When it comes to the intersection of politics and cryptocurrency, few figures generate as much heat as Elizabeth Warren and Donald Trump. Elizabeth Warren, a fierce critic of the crypto world, has openly expressed her concerns about the emerging risks that cryptocurrencies pose—especially when influential figures like Donald Trump get involved. On the other side, Donald Trump has not only dismissed these criticisms but also actively embraced crypto ventures, including launching his own meme coin and planning major Bitcoin investments.

In this detailed breakdown, we’ll dive deep into Donald Trump’s crypto holdings, the controversy surrounding his meme coin, and why Elizabeth Warren’s fury is making waves in the crypto community. Whether you’re an avid Bitcoin investor, a crypto enthusiast, or simply curious about how blockchain technology intersects with politics and money, this comprehensive guide covers everything you need to know about Trump’s crypto fortune and the ongoing debate.

Elizabeth Warren’s Warning: Crypto as a New Threat

Elizabeth Warren has been one of the most vocal critics of cryptocurrencies, labeling them a serious threat to consumers and the financial system. Her message is clear: crypto needs strong regulation to prevent corruption and protect ordinary investors from scams and market manipulation. Warren’s stance is rooted in her broader agenda to crack down on financial misconduct, and she sees crypto as a new frontier where bad actors could exploit the system.

Her criticism extends beyond abstract warnings. Warren has specifically targeted Donald Trump’s crypto activities, describing events like Trump’s exclusive dinner for meme coin holders as an “orgy of corruption.” For Warren, the dinner, which gathered the top 220 holders of Trump’s meme coin, symbolized the kind of unchecked greed and insider dealings that crypto’s decentralized promise was supposed to eliminate.

“Donald Trump's dinner is an orgy of corruption. That’s what this is all about. We are here today to talk about exactly one topic, corruption. Corruption in its ugliest form.”

Donald Trump’s Crypto Ventures: A Closer Look

Despite the backlash from Elizabeth Warren and other critics, Donald Trump has been actively building a crypto empire. But how much of Trump’s wealth is actually tied to crypto? What are the main components of his crypto portfolio? And why is the crypto world buzzing about an upcoming event in fifteen days that could change everything?

Thanks to a recent Bloomberg article and detailed financial disclosures, we can break down the components of Trump’s crypto exposure and understand the stakes.

World Liberty Financial: Trump’s DeFi Powerhouse

One of the most significant parts of Trump’s crypto holdings is his stake in World Liberty Financial, a decentralized finance (DeFi) protocol. World Liberty is not just any DeFi project; it’s preparing to launch a stablecoin called USD One, which is rapidly gaining traction in the market.

Here are some key facts about World Liberty Financial:

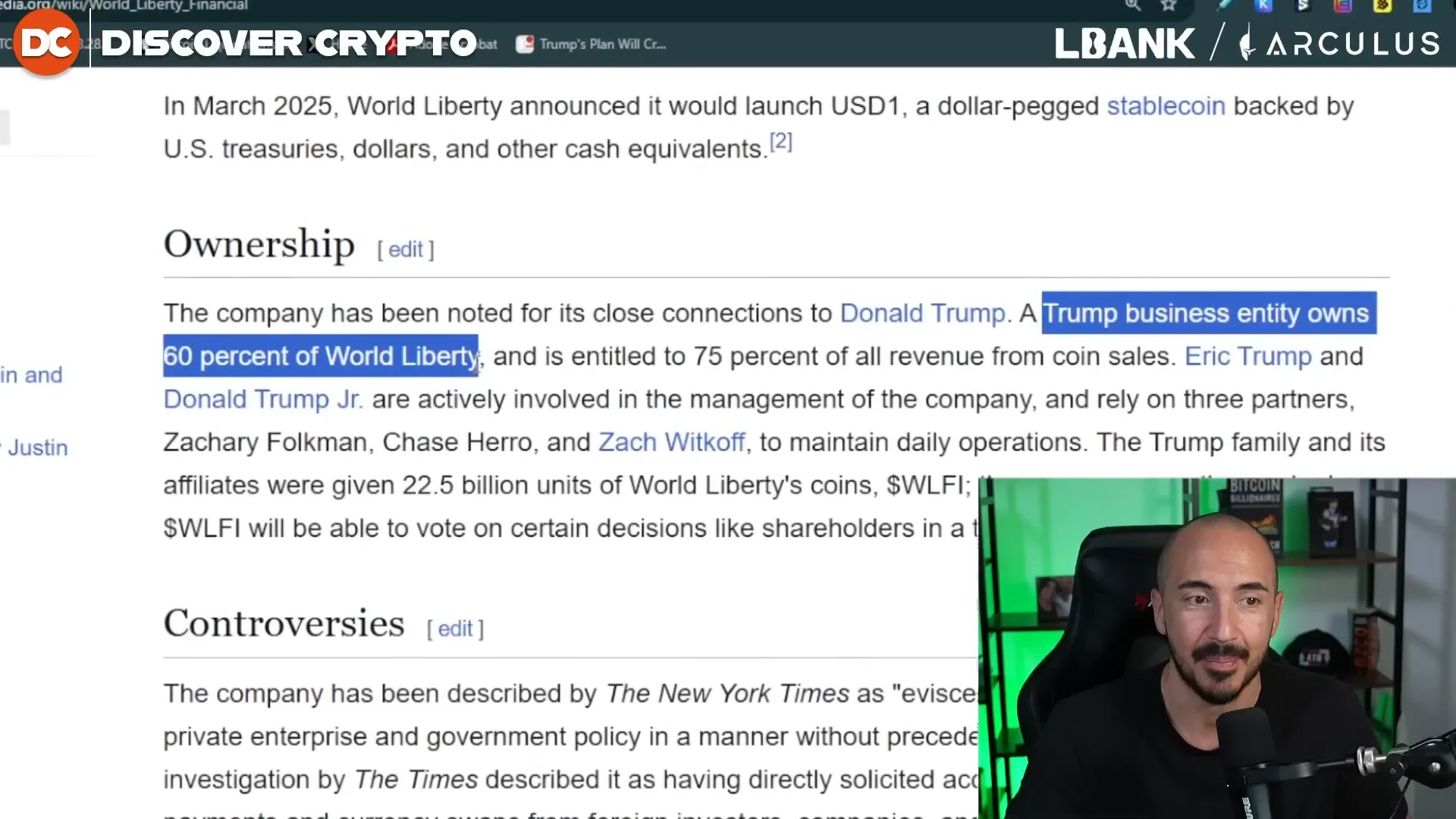

- Trump-related business entities own 60% of World Liberty Financial.

- They receive 75% of all revenue generated from the coin sales.

- The current valuation of this position is approximately $460 million.

- The stablecoin USD One is among the fastest-growing stablecoins in the market, positioning World Liberty for significant future value appreciation.

This means that as USD One gains adoption and the DeFi protocol expands, Trump’s stake in World Liberty could become exponentially more valuable, fueling his crypto fortune in a big way.

