In the fast-evolving world of cryptocurrency, bitcoin continues to dominate as the most compelling asset class of the decade. What started as a speculative experiment is rapidly transforming into a foundational monetary network reshaping global finance. This article dives deep into the seismic shifts in Bitcoin’s institutional adoption, macroeconomic drivers, and what the future holds for investors and nations around the world.

Let’s explore how Bitcoin has surged past traditional assets, gained unprecedented political and regulatory support, and why it is poised to create massive wealth in the coming years.

Table of Contents

- Bitcoin’s Meteoric Rise Amidst a Challenging Macro Economy

- 2024: Bitcoin at a Crossroads with Institutional Capital Returning

- The Institutional and Political Embrace of Bitcoin

- The Rise of Bitcoin ETFs and Sovereign Interest

- Bitcoin as Base Layer Monetary Infrastructure

- Regulatory and Legislative Momentum: Bitcoin’s New Normal

- The Crypto Industry’s Unified Front: Bitcoin as the Foundation

- Why Public Companies Are Recapitalizing on Bitcoin

- The Path Forward: Bitcoin’s Institutional Evolution and Global Monetary Repricing

- Are You Positioned for the Bitcoin Revolution?

- Final Thoughts

Bitcoin’s Meteoric Rise Amidst a Challenging Macro Economy

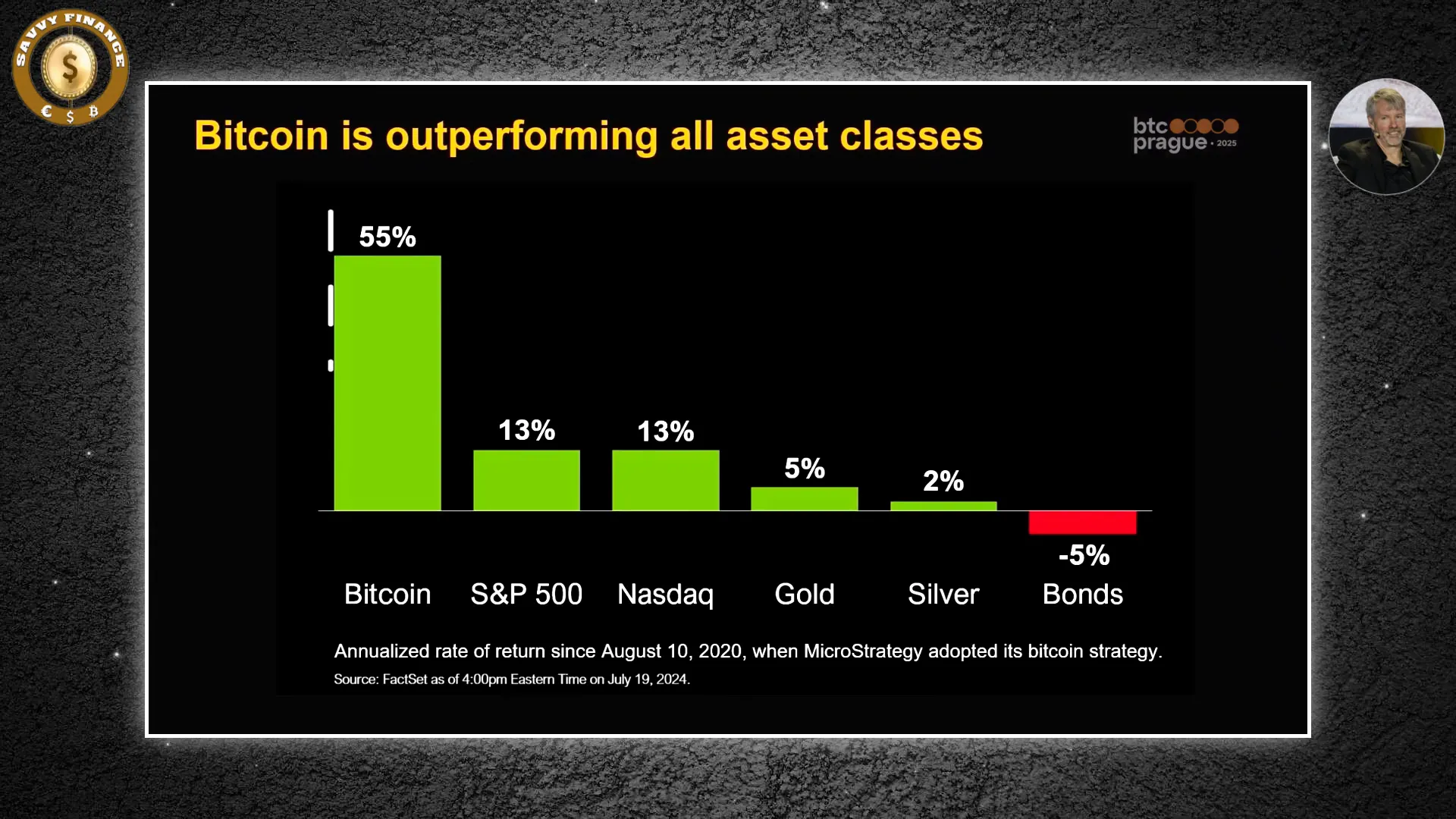

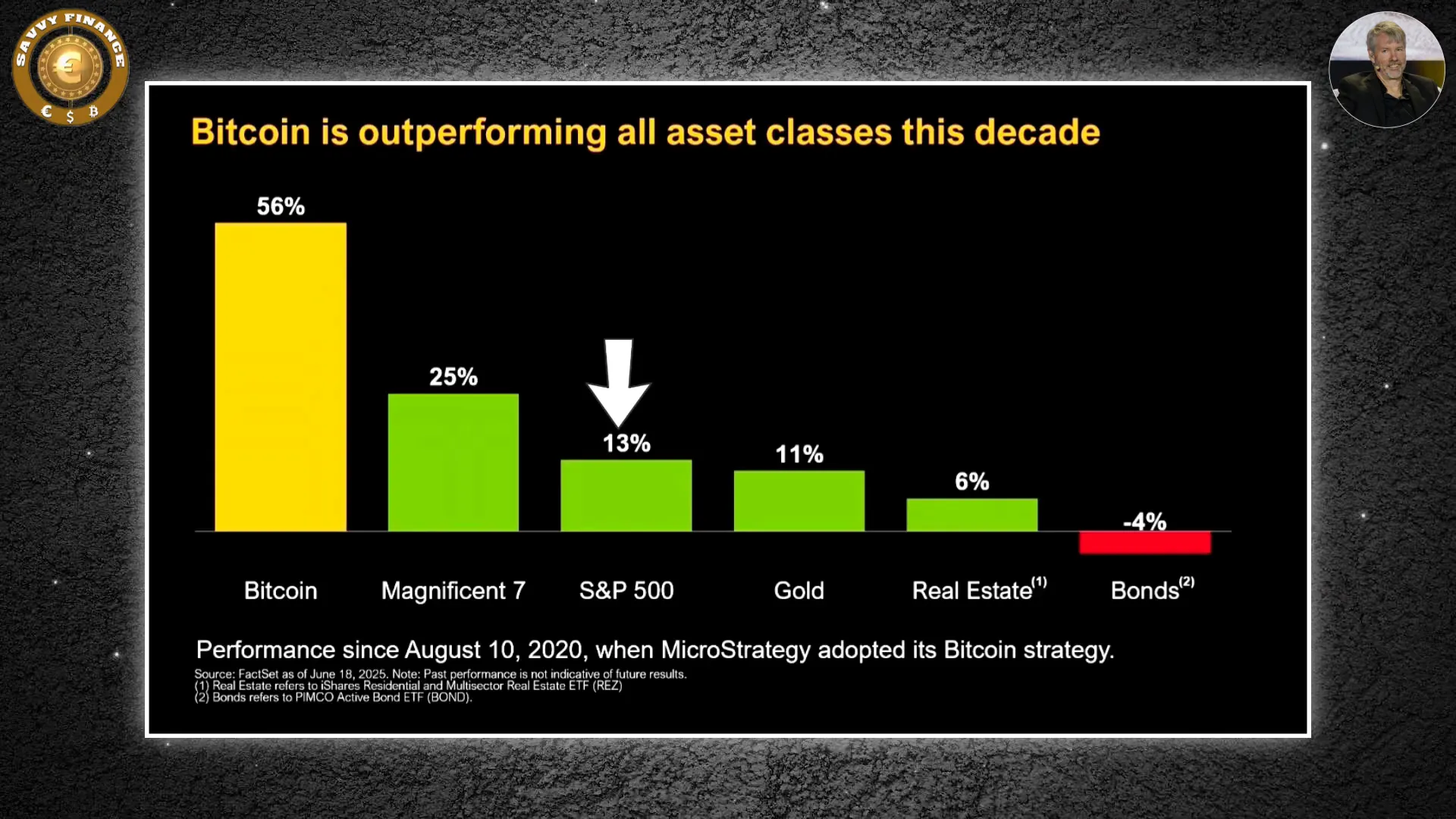

Back in July, Bitcoin was already making headlines by appreciating an impressive 55%, outpacing major market indices like the Nasdaq and S&P 500, while traditional assets like gold, silver, and bonds lagged behind.

