Cryptocurrency continues to captivate investors worldwide, and Bitcoin remains the undisputed leader of this digital revolution. In this article, we explore why Bitcoin is experiencing massive demand, limited supply challenges, and how institutional investors are shaping its future price trajectory. We’ll also break down key on-chain metrics that help you understand when to buy or sell Bitcoin, giving you an edge in the crypto market.

Table of Contents

- The Driving Force Behind Bitcoin’s Price Surge: Demand Meets Limited Supply

- Using On-Chain Metrics to Navigate Bitcoin’s Price Movements

- Risk Metrics: Adding Structure to Your Crypto Investment Decisions

- Final Thoughts: Growing with Cryptocurrency Intelligence

The Driving Force Behind Bitcoin’s Price Surge: Demand Meets Limited Supply

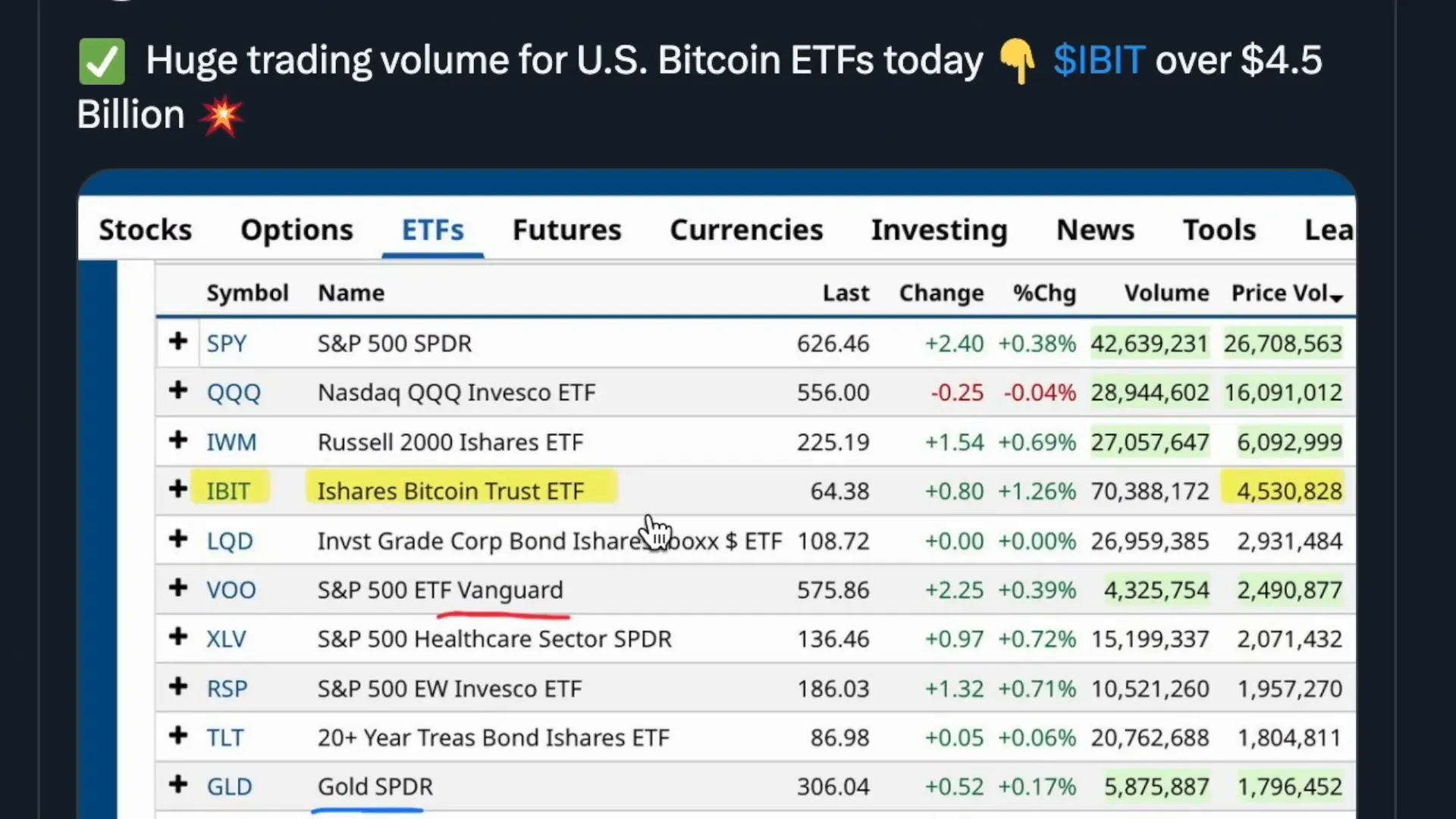

The cryptocurrency space, especially Bitcoin, is currently witnessing an incredible surge in demand. This isn’t just a short-lived spike; it’s a wave with significant staying power. Institutional investors and companies are buying vast amounts of Bitcoin, while Bitcoin ETFs are accumulating billions of dollars worth of the asset. In the past 30 days alone, Bitcoin ETFs have acquired $5.2 billion worth of Bitcoin. Remarkably, just last Thursday saw $1.18 billion in inflows — the largest single-day inflow since November 2024.

What does this mean? Institutional investors buying Bitcoin today are doing so with the same intensity as they did at the peak of the last major bull run. The total Bitcoin ETF inflows have now topped $51 billion, with Bitcoin accounting for 83% of those inflows. This is real-time mass accumulation — a clear sign that large players are making significant allocations to the crypto space. With Bitcoin’s supply capped and limited, this unrelenting demand is pushing prices higher and higher.

Experts predict that Bitcoin is breaking away from the $100,000 range, and the outlook is for substantial gains ahead. In fact, some forecasts suggest Bitcoin could top $200,000 by the end of this year, driven by accelerating institutional flows and corporate investments.

