Imagine turning a modest $1,000 into a dream car like the Porsche GT3 RS. It sounds like a fantasy, right? Last year, I made a $75,000 trade and drove off in a Tesla Model Y. Today, I’m kicking off a new challenge—starting with just $1,000 and aiming to trade my way up to that Porsche. This journey isn’t just about making money; it’s about mastering the art of trading Bitcoin, crypto, BTC, and blockchain investments with patience, discipline, and the right tools.

Whether you’re new to crypto investing or looking for practical strategies to optimize your trades, this guide will walk you through the essentials of setting up a winning trade, understanding market signals, managing risk, and keeping your mindset sharp. Plus, I’ll share how I use simple yet powerful indicators like Fomo.io to make trading stupid easy and profitable.

Why Trading Bitcoin and Crypto Can Change Your Life

Cryptocurrency markets offer a dynamic playground for investors and traders alike. The wild swings in price, the constant flow of new information, and the evolving technology behind blockchain create both opportunities and risks. But with the right approach, you can harness the volatility to grow your portfolio significantly.

Last year’s $75,000 trade that got me a Tesla Model Y wasn’t luck—it was strategy, timing, and a disciplined mindset. This year, I’m turning the tables: can I start with just $1,000 and turn it into $10,000, and eventually enough to buy that Porsche GT3 RS? It’s an ambitious goal, but with a clear plan and smart trading practices, it’s possible.

Step 1: Finding the Perfect Trade Setup

The first step in any successful trade is patience. Waiting for the perfect trade setup is crucial. I like to keep things simple—no complicated charts or confusing jargon. Instead, I rely on tools that make trading straightforward and fun.