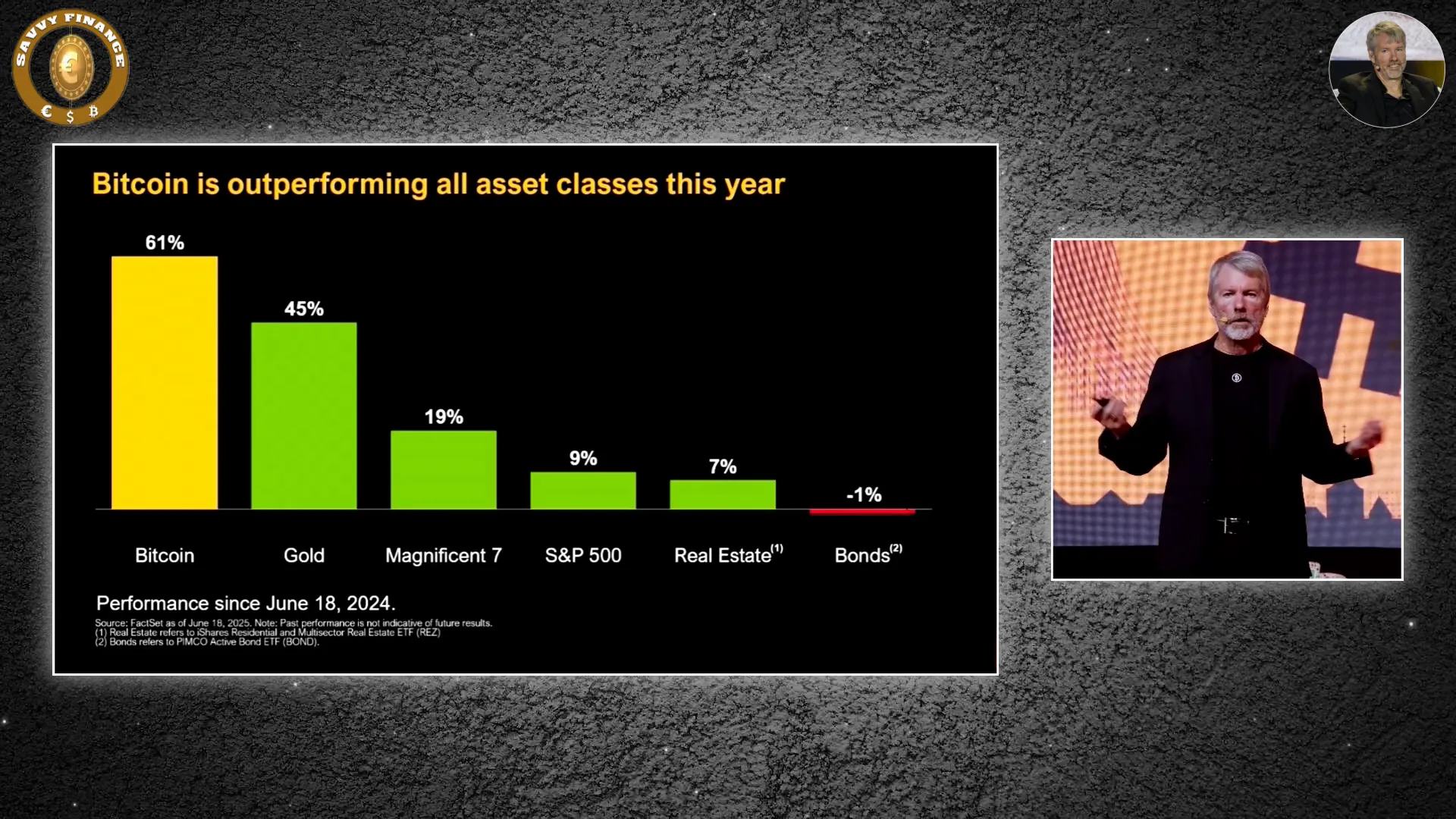

Fast forward twelve months, and Bitcoin’s momentum has only strengthened, running harder than ever with a 61% gain. Despite tariff wars, trade tensions, and a general decline in mainstream confidence affecting tech mega caps and bonds, Bitcoin continues to outperform all asset classes, including gold and real estate.

What makes this especially remarkable is Bitcoin’s sustained outperformance over the past decade, averaging a 56% annualized return—more than double that of the S&P 500’s “Magnificent Seven” tech giants.

