In today’s rapidly shifting economic landscape, understanding the intersection of cryptocurrency and traditional finance is more crucial than ever. Jack Mallers delivers a compelling perspective on why Bitcoin is becoming an indispensable asset amid unprecedented fiscal challenges facing the United States. This article dives deep into the realities of fiscal dominance, the erosion of the dollar, and how Bitcoin, alongside emerging technologies like AI, could shape a new era of prosperity.

Table of Contents

- The Reality of Fiscal Dominance and Money Printing

- Bitcoin: A Unique Asset in Turbulent Times

- The New Monetary Regime and the Decline of the World Reserve Currency

- AI, Automation, and Their Impact on the Economy

- Conclusion: Preparing for the Future with Bitcoin

The Reality of Fiscal Dominance and Money Printing

We are living in an era where fiscal dominance has firmly taken hold. Regardless of political affiliation or intentions, governments must print money to manage overwhelming debt. The recent passage of a massive spending bill, affectionately dubbed the "Big Beautiful Bill" (BBB), exemplifies this trend. It marks a stark reversal from prior promises, signaling that money printing is now inevitable and ongoing.

Jack Mallers points out that this isn’t about politics—it’s about facts. The United States is stuck in a debt crisis where excessive borrowing and spending dictate economic policy. Inflation is rising, traditional currencies are losing value, and the government’s only viable option is to continue debasing its debt through relentless money printing.

