If you’re looking to understand where cryptocurrency and bitcoin markets are headed, billionaire investor Chamath Palihapitiya’s recent insights offer a compelling forecast. Based on data-driven analysis, Chamath believes we’re on the verge of a major market move that savvy investors can capitalize on. In this article, we’ll break down his predictions, explore what it means for bitcoin holders, and explain why the “free money trade” might be to be levered long heading into 2025 and beyond.

Table of Contents

- Chamath’s History With Bitcoin: A Track Record Worth Noting

- The Bitcoin Halving Cycle: Why October 2025 Could Be Huge

- Why Leveraged Long Positions Could Be the “Free Money Trade” Now

- The Jerome Powell Dilemma and Its Impact on Markets

- Global Money Supply and the Untapped Potential for Bitcoin

- What Does This Mean for Cryptocurrency and Bitcoin Investors?

- Final Thoughts

Chamath’s History With Bitcoin: A Track Record Worth Noting

Chamath Palihapitiya isn’t just another market pundit. While he’s not always right, his track record speaks volumes. Back in January 2020, he advised buying bitcoin when the price was hovering around $7,000 per coin. Those who listened have seen substantial gains since then.

Many investors wonder if bitcoin’s rally to $20,000 means it won't climb like that again. But Chamath reminds us that hindsight always brings “I wish I got in at…” moments. Whether it’s $1,000, $6,000, or $20,000, the sentiment repeats itself every few years. His point? The opportunity to buy bitcoin at “lower” prices keeps coming, and history suggests more growth ahead.