2024: Bitcoin at a Crossroads with Institutional Capital Returning

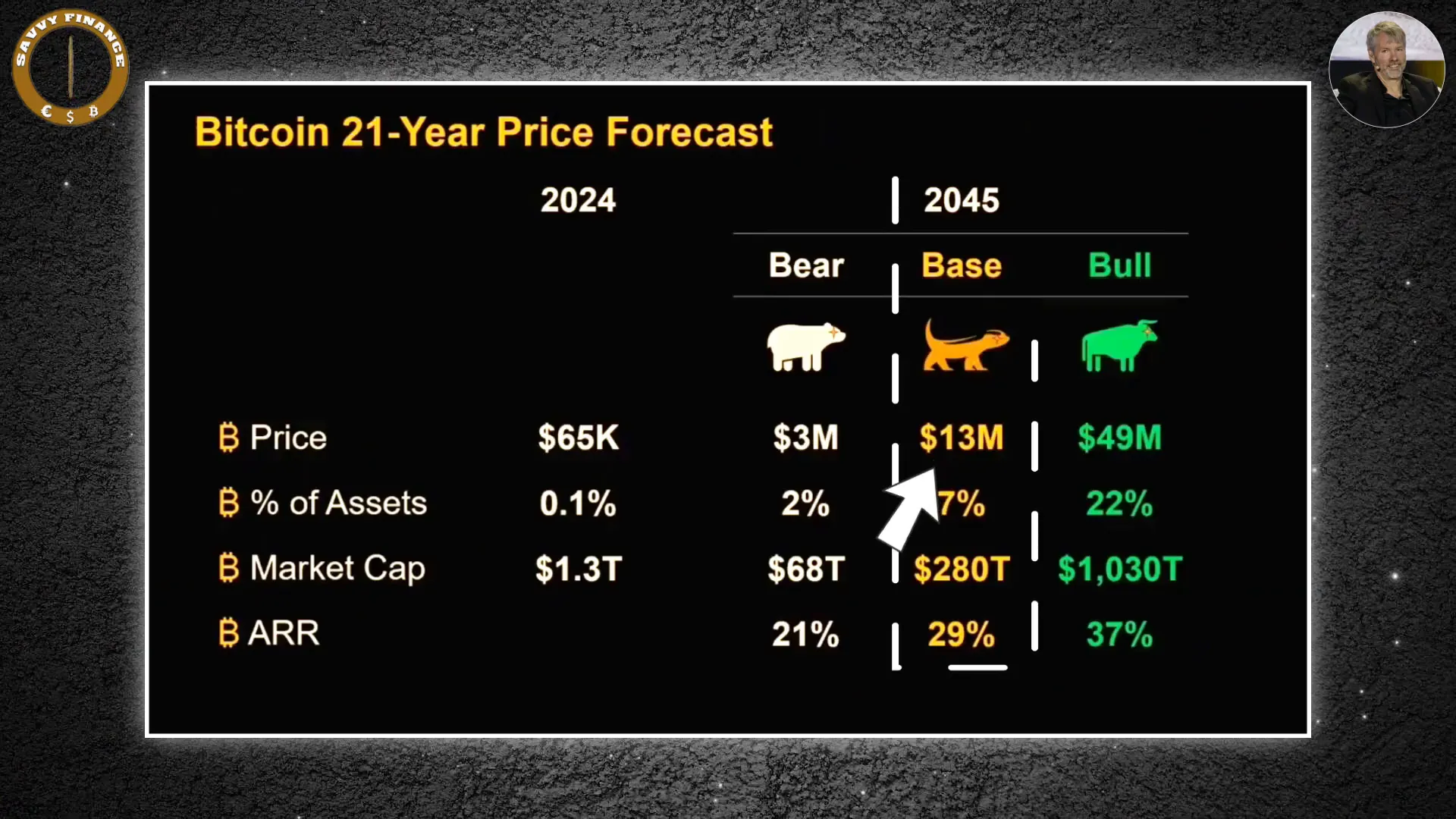

Mid-2024 marked a pivotal moment. Bitcoin’s market capitalization hovered around $1 trillion, a mere 0.1% of the $280 trillion global asset pool—a small foothold, but a foothold nonetheless. Institutional capital began flowing back after the crypto winter, but widespread conviction was still tentative.

During a landmark event, Michael Saylor, executive chairman of MicroStrategy, presented a bold long-term thesis forecasting Bitcoin’s rise to $13 million per coin over 21 years. This forecast implied a 29% annual growth rate and Bitcoin capturing up to 7% of global assets, effectively establishing it as its own asset class.

While many dismissed this as science fiction, less than a year later, Bitcoin’s surge of over 60% and growing institutional embrace have validated much of Saylor’s vision.

The Institutional and Political Embrace of Bitcoin

One of the most extraordinary developments in the past year has been Bitcoin’s embrace by political and financial institutions. Contrary to expectations, the White House publicly declared its strategic intent for America to become the global Bitcoin superpower—a historic first for any sitting U.S. administration.

Key figures across the political spectrum, including JD Vance, Robert F. Kennedy, Tulsi Gabbard, and others, have publicly supported Bitcoin, signaling a new era of bipartisan endorsement.

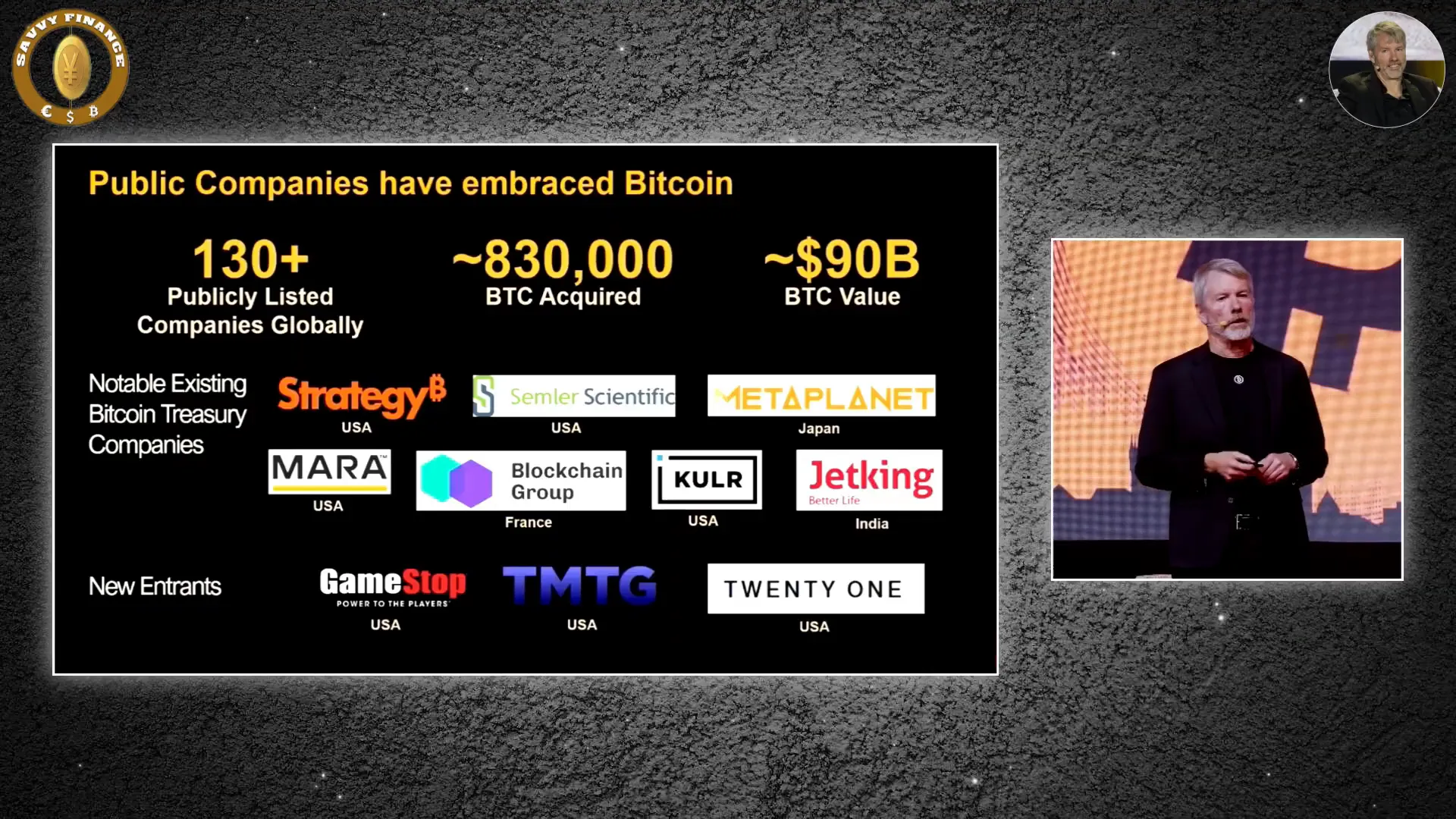

Wall Street’s attitude has also shifted dramatically. From skepticism and viewing Bitcoin as a toxic asset, the conversation has evolved to formal equity analyst coverage with price targets. Public companies are now racing to add Bitcoin to their treasuries, with MicroStrategy leading the charge and over 130 companies following suit.

Notable entrants include Trump Media and GameStop, reflecting a broadening adoption across industries. The Bitcoin 100 leaderboard is becoming a competitive space, symbolizing Bitcoin’s institutionalization.

The Rise of Bitcoin ETFs and Sovereign Interest

Bitcoin ETFs, once considered a long shot, have now amassed over $200 billion in cumulative assets, spearheaded by financial giants like BlackRock, Fidelity, and Franklin Templeton. This shift has made Bitcoin accessible to a wider range of investors and institutional portfolios.

Moreover, sovereign nations are no longer dismissing Bitcoin as conspiracy or speculation. Countries such as El Salvador, Bhutan, and even Russia and China are publicly acknowledging Bitcoin’s strategic importance, viewing it as a reserve-grade, non-sovereign asset that hedges against dollar dependency and promotes digital sovereignty.

Bitcoin as Base Layer Monetary Infrastructure

Technologically, Bitcoin is shedding its speculative label. It is increasingly recognized as foundational monetary infrastructure, akin to TCP/IP for the internet. This base layer status means Bitcoin is not just an asset but a protocol enabling a new financial order.

With improved regulatory clarity and political support, banks, pension funds, and corporations are incentivized to integrate Bitcoin rather than ignore it. This realignment of incentives marks Bitcoin’s transition from a decentralized experiment to a geopolitical asset class of systemic relevance.

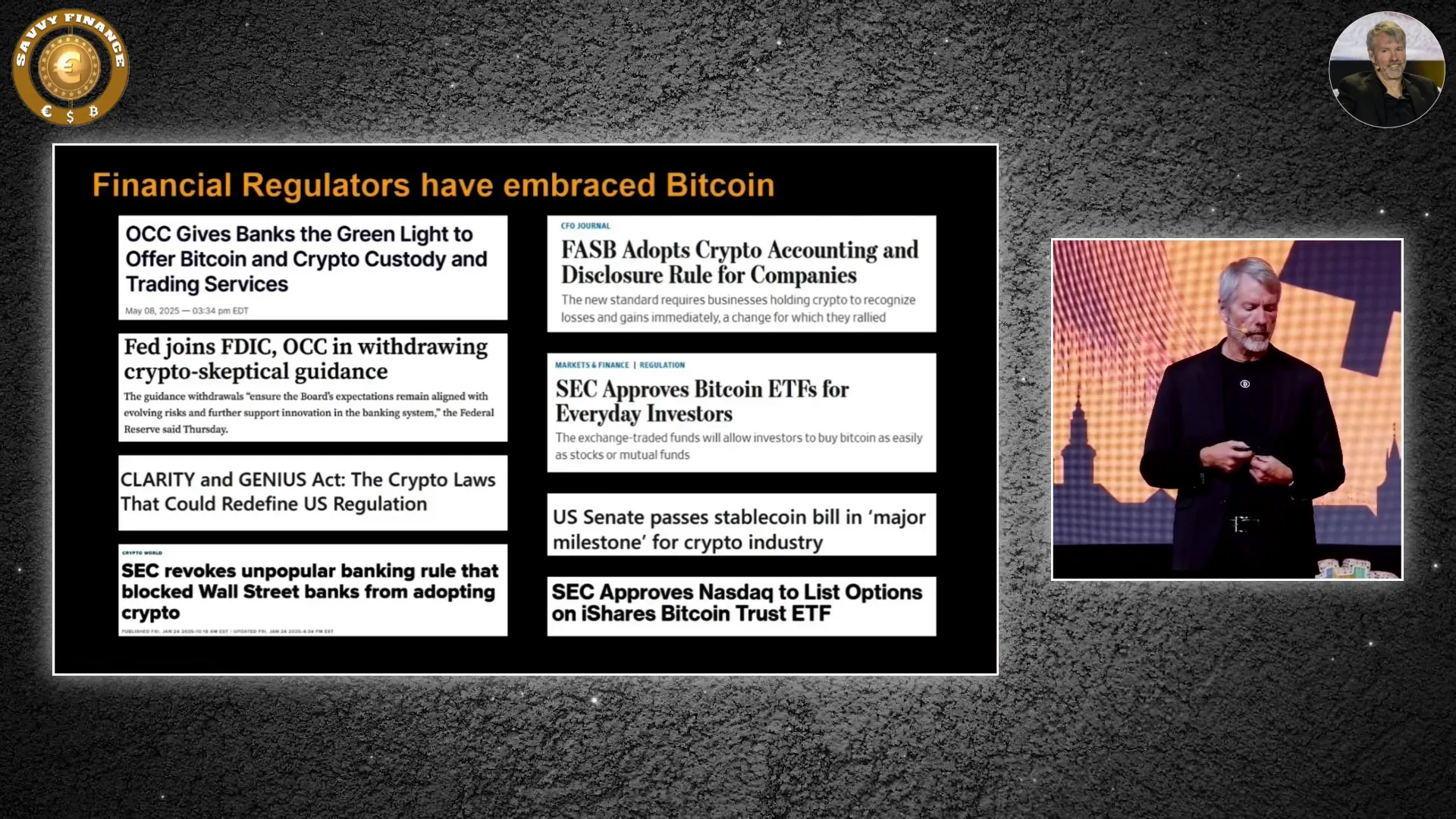

Regulatory and Legislative Momentum: Bitcoin’s New Normal

Regulators have embraced Bitcoin in unprecedented ways. The Office of the Comptroller of the Currency (OCC) and the Federal Reserve encourage banks to support Bitcoin. The SEC has authorized Bitcoin ETFs, while accounting bodies advocate for fair Bitcoin accounting standards.

Capitol Hill is actively advancing legislation such as the Clarity Act, Genius Act, and Bitcoin Act, signaling growing bipartisan support. States across the U.S. are also passing pro-Bitcoin policies, further embedding Bitcoin into the financial system.

The Crypto Industry’s Unified Front: Bitcoin as the Foundation

Within the crypto ecosystem, an unprecedented coalition has emerged acknowledging Bitcoin as the ethical, economic, and technical foundation of the entire industry. Bitcoin is now viewed as the reserve currency of the crypto economy, the unshakable protocol upon which all other projects depend.

This unity bodes well for Bitcoin’s future, ensuring it remains the fulcrum of innovation and value creation across decentralized finance.

Why Public Companies Are Recapitalizing on Bitcoin

One of the most compelling financial arguments for Bitcoin adoption lies in its ability to outperform the cost of equity. The global cost of equity is approximately 13%, but Bitcoin’s average annualized return over the past five years stands at 56%—far exceeding this benchmark.

This means companies holding Bitcoin can generate accretive returns on capital raised through equity issuance, unlike real estate, bonds, or commodities, which are dilutive to shareholder value. This dynamic explains the explosion of Bitcoin treasury companies like MicroStrategy, Meta Planet, and Smarterweb.

The Path Forward: Bitcoin’s Institutional Evolution and Global Monetary Repricing

We are at a global inflection point. Although Bitcoin’s dominance is evident, 99.8% of global capital remains allocated to systems that neither preserve real value nor deliver sustainable returns. This misallocation is unsustainable and will accelerate capital rotation toward Bitcoin.

As capital seeks yield, liquidity, and security in the digital age, Bitcoin is not just a hedge—it is becoming a requirement. Its neutrality, immutability, and decentralization are now seen as strengths by regulators, corporations, and geopolitical actors alike.

Bitcoin is evolving beyond an asset class into a benchmark, a base layer, and a new standard for sound money in the 21st century.

Are You Positioned for the Bitcoin Revolution?

The Bitcoin revolution is well underway. The question now is whether you are building with Bitcoin as your foundation or clinging to legacy systems losing trust and relevance.

For investors, companies, and nations, understanding this shift and positioning accordingly could unlock unprecedented wealth creation over the next decade.

“The question now is, are you positioned for what’s coming? Are you building with Bitcoin as your foundation, or are you still anchored to a system that’s losing trust, yield, and relevance?”

Final Thoughts

Bitcoin’s journey from fringe speculation to mainstream monetary asset is one of the most significant financial stories of our time. With institutional capital flooding in, regulatory clarity improving, and global political support growing, Bitcoin stands poised to reshape the global financial landscape.

Whether you are a seasoned investor or new to cryptocurrency, bitcoin, the time to understand and engage with this evolving ecosystem is now. The coming years will reveal who capitalizes on this top secret that could make many billionaires in 2025 and beyond.

What do you think is the biggest barrier left before Bitcoin fully enters the global financial mainstream? Share your thoughts and be part of this historic conversation.

This Top Secret Will Make Lots of Billionaires in 2025: The Bitcoin Revolution. There are any This Top Secret Will Make Lots of Billionaires in 2025: The Bitcoin Revolution in here.