If you're following the world of cryptocurrency and bitcoin, there’s plenty to digest in the current market. Recent expert analysis reveals that while Bitcoin’s price action might seem volatile and uncertain on the surface, under the hood, it’s more about strategic shifts than fresh capital flooding in. Let’s unpack what’s really happening and what could be next for Bitcoin in this cycle.

Table of Contents

- Why Bitcoin’s Recent Moves Are More Rotation Than Rally

- Bitcoin’s Current Price Action and Key Market Metrics

- Tom Lee’s Take: Why Aren’t Bitcoin ETFs Driving Prices Higher?

- Three Market Levers to Watch for Bitcoin’s Next Big Move

- Bitcoin’s Resilience: A Powerful Industry Backed by High-Profile Endorsements

- Max Keiser’s Bold Prediction: Bitcoin at $850,000 in This Cycle

- What’s Next for Bitcoin? The Waiting Game for New Money

Why Bitcoin’s Recent Moves Are More Rotation Than Rally

At first glance, the market seems to be buzzing with intense Bitcoin price swings. However, these fluctuations largely stem from seasoned holders selling their coins and reentering the market through Bitcoin ETFs or companies like MicroStrategy. This dynamic isn’t about an influx of new money but rather a calculated reallocation of existing assets.

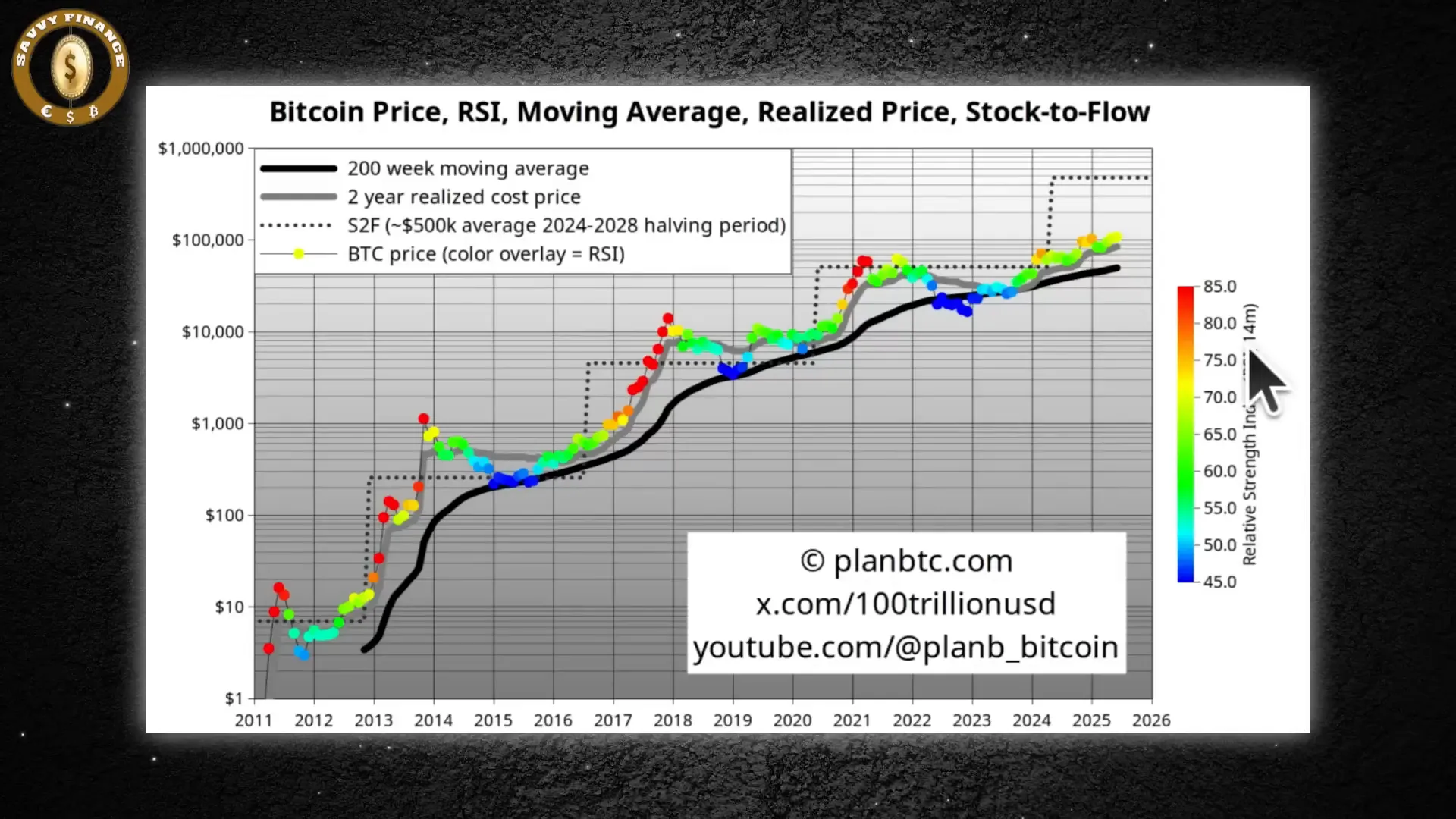

Market experts PlanB, known for his data-driven stock-to-flow model, and Tom Lee, a strategist with deep market foresight, both emphasize this point. According to them, the significant price activity reflects long-term holders shifting positions rather than fresh institutional capital entering the space.