Using On-Chain Metrics to Navigate Bitcoin’s Price Movements

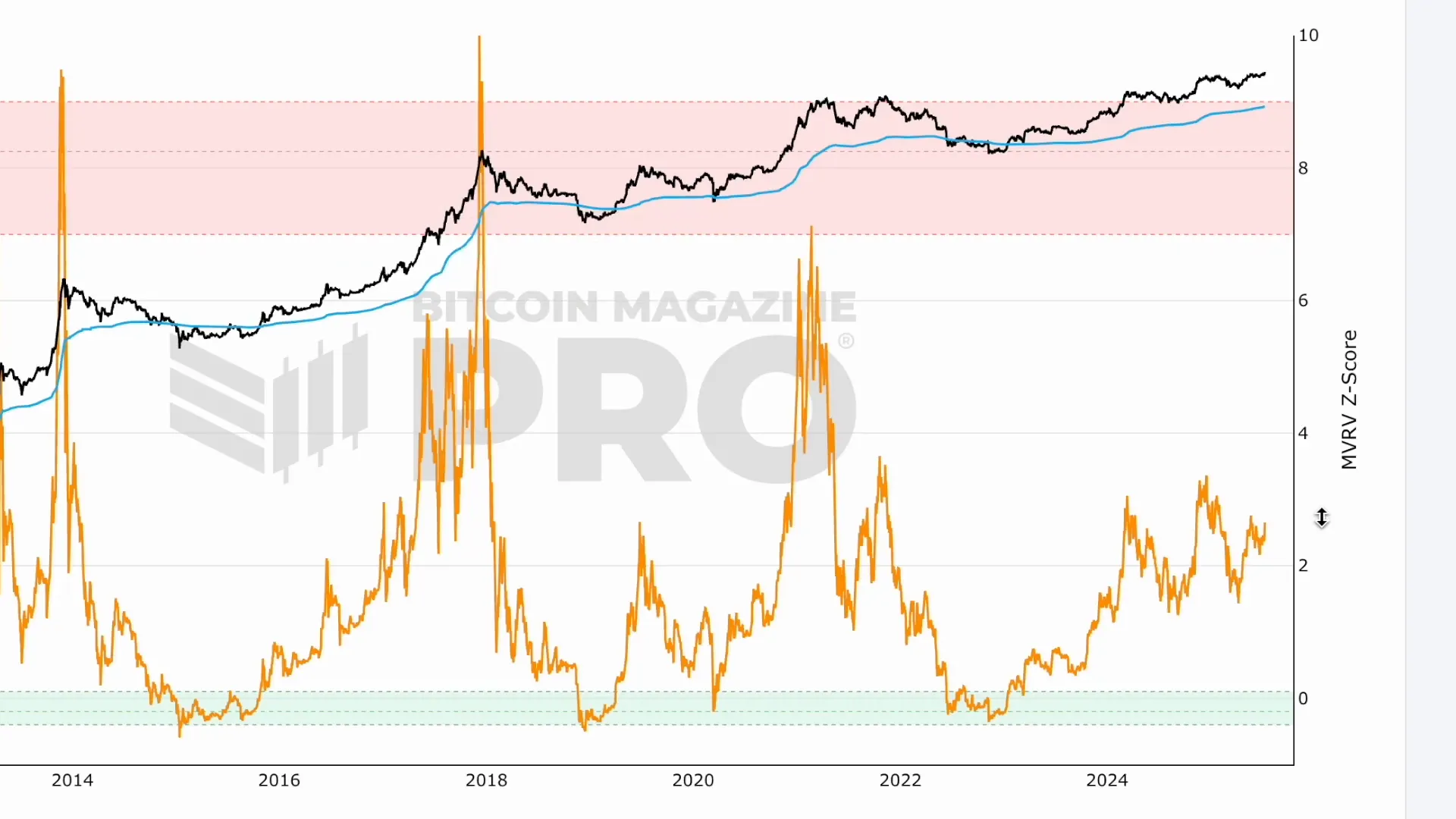

Understanding Bitcoin’s price dynamics goes beyond watching the current market price. One of the most insightful tools to gauge Bitcoin’s valuation is the MVRV Z Score. This metric compares Bitcoin’s market value (the price you see on exchanges) to its realized value, which reflects the average purchase price of all Bitcoins currently in circulation based on the last time they were transacted on-chain.

Why does realized value matter? Because Bitcoin holders typically move their coins only when buying or selling. If coins aren’t moving, it generally means holders are simply holding. The MVRV Z Score uses this data to identify when Bitcoin is overvalued or undervalued relative to its fair value.

Historically, a Z Score above 7 has signaled that Bitcoin might be overvalued and it could be time to start scaling out your holdings, while a score near zero is an attractive buying opportunity. Currently, the Z Score is around 2.65 — indicating we are neither at the beginning nor the end of the bull run. This metric suggests that Bitcoin has room to grow before hitting typical top signals.

It’s important to remember that as Bitcoin matures, it might not reach the extreme highs and lows we’ve seen in previous cycles. So even if the Z Score peaks lower than before, it still provides valuable guidance for managing your investments.

Practical Buying and Selling Strategy Using MVRV Z Score

- Start scaling out profits around a Z Score of 5 to 5.5 to protect your principal.

- Take additional profits if the score moves to 6 or 6.5 (for example, sell 20-25%).

- At 7 to 7.8, consider selling 50% of remaining holdings.

- If it reaches 10, it’s a strong signal to scale out completely.

Likewise, on the downside, when the Z Score drops to 2 or below, it’s a good time to start dollar-cost averaging (DCA) in. This approach helps you avoid chasing exact tops or bottoms, which is nearly impossible.

Risk Metrics: Adding Structure to Your Crypto Investment Decisions