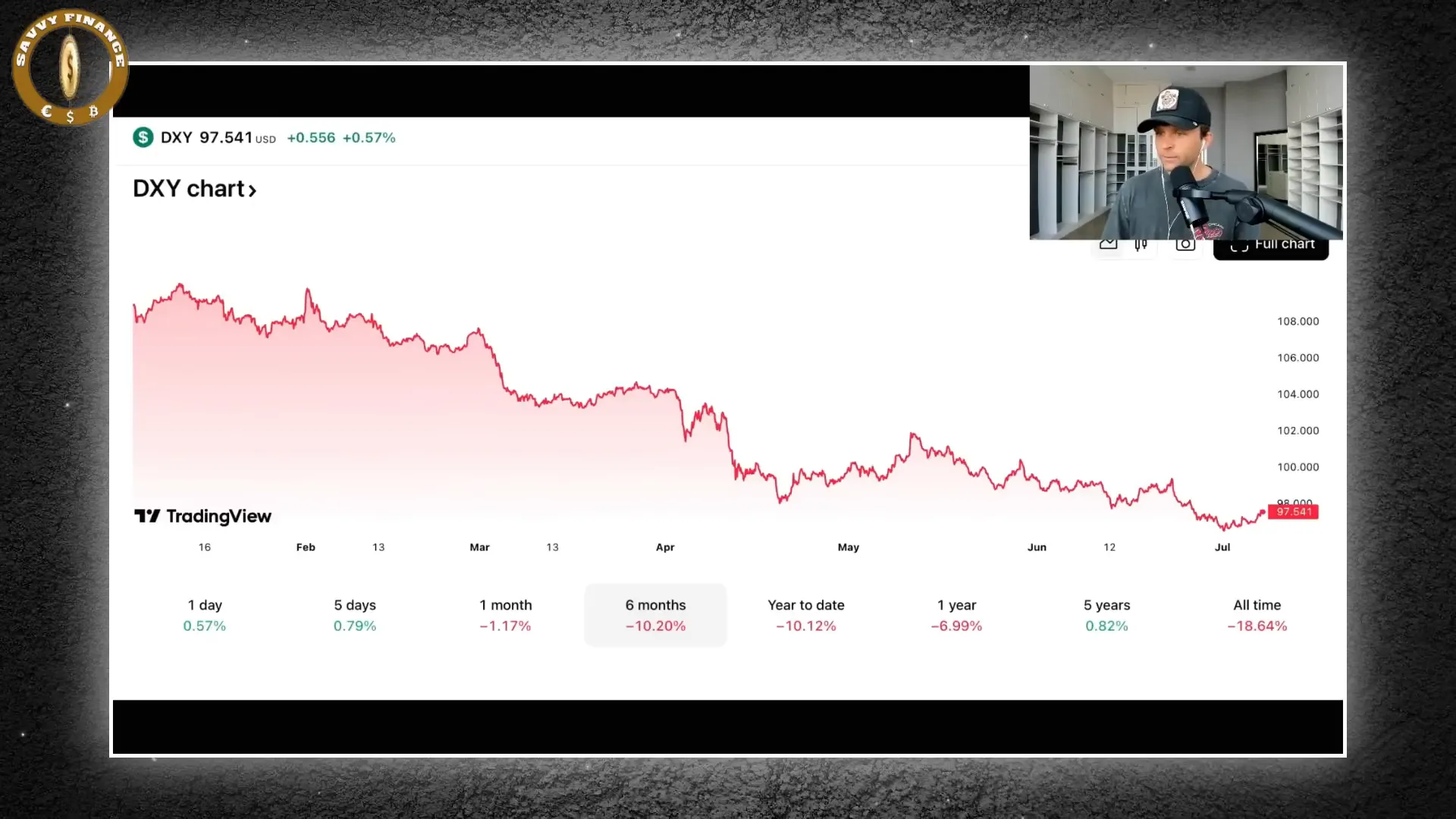

Why the Dollar is Losing Its Shine

The U.S. dollar has experienced its worst start since 1973, dropping over 10% in just the first half of 2025. This decline is occurring simultaneously with the government’s aggressive spending policies. Jack highlights that the strength of the dollar has been artificially inflated by its status as the world reserve currency, but that status is now waning.

Maintaining the world reserve currency status forces the U.S. to choose between domestic economic health and global growth. This balancing act is unsustainable, and the fallout is clear: manufacturing jobs vanish, the middle class struggles, and asset inflation widens the wealth gap.

Bitcoin: A Unique Asset in Turbulent Times

Bitcoin stands out as a rare asset that anyone can own, providing a form of true ownership that is especially valuable during economic instability. Despite recent dips, Bitcoin’s price has shown resilience, bouncing back above $109,000. Analysts attribute this to increased institutional purchases and growing interest from retail investors.

More importantly, Bitcoin is gaining traction beyond individual investors. Businesses and governments are exploring ways to integrate Bitcoin into their financial systems, recognizing its potential as a hedge against inflation and currency debasement.

Why Everyone Should Consider Bitcoin Now

Jack’s message is clear and urgent: Buy Bitcoin or lose. As the government continues printing money, the real value of traditional currencies will erode. Most Americans don’t own assets like stocks or real estate—over 90% of those without a college degree lack equity ownership. This leaves the majority vulnerable to inflation and asset bubbles.

Bitcoin offers an accessible way for everyday people to gain exposure to a hard money asset that isn’t subject to government manipulation. It’s a tool for preserving wealth and planning for the future amid fiscal uncertainty.

The New Monetary Regime and the Decline of the World Reserve Currency

The traditional concept of the world reserve currency is evolving. It’s no longer just about the currency in which goods are priced but about where the world stores its cash balances. The U.S. dollar’s declining position is clear, with gold and Bitcoin reacting to this shift.

Jack challenges us to think critically: if the U.S. runs persistent twin deficits (budget and trade), who pays for efforts to bring manufacturing and jobs back? The answer is simple—money printing. This new monetary regime demands a different approach to how we view money, debt, and economic growth.

