When it comes to investing in ETFs (Exchange-Traded Funds), one of the most common questions investors ask is: Where should I put my money? Should it be in a taxable brokerage account, a traditional IRA, or a Roth IRA? Understanding the differences between these accounts and how taxes impact your investments is crucial to building wealth effectively over time.

In this comprehensive guide, inspired by insights from Investing Simplified - Professor G, we’ll break down the three main types of accounts where you can invest ETFs. We’ll explore the pros and cons of each, how taxes play a role, and which might be best suited for your financial goals—whether short term or long term. Plus, we'll dive into the power of compound interest and how it can turn consistent investing into a pathway to financial freedom.

So, whether you’re new to investing or looking to optimize your portfolio with the best account type, this article will equip you with the knowledge you need to make confident, informed decisions.

Understanding the Basics: Why Compound Interest Is Your Best Friend

Before we dive into the different account types, it’s important to understand the magic behind investing: compound interest. Simply put, compound interest means you earn returns not only on your initial investment but also on the returns that investment generates over time.

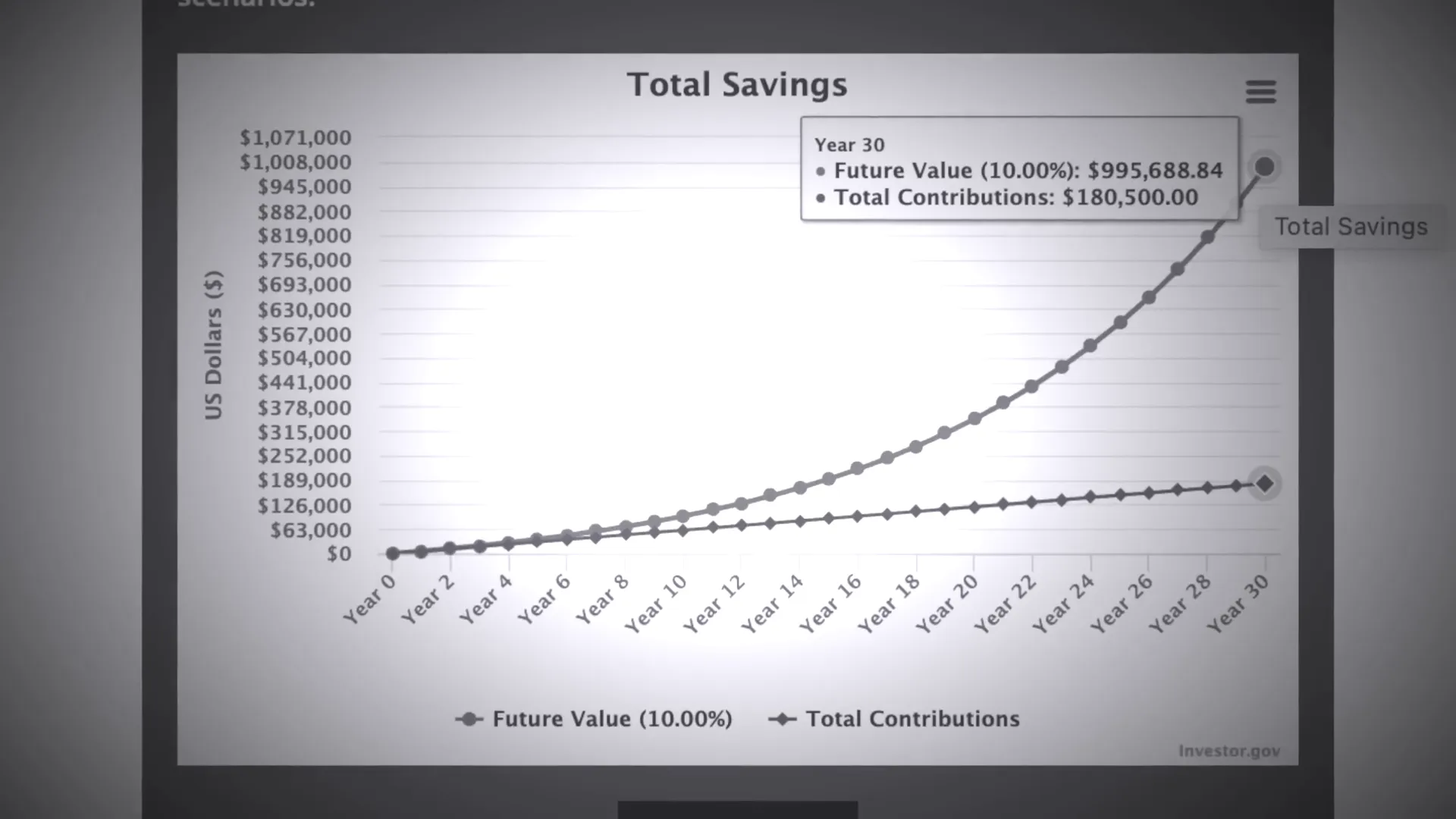

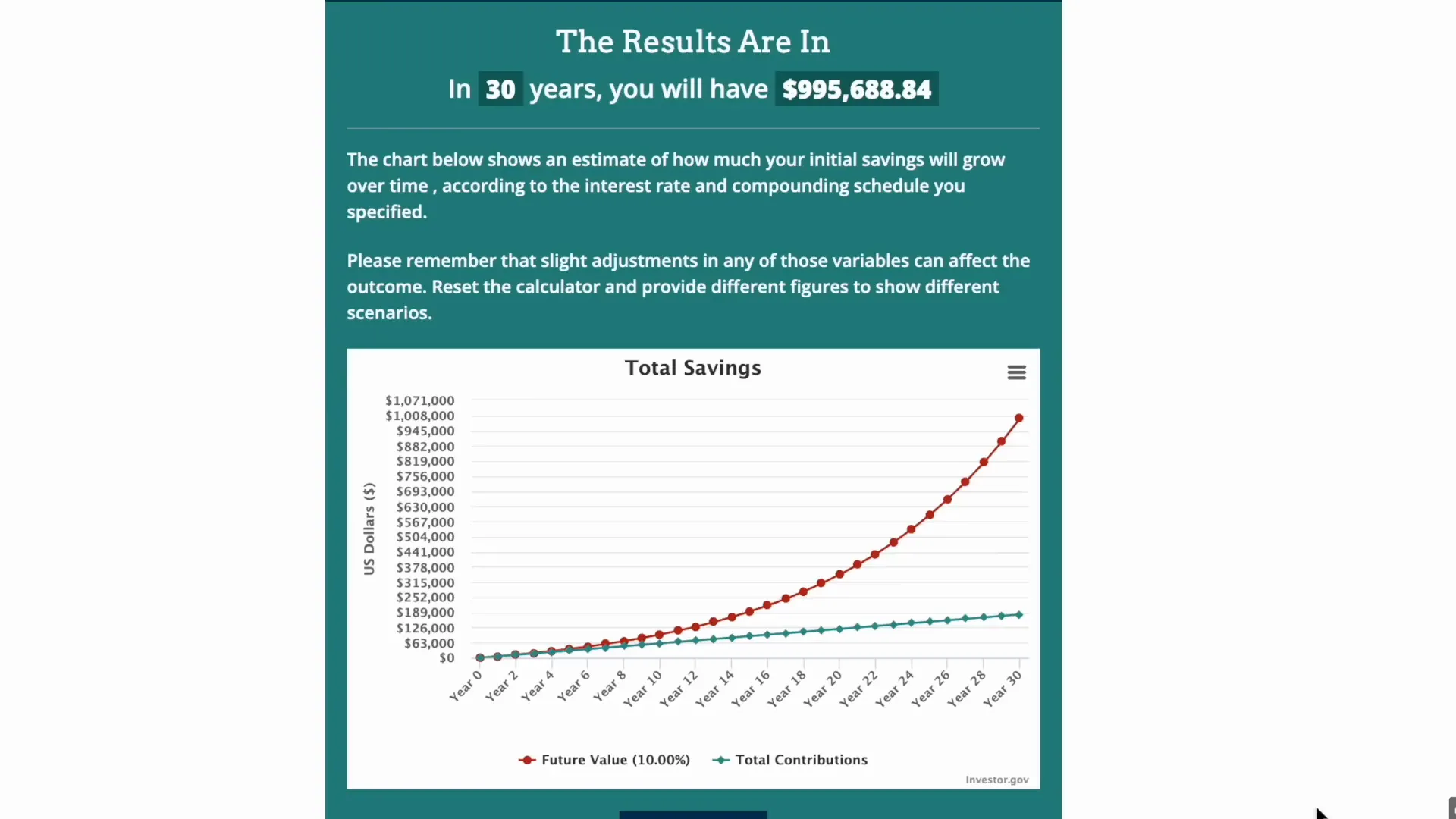

For example, if you invest $500 every month into an ETF that tracks the S&P 500 or the total US stock market, and it grows on average by over 10% per year, in 30 years, you could accumulate about one million dollars. What’s fascinating is that most of this wealth doesn’t come from the money you put in directly, but from the compound interest earned over time.