The Bitcoin Halving Cycle: Why October 2025 Could Be Huge

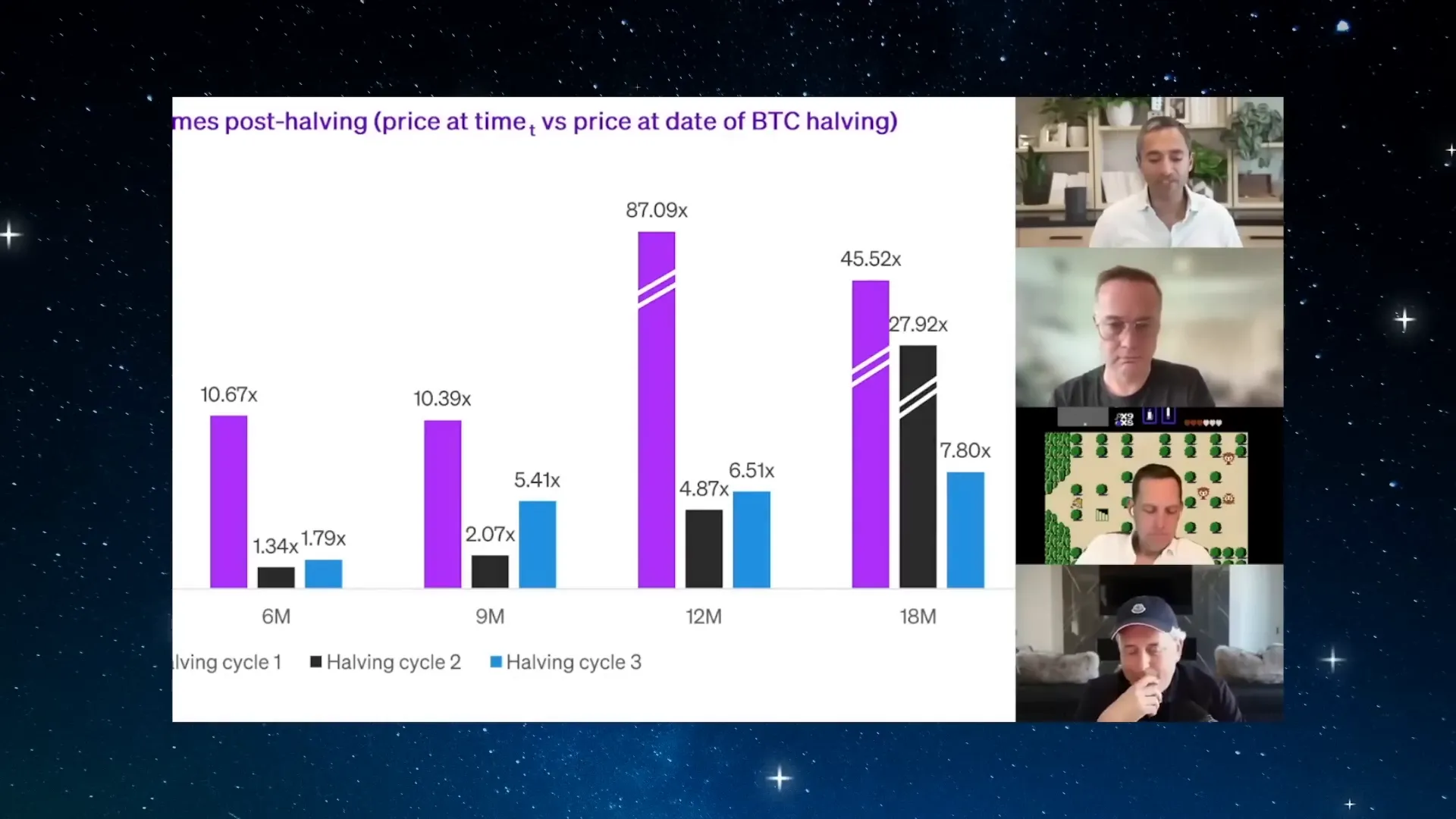

One of Chamath’s key analyses revolves around the bitcoin halving cycle—a scheduled event that cuts bitcoin’s mining rewards in half approximately every four years. Historically, bitcoin’s price has surged significantly in the 18 months following each halving:

- After the first halving, bitcoin returned 45x

- After the second halving, it returned nearly 28x

- After the third halving, it returned almost 8x

Using these historical averages (focusing on cycles two and three to avoid the extreme first cycle), Chamath forecasted that one bitcoin could reach over $500,000 by October 2025. This isn’t financial advice, but a data-backed projection that signals potentially massive upside.

This potential price appreciation aligns with bitcoin’s growing commercialization. The introduction of bitcoin ETFs in 2024 is expected to help bitcoin “cross the chasm,” making it more accessible and appealing to mainstream investors. If bitcoin reaches these levels, it could begin to replace gold as a store of value and gain transactional utility for hard assets.

Why Leveraged Long Positions Could Be the “Free Money Trade” Now

Chamath believes that the current market environment is ripe for leveraged long positions, meaning investors who borrow capital to increase their exposure to assets like bitcoin could stand to make significant gains.

Why? One key reason is the amount of “dry powder” — trillions of dollars in money market funds — sitting on the sidelines waiting to be deployed. This capital accumulation signals patience, not apathy, suggesting that investors are waiting for the right moment to move their money into higher-return assets like equities and cryptocurrencies.

The velocity of money, a measure of how quickly money circulates in the economy, recently contracted due to rising interest rates but has started to pick back up as the economy stabilizes. When interest rates eventually come down, many expect this large pool of capital to flow into investments seeking superior returns, giving a strong bid to equity and crypto markets.

The Jerome Powell Dilemma and Its Impact on Markets

Federal Reserve Chair Jerome Powell faces a challenging situation. The market currently prices in an 80% chance that Powell will hold rates steady in the upcoming FOMC meeting, with a 75% chance of a rate cut expected in the fall. If rates are cut, it could incentivize investors to move money out of money market funds and into riskier assets like bitcoin and stocks.

Given that rates are at about 4.5%—a high point in recent years—the pressure to ease monetary policy is mounting. Historically, rate cuts increase the velocity of money and asset prices, which could propel bitcoin and other cryptocurrencies higher.

