Photo by Jakub Żerdzicki on Unsplash

Bitcoin and crypto enthusiasts, buckle up! Today’s landscape is buzzing with some intriguing developments that could signal a turning point for the market. From a rumored handwritten note from President Trump to Fed Chair Jerome Powell, to Elon Musk’s political shifts, and promising moves in tokenized stocks—there’s plenty to unpack. Let’s dive into the latest moves shaking up the crypto and bitcoin world and what they mean for you as an investor.

Trump's Handwritten Note: A Rate Cut Ultimatum

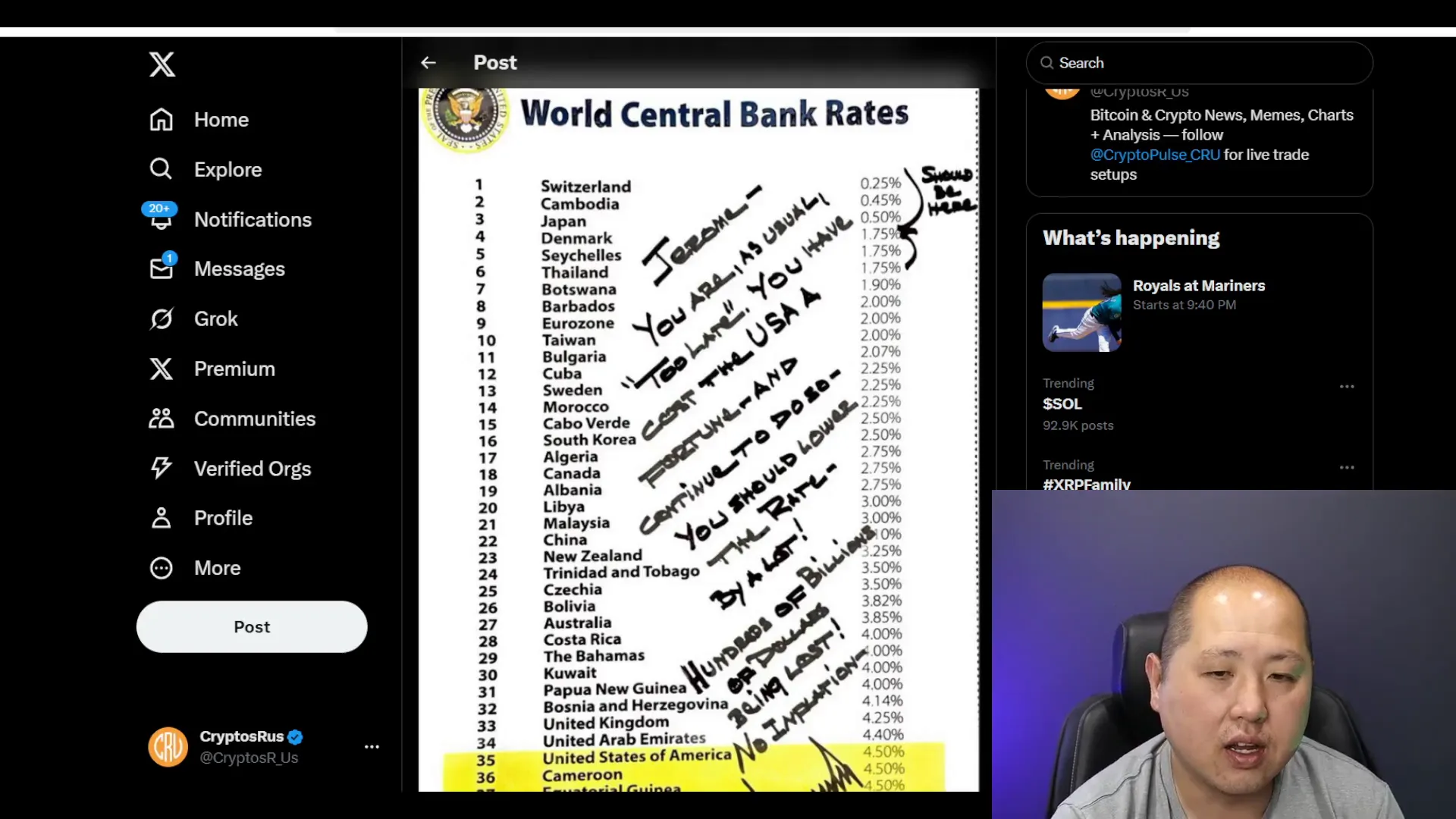

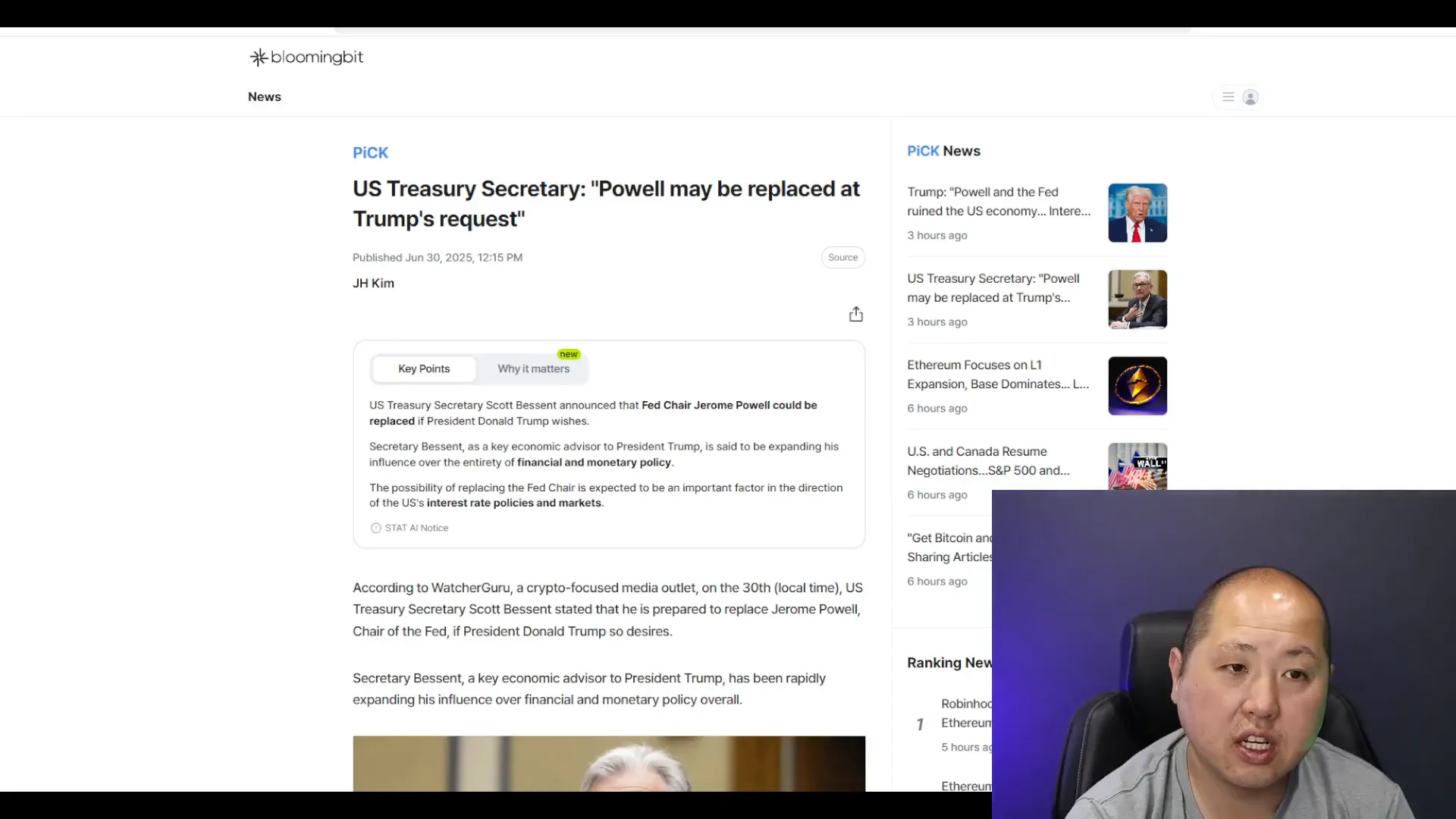

One of the most talked-about stories today is a supposed handwritten note from President Trump to Jerome Powell, the Fed Chair. In this note, Trump criticizes Powell for being "too late" and accuses him of costing the U.S. "a fortune" by not cutting interest rates sooner. He writes that the Fed fund rate "should be here like around 1.75" and urges Powell to lower rates significantly, hinting at hundreds of billions of dollars being lost due to current policies.