This highlights why a long-term mindset is crucial when investing in ETFs. The longer you stay invested, the more powerful compound interest becomes, exponentially increasing your wealth.

The Three Main Types of Accounts to Invest ETFs In

Now that you understand the importance of compound interest, let’s explore the three main types of accounts where you can invest ETFs:

- Taxable Brokerage Account (Taxable Account)

- Traditional Retirement Account (Traditional IRA or 401(k))

- Roth Retirement Account (Roth IRA or Roth 401(k))

Each account type has unique characteristics, especially regarding taxes and accessibility, which can affect your overall investment strategy.

1. Taxable Brokerage Account: Flexibility with Some Tax Implications

The taxable brokerage account is the most straightforward and accessible type of investment account. It’s sometimes called a “taxable account” because you don’t get any special tax benefits. You can open one through most financial institutions and start buying and selling ETFs immediately.

One of the biggest advantages of a taxable brokerage account is liquidity. You can buy an ETF like VOO (which tracks the S&P 500) or QQQ (which tracks the Nasdaq 100) today, and if the price goes up tomorrow, you can sell it and take your profits immediately without any penalties.

However, the downside is taxes. When you sell an investment for a profit, you pay capital gains tax on the amount you earned. For example, if you bought an ETF and sold it for a $3 profit per share, you owe taxes on that $3 gain in the year you sell.

This means your earnings are taxable annually as you realize gains, which can add up and reduce your overall returns. Despite this, the liquidity and accessibility make taxable accounts ideal for short-term or medium-term financial goals where you might need to access your money before retirement age.

In contrast to retirement accounts, taxable brokerage accounts don’t have restrictions on withdrawals. You can pull out money whenever you need it, making it a great option if you want the freedom to use your investments without waiting until you’re 59½ years old.

2. Traditional Retirement Accounts: Tax Benefits Now, Taxes Later

The traditional retirement account includes options like the traditional IRA and the 401(k). These accounts are designed primarily for retirement savings and come with tax advantages that can help reduce your taxable income today.

Here’s how it works: when you contribute to a traditional IRA or 401(k), the money you put in is pre-tax. This means you can deduct your contributions from your taxable income for the year. For example, if you earn $80,000 annually and contribute $5,000 to a traditional IRA, your taxable income for that year effectively drops to $75,000.

This upfront tax deduction can be especially beneficial if you’re in a higher income bracket because it lowers your tax bill right now.

However, the catch is that when you withdraw money from a traditional retirement account after age 59½, those withdrawals are taxed as ordinary income. The money grows tax-deferred, meaning you don’t pay taxes on dividends, interest, or capital gains during the investment period, but you will pay taxes when you take the money out.

There are penalties for early withdrawals before 59½, which can be quite hefty, so these accounts are best suited for long-term retirement savings.

Many wealthy individuals use traditional retirement accounts strategically to offset taxable income and defer taxes until retirement when they might be in a lower tax bracket.

3. Roth Retirement Accounts: Pay Taxes Now, Withdraw Tax-Free Later

The Roth IRA and Roth 401(k) are the opposite of traditional retirement accounts when it comes to taxes. With Roth accounts, you contribute money that has already been taxed, so there’s no upfront tax deduction.

For example, if you make $80,000 per year and contribute $5,000 to a Roth IRA, you still pay taxes on the full $80,000 that year. However, the benefit is that your investments grow tax-free, and when you withdraw funds after age 59½, you pay no taxes at all on your contributions or the earnings.

This tax-free growth is incredibly powerful, especially when combined with compound interest over a long investment horizon. If you invest $500 per month in a Roth IRA and hold it for 30 years with an average return of 10%, you could have approximately a million dollars tax-free at retirement.

