Cryptocurrency, especially bitcoin, has long been a subject of fascination and speculation. While many see its price volatility as chaotic or driven by hype, a fresh perspective reveals a deeper, mathematical rhythm behind bitcoin's long-term price trajectory. This article explores groundbreaking insights from mathematician Giovanni Santostasi, who uncovered a power law governing bitcoin’s price growth. His predictions and explanations provide a compelling framework for understanding bitcoin’s past, present, and future—suggesting that the journey to a million-dollar bitcoin might be closer than you think.

Table of Contents

- The Mathematical Rhythm Behind Bitcoin's Price

- Why the Power Law Matters

- Early Volatility Was Not Just Noise

- How Good Is the Model? Understanding the Regression Line and R²

- What the Power Law Predicts for Bitcoin’s Future Price

- Conclusion: The Power Law as a Framework for Understanding Bitcoin

The Mathematical Rhythm Behind Bitcoin's Price

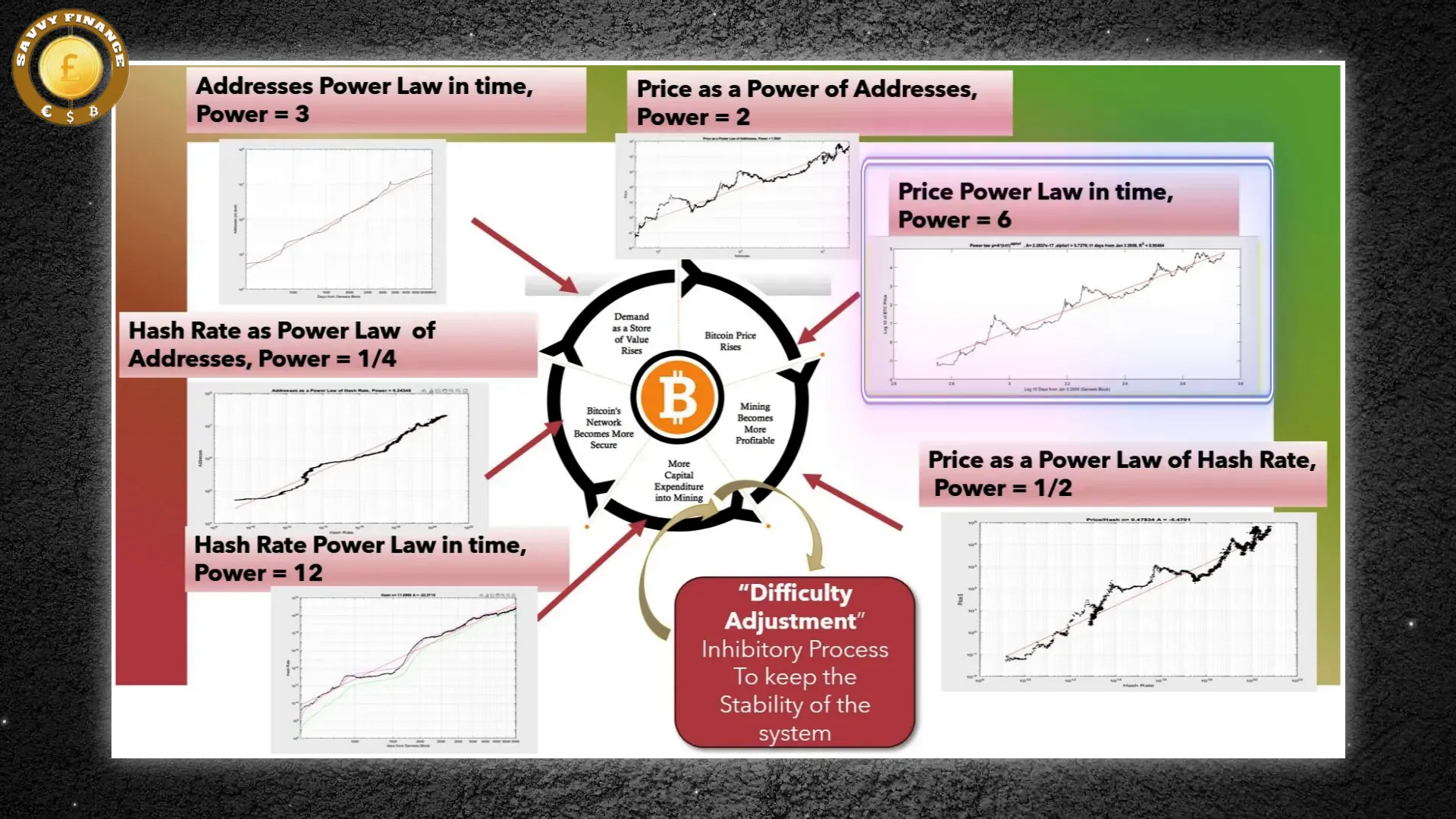

Bitcoin’s price has often been described as unpredictable, marked by bubbles and crashes. Yet, beneath this apparent chaos lies an elegant mathematical pattern. Giovanni Santostasi, a physicist and mathematician, studied bitcoin’s price data extensively and discovered that its growth follows a power law function related to the age of the bitcoin network. Specifically, the price is proportional to the time elapsed since the genesis block raised to approximately the sixth power.

What does that mean? Simply put, bitcoin’s price growth is not random or purely speculative. Instead, it follows a consistent scaling behavior, much like natural phenomena and digital systems studied in physics. This power law relationship suggests that bitcoin’s price is mathematically tied to how long the network has existed.

Why the Power Law Matters

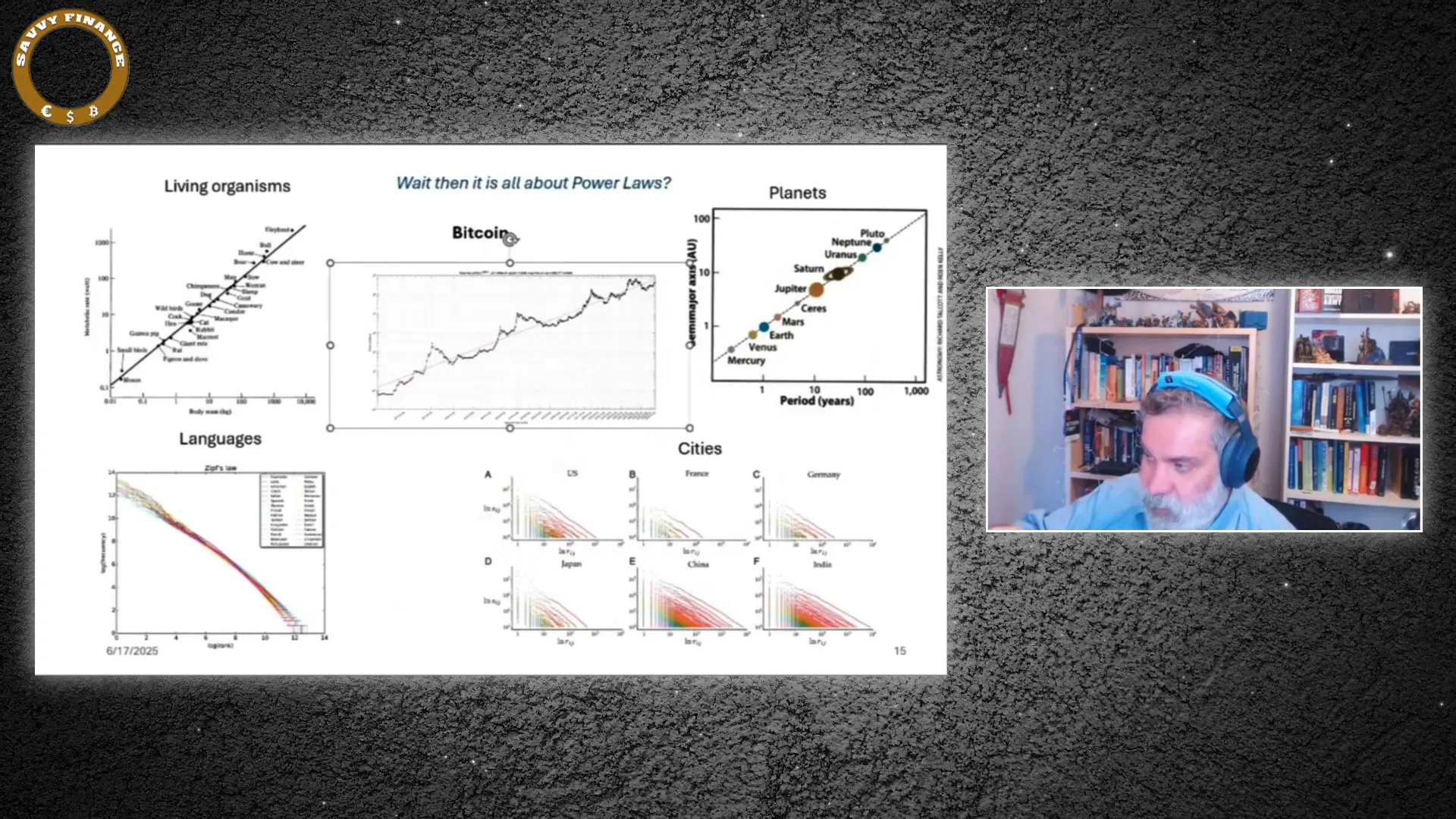

Power laws are special mathematical relationships that rarely appear by chance. They are signals of underlying mechanisms that drive growth or change in a system. Unlike exponential growth, which is often assumed in digital trends, power laws have distinct characteristics and implications.

For Santostasi, identifying a power law in bitcoin’s price is more than just fitting a curve to data. It offers a framework to interpret bitcoin’s behavior, anticipate its future, and understand the forces at play. For example, despite multiple dramatic price bubbles, bitcoin’s price consistently returns to this power law trajectory, acting like an attractor that pulls price back to its expected path.

This means that while bitcoin’s price can deviate temporarily due to hype or fear, the long-term trend remains governed by this deep mathematical pattern.

Early Volatility Was Not Just Noise

Bitcoin’s early years were marked by wild price swings that many dismissed as tulip mania—a bubble bound to burst and never recover. In 2010, bitcoin went from about $20 down to $3, shaking confidence among investors. However, Santostasi points out that unlike typical bubbles, bitcoin’s price recovered and continued rising, which is a crucial distinction.

An early essay even argued bitcoin was fundamentally different from tulip mania because it kept bouncing back. The power law model confirms this by showing that even the earliest bitcoin transactions fit neatly into the predicted curve once you filter out bubble noise scientifically.

How Good Is the Model? Understanding the Regression Line and R²

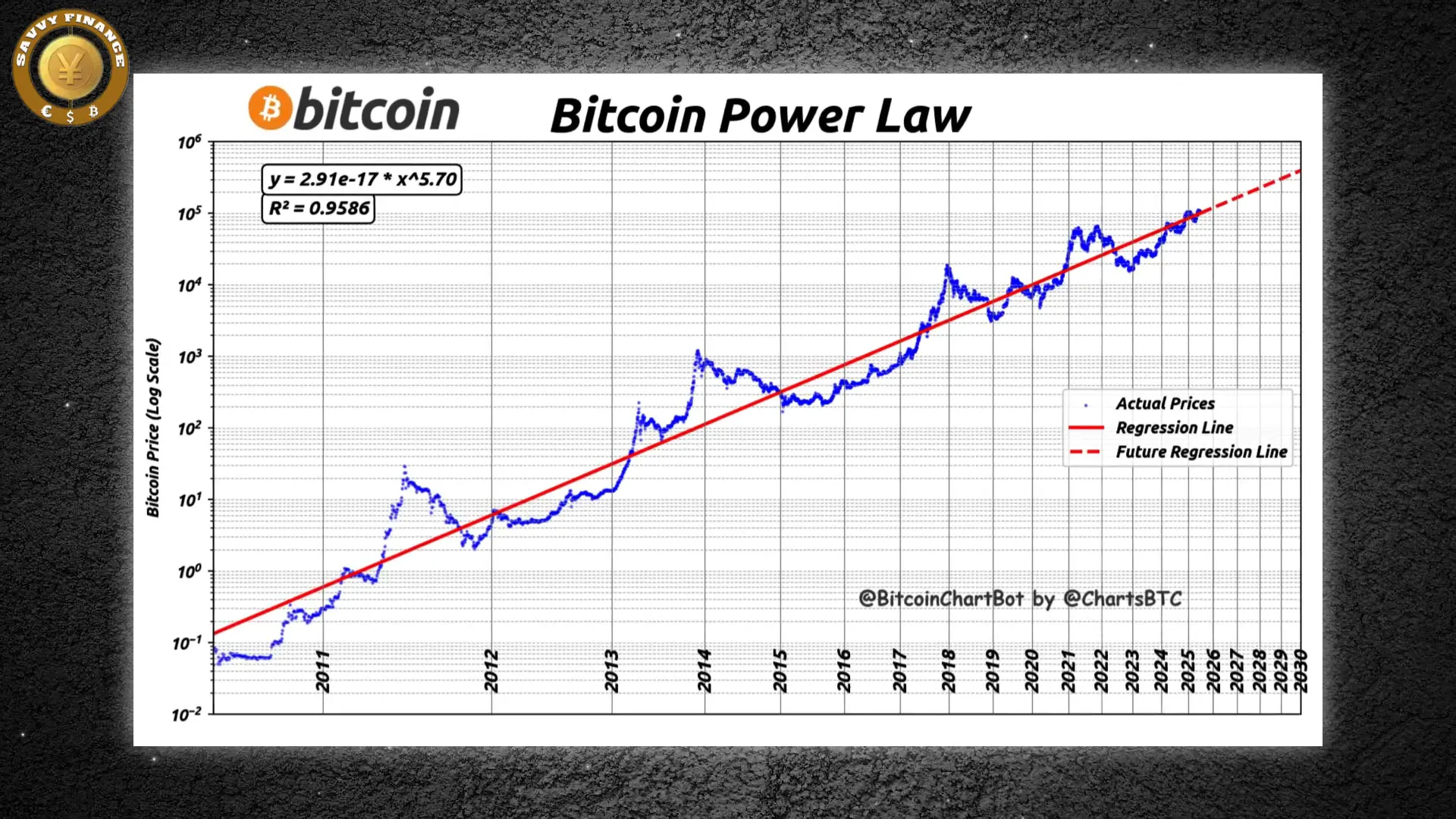

Santostasi uses a statistical tool called the regression line to summarize bitcoin’s price behavior. This line represents the average relationship between bitcoin price and the age of the network, minimizing the distance from all data points.

To measure how well this line fits the data, he uses the R squared (R²) value, which ranges from 0 to 1. An R² closer to 1 means the model explains more of the variation in price. Remarkably, the bitcoin power law model boasts an R² of about 0.95, meaning it accounts for 95% of the price data's behavior. As more data accumulates, this value is improving, indicating the model’s increasing accuracy.

While not every data point lies exactly on the line, the points balance out above and below it, which is mathematically sound for regression analysis. This provides strong evidence that the power law is a genuine, underlying pattern rather than a coincidence.

What the Power Law Predicts for Bitcoin’s Future Price

Based on this power law, bitcoin’s price is expected to reach $1 million in about eight years. Following that, it could hit $10 million within two decades. These projections are staggering but grounded in the consistent scaling behavior observed since bitcoin’s inception.

Santostasi emphasizes that while no prediction in finance is certain, the power law pattern has endured through multiple market cycles and institutional shifts. Bitcoin has already grown by eight orders of magnitude, and adding one or two more orders of magnitude is not impossible.

Role of Institutions and Market Growth

As bitcoin’s market capitalization grows into trillions, the nature of investors evolves—from retail enthusiasts to large institutions and ETFs. Some might expect this shift to disrupt bitcoin’s price growth pattern. However, the power law model suggests otherwise.

Institutions, likened to “elephants” in the animal kingdom analogy, fit perfectly into the same scaling framework. Their entry is not a break from the pattern but a natural progression that may even stabilize volatility and reinforce the power law trajectory.

When Will Governments Step In?

Another big question is when governments will actively participate in the bitcoin market. Santostasi explains that this too can be understood through the power law framework. Governments and nations will become relevant players when bitcoin’s market cap approaches the GDP size of countries.

Thus, regulatory clarity and strategic reserves are likely to emerge naturally as bitcoin’s market scales, not arbitrarily or suddenly. This scaling perspective offers a powerful lens to interpret future developments around bitcoin regulation and adoption.

Conclusion: The Power Law as a Framework for Understanding Bitcoin

Giovanni Santostasi’s discovery of a power law governing bitcoin’s price growth shifts our understanding from speculation to scientific insight. It frames bitcoin as a digital phenomenon following its own law of motion—one that has persisted through bubbles, volatility, and institutional evolution.

Whether bitcoin reaches $1 million in the next eight years or $10 million in twenty, this model offers a compelling way to anticipate the future grounded in data and mathematical principles.

What do you think about this mathematical approach? Could bitcoin really follow this trajectory? Share your thoughts, and stay curious about the fascinating intersection of cryptocurrency, bitcoin, and mathematics.

This Mathematician Just Cracked Bitcoin’s Price Code & What’s Next Is Shocking. There are any This Mathematician Just Cracked Bitcoin’s Price Code & What’s Next Is Shocking in here.