Interestingly, the note refrains from the usual name-calling, making it a pointed but measured message. This pressure on Powell could lead to significant policy shifts. Rumors are swirling that Powell might even be replaced soon, possibly by someone within the current administration. If such a change happens, it could trigger a rate cut, a move that historically tends to boost risk assets, including bitcoin and crypto.

Elon Musk’s Political Shift: Calling for a New Party

Elon Musk is stirring the political pot, too. While not directly attacking Trump, Musk criticizes the Republican Party as a whole, calling for a new political party that genuinely cares about the people. This is notable because Musk previously spent $300 million to support Republicans and help Trump get elected. Now, he’s distancing himself from that party and looking for something better.

What does this mean for crypto? Political shifts often influence regulatory environments and market sentiment. Musk’s stance could signal changes ahead in crypto-friendly policies or at least add volatility to the political landscape that crypto investors should watch.

Potential Crypto Win: No Capital Gains Tax on Bitcoin Transactions?

Here’s a big potential win for crypto holders: rumors suggest that the so-called “big beautiful bill” under discussion may have slipped in a provision that eliminates capital gains tax on Bitcoin transactions. If true, this would be a massive boost to the crypto market, reducing tax burdens and encouraging more trading and investment in bitcoin.

Such a move would position bitcoin even more firmly as a favored asset class for investors looking to maximize returns and minimize tax liabilities.

Bitcoin’s Price and The Best Time to Invest

Robert Kiyosaki, author of Rich Dad Poor Dad, recently made a compelling point that resonates with many bitcoin investors: "The best time to invest was yesterday. The next best time is today." It’s a reminder that timing the market perfectly is impossible, and holding or dollar-cost averaging (DCA) bitcoin is a smart long-term strategy.