AI, Automation, and Their Impact on the Economy

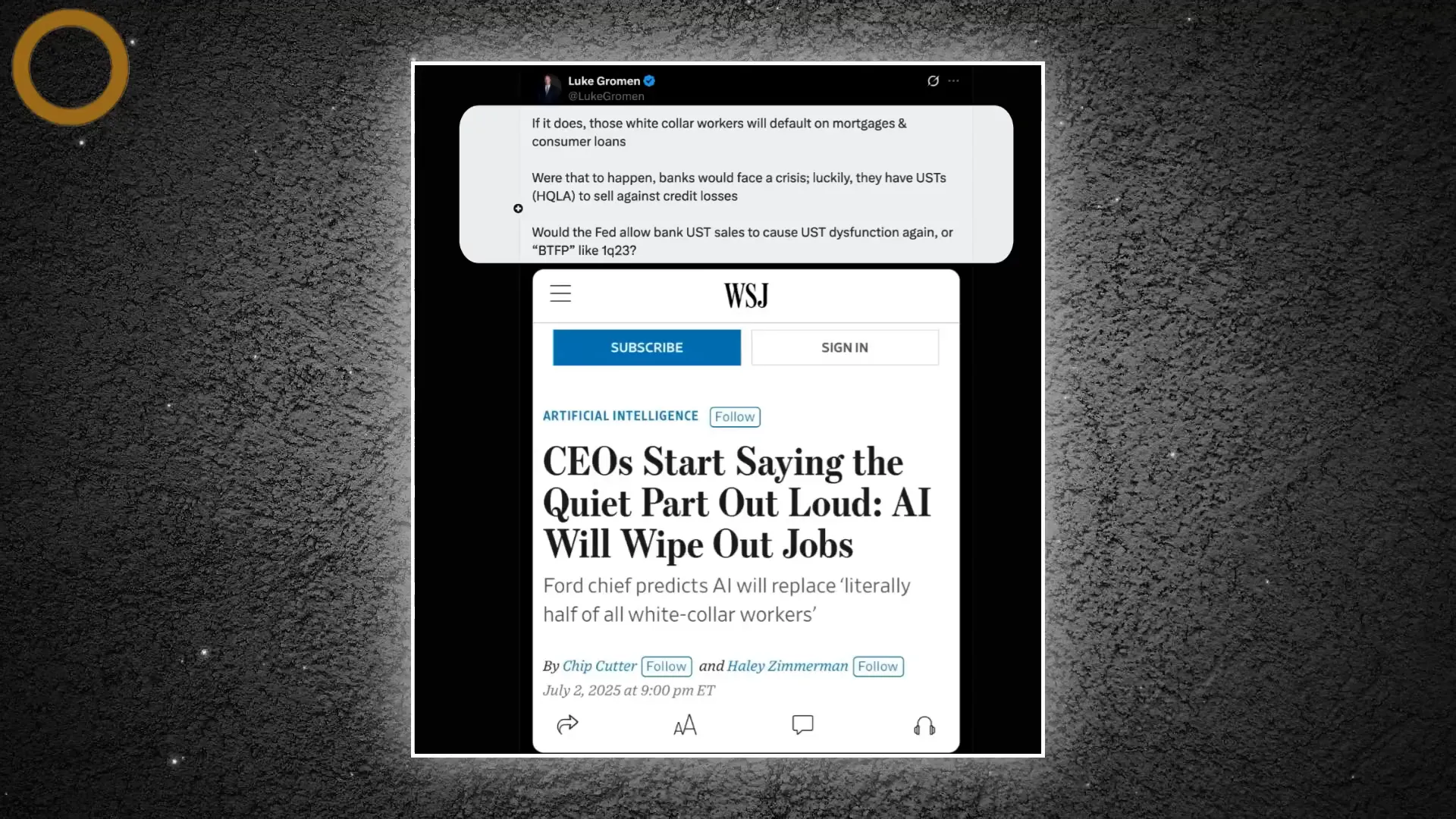

Jack Mallers also discusses the rapid rise of Artificial Intelligence and its profound impact on jobs and the economy. Companies like Microsoft have already cut thousands of jobs due to AI automation. CEOs are openly acknowledging workforce reductions as a reality.

While this disruption poses challenges, Jack offers an optimistic vision: AI combined with Bitcoin could usher in a new era of prosperity. With a hard money asset like Bitcoin, people can save and lower their time preference, enabling long-term planning. Meanwhile, AI automates mundane tasks, freeing humans to focus on creativity, art, and innovation—potentially sparking a renaissance.

The Risks of Job Displacement and Financial Stress

However, this transition isn’t without risks. Job losses in white-collar sectors due to AI could lead to defaults on mortgages and loans, potentially triggering banking crises. Banks with risky loan portfolios face stress, and without the ability to fail, governments may resort to printing more money to stabilize markets.

This cycle of disruption and monetary intervention underscores the urgency of understanding these economic forces and positioning oneself accordingly—Bitcoin being a critical part of that strategy.

Conclusion: Preparing for the Future with Bitcoin

Jack Mallers’ insights paint a vivid picture of a world where fiscal dominance, currency devaluation, and technological disruption are reshaping the financial landscape. Bitcoin emerges not just as an investment but as a lifeline—an asset that offers true ownership and protection against the erosion of traditional currencies.

As governments continue printing money and economic uncertainty grows, the question becomes clear: Is Bitcoin the safest way to protect your money? For many, the answer is a resounding yes.

Understanding these dynamics and embracing Bitcoin could be the key to navigating the coming financial challenges and participating in a new era of economic opportunity.

What do you think? Is Bitcoin the best hedge against money printing and fiscal dominance? Share your thoughts in the comments below.

WARNING for EVERY Bitcoiner: We Are Past the Point of No Return. There are any WARNING for EVERY Bitcoiner: We Are Past the Point of No Return in here.