Another valuable tool for cryptocurrency investors is the historical risk level metric. This chart measures Bitcoin’s risk level by assigning color-coded values that help identify attractive buying or selling zones over the long term.

The risk metric isn’t designed to predict exact tops or bottoms but to help investors make informed decisions with less emotional bias. Here’s how to use it:

- Risk below 0.5: Increasingly attractive buying opportunities.

- Risk below 0.4: Clear buying zone — consider deploying more capital.

- Risk above 0.6: Start thinking about selling or taking profits.

- Risk near 0.8 or 0.9: Strong sell signals — consider scaling out.

Currently, Bitcoin’s price is around $118,000, and the risk metric confirms that the market is not overvalued. While pullbacks are expected, the data shows we’re still in a healthy uptrend with room to grow. When these risk metrics align with other indicators like the MVRV Z Score, they paint a compelling picture of the market’s direction.

Final Thoughts: Growing with Cryptocurrency Intelligence

Bitcoin’s current market environment is defined by massive institutional demand and limited supply — a combination that historically drives prices higher. The use of on-chain metrics like the MVRV Z Score and risk levels provides investors with a structured, data-driven way to navigate the volatility and cyclical nature of the crypto markets.

Remember, no single chart or metric should dictate your entire investment strategy. Instead, using multiple data points helps build a clearer understanding of when to buy, hold, or sell. Dollar-cost averaging remains a prudent approach to managing risk, especially in this fast-evolving space.

As Bitcoin continues to mature and attract more institutional capital, staying informed and using these tools can give you the edge needed to grow your cryptocurrency portfolio wisely.

Stay tuned for upcoming insights on top altcoins and practical trading strategies to further enhance your crypto journey.

Why Now Is the Time to Buy Bitcoin: Understanding Cryptocurrency Demand and Market Metrics. There are any Why Now Is the Time to Buy Bitcoin: Understanding Cryptocurrency Demand and Market Metrics in here.