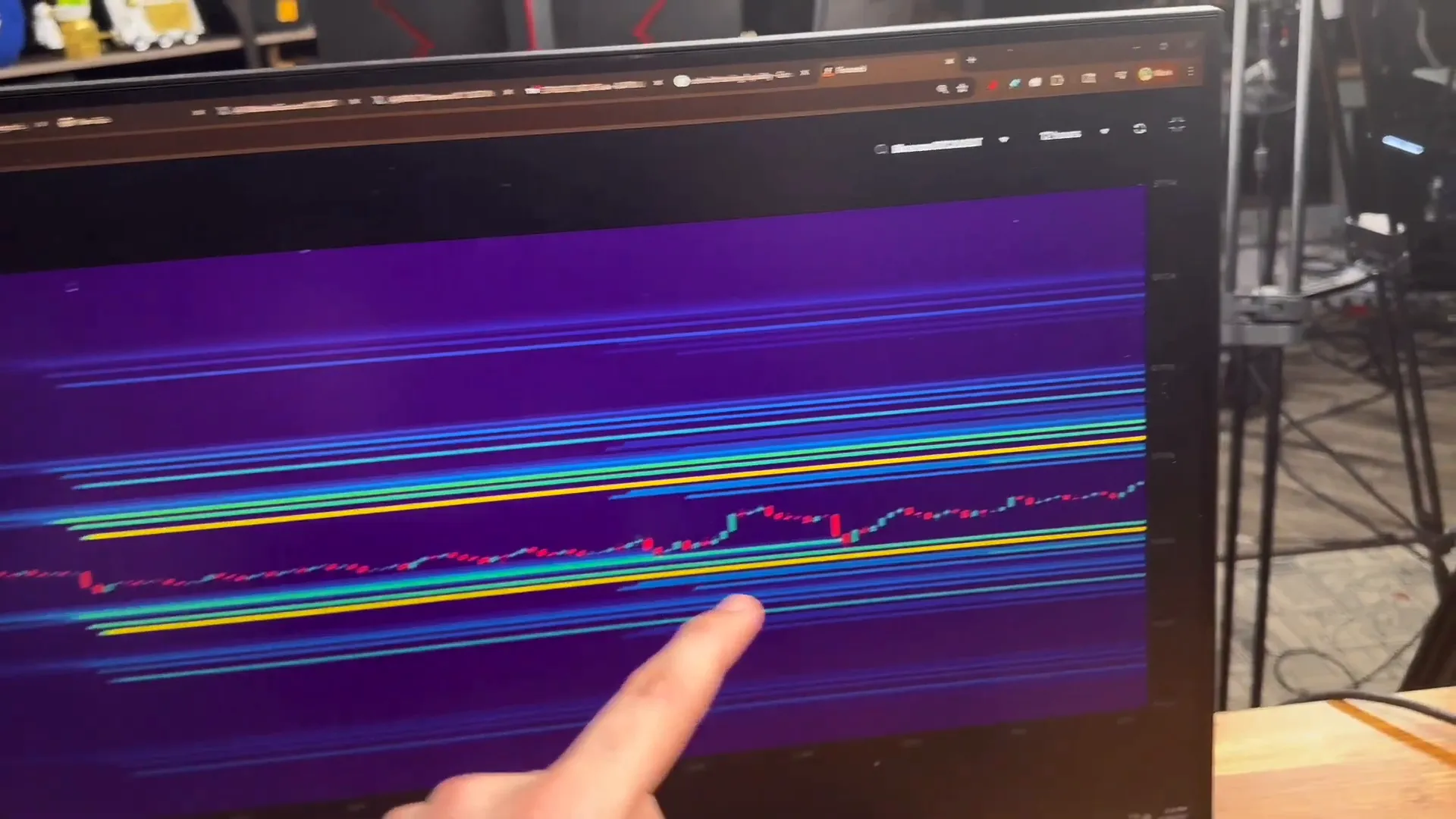

One of my favorites is Fomo.io, a crypto indicator that visually shows liquidity levels on the chart. The brighter the color, the more money is concentrated at that price level, acting as dynamic support and resistance zones. This helps me identify where price is likely to bounce or reverse.

Right now, for example, Ethereum’s price is sitting between two bright yellow lines on the Fomo.io chart, signaling potential entry points. I want to enter a trade either when the price hits the lower yellow line or the upper one, depending on the market movement.

Why Simplicity Matters in Trading

Trading can be intimidating, especially for newcomers. I treat it like a game—making it stupid easy and even entertaining. While waiting for the right trade setup, I mix in other activities like workouts to stay sharp and motivated. After all, a healthy body supports a healthy mind, which is critical for the discipline trading requires.

Step 2: The Importance of Confluence in Trading

Once you spot a potential trade setup, it’s time to check for confluence. Confluence means multiple signals or indicators lining up to suggest the same market direction. Think of it like having four friends all telling you the same story—it adds credibility.

For example, when trading Ethereum, I look at Bitcoin’s movements because Ethereum often follows Bitcoin’s lead. If Bitcoin shows strength at a certain price level, Ethereum is likely to bounce as well.

In our current setup, I’m looking for Ethereum to come down to around $2,402, which is a key support level backed by liquidity analysis. This level also wipes out most of the downside liquidity, making it a strong zone for a potential bounce.

Understanding Liquidity: The Windshield Wiper Analogy

Liquidity is a crucial concept in crypto trading. Imagine it as rain on a windshield. When too many positions or orders accumulate on one side, the market “wiper” swings the other way to clear it out. If there are too many short positions, the price will rise to wipe them out. If there are too many longs, the price will fall to clear those.

Another way to think about it is as a game of ping pong. The price bounces back and forth until someone gets liquidated, causing a sharp move in the opposite direction.

Step 3: Timing Your Entry with Limit Orders

Patience pays off in trading. Instead of jumping in with a market order (which buys at the current price), I prefer limit orders that let me specify the exact price I want to enter at. This avoids chasing the market and getting caught in unfavorable price swings.