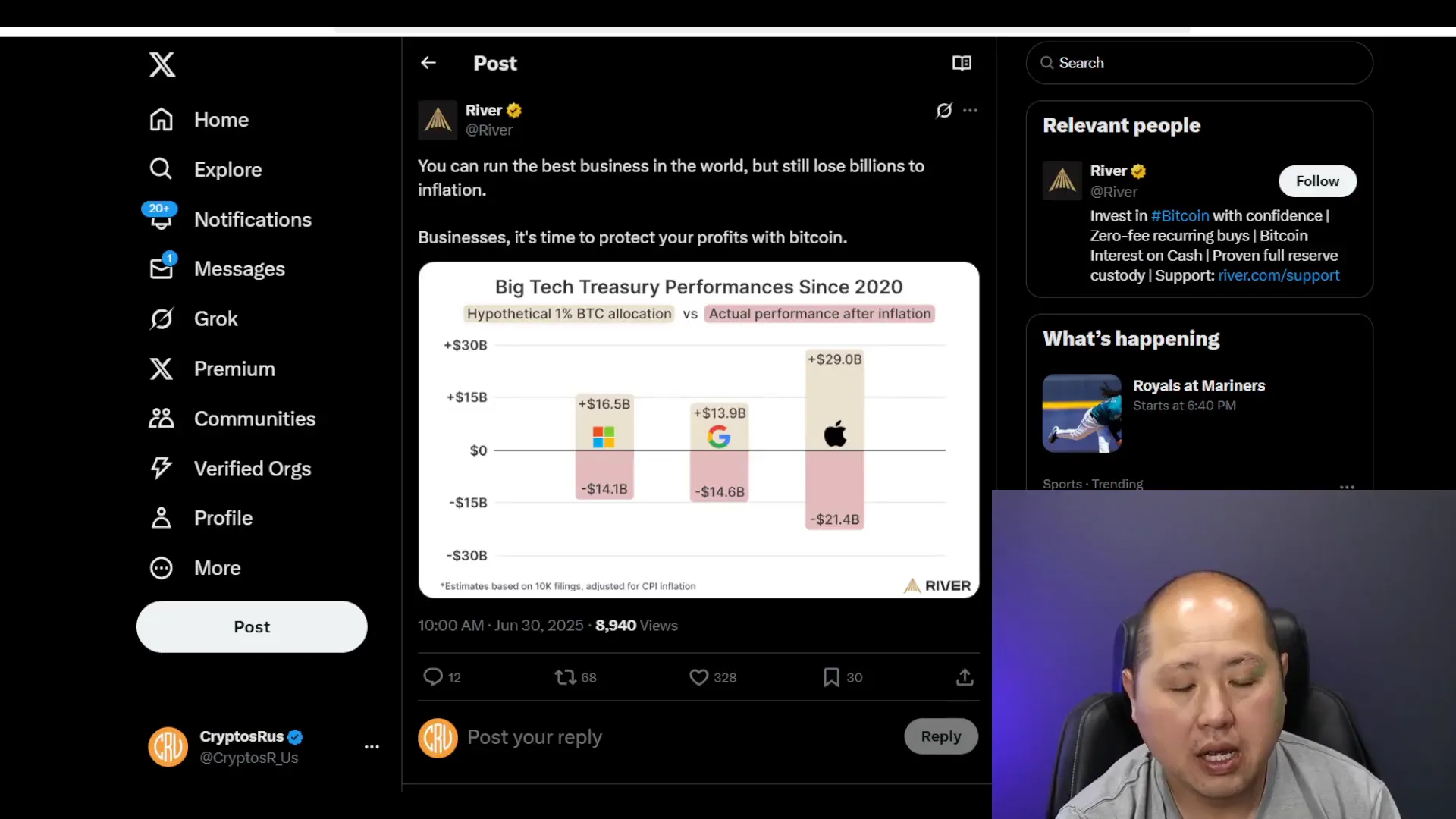

Bitcoin’s current price might seem high to some, but history tells a different story. The best time to invest in bitcoin is now because of its unmatched performance as an asset class. Just consider this: if Microsoft, Google, and Apple had invested only 1% of their funds into bitcoin since 2020, they would be sitting on gains worth billions—far outpacing losses from inflation.

Technical Outlook: Bitcoin Ready for the Next Leg Up

Looking at bitcoin’s technicals, we’re seeing signs that the next bullish move might be just around the corner. Bitcoin has been consolidating around the 107,000 mark, forming what looks like a bullish flag or pennant pattern. This suggests a potential breakout soon.

Institutional buying, ETF inflows, and possible catalysts like the rumored rate cut and tax changes add fuel to the fire. July historically tends to be a strong month for bitcoin, and with all these factors aligning, the stage is set for a promising run.

Beyond Bitcoin: Tokenized Stocks and New Blockchain Developments

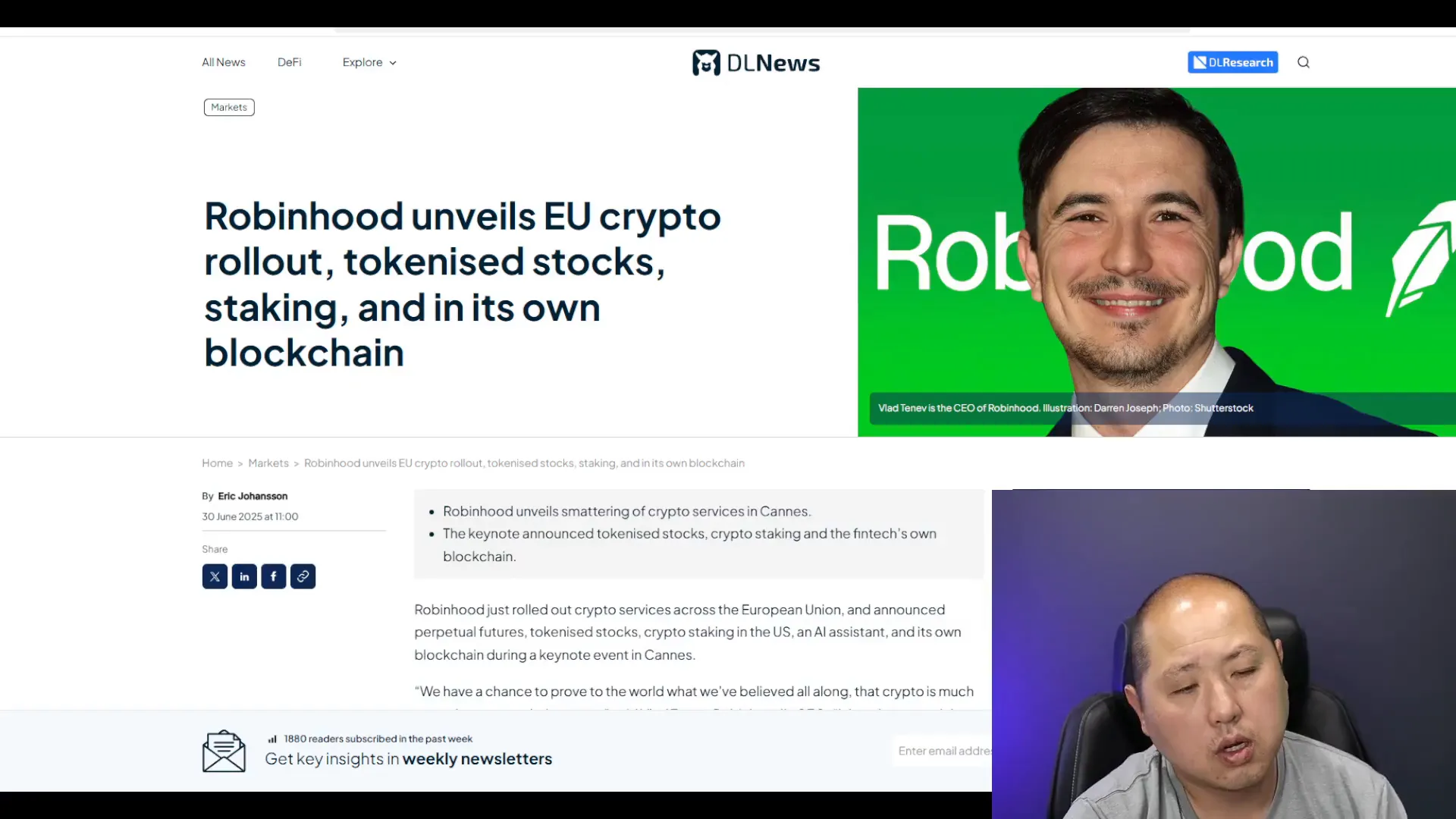

It’s not just bitcoin making waves. Exchanges like Robinhood are rolling out big plans, including launching their own blockchain on Aptos and enabling tokenized US stocks and ETFs to operate in the EU. This opens up exciting new opportunities for investors worldwide to access American tech giants like Nvidia, Apple, and Tesla through tokenized assets.

Kraken has also launched X stocks, allowing trading of 60 tokenized US stocks, further expanding access. Buybit is joining the fray as well, signaling a growing trend in tokenization of real-world assets (RWA). This is a game-changer for global investors looking to diversify portfolios beyond traditional boundaries.

What’s Next for Crypto and Bitcoin Investors?

Today wasn’t a blockbuster day for bitcoin and crypto, but it wasn’t bad either. We’re holding steady, consolidating, and gearing up for what feels like an imminent move higher. With so many bullish signals—political pressure on the Fed, potential tax benefits, institutional buying, and exciting new blockchain developments—the crypto space is primed for growth.

Stay tuned, keep your eyes on the market, and remember the golden rule of investing: the best time to buy is always now, because you never know what tomorrow will bring.

Happy investing, and here’s to the next big leg up in bitcoin and crypto!

Trump’s Ultimatum to Powell: What It Means for Crypto and Bitcoin Investors. There are any Trump’s Ultimatum to Powell: What It Means for Crypto and Bitcoin Investors in here.