The fact that you don’t pay any taxes on the gains at withdrawal makes Roth accounts a favorite for younger investors or those who expect to be in a higher tax bracket in retirement.

Which Account Should You Choose for Your ETFs?

Each type of account serves a different purpose depending on your financial goals, time horizon, and tax situation. Here are some guidelines to help you decide where to invest your ETFs:

- Taxable Brokerage Account: Best for short-term or medium-term goals where you might need access to your funds before retirement age. Offers full liquidity but no tax advantages.

- Traditional IRA/401(k): Ideal if you want to reduce your taxable income now and expect to be in a lower tax bracket at retirement. Good for long-term retirement savings, but early withdrawals incur penalties.

- Roth IRA/401(k): Best if you expect to be in the same or higher tax bracket in retirement, or want tax-free withdrawals. Excellent for long-term growth thanks to tax-free compounding.

Tax Strategy and Investment Placement

Not all ETFs are created equal when it comes to taxes. Some ETFs generate dividends, which can be taxable in a taxable account, while others might be more tax-efficient.

A common strategy is to place ETFs that generate more taxable income (like bond ETFs or high-dividend ETFs) inside tax-advantaged accounts such as IRAs. Conversely, tax-efficient stock ETFs that don’t generate much taxable income can be held in taxable brokerage accounts.

Understanding these nuances can help you maximize after-tax returns and grow your wealth faster.

Why Consider a Roth Account in Today’s Tax Environment?

One important consideration that many investors overlook is the future of taxes. Historically, tax rates tend to increase over time, especially in countries with growing debt loads like the United States.

Given the massive debt incurred recently due to events like the COVID-19 pandemic, it’s reasonable to expect that taxes might rise in the next 10 to 20 years. This makes the Roth IRA or Roth 401(k) an attractive option because you pay taxes upfront at today’s rates and enjoy tax-free withdrawals later, protecting you from potential higher taxes.

For investors with a time horizon of 10 years or more before retirement, starting a Roth account can be a smart move to lock in current tax rates and maximize your tax-free growth.

Summary: Balancing Liquidity, Tax Benefits, and Growth Potential

Choosing between a taxable brokerage account, traditional IRA, and Roth IRA depends on your unique financial situation, goals, and expectations about taxes.

- Taxable Brokerage Account: Offers liquidity and no penalties for withdrawals but comes with annual taxes on gains.

- Traditional Retirement Accounts: Provide immediate tax deductions but taxes are due upon withdrawal, with penalties for early access.

- Roth Retirement Accounts: Taxes are paid upfront, but withdrawals are completely tax-free, making them excellent for long-term growth.

Remember, the goal is to leverage these accounts to maximize your compound interest benefits while minimizing your tax burden. Knowing where to place your ETFs within these accounts can make a significant difference in how quickly your wealth grows.

By investing wisely, understanding your accounts, and thinking ahead about taxes, you set yourself up for a prosperous financial future.

Protect Your Financial Privacy While Investing

As you invest and manage your finances online, it’s essential to protect your personal data. Data brokers collect and sell your information, which can put your privacy at risk.

Services like DeleteMe offer hands-free subscription options to remove your personal information from hundreds of data brokers, helping you safeguard your privacy year-round. This extra layer of protection is especially important when dealing with sensitive financial information.

For those interested, you can get 20% off DeleteMe US consumer plans using the code professor at checkout by visiting join delete me dot com slash professor.

Final Thoughts on ETF Investing and Account Selection

Investing in ETFs is a powerful way to build wealth over time, but the account you choose to hold them in can dramatically affect your investment outcome. Understanding the differences between taxable brokerage accounts, traditional retirement accounts, and Roth retirement accounts is crucial.

By balancing your need for liquidity, tax advantages, and long-term growth potential, you can create a tailored investment strategy that aligns with your financial goals. And remember, the earlier you start investing with a long-term mindset, the more you benefit from the incredible power of compound interest.

Keep educating yourself, review your tax situation regularly, and adjust your investment accounts accordingly to stay on track toward financial freedom.

Where Should I Invest ETF? Brokerage vs IRA vs ROTH IRA – A Guide to Maximizing Your Investment Returns. There are any Where Should I Invest ETF? Brokerage vs IRA vs ROTH IRA – A Guide to Maximizing Your Investment Returns in here.