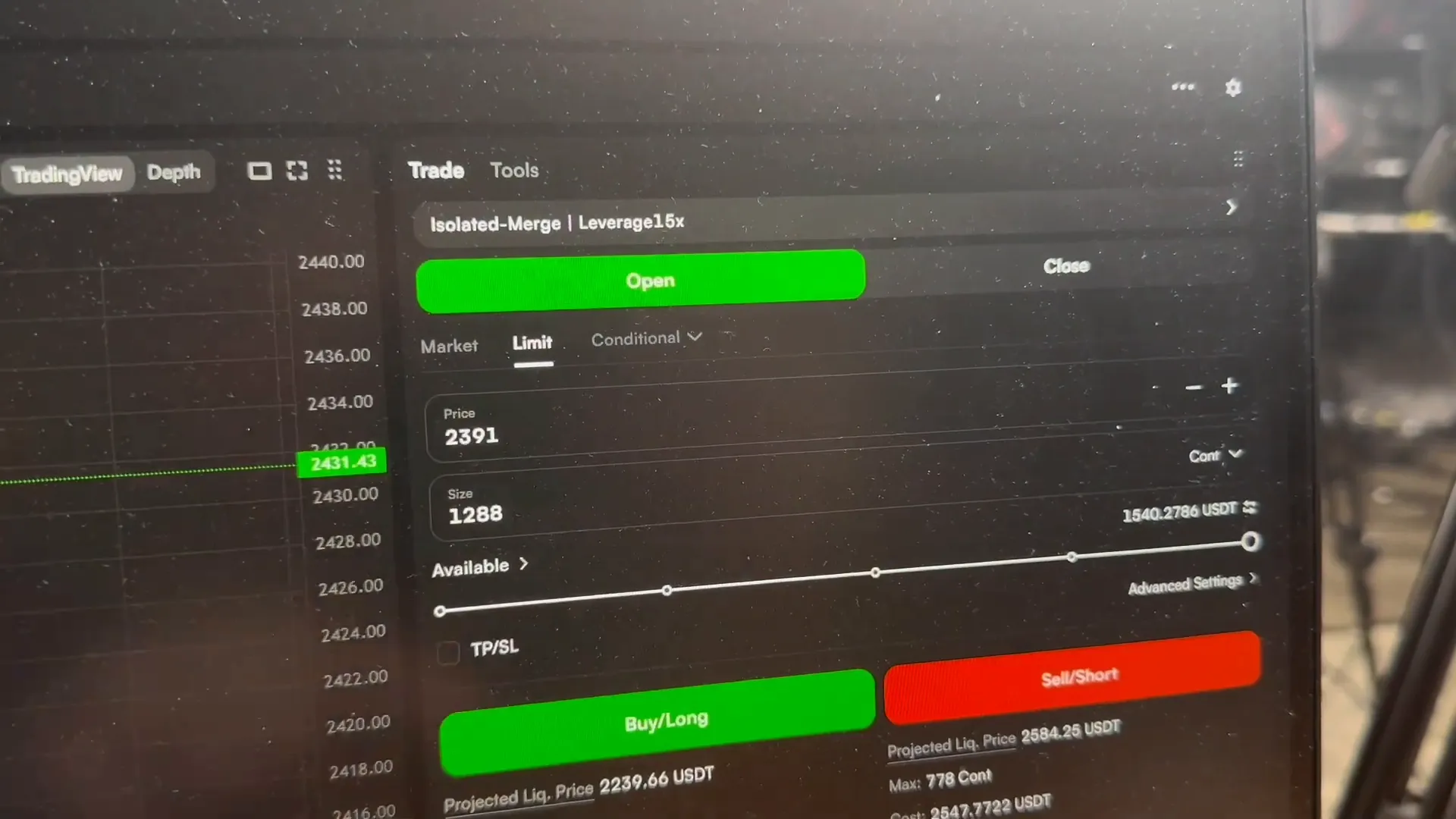

For this trade, I’m placing a limit buy order for Ethereum at $2,391, which is just below the key support level I identified. This price point is where the “windshield wiper” (liquidity indicator) hits the leftmost point, signaling a potential reversal.