This rotation explains why, despite the wildly popular Bitcoin ETFs ranking among the most in-demand financial products ever launched, the market remains in a holding pattern. We are yet to see the explosive growth many expected after these ETFs hit the scene.

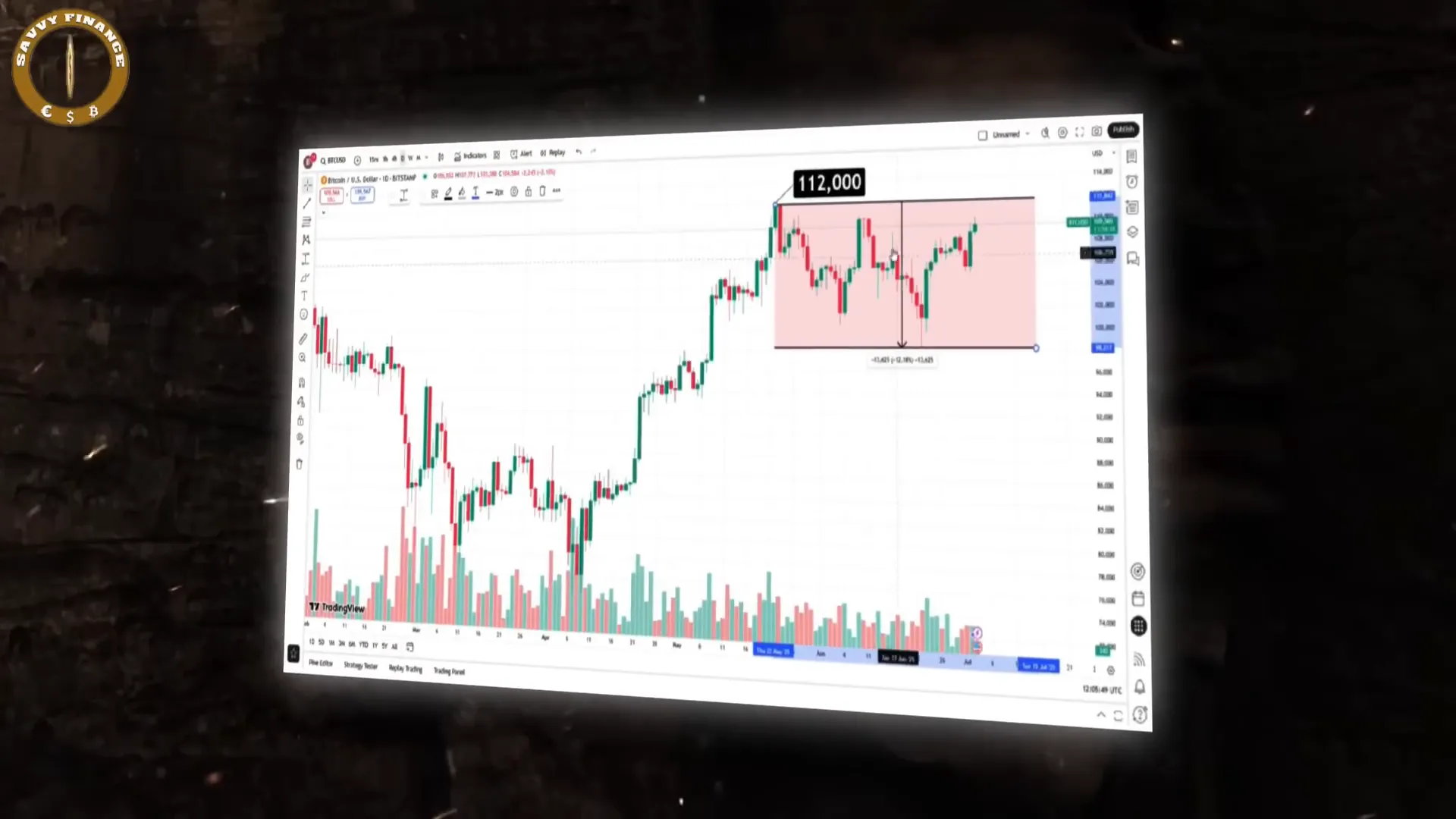

Bitcoin’s Current Price Action and Key Market Metrics

Bitcoin is currently trading above important realized price levels, hovering near $107,000. This price is above all realized price metrics—a classic hallmark of a bull market seen in previous cycles like 2013 and 2017. Supporting data shows:

- The 200-week moving average sits at $50,000

- The two-year realized price is around $84,000

- The 14-month Relative Strength Index (RSI) stands at 70, indicating strong but not yet peak momentum

PlanB highlights that despite Bitcoin being well below his stock-to-flow model’s $500,000 average forecast for this cycle, there are nearly three years left until the next halving — plenty of time for Bitcoin to reach new all-time highs. Interestingly, about 40% of market participants doubt Bitcoin will hit $200,000 before the end of 2026, but the data and historical patterns suggest otherwise.

Tom Lee’s Take: Why Aren’t Bitcoin ETFs Driving Prices Higher?

Tom Lee provides a compelling explanation for why Bitcoin ETFs, despite their record-breaking success, haven’t pushed prices into the stratosphere:

- In-kind Exchange Mechanism: Many investors transfer their Bitcoin directly to ETF providers, which only changes ownership but doesn’t increase demand or price. This is a neutral move that steps up the investor’s cost basis without creating buying pressure.

- Profit-Taking by Early Adopters: Many holders who bought Bitcoin at very low prices (e.g., $10 or $100) are now sitting on huge gains and tend to sell around the $100,000 level, creating resistance against further price surges.

In other words, the market is currently churning its base rather than expanding it with new money. Despite this, companies supporting Bitcoin infrastructure like Coinbase and Circle have seen tremendous growth and strong stock performance, providing alternative ways to benefit from the Bitcoin ecosystem.

Three Market Levers to Watch for Bitcoin’s Next Big Move

Tom Lee identifies three critical factors that could ignite the next major wave for Bitcoin and the broader market:

- Federal Reserve Policy: The Fed has held tight and not unleashed liquidity since the April lows. If data turns dovish, we could see 12 to 24 months of liquidity that might fuel a rally.

- Valuation Multiples: Despite skepticism, companies have survived multiple economic stress tests (COVID, inflation surges, Fed hikes), suggesting potential for expanded valuation multiples in the next two years.

- Trade and Tariffs: Improvements in tariff situations and reshaped economic flows could lead to earnings surprises, adding upside potential.

Lee notes that while there is $7 trillion in cash on the sidelines, institutional investors remain cautious. The market is currently skeptical, with many shorting the rally or defensively positioned. However, if the Fed eases rates, it could force a cyclical tilt that brings fresh capital back in.

Bitcoin’s Resilience: A Powerful Industry Backed by High-Profile Endorsements

Bitcoin’s ability to weather market downturns better than stocks has caught the attention of even high-profile figures like former President Donald Trump. He described the crypto space as a “very powerful industry” and highlighted how Bitcoin dropped far less than the stock market during recent pullbacks.

This resilience shifts Bitcoin’s narrative from pure speculation to a strategic portfolio stabilizer. Unlike stocks, Bitcoin doesn’t move in lockstep with economic fears or market panics, making it an attractive asset for risk management amid ongoing macroeconomic uncertainty.

Max Keiser’s Bold Prediction: Bitcoin at $850,000 in This Cycle

Billionaire investor Max Keiser has made one of the most ambitious Bitcoin price predictions yet: $850,000 per coin within the current cycle. He bases this forecast on Bitcoin achieving market capitalization parity with gold — an asset Bitcoin replicates but improves upon.

Keiser points to key macro trends driving this trajectory:

- Global money printing and untamed debt growth

- Currencies losing purchasing power

- Institutional adoption becoming mainstream, not niche

- Fixed Bitcoin supply combined with increasing utility

This combination, he argues, will push Bitcoin into the mid-six-figure range, delivering potentially 1,000% returns over the next five years. While Keiser’s prediction is bold, it’s grounded in historical precedent — Bitcoin has shown exponential growth across past cycles.

What’s Next for Bitcoin? The Waiting Game for New Money

Right now, the market is in a holding pattern, largely fueled by internal rotations rather than fresh capital. The big question remains: what will bring the next wave of new money into Bitcoin?

Potential catalysts include:

- Dovish shifts in Federal Reserve policy

- Greater institutional adoption beyond current holders

- Macro events increasing demand for scarce assets like Bitcoin

Until then, Bitcoin continues to trade above key support levels, reflecting its scarcity and growing realized price base. The fundamentals and market visibility are improving, setting the stage for further all-time highs in the months and years ahead.

What do you think will be the catalyst for Bitcoin’s next big move? Share your thoughts below.

This Chart Just Confirmed a GIANT Move for Bitcoin in July! Insights from PlanB & Tom Lee. There are any This Chart Just Confirmed a GIANT Move for Bitcoin in July! Insights from PlanB & Tom Lee in here.