Global Money Supply and the Untapped Potential for Bitcoin

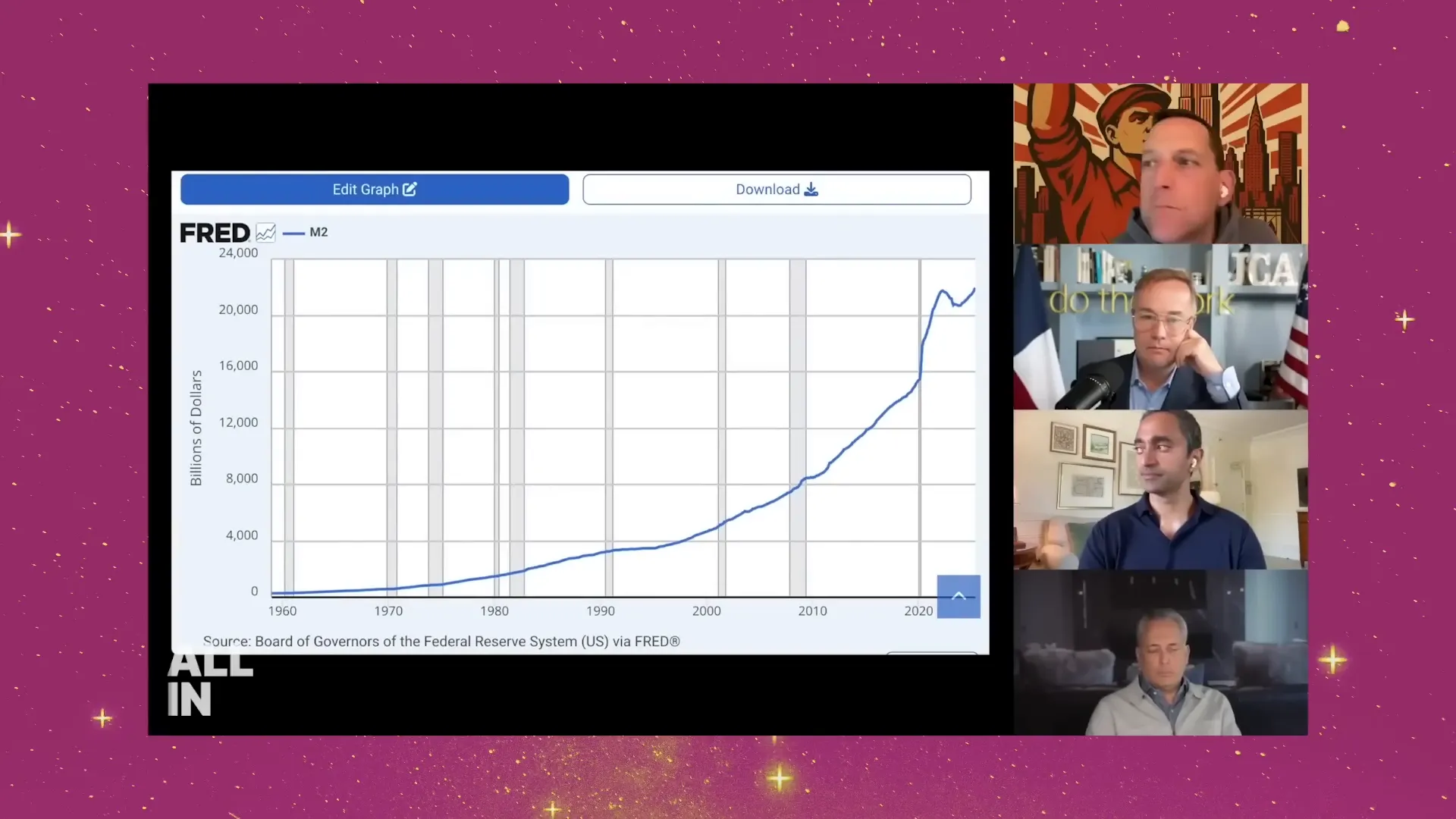

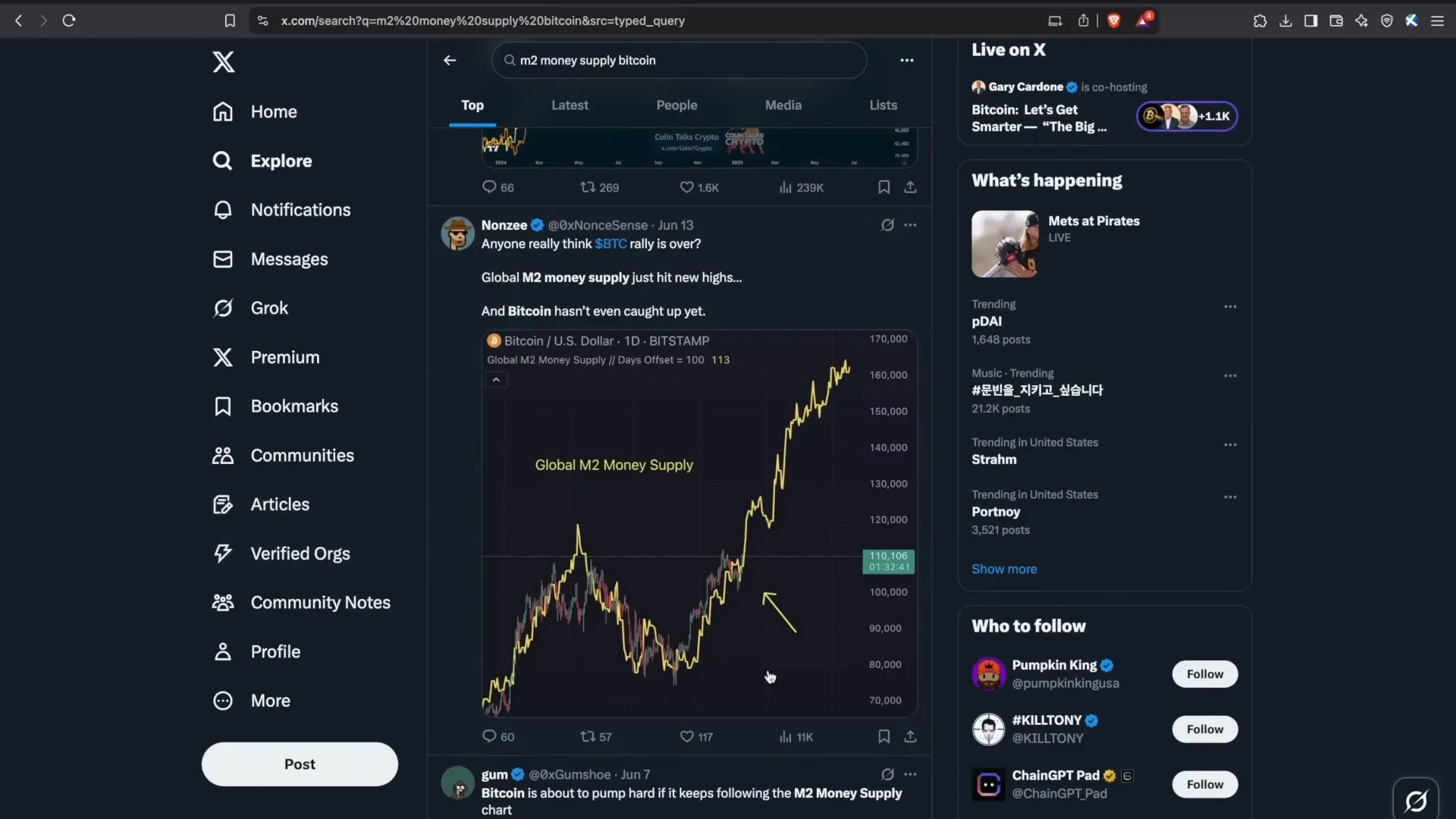

It’s not just the U.S. money supply that matters. Globally, the M2 money supply has hit new highs as countries outside the U.S. have already started easing monetary policy. This global increase in money supply combined with bitcoin’s relatively low price in comparison to its potential indicates a strong upside opportunity.

With roughly $7.4 trillion parked in money market funds alone, patience among investors is palpable. When the tides turn, this capital could flood into cryptocurrencies, driving prices significantly upward.

What Does This Mean for Cryptocurrency and Bitcoin Investors?

Chamath’s data-driven outlook suggests that bitcoin and crypto holders should “strap in” for a potentially explosive market phase. The convergence of historical bitcoin halving cycles, growing commercialization through ETFs, massive capital waiting on the sidelines, and impending monetary policy shifts creates a unique environment for growth.

While no investment is without risk, especially in volatile markets like cryptocurrency, the current conditions arguably set the stage for one of the most exciting periods in bitcoin investment history.

Final Thoughts

Billionaire investor Chamath Palihapitiya’s forecast isn’t just hype—it’s a call to pay attention to the data. For those holding or considering bitcoin and cryptocurrency exposure, understanding the interplay of market cycles, monetary policy, and capital flows is crucial.

Whether you’re a seasoned investor or new to the crypto space, the message is clear: the next 18 to 24 months could bring significant opportunities. Leveraged long positions could be the “free money trade,” but always remember to do your own research and invest wisely.

Stay informed, stay patient, and prepare for what could be a defining moment in cryptocurrency history.

Why Billionaire Chamath Palihapitiya Signals 'Strap In' for Bitcoin & Cryptocurrency in 2025. There are any Why Billionaire Chamath Palihapitiya Signals 'Strap In' for Bitcoin & Cryptocurrency in 2025 in here.