Using 15x leverage, I’m also setting a 5% stop loss to control risk, meaning if the trade moves against me by 5%, I’ll automatically exit to prevent bigger losses.

Why Discipline Beats Luck in Crypto Trading

It’s tempting to “ape in” or jump into trades impulsively, especially when the market looks exciting. But trading without a plan or patience is a recipe for losses. The key is to be in the right mental state and only enter trades when multiple indicators align.

If you miss a trade or get stopped out, it’s not the end of the world. That’s why limit orders and stop losses are essential—they help you stick to your strategy and protect your capital.

Step 4: Managing Risk with Stop Losses and Take Profits

Risk management is the backbone of sustainable trading. Since I’m trading $1,000 with 15x leverage, I’m taking on more risk than usual, but I’m still cautious. For bigger accounts, like $10,000 or $20,000, I lower leverage and risk only 1-2% per trade.

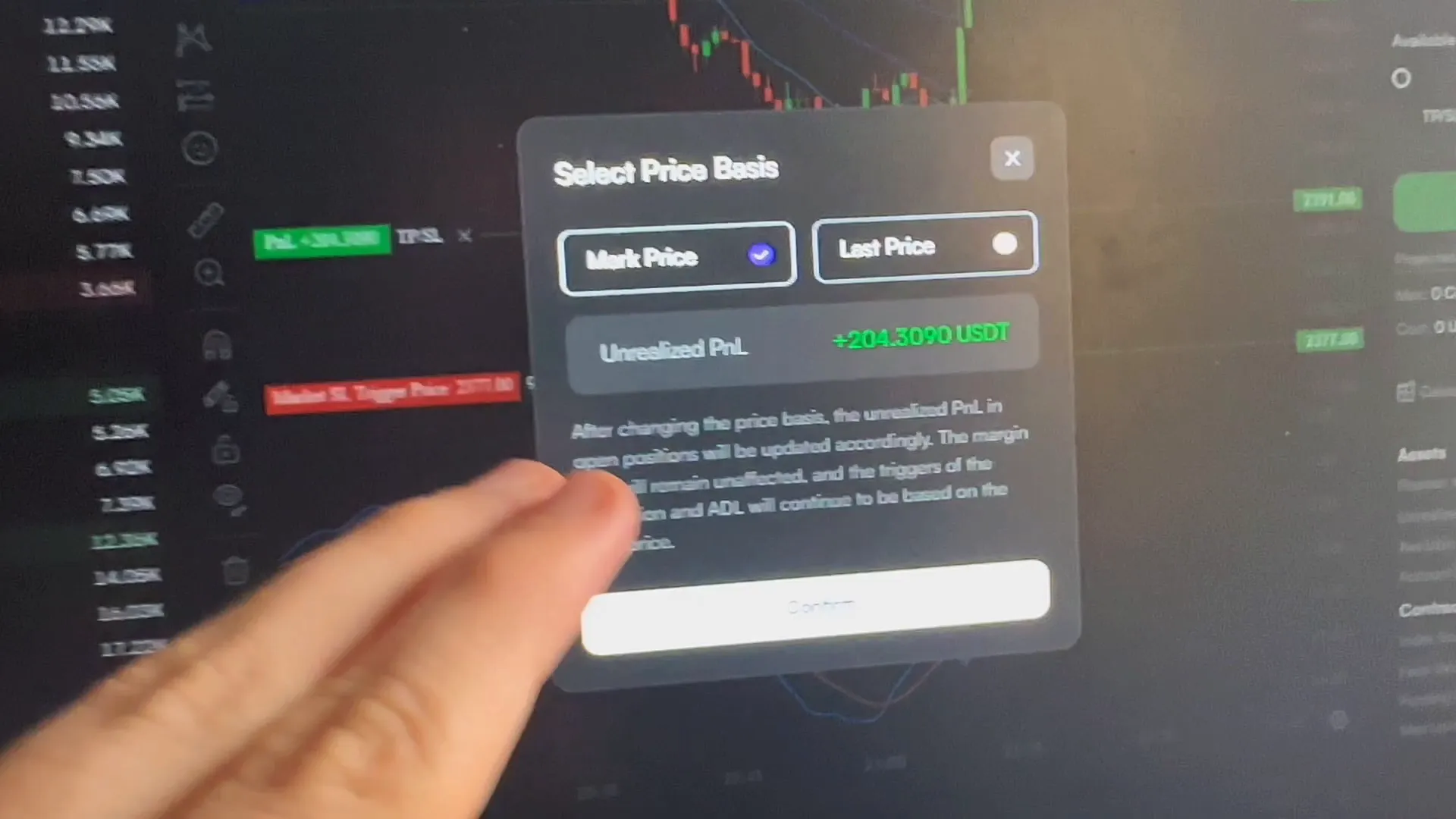

Once the trade is open and moving in my favor, I adjust my stop loss to lock in profits. For example, after Ethereum’s price moves up and sweeps out all the blue liquidity (short positions), I raise my stop loss to secure $50 in profit, guaranteeing a winning trade.

Additionally, I set partial take profit levels. One key target is $2,428, where I plan to take 33% of my position off the table, locking in $114 in gains while letting the rest of the trade run.

Why Partial Profits Matter

Taking partial profits helps you reduce risk and secure gains while still participating in potential further upside. It’s a balanced approach that keeps your emotions in check and your portfolio growing steadily.

Step 5: Staying Patient and Focused

Trading isn’t about constant action; it’s about waiting for the right moments. While the market does its thing, I keep myself entertained and relaxed—watching videos, playing with my dog, or even doing the Elon Musk dance (yes, really!).

This downtime is essential to avoid burnout and stress, helping maintain a clear mindset for the next trade.

Tracking Progress: From $1,000 to $10,000 and Beyond

So far, this challenge is off to a great start. From last night’s stream alone, we secured around $500 in profit, bringing the total to $1,500 on the road to $10,000. Each successful trade builds confidence and capital, bringing us closer to that Porsche GT3 RS.

Remember, this isn’t a sprint—it’s a multi-month journey that requires consistency, learning, and adaptation. By following this disciplined approach, anyone can start small and grow their crypto portfolio over time.

Join the Community and Keep Learning

If you want to catch these trade calls live, join our free Discord community or Telegram channel where I post all my targets and trade ideas. It’s a great way to learn, share, and stay motivated.

Also, check out Fomo.io—the indicator that’s been a game-changer for me. It’s simple, visual, and helps you understand liquidity and support/resistance levels with ease.

And don’t forget to subscribe to stay updated on this exciting journey to turn $1,000 into a Porsche GT3 RS. Only $200,000 to go!

Final Thoughts on Bitcoin, Crypto, BTC, Blockchain, and Investing

Trading Bitcoin and crypto isn’t about luck or secret formulas—it’s about understanding market mechanics, managing risk, and maintaining a disciplined mindset. The blockchain revolution offers incredible opportunities, but success requires education, patience, and smart strategies.

Whether you’re investing for the long term or trading for quick gains, tools like Fomo.io and platforms like CoinW can help you make informed decisions. Stick to your plan, respect your risk limits, and don’t let emotions drive your trades.

Remember, every big journey starts with a single step. Starting with $1,000 and aiming for a Porsche GT3 RS might sound crazy, but with the right approach, it’s within reach. So buckle up, stay focused, and let’s make those crypto dreams a reality.

Turning $1000 into a Porsche GT3: A Beginner’s Guide to Trading Bitcoin, Crypto, and Blockchain Investing. There are any Turning $1000 into a Porsche GT3: A Beginner’s Guide to Trading Bitcoin, Crypto, and Blockchain Investing in here.