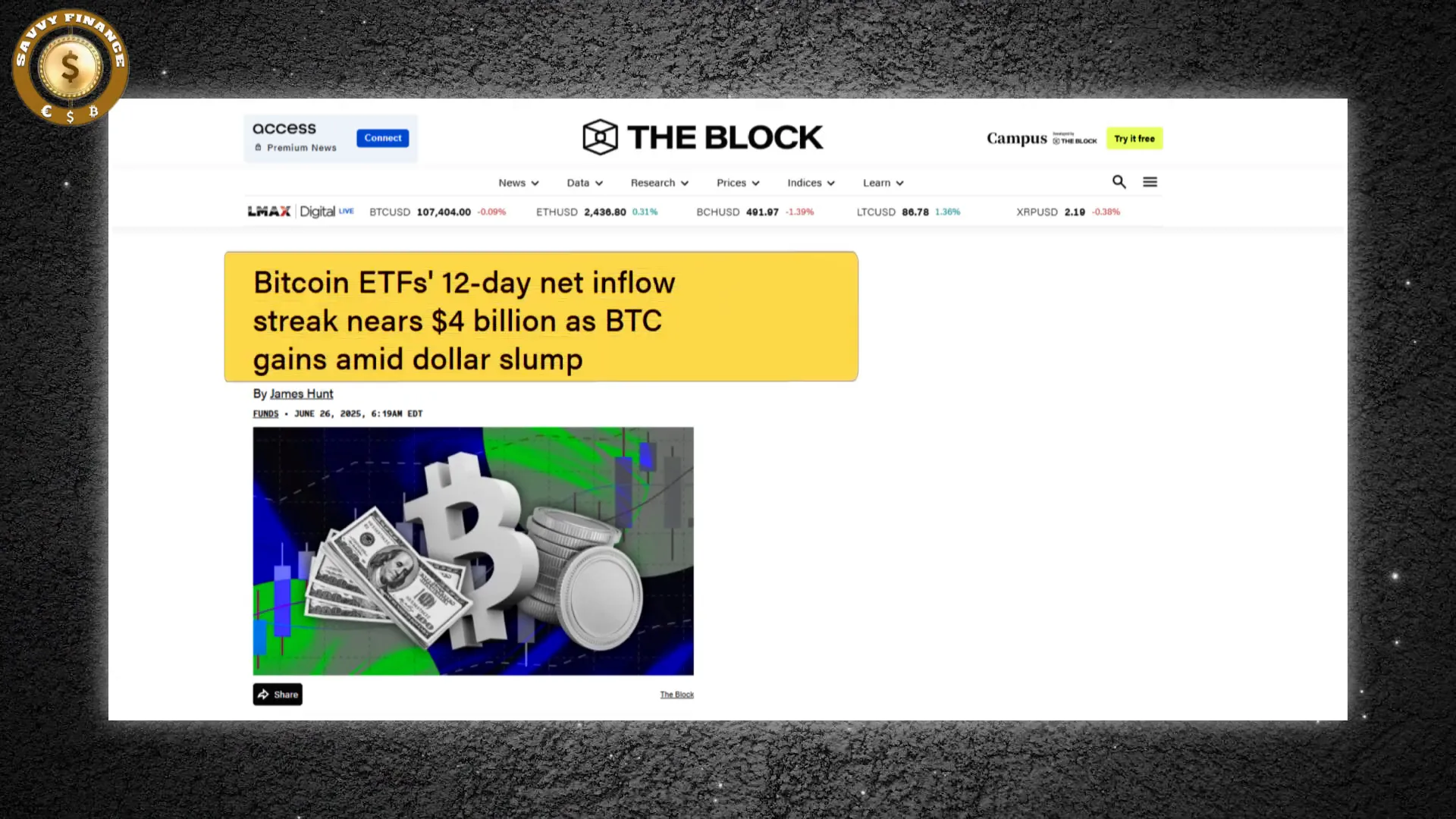

Despite surging demand, Bitcoin’s price has remained surprisingly flat. Michael Bucella from Neoclassic Capital sheds light on this paradox. Billions of dollars are flowing into Bitcoin treasury products backed by notable names like Anthony Pompliano, David Bailey, Cantor Fitzgerald, Tether, and SoftBank’s Twenty One Capital. ETF inflows alone hit around $4 billion in June.

So, why isn’t Bitcoin “mooning” yet? Bucella points to supply-side factors. Some investors are shifting from direct Bitcoin exposure to proxy assets such as crypto-related equities like Coinbase or stablecoin firms. Additionally, many Bitcoin miners are operating on razor-thin margins, often selling Bitcoin to cover operating costs due to limited alternative revenue streams like AI or hyperscale contracts.

Bitcoin: The Hardest Asset in a Weakening Global Currency Landscape

Bitcoin continues to benefit as global reserve currencies weaken against hard assets. Bucella describes Bitcoin as the “hardest asset” in this environment, attracting significant institutional capital through convertible debt markets and preferred equity pipes. Yet, as these investment avenues mature, Bitcoin companies are pressured to evolve beyond merely holding Bitcoin—they must adopt innovative business models, such as asset management or other strategies, to attract and maintain investor interest.

Michael Saylor’s Bold Bitcoin Predictions

Michael Saylor, a prominent Bitcoin advocate, recently made headlines with daring predictions. He cautions that most people will realize Bitcoin’s value too late. By the time traditional financial advisors endorse Bitcoin, it could cost $1 million per coin, and later, $10 million. This isn’t speculation but a reflection of how slowly traditional finance moves compared to Bitcoin’s rapid advancement.

Saylor highlights that major institutions have quietly amassed over $19 billion through crypto-related ETFs, while many others remain on the sidelines. Once regulatory approvals broaden access, demand could skyrocket, potentially outstripping available supply at current prices.

Looking further ahead, Saylor envisions Bitcoin reaching $21 million per coin within 21 years, supported by rising global demand, declining fiat trust, and growing U.S. political support. He frames Bitcoin not just as an investment but as a lifeboat—a form of digital property that cannot be diluted or seized.

Understanding Bitcoin’s Scarcity: A Digital Land Analogy

To grasp Bitcoin’s scarcity, imagine dividing Earth’s 32 million square miles of livable land into 21 million plots—each representing one Bitcoin. Each plot would be over 1,000 acres, equivalent to about 750 football fields. Owning that much land today would cost hundreds of millions of dollars. This analogy underscores Bitcoin’s status as the scarcest digital land known to man, a resource many are just beginning to understand.

Jack Mallers: The Blunt Truth About Bitcoin

Jack Mallers, a leading Bitcoin advocate, delivers a no-nonsense message: “Bitcoin doesn’t need you, you need Bitcoin.” This isn’t marketing hype but a statement of fact. Bitcoin is money built on math and trust, not on any single person or company.

Bitcoin operates globally, 24/7, without requiring permission or fearing a shutdown. It can’t be inflated away, censored, or confined by borders. Mallers stresses that belief in Bitcoin is irrelevant—the network functions because everyone is aligned by mathematical consensus. Your wallet and keys are proof, more powerful than any press release or central bank announcement.

This perspective shifts the conversation away from price targets to positioning. Bitcoin is already here, and the question is whether you move with it or get left behind.

Recent Price Volatility Amid Geopolitical Tensions

Bitcoin experienced notable price swings during a week marked by geopolitical uncertainty. It dipped below $100,000 for the first time in over 46 days before recovering to around $107,000 by the week’s end. This volatility was largely driven by investor reactions to global tensions, which temporarily shook market sentiment.

On June 23, Bitcoin fell to just above $101,000 amid heightened risk aversion. However, signs of de-escalation quickly eased concerns, leading to a recovery above $103,700. By June 28, Bitcoin stabilized just under $108,000, reflecting improved market confidence.

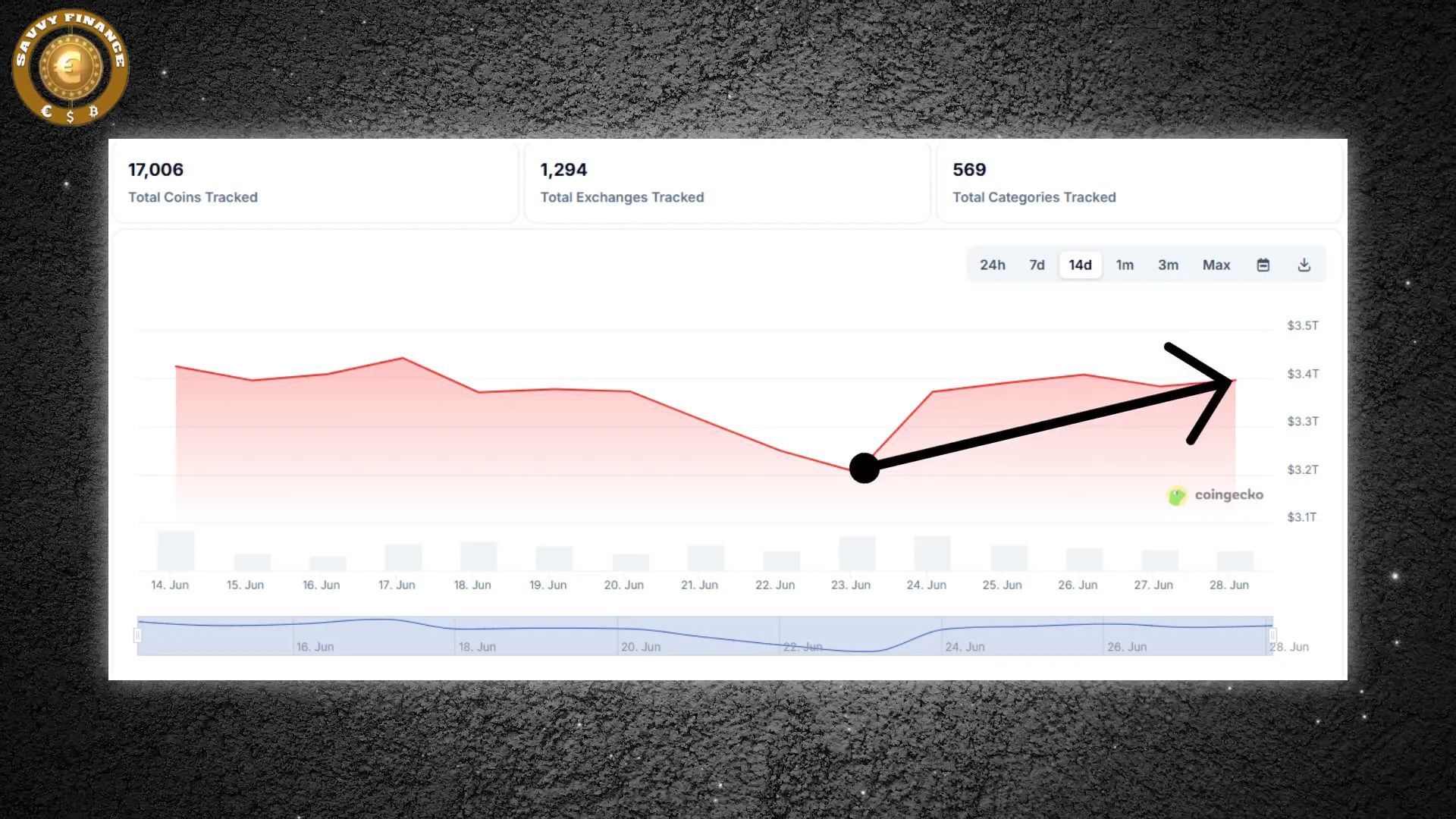

The broader crypto market followed suit, with total market capitalization rebounding from around $3.2 trillion to $3.4 trillion within days, signaling renewed investor optimism.

Conclusion: Are We on the Cusp of a Major Bitcoin Breakout?

With data backing the current Bitcoin setup rather than hype, the question remains: do these numbers reveal something most people still don’t see? Plan B’s stock-to-flow model, Tom Lee’s network effect analysis, institutional demand, and the evolving regulatory landscape all point to a potentially massive Bitcoin rally ahead.

From Michael Saylor’s million-dollar warnings to Jack Mallers’ stark truths, the narrative is clear—Bitcoin’s next move could redefine financial markets. Whether you’re a seasoned investor or new to cryptocurrency, positioning yourself wisely now could make all the difference.

What’s your take? Is Bitcoin’s setup signaling a breakout that will terrify the bears? Share your thoughts and join the conversation.

Why This Cryptocurrency, Bitcoin Setup Should TERRIFY the Bears. There are any Why This Cryptocurrency, Bitcoin Setup Should TERRIFY the Bears in here.