Trump Media and Technology: A Bitcoin Treasury in the Making

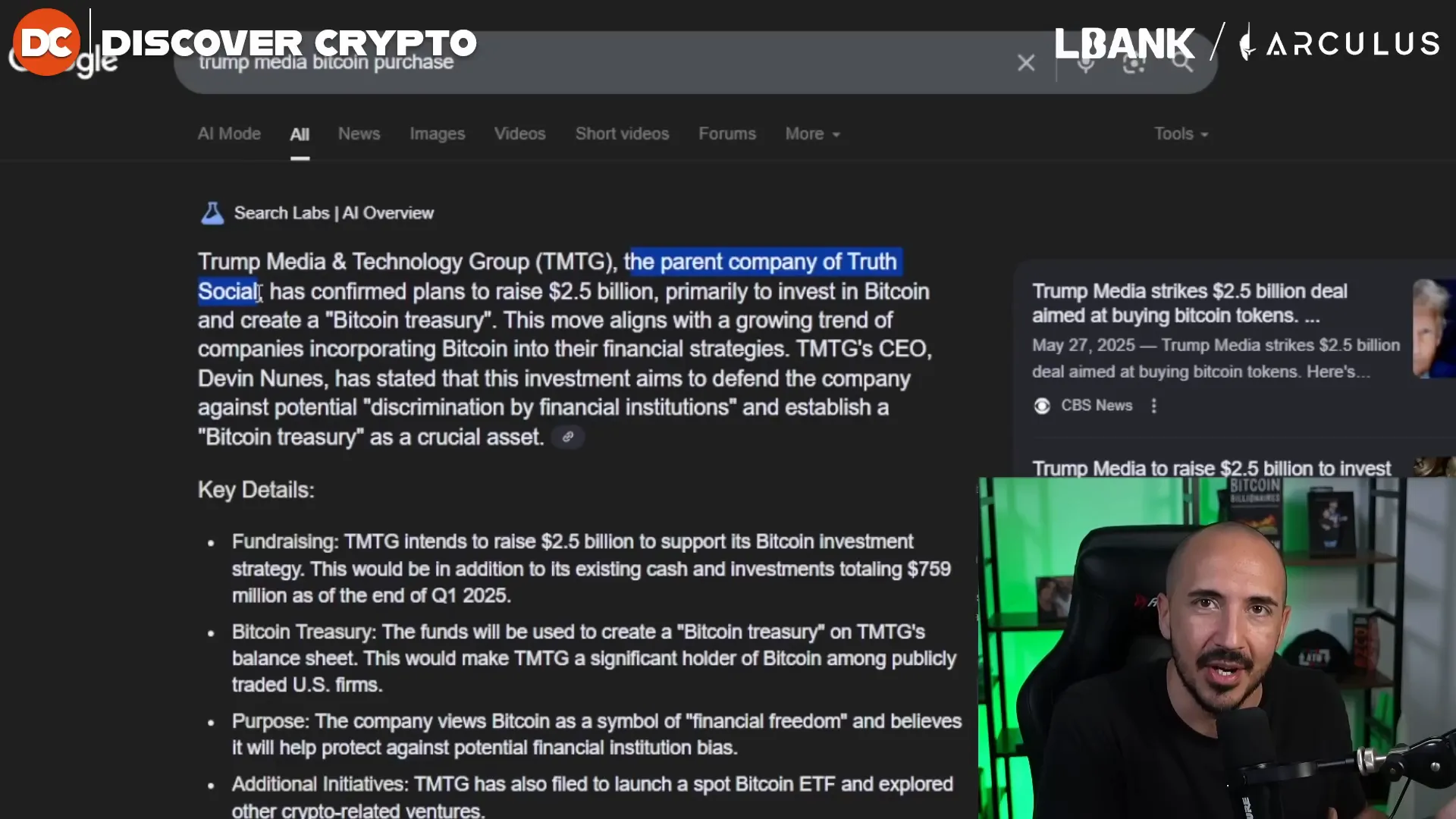

Next, we have Trump Media and Technology Group, the parent company of Truth Social, Donald Trump’s own social media platform. This company is planning to raise a massive $2.5 billion fund, primarily aimed at investing in Bitcoin and establishing a Bitcoin treasury.

Here’s what you need to know about Trump Media’s crypto ambitions:

- Trump Media plans to raise $2.5 billion, with $2 billion earmarked for Bitcoin investments.

- Donald Trump personally owns about 58.7% of Trump Media.

- The value of Trump’s Bitcoin investment through Trump Media is estimated at around $2.2 billion.

- While this $2 billion investment isn’t currently counted as part of Trump’s direct crypto holdings, it technically will become part of his crypto portfolio once Bitcoin is acquired.

Trump’s strategy here reflects a broader trend of companies building Bitcoin treasuries as a store of value and hedge against inflation. It also signals his commitment to making Bitcoin a cornerstone of his financial empire.

The Trump Token: Meme Coin Controversy and Upcoming Unlock

Perhaps the most controversial aspect of Trump’s crypto involvement is the Trump Token, a meme coin launched under the Trump brand. Meme coins have exploded in popularity recently, but they are often criticized for their extreme volatility and speculative nature.

Here’s a snapshot of the Trump Token situation:

- The Trump Token’s market cap is estimated at over $1 billion.

- Donald Trump and his affiliates own about 80% of the Trump Token supply.

- The token once traded at an all-time high above $70 but has since plummeted to around $8.87.

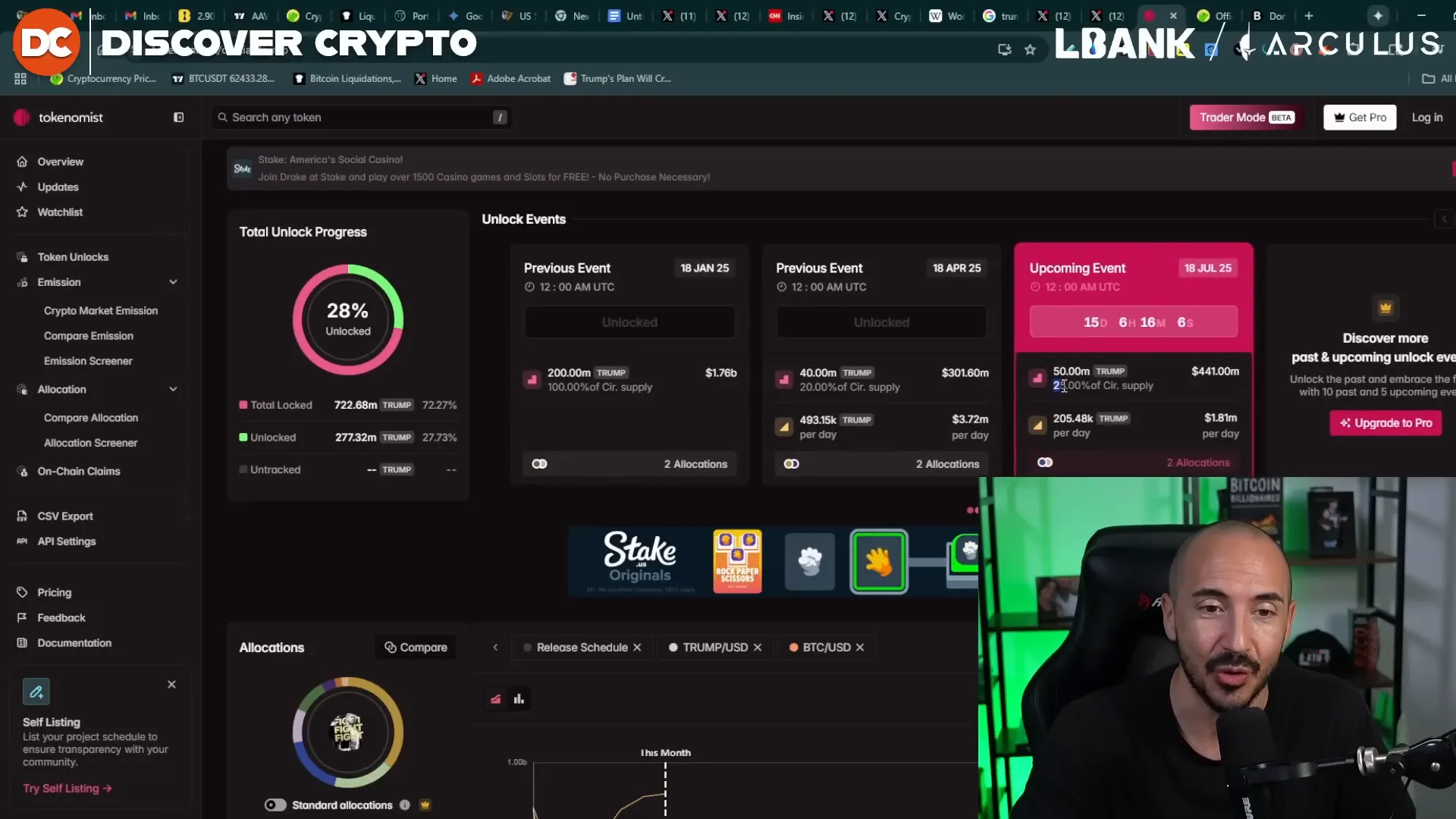

What has the crypto community alarmed is an upcoming token unlock event scheduled in fifteen days. Token unlocks refer to the release of previously locked tokens into the circulating supply, which can drastically affect price and market dynamics.

According to Tokenomus, a platform that tracks token unlocks, the Trump Token is set to release 50 million tokens—equivalent to 25% of the circulating supply—in just over fifteen days. Given the current price, this unlock represents over $400 million worth of tokens entering the market.

Such a large unlock can create significant sell pressure, potentially tanking the token’s price and sparking accusations of a pump-and-dump or scam. This is why many critics are calling Trump a scammer in the crypto space.

Why Is Elizabeth Warren So Furious?

Elizabeth Warren’s anger towards Trump’s crypto dealings is grounded in her broader fight against corruption and financial manipulation. She sees Trump’s crypto activities, especially the meme coin and the exclusive dinner for top holders, as emblematic of the worst abuses in the crypto space.

Warren’s concerns touch on several key issues:

- Market manipulation: With Trump and his affiliates owning 80% of the Trump Token, there is a high risk of price manipulation.

- Insider benefits: Exclusive events like the dinner for top token holders raise questions about fairness and transparency.

- Investor protection: Meme coins are notoriously volatile and risky, and Warren argues that many retail investors could be misled or harmed.

- Corruption fears: Warren’s repeated use of the term “orgy of corruption” highlights her view that Trump’s crypto ventures are not just risky but potentially exploitative.

Her message is a call for stronger regulation and oversight, aiming to prevent the crypto space from becoming a playground for the wealthy and well-connected to profit at the expense of everyday investors.

What Does This Mean for Bitcoin, Crypto, BTC, Blockchain, and Investing?

The saga of Donald Trump’s crypto fortune and Elizabeth Warren’s fierce opposition is a microcosm of the broader tensions in the cryptocurrency world. Here are some takeaways for investors and crypto enthusiasts:

1. Crypto Is Becoming Mainstream—and Political

As figures like Donald Trump embrace Bitcoin and crypto projects, these assets are no longer just niche investments for tech-savvy enthusiasts. They are becoming intertwined with politics, public policy, and regulatory debates. This means investors need to be aware of the political landscape and how it might impact crypto markets.

2. Transparency and Ownership Matter

The Trump Token controversy underscores the importance of understanding tokenomics—how tokens are distributed, who owns what percentage, and how token unlocks can affect prices. Investors should always dig into these details before buying into any crypto project.

3. Stablecoins Are Gaining Traction

Trump’s stake in World Liberty Financial and its stablecoin USD One highlights the growing role of stablecoins in the crypto ecosystem. Stablecoins aim to provide price stability, making them useful for everyday transactions and as a gateway into DeFi.

4. Regulatory Scrutiny Is Increasing

Elizabeth Warren’s vocal opposition signals that lawmakers are paying close attention to crypto. Investors should expect more regulations, which could bring both challenges and opportunities.

5. Meme Coins Are Risky but Popular

While meme coins like the Trump Token can generate hype and short-term gains, they come with high risk and volatility. Investors should approach them with caution and be prepared for rapid price swings.

How to Navigate the Crypto Landscape Amidst Controversies

Given the complexity and rapidly evolving nature of the crypto market, here are some practical tips for investors looking to protect their interests:

- Do Your Own Research: Never rely solely on celebrity endorsements or hype. Investigate the project’s fundamentals, team, token distribution, and roadmap.

- Understand Token Unlocks: Be aware of upcoming unlock events that can flood the market with new tokens and impact prices.

- Diversify Your Portfolio: Spread your investments across different assets to reduce risk.

- Beware of Scams: Watch out for projects with opaque ownership or promises that sound too good to be true.

- Stay Updated on Regulations: Keep an eye on policy changes that could affect your investments.

- Use Secure Wallets: Protect your assets by using hardware wallets or trusted custody solutions.

For those considering jumping into Bitcoin, crypto, BTC, blockchain, or investing in new projects, being informed and cautious is the best defense against volatility and potential fraud.

Looking Ahead: What’s Next for Trump’s Crypto Empire?

The next fifteen days are critical. The scheduled unlock of 50 million Trump Tokens could redefine the market dynamics for the coin. If a large portion of those tokens hit the market quickly, it could trigger a sell-off and further price declines. This event will be closely watched by crypto investors, regulators, and critics alike.

Beyond the meme coin, Trump’s larger crypto initiatives, like the Bitcoin treasury through Trump Media and the growing stablecoin USD One, suggest that his crypto involvement is not a passing fad but a long-term strategy. Whether these ventures succeed or falter will have ripple effects across the crypto ecosystem and could influence how politicians engage with blockchain technology in the future.

Elizabeth Warren’s continued scrutiny ensures that Trump’s crypto activities will remain under the microscope, fueling debates about ethics, transparency, and the role of regulation in the rapidly evolving world of digital assets.

Final Thoughts on Trump, Warren, and the Crypto Clash

The clash between Donald Trump’s crypto ambitions and Elizabeth Warren’s regulatory crusade highlights the growing pains of the cryptocurrency industry. It’s a space bursting with potential but fraught with risks, scams, and political battles.

For investors, the key is staying informed, understanding the risks, and approaching crypto with both enthusiasm and caution. Whether you’re bullish on Bitcoin, intrigued by DeFi, or skeptical of meme coins, the story of Trump’s crypto fortune is a powerful reminder of how money, power, and blockchain technology intersect in today’s world.

As we watch these developments unfold, the crypto community will be looking to see whether Trump’s investments pay off or become another cautionary tale—and how regulators like Elizabeth Warren shape the future of Bitcoin, crypto, BTC, blockchain, and investing.

Trump Crypto Fortune Breakdown: Why Elizabeth Warren Is FURIOUS About Bitcoin, Crypto, BTC, Blockchain, and Investing. There are any Trump Crypto Fortune Breakdown: Why Elizabeth Warren Is FURIOUS About Bitcoin, Crypto, BTC, Blockchain